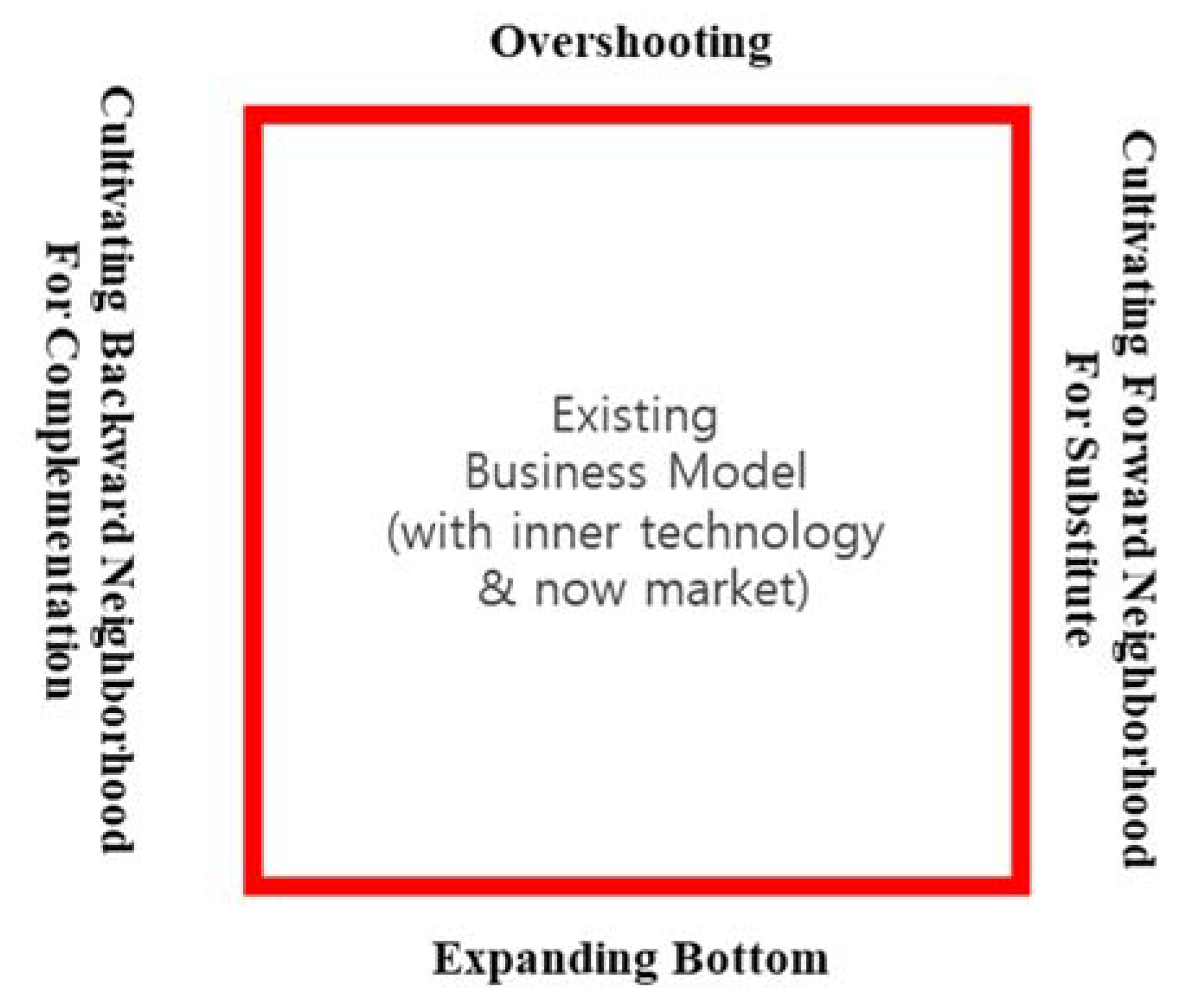

overshot the mark supplier

"Chairman Pitofsky"s timely book teaches us important truths about antitrust. This book convincingly rebuts the Chicago School approach to economics and competition policy while reminding us that the antitrust laws, when effectively applied, are robust tools that enhance competition and benefit consumers. Chairman Pitofsky and the other distinguished contributors provide a badly needed counterpoint to the excesses of Chicago School economic theory that has led to an overly hands-off and lifeless approach to antitrust enforcement in recent years. This excellent volume should be studied by all those who care about competition policy."--Senator Herb Kohl

"Into the grand antitrust debate between Warren Court advocates, on the one hand, and the treatises and court opinions out of the Chicago School tradition, on the other, comes finally a voice of reasoned moderation--or rather a full-throated chorus of such voices. With a clear-eyed regard for the paramount importance of consumer welfare a the central governing principle of antitrust enforcement, this collection of essays deserves to be read carefully by practitioners, academics and politicians--but especially-- and exceedingly carefully--by federal judges all across the country, not least of all by the current justices of the U.S. Supreme Court."--John Shenefield, Former Assistant Attorney General for Antitrust

"When they asserted efficiency as the new benchmark of antitrust, the scholars of Chicago paved the way to very welcome developments. But efficiency is more and more treated as an ideology and therefore it leads to forgetting the facts and restoring presumptions. If avoiding false positives becomes the priority of antitrust, how many real negatives will receive undeserved immunity? The questions raised by this book are no less timely than those raised by those scholars forty years ago and deserve no less attention from practitioners, academics and judges all over the world. I am confident that some copies of it will also be available in the library of the U.S. Supreme Court."--Giuliano Amato, Former Prime Minister of Italy

"This collection of essays--by lawyers and economists, many of whom are former antitrust enforcement officials--will generously reward a close read by anyone who is interested in the current intellectual state of antitrust thinking. As largely a critique of recent legal decisions and of recent enforcement, these essays are likely to form the basis for new directions for antitrust in the coming decade."--Lawrence J. White, Professor of Economics, NYU Stern School of Business

"Taken as a whole, the book makes a forceful argument that the many positive contributions of the Chicago school have been overshadowed by an increasingly conservative laissez faire view of antitrust in the federal agencies and the courts. The results of this change have been an emphasis of theory over empirical evidence and a deliberate choice among confl icting economic theories and evidence, rather than a consensus about that theory and evidence. For me, this was the best and most provocative antitrust book of 2008." --Spencer Weber Waller, Loyola University Chicago, School of Law

To ensure that customers suffer no downtimes during the modernization, StrikoWestofen offers a special service: depending on the requirements, it is possible to lease melting capacities. However, as the downtime was scheduled beforehand, that was not necessary in the case of Česká zbrojovka. In the course of the modernization, the company also decided to retrofit a shaft filling level laser.

This allows the charging cycles to be optimized so that the shaft has an optimal filling level at all times. Thereby, the ETAMax principle of integrated heat recovery can unfold its full effect. Through the intelligent utilization of the waste heat in the melting shaft, fuel consumption and metal loss are considerably lower than they are with comparable technologies to be found on the market. At the same time, the experts from StrikoWestofen installed a new charging unit. Besides increasing the operational reliability, this also makes a considerable contribution to the efficiency and performance of the system.

The aim was for the upgrade to reduce the energy consumption to 670 kWh/t. The actual result exceeded the expectations, however: after modernization, an energy consumption of only 520 KWh/t was measured, i.e. only approx. 52 m3 of natural gas per tonne of molten aluminium. Also, it was possible to increase the melting performance by 40% - from one tonne per hour to about 1.4 tonnes. “We didn’t think it was possible. Also, thanks to the smooth handling, we had next to no downtimes and were able to take the furnace back into operation after a short time,” says Petr Havelec, the director of the metallurgy division at Česká zbrojovka. Now the modernized furnace can match the performance of a comparable new installation.

The excitement continued, so that StrikoWestofen is also being consulted now that the second StrikoMelter is to be adapted to meet the latest standards. This is extremely gratifying for Holger Stephan, manager of the Service and Spare Parts division of StrikoWestofen: “We are glad to see more and more aluminum foundries realizing that investments in existing tried-and-tested systems can be worthwhile. If these are made in cooperation with us as the OEM, we are often also able to retrofit our latest developments. Thereby, enormous increases in performance and efficiency are possible. The rising number of inquiries coming in after the completion of individual modernization projects shows us that the word is spreading.”

Whether it is in the field of electronics, PCB design, theoretical analysis, or in the area of sports, accuracy is the ultimate goal. However, phrases like, “you missed your mark,” or “you overshot your target,” are all too common. In any case, it is never a good thing.

For example, if you are a CFO of a company and the budget for the current fiscal year is 1 billion dollars, and you overshoot it by 50%. Well, you may have an MBA from Harvard, but it no longer stands for Master of Business Administration; now it represents your choices; McDonald"s, Burger King, or Arby’s. Moreover, this is not a slight, but rather a point on the fact that missing your mark can have devastating repercussions on your career path.

Similarly, in the field of electronics, overshoot is the existence of a signal or function surpassing its target or final value. As you can imagine, this is not an acceptable parameter, and a circuit by design is to afford control over such phenomena. In the paragraphs to follow, I will discuss in more detail the subject of overshoot and methods of reducing it as well.

In control theory, signal processing, mathematics, and electronics, overshoot is the manifestation of a function or signal that exceeds its target. It occurs primarily in bandlimited systems, for example, low-pass filters during the step response. Also, ringing often follows the overshoot, and at times, they combine.

Also, in control theory, we refer to overshoot as an output that exceeds its steady-state or final value. Moreover, in a step input, the PO or percentage overshoot is the maximum value minus the step value divided by the step value. Whereas with a unit step, the overshoot is simply the maximum value of the step response minus one.

Overshoot is a reference to the transient values of any parametric measurement that exceeds its steady-state or final value during its transition from one value to another. Moreover, in terms of the application of the term overshoot, it includes the output signals of amplifiers.

Note: Furthermore, there is another parameter that warrants mentioning in the area of control systems, and it is called maximum overshoot. Also, the definition of maximum overshoot is the maximum peak value when measuring a response curve of the desired response of a system.

Overshoot occurs when the transient values exceed the final value. Whereas, undershoot is when they are lower than the final value. Furthermore, within the confines of acceptable limits, a circuit’s design targets the rise time to minimize it while simultaneously containing the distortion of the signal. However, in its purest form, overshoot represents a distortion of a signal.

Also, since a circuit’s design goal is to minimize overshoot, as well as decrease rise times, these two functional tasks often cause conflicts. In other words, if your job requires you always to find the highest quality when making a business purchase, but at the same time, you must always find the overall lowest price.

Moreover, in terms of magnitude, in reference to overshoot, it is dependent on time and the damping. Furthermore, we usually associate overshoot with settling time or the length of time an output requires to reach its steady-state.

In terms of approximation, the term overshoot describes the quality of the approximation. For example, the summation of terms representing a square wave. Such as an expansion in orthogonal polynomials or a Fourier series, the estimation of the function by a condensed number of terms in the series can display undershoot, overshoot, and ringing. Moreover, the more significant the number of terms retained in the series, the less distinct the migration of the estimate from the function it represents.

However, this function of overshoot or ringing of Fourier series and other eigenfunction series that occurs at simple discontinuities; we refer to it as the Gibbs phenomenon. In other words, it is a span in which the amplitude of the signal does not decrease, but at the same time, the oscillations do. Also, a Fourier series is an expansion of a periodic function in terms of an infinite sum of sines and cosines. Moreover, its use pertains to the representation of a periodic signal in terms of sine and cosine waves.

Furthermore, with regards to signal processing, overshoot is essentially the point in which the filter output is a higher maximum value than the input, and it is explicitly for the step response. Also, this will frequently yield the relative phenomenon, ringing artifacts. In terms of a definition, ringing artifacts are artifacts that occur in signal processing, that appear as specious signals near the sharp transitions of a signal.

In control systems engineering, there is a subfield of mathematics called control theory. The primary function of control theory is to address the control of continuously operating dynamical systems that exist within machines and in engineered processes. Furthermore, the overall objective is to cultivate a control model for the purpose of controlling such systems through the use of optimized control actions. This, of course, encompasses actions that optimally address these control functions without overshoot or delays, thus ensuring control stability.

Also, a device called the Proportional-Integral-Derivative (PID) controller is in extensive use as a facilitator of control theory. The PID controller is a versatile feedback compensator that is complex in its functional design, but easy to use. Furthermore, the two most essential characteristics of the PID controller is its ability to be easily understood and its effectiveness.

Moreover, it affords engineers the conceptional understanding of its differentiation and integration functions. This, in turn, makes it easier for them to implement the control system even without an in-depth knowledge of control theory. Although the PID controller’ compensator is simple, it is rather complicated since it can both anticipate future system behavior and capture system history.

When using a PID controller, increasing the proportional gain effectively and proportionally increases the control signal equal to the level of the error. Furthermore, this will cause closed-loop systems to increase reaction since the PID pushes harder for a specified level of error. However, the unwanted side effect of this increase in reaction time is overshoot. Moreover, an additional effect of increasing the proportional gain is the fact that it also tends to reduce the steady-state error, but not entirely.

However, adding the derivative to the controller affords the ability to anticipate errors. Also, in simple proportional control, if the proportional gain is static, the control will only increase if the error increase. Whereas with derivative control, if the error begins sloping upward, the control signal may increase substantially, even with a small error magnitude. Moreover, the ability to anticipate system behavior lends itself to the addition of system damping, and thus decreases overshoot. Overall, the added derivative term does not affect the steady-state error.

Finally, the adding of the integral term to the controller helps to reduce steady-state error. Furthermore, if there happens to be a persistent, steady-state error, the integrator builds and builds, thus increasing the control signal and in turn, driving the error down. However, the side effect of the integral term is that it slows the system because when an error signal changes sign, there is an integrator delay.

Another essential technique is to use damping resistors (snubbing resistor) in series near all driving signal sources with fast rise and fall times. Therefore, any signal reflection that occurs will be abruptly diminished by each pass through the resistor. Generally, these resistors are less than 100 ohms and positioned close to the driving signal source. In summary, this creates a damped circuit so that the signal rises to the proper logic level once without excessive ringing and overshoot.

Overshoot is more often than not, an undesired occurrence, mainly when it results in clipping. However, there are times when it is a desirable occurrence, such as in image sharpening, but for those in the field of PCB design, overshoot resides on the side of undesirable. Moreover, with the increasing competition for space on a finite landscape, approaching the ever-increasing design demands is even more critical. Though, all is not lost, with the proper care and simulation regimen in your design plans, overcoming overshoot and the myriad of other design challenges are but a simulation away

Cadence’s suite of design and analysis tools will have you and your designers and production teams working together to reduce overshoot in all of your PCB designs.Allegro PCB Designer can make it easy for your design to be segmented where signal integrity can be optimized while layout is happening among other production concerns.

Cornell said Target decided to roll out its new inventory plan after hearing retail competitors had similar woes. He said the company also wanted to get ahead of key sales seasons, such as back-to-school and the holidays, when stale merchandise could clutter stores and drive away customers.

Target said it had nearly $15.1 billion of inventory as of April 30, the end of the fiscal first quarter. That"s about 43% higher than in the year-ago period.

Target shocked Wall Street on May 18 with a wide earnings miss for the fiscal first quarter, as it got hit by fuel and freight costs, higher levels of discounting, and a rotation away from items like TVs, small kitchen appliances and bicycles. Its shares fell nearly 25%, marking the company"s worst day on Wall Street in 35 years.

Walmart missed earnings expectations, too. Its inventory levels were up about 33% compared with a year ago. Walmart U.S. CEO John Furner said at an investor event on Friday that about 20% of that is merchandise the retailer wishes it did not have. Roughly a third is additional inventory to help the retailer restock key items. He said it will be "a couple of quarters to get back to where we want to be."

Cornell said Target is sorting through its inventory, deciding in some cases to pack away merchandise to sell at full price in the future and in other cases to promote or come up with ways to sell through it now.

<script>var vtDt = {"name":"overshoot","type":0,"children":[{"name":"an approach that fails and gives way to another attempt","type":1,"children":[{"name":"go-around","type":2},{"name":"wave-off","type":2},{"name":"landing approach","type":4}],"end":true},{"name":"shoot beyond or over (a target)","type":1,"children":[{"name":"shoot","type":4},{"name":"blast","type":4},{"name":"miss","type":4},{"name":"undershoot","type":3}],"end":true},{"name":"aim too high","type":1,"children":[{"name":"aspire","type":4},{"name":"shoot for","type":4},{"name":"draw a bead on","type":4},{"name":"aim","type":4},{"name":"overrun","type":4}],"end":true}]}</script>

On December 7th, 1972, NASA’s Apollo 17 crew took photograph AS17-148-22727, better known as the Blue Marble. Seeing the Earth as a whole, comprehending it, and perceiving its fragility, was a game changer for the future of the planet and became the catalyst for the environmental movement of the 70s.

When confronted with issues of resource scarcity and climate change, many still find these issues either distant and impersonal, or overwhelming. That goes for individuals, organisations, and governments. Yet having conversations about these challenging issues is vital if we are to return our consumption to within the limits of the Earth’s annual regeneration capacity.

Earth Overshoot Day is the day when humanity’s demand for ecological resources in a given year exceeds what Earth can regenerate in that year. For the rest of the year, we are over-using resources (overshooting) and further degrading the natural world upon which we all rely.

In 2022, Earth Overshoot Day falls on 28th July, meaning that since the start of the year, our demand for resources is now already equivalent to the planet’s entire annual regeneration capacity. We are, in effect, using the resources of 1.7 Earths.

Compared to 2021, Earth Overshoot Day was on 29th July. As this day moves forward in 2022, it highlights the rapid increase in our consumption of Earth’s resources.

In 2020, the fall in world’s carbon emissions owing partially to COVID-19, pushed back the date of Earth Overshoot Day to August 22nd, showing us that change is possible.

The impacts of our annual overshoot is already visible , as seen through food shortages, extinctions, and extreme weather events which this year alone have included: unusually early heat waves globally, powerful floods and devastating wildfires. June 2022 alone had a multiple temperature records broken, alongside severe flooding in both the US and China.

Biodiversity loss is occurring more rapidly than at any other time in human history with resource consumption and associated land use responsible for 90% of biodiversity loss.

Resource consumption is highly unequal across the world with higher-income countries contributing the most to the over exploitation of resources. For most wealthy countries, where consumption is highest, earth overshoot day has already come and gone (in 2022, the date for the UK was May 19th).

Meanwhile, lower-income countries although contributing the least to the ecological crisis, are disproportionately negatively affected by the degradation of the natural world such as declines in agricultural production and food insecurity. The wealth of high-income countries generated primarily from the exploitation and degradation of natural resources, has created a buffer from the negative consequences they have created.

Wealthy countries and the company’s selling to them, consequently, have a responsibility to lead on bringing us back to operating within the earth’s ecological boundaries whilst supporting and enabling the social and economic development of lower-income countries.

Your personal Earth Overshoot day is the date in the year that would mark Earth Overshoot day if everyone had the same impact as you on the environment.

We have to remain self-aware, adaptive, and resilient to allow ourselves to operate well in a space that is uncertain. If we moved Earth Overshoot Day back 5 days a year from now until 2050, we would return back to within the planet’s limits. In order to move the date, governments, businesses and individuals alike must commit to living within the means of our planet with those who have contributed the most to the overshoot, taking accountability and leading a socially just sustainability transition.

According to the UN’s Global Biodiversity Framework, all businesses should assess, report on, and reduce by at least half, their impacts on biodiversity. With resource extraction and associated land-use accounting for 90% of biodiversity loss, companies need to start mapping and reducing their use of extracted resources. Anthesis can help clients develop material footprint for their products, brands and corporate operations, and from that, start developing targeted reduction strategies.

As leaders in driving sustainable performance globally, we help clients to build their sustainability goals and commitments, as well as develop roadmaps for a Net Zero future. Our expertise and technological solutions support clients in realising their sustainability ambitions.

A great example of this is the Game Console Voluntary Agreement founded by Sony, Microsoft and Nintendo in 2015. The competitive gaming giants came together to reduce the environmental impact of game consoles over their life-cycle and to achieve energy savings through better design. By putting their hands up and acknowledging that they are part of the problem, these manufacturers been able to make environmental commitments that cover the majority of the multi-billion dollar market.

A similar story can be told in relation to the long-term thinking of the Product Sustainability Round Table (PSRT), which Anthesis members organised for almost 25 years. The PSRT brought together sustainability experts from many of the world’s leading organisations to collaborate and learn from each other in a non-competitive environment.

Anthesis has offices in the U.S., Canada, UK, France, the Netherlands, Belgium, South Africa, Ireland, Italy, Germany, Sweden, Spain, Portugal, Andorra, Finland, Colombia, Brazil, China, the Philippines and the Middle East.

Intel’s announcement that it will spend $20 billion on a new chipmaking factory, or fab, in Ohio underscores the rising investment in semiconductor manufacturing. Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) doubled its factory investment (capex) last year and plans to spend as much as $44 billion in 2022. Most of this spending goes to new fabs; since TSMC is the leading foundry for fabless semiconductor vendors such as AMD, Nvidia, and Qualcomm, these factories should help break the supply-chain bottlenecks that have been hampering the industry. Samsung, the leading memory supplier and TSMC’s largest foundry competitor, plans to spend another $35 billion or so.

The problem is that new chip factories are extremely complex and require about two years from start of construction to producing chips in high volume. Any factories TSMC builds this year won’t kick in until 2024. Intel’s Ohio plant, which will take longer because it is starting from an empty site, targets first production in 2025.

Fortunately, chipmakers started to build more factories in 2H20, as the chip shortage first emerged, and these fabs should come on line later this year, helping to ease the shortage. But it will likely be 2023 by the time supply and demand are fully in balance. With even more fabs ramping up in subsequent years, will chipmakers overshoot the mark, resulting in a glut of chips in 2024 and beyond?

Those who follow the semiconductor market know that the industry is cyclical. The delay between starting a new fab and its production means that chipmakers must guess market conditions two years in advance, and they often guess poorly. As a result, the industry typically builds too much factory capacity when supply is short (as it is now), resulting in too much capacity two years later, by which time demand may have eased. The most recent example happened when memory demand surged in 2017 due to rapid growth in cloud computing; by the time new memory fabs finally began producing in 2019, they flooded the market with too many chips, and memory prices crashed.

This cycle should be different. Memory vendors have difficulty forecasting demand because they sell commodity chips, so many customers simply buy chips when they need them. Large customers may sign contracts for a year at a time, but that isn’t long enough to forecast demand for new fabs. In contrast, Intel and TSMC produce processors and other specialized parts that take two to three years to design. Thus, both companies know well ahead of time exactly what products they will be building and can make a fairly good forecast of demand.

Intel builds its own processors, so it just has to estimate PC and server demand. TSMC builds chips for others, but those companies engage with the foundry early in the design cycle to ensure compatibility with TSMC’s processes. The foundry works closely with its customers to project demand for these products. These chipmakers can still be caught off guard if demand suddenly surges, as it did in 2020, or drops, but they are unlikely to overbuild by a large amount.

The big increases in semiconductor capex can be seen partly as catching up from recent underspending. Total capex for the chip industry rose at an annual rate of only 6% from 2017 to 2020, according to IC Insights. In 2021, however, it jumped 34%, and projections from the three largest chipmakers indicate 2022 will see another 27% rise. Intel, for example, cut capex under CFO-turned-CEO Bob Swan, but new CEO Pat Gelsinger has embarked on a turnaround plan that includes spending up to $100 billion at the Ohio site and another $100 billion on European fabs over the next several years. Samsung, newly aggressive now that its de facto leader Lee Jae-Yong has returned from jail, plans to spend $205 billion in capex over the next three years, about half on chip factories. TSMC’s three-year plan includes $100 billion on new fabs.

Another reason that capex is rising is that chip factories are becoming more expensive. As transistors get smaller, the high-precision equipment required to manufacture them costs more; a single state-of-the-art EUV tool, for example, exceeds $100 million. These leading-edge technologies also require more steps, so fabs need more machines to maintain throughput. Thus, even with the growth in spending, a new factory may produce about the same number of chips as the previous one.

The bad news for CIOs is that it will take another year for the chip shortage to fully disappear, although supplies should improve during that period. The good news is that chipmakers are investing heavily to make sure that they are prepared for demand in 2024 and beyond, so we won’t have another painful shortage any time soon.

Disclosure: The Linley Group, a subsidiary of TechInsights, provides research services to and receives revenue from most of the technology companies named in this article.

Additional research from the St. Louis Fed shows that price pressures tended to be greatest in U.S. industries with heightened exposure to foreign countries experiencing particularly severe supply bottlenecks, as measured by indexes of work backlogs and supplier delivery times. Some of the largest exposures were in the U.S. motor vehicles, petroleum, basic metals, and electrical equipment industries.

A natural question is the extent to which increased inflation is due to overly accommodative macroeconomic policies versus the supply-side shocks caused by the COVID-19 pandemic and, more recently, the war in Ukraine. The multiplicity of shocks and their staggered arrival times make this a difficult question to answer definitively.

Researchers have responded to the challenge by taking a variety of approaches. One such effort was undertaken by the Richmond Fed"s Alex Wolman in a recent working paper, "Relative Price Shocks and Inflation," which he co-authored with Francisco Ruge-Murcia of McGill University. Within the context of a more general analysis of the relationship between relative price shocks and inflation, the researchers presented a model that they used to break down the behavior of U.S. inflation from March 2021 through November 2021 into contributions from supply-side shocks versus overly accommodative monetary policy.

In the model, the monetary authorities do not attempt to stabilize the prices of individual goods and services, nor do they attempt to constrain overall inflation to an extremely narrow range in the short run. "If the relative price of used cars needs to go sky high because of supply disruptions, the way that"s going to happen at first is for the prices of used cars to go sky high," says Wolman. "It"s not going to happen by having the prices of all of the other goods in the economy decline all at once." Thus, sector-specific supply shocks can affect the economy-wide rate of inflation on a month-by-month basis, even under a monetary regime marked by low inflation and policy stability.

Over the model"s long-term horizon, however, monetary policy does stabilize inflation. Although the central bank allows unusually large relative price shocks to pass through to inflation, those shocks are — by definition — unusual, so inflation tends to remain close to the Fed"s target.

Wolman and Ruge-Murcia found that the inflationary increase during the period between March 2020 and November 2021 was roughly four-fifths due to supply-side shocks, with the single largest supply-side shock coming from the vehicle sector. Overly accommodative monetary policy explained the remaining one-fifth of the inflation overshoot. Although the model does not explicitly incorporate fiscal policy, Wolman believes that, in practice, their calculation of monetary policy"s contribution to inflation most likely captures the combined inflationary contributions of both monetary and fiscal policy. "My view is that there was a big expansionary fiscal shock, and that if the Fed had followed its usual policy rule, it would have chosen a much higher interest rate than it actually did," says Wolman. "To the extent that the Fed did not raise rates in response to the fiscal stimulus, it"s going to show up in our model as a monetary policy shock."

Recent research by economists at the New York Fed broadly concurs with Wolman"s finding that the inflationary increase seen during 2021 owed much to supply-side factors such as production and shipping bottlenecks and higher input prices. They also agreed in the assessment that loose monetary policy played a secondary role, concluding that the global nature of recent supply shocks suggests that "domestic monetary policy actions would have only a limited effect on these sources of inflationary pressures."

But these two studies come with an important caveat: They only cover the period through late 2021, when U.S. inflation was still behaving much like it had during 1995-2019 — a period of low and stable inflation in which relatively high monthly inflation readings were mostly accounted for by large price increases in a small share of goods and services. More recent data have deviated from this pattern. "Not only has inflation continued to be high," says Wolman, "it has also been associated with a larger share of goods with large price increases." To Wolman, this increased inflationary breadth raises concern that inflation may be becoming more of a monetary phenomenon and less a supply-side phenomenon.

Ana Maria Santacreu of the St. Louis Fed has taken a variety of approaches to understanding the recent increase in inflation. "We"ve done a lot of things from different angles," she says. "There"s no one method that can tell us, "how much is demand, and how much is supply?"" While some of her research has pointed to the importance of supply-side factors, she has also found evidence suggesting that expansionary fiscal policies have played an important role. She recently co-authored a working paper that examined recent increases in inflation across a sample of advanced and emerging economies. The researchers found that expansionary fiscal policies tended to increase consumption but had only a limited impact on the supply of goods as measured by industrial production indexes. "We take the results as evidence that fiscal policies contributed to inflationary mismatches between demand and supply," says Santacreu.

Pinning down the precise sources of current inflationary pressure has important implications for policy. To the extent that increased inflation reflects overly stimulative policy, the antidote is apparent: Reverse course and revert to policies more consistent with past periods in which inflation was stabilized. To the extent that increased inflation reflects supply-side shocks, however, the usual tools of aggregate demand management are likely to offer little help.

In the wake of the global oil price shocks of the 1970s, economists devoted much effort to understanding the optimal monetary policy response to supply shocks. Unfortunately, however, the consensus conclusion was that the standard tools of monetary and fiscal policy are not well designed to address supply shocks. Edward Gramlich of the University of Michigan provided a summary of this viewpoint in a 1979 article that appeared in Brookings Papers on Economic Activity. He concluded that supply shocks are very costly, no matter what the policy response: "If their unemployment impact is minimized by accommodating policies, the shock-induced inflation can linger for several years. If their inflationary impact is minimized by an immediate recession, the cost in terms of high unemployment is sizable."

As a practical matter, economists have often advocated some degree of accommodation in response to aggregate supply shocks. But the prescription for accommodation typically rests on the assumption of an economy initially at equilibrium — that is, one with stable inflation and full employment. While that was likely the case at the onset of the pandemic, it certainly was not the case when global energy and grain supplies were disrupted at the onset of the war in Ukraine. Indeed, year-over-year U.S. inflation had already hit a nearly 40-year record before that point.

While monetary policy is generally not an effective avenue for alleviating supply shocks, companies and governments are likely to take measures designed to soften such blows in the future. Undoubtedly, changing perceptions of risk will cause some firms to reassess their supply chains, just as Japanese automakers did after their supply networks were heavily disrupted by the 2011 Tōhoku earthquake. Indeed, even before the pandemic, many companies had been already reassessing their reliance on foreign value chains, due to, among other things, increased labor costs in China and the growing importance of "speed-to-market" as a competitive factor.

Calls for government policies to decrease dependency on global supply chains have come from many circles in the United States, Europe, and Japan. Treasury Secretary Janet Yellen, for example, has raised the prospect of "friend-shoring" policies. Similarly, officials from France and Germany have spoken of "reshoring projects" and "minimizing one-sided dependencies." Within the United States, the costs and benefits of such policies will continue to be debated among researchers and politicians, while Fed officials focus on the appropriate extent of monetary tightening or accommodation.

Akinci, Ozge, Gianluca Benigno, Ruth Cesar Heymann, Julian di Giovanni, Jan J. J. Groen, Lawrence Lin, and Adam Noble. "The Global Supply Side of Inflationary Pressures." New York Fed"s "Liberty Street Economics" blog, Jan. 28, 2022.

de Soyres, François, Ana Maria Santacreu, and Henry Yong. "Demand-Supply Imbalance During the COVID-19 Pandemic: The Role of Fiscal Policy." Working Paper, June 2022.

Once the 2018 Farm Bill decriminalized hemp cultivation at the federal level, growers of everything from canola to tobacco started seeing green in the idea of dedicating acreage to the cannabis plant—which, as the source of cannabidiol (CBD), also happens to be the source of one of the most hyped botanicals to hit the health-and-wellness sector in years.

But as often occurs when entrepreneurial spirits rush in to satisfy what they suspect will be stratospheric demand, these newly minted hemp farmers overshot the mark and grew more hemp than the market could absorb.

When Nutritional Outlook explored the state of the nation’s hemp supply in late-2019, things were already in a state of surplus, with the Washington, DC-based advocacy organization Vote Hemp noting in its 2019 U.S. Hemp Grower License Report that licensed domestic hemp acreage had quadrupled over the previous year’s figure, with 510,000-plus acres licensed to grow hemp in 34 states at the time.

More than a year later—and a world away, given all that’s happened since then—the situation remains largely the same, with more hemp out there than the industry knows what to do with.

Portland, OR-based Whitney Economics monitors the cannabis space closely, and according to founder Beau Whitney, “The excess inventory of biomass, specifically for CBD, carried over into 2020.”

He attributes much of the overage to what he calls “an immature supply chain,” along with a lack of buyers at the processing level. “Based on market prices at the time, it would have taken an average of $1.7 million for every licensed processor to purchase all of the biomass produced in 2019,” he observes. Alas, “The processing industry was underfunded.”

Moreover, with COVID-related retailing restrictions compounding somewhat dampened consumer demand for CBD products, CPG brands had little incentive to top off their inventories, and thus dialed back their orders into the processing sector, exacerbating the surfeit of idle hemp.

Perhaps that’s why Eric Steenstra, Vote Hemp’s president, suggests that 2020 might best be characterized as a year of consolidation and “survival of the fittest” within the industry—trends he foresees persisting into 2021. “Many farmers who jumped in speculatively have already dropped out after realizing that supply had outpaced demand,” he says.

Yet more hemp cultivators actually jumped into the game last year to replace those who’d exited, Whitney notes, adding that the number of hemp-processing companies in the U.S. grew by more than 100% in 2020, too.

Whitney assigns no small blame to the COVID-19 pandemic for stymieing sector manufacturers’ main channel: retail. And while savvy brands pivoted—“as usual,” he says—toward strengthening their online presence, “the inability to advertise on Google, Facebook, etc., hurt.”

Steenstra also declares the pandemic “a significant factor” in shaping industry outcomes in 2020, principally for its role in forcing most sales online. Nevertheless, he predicts, “As the virus begins to dissipate following significant vaccination, we should see retailer sales of CBD products rebound.”

That’s the hope. Yet even if vaccinations accelerate and the country resumes something resembling normal, the path ahead won’t be crystal clear for the CBD sector or the hemp supplies that feed it.

Why? “Regulatory uncertainty has been the main contributor to the suppression of the market and remains the top existential threat to the industry,” Whitney asserts.

Steenstra agrees. “FDA and its failure to regulate are the biggest limiting factors on CBD sales,” he says, adding that although the agency submitted proposed enforcement guidelines to the Federal Office of Management and Budget in 2020, those guidelines have yet to receive approval.

So industry members wait in limbo. “It’s difficult to predict when CBD regulation will finally be resolved and how,” Steenstra laments. “Will it be via FDA regulation, or legislation?” Regardless, he says, “When it does, we’ll see things shift back to a seller’s market for hemp products.”

For example, says Brian Zapp, creative director, Applied Food Sciences (AFS; Austin, TX), “The narrative I think we should be wary of is excusing growers who simply aren’t working with genuine ‘hemp’ varietals.” With some farmers growing “marijuana-hybrids” formally defined by U.S. Pharmacopeia (USP) as THC/CBD-intermediate type II chemotypes, “It’s not surprising how many businesses are struggling to keep their THC levels within the legal range” of not more than 0.3% on a dry-weight basis, he says.

Trial plots across the country are helping researchers better understand seed genetics to get a handle on the issue, he says, “but it will take time for hemp to become more of a landrace industrial crop with more predictable levels of active compounds.”

In the meantime, European growers have long cultivated “true industrial hemp,” which USP defines as type III CBD-dominant chemotypes, and the European Commission recognizes 64 varieties of authorized non-narcotic industrial hemp in an EU plant-variety database. Zapp is confident the U.S. will get there, “but we need to remain patient and careful not to overreact to the inevitable variables that come up.”

For his part, Tim Hitchman, vice president, operations, CV Sciences (San Diego), expresses concern that the current oversupply has motivated some hemp and hemp-extract suppliers to “aggressively diversify their portfolios to provide differentiated offerings and promote hemp cultivars and extracts high in minor cannabinoids such as CBG (cannabigerol) and CBN (cannabinol).”

Despite burgeoning interest in these compounds, Hitchman points to a lack of published safety data on their use and concludes that “in this time of excess supply, it’s more important than ever to follow best practices in choosing partners to ensure that ingredients and products are made under cGMP guidelines. Not all companies are yet able to comply.”

Returning to market conditions, Whitney expects hemp prices to continue falling below production costs as cultivators and processors—he cites GenCanna as one—leave the market. But he doesn’t expect supplies themselves to come into balance anytime soon.

In fact, “Whitney Economics does not see a recalibration but rather a supply expansion,” he says. Forecasts project licensed hemp acreage going from 525,000 acres in 2019 to 9.0 million acres by 2030—“and that,” he adds, “is extremely conservative.”

Where will all the hemp go? He thinks the expansion could drive support for “major markets” including human and animal feed, automotive, textiles, construction, plastics and semiconductors, as well as holistic medicines.

And Steenstra himself is bullish on hemp’s future in food. “Sales of hemp foods continue to grow at a double-digit rate,” he notes, “and hemp will likely play a bigger role in the plant-based meats trend going forward—driving further demand.”

Whitney believes that for the market to reach its true potential, “It will take visionaries willing to invest not only in the industry’s supply side, but in creating the demand, as well.”

Steenstra chalks it all up to a bump in the road. “I think we’re mostly seeing typical growing pains for a new crop,” he wagers. “Businesses and brands with a strong plan to survive from now until FDA regulation will thrive.”

Besides, interest in hemp CBD abides. As Steenstra says, “CBD isn’t just a fad or hot trend. These products work, and millions of consumers have used them with good results. Hemp-derived CBD-rich extracts are here to stay.”

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time 86193dc73cbca3c9758c8f2d30abff66 63.210.148.230 02/10/2023 12:45 PM UTC

Vanishing middle-class purchasing power is not just a concern of auto manufacturers. Antal Pinter, commercial director of Levi Strauss Trading Ltd., which manufactures 1.8 million pairs of jeans annually in Hungary, said: "The middle-class here is disappearing, and that is worrying. We don"t want to be suppliers just of the thin layer of new rich at the top of the market who can afford almost anything."

This new elite, which other Hungarians refer to as the "high society," using the English expression with a bitter twist, is getting rich by cutting corners. "Eighty to 90 percent of businesses here are not doing regular VAT invoicing," Mr. Pinter of Levi Strauss said. "That creates a strong competitive disadvantage for multinationals like ourselves who work by the book and don"t evade taxes."

Because crime often does pay in today"s Hungary, the "high society" itself is becoming an interesting market for those who know how to meet its special needs.

Zoltan Klivinyi specializes in importing American performance cars for a select clientele. He said he kept his dealership open every evening until 10:00 because "most of my clients are gangsters, and they sleep all day." He added, "I never sell anything before 5:00."

Mr. Klivinyi said he was moving 10 to 15 big-ticket autos a month and that "business just keeps getting better." There"s probably not another auto dealer in Budapest who could say the same.

He sells "performance cars" - autos such as Vipers, Corvettes and Mustangs with big engines - that he says are "slightly previously owned." Mr. Klivinyi said he got them from "a friend in Miami."

He was patting the flank of a muscular white Mustang convertible as he spoke. He said he thought that one would go for around 5 million forints ($39,600) - a price beyond the reach of most in Hungary, where good industrial jobs pay between $400 and $500 a month.

The automotive industry is likely to miss climate goals by 75%, according to a study backed by electric vehicle makers Polestar and Rivian that was released on Wednesday.

The study by global management consultants Kearney, called the Pathway report, said the industry would dramatically overshoot the Intergovernmental Panel on Climate Change"s target to try to limit the average global temperature increase to 1.5 Celsius by 2050 if automakers did not take action.

"Electrification alone is not the solution – even if everycarsold in the world tomorrow would be electric, we"re still on track to overshoot," Polestar and Rivian said, adding that they had invited the world"s leadingcarmakers to a roundtable and briefing discussion.

The report calls for urgent, collective action industrywide. “Car companies may be on different paths when it comes to brand, design, and business strategies, and some won’t even admit that the road to the future is electric. I believe it is, and that the climate crisis is a shared responsibility, and we must look beyond tailpipe emissions,” said Polestar head of sustainability Fredrika Klarén. “This report makes clear the importance of acting now and together. There’s a clear cost to inaction, but there’s also a financial opportunity for innovators who find new answers to the challenges we face.”

And focusing on reducing emissions in production and supply chains. The report stresses that this step is key and will create bigger gains than just putting EVs on the road.

Climate goals have been at the forefront ofcarmakers" priority for the past decade as customers become increasingly sustainability-conscious, with the recent energy crisis and war in Ukraine underscoring the importance of accelerating the green shift.

Swedish automaker VolvoCars is among those that have pledged ambitious goals, promising that by 2030 it will sell only electriccars. It also plans on reducing emissions across its entire value chain, aiming to become a climate-neutral company by 2040. Othercarmakers have similar goals.

Despite the will of automakers to make the shift, geopolitical and macroeconomic conditions have continued to make life difficult for the industry, with higher costs, component shortages and supply chain issues continuing.

Rivian is one of the companies that has struggled with production ramp-up for its vehicles, and has been squeezed further as EV giant Tesla cut its prices. In early February, Rivian said it would lay off 6% of its workforce in an effort to cut cost.

Auto suppliers are also struggling with coping with the additional costs for making their components sustainable in order to meetcarmakers" sustainability goals.

8613371530291

8613371530291