workover rig companies in north dakota price

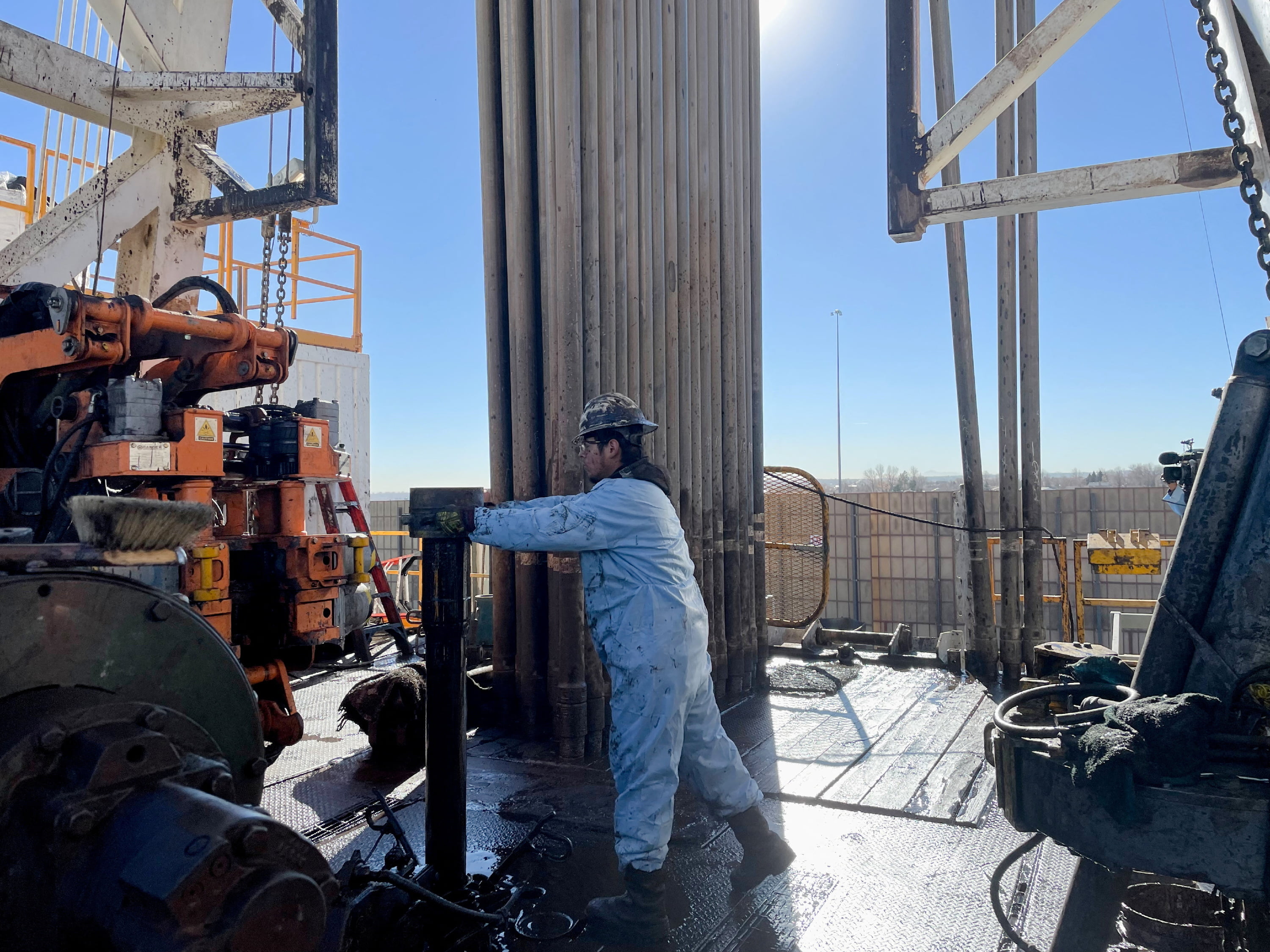

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Manages tools on the workover rig floor and assists in daily maintenance. Must have a minimum of 1 year of experience as a workover rig floorhand to be…

Spot in, rig up, and rig down well service unit (rig). Minimum of 1 year operating rig. Workover rig experience (minimum 6 months verified experience).

Installs / disassembles (rig up/rig down) of wireline and pressure control equipment in accordance with original equipment manufacturer’s standards including…

Operate the rig safely during rig up/down and pulling operations. Perform all required equipment inspections-workover rig, fall arrest system, derrick, hoisting…

The successful candidate will have an outstanding track record of success in workover rig experience in operating heavy equipment while ensuring communication…

Ensures all crew members are at the rig and prepared to work at the scheduled time. Determines how a service job will be performed based on specific conditions…

Inspects the setting up, taking down and transportation of the assigned workover rig. The Rig Operator, reporting to the assigned Tool Pusher/Field Supervisor,…

Operate the rig safely during rig up/down and pulling operations. Perform all required equipment inspections-workover rig, fall arrest system, derrick, hoisting…

Communicates with customer and/or the delegated well site representative, rig crew and field support staff. Plans, directs, supervises, and evaluates the work…

3+ years workover rig / wellsite supervisory experience. Ensures efficient maintenance of assigned rig and equipment. High school diploma, equivalent or higher.

The Floor Hand position is part of a 4-5 person workover rig crew on a well service rig, who are responsible for performing services on oil and gas wells…

Operate the rig safely during rig up/down and pulling operations. Perform all required equipment inspections-workover rig, fall arrest system, derrick, hoisting…

Perform services on oil and gas wells as part of a 3-5 person workover rig crew. Lifts, removes, installs and operates well head pump, jacks and performs other…

We are immediately hiring full snubbing crews for 170k stand alone rig assist and 150k rig assist snubbing units! High school diploma, GED or equivalent.

Every workover rig available is going right now in the Bakken, North Dakota’s top oil and gas regulator Lynn Helms said on Friday, during his monthly oil production report, as companies try to get wells online as quickly as possible after back-to-back blizzards idled a substantial number of four and five-well pads in Williams, Divide, and McKenzie counties.

March was a good month for production, Helms said, with a 2.8 percent increase in crude oil production from 1.089 million barrels per day to 1.12 million barrels per day. That figure is 2 percent above revenue forecast. Gas production, meanwhile, rose 4.5 percent to 3.01 billion cubic feet per day from 2.87 billion cubic feet per day in February.

Gas capture percentages were 95 percent, and this time Fort Berthold was a bright spot, with 97 percent capture. Helms said he expects continued improvement in the Fort Berthold area, with new solutions for gas capture in the works for the Twin Buttes area, which has been a problem spot.

But production is not going to look as rosy in April, Helms said, and may not look great in May either, given the time it will take to repair electrical distribution infrastructure. Load limits remain in place because of wet conditions, and that is a condition that might go on for a while, given the recent flooding issues caused by rain.

“We saw production in the first blizzard dropped from about 1.1 million barrels a day to 750,000 a day,” Helms said. “We recovered not quite back to a million barrels a day. And then the second blizzard came in. It was heavily impactful on electrical power and infrastructure in the Bakken oil fields.”

“It took a week, or I guess within a little bit less than a week, we recovered to 700,000 and it’s taken another week, we think we’re back at about a million barrels a day.”

One of the biggest of problems was that so many natural gas processing plants were knocked out of service, some for nine hours and others for well over a week.

“Just this past week, our largest gas plant came on and that’s really enabled a lot of production to come back on,” Helms said. “So we’re back to a million barrels a day, maybe a little more. You know all of the large operators reported enormous production losses. And of course that has led to the deployment of every workover rig available being out there trying to get wells back on production.”

Last weekend in Williams County, a dozen four and five-well pads along Highway 2, headed toward Ray, remained idle. They appeared to be without electricity, with some poles still clearly broken and lines laying down on the ground.

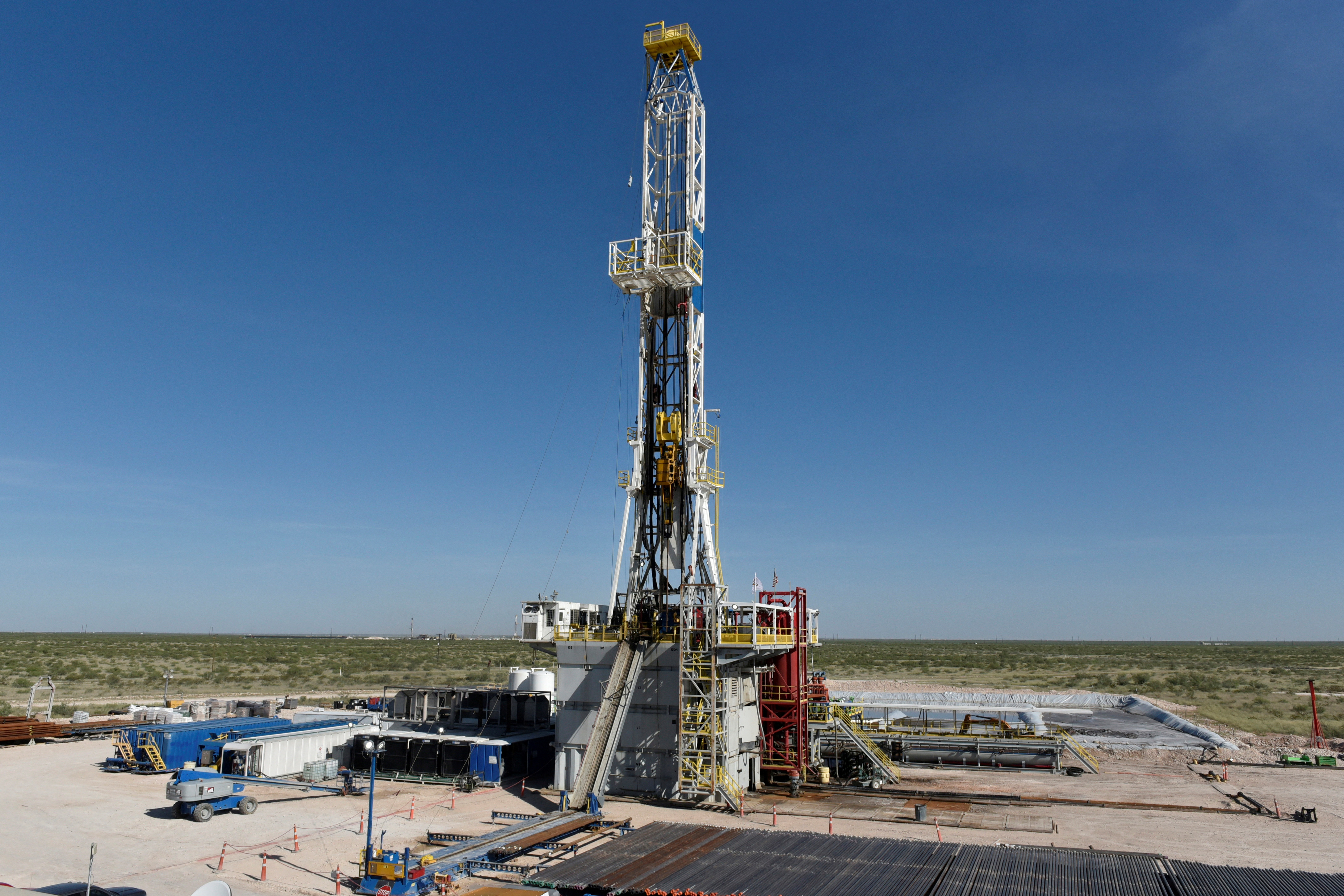

In his discussions with drilling contractors, Helms has learned that most drilling rigs went south to Texas and New Mexico, both of which escape winter sooner than the Bakken. Those areas hired the available workforce, too, which has added to the Bakken’s difficulty in attracting workforce.

“It’s taking around two months to train and deploy a drilling rig and crew, and very similar timeframes for frack crews,” Helms said. “So it’s just very, very slowly coming back.”

“There have not been any new frack fleets constructed since before the pandemic,” Helms said. “So the iron that’s out there is starting to show some wear and tear, some age, and, at some point, we’re going to have to see capital deployed to bring that iron back on.”

“I was reading an article today, and some of the large operators were saying, ‘Well you know we could bid up the price to hire frack crews, but all we would be doing is hiring them away from smaller companies that can’t afford to pay as much.’ So there wouldn’t be a gain in the number operating, in the number of wells completed, or really a more rapid rise in production. So it’s very much workforce limited.”

North Dakota rig counts are at 40 right now and Montana rigs are at 2, according to figures from North Dakota Pipeline Authority Justin Kringstad. Helms said the Bakken hasn’t seen those numbers since March of 2020. There are about 15 frack crews running now, a number last seen in April 2020.

Prices, however, have been well ahead of revenue forecasts, pushed in part by sanctions against Russia, which attempt to choke a major source of financial capital for the invasion of Ukraine, as well as continued supply chain issues and lower than expected production from OPEC.

“Today’s price is almost $102 a barrel for North Dakota light sweet and $106 West Texas,” Helms said. “So we’re estimating about $104 a barrel for North Dakota crude prices. That’s more than double revenue forecast. Revenue forecast was based on $50 oil, so that’s 108 percent above that.”

“And of course the market did not like the signal that it got this week or late last week of the cancellation of the offshore lease sales in the Alaskan lease sales,” Helms said.

“For example, the RMPs, or the resource management programs, and the records of decision from Corps of Engineers and Forest Service weren’t filed along with information about why various quarterly lease sales were canceled,” Helms said. “And why some of the tracts were chosen that were chosen to be in this latest lease sale.”

North Dakota is a few days away from a May 18 deadline for protests in the projected June sale, which has 15 parcels listed. If there’s a protest against one or more of the tracts, they could be pulled from the sale for further consideration.

ND Energy Services offers an experienced team to help our customer’s move a wide variety of equipment ranging from pumping units, pipe, heavy equipment, tank batteries, buildings, workover rig equipment, and other equipment that supports the oilfield. Our team is also experienced in construction as far as setting rafters, steel erection, houses, etc.

We have cranes that range from 23 ton to 140 ton with capabilities of reaching over 200’. Our cranes are operated by NCCCO certified operators to help move the job along at a safe and efficient pace. Our rigging is all certified and annually certified by a third-party rigging company. We have spreader bars that are rated up to 100,000 pounds and can extend to 30’.

CountryUnited StatesCanadaAbkhaziaAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBaker IslandBangladeshBarbadosBelarusBelgiumBelizeBeninBermudaBhutanBoliviaBosnia and HerzegovinaBotswanaBrazilBritish Virgin IslandsBruneiBulgariaBurkina FasoBurundiCambodiaCameroonCape VerdeCayman IslandsCentral African RepublicChadChileChinaClipperton IslandColombiaComorosCongoCook IslandsCosta RicaCroatiaCubaCyprusCzech RepublicDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland IslandsFaroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHondurasHong KongHowland IslandHungaryIcelandIndiaIndonesiaIranIraqIrelandIsle of ManIsraelItalyIvory CoastJamaicaJapanJarvis IslandJerseyJohnston AtollJordanKazakhstanKenyaKingman ReefKiribatiKosovoKuwaitKyrgyzstanLaosLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacauMacedoniaMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesiaMidway AtollMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNagorno-KarabakhNamibiaNauruNavassa IslandNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorth KoreaNorthern CyprusNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian territoriesPalmyra AtollPanamaPapua New GuineaParaguayPeruPhilippinesPitcairn IslandsPolandPortugalPuerto RicoQatarReunionRomaniaRussiaRwandaSaint BarthélemySaint HelenaSaint Kitts and NevisSaint LuciaSaint MartinSaint Pierre and MiquelonSaint Vincent and the GrenadinesSamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSlovakiaSloveniaSolomon IslandsSomaliaSomalilandSouth AfricaSouth KoreaSouth OssetiaSpainSri LankaSudanSurinameSvalbardSwazilandSwedenSwitzerlandSyriaTaiwanTajikistanTanzaniaThailandTimor-LesteTogoTokelauTongaTransnistriaTrinidad and TobagoTunisiaTurkeyTurkmenistanTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States Minor Outlying IslandsUnited States Virgin IslandsUruguayUzbekistanVanuatuVatican CityVenezuelaVietnamVirgin IslandsWake IslandWallis and FutunaWestern SaharaYemenZambiaZimbabwe

Rig Operator Well Name & Number Current Location County File No API Start Date Next Location fullCounty twp rng sec qq lat lng geometry

Rig Operator Well Name & Number Current Location County File No API Start Date Next Location fullCounty twp rng sec qq lat lng geometry

DISCLAIMER AND TERMS OF USE: HISTORICAL DATA IS PROVIDED “AS IS” AND SOLELY FOR INFORMATIONAL PURPOSES – NOT FOR TRADING PURPOSES OR ADVICE. NORTHDAKOTARIGSMAP.COM WILL NOT BE LIABLE FOR ANY DAMAGES RELATING TO YOUR USE OF THE DATA PROVIDED.

The number is preliminary but North Dakota has a new all-time high of 17,369 producing wells in July, the most recent oil and gas production numbers available.

BISMARCK – North Dakota reached a new all-time high (preliminary) of 17,369 producing wells in the state, according to a report from the North Dakota Department of Mineral Resources released on Thursday.

The report, released by Lynn Helms, director of the Mineral Resources Department, states North Dakota produced 1,069,517 barrels of oil a day in July.

The price of North Dakota light sweet crude on Thursday was $85.50 a barrel and West Texas Intermediate was $88.48. The all-time high was June 2008, when North Dakota light sweet crude was $125.62 a barrel and West Texas Intermediate was $134.02.

As of Thursday, 45 rigs were actively drilling in North Dakota. No rigs were drilling on federal surface. The all-time high was 218 rigs on May 29, 2012.

In July, the state produced 96,172,149 million cubic feet (MCF), or 3,102,327 MCF a day, of natural gas. In June, the state produced 91,883,343 MCF or 3,062,778 MCF a day.

Fort Berthold Reservation produced 202,689 barrels of oil a day in July, according to the report. Four rigs were drilling on the reservation. The reservation has 2,632 active wells and 20 wells are waiting on completion.

Helms said the drilling rig count has stalled in the mid-40s with a slow increase expected over the next two years. He said the number of active completion crews increased to 17 this week.

“The surge in the cost of services and supplies pushed the average oil price needed to justify drilling a new oil well in the Mid-Continent to $65/bbl (barrel of crude oil), according to a survey of industry experts by the Federal Reserve Bank of Kansas City released on 8 July.

“When they were asked what it would take to get them to substantially increase drilling, they put the number at $98/bbl, which was higher than the closing price for the WTI price in futures trading on 14 July.”

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XMYRPMRVYVIVFDQ3B63SKJODDY.jpg)

Limited partly by weather, North Dakota pumped out 1.09 million barrels of oil a day in February, about the same as the previous month, according to state data released Tuesday. Natural gas production rose 1.5 % from January to February.

"The weather was bad, production was not too bad and the prices were amazing," Lynn Helms, North Dakota"s mineral resources director, told reporters Tuesday.

North Dakota light sweet crude stood at $86 per barrel on average in February, well above the state"s oil tax revenue forecasts. Today, that price is around $110, boosted by Russia"s invasion of Ukraine.

Since disruptions caused by the pandemic caused U.S. oil output to crash in 2020, the industry"s recovery since has been led by the nation"s largest and most cost-efficient shale oil patch: the Permian Basin in Texas and New Mexico.

In North Dakota, the drill rig count — a key indicator of new oil production — rose in recent months, a good sign. Today, there are 38 rigs working in the state, up from 34 last month and 31 in January.

Still, North Dakota"s oil production is expected to grow conservatively in 2022. Helms said oil companies have told him they expect 1 to 2 % growth, but not until the third quarter.

Oil field operators "have increased hourly wages by $10 an hour, and that has not flipped the switch," Helms said. "We are going to have to train our North Dakota youth to be our workforce."

"Our privately owned companies have gone back to their pre-pandemic production levels," Helms said. They"re financing their drilling and fracking operations from cash flow, which is very strong given high oil prices, he said.

It’s no secret that North Dakota’s oil industry is booming. Advancements in hydraulic fracturing have helped Western North Dakota experience month after month of record-setting oil production, making for one of the fastest-growing economic expansions the U.S. has ever seen. With the region having one of the lowest unemployment rates in the country and generating over 75,000 new jobs in the past few years, thousands of workers have showed up searching for high-paying jobs. Oil field workers in the state saw an average annual wage of $112,462 in 2012. Competition has intensified since the boom started around 2007, but entry level rig workers still average about $66,000 a year, according to Rigzone, an industry information provider and job website.

Though the salary figures may sound appealing, be warned that few of these jobs are located in a cushy office environment or require a mere 40 hours a week. Most employees report working anywhere from 80 to 120 hours a week, and conditions in North Dakota can be brutal, with temperatures regularly dropping below minus 30 degrees during the long winters. Housing is difficult to find, and many workers live in man camps with shared bathrooms and dining quarters.

If you’re thinking about giving the oil industry a try despite all those warnings, what can you expect? Which jobs should you shoot for? Here’s a rundown of the highest-paying jobs in North Dakota’s oil industry. The data come from Rigzone and are averages based on total annual compensation, including overtime and incentive pay. Though the data are calculated using industry figures from around the country, we only included positions that can be found in North Dakota’s oil patch.

A drilling consultant is an expert in all types of drilling operations. To become one, you typically need a bachelor’s degree or higher in engineering or a related field and at least five to 10 years experience in the oil field. The job tends to require frequent travel.

Sometimes called a “company man,” this managerial/supervisor position involves overseeing day-to-day operations of a crew, including safety, budget and maintenance, and coordinating with the various contractors that work with the company. The job is largely held by senior oil and gas professionals with many years of experience.

A “workover” or “completion” rig is placed on a hole after it’s been drilled. It’s typically used to insert tubing or pipe into the hole, perform major maintenance operations and set up the infrastructure for a hydraulic fracturing job. It’s one of the more technically difficult jobs in the field and tends to require an engineering degree. A workover driller will also assess well performance and recommend solutions for optimizing oil production.

There are many types of engineers in the oil field. One of the highest paid is a reservoir engineer, which involves estimating oil reserves and performing modeling studies to determine optimal locations and recovery methods. Other high-paid engineering jobs include a drilling engineer (averaging $142,664 a year), petroleum engineer ($126,448 a year) and mud engineer ($109,803 year).

Rig managers tend to oversee and manage the crew that’s working on-site. The job could include prepping and managing the budget and making sure targets are met. A bachelor’s degree isn’t usually required, as most rig managers start at the bottom as a rig hand or roustabout and work their way up.

Geoscientists and geologists in the field study the composition, structure, process and physical aspects of the earth’s energy resources, including analyzing data and collecting samples. A bachelor’s degree or higher is required.

Coil tubing refers to the metal piping used in an oil well after it’s been drilled. The tubing needed to pump fracking fluid down a well, among other operations. A coil tubing professional provides technical support and overseas the operation from start to finish, and tends to work as a contractor with many different oil companies. No bachelor’s degree is required.

Well control specialists or well testers typically travel from site to site, setting up and taking down rigs; inspecting production levels and equipment; and testing flowback quality. No bachelor’s degree required, though strong analytical skills, computer skills and experience with Excel spreadsheets is needed.

These jobs involve the work done to a well to increase production, including the process of hydraulic fracturing, when a mix of chemicals is pumped down the well to create fissures in the rock formation. It helps to have a degree in organic chemistry, chemical engineering or many years of experience working on fracking operations.

Axis is a completion and workover company built for today’s operators, as you shift into manufacturing mode while drilling ever-longer laterals. We’re advancing both goals through our core mission: optimizing completions.

For too long, well services has lagged other oil and gas sectors in innovation. Axis is changing that with integrated, data-driven services. New, purpose-engineered equipment. And a team that unites oilfield veterans with the next generation of crews and engineers through our leading-edge training culture.

The U.S. rig count has gained one more rig in the last week to reach a total of 707 active drilling rigs. This count is up just 1% over the last month, but up 155% in the last year. The most notable rig increases are unfortunately not in the Bakken, however the rig count is currently at 33 in North Dakota which is an increase from the 10 operating rigs we had at this time last year.

At the time this article was written WTI Crude oil is sitting just over $78 per barrel, which represents a major improvement over the $52 per barrel prices that were seen at this time last year. While many factors go into the price of oil, most recently, factors such as improved risk sentiment and the global energy crunch appear to be the driving forces behind keeping prices stable for now. Even with OPEC enacting a slight output hike, prices appear around $80 appear to be here to stay during the winter.

Where are oil prices going from here? While we wish we had a crystal ball to tell us this we do have several key points we can look at to help us see where the market feels the prices of oil may be going in the near future. Predictions were for a price forecast of $80 a barrel for the last quarter of 2021 and we are seeing that now. Due to natural gas shortages and a post-pandemic demand that is outstripping supply, we could very well be on our way to $100 per barrel oil.

As you may have heard, due to substantially increased activity in New Mexico, North Dakota gave up its spot as the No. 2 oil producer. What does this mean for North Dakota? The production drop in North Dakota is not the main driving force behind this. New Mexico currently has 62 more active drillings rigs than North Dakota. Per the North Dakota Industrial Commission, companies are starting to bring on additional frack crews and have a fairly substantial back log of drilled but not yet completed wells to frack.

In summary: While the oil industry as a whole was hit especially hard during the pandemic, many of the producers that had high debt loads were forced out of the market through sales or bankruptcies which has allowed these companies to reorganize and fine tune their development plans going forward. This combined with the current backlog of wells needing to be fracked should provide for substantial oil and gas development in North Dakota for many years to come.

MOUNTRAIL COUNTY, N.D. (KFGO) – Three crew members working on a workover oil rig near Stanley in northwest North Dakota were injured after an explosion and fire on the site Friday night.

Mountrail County Sheriff Corey Bristol said the oil well site is owned by Chord Energy and was being serviced by crews from Blackhawk when the fire occurred.

The three workers who were injured in the blast were transported to the hospital with burns – a company spokesperson said those workers are in stable condition.

BISMARCK, N.D. (KUMV) - Oil and Gas production numbers in North Dakota are trending in the right direction going into the summer months, according to Department of Mineral Resources Director Lynn Helms.

In the latest Director’s Cut report, the state produced nearly 1.1 million barrels of oil in June, which is a 3.5% increase. Gas capture figures also showed a 9.7% increase during that period. Helms said that while more production is expected throughout the year, workforce and oil prices remain challenges to see significant growth.

“We’re not anticipating a big spike or a ramp up in drilling activity, just a slow increase in rig count and frack crews or completion crew count taking us through the end of the year,” said Helms.

He cited a recent survey by the U.S. Energy Information Administration that said producers need oil prices to remain around $98 a barrel for them to substantially increase drilling. Today, the price is at $88 a barrel.

One reason American gas prices remain so high lies in the ruts of J&J Rental’s parking lot here in Watford City – the heart of North Dakota’s oil country.

At a time when spiking oil prices should be driving a boom in U.S. production, and helping to relieve those painful numbers at the pump and on monthly utility bills, two of the company’s five service rigs have been idle. Vice President Greg Burbach, whose coveralls are spattered with mud, sits down in his office to explain why.

In January, as the price of oil climbed steadily higher, he started getting daily calls from customers interested in hiring the rigs, which are used for maintaining and repairing oil wells. So over the next two months, he spent $12,000 on ads in 10 markets across the country trying to hire workers. He only got one.

Spiking oil prices have heightened the debate over whether the U.S. should emphasize more drilling or saving the planet. In North Dakota, officials think they’ve found a third way – doing both.

Customers still call weekly to see if he’s assembled any crews to run the $900,000 pieces of equipment. He hasn’t – despite offering a monthly housing allowance, a daily bonus, and a 10% pay raise.

“I can’t just hire people off the street,” says Mr. Burbach, walking around one of the rigs, which stands 104 feet tall, with a ladder for crews to climb and long guy wires to anchor it to the ground. With the winds that whip across the prairie here, it requires experienced hands to operate the machines safely.

Greg Burbach (left), a vice president with the oil-services firm J&J Rental, stands with his colleague John Thiers near one of their rigs used to repair and maintain oil wells. The North Dakota company is having a hard time finding experienced workers, despite offering hefty bonuses and housing allowances.

After decades in the industry, Mr. Burbach has seen his fair share of booms and busts. But something is different this time. Despite oil soaring to more than $100 a barrel, almost no one here is expecting a significant boost in production this year.

They can’t get workers. They can’t get capital from Wall Street. They can’t secure new leases on federal lands. And the cost of doing business has gone up dramatically – everything from labor to steel to the diesel needed to drill for oil.

“We were told not to drill and shut everything down because the planet’s going to burn up,” says Dave Williams, chief executive officer of Missouri River Resources, an oil producer on the Fort Berthold Reservation. “And now we’ve got everyone saying we’ve got to produce as much as we can.”

North Dakota illustrates that there is no switch to flip that will instantly boost U.S. oil production, not even in one of the most prolific, pro-oil states in the country. And part of that, people here say, is due to the Biden administration’s hard pivot away from fossil fuels in its bid to mitigate climate change.

To be sure, there has long been a fundamental tension between meeting America’s energy needs and saving the planet. But that cleavage has grown in recent years amid increasingly urgent warnings that Earth is on the verge of a meltdown.

Now, in the wake of Russia’s invasion of Ukraine, Republicans in Congress are calling for an overhaul of America’s energy policy. The president has miscalculated in his efforts to fight climate change, they say, undermining national security and U.S. foreign policy. They argue instead for increased oil production to enable America to lead unfettered by unsavory leaders like Russian President Vladimir Putin. Meanwhile, progressives are accusing oil companies of profiteering – taking advantage of high oil prices and federal subsidies – while ruining the planet.

Amid the national debate, North Dakota presents an interesting case study in balancing the push for increased U.S. production with the growing social and political momentum toward mitigating climate change. Some states have sought to transition off fossil fuels, following the lead of many European countries. Others have dug in with a “drill, baby, drill” mentality, suing their way out of federal regulations or waiting until the next GOP president. North Dakota was arguably in the drill camp – until last May. At a conference of oil bigwigs, Republican Gov. Doug Burgum shocked the crowd by announcing that he planned to take North Dakota carbon neutral by 2030.

Controversy has swirled about the environmental impact of a proposed oil refinery near Theodore Roosevelt National Park, which lies in the Badlands of western North Dakota.

“We’re trying to chart a course that takes us down the middle of that road – not drill at all costs and produce at all costs, or shut things down because we have a climate crisis,” says Lynn Helms, director of the state’s Department of Mineral Resources. “We think we can do both.”

The last time oil prices spiked, Gary Goodman left Kentucky for a fresh start in the oil fields of North Dakota. It was 2012. With a felony conviction and few job prospects, he boarded a train in Cincinnati and headed west with a few work clothes, a sleeping mat, and $1,600 he’d saved up from doing odd jobs. Thirty-nine hours later, he arrived in North Dakota.

People from all over the country poured into Williston and Watford City, staying in “man camps,” tents along the street, or RVs in the Walmart parking lot. Mr. Goodman headed for a Lutheran church that was letting people sleep on the floor. “You ever been in trouble?” he recalls the pastor asking him.

“I’ve got a rap sheet as long as your arm,” admitted Mr. Goodman, explaining he was imprisoned on drug-related charges, but nothing violent. “I’m here to make a life, to try to do the right thing.”

The pastor checked out his story and let him in. Mr. Goodman bought a pillow and hunkered down with 60 other guys for a couple of months, getting a gym membership so he could take daily showers. He soon landed a full-time gig and stayed for seven years.

It was thanks to workers like Mr. Goodman that North Dakota became the country’s No. 2 oil producer after Texas. “We were paying gobs of money for a pulse,” says Paula Lankford, who runs the Williston branch of Job Service North Dakota.

The boom transformed Watford City from a town of 1,700 to 6,200, and made the surrounding county the fastest-growing in the United States, according to the 2020 census.

From 2019 to 2021, North Dakota’s oil production dropped 25% – far worse than the 9% decline nationally. One of the main reasons it’s not possible to simply turn on the oil spigot now that prices have surged again is that many of the itinerant workers have vanished. Some have headed to the Permian, the large oil field that stretches across Texas and New Mexico. The oil is cheaper to extract, and there are no cryogenic windchills that leave icicles on your eyelashes and “make you wish you’d never been born,” as one worker here puts it.

In March, the local job service office had seven times more openings as active résumés in construction and extraction, says Ms. Lankford. An RV park where out-of-state workers used to sleep stands empty, a “for sale” sign tacked to the fence.

“I had guys asking me to lay them off so they could collect unemployment insurance,” says Shane Johnson, who owns J&J Rental, which includes the oil-services operation in Watford City where Mr. Burbach has been trying to woo workers.

But Mr. Goodman is still driven to work. After recently returning from Kentucky to Watford City, he swings by J&J Rental to fill out paperwork, pick up a harness to keep him safe on the derrick, and grab a hat with the company’s black-and-red logo. Then he heads to Outlaws’ Bar and Grill on North Main Street, to fill up on bison meatloaf and mashed potatoes.

The next morning, with a full moon still hanging in the sky, workers in Carhartts and muddy work boots trudge into The Corner Post gas station to fuel up for another day in the oil patch. They clutch sodas, sticks of beef jerky, and wedges of frosted cake, as well as foam containers loaded with eggs, biscuits, and bacon from the breakfast buffet. The four cashiers punching registers have been working since 5 a.m.

Outside, supersize pickups and flatbed trucks brimming with equipment fill up with gas before rumbling out of the parking lot. There are pipelines to fix, wells to drill, and, yes, there’s oil to pump.

But despite the high prices, Mr. Helms at the Department of Mineral Resources projects that North Dakota will only see an increase in production of at most 9% this year, to 1.2 million barrels per day – still 300,000 barrels short of the 2019 peak. Currently 40 rigs are operating across the state, down from 55 pre-pandemic.

Iron Oil CEO J.R. Reger says he’s sticking to his plan to use only one drilling rig in the Williston Basin for now because his costs have risen as much as 15% over the past year. He worries oil prices will plummet before he can recoup his costs.

Industry officials say investors are hesitant, too, for several reasons. They poured money into oil for years and didn’t get great returns. Secondly, as socially responsible investing picks up, windmills are in vogue, not oil rigs. Then came the Biden administration’s pivot – and with it, increased regulation.

The federal government has canceled the $9 billion Keystone XL pipeline; suspended lease sales; bogged down the permitting process, according to industry executives; and nominated people who see banking policy as a key tool in accelerating the transition away from fossil fuels.

“I really think the regulatory impact on the financial sector is the largest thing tamping down the industry,” says Kathy Neset, a geologist and founder of Neset Consulting Service, who recently finished a term on the Federal Reserve Bank of Minneapolis. She says Biden administration officials are putting unrealistic expectations on the industry during a crisis.

They see it differently: The Ukraine war and its consequences for energy underscore the need for weaning the country not only off foreign oil, but also off fossil fuels altogether. And it’s “important and appropriate” for the market to price in climate risks, says Brian Deese, director of the National Economic Council, who formerly led the sustainable investment team at BlackRock, the world’s largest investment fund manager.

In the short term, there are no policy constraints on ramping up production, he adds, noting that corporations like Exxon and Chevron are already doing so. Speaking at a Monitor Breakfast in Washington April 6, Mr. Deese acknowledged that smaller companies reliant on private equity are having a tougher time boosting production and said the administration is willing to help. “We are open to practical and pragmatic ideas as long as they’re grounded in real, not imagined constraints.”

GOP Rep. Kelly Armstrong, North Dakota’s sole House member, has a few suggestions: Approve permit applications that have languished since last year, signal support for building natural gas pipelines, and reform the environmental review process.

Over in the Senate, his fellow North Dakota Republican Kevin Cramer is also pushing for less federal regulation as well as more investment in the industry. But Senator Cramer, who sits on the Senate Banking Committee, says it’s important for both sides to step away from extreme positions and work together.

“You can’t dig your heels in on, ‘Climate change is a hoax,’ or the other side saying, ‘The world is ending tomorrow if we don’t do something about it,’ and expect a real solution,” he says.

Delvin Rabbithead Sr.worked as a roughneck in the oil patch for a year during the last boom. Then one winter, as the temperatures started dipping to minus 30, he decided to switch to the comfort of a heated truck cab. As a driver, he hauled away the salty water that is a byproduct of oil production.

– Delvin Rabbithead Sr., a former truck driver for oil companies who became concerned about practices he was seeing in the industry and joined an environmental group

Yet he quickly witnessed something on the new job that disturbed him: drivers who wouldn’t bother to go to the designated disposal sites but would dump their effluents elsewhere under the cover of darkness. These and other experiences served as a wake-up call about the industry he’d grown up around. “I started realizing what it was doing to our land,” he says.

Much of North Dakota’s oil and gas is obtained through fracking, a controversial extraction technique that enabled the U.S. to become the world’s biggest producer in 2018. In this GOP state that gets 50% of its tax revenues from energy production, few are calling for scrapping fossil fuels altogether. But environmental activists and landowners are concerned about everything from saltwater spills and leaky pipelines to emissions from the flaring of gas that is extracted alongside oil.

During the previous oil boom, the flames could be seen from the International Space Station. “It was like a Christmas tree, all lit up,” says Mr. Rabbithead.

The Fort Berthold Reservation where he grew up is particularly notorious for gas flaring. So he joined a group called Fort Berthold Protectors of Water and Earth Rights, and says they were close to reaching a deal with tribal leadership to lower emissions before the pandemic hit.

Natural gas flaring statewide has dropped 96% since 2011, according to state officials, who inspect flaring sites and review companies’ self-reported numbers on the practice. But activists say the rates are far higher, citing a satellite study.

Across the Missouri River that Lewis and Clark once plied, farmer Donny Nelson is fighting another battle. He personally has lost about 100 acres to saltwater spills, despite the state’s remediation efforts.

As co-founder of the Salted Lands Council, he’s fundraising to map saltwater spills statewide and determine the cost of properly restoring the land. His guess: $1 billion or more.

As trucks rumble outof The Corner Post headed for the oil fields, Larry Dokken is driving 70 mph awayfrom the Bakken. Mr. Dokken been working in the oil industry here since 1964. But now he’s on a new mission for Neset Consulting: overseeing a carbon storage initiative that would be the largest in the world.

The idea is to capture emissions at 31 ethanol plants in the Upper Midwest and send it by pipeline to Beulah, North Dakota, where it would be injected deep underground and stored permanently. The state would get to claim huge carbon offsets, and the ethanol producers would be able to sell their low-carbon ethanol at a premium in states like California, the largest ethanol market in the nation.

It’s one of numerous initiatives launched since Governor Burgum announced his carbon-neutral goal last year, and by far the biggest. Other projects include advancing a $1 billion plan to capture and store coal emissions, building one of the nation’s largest low-cost hydrogen hubs, and turning soybeans into diesel fuel.

The $4.5 billion carbon storage project is not yet approved, and there are plenty of skeptics. In order to get the necessary permits, Summit Carbon Solutions is drilling three wells and bringing up core samples from thousands of feet underground, then shipping them to Denver for analysis. Its goal: prove that the sandstone layers can hold carbon, and that the cap rock just above them is impermeable enough to keep it from escaping.

Mr. Dokken, the project manager, pulls up to the entrance gate at the site on a recent sun-dappled morning. A drilling rig is boring 4,000 feet underground. Inside one of the heated trailers on-site, a geologist monitors the rock layers they are expecting to find, and at what depth. The crew is pleased with the progress so far.

Summit is offering to pay landowners to lay a pipeline across their property and for carbon storage rights. But not all are thrilled with the project.

One disgruntled local landowner has been leaving leaflets in people’s mailboxes warning about the dangers of transporting carbon gas. In Richland County, to the east, residents recently approved a resolution to deny Summit the right to invoke eminent domain for the pipeline.

running across his property concerns him. He says his insurance wouldn’t cover an accidental leak or its effects, including on livestock grazing nearby.

– Larry Dokken, an oil industry veteran who, along with engineer Jean Datahan (right), is overseeing work on a huge carbon sequestration project in North Dakota

“Good things still have to be done in a thoughtful way – not the wild, Wild West approach that we just got done with in the Bakken oil field,” says Mr. Coons, whose organization recently sued the state over a new law governing “pore space,” where carbon would be stored.

Questions still linger about how well carbon storage works. In 2020, a $1 billion coal carbon-capture plant in Texas sequestered 15% less carbon than was projected. The project was mothballed after three years because it wasn’t economically viable.

“You’ve got to develop the technology so you can make it pay in the free market,” says Sen. John Hoeven, who as the GOP governor of North Dakota laid the regulatory groundwork for carbon storage and later advanced tax credits for the technology. “We’ve got about a 10-year head start on everybody else.”Get stories that

“[These companies] are trying to figure out how to be the next robber barons,” says Scott Skokos of the Dakota Resource Council, an environmental watchdog group. Although he credits the governor with finding a third way between unchecked drilling and an abrupt turn toward green energy, he sees it as a quixotic quest. “He’s trying to have his cake and eat it, too – and I don’t think it’s possible.”

8613371530291

8613371530291