overshot oil and gas price

"We believe this move has overshot," Goldman Sachs commodities strategist Damien Courvalin stated in a new note to clients. "While risks of a futurerecession are growing, key to our bullish view is that the current oil deficit remains unresolved, with demand destruction through high prices the only solver left as still declining inventories approach critically low levels."

Oil prices have been dropping in July as economists across Wall Street increasingly state that a 2023 recession is in the cards. On Tuesday, WTI Crude fell below $100 a barrel for the first time since May, placing further pressure on shares of crude sensitive stocks such as ExxonMobil, Chevron, and Transocean. Oil prices touched slightly below $96 a barrel on Wednesday, a price not seen since mid-April.

The pullback in crude oil — even if short-lived — is beginning to feed its way to relief at the gas pump for inflation battered consumers. The current average price of regular gasoline in the U.S. is $4.77 a gallon, according to Gas Buddy data, down from an all-time high of $5.03 a gallon on June 16.

“While we may see prices decline into this week, the drop could fade soon if oil prices reverse, especially with strong demand over the holiday," stated Patrick De Haan, Gasbuddy head of petroleum analysis. "For the time being, Americans are spending nearly $100 million per day less on gasoline than when prices peaked a few weeks ago, and that’s well-needed relief at a time when gas prices remain near records."

The surge in oil prices this year has angered drivers, tainted Americans’ views on the economy and confounded both the White Houseand Federal Reserve. Unfortunately, JPMorgan Chase says the oil spike is just getting started.

(JPM) warned clients that Brent crude oil will hit $125 a barrel next year and $150 in 2023, in large part because OPEC doesn’t have nearly as much firepower to respond to high prices as many assume.

“They don’t have the barrels. It’s a mirage,” Christyan Malek, JPMorgan’s head of oil and gas research and the lead author of the new report, told CNN in a phone interview.

$150 oil is more than double today’s Brent price of about $73.50. If that forecast proves accurate, it would likely translate to national gas prices topping $5 a gallon and surely exacerbate inflationary pressures hitting the US economy and squeezing American families.

The central problem, Malek said, is that while OPEC nations have plenty of oil in the ground, they don’t have the capital and logistics to deliver it quickly.

OPEC’s real spare capacity, a closely watched metric that measures the amount of barrels that can swiftly be added to the market, stands at just 2 million barrels per day next year, JPMorgan estimates. That is less than half of what many on Wall Street assume.

OPEC’s spare capacity equates to just 4% of total capacity, down from an average of 14% between 1995 and 2020 and well below the 10% comfort level, JPMorgan said. When this buffer gets unusually low, oil prices can spike and investors apply a premium to prices.

The fear in those situations is that the oil market is just one shock (a war, natural disaster or another supply disruption) away from being unable to meet demand.

Importantly, JPMorgan is not calling for oil to trade at $125 a barrel for all of 2022. Instead, the bank is predicting crude will average $88 next year and “overshoot” to $125 at some point. Likewise, JPMorgan sees Brent averaging $82 in 2023 but overshooting to $150.

Oil prices collapsed on Friday on fears that the Omicron variant will deal a blow to surging energy demand by eating into the amount of people driving and flying. Crude bounced back Monday, though it remains well below recent highs.

But Malek explained he has been working on this analysis for months and the forecast isn’t altered by Omicron. That’s because if the new coronavirus variant does dent demand, OPEC would likely offset it by cutting supply.

OPEC and its allies are meeting on Thursday and must decide whether to push forward with a plan to add 400,000 barrels per day in supply despite the Omicron fears and a United States-led intervention to unleash strategic reserves. Prior to the emergence of Omicron, the White House urged OPEC+ to stick with its plans to gradually increase supply.

Veteran energy analyst Tom Kloza, president of the Oil Price Information Service, said $150 oil would roughly translate to $5-a-gallon gasoline nationally.

Prices at the pump have already been a sore spot for consumers. The national average currently stands at $3.39 a gallon, up from $2.13 a year ago, according to AAA.

JPMorgan said world oil producers, including OPEC, have failed to put up the amount of capital required to ramp up production enough to meet demand. The Wall Street bank estimates there is a $750 billion gap in terms of global oil capital spending, requiring oil to rise to $80 to incentivize further investment.

Secondly, Wall Street investors have demanded oil companies stop spending all their cash flows on expensive drilling projects. Oil drillers are being strongly encouraged to live within their means and return extra cash to shareholders through dividends and buybacks.

And then there’s the energy transition. Under pressure from shareholders, governments and society at large, oil companies are spending money on reducing emissions and building low-carbon businesses. That’s especially the case in Europe, where BP, Shell and other major companies have promised to slash emissions and invest heavily in electric charging and renewable energy.

The Energy Information Administration expects Brent crude to slide to an annual average of $72 a barrel next year as production grows from OPEC+, US shale and other non-OPEC countries.

“It reminds me of when we hit $145 a barrel in July 2008 and some banks predicted $200 by year’s end,” Kloza said in an email to CNN, “only to see the post Lehman Brothers financial debacle push prices instead to the $30s.”

Oil prices have rallied to multiyear highs on surging demand, tight supply, and the crunch on natural gas. Brent crude futures, the benchmark in global energy markets, hit a three-year high of above $86 a barrel in late October. Futures for West Texas Intermediate (WTI), the U.S. benchmark, surpassed $85 a barrel, the highest since October 2014. We analyze the dynamics of the crude market below.

The key question is whether the rally in oil prices can be sustained. Rising natural gas prices and a cold winter could lead to a further increase in prices. However, this rally has extended beyond market fundamentals. Oil markets are historically volatile, and should crude overshoot current levels, a correction would likely be sharp. From a trading perspective, this isn’t the right time or price to take long positions, in our view. That is partly because many sell-side commodity traders are revising their forecast to $100 a barrel, while physical markets aren’t showing a level of tightness consistent with that.

It’s true that in the United States, inventories of crude and petroleum products have fallen below the five-year average. This indicator, however, is misleading due to the jump in inventories during the Covid-19 pandemic. It is fair to say that inventory levels are now close to those of late 2018 and early 2019. During that period, oil prices were volatile, between $40–$70 a barrel.

Our fair value model for oil shows $69 a barrel for WTI. But prices have already overshot this level, showing the steepest increase since we started our fair value analysis. In our view, for oil to continue to trade at more than $80 a barrel, inventories will need to decline in January and February — the seasonally weakest months of the year. If inventories do not decline during this winter, we believe prices of WTI in the futures market will likely converge to our fair value to reflect existing supply-demand conditions.

Why are prices overshooting? We believe it is because of concerns about shortages as the northern hemisphere heads into winter. It has little to do with oil’s physical markets. Prices of other energy sources, natural gas, and coal, have spiked due to low inventories, rising demand from China, and worries about a cold winter. The surge in global natural gas and coal prices has also lifted oil futures, partly because of expectations about rising demand for cheaper oil. There are also supply shortages for light, sweet crude in Europe.

Demand for light, sweet crude is high because of refinery dynamics, including its lower refining cost. Refineries are heavy users of energy. Complex and profitable refineries process high sulfur oil (cheaper oil) at hydrocrackers that use hydrogen generated from natural gas. Higher gas prices in Europe and Asia have raised the operational cost of these hydrocrackers. As a result, crude inventories remain low in Cushing, Oklahoma, a storage hub and delivery point for the NYMEX WTI futures contract, while more barrels are being diverted to fill the new Capline pipeline in Illinois. These dynamics have contributed to the low price spread between Brent and WTI crude.

Demand, however, remains low for heavier, sour crude. There are still unsold barrels of this oil in the Middle East, including the Upper Zakum grade crude from the United Arab Emirates. West African grades are also having a tough time as freight costs increase. In addition, China’s limited oil import quotas are having a troubling impact on oil from Angola.

The rally in the futures market has extended beyond the fundamentals of the physical markets, in our view. The Organization of Petroleum Exporting Countries and its partners (OPEC+), a 23-nation grouping led by Saudi Arabia and Russia, are sellers in the real market. They are more concerned about the physical market for oil versus the financial markets.

A colder winter could send natural gas and coal prices soaring, and this could impact crude prices as companies and manufacturers further switch to using oil. However, because we rely on physical markets, and not necessarily the weather, to forecast the trend in oil markets, we believe it is time to question the current rally. We have a neutral view on oil prices over the short term and a bearish view over the long term.

Oil prices have rallied to multiyear highs on surging demand, tight supply, and the crunch on natural gas. Brent crude futures, the benchmark in global energy markets, hit a three-year high of above $86 a barrel in late October. Futures for West Texas Intermediate (WTI), the U.S. benchmark, surpassed $85 a barrel, the highest since October 2014. We analyze the dynamics of the crude market below.

The key question is whether the rally in oil prices can be sustained. Rising natural gas prices and a cold winter could lead to a further increase in prices. However, this rally has extended beyond market fundamentals. Oil markets are historically volatile, and should crude overshoot current levels, a correction would likely be sharp. From a trading perspective, this isn’t the right time or price to take long positions, in our view. That is partly because many sell-side commodity traders are revising their forecast to $100 a barrel, while physical markets aren’t showing a level of tightness consistent with that.

It’s true that in the United States, inventories of crude and petroleum products have fallen below the five-year average. This indicator, however, is misleading due to the jump in inventories during the Covid-19 pandemic. It is fair to say that inventory levels are now close to those of late 2018 and early 2019. During that period, oil prices were volatile, between $40–$70 a barrel.

Our fair value model for oil shows $69 a barrel for WTI. But prices have already overshot this level, showing the steepest increase since we started our fair value analysis. In our view, for oil to continue to trade at more than $80 a barrel, inventories will need to decline in January and February — the seasonally weakest months of the year. If inventories do not decline during this winter, we believe prices of WTI in the futures market will likely converge to our fair value to reflect existing supply-demand conditions.

Why are prices overshooting? We believe it is because of concerns about shortages as the northern hemisphere heads into winter. It has little to do with oil’s physical markets. Prices of other energy sources, natural gas, and coal, have spiked due to low inventories, rising demand from China, and worries about a cold winter. The surge in global natural gas and coal prices has also lifted oil futures, partly because of expectations about rising demand for cheaper oil. There are also supply shortages for light, sweet crude in Europe.

Demand for light, sweet crude is high because of refinery dynamics, including its lower refining cost. Refineries are heavy users of energy. Complex and profitable refineries process high sulfur oil (cheaper oil) at hydrocrackers that use hydrogen generated from natural gas. Higher gas prices in Europe and Asia have raised the operational cost of these hydrocrackers. As a result, crude inventories remain low in Cushing, Oklahoma, a storage hub and delivery point for the NYMEX WTI futures contract, while more barrels are being diverted to fill the new Capline pipeline in Illinois. These dynamics have contributed to the low price spread between Brent and WTI crude.

Demand, however, remains low for heavier, sour crude. There are still unsold barrels of this oil in the Middle East, including the Upper Zakum grade crude from the United Arab Emirates. West African grades are also having a tough time as freight costs increase. In addition, China’s limited oil import quotas are having a troubling impact on oil from Angola.

The rally in the futures market has extended beyond the fundamentals of the physical markets, in our view. The Organization of Petroleum Exporting Countries and its partners (OPEC+), a 23-nation grouping led by Saudi Arabia and Russia, are sellers in the real market. They are more concerned about the physical market for oil versus the financial markets.

A colder winter could send natural gas and coal prices soaring, and this could impact crude prices as companies and manufacturers further switch to using oil. However, because we rely on physical markets, and not necessarily the weather, to forecast the trend in oil markets, we believe it is time to question the current rally. We have a neutral view on oil prices over the short term and a bearish view over the long term.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Dutch natural gas prices plunged as much as 21% on Monday as European countries continue to build up supplies in anticipation of the upcoming winter months.

September futures prices for Dutch natural gas saw their steepest drop since March, falling to as low as 268 euros per megawatt hour. Still, the sharp decline only brought prices down to levels seen last week, highlighting just how far the commodity has surged in recent weeks and months. Dutch natural gas prices are up more than 1,000% since last year.

Driving Monday"s decline is a mix of supply and demand dynamics that include ongoing demand destruction as various industries adapt to the surging prices and a potential recession, and Germany indicating that its gas storage facilities are reaching capacity faster than expected.

German Economy Minister Robert Habeck said he expects gas prices to start cooling down now that Germany"s gas storage facilities are 85% full, ahead of its October target. "As a result, the markets will calm and go down," Habeck said.

"European gas prices have in our view overshot fundamentals fueled by a combination of supply and demand (heat wave, nuclear outages) concerns and exceptionally poor liquidity in the market, illustrated by erratic and sparse intra-day price moves," Goldman Sachs" analyst Samantha Dart said.

A resumption of gas flows from the Nord Stream 1 pipeline could add to further natural price declines, Goldman added, though there is no indication of when that may happen as the pipeline deals with reported maintenance issues.

Goldman ultimately expects Dutch natural gas prices to fall to a range of 170 to 190 euro per megawatt hour, which would represent a sharp decline of as much as 41% from current levels.

"The longer prices remain this high, the higher the impact on demand, further reinforcing our view that storage will enter winter at comfortable levels, setting the stage for sequentially lower prices through winter," Dart said.

From corn to crude and copper, commodities have enjoyed a stellar start to 2021 as investors scour the market for inflation hedges and bets on the “greening” of the global economy.

A fierce rally in copper has sent it above $9,000 a tonne for the first time since 2011. After a dramatic recovery, Brent crude on Tuesday briefly crossed $66 a barrel, the level at which it started a tumultuous 2020. And corn is up about 17 per cent since the start of 2021 to an almost eight-year high of $5.54 a bushel.

Predictions of a so-called supercycle — a prolonged period of high prices as demand outstrips supply — have lured investors to commodities, according to sector specialists. Others are seeking to buy real assets as protection against inflation.

“The latest commodity price gains are being driven by money inflows and inflationary expectations, rather than actual physical buyers,” said Alastair Munro of Marex Spectron, a brokerage.

Inflation is becoming more of a concern among investors, as a result of the unprecedented monetary and fiscal policies enacted during the crisis. A weakening dollar is also making commodities cheaper in other currencies, fanning demand.

“There are many signs that economic recovery, combined with massive monetary and fiscal stimulus, could lead to inflation as newly created money finds its way into the real economy rather than just financial assets,” said Ian Lance, co-manager of Temple Bar Investment Trust.

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

Ole Hansen, head of commodities strategy at Saxo Bank, said the market risked entering a “vicious cycle” where speculators, and investors looking for a hedge against inflation, fed off each other.

In China, the net speculative long position in copper on the Shanghai Futures Exchange — the difference between bets on rising and falling prices — has jumped sharply since the end of the lunar new year holiday.

Goldman Sachs and other big investment banks believe copper is heading for its biggest supply deficit in a decade as production fails to keep pace with demand in China and the rest of the world — especially as government spending on green infrastructure rises.

However, some analysts are concerned that policymakers in China will move to tighten credit conditions to rein in asset bubbles. That could sap its demand for industrial inputs.

The oil rally in recent months has been stoked by a recovery in transport demand as countries loosen virus-related curbs. But there has also been strong support provided by oil producers, which have cut output substantially to offset the hit to consumption.

Morgan Stanley said this week that it estimated the oil market was now in a deep deficit, with demand outstripping supply by as much as 2.8m barrels a day this year. “The stars have aligned for the oil market even faster than expected,” said Martijn Rats at Morgan Stanley.

While oil demand is still at least 5m b/d lower than in 2019, primarily due to economic fallout from the pandemic, it is expected to rebound once Covid-19 vaccinations are rolled out.

The Opec producer group could respond by raising production, but oil companies globally have been slashing investments in new supply. Some Wall Street banks argue that demand will continue to outstrip supply growth in the coming years, potentially creating one last price surge before electric vehicles cause consumption to peak.

Bank of America analysts said on Tuesday that under-investment in supply could send oil as high as $100 a barrel in the next five years. But such a surge would probably be shortlived, they said, forecasting Brent is more likely to average $50 to $70 a barrel between now and 2026.

High oil prices are still the cure for high oil prices. In October 2021, West Texas Intermediate (WTI) crude oil advanced to more than USD 80 per barrel—a level last seen in 2014—reflecting the mismatch between a sharp, year-over-year recovery in global energy demand as economies reopen and the time needed for the industry to ramp up output to pre-pandemic levels. The upsurge in oil prices has fueled a strong rally in energy stocks and contributed meaningfully to the inflationary pressures affecting both consumer prices and producer costs. While we see the potential risk of further oil price upside in the next quarter or two, our conviction in the secular bear market for commodities remains intact.

We’ve seen this story before. The prices of crude oil and other commodities tend to overshoot on the downside to disincentivize production when there is a negative demand shock and then rebound, temporarily, to artificially high levels as demand recovers to stimulate a supply response and rebalance the market. Even amid a global economic recovery, higher oil prices are unlikely to prove sustainable and, in our view, should start to recede toward midcycle levels at some point next year.

Given elevated equity valuations and commodity prices, we are remaining disciplined in our exposure to oil and gas producers and mining companies. On the other hand, we are finding what we regard as compelling opportunities in specialty chemicals and paper packaging.

We do not believe that fundamentals support a prolonged bull market in oil, but we see the potential for crude prices to remain elevated in the near term.

Although WTI has climbed to levels that we believe should be sufficient to engender the supply response needed to balance the market, it still takes time for energy producers to ramp up activity and output because of the coronavirus pandemic and the challenges of mobilizing people and equipment after suffering through two oil price collapses in the past five years.

At the same time, surging prices in international gas markets threaten to increase demand for crude oil as an alternative feedstock in electricity generation and industrial applications. Among other factors, we believe that this unusual strength reflects supply outages and increased competition from Asia and Latin America for liquefied natural gas (LNG) cargos. The international market could tighten further if cold temperatures in the Northern Hemisphere spur heating demand, a scenario that would likely propel natural gas prices even higher and increase the call on crude oil as a substitute thermal fuel.

We do not view the upsurge in Asian and European natural gas prices as a product of a structural change in this commodity market. As heating demand recedes in the spring and some of the temporary factors that have tightened the natural gas market start to alleviate, we would expect inventory levels to rebuild and prices to normalize, reducing crude oil’s appeal as a replacement fuel.

The magnitude of the oil demand shock stemming from the coronavirus pandemic was unprecedented and briefly plunged WTI prices to negative levels in April 2020—a clear signal that energy companies needed to curtail their output. This year, the recovery in oil production has lagged the sharp recovery in crude oil demand as economic activity has resumed, sending WTI prices to levels that should prompt the energy patch to accelerate drilling.

Some market participants have questioned whether the supply response will be enough. A narrative has emerged that U.S. shale players’ capital discipline and potential disinvestment in oil and gas development because of environmental, social, and governance (ESG) concerns have contributed to and could sustain higher oil prices.

But evidence suggests that we are seeing the familiar pattern of oil prices and industry activity levels overshooting to the downside and then to the upside in response to an extreme market dislocation. Debt issuance and credit spreads indicate that high yield energy companies continue to enjoy access to the capital markets, despite the market’s increased sensitivity to ESG factors (Figure 1). More importantly, the U.S. oil-directed rig count has increased at a similar pace off the bottom as in 2016 and 2017 (Figure 2), when drilling activity began to rebound from a downcycle driven by surging hydrocarbon output from shale and OPEC’s decision not to cut supply.

Admittedly, the recent recovery in the U.S. oil-directed rig count has occurred from a lower base. However, we believe that the market does not fully appreciate the massive strides that the industry has made in producing more oil and gas with fewer rigs over the past three years. In our view, the U.S. oil-directed rig count has already recovered to levels that, eventually, should generate at least the incremental output needed to fill the gap created by typical demand growth and the base decline rate in production from existing wells.

...we believe that the market does not fully appreciate the massive strides that the industry has made in producing more oil and gas with fewer rigs over the past three years.

Looking beyond the rebalancing process that should take place as the industry steps up drilling and well completion in response to higher prices, we see the potential for ongoing productivity gains to continue to pressure the cost curve for oil and, accordingly, higher-cost operators’ profit margins on invested capital.

Going forward, the pace of efficiency gains in U.S. shale may slow from the rapid rates experienced over the past seven to 10 years. However, there is likely still significant room for progress. Rig productivity in the Permian Basin, an area in West Texas and New Mexico that we believe contains some of the best reservoir rock in the U.S. onshore market, eventually should catch up with operations in the Bakken region, an area predominantly in North Dakota that is further along in its development cycle (Figure 3). We also continue to monitor leading upstream operators’ efforts to improve overall resource recovery rates from shale formations—currently estimated at 7% to 8% of oil in place—through various innovations that would boost reservoir pressures.

*The Bakken is an oil-producing region predominantly in North Dakota that is further along in its development life cycle than the Permian Basin, an area in West Texas and New Mexico. Note that extreme oil supply and demand shocks, such as the ones experienced in 2016 and 2020, can distort drilling efficiency metrics because of the consequent drawdown in the active rig count and, then, during the initial stages of the recovery phase, the completion of backlogs of drilled but uncompleted wells, leading to increased production at a lower rig count. We believe that oil and gas producers should retain some of the incremental efficiency gains that occurred during the downturn, as in 2016.

And the potential productivity gains aren’t restricted to U.S. shale. The costs associated with offshore and deep-water oil and gas production also have come down significantly. Factors at play include an increasing emphasis on opportunities that tie in to existing infrastructure, a focus on new developments that target high-quality reserves without taking on too much engineering complexity, and material deflation in service and equipment costs.

The combination of what we regard as elevated valuations and commodity prices in the context of a longer-term bear market creates, in our view, an unfavorable risk/reward setup for many of the higher-beta segments in the natural resource universe. Accordingly, we remain selective in our energy and mining investments. In keeping with our mandate, we aim to maintain a philosophically appropriate level of risk-adjusted exposure to these commodity-sensitive industries through valuation discipline and a focus on what we regard as the highest-quality names.

Specialty chemicals is one area that we like, as we believe that the industry should benefit over the long term from lower commodity prices. The setup in companies that focus on paints and other coating products strikes us as potentially attractive. Historically, the best of these firms have been able to protect margins by passing along rising input costs to customers and then retained a portion of these pricing gains when oil prices eventually recede.

We also prefer investments in industries in which a rising incentive cost curve can pull commodity prices higher, potentially improving producers’ profit margins. For example, over the next three to five years, we expect demand growth related to online shopping and the increasing substitution of paper for plastic packaging to be a tailwind for containerboard producers. In contrast to the energy sector, we see the potential for the cost of adding incremental capacity to rise in the coming years, in part, because the number of existing paper plants that could be converted inexpensively to producing cardboard has dwindled. This scenario of increasing demand and, critically, rising cost curves on the supply side should support higher containerboard prices—and, in our view, potentially higher profit margins for the industry’s leading players.

Shop for petroleum overshot on Alibaba.com to find a variety for every season. Place small orders for individual use or large shipments to sell as a brand. Look for petroleum overshot that are designed for long-lasting comfort and trendy style. Each one pairs well with a wide range of other clothes and accessories to make versatile outfits for any occasion. Find different suppliers to help you get just the right price.

Most petroleum overshot have short sleeves that make them ideal for keeping cool in warmer weather. Some are designed to have a fashionable appearance, while others are made for athletic wear. Look for garments made of woven fabrics such as cotton when you need something comfortable. Fabrics such as spandex or bamboo allow for flexibility and stretchiness for a better fit.

Most manufacturers of petroleum overshot on Alibaba.com allow for a wide array of customization options. Order a shipment with just the right colors and sizes for your needs. Packaging and graphics can be made to order as well, ensuring your clothing will look just the way you want. Some suppliers offer sample shipments to try the product out before placing a full-sized order in the future.

Look for petroleum overshot on Alibaba.com to get as many as you need while keeping within your budget. A wide selection of fashionable and athletic versions are available. Whether you need them for yourself or your customers, petroleum overshot can be found with the features and styles to suit your tastes.

But in doing so the organization risks tightening the market too much, sending prices sharply higher and encouraging a faster-than-expected acceleration in production from U.S. shale producers.

Saudi Arabia’s oil minister, who is OPEC’s de facto leader, has reiterated that stocks are still around 150 million barrels (MMbbl) too high and it would be premature to discuss an exit strategy or change of course.

“Almost the single metric we look at is global inventories and of course the most transparent and trustworthy is the OECD,” he said in an interview before Christmas.

OPEC, the International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) all have slightly different figures for OECD commercial crude and products stocks, but they show a similar trend.

While the specific numbers differ, mostly for definitional and methodological reasons, the data from each of the agencies shows the stock overhang compared with the five-year average has narrowed significantly. Most of the remaining overhang is concentrated in crude oil rather than refined products such as gasoline and heating oil.

OPEC seems determined to drive total stocks down to the five-year average, or very close to it, before starting to increase its own output. But that would almost certainly leave stockpiles uncomfortably low, send benchmark Brent prices well above $70 per barrel and push the market into a big backwardation.

Brent futures prices for the next six months are already trading in a backwardation of about $2 per barrel, which is consistent with a market that is already tight and undersupplied.

The six-month Brent calendar spread is trading about the 78th percentile of its historical range, up from the 22nd percentile at the same point last year. The calendar spread is watched by many physical traders as the most reliable indicator of the balance between production, consumption and inventories.

Backwardation is normally associated with a market that is undersupplied and a low and declining level of inventories, while contango is normally associated with oversupply and high/rising stocks.

The Brent market has cycled regularly between backwardation and contango over the last 25 years as it moves between periods of undersupply and oversupply. The sustained shift from contango in 2015-2016 to backwardation in late 2017 and at the start of 2018 strongly suggests the market has switched from oversupply to undersupply.

Most forecasters, including the IEA and OPEC, predict the oil market will be in a small surplus during the first-half 2018, followed by a deficit in the second.

The expected rise in stocks during the first half is one reason why OPEC and its allies think market rebalancing will not be completed until later in the year and agreed to keep their output unchanged.

Later in the year, the summer driving season in the United States and winter heating season in the northern hemisphere typically boost consumption in the second half.

History suggests that OPEC will gamble on tightening the market too much, with prices overshooting on the upside, rather than risk not tightening it enough and prices fall back.

After the past two oil market slumps, in 1997-1998 and 2008-2009, prices subsequently overshot OPEC’s formal and informal targets of $28 per barrel and $75 per barrel, respectively.

Saudi Arabia also needs higher prices to finance its ambitious social and economic transformation program and create positive sentiment around the planned sale of shares in its national oil company.

But the more prices increase, especially with Brent prices near $70 and WTI prices above $60, the more likely U.S. shale drilling and production rates will accelerate, which will tend to frustrate the objective of lowering stocks.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

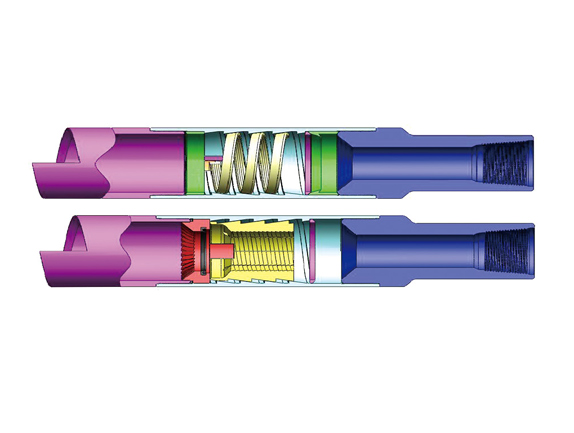

PARVEEN Wireline Overshots are used retrieve a fish lost in the well that does not have a conventional fishing neck or a damaged fishing neck on it. The tool is operated by applying the weight of the tool string on to the fish. This will allow the slips to expand around the fish when the tool string is picked up, the slip will engage the fish. These are non releasable type overshots.

8613371530291

8613371530291