schlumberger mud pump quotation

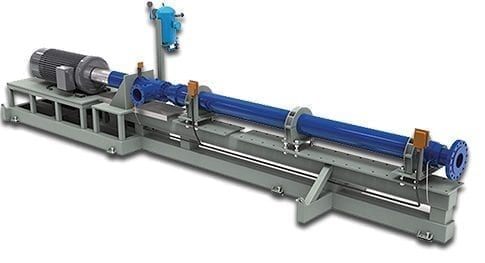

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

A comprehensive range of mud pumping, mixing, and processing equipment is designed to streamline many essential but time-consuming operational and maintenance procedures, improve operator safety and productivity, and reduce costly system downtime.

The trailer is equipped with two triplex pumps and features two 10-bbl stainless steel displacement tanks used to store and measure fluids. The advanced cement control (ACC) system is used in conjunction with a 6-bbl mixing tub and a 14-bbl density-averaging tank to provide superior density control. It enables accurate mixing of lightweight slurries down to 5 lbm/galUS via solids fraction monitoring and control.

The CPF-377 has four direct-drive centrifugal pumps to mix the cement slurry, pressurize the triplex pumps, and deliver water to the unit. CemCAT cementing computer-aided treatment can be used with this pump trailer to monitor and record sensor signals at the wellsite during pumping operations.

⊙Mud pump spare parts of abroad brand:Eg. Liner, piston, valve assembly, valve seat, valve spring, valve rubber could be alternative for original with lower price.

⊙Original brand:Emsco、Gardner-Denver, National oilwell, Ideco, Brewster, Drillmec, Wirth, Ellis, Williams, OPI, Mud King, LEWCO, Halliburton, SPM, Schlumberger, Weatherford.

Mud pumps are the pumps deployed in the oil and gas industry, mainly to circulate drilling fluids and other kinds of fluids in and out of the drilled wells for exploration. The mud pumps transfer the fluids at a very high pressure inside the well using the piston arrangement. The number of pistons decides the displacement and efficiency of working of the mud pumps, originally only dual piston pumps and three-piston pumps were used, but the technological advancements have seen pumps with five and six pistons to come up. Currently the triplex pumps which have three pistons are used, but the duplex pumps having two pumps are still deployed in the developing countries.

Based on its types, global mud pump market can be segmented into duplex, triplex, and others. The triplex mud pumps will dominate the mud pump marking in the given forecast period owing to its advantages and ongoing replacement of duplex pumps with triplex pumps. Based on operation, the global mud pumps market can be segmented into electric and fuel engine.

The electric mud pumps will dominate the market during the given forecast period due to the advantage of eliminating the harmful carbon emission which is done in the case of fuel engine pumps. Based on its application, the global mud pumps market can be segmented into oil & gas, mining, construction, and others.

The major market driver for the global mud pumps market is the increasing exploration activities taking place in various regions of the world to satisfy the increased energy demand. The number of drilled wells has increased in recent years, which has certainly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

Key market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to reduce the carbon emissions, which will certainly decrease the demand for oil & gas and therefore will have a negative impact on the growth of the global mud pumps market.

Some of the notable companies in the global mud pump market are Mud King Products, Inc. Gardner Denver Pumps, Weatherford, Schlumberger, National Oilwell Varco, China National Petroleum Corporation, Flowserve Corporation, MHWirth, American Block, Herrenknecht Vertical Gmbh, Bentec GmbH Drilling & Oilfield Systems, Drillmec Inc, Sun Machinery Company, Shale Pumps, and Dhiraj Rigs.

The global mud pump market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Owing to the well-established production sector and stable exploration industry North America holds the largest market for the mud pumps. The onshore exploration activities of oil & gas have increased at a good rate in the North America region, which has certainly boosted the growth of the mud pumps market in the region.

The demand from Europe and Asia Pacific has also increased due to exploration activities in both the regions owing to the increased energy demand. The energy demand specifically in the Asia Pacific has increased due to the increased population and urbanization. The Middle East and Africa also hold significant opportunities for the mud pumps market with increased exploration activities in the given forecast period.

In August 2018, Henderson which is a leading company in sales and service of drilling rigs, and capital drilling equipment in Texas signed a contract with Energy Drilling Company for the purchase and upgrade of oil field equipment’s which included three 1600hp × 7500psi mud pumps. This will be the first refurbishment completed at Henderson’s new service center and rig yard.

In January 2018, Koltek Energy Services launched the 99-acre facility for the testing of the oil field equipment in Oklahoma. This will allow the oil field equipment manufacturers to test their equipment at any given time. The company has deployed the MZ-9 pump which has a power rating of 1000Hp.

F04B15/02—Pumps adapted to handle specific fluids, e.g. by selection of specific materials for pumps or pump parts the fluids being viscous or non-homogeneous

A quintuplex mud pump has a crankshaft supported in the pump by external main bearings. The crankshaft has five eccentric sheaves, two internal main bearing sheaves, and two bull gears. Each of the main bearing sheaves supports the crankshaft by a main bearing. One main bearing sheave is disposed between second and third eccentric sheaves, while the other main bearing sheave is disposed between third and fourth eccentric sheaves. One bull gear is disposed between the first and second eccentric sheaves, while the second bull gear is disposed between fourth and fifth eccentric sheaves. A pinion shaft has pinion gears interfacing with the crankshaft"s bull gears. Connecting rods on the eccentric sheaves use roller bearings and transfer rotational movement of the crankshaft to pistons of the pump"s fluid assembly.

Triplex mud pumps pump drilling mud during well operations. An example of a typical triplex mud pump 10 shown in FIG. 1A has a power assembly 12, a crosshead assembly 14, and a fluid assembly 16. Electric motors (not shown) connect to a pinion shaft 30 that drives the power assembly 12. The crosshead assembly 14 converts the rotational movement of the power assembly 12 into reciprocating movement to actuate internal pistons or plungers of the fluid assembly 16. Being triplex, the pump"s fluid assembly 16 has three internal pistons to pump the mud.

As shown in FIG. 1B, the pump"s power assembly 14 has a crankshaft 20 supported at its ends by double roller bearings 22. Positioned along its intermediate extent, the crankshaft 20 has three eccentric sheaves 24-1 . . . 24-3, and three connecting rods 40 mount onto these sheaves 24 with cylindrical roller bearings 26. These connecting rods 40 connect by extension rods (not shown) and the crosshead assembly (14) to the pistons of the pump"s fluid assembly 16.

In addition to the sheaves, the crankshaft 20 also has a bull gear 28 positioned between the second and third sheaves 24-2 and 24-3. The bull gear 28 interfaces with the pinion shaft (30) and drives the crankshaft 20"s rotation. As shown particularly in FIG. 1C, the pinion shaft 30 also mounts in the power assembly 14 with roller bearings 32 supporting its ends. When electric motors couple to the pinion shaft"s ends 34 and rotate the pinion shaft 30, a pinion gear 38 interfacing with the crankshaft"s bull gear 28 drives the crankshaft (20), thereby operating the pistons of the pump"s fluid assembly 16.

When used to pump mud, the triplex mud pump 10 produces flow that varies by approximately 23%. For example, the pump 10 produces a maximum flow level of about 106% during certain crankshaft angles and produces a minimum flow level of 83% during other crankshaft angles, resulting in a total flow variation of 23% as the pump"s pistons are moved in differing exhaust strokes during the crankshaft"s rotation. Because the total flow varies, the pump 10 tends to produce undesirable pressure changes or “noise” in the pumped mud. In turn, this noise interferes with downhole telemetry and other techniques used during measurement-while-drilling (MWD) and logging-while-drilling (LWD) operations.

In contrast to mud pumps, well-service pumps (WSP) are also used during well operations. A well service pump is used to pump fluid at higher pressures than those used to pump mud. Therefore, the well service pumps are typically used to pump high pressure fluid into a well during frac operations or the like. An example of a well-service pump 50 is shown in FIG. 2. Here, the well service pump 50 is a quintuplex well service pump, although triplex well service pumps are also used. The pump 50 has a power assembly 52, a crosshead assembly 54, and a fluid assembly 56. A gear reducer 53 on one side of the pump 50 connects a drive (not shown) to the power assembly 52 to drive the pump 50.

As shown in FIG. 3, the pump"s power assembly 52 has a crankshaft 60 with five crankpins 62 and an internal main bearing sheave 64. The crankpins 62 are offset from the crankshaft 60"s axis of rotation and convert the rotation of the crankshaft 60 in to a reciprocating motion for operating pistons (not shown) in the pump"s fluid assembly 56. Double roller bearings 66 support the crankshaft 60 at both ends of the power assembly 52, and an internal double roller bearing 68 supports the crankshaft 60 at its main bearing sheave 64. One end 61 of the crankshaft 60 extends outside the power assembly 52 for coupling to the gear reducer (53; FIG. 2) and other drive components.

As shown in FIG. 4A, connecting rods 70 connect from the crankpins 62 to pistons or plungers 80 via the crosshead assembly 54. FIG. 4B shows a typical connection of a connecting rod 70 to a crankpin 62 in the well service pump 50. As shown, a bearing cap 74 fits on one side of the crankpin 62 and couples to the profiled end of the connecting rod 70. To reduce friction, the connection uses a sleeve bearing 76 between the rod 70, bearing cap 74, and crankpin 62. From the crankpin 62, the connecting rod 70 connects to a crosshead 55 using a wrist pin 72 as shown in FIG. 4A. The wrist pin 72 allows the connecting rod 70 to pivot with respect to the crosshead 55, which in turn is connected to the plunger 80.

In use, an electric motor or an internal combustion engine (such as a diesel engine) drives the pump 50 by the gear reducer 53. As the crankshaft 60 turns, the crankpins 62 reciprocate the connecting rods 70. Moved by the rods 70, the crossheads 55 reciprocate inside fixed cylinders. In turn, the plunger 80 coupled to the crosshead 55 also reciprocates between suction and power strokes in the fluid assembly 56. Withdrawal of a plunger 80 during a suction stroke pulls fluid into the assembly 56 through the input valve 82 connected to an inlet hose or pipe (not shown). Subsequently pushed during the power stroke, the plunger 80 then forces the fluid under pressure out through the output valve 84 connected to an outlet hose or pipe (not shown).

In contrast to using a crankshaft for a quintuplex well-service pump that has crankpins 62 as discussed above, another type of quintuplex well-service pump uses eccentric sheaves on a direct drive crankshaft. FIG. 4C is an isolated view of such a crankshaft 90 having eccentric sheaves 92-1 . . . 92-5 for use in a quintuplex well-service pump. External main bearings (not shown) support the crankshaft 90 at its ends 96 in the well-service pumps housing (not shown). To drive the crankshaft 90, one end 91 extends beyond the pumps housing for coupling to drive components, such as a gear box. The crankshaft 90 has five eccentric sheaves 92-1 . . . 92-5 for coupling to connecting rods (not shown) with roller bearings. The crankshaft 90 also has two internal main bearing sheaves 94-1, 94-2 for internal main bearings used to support the crankshaft 90 in the pump"s housing.

In the past, quintuplex well-service pumps used for pumping frac fluid or the like have been substituted for mud pumps during drilling operations to pump mud. Unfortunately, the well-service pump has a shorter service life compared to the conventional triplex mud pumps, making use of the well-service pump as a mud pump less desirable in most situations. In addition, a quintuplex well-service pump produces a great deal of white noise that interferes with MWD and LWD operations, further making the pump"s use to pump mud less desirable in most situations. Furthermore, the well-service pump is configured for direct drive by a motor and gear box directly coupling on one end of the crankshaft. This direct coupling limits what drives can be used with the pump. Moreover, the direct drive to the crankshaft can produce various issues with noise, balance, wear, and other associated problems that make use of the well-service pump to pump mud less desirable.

One might expect to provide a quintuplex mud pump by extending the conventional arrangement of a triplex mud pump (e.g., as shown in FIG. 1B) to include components for two additional pistons or plungers. However, the actual design for a quintuplex mud pump is not as easy as extending the conventional arrangement, especially in light of the requirements for a mud pump"s operation such as service life, noise levels, crankshaft deflection, balance, and other considerations. As a result, acceptable implementation of a quintuplex mud pump has not been achieved in the art during the long history of mud pump design.

What is needed is an efficient mud pump that has a long service life and that produces low levels of white noise during operation so as not to interfere with MWD and LWD operations while pumping mud in a well.

A quintuplex mud pump is a continuous duty, reciprocating plunger/piston pump. The mud pump has a crankshaft supported in the pump by external main bearings and uses internal gearing and a pinion shaft to drive the crankshaft. Five eccentric sheaves and two internal main bearing sheaves are provided on the crankshaft. Each of the main bearing sheaves supports the intermediate extent of crankshaft using bearings. One main bearing sheave is disposed between the second and third eccentric sheaves, while the other main bearing sheave is disposed between the third and fourth eccentric sheaves.

One or more bull gears are also provided on the crankshaft, and the pump"s pinion shaft has one or more pinion gears that interface with the one or more bull gears. If one bull gear is used, the interface between the bull and pinion gears can use herringbone or double helical gearing of opposite hand to avoid axial thrust. If two bull gears are used, the interface between the bull and pinion gears can use helical gearing with each having opposite hand to avoid axial thrust. For example, one of two bull gears can be disposed between the first and second eccentric sheaves, while the second bull gear can be disposed between fourth and fifth eccentric sheaves. These bull gears can have opposite hand. The pump"s internal gearing allows the pump to be driven conventionally and packaged in any standard mud pump packaging arrangement. Electric motors (for example, twin motors made by GE) may be used to drive the pump, although the pump"s rated input horsepower may be a factor used to determine the type of motor.

Connecting rods connect to the eccentric sheaves and use roller bearings. During rotation of the crankshaft, these connecting rods transfer the crankshaft"s rotational movement to reciprocating motion of the pistons or plungers in the pump"s fluid assembly. As such, the quintuplex mud pump uses all roller bearings to support its crankshaft and to transfer crankshaft motion to the connecting rods. In this way, the quintuplex mud pump can reduce the white noise typically produced by conventional triplex mud pumps and well service pumps that can interfere with MWD and LWD operations.

Turning to the drawings, a quintuplex mud pump 100 shown in FIGS. 5 and 6A-6B has a power assembly 110, a crosshead assembly 150, and a fluid assembly 170. Twin drives (e.g., electric motors, etc.) couple to ends of the power assembly"s pinion shaft 130 to drive the pump"s power assembly 110. As shown in FIGS. 6A-6B, internal gearing within the power assembly 110 converts the rotation of the pinion shaft 130 to rotation of a crankshaft 120. The gearing uses pinion gears 138 on the pinion shaft 130 that couple to bull gears 128 on the crankshaft 120 and transfer rotation of the pinion shaft 130 to the crankshaft 120.

For support, the crankshaft 120 has external main bearings 122 supporting its ends and two internal main bearings 127 supporting its intermediate extent in the assembly 110. As best shown in FIG. 6A, rotation of the crankshaft 120 reciprocates five independent connecting rods 140. Each of the connecting rods 140 couples to a crosshead 160 of the crosshead assembly 150. In turn, each of the crossheads 160 converts the connecting rod 40"s movement into a reciprocating movement of an intermediate pony rod 166. As it reciprocates, the pony rod 166 drives a coupled piston or plunger (not shown) in the fluid assembly 170 that pumps mud from an intake manifold 192 to an output manifold 198. Being quintuplex, the mud pump 100 has five such pistons movable in the fluid assembly 170 for pumping the mud.

The cross-section in FIG. 10A shows a crosshead 160 for the quintuplex mud pump. The end of the connecting rod 140 couples by a wrist pin 142 and bearing 144 to a crosshead body 162 that is movable in a crosshead guide 164. A pony rod 166 coupled to the crosshead body 162 extends through a stuffing box gasket 168 on a diaphragm plate 169. An end of this pony rod 166 in turn couples to additional components of the fluid assembly (170) as discussed below.

The cross-section in FIG. 10B shows portion of the fluid assembly 170 for the quintuplex mud pump. An intermediate rod 172 has a clamp 174 that couples to the pony rod (166; FIG. 10A) from the crosshead assembly 160 of FIG. 10A. The opposite end of the rod 172 couples by another clamp to a piston rod 180 having a piston head 182 on its end. Although a piston arrangement is shown, the fluid assembly 170 can use a plunger or any other equivalent arrangement so that the terms piston and plunger can be used interchangeably herein. Moved by the pony rod (166), the piston head 182 moves in a liner 184 communicating with a fluid passage 190. As the piston 182 moves, it pulls mud from a suction manifold 192 through a suction valve 194 into the passage 190 and pushes the mud in the passage 190 to a discharge manifold 198 through a discharge valve 196.

As noted previously, a triplex mud pump produces a total flow variation of about 23%. Because the present mud pump 100 is quintuplex, the pump 100 offers a lower variation in total flow, making the pump 100 better suited for pumping mud and producing less noise that can interfere with MWD and LWD operations. In particular, the quintuplex mud pump 100 can produce a total flow variation as low as about 7%. For example, the quintuplex mud pump 100 can produce a maximum flow level of about 102% during certain crankshaft angles and can produce a minimum flow level of 95% during other crankshaft angles as the pump"s five pistons move in their differing strokes during the crankshaft"s rotation. Being smoother and closer to ideal, the lower total flow variation of 7% produces less pressure changes or “noise” in the pumped mud that can interfere with MWD and LWD operations.

Although a quintuplex mud pump is described above, it will be appreciated that the teachings of the present disclosure can be applied to multiplex mud pumps having at least more than three eccentric sheaves, connecting rods, and fluid assembly pistons. Preferably, the arrangement involves an odd number of these components so such mud pumps may be septuplex, nonuplex, etc. For example, a septuplex mud pump according to the present disclosure may have seven eccentric sheaves, connecting rods, and fluid assembly pistons with at least two bull gears and at least two bearing sheaves on the crankshaft. The bull gears can be arranged between first and second eccentric sheaves and sixth and seventh eccentric sheaves on the crankshaft. The internal main bearings supporting the crankshaft can be positioned between third and fourth eccentric sheaves and the fourth and fifth eccentric sheaves on the crankshaft.

a crankshaft rotatably supported in the pump by a plurality of main bearings, the crankshaft having five eccentric sheaves and a first bull gear disposed thereon, the main bearings including a first internal main bearing sheave disposed between the second and third eccentric sheaves and including a second internal main bearing sheave disposed between the third and fourth eccentric sheaves;

a pinion shaft for driving the crankshaft, the pinion shaft rotatably supported in the pump and having a first pinion gear interfacing with the first bull gear on the crankshaft; and

6. A pump of claim 1, wherein the crankshaft comprises a second bull gear disposed thereon, and wherein the pinion shaft comprises a second pinion gear disposed thereon and interfacing with the second bull gear.

7. A pump of claim 6, wherein the first bull gear is disposed between the first and second eccentric sheaves, and wherein the second bull gear is disposed between the fourth and fifth eccentric sheaves.

8. A pump of claim 6, wherein the five eccentric sheaves, the first and second internal main bearing sheaves, and the first and second bull gears are equidistantly spaced from one another on the crankshaft.

9. A pump of claim 6, wherein the first and second pinion gears comprise helical gearing of opposite hand, and wherein the first and second bull gears comprise helical gearing of opposite hand complementary to the pinion gears.

a crankshaft rotatably supported in the pump by two external main bearings and two internal main bearings, the crankshaft having five eccentric sheaves, two internal main bearing sheaves for the internal main bearings, and at least one bull gear disposed thereon;

13. A pump of claim 11, wherein a first of the main bearing sheaves is disposed between the second and third eccentric sheaves, and wherein a second of the main bearing sheaves is disposed between the third and fourth eccentric sheaves.

16. A pump of claim 11, wherein the at least one bull gear comprises first and second bull gears disposed on the crankshaft, and wherein the at least one pinion gear comprises first and second pinion gears disposed on the crankshaft.

17. A pump of claim 16, wherein the first bull gear is disposed between the first and second eccentric sheaves, and wherein the second bull gear is disposed between the fourth and fifth eccentric sheaves.

18. A pump of claim 16, wherein the five eccentric sheaves, the two internal main bearing sheaves, and the first and second bull gears are equidistantly spaced from one another on the crankshaft.

19. A pump of claim 16, wherein the first and second pinion gears comprise helical gearing of opposite hand, and wherein the first and second bull gears comprise helical gearing of opposite hand complementary to the pinion gears.

a crankshaft rotatably supported in the pump by a plurality of main bearings, the crankshaft having five eccentric sheaves and first and second bull gears disposed thereon, the first bull gear disposed between the first and second eccentric sheaves, the second bull gear disposed between the fourth and fifth eccentric sheaves;

a pinion shaft for driving the crankshaft, the pinion shaft rotatably supported in the pump, the pinion shaft having a first pinion gear interfacing with the first bull gear on the crankshaft and having a second pinion gear interfacing with the second bull gear on the crankshaft; and

26. A pump of claim 21, wherein the main bearings include first and second internal main gearing sheaves disposed on the crankshaft, and wherein the five eccentric sheaves, the two internal main bearing sheaves, and the first and second bull gears are equidistantly spaced from one another on the crankshaft.

27. A pump of claim 21, wherein the first and second pinion gears comprise helical gearing of opposite hand, and wherein the first and second bull gears comprise helical gearing of opposite hand complementary to the pinion gears.

a crankshaft rotatably supported in the pump by a plurality of main bearings, the crankshaft having five eccentric sheaves and first and second bull gears disposed thereon, the main bearings including two internal main bearing sheaves disposed on the crankshaft, wherein the five eccentric sheaves, the two internal main bearing sheaves, and the first and second bull gears are equidistantly spaced from one another on the crankshaft;

a pinion shaft for driving the crankshaft, the pinion shaft rotatably supported in the pump, the pinion shaft having a first pinion gear interfacing with the first bull gear on the crankshaft and having a second pinion gear interfacing with the second bull gear on the crankshaft; and

34. A pump of claim 29, wherein the first and second pinion gears comprise helical gearing of opposite hand, and wherein the first and second bull gears comprise helical gearing of opposite hand complementary to the pinion gears.

"Triplex Mud Pump Parts and Accessories;" Product Information Brochure; copyright 2007 Sunnda LLC; downloaded from http://www.triplexmudpump.com/triplex-mud-pump-parts.php on Sep. 5, 2008.

"Triplex Mud Pumps Triplex Mud Pump Parts for Sale;" copyright 2007 Sunnda LLC; Product Information Brochure located at http://www.triplexmudpump.com/.

"Triplex Mud Pumps Triplex Mud Pump Parts;" copyright 2007 Sunnda LLC; downloaded from http://www.triplexmudpump.com/F-series-triplex-mud-pumps-power-end.php on Sep. 5, 2008.

China Petrochemical International Co., Ltd.; "Quintuplex Mud Pump;" Product Information Brochure downloaded from http://www.intl.sinopec.com.cn/emExp/upstream/Quituplex-Mud-Pump.htm downloaded on Oct. 2, 2008.

FMC Technologies; "Fluid Control: Well Service Pump;" Product Information Brochure; downloaded from http://www.fmctechnologies.com/-FluidControl-old/WellServicePump.aspx on Sep. 5, 2008.

National Oilwell; "Triplex Mud Pumps;" Product Information Brochure; downloaded from http://nql.com/Archives/2000%20Composite%20Catalog/pg-32.html downloaded on Sep. 5, 2008.

The MI Swaco Max Gel 50 lb viscosifier is a premium 220-bbl yield Wyoming bentonite blended with special extenders. Applications for the MI Swaco Max Gel 50 lb viscosifier include rapidly building mud viscosity and providing superior hole cleaning as well as helping to control lost circulation, formation sloughing, and hole instability in unconsolidated formations. The viscosifier is capable of yielding more than twice as much viscosity as regular Wyoming bentonite and is usable in the following types of wells:potable-water wells

We believe energy makes society progress, so we find ways to help our customers fuel agriculture, industry, medicine, science, space, technology, and transportation. Few parts of modern life, if any, are untouched by the raw materials of oil and gas. And it all starts with competent and talented teams working together to drill wells through subterranean environments they can never actually see. It takes a combination of engineering disciplines, along with computer science, geophysics, and metallurgy. Then there are astounding efforts to keep older wells pumping despite time’s inevitable drain on production. From a well’s cradle to grave, and everywhere in between—that is where the people of Schlumberger come in.”

Schlumberger is now aiming its expertise in a new direction: lowering the cost per barrel of oil and gas development via the provisioning of integrated, performance-linked services. Management believes that a combination of Schlumberger’s unique technologies along with a new business model embodying full integration and alignment of interests will allow for transformational leaps in oilfield efficiencies and reservoir productivity, and early signs have been positive.

This cost-cutting focus puts Schlumberger in an ideal position in the coming years as international oil and gas activity recovers. International producers have struggled with rising costs for decades thanks to limited efficiency improvements. We think the success of Schlumberger in addressing this problem will drive market share gains in the years ahead.

Intangible Assets and Cost Advantages Dig Narrow Moat We award Schlumberger a narrow economic moat rating. We believe the company’s history of generating strong returns on capital is very likely to continue.

Schlumberger has delivered strong returns on capital for decades via its ability to develop and sell differentiated products and services in the oilfield-service industry. Often these differentiated products are new, or novel variations of older technologies, which particularly limits competition and ensures high margins and returns on capital for Schlumberger. New products’ share of revenue has averaged about 20% for about three decades, since the company began reporting the metric.

Schlumberger’s ability to develop differentiated products with low product development costs (or, equivalently, high returns on R&D) is enabled by the company’s intangible assets and cost advantage. Intangible assets include intellectual property, organizational know-how, brand, and (increasingly) data. The existing stock of thousands of patents alone should provide a long runway of existing and new products, and hundreds of new patents are filed each year.

One unconventional source of intangible assets is the company’s human capital. Schlumberger is superior, particularly in international markets, in providing an excellent platform for human capital, including scientific and engineering talent. The company has a distinguished record in utilizing local talent internationally, which is cheaper, more captive, and in many cases better suited to adapt technology to local conditions.

Additionally, Schlumberger benefits from a cost advantage in terms of economies of scale in its international service lines as well as economies of scope in its R&D investments. Not only does Schlumberger invest more in R&D than all its peers combined, but we believe it earns superior returns on this, with these economies of scope being a major contributor. The company has long been successful in utilizing its core knowledge in reservoir characterization to drive new product development in that segment as well as others, like drilling and production’s artificial lift.

Reservoir characterization is composed of business lines like seismic and wireline logging, which have traditionally been used to discover and understand new oil and gas reservoirs. Although its share of revenue shrank from perhaps over 50% in the mid-2000s to only 19% in 2016, the segment has generally yielded the highest returns on capital. More important, it nourishes Schlumberger’s core capabilities in understanding oil and gas reservoirs and downhole environments, allowing the company to best its peers in many non-reservoir characterization business lines like those in drilling or production.

The ongoing shift away from the discovery of new conventional oil and gas resources to the development of shale oil and gas is a challenging development for Schlumberger’s reservoir characterization segment. Before the ascendance of shale, a race to explore new oil and gas reservoirs in increasingly difficult environments, such as the presalt deep-water reservoirs, was a key driver of high exploration activity and Schlumberger’s competitive advantage in reservoir characterization. Schlumberger has long maintained a large share of sales coming from new products that carry very wide margins owing to limited or no competition.

Following the fall in oil prices in 2014, exploration and production expenditure shriveled up. The value of new oil discoveries has diminished tremendously due to the unlocking of abundant U.S. shale resources. Future exploration activity is likely to be not only lower but also somewhat less complex, focusing on targets more similar to existing developments of oil and gas, such as deep-water Mexico. This would seem to increase the likelihood of competitors being able to narrow the gap with Schlumberger, challenging the company’s returns on capital.

However, the closing of the exploration frontier does not mean that Schlumberger will lose all ability to stay ahead of the curve in reservoir characterization. Mature fields, in which Schlumberger has developed a leading expertise, in many respects require a large degree of reservoir characterization input. Maintaining production from mature fields requires a dynamic understanding of the reservoir (necessitating continuing gathering of data), as well as a very fine-grained understanding of the reservoir, in order to identify bypassed hydrocarbons and maximize total production of oil in place.

Thus, while we think that reservoir characterization revenue and economic profit will be smaller than in the past, we are confident that economic profit will not erode entirely. We expect Schlumberger’s moat and excess returns on capital in the segment to remain in place for years to come.

In the drilling group, Schlumberger creates the basis for a moat by delivering drilling products and services that lower operators’ cost of drilling relative to alternatives. The value created is shared with Schlumberger. Most commonly, this comes in the form of premium pricing, which is value-accretive to the operator by reducing the operator’s total drilling cost in other areas, often from reducing drilling operating days per well or project.

For decades, Schlumberger has benefited from its ability to transfer its unique knowledge from its core reservoir characterization business lines to its drilling business lines to develop new technologies. The company has since at least the late 1980s been a dominant player and earned high margins in directional drilling, logging while drilling, and associated business lines. With the 2010 acquisition of Smith International, however, the company made a bold move to enter a much broader array of drilling businesses, including drillbits and other drilling tools. Management’s thesis was that future improvements in drilling performance would come predominantly from companies able to integrate the full spectrum of downhole drilling products and services. This ability to deliver differentiated drilling performance would drive value creation for Schlumberger and its customers alike.

At first, the Smith acquisition was not accretive to shareholder value, owing to the high price paid for the business, as well as slightly lower operating margins relative to mid-2000s levels. By 2014, this had turned around, with drilling earning solid economic profits. To some degree, this was due to a strong uptick in industry drilling activity. But it also was due to Schlumberger’s ability to launch new drilling products derived from a synergy of Smith’s capabilities with its own expertise.

Steep competition in U.S. shale is likely to hold down North American drilling group margins at midcycle relative to 2014 levels. We think Schlumberger, along with other large integrated service companies, has benefited thus far from an ability to transfer select leading-edge drilling technologies pioneered in markets like deep-water offshore into U.S. shale in order to drive horizontal drilling efficiencies. Competition here is likely to escalate as we believe operators are willing to experiment with cheaper alternative products.

But with North America accounting for only 25% of 2014 drilling group revenue and 27% of our forecast 2021 revenue, weakness in this market shouldn’t hold back Schlumberger’s ability to generate economic profits at midcycle in the segment overall. Without the combination of local engineering talent, entrepreneurial drive, and high-rep trial-and-error opportunity afforded by U.S. shale development, international customers will continue to rely on Schlumberger’s expertise to select the right combination of drillbit, mud, directional drilling tool, and other drilling products.

Schlumberger’s differentiation in this regard will only increase with continued moves toward integrated provision of services. Integrated projects have increased as a share of revenue across Schlumberger in recent years. We believe a large portion of this increase has come from drilling group revenue associated with integrated drilling services projects, with major projects in the Middle East, Russia, Latin America, and the North Sea. Particularly in international markets, the data and knowledge that Schlumberger will glean from its integrated projects will be vital in allowing the company to market and develop products that boost drilling efficiencies, substituting for the bottom-up experimentation that prevails in U.S. shale.

We incorporate much lower offshore deep-water drilling activity into our model. But Schlumberger has strong exposure to non-deep-water international drilling markets, and profits overall will still be sufficient to generate high levels of economic profit on the company’s drilling capital base even including its large amount of goodwill.

The production group comprises a relatively diverse array of business lines. Although North American pressure pumping does not have a moat, in our view, we believe most of the other business lines of the segment do.

These include completion products (used just prior to starting a well) as well as artificial lift products (essentially pumps used to boost well production). Completion products include many technologies used in conjunction with pressure pumping in the hydraulic fracturing process but much more differentiated. The company’s BroadBand products, along with Halliburton’s offerings, stand as the most effective diverter solutions in the industry and yield better, more distributed fracturing jobs with higher production levels.

In artificial lift, Schlumberger’s sales are predominantly in high-complexity products like electrical submersible pumps, where Schlumberger and Baker Hughes dominate the market with about 50% share collectively. These pumps are highly efficient but must be customized to various downhole operating environments, allowing Schlumberger to derive a competitive advantage through its downhole/reservoir knowledge base.

Schlumberger Production Management has become the company’s new star business unit. Management has said that SPM has delivered returns on capital about 700 basis points higher than the rest of the business since 2011. In SPM contracts, Schlumberger takes full responsibility for managing the development and production of a large oil or gas field. Such arrangements have been long sought after by large oilfield-service companies, but only Schlumberger has had success at such a large scale thus far. In SPM, Schlumberger’s margins are driven by either the cash flows the project generates or the production the project yields above a baseline level. Because Schlumberger has been able to consistently produce more oil and gas at a lower cost per barrel, it has been rewarded handsomely.

Cameron contributes to Schlumberger’s narrow moat, although our confidence is slightly lower owing to the segment’s historically lower pregoodwill returns on invested capital as well as the possibility that lasting overcapacity in erstwhile high-return business like blowout preventers and well trees could depress profitability in the business. These businesses remain essential oligopolies, dominated by Cameron along with giants like General Electric and National Oilwell Varco in blowout preventers and GE and TechnipFMC in trees. The barriers to entry, in terms of intellectual property acquisition, are quite large.

In OneSubsea, which includes subsea trees and production systems as well as a variety of technologies contributed from Schlumberger before the merger, we think there is healthy room for Cameron to differentiate itself. For example, its ability to deliver small one- to three-well subsea projects that are tied back to existing infrastructure at a lower cost to offshore operators has led to several contract wins. Such projects, which benefit economically from the ability to utilize sunk costs in the form of existing infrastructure, are likely to be a higher share of offshore development moving forward.

Success Depends on Long-Term Oil and Gas Demand Like essentially all oilfield-service companies, Schlumberger would be vulnerable to an economic or technological shock that reduced the long-term growth in oil and gas demand. Short-term, cyclical movements in economic growth, oil and gas demand, or oil and gas prices are all less consequential for the value of the enterprise.

Like most diversified oilfield-service companies, Schlumberger faces significant geopolitical risk. Oil resources are spread across a wide variety of countries, meaning that oil producers have less available discretion with respect to choosing political partners compared with participants in other industries. The ability of oil-producing countries to seize oil assets means that Schlumberger’s receivables to national oil companies entail counterparty risk. This has been demonstrated in Venezuela, where Schlumberger was forced to write down the value of its receivables by $500 million.

Unsurprisingly for a company that has long generated high returns on capital, Schlumberger has superb financial health. Net debt has not risen above 2 times adjusted EBITDA in over a decade, and we expect net debt to shrink to below 1 by the end of our forecast period. Even in our bear case, we believe net debt/EBITDA will be below 1 by 2023.

Stewardship Is Exemplary Within Schlumberger’s core oilfield-service business, management has long demonstrated an outstanding ability to derive great value from investing in a combination of capital expenditure, research and development, and bolt-on acquisitions. Along with the intrinsic moat of the business, management deserves a large share of credit for the outstanding shareholder value creation of the last 10-15 years. Because a large part of Schlumberger’s moat derives from its diversification and scale--via R&D efficiencies and the ability to integrate services--management is uniquely positioned to either squander or supplement the value stemming from the Schlumberger moat. Management faces the unceasing mandate to allocate capital across a diverse array of business lines. For other integrated service companies, this responsibility has been borne quite poorly by management in the past (most notably Weatherford). Comparing Schlumberger’s remarkable performance with that of peers starkly highlights management’s contribution. We applaud management’s foresight and aggressive initiative, which has played a large role in maintaining Schlumberger’s edge over peers.

Schlumberger has a more mixed record when it has ventured into larger, more ambitious acquisitions. Prior management’s infatuation with becoming an oilfield services/information technology conglomerate led to large amounts of value destruction, culminating in the multi-billion-dollar loss stemming from the 2001 acquisition and 2003 sale of Sema. More recently, we think management created a modest amount of value via the $11 billion acquisition of Smith in 2010 but likely destroyed an offsetting amount of value in the $15 billion acquisition of Cameron in 2015 via the too-hopeful offshore recovery expectations embedded in the purchase price. In any case, with Schlumberger now possessing an essentially complete portfolio of upstream oil and gas services, we think chances are remote that the company will embark on another mega-acquisition in at least the next decade. Furthermore, Schlumberger’s 2018 exit from its seismic acquisition business, while likely coming too late to create substantial value for the company, at the very least signals management’s continued discipline in avoiding future value destruction.

The Nahr Umr / Shuaiba interface is often a point where highly conductive faults are encountered. Severe losses of drilling mud often occur at this interface resulting in a dramatic reduction of hydrostatic pressure as the wellbore annulus fluid level falls. This pressure loss causes the unstable formation to collapse in on the drillstring and BHA, packing it off and making it practically impossible to retrieve.

8613371530291

8613371530291