overshot oil and gas pricelist

"We believe this move has overshot," Goldman Sachs commodities strategist Damien Courvalin stated in a new note to clients. "While risks of a futurerecession are growing, key to our bullish view is that the current oil deficit remains unresolved, with demand destruction through high prices the only solver left as still declining inventories approach critically low levels."

Oil prices have been dropping in July as economists across Wall Street increasingly state that a 2023 recession is in the cards. On Tuesday, WTI Crude fell below $100 a barrel for the first time since May, placing further pressure on shares of crude sensitive stocks such as ExxonMobil, Chevron, and Transocean. Oil prices touched slightly below $96 a barrel on Wednesday, a price not seen since mid-April.

The pullback in crude oil — even if short-lived — is beginning to feed its way to relief at the gas pump for inflation battered consumers. The current average price of regular gasoline in the U.S. is $4.77 a gallon, according to Gas Buddy data, down from an all-time high of $5.03 a gallon on June 16.

“While we may see prices decline into this week, the drop could fade soon if oil prices reverse, especially with strong demand over the holiday," stated Patrick De Haan, Gasbuddy head of petroleum analysis. "For the time being, Americans are spending nearly $100 million per day less on gasoline than when prices peaked a few weeks ago, and that’s well-needed relief at a time when gas prices remain near records."

Oil prices have rallied to multiyear highs on surging demand, tight supply, and the crunch on natural gas. Brent crude futures, the benchmark in global energy markets, hit a three-year high of above $86 a barrel in late October. Futures for West Texas Intermediate (WTI), the U.S. benchmark, surpassed $85 a barrel, the highest since October 2014. We analyze the dynamics of the crude market below.

The key question is whether the rally in oil prices can be sustained. Rising natural gas prices and a cold winter could lead to a further increase in prices. However, this rally has extended beyond market fundamentals. Oil markets are historically volatile, and should crude overshoot current levels, a correction would likely be sharp. From a trading perspective, this isn’t the right time or price to take long positions, in our view. That is partly because many sell-side commodity traders are revising their forecast to $100 a barrel, while physical markets aren’t showing a level of tightness consistent with that.

It’s true that in the United States, inventories of crude and petroleum products have fallen below the five-year average. This indicator, however, is misleading due to the jump in inventories during the Covid-19 pandemic. It is fair to say that inventory levels are now close to those of late 2018 and early 2019. During that period, oil prices were volatile, between $40–$70 a barrel.

Our fair value model for oil shows $69 a barrel for WTI. But prices have already overshot this level, showing the steepest increase since we started our fair value analysis. In our view, for oil to continue to trade at more than $80 a barrel, inventories will need to decline in January and February — the seasonally weakest months of the year. If inventories do not decline during this winter, we believe prices of WTI in the futures market will likely converge to our fair value to reflect existing supply-demand conditions.

Why are prices overshooting? We believe it is because of concerns about shortages as the northern hemisphere heads into winter. It has little to do with oil’s physical markets. Prices of other energy sources, natural gas, and coal, have spiked due to low inventories, rising demand from China, and worries about a cold winter. The surge in global natural gas and coal prices has also lifted oil futures, partly because of expectations about rising demand for cheaper oil. There are also supply shortages for light, sweet crude in Europe.

Demand for light, sweet crude is high because of refinery dynamics, including its lower refining cost. Refineries are heavy users of energy. Complex and profitable refineries process high sulfur oil (cheaper oil) at hydrocrackers that use hydrogen generated from natural gas. Higher gas prices in Europe and Asia have raised the operational cost of these hydrocrackers. As a result, crude inventories remain low in Cushing, Oklahoma, a storage hub and delivery point for the NYMEX WTI futures contract, while more barrels are being diverted to fill the new Capline pipeline in Illinois. These dynamics have contributed to the low price spread between Brent and WTI crude.

Demand, however, remains low for heavier, sour crude. There are still unsold barrels of this oil in the Middle East, including the Upper Zakum grade crude from the United Arab Emirates. West African grades are also having a tough time as freight costs increase. In addition, China’s limited oil import quotas are having a troubling impact on oil from Angola.

The rally in the futures market has extended beyond the fundamentals of the physical markets, in our view. The Organization of Petroleum Exporting Countries and its partners (OPEC+), a 23-nation grouping led by Saudi Arabia and Russia, are sellers in the real market. They are more concerned about the physical market for oil versus the financial markets.

A colder winter could send natural gas and coal prices soaring, and this could impact crude prices as companies and manufacturers further switch to using oil. However, because we rely on physical markets, and not necessarily the weather, to forecast the trend in oil markets, we believe it is time to question the current rally. We have a neutral view on oil prices over the short term and a bearish view over the long term.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Oil prices have rallied to multiyear highs on surging demand, tight supply, and the crunch on natural gas. Brent crude futures, the benchmark in global energy markets, hit a three-year high of above $86 a barrel in late October. Futures for West Texas Intermediate (WTI), the U.S. benchmark, surpassed $85 a barrel, the highest since October 2014. We analyze the dynamics of the crude market below.

The key question is whether the rally in oil prices can be sustained. Rising natural gas prices and a cold winter could lead to a further increase in prices. However, this rally has extended beyond market fundamentals. Oil markets are historically volatile, and should crude overshoot current levels, a correction would likely be sharp. From a trading perspective, this isn’t the right time or price to take long positions, in our view. That is partly because many sell-side commodity traders are revising their forecast to $100 a barrel, while physical markets aren’t showing a level of tightness consistent with that.

It’s true that in the United States, inventories of crude and petroleum products have fallen below the five-year average. This indicator, however, is misleading due to the jump in inventories during the Covid-19 pandemic. It is fair to say that inventory levels are now close to those of late 2018 and early 2019. During that period, oil prices were volatile, between $40–$70 a barrel.

Our fair value model for oil shows $69 a barrel for WTI. But prices have already overshot this level, showing the steepest increase since we started our fair value analysis. In our view, for oil to continue to trade at more than $80 a barrel, inventories will need to decline in January and February — the seasonally weakest months of the year. If inventories do not decline during this winter, we believe prices of WTI in the futures market will likely converge to our fair value to reflect existing supply-demand conditions.

Why are prices overshooting? We believe it is because of concerns about shortages as the northern hemisphere heads into winter. It has little to do with oil’s physical markets. Prices of other energy sources, natural gas, and coal, have spiked due to low inventories, rising demand from China, and worries about a cold winter. The surge in global natural gas and coal prices has also lifted oil futures, partly because of expectations about rising demand for cheaper oil. There are also supply shortages for light, sweet crude in Europe.

Demand for light, sweet crude is high because of refinery dynamics, including its lower refining cost. Refineries are heavy users of energy. Complex and profitable refineries process high sulfur oil (cheaper oil) at hydrocrackers that use hydrogen generated from natural gas. Higher gas prices in Europe and Asia have raised the operational cost of these hydrocrackers. As a result, crude inventories remain low in Cushing, Oklahoma, a storage hub and delivery point for the NYMEX WTI futures contract, while more barrels are being diverted to fill the new Capline pipeline in Illinois. These dynamics have contributed to the low price spread between Brent and WTI crude.

Demand, however, remains low for heavier, sour crude. There are still unsold barrels of this oil in the Middle East, including the Upper Zakum grade crude from the United Arab Emirates. West African grades are also having a tough time as freight costs increase. In addition, China’s limited oil import quotas are having a troubling impact on oil from Angola.

The rally in the futures market has extended beyond the fundamentals of the physical markets, in our view. The Organization of Petroleum Exporting Countries and its partners (OPEC+), a 23-nation grouping led by Saudi Arabia and Russia, are sellers in the real market. They are more concerned about the physical market for oil versus the financial markets.

A colder winter could send natural gas and coal prices soaring, and this could impact crude prices as companies and manufacturers further switch to using oil. However, because we rely on physical markets, and not necessarily the weather, to forecast the trend in oil markets, we believe it is time to question the current rally. We have a neutral view on oil prices over the short term and a bearish view over the long term.

Dec 2 (Reuters) - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ production, JP Morgan Global Equity Research said.

"As the group"s (OPEC+) real volume potential is discovered, this should drive a higher risk premium to oil prices," the bank said in a note dated Nov. 29.

Oil rose on Thursday, with benchmark Brent crude futures around $69 a barrel, as investors adjusted positions ahead of an OPEC+ decision on supply policy, although concern the Omicron coronavirus variant could hit fuel demand capped price gains.

The Organization of the Petroleum Exporting Countries and its allies will decide whether to release more oil into the market or restrain supply. read more

"We think OPEC+ will slow committed increases in early 2022, and believe the group is unlikely to increase supply unless oil prices are well underpinned," the bank said.

LONDON, Jan 12 (Reuters) - Oil prices that rallied 50% in 2021 will power further ahead this year, some analysts predict, saying a lack of production capacity and limited investment in the sector could lift crude to $90 or even above $100 a barrel.

Though the Omicron coronavirus variant has pushed COVID-19 cases far above peaks hit last year, analysts say oil prices will be supported by the reluctance of many governments to restore the strict restrictions that hammered the global economy when the pandemic took hold in 2020.

"Assuming China doesn"t suffer a sharp slowdown, that Omicron actually becomes Omi-gone, and with OPEC+’s ability to raise production clearly limited, I see no reason why Brent crude cannot move towards $100 in Q1, possibly sooner," said Jeffrey Halley, senior market analyst at OANDA.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, are gradually relaxing the output cuts implemented when demand collapsed in 2020.

However, many smaller producers can"t raise supply and others have been wary of pumping too much oil in case of renewed COVID-19 setbacks. read moreOPEC+ over/underperformance vs production quotas

With the prospect of depleting crude inventories and low spare capacity by the second half of 2022, and limited investments in the oil and gas sector, the market will have little margin of safety, the bank said.

JPMorgan analysts said in a note on Wednesday that they could see oil prices rising by up to $30 after the Energy Information Administration (EIA) and Bloomberg lowered OPEC capacity estimates for 2022 by 0.8 million barrels per day (bpd) and 1.2 million bpd respectively.

Rystad Energy"s senior vice-president of analysis Claudio Galimberti said if OPEC was disciplined and wanted to keep the market tight, it could boost prices to $100.

However, he said he did not consider this a likely scenario and while oil could "momentarily" reach above $90 this year, downward pressure on prices would come from production increases in Canada, Norway, Brazil and Guyana.

High oil prices, which also drive up gasoline and diesel prices, could keep inflation uncomfortably high well into 2022 amid snarled global supply chains, slowing the economic recovery from the pandemic in many countries.

In a Reuters poll in late December, 35 economists and analysts forecast Brent would average $73.57 a barrel in 2022, about 2% lower than $75.33 consensus in November. The forecast shows the average price for the year, not the peak. read more

WILHELMSHAVEN, GERMANY - SEPTEMBER 14: Workers construct a pipeline for transporting natural gas ... [+]from the new, nearby liquified natural gas (LNG) terminal to the Etzel underground storage facility on September 14, 2022 near Wilhelmshaven, Germany. The new terminal will allow the docking of floating storage and regasification units (FSRU), which are ships that can convert liquified natural gas back into gas form and then deliver it directly into Germany"s gas network and storage system. Natural gas from the Wilhelmshaven terminal will be sent through a 30km pipeline to the Etzel underground storage facility. The new terminal, scheduled for completion by the end of this year, will allow Germany to import LNG by ship from countries including the USA and Qatar in order to lower Germany"s reliance on gas imports from Russia. (Photo by David Hecker/Getty Images)Getty Images

Following my previous article on U.S. natural gas production, I engaged in a Twitter discussion on the causes of the natural gas price surge over the past two years.

What ensued was a discussion of the influences in the natural gas markets in recent years. Indeed, the comment above is correct that most of the demand increase in U.S. natural gas production in recent years has been in power generation, as power plants phased out coal.

Over the past 20 years, natural gas devoted to power production has increased from 5.3 trillion cubic feet (Tcf) in 2001 (24 % of production that year) to 11.3 Tcf in 2021 (37 % of total production last year).

But my article identified liquefied natural gas (LNG) exports as a culprit in the recent price surge. I was asked in response how this could have helped drive natural gas prices from under $2/MMBtu in early 2020 to nearly $9/MMBtu in August 2022.

In 2015, U.S. LNG exports were equal to about 0.01% of U.S. production. By 2019, that had risen to 5.1%. By 2019 it had grown to 10%, and it will be even higher this year. That is a significant amount of incremental demand added in a short period of time.

Indeed, over the same time period of 2015 to 2021, natural gas that went into electricity production only increased by 1.7 Tcf (Source). So, at present LNG is the fastest-growing outlet for U.S. natural gas production (although pipeline exports to Mexico have also soared in recent years).

The second thing to consider is that LNG exports have converted the natural gas markets in the U.S. from a mostly captive market, to one that is partially exposed to world prices. With those prices soaring as Europe seeks to acquire supplies to make up for the loss of Russian gas imports, U.S. companies are exporting as much LNG as they can. That reduces the amount available for sale in the domestic market, which leads me to the third point.

The primary reason natural gas was at $2/MMBtu two years ago is that the 2019-2020 winter was one of the warmest on record. That meant that we exited the winter with natural gas storage levels at the top of the five year average range, as seen below.Natural gas in underground storage 2020 to 2022Energy Information Administration

Note the two areas I have circled in the graphic. In 2020, natural gas inventories were at the top of the normal range, and this year they have dropped to nearly the bottom. In fact, the drop to the bottom roughly coincides with Russia’s invasion of Ukraine.

Historically, natural gas inventories are a strong predictor of natural gas prices. Exit the winter with high inventories, and prices are going to be low. Head into winter with low inventories, and prices are going to be high.

Note that natural gas production levels are at record highs, so we can’t blame a lack of production on this issue. This is from soaring demand, led in the past two years by the fastest-growing LNG export market in the world.

Finally, some might express skepticism that what amounts to relatively small changes in supply and demand (with respect to overall consumption) could have such a dramatic impact on prices.

My final point is that historically oil and gas prices tend to overshoot in both directions. A classic example is 2008. The price of West Texas Intermediate (WTI) opened the year under $100/bbl, raced to over $140/bbl by July, and then fell all the way to $30 by December.

Supply and demand didn’t dramatically change in 2008, but the short-term outlook did. During the first half of 2008, prices were driven by fear that oil producers wouldn’t be able to keep up with demand, and in the second half of the year it was driven by fear of a recession-induced demand collapse.

In fact, demand for oil did fall from 2007 to 2009, but only by 2.5% (before rebounding to a new record in 2010). But that very small change in the supply/demand picture sent oil prices on a volatile ride.

The same is true for the natural gas markets. Fear of having too much gas transitioning to fear of not having enough is indeed enough to cause the price to quadruple.

Quantum Commodity Intelligence - European natural gas prices surged to record highs Friday as the market maintained its firm upwards momentum, with upcoming maintenance on the Nord Stream 1 pipeline seen as a potential precursor for ongoing Russian supply shortfalls.

Dutch TTF futures for Oct22 traded at a high of €348.785/MWh, an oil equivalent of around $600/b, before settling at €346.522/MWh, while the Nov22 and Dec22 contracts both traded above €350/MWh, over 6% higher on the day.

The front-line Sep22 contract traded at a high of €342/MWh before easing to €339/MWh, still up 5% on the day and the equivalent of around $100/mmBtu, or more than 10x times current US natural gas prices.

The US investment bank noted that European gas prices have rallied around 60% over the past three weeks, driven by a renewed heat wave across Europe and, more recently, by the Gazprom announcement that it would bring NS1 to zero for three days for maintenance at the end of this month, raising supply uncertainty in the region.

"Even taking these events into account, we believe gas prices have overshot fundamentals helped by poor market liquidity and that European gas markets can balance with TTF well below current levels."

"Even if the upcoming NS1 outage becomes permanent, requiring higher demand destruction, we estimate the region can manage storage levels with 3Q22 TTF at €215-230/MWh, well below current price levels."

On Thursday, Morgan Stanley said European inventories of natural gas are likely enough to last through winter even if flows of gas from Russia"s main pipeline to Europe fall to zero.

The surge in oil prices this year has angered drivers, tainted Americans’ views on the economy and confounded both the White Houseand Federal Reserve. Unfortunately, JPMorgan Chase says the oil spike is just getting started.

(JPM) warned clients that Brent crude oil will hit $125 a barrel next year and $150 in 2023, in large part because OPEC doesn’t have nearly as much firepower to respond to high prices as many assume.

“They don’t have the barrels. It’s a mirage,” Christyan Malek, JPMorgan’s head of oil and gas research and the lead author of the new report, told CNN in a phone interview.

$150 oil is more than double today’s Brent price of about $73.50. If that forecast proves accurate, it would likely translate to national gas prices topping $5 a gallon and surely exacerbate inflationary pressures hitting the US economy and squeezing American families.

The central problem, Malek said, is that while OPEC nations have plenty of oil in the ground, they don’t have the capital and logistics to deliver it quickly.

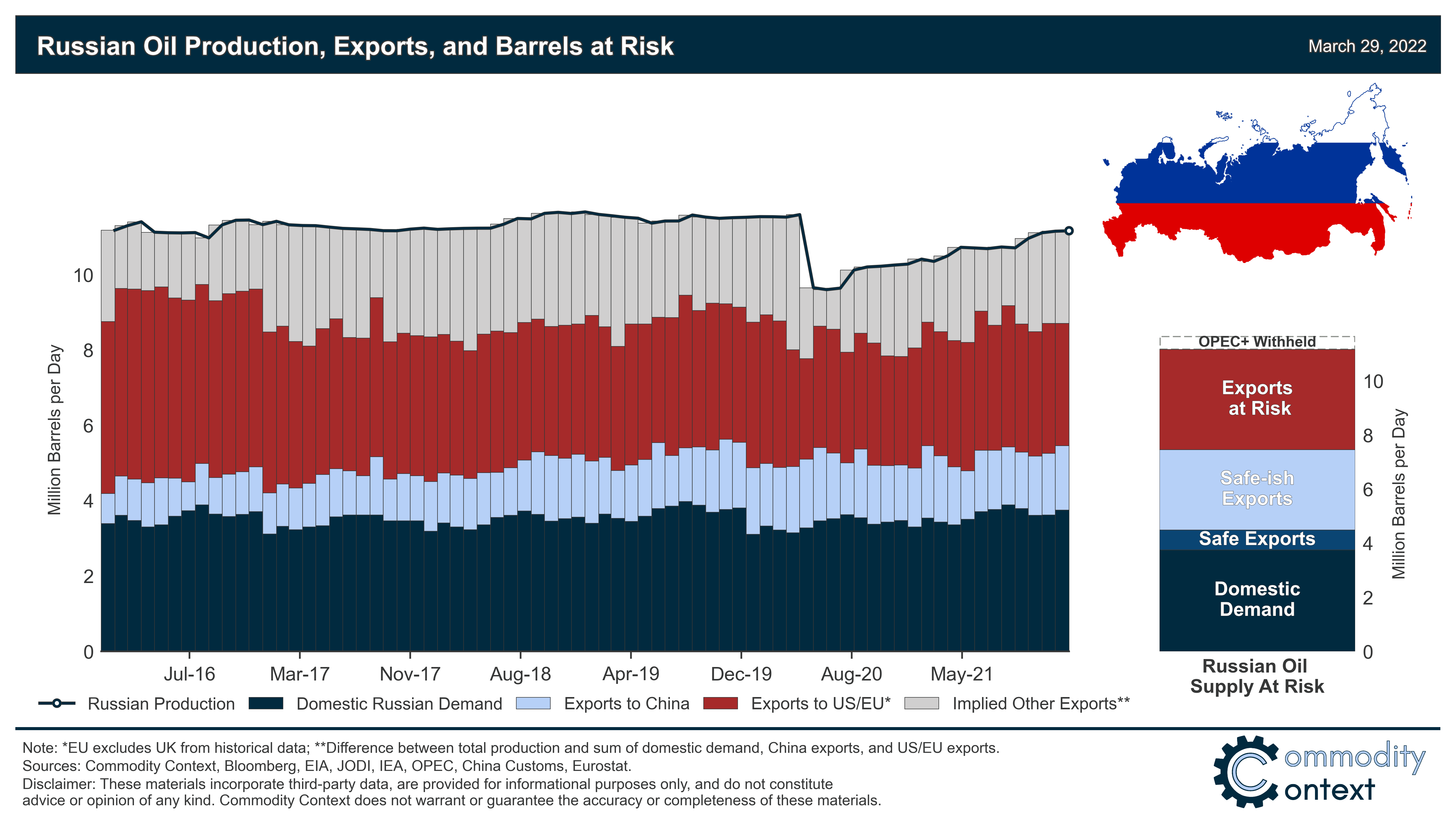

OPEC’s real spare capacity, a closely watched metric that measures the amount of barrels that can swiftly be added to the market, stands at just 2 million barrels per day next year, JPMorgan estimates. That is less than half of what many on Wall Street assume.

OPEC’s spare capacity equates to just 4% of total capacity, down from an average of 14% between 1995 and 2020 and well below the 10% comfort level, JPMorgan said. When this buffer gets unusually low, oil prices can spike and investors apply a premium to prices.

The fear in those situations is that the oil market is just one shock (a war, natural disaster or another supply disruption) away from being unable to meet demand.

Importantly, JPMorgan is not calling for oil to trade at $125 a barrel for all of 2022. Instead, the bank is predicting crude will average $88 next year and “overshoot” to $125 at some point. Likewise, JPMorgan sees Brent averaging $82 in 2023 but overshooting to $150.

Oil prices collapsed on Friday on fears that the Omicron variant will deal a blow to surging energy demand by eating into the amount of people driving and flying. Crude bounced back Monday, though it remains well below recent highs.

But Malek explained he has been working on this analysis for months and the forecast isn’t altered by Omicron. That’s because if the new coronavirus variant does dent demand, OPEC would likely offset it by cutting supply.

OPEC and its allies are meeting on Thursday and must decide whether to push forward with a plan to add 400,000 barrels per day in supply despite the Omicron fears and a United States-led intervention to unleash strategic reserves. Prior to the emergence of Omicron, the White House urged OPEC+ to stick with its plans to gradually increase supply.

Veteran energy analyst Tom Kloza, president of the Oil Price Information Service, said $150 oil would roughly translate to $5-a-gallon gasoline nationally.

Prices at the pump have already been a sore spot for consumers. The national average currently stands at $3.39 a gallon, up from $2.13 a year ago, according to AAA.

JPMorgan said world oil producers, including OPEC, have failed to put up the amount of capital required to ramp up production enough to meet demand. The Wall Street bank estimates there is a $750 billion gap in terms of global oil capital spending, requiring oil to rise to $80 to incentivize further investment.

Secondly, Wall Street investors have demanded oil companies stop spending all their cash flows on expensive drilling projects. Oil drillers are being strongly encouraged to live within their means and return extra cash to shareholders through dividends and buybacks.

And then there’s the energy transition. Under pressure from shareholders, governments and society at large, oil companies are spending money on reducing emissions and building low-carbon businesses. That’s especially the case in Europe, where BP, Shell and other major companies have promised to slash emissions and invest heavily in electric charging and renewable energy.

The Energy Information Administration expects Brent crude to slide to an annual average of $72 a barrel next year as production grows from OPEC+, US shale and other non-OPEC countries.

“It reminds me of when we hit $145 a barrel in July 2008 and some banks predicted $200 by year’s end,” Kloza said in an email to CNN, “only to see the post Lehman Brothers financial debacle push prices instead to the $30s.”

It has been almost a year since I first covered Chevron (NYSE:CVX) and took a long position in April of 2021. In hindsight, I regret that I didn"t act earlier since I was aware of the favorable position that oilmajors were in even before that. If I had bought in October of 2020, when Ilaid out the strong investment thesisfor Exxon Mobil (XOM), my returns would have been even higher.

Even if it wasn"t for recent events that drove the price of oil to new highs, Chevron would havebeen a far superior investment than most large-cap U.S. companies during this period, including many of the equity market darlings in the tech sector.

But let"s ignore the historical performance and similar to one year ago, when pessimism in the oil & gas sector was very high, ignore the rear-view mirror and look to what lies ahead.

In contrast to a year ago, the outlook for Chevron and all other oil majors appears very favorable at the moment. In addition to the inflationary pressures, the full swing of the realized geopolitical risk is also feeding the share price rally. As the world becomes more polarized and deglobalization accelerates, as I predicted in the months following the pandemic, security of energy supply will be of paramount importance. Consequently, a large chunk of global energy resources will become too risky to depend on and that will favor local energy providers.

Moreover, during times of peak globalization and loose monetary and fiscal policies, the market does not care much about companies like Chevron or Exxon Mobil. On the contrary, they were seen as the legacy dinosaurs of the corporate world that should be replaced by fancy solar tiles or wind turbines. However, as inflation starts to bite and affects predominantly lower-income consumers, the overall sentiment will likely continue to shift towards security in the face of low-cost energy producers. Like it or not, the front seat here is reserved for the oil majors.

However, as this narrative gains momentum, so are the valuations in the sector. The market has a tendency to overshoot in both directions - both on the downside when the outlook is grim and on the upside when market conditions are favorable.

Having said all that, I still believe in the long-term success of Chevron as it will benefit from a push towards more energy security, while at the same time the company will invest heavily into future energies, such as hydrogen, carbon capture & storage, and renewable fuels. However, future earnings are unlikely to increase on a straight-line basis as current valuations seem to suggest.

Based on current oil prices of around $100 per barrel and the current average for the year of $92, CVX upstream earnings are likely to come within the range of $21bn to $25bn.

Based on that range and Chevron"s current price per share, the company could buyback between 20m and 30m shares by the end of 2022. As a result, the company"s EPS for 2022 could come in between $11 and $13.2 in the most optimistic scenario. These numbers do not take into account any other idiosyncratic and political risks highlighted above.

The long-term investment thesis for Chevron remains intact. Oil & gas investments will need to increase in order to provide secure energy in a more destabilized world, while higher oil & gas prices will allow the company to make the necessary investments in new technologies. However, investors should not forget that the industry is a highly cyclical one and prone to political risk. At the moment, Chevron"s valuation appears stretched and already prices in a massive improvement in earnings for 2022. Therefore, the risk-reward profile of the company is now far less appealing than it was a year ago and calls for a more cautious approach. For the time being, I will abstain from increasing my positions in the company.

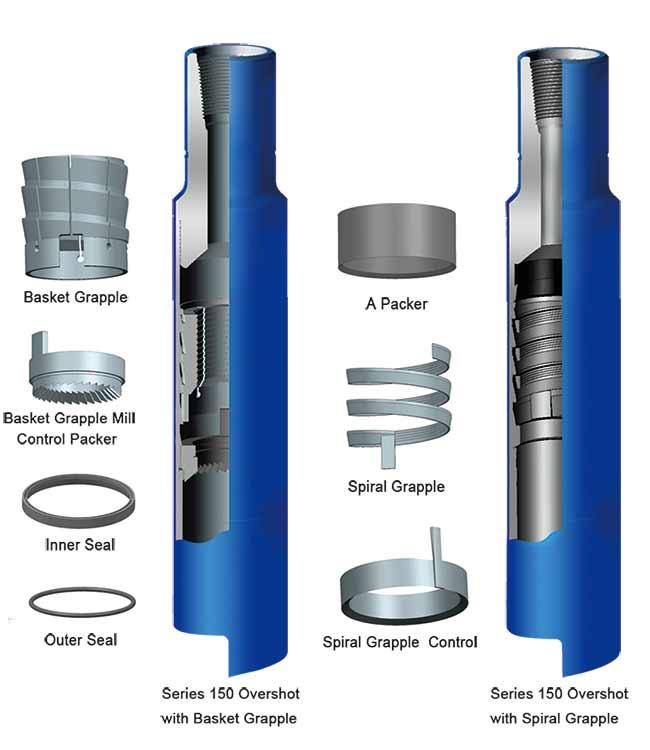

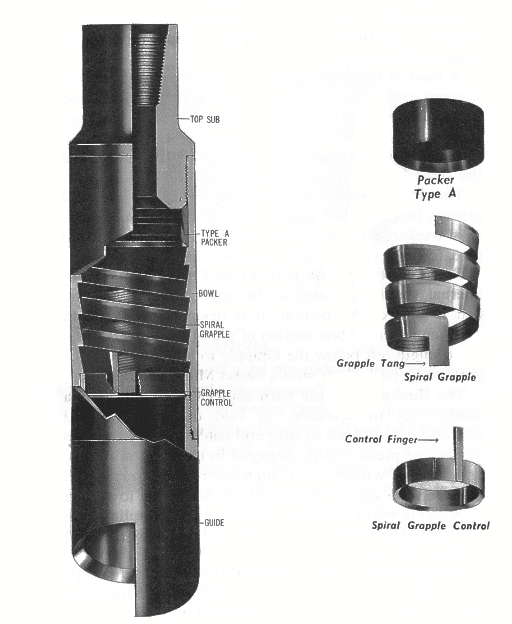

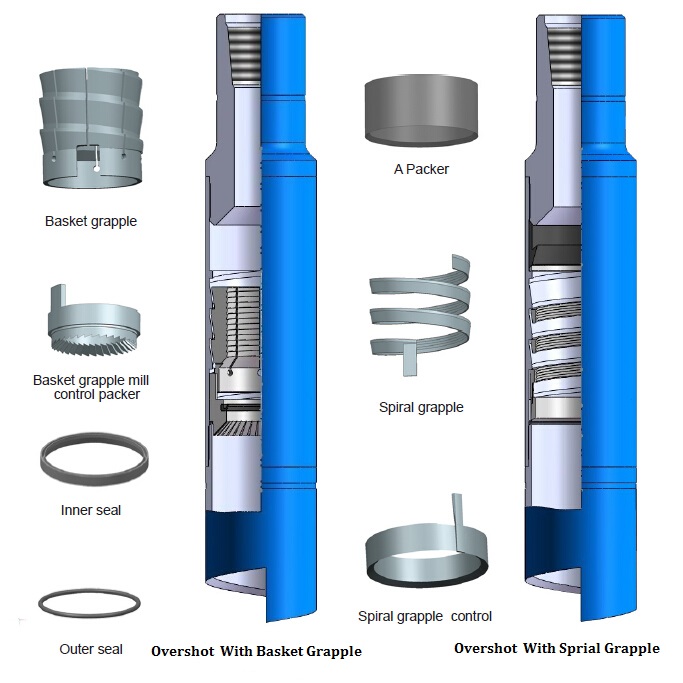

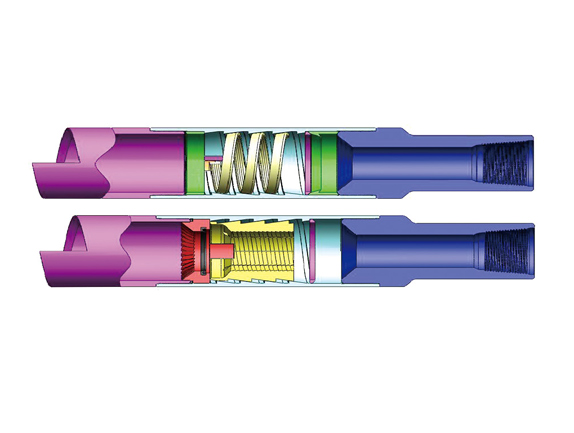

PARVEEN Wireline Overshots are used retrieve a fish lost in the well that does not have a conventional fishing neck or a damaged fishing neck on it. The tool is operated by applying the weight of the tool string on to the fish. This will allow the slips to expand around the fish when the tool string is picked up, the slip will engage the fish. These are non releasable type overshots.

Dutch natural gas prices plunged as much as 21% on Monday as European countries continue to build up supplies in anticipation of the upcoming winter months.

September futures prices for Dutch natural gas saw their steepest drop since March, falling to as low as 268 euros per megawatt hour. Still, the sharp decline only brought prices down to levels seen last week, highlighting just how far the commodity has surged in recent weeks and months. Dutch natural gas prices are up more than 1,000% since last year.

Driving Monday"s decline is a mix of supply and demand dynamics that include ongoing demand destruction as various industries adapt to the surging prices and a potential recession, and Germany indicating that its gas storage facilities are reaching capacity faster than expected.

German Economy Minister Robert Habeck said he expects gas prices to start cooling down now that Germany"s gas storage facilities are 85% full, ahead of its October target. "As a result, the markets will calm and go down," Habeck said.

"European gas prices have in our view overshot fundamentals fueled by a combination of supply and demand (heat wave, nuclear outages) concerns and exceptionally poor liquidity in the market, illustrated by erratic and sparse intra-day price moves," Goldman Sachs" analyst Samantha Dart said.

A resumption of gas flows from the Nord Stream 1 pipeline could add to further natural price declines, Goldman added, though there is no indication of when that may happen as the pipeline deals with reported maintenance issues.

Goldman ultimately expects Dutch natural gas prices to fall to a range of 170 to 190 euro per megawatt hour, which would represent a sharp decline of as much as 41% from current levels.

"The longer prices remain this high, the higher the impact on demand, further reinforcing our view that storage will enter winter at comfortable levels, setting the stage for sequentially lower prices through winter," Dart said.

But in doing so the organization risks tightening the market too much, sending prices sharply higher and encouraging a faster-than-expected acceleration in production from U.S. shale producers.

Saudi Arabia’s oil minister, who is OPEC’s de facto leader, has reiterated that stocks are still around 150 million barrels (MMbbl) too high and it would be premature to discuss an exit strategy or change of course.

“Almost the single metric we look at is global inventories and of course the most transparent and trustworthy is the OECD,” he said in an interview before Christmas.

OPEC, the International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) all have slightly different figures for OECD commercial crude and products stocks, but they show a similar trend.

While the specific numbers differ, mostly for definitional and methodological reasons, the data from each of the agencies shows the stock overhang compared with the five-year average has narrowed significantly. Most of the remaining overhang is concentrated in crude oil rather than refined products such as gasoline and heating oil.

OPEC seems determined to drive total stocks down to the five-year average, or very close to it, before starting to increase its own output. But that would almost certainly leave stockpiles uncomfortably low, send benchmark Brent prices well above $70 per barrel and push the market into a big backwardation.

Brent futures prices for the next six months are already trading in a backwardation of about $2 per barrel, which is consistent with a market that is already tight and undersupplied.

The six-month Brent calendar spread is trading about the 78th percentile of its historical range, up from the 22nd percentile at the same point last year. The calendar spread is watched by many physical traders as the most reliable indicator of the balance between production, consumption and inventories.

Backwardation is normally associated with a market that is undersupplied and a low and declining level of inventories, while contango is normally associated with oversupply and high/rising stocks.

The Brent market has cycled regularly between backwardation and contango over the last 25 years as it moves between periods of undersupply and oversupply. The sustained shift from contango in 2015-2016 to backwardation in late 2017 and at the start of 2018 strongly suggests the market has switched from oversupply to undersupply.

Most forecasters, including the IEA and OPEC, predict the oil market will be in a small surplus during the first-half 2018, followed by a deficit in the second.

The expected rise in stocks during the first half is one reason why OPEC and its allies think market rebalancing will not be completed until later in the year and agreed to keep their output unchanged.

Later in the year, the summer driving season in the United States and winter heating season in the northern hemisphere typically boost consumption in the second half.

History suggests that OPEC will gamble on tightening the market too much, with prices overshooting on the upside, rather than risk not tightening it enough and prices fall back.

After the past two oil market slumps, in 1997-1998 and 2008-2009, prices subsequently overshot OPEC’s formal and informal targets of $28 per barrel and $75 per barrel, respectively.

Saudi Arabia also needs higher prices to finance its ambitious social and economic transformation program and create positive sentiment around the planned sale of shares in its national oil company.

But the more prices increase, especially with Brent prices near $70 and WTI prices above $60, the more likely U.S. shale drilling and production rates will accelerate, which will tend to frustrate the objective of lowering stocks.

Despite failing miserably in their prior $8/MMBtu gas price predictions for this summer and fall (see Daily GPI, June 29), analysts at Raymond James & Associates said in their “Stat of the Week” that once the weather returns to normal, bullish gas market fundamentals will again push prices sharply higher. As a result, the analysts have raised their gas price forecast for 2005 yet again to $6.65 from $6.25. They also bumped up their crude oil price forecast for the fourth quarter to $40/bbl from $36.

“We believe that the current bearish sentiment in the natural gas market will reverse by the end of the year and year-over-year weather comparisons become more favorable and surplus gas currently available shrinks as a result of continuing declines in supply,” said Raymond James analysts J. Marshall Adkins and Wayne Andrews. “The weather has briefly interrupted an extremely bullish U.S. natural gas price move, but as the weather factor fades gas should resume its strong upward move.

“Assuming traditional BTU parity of 6:1 and our new 2005 oil forecast ($40), fair value for natural gas in 2005 should be between $6.50 and $7,” they added.

The new $6.65 forecast is $1.30 more than the current Wall Street consensus and 50 cents more than the 2005 strip of futures prices on the New York Mercantile Exchange as of Friday’s close. Current near-month futures are well below $5.

However, the Raymond James analysts said they are still considering the possibility that gas prices could be pushed even higher than their extremely bullish projections in the short term to more than $7/MMBtu because of a strong economy, favorable fuel switching ratios and declining domestic supply.

Over the longer term, Adkins and Andrews also have raised their price forecasts mainly due to the ongoing tight supply situation in gas and oil. Their new gas price forecast is $6, up from $5.50. “[A]ssuming only a 2% annual long-term decline in domestic production (versus the 3-4% decline we project in 2004) and an average 2% growth in domestic gas demand we belive there could be a 4-5 Bcf/d supply shortfall (about 6-8% of demand) in 2007 — despite an estimated 250% increase in LNG imports over this time fame. This gap could potentially widen further to 9-10 Bcf/d by 2010 under the same assumptions.” Their long-term crude oil forecast is $35/bbl, up from $30.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time 406b4f95116c28dca247da206ca234ea 63.210.148.230 02/10/2023 01:17 PM UTC

High oil prices are still the cure for high oil prices. In October 2021, West Texas Intermediate (WTI) crude oil advanced to more than USD 80 per barrel—a level last seen in 2014—reflecting the mismatch between a sharp, year-over-year recovery in global energy demand as economies reopen and the time needed for the industry to ramp up output to pre-pandemic levels. The upsurge in oil prices has fueled a strong rally in energy stocks and contributed meaningfully to the inflationary pressures affecting both consumer prices and producer costs. While we see the potential risk of further oil price upside in the next quarter or two, our conviction in the secular bear market for commodities remains intact.

We’ve seen this story before. The prices of crude oil and other commodities tend to overshoot on the downside to disincentivize production when there is a negative demand shock and then rebound, temporarily, to artificially high levels as demand recovers to stimulate a supply response and rebalance the market. Even amid a global economic recovery, higher oil prices are unlikely to prove sustainable and, in our view, should start to recede toward midcycle levels at some point next year.

Given elevated equity valuations and commodity prices, we are remaining disciplined in our exposure to oil and gas producers and mining companies. On the other hand, we are finding what we regard as compelling opportunities in specialty chemicals and paper packaging.

We do not believe that fundamentals support a prolonged bull market in oil, but we see the potential for crude prices to remain elevated in the near term.

Although WTI has climbed to levels that we believe should be sufficient to engender the supply response needed to balance the market, it still takes time for energy producers to ramp up activity and output because of the coronavirus pandemic and the challenges of mobilizing people and equipment after suffering through two oil price collapses in the past five years.

At the same time, surging prices in international gas markets threaten to increase demand for crude oil as an alternative feedstock in electricity generation and industrial applications. Among other factors, we believe that this unusual strength reflects supply outages and increased competition from Asia and Latin America for liquefied natural gas (LNG) cargos. The international market could tighten further if cold temperatures in the Northern Hemisphere spur heating demand, a scenario that would likely propel natural gas prices even higher and increase the call on crude oil as a substitute thermal fuel.

We do not view the upsurge in Asian and European natural gas prices as a product of a structural change in this commodity market. As heating demand recedes in the spring and some of the temporary factors that have tightened the natural gas market start to alleviate, we would expect inventory levels to rebuild and prices to normalize, reducing crude oil’s appeal as a replacement fuel.

The magnitude of the oil demand shock stemming from the coronavirus pandemic was unprecedented and briefly plunged WTI prices to negative levels in April 2020—a clear signal that energy companies needed to curtail their output. This year, the recovery in oil production has lagged the sharp recovery in crude oil demand as economic activity has resumed, sending WTI prices to levels that should prompt the energy patch to accelerate drilling.

Some market participants have questioned whether the supply response will be enough. A narrative has emerged that U.S. shale players’ capital discipline and potential disinvestment in oil and gas development because of environmental, social, and governance (ESG) concerns have contributed to and could sustain higher oil prices.

But evidence suggests that we are seeing the familiar pattern of oil prices and industry activity levels overshooting to the downside and then to the upside in response to an extreme market dislocation. Debt issuance and credit spreads indicate that high yield energy companies continue to enjoy access to the capital markets, despite the market’s increased sensitivity to ESG factors (Figure 1). More importantly, the U.S. oil-directed rig count has increased at a similar pace off the bottom as in 2016 and 2017 (Figure 2), when drilling activity began to rebound from a downcycle driven by surging hydrocarbon output from shale and OPEC’s decision not to cut supply.

Admittedly, the recent recovery in the U.S. oil-directed rig count has occurred from a lower base. However, we believe that the market does not fully appreciate the massive strides that the industry has made in producing more oil and gas with fewer rigs over the past three years. In our view, the U.S. oil-directed rig count has already recovered to levels that, eventually, should generate at least the incremental output needed to fill the gap created by typical demand growth and the base decline rate in production from existing wells.

...we believe that the market does not fully appreciate the massive strides that the industry has made in producing more oil and gas with fewer rigs over the past three years.

Looking beyond the rebalancing process that should take place as the industry steps up drilling and well completion in response to higher prices, we see the potential for ongoing productivity gains to continue to pressure the cost curve for oil and, accordingly, higher-cost operators’ profit margins on invested capital.

Going forward, the pace of efficiency gains in U.S. shale may slow from the rapid rates experienced over the past seven to 10 years. However, there is likely still significant room for progress. Rig productivity in the Permian Basin, an area in West Texas and New Mexico that we believe contains some of the best reservoir rock in the U.S. onshore market, eventually should catch up with operations in the Bakken region, an area predominantly in North Dakota that is further along in its development cycle (Figure 3). We also continue to monitor leading upstream operators’ efforts to improve overall resource recovery rates from shale formations—currently estimated at 7% to 8% of oil in place—through various innovations that would boost reservoir pressures.

*The Bakken is an oil-producing region predominantly in North Dakota that is further along in its development life cycle than the Permian Basin, an area in West Texas and New Mexico. Note that extreme oil supply and demand shocks, such as the ones experienced in 2016 and 2020, can distort drilling efficiency metrics because of the consequent drawdown in the active rig count and, then, during the initial stages of the recovery phase, the completion of backlogs of drilled but uncompleted wells, leading to increased production at a lower rig count. We believe that oil and gas producers should retain some of the incremental efficiency gains that occurred during the downturn, as in 2016.

And the potential productivity gains aren’t restricted to U.S. shale. The costs associated with offshore and deep-water oil and gas production also have come down significantly. Factors at play include an increasing emphasis on opportunities that tie in to existing infrastructure, a focus on new developments that target high-quality reserves without taking on too much engineering complexity, and material deflation in service and equipment costs.

The combination of what we regard as elevated valuations and commodity prices in the context of a longer-term bear market creates, in our view, an unfavorable risk/reward setup for many of the higher-beta segments in the natural resource universe. Accordingly, we remain selective in our energy and mining investments. In keeping with our mandate, we aim to maintain a philosophically appropriate level of risk-adjusted exposure to these commodity-sensitive industries through valuation discipline and a focus on what we regard as the highest-quality names.

Specialty chemicals is one area that we like, as we believe that the industry should benefit over the long term from lower commodity prices. The setup in companies that focus on paints and other coating products strikes us as potentially attractive. Historically, the best of these firms have been able to protect margins by passing along rising input costs to customers and then retained a portion of these pricing gains when oil prices eventually recede.

We also prefer investments in industries in which a rising incentive cost curve can pull commodity prices higher, potentially improving producers’ profit margins. For example, over the next three to five years, we expect demand growth related to online shopping and the increasing substitution of paper for plastic packaging to be a tailwind for containerboard producers. In contrast to the energy sector, we see the potential for the cost of adding incremental capacity to rise in the coming years, in part, because the number of existing paper plants that could be converted inexpensively to producing cardboard has dwindled. This scenario of increasing demand and, critically, rising cost curves on the supply side should support higher containerboard prices—and, in our view, potentially higher profit margins for the industry’s leading players.

You are viewing Bowen or Logan Overshots for sale by Pickett Oilfield, LLC. We have an extensive range of good used or rebuilt Overshots along with the accessories. Call us for your fishing tool needs. For more information contact us by phone at sales@pickettoilfield.com.

PickettOilfield.com offers prospective buyers an extensive selection of quality new, used, and refurbished Oilfield Equipment at competitive prices, including Overshots.

Overshots are a tool used on the downhole process during the fishing operations. It engages the tube or tool on the outside surface. A Grapple or other piece of equipment that is similar attaches onto the overshot and grabs the fish.

A downhole tool used in fishing operations to engage on the outside surface of a tube or tool. A grapple, or similar slip mechanism, on the overshot grips the fish, allowing application of tensile force and jarring action. If the fish cannot be removed, a release system within the overshot allows the overshot to be disengaged and retrieved.

8613371530291

8613371530291