rongsheng refinery capacity made in china

Rongsheng Petrochemical (brand value up 43% to US$2.3 billion) achieved very strong growth this year, rising two places in the chemicals ranking and jumpingfrom 10th to 8th place amongst global chemicals brands. The Chinese brand owns various globally significant facilities, including an integrated refining-petrochemical complex with the refining capacity of 40 million tons per annum.

SINGAPORE, Oct 14 (Reuters) - Rongsheng Petrochemical, the trading arm of Chinese private refiner Zhejiang Petrochemical, has bought at least 5 million barrels of crude for delivery in December and January next year in preparation for starting a new crude unit by year-end, five trade sources said on Wednesday.

Rongsheng bought at least 3.5 million barrels of Upper Zakum crude from the United Arab Emirates and 1.5 million barrels of al-Shaheen crude from Qatar via a tender that closed on Tuesday, the sources said.

Rongsheng’s purchase helped absorbed some of the unsold supplies from last month as the company did not purchase any spot crude in past two months, the sources said.

Zhejiang Petrochemical plans to start trial runs at one of two new crude distillation units (CDUs) in the second phase of its refinery-petrochemical complex in east China’s Zhoushan by the end of this year, a company official told Reuters. Each CDU has a capacity of 200,000 barrels per day (bpd).

Zhejiang Petrochemical started up the first phase of its complex which includes a 400,000-bpd refinery and a 1.2 million tonne-per-year ethylene plant at the end of 2019. (Reporting by Florence Tan and Chen Aizhu, editing by Louise Heavens and Christian Schmollinger)

(Reuters) Chinese conglomerate Zhejiang Rongsheng Holding Group plans to double capacity of a joint venture refining project to 800 Mbpd in 2020, two years after the first phase starts up, senior company officials said Thursday.

The project, a venture among private companies led by Rongsheng, is planning to start up the 400 Mbpd first phase in 2018, aiming to meet the group"s requirements for petrochemical feedstocks.

The higher throughput in 2021 was attributed to refining capacity expansion, and as refineries produced more oil products to compensate for the reduction in imports of blending materials for gasoline and gasoil, analysts said.

The integrated Zhejiang Petroleum & Chemical refinery continued to raise its crude throughput to around 2.84 million mt in December, up 7.2% from 1.72 million mt in November, which was up 54% from October, according to JLC data. The refinery ramped up throughput after it was allocated more quotas in late October.

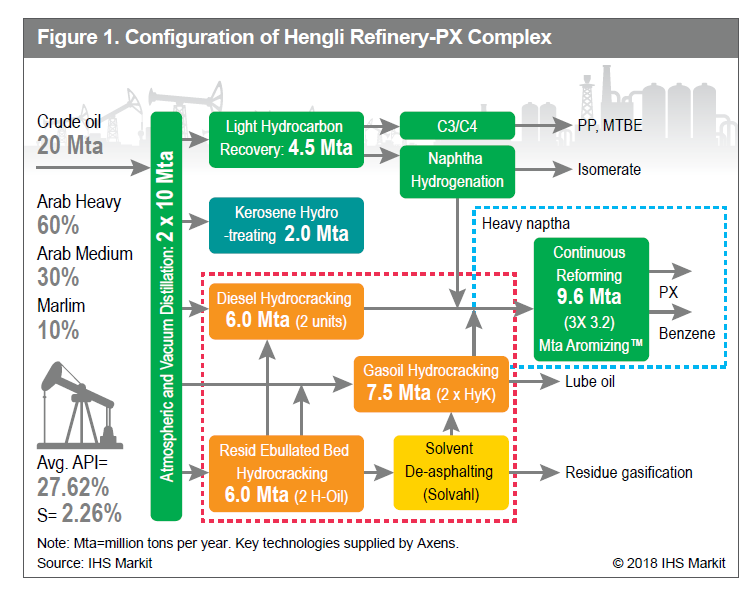

The Hengli Petrochemical (Dalian) Refinery in Liaoning province also raised its throughput by 3.6% month on month to 1.7 million mt in December. This comes after the completion of the maintenance at its secondary units, according to refinery sources.

However, Shandong independent refineries have gradually started to cut crude throughput from around Jan. 22 in response to a directive to cap utilization below 70% during the Winter Olympics, as Beijing aims to ensure that emissions remain under control, refinery sources told S&P Global Platts. But some refinery sources believe the overall impact will not be much more than what occurs every year since the Winter Olympics will be held around the Lunar New Year holidays, when independent refineries are forced to cut crude throughput due to logistics and manpower constraints.

In other news, Sinopec"s Hainan Petrochemical refinery in southern China is expected to export about 50,000 mt of refined oil products in January 2022, according to a refinery source. This was down 55% from 110,000 mt planned for export in December 2021.

PetroChina"s West Pacific Petrochemical Corp. refinery will skip gasoil exports in January after skipping them in December and November due to good demand in the domestic market.

PetroChina"s flagship refinery Dalian Petrochemical in northeastern Liaoning province will raise its gasoline exports to 160,000 mt in January, according to sources with knowledge of the matter. This will be about 357% higher than its planned exports in December. Dalian will double jet fuel exports to 80,000 mt in January, from 40,000 mt last month. Dalian plans to process around 1.3 million mt of crudes in January, translating to 75% of its nameplate capacity, stable on the month.

** Sinochem has been in the process of starting up its 12 million mt/year CDU and related refining units at its Quanzhou Petrochemical facility in southern Fujian province, according to a source with knowledge of the matter Jan. 19. The refining and petrochemical units were shut at around Dec. 1, 2021 for maintenance, which lasted for about 40-50 days, according to the maintenance schedule. The refinery will likely process about 450,000 mt to 500,000 mt of crudes for the remainder of February, compared with around 1.2 million mt during normal months.

** Sinopec"s Fujian Refining and Chemical Co. refinery in southeastern Fujian province has been in the process of restarting from a scheduled maintenance this week, according to a source with knowledge of the matter Jan. 19. The refinery was expected to return to normal operations around Jan. 20, about nine days behind schedule, mainly due to the slow progress in procuring some parts, the source added. The 4 million mt/year crude distillation unit, as well as some secondary units, including the aromatics units, were to be restarted along the way. Following the restart of the CDU, the crude throughput at the refinery will likely increase to around 750,000 mt in January, or 63% of its nameplate capacity. This compares with a run rate of 56%, or 660,000 mt, in December 2021.

** Japan"s ENEOS said Dec. 28 it plans to shut the sole crude distillation unit at its Marifu refinery in the west in late January for scheduled maintenance until early March 2022.

** Idemitsu Kosan restarted the sole 160,000 b/d crude distillation unit at its Aichi refinery in central Japan on Dec. 5 after completing planned maintenance, a spokesperson said Dec. 20.

** PetroChina"s Yunnan Petrochemical refinery in southwestern Yunnan province, has shut its 4 million mt/year residual hydrogenation unit and some of its relative downstream facilities due to a blast. The blast hit the residual hydrogenation unit Dec. 13 morning, according to a press release issued by the Anning city local government in Yuannan. A refining engineer said the closure of residual hydrogenation unit would cut about 30% of the refinery"s daily production.

** Sinopec"s Hainan Petrochemical refinery in southern China plans to completely shut for scheduled maintenance over March-April 2022, a source with the refinery said. This is a routine maintenance that is normally carried out by Chinese refineries every three to four years, according to the source. Sinopec Hainan refinery last carried out complete maintenance over November 2017-January 2018.

** Japan"s ENEOS said it will decommission the 120,000 b/d No. 1 CDU at its 270,000 b/d Negishi refinery in Tokyo Bay in October 2022. It will also decommission secondary units attached to the No. 1 CDU, including a vacuum distillation unit and fluid catalytic cracker. ENEOS will also decommission a 270,000 mt/year lubricant output unit at the Negishi refinery.

** Sinopec is looking to launch its 2 million mt/year crude distillation unit expansion at Luoyang Petrochemical in central China in January, with a new crude pipeline able to supply sufficient feedstock, a refinery source said late December. "We have reconfigured an existing crude pre-treater into a 2 million mt/year CDU to increase the primary capacity to 10 million mt/year. The start-up will be in the next month with the crude pipeline having been put into use in November," the refinery source said. The expansion was initially set to be put into use in H2 2020, but was delayed to H1 2021 due to construction of the 10 million mt/year Rizhao-Puyang-Luoyang crude pipeline and weak demand in oil product market, Platts reported. The source said the expansion needs more crude supplies discharged from Rizhao port in Shandong province and transmitted through the Rizhao-Puyang-Luoyang crude pipeline.

** Chinese Sinopec"s refinery Zhenhai Refining and Chemical currently has a 27 million mt/year refining capacity and a 2.2 million mt/year ethylene plant, after its phase 1 expansion project of 4 million mt/year crude distillation unit and a 1.2 million mt/year ethylene unit was delivered end-June.

** PetroChina"s Guangxi Petrochemical in southern Guangxi province plans to start construction at its upgrading projects at the end of 2021, with the works set to take 36 months. The projects include upgrading the existing refining units as well as setting up new petrochemical facilities, which will turn the refinery into a refining and petrochemical complex. The project will focus on upgrading two existing units: the 2.2 million mt/year wax oil hydrocracker and the 2.4 million mt/year gasoil hydrogenation refining unit. For the petrochemicals part, around 11 main units will be constructed, which include a 1.2 million mt/year ethylene cracker.

** Axens said its Paramax technology has been selected by state-owned China National Offshore Oil Corp. for the petrochemical expansion at the plant. The project aims at increasing the high-purity aromatics production capacity to 3 million mt/year. The new aromatics complex will produce 1.5 million mt/year of paraxylene in a single train.

** China"s privately held refining complex, Shenghong Petrochemical, is likely to start feeding crudes into its newly built 16 million mt/year crude distillation unit, according to a company source in early January. The refinery initially planned to start up at the end of August, but this was postponed to the end of December due to slower-than-expected construction work, and then again to around the Lunar New Year. The construction of the complex started in December 2018. Located in the coastal city of Lianyungang in Jiangsu province, the company"s 16 million mt/year CDU is the country"s single biggest by capacity.

** Chinese privately owned refining and petrochemical complex Zhejiang Petroleum & Chemical has fully started up commercial operation at it 400,000 b/d Phase 2 refining and petrochemical project, parent company Rongsheng Petrochemical said in a document Jan. 12. There are two crude distillation units in the Phase 2 project, each with a capacity of 200,000 b/d. ZPC started trial run at one of the CDUs in November 2020. Due to tight feedstock supplies, the refiner could not feed the other CDU until the end of November 2021, when it gained crude import quota for the project. The nameplate capacity of the company doubled to 800,000 b/d in Phase 2. It will run four CDUs at about 82% of nameplate capacity in January. Rongsheng said Phase 2 adds 6.6 million mt/year aromatics and 1.4 million mt/year ethylene production capacity.

** Saudi Aramco continues to pursue and develop the integrated refining and petrochemical complex in China with Norinco Group and Panjin Sinchen. The joint venture plans to build an integrated refining and petrochemical complex in northeast China"s Liaoning province Panjin city with a 300,000 b/d refinery, 1.5 million mt/year ethylene cracker and a 1.3 million mt/year PX unit.

Construction work is expected to be completed in 24 months. The complex has been set up with the aim of consolidating the outdated capacities in Shandong province. A total of 10 independent refineries, with a total capacity of 27.5 million mt/year, will be mothballed over the next three years. Jinshi Petrochemical, Yuhuang Petrochemical and Zhonghai Fine Chemical, Yuhuang Petrochemical and Zhonghai Fine Chemical will be dismantled, while Jinshi Asphalt has already finished dismantling.

** PetroChina officially started construction works at its greenfield 20 million mt/year Guangdong petrochemical refinery in the southern Guangdong province on Dec. 5, 2018.

Zhejiang Petrochemical operates the Dayushan Island refinery, which is located in Zhejiang, China. It is an integrated refinery owned by Zhejiang Rongsheng Holding Group, Tongkun Group, Jihua Group, and others. The refinery, which started operations in 2019, has an NCI of 12.06.

Information on the refinery is sourced from GlobalData’s refinery database that provides detailed information on all active and upcoming, crude oil refineries and heavy oil upgraders globally. Not all companies mentioned in the article may be currently existing due to their merger or acquisition or business closure.

Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities in support of ADNOC’s 2030 growth strategy.

The companies will examine opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates (UAE) and the supply of liquified natural gas (LNG) to Rongsheng.

Under the terms of the deal, the companies will also study chances to increasing the volume and variety of refined product sales to Rongsheng as well as ADNOC’s participation as the China firm’s strategic partner in refinery and petrochemical projects. This could include an investment in Rongsheng’s downstream complex.

In return, Rongsheng will also look at investing in ADNOC’s downstream industrial ecosystem in Ruwais, UAE, including a proposed gasoline-to-aromatics plant as well as reviewing the potential for ADNOC to supply LNG to Rongsheng for use within its own complexes in China.

Rongsheng’s chairman Li Shuirong added that the cooperation will ensure that its project, which will have a refining capacity of up to 1 million bbl/day of crude oil, has adequate supplies of feedstock.

As MRC informed before, TotalEnergies has recently inaugurated the extension of Synova in Normandy, the French leader in recycled polypropylene production. TotalEnergies is therefore doubling its mechanical recycling production capacity for recycled polymers, to meet growing demand for sustainable polymers from customers, such as Automotive Manufacturer (Auto OEM) and the construction industry.

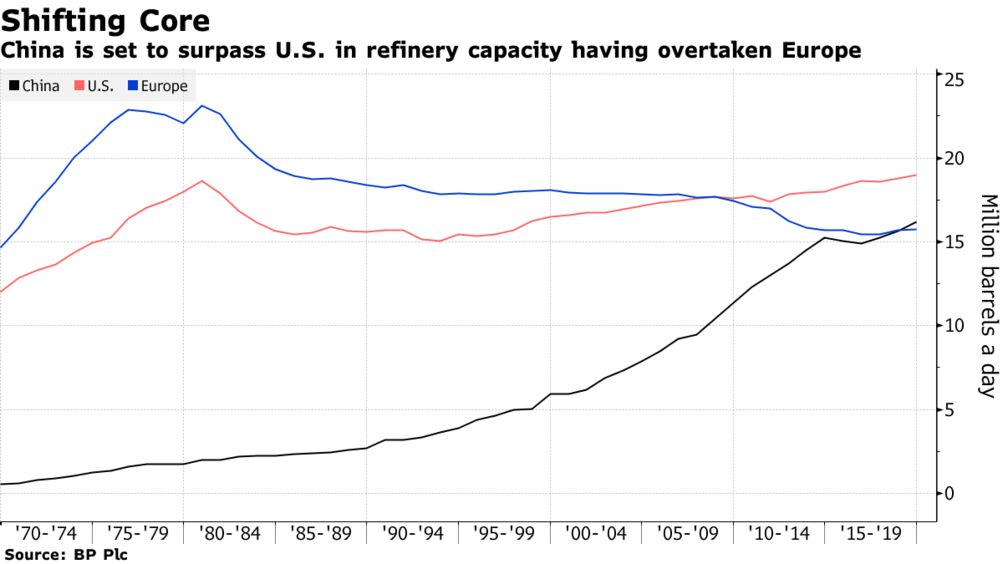

This year, China is expected to overtake the United States as the world’s largest oil refining country.[1] Although China’s bloated and fragmented crude oil refining sector has undergone major changes over the past decade, it remains saddled with overcapacity.[2]

Privately owned unaffiliated refineries, known as “teapots,”[3] mainly clustered in Shandong province, have been at the center of Beijing’s longtime struggle to rein in surplus refining capacity and, more recently, to cut carbon emissions. A year ago, Beijing launched its latest attempt to shutter outdated and inefficient teapots — an effort that coincides with the emergence of a new generation of independent players that are building and operating fully integrated mega-petrochemical complexes.[4]

China’s “teapot” refineries[5] play a significant role in refining oil and account for a fifth of Chinese crude imports.[6] Historically, teapots conducted most of their business with China’s major state-owned companies, buying crude oil from and selling much of their output to them after processing it into gasoline and diesel. Though operating in the shadows of China’s giant national oil companies (NOCs),[7] teapots served as valuable swing producers — their surplus capacity called on in times of tight markets.

Four years later, the NDRC adopted a different approach, awarding licenses and quotas to teapot refiners to import crude oil and granting approval to export refined products in exchange for reducing excess capacity, either upgrading or removing outdated facilities, and building oil storage facilities.[10] But this partial liberalization of the refining sector did not go exactly according to plan. Swelling with new sources of feedstock that catapulted China into the position of the world’s largest oil importer, teapots increased their production of refined fuels and, benefiting from greater processing flexibility and low labor costs undercut larger state rivals and doubled their market share.[11]

Meanwhile, as teapots expanded their operations, they took on massive debt, flouted environmental rules, and exploited taxation loopholes.[12] Of the refineries that managed to meet targets to cut capacity, some did so by double counting or reporting reductions in units that had been idled.[13] And when, reversing course, Beijing revoked the export quotas allotted to teapots and mandated that products be sold via state-owned companies, it trapped their output in China, contributing to the domestic fuel glut.

2021 marked the start of the central government’s latest effort to consolidate and tighten supervision over the refining sector and to cap China’s overall refining capacity.[14] Besides imposing a hefty tax on imports of blending fuels, Beijing has instituted stricter tax and environmental enforcement[15] measures including: performing refinery audits and inspections;[16] conducting investigations of alleged irregular activities such as tax evasion and illegal resale of crude oil imports;[17] and imposing tighter quotas for oil product exports as China’s decarbonization efforts advance.[18]

The politics surrounding this new class of greenfield mega-refineries is important, as is their geographical distribution. Beijing’s reform strategy is focused on reducing the country’s petrochemical imports and growing its high value-added chemical business while capping crude processing capacity. The push by Beijing in this direction has been conducive to the development of privately-led mega refining and petrochemical projects, which local officials have welcomed and staunchly supported.[20]

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

As China’s independent oil refining hub, Shandong is the bellwether for the rationalization of the country’s refinery sector. Over the years, Shandong’s teapots benefited from favorable policies such as access to cheap land and support from a local government that grew reliant on the industry for jobs and contributions to economic growth.[22] For this reason, Shandong officials had resisted strictly implementing Beijing’s directives to cull teapot refiners and turned a blind eye to practices that ensured their survival.

But with the start-up of advanced liquids-to-chemicals complexes in neighboring provinces, Shandong’s competitiveness has diminished.[23] And with pressure mounting to find new drivers for the provincial economy, Shandong officials have put in play a plan aimed at shuttering smaller capacity plants and thus clearing the way for a large-scale private sector-led refining and petrochemical complex on Yulong Island, whose construction is well underway.[24] They have also been developing compensation and worker relocation packages to cushion the impact of planned plant closures, while obtaining letters of guarantee from independent refiners pledging that they will neither resell their crude import quotas nor try to purchase such allocations.[25]

To be sure, the number of Shandong’s independent refiners is shrinking and their composition within the province and across the country is changing — with some smaller-scale units facing closure and others (e.g., Shandong Haike Group, Shandong Shouguang Luqing Petrochemical Corp, and Shandong Chambroad Group) pursuing efforts to diversify their sources of revenue by moving up the value chain. But make no mistake: China’s teapots still account for a third of China’s total refining capacity and a fifth of the country’s crude oil imports. They continue to employ creative defensive measures in the face of government and market pressures, have partnered with state-owned companies, and are deeply integrated with crucial industries downstream.[26] They are consummate survivors in a key sector that continues to evolve — and they remain too important to be driven out of the domestic market or allowed to fail.

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

Earlier this month, Royal Dutch Shell pulled the plug on its Convent refinery in Louisiana. Unlike many oil refineries shut in recent years, Convent was far from obsolete: it’s fairly big by US standards and sophisticated enough to turn a wide range of crude oils into high-value fuels. Yet Shell, the world’s third-biggest oil major, wanted to radically reduce refining capacity and couldn’t find a buyer.

Saudi Aramco today signed three Memoranda of Understanding (MoUs) aimed at expanding its downstream presence in the Zhejiang province, one of the most developed regions in China. The company aims to acquire a 9% stake in Zhejiang Petrochemical’s 800,000 barrels per day integrated refinery and petrochemical complex, located in the city of Zhoushan.

The first agreement was signed with the Zhoushan government to acquire its 9% stake in the project. The second agreement was signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, who are the other shareholders of Zhejiang Petrochemical. Saudi Aramco’s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical’s large crude oil storage facility to serve its customers in the Asian region.

Phase I of the project will include a newly built 400,000 barrels per day refinery with a 1.4 mmtpa ethylene cracker unit, and a 5.2 mmtpa Aromatics unit. Phase II will see a 400,000 barrels per day refinery expansion, which will include deeper chemical integration than Phase I.

Earlier this month, Royal Dutch Shell Plc pulled the plug on its Convent refinery in Louisiana. Unlike many oil refineries shut in recent years, Convent was far from obsolete: it’s fairly big by U.S. standards and sophisticated enough to turn a wide range of crude oils into high-value fuels. Yet Shell, the world’s third-biggest oil major, wanted to radically reduce refining capacity and couldn’t find a buyer.

As Convent’s 700 workers found out they were out of a job, their counterparts on the other side of Pacific were firing up a new unit at Rongsheng Petrochemical’s giant Zhejiang complex in northeast China. It’s just one of at least four projects underway in the country, totaling 1.2 million barrels a day of crude-processing capacity, equivalent to the U.K.’s entire fleet.

America has been top of the refining pack since the start of the oil age in the mid-nineteenth century, but China will dethrone the U.S. as early as next year, according to the International Energy Agency. In 1967, the year Convent opened, the U.S. had 35 times the refining capacity of China.

The rise of China’s refining industry, combined with several large new plants in India and the Middle East, is reverberating through the global energy system. Oil exporters are selling more crude to Asia and less to long-standing customers in North America and Europe. And as they add capacity, China’s refiners are becoming a growing force in international markets for gasoline, diesel and other fuels. That’s even putting pressure on older plants in other parts of Asia: Shell also announced this month that they will halve capacity at their Singapore refinery.

But while capacity will rise is China, India and the Middle East, oil demand may take years to fully recover from the damage inflicted by the coronavirus. That will push a few million barrels a day more of refining capacity out of business, on top of a record 1.7 million barrels a day of processing capacity already mothballed this year. More than half of these closures have been in the U.S., according to the IEA.

About two thirds of European refiners aren’t making enough money in fuel production to cover their costs, said Hedi Grati, head of Europe-CIS refining research at IHS Markit. Europe still needs to reduce its daily processing capacity by a further 1.7 million barrels in five years.

Chinese refining capacity has nearly tripled since the turn of the millennium as it tried to keep pace with the rapid growth of diesel and gasoline consumption. The country’s crude processing capacity is expected to climb to 1 billion tons a year, or 20 million barrels per day, by 2025 from 17.5 million barrels at the end of this year, according to China National Petroleum Corp.’s Economics & Technology Research Institute.

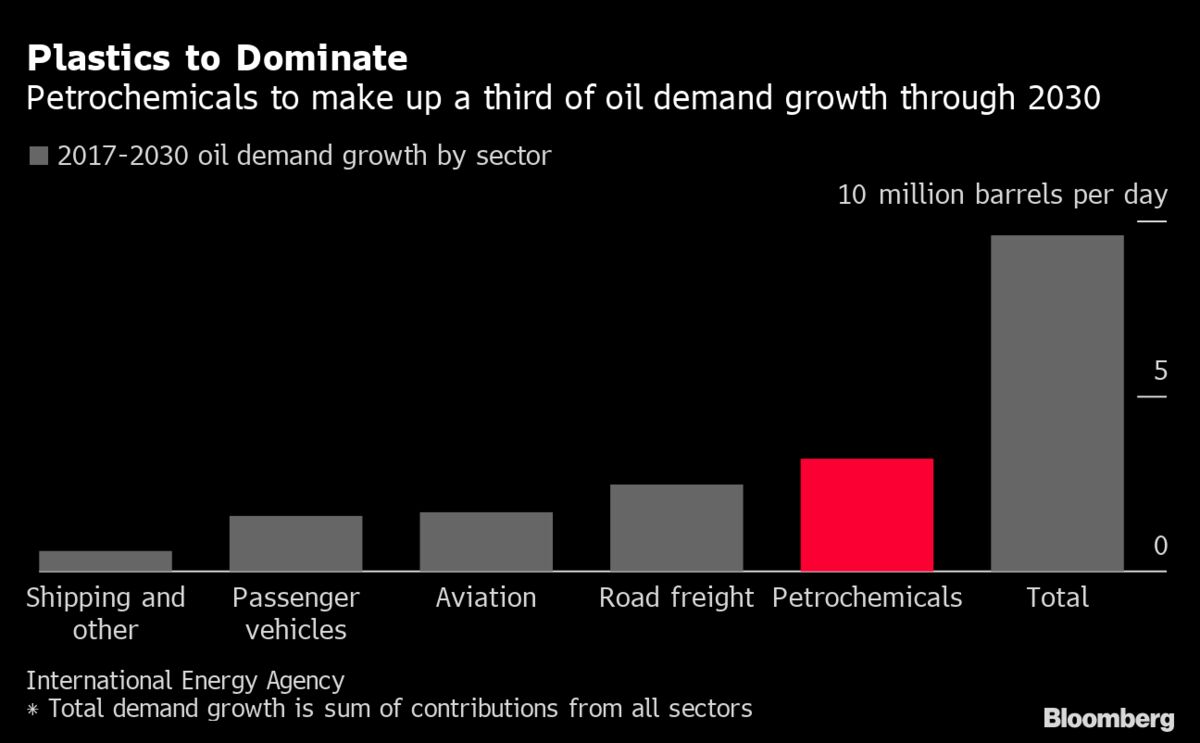

One of the key drivers of new projects is growing demand for the petrochemicals used to make plastics. More than half of the refining capacity that comes on stream from 2019 to 2027 will be added in Asia and 70% to 80% of this will be plastics-focused, according to industry consultant Wood Mackenzie.

The refineries being closed tend to be relatively small, not very sophisticated and typically built in the 1960s, according to Alan Gelder, vice president of refining and oil markets at Wood Mackenzie. He sees excess capacity of around 3 million barrels a day. “For them to survive, they will need to export more products as their regional demand falls, but unfortunately they’re not very competitive, which means they’re likely to close.”

Some refineries were set to shutter even before the pandemic hit, as a global crude distillation capacity of about 102 million barrels a day far outweighed the 84 million barrels of refined products demand in 2019, according to the IEA. The demand destruction due to Covid-19 pushed several refineries over the brink.

Even China may be getting ahead of itself. Capacity additions are outpacing its demand growth. An oil products oversupply in the country may reach 1.4 million barrels a day in 2025, according to CNPC. Even as new refineries are built, China’s demand growth may peak by 2025 and then slow as the country begins its long transition toward carbon neutrality.

“In an environment where the world has already got enough refining capacity, if you build more in one part of the world, you need to shut something down in another part of the world to maintain the balance,” FGE’s Sawyer said. “That’s the sort of environment that we are currently in and are likely to be in for the next 4-5 years at least.”

As the shift in oil demand from Covid-19 turned the tables of regional levels of fuel production and exports, China succeeded in overtaking the USA as the world’s biggest oil refiner in 2020. As China began to ramp up its refining capacity throughout the pandemic, the US Energy Information Administration (EIA) published data showing thatChina processed more crude oil than the U.S.for much of 2020.

Oil refineries across the U.S. have been losing momentum in response to the Covid-19 pandemic. At the end of last year, Royal Dutch Shell Plc ground production at its Convent refinery in Louisiana to a halt. This same facility had 35 times the refining capacity of China when it opened in 1967, showing how dramatically the tables have turned over the past couple of decades.

Oil refineries have also been impeded this year by the severe storm that hit the state of Texas in February. During the storm, oil refining fell to its lowest levels since 2008. This was largely due to frozen pipelines which forced producers to halt activities.Refinery crude runs fell by 2.6 million bpdthroughout the week to 12.2 million bpd.

Meanwhile, in November, China was processing around1.2 million bpd of crude oil. Much of this new refining work was taking place in the new unit at Rongsheng Petrochemical’s giant Zhejiang facility in northeast China.

China is not the only Asian giant to invest in refining over the next decade. Just a few weeks ago,India announced plan to invest $4.5 billion in a Panipat refinery expansionby September 2024. This would increase Panipat’s capacity by two-thirds to 500,000 bpd.

Only slightly behind China, as the world’s third largest oil importer and consumer, India is striving to increase its oil refining capacity by 60 percent to meet the country’s increasing oil demand. This comes as Prime Minister Narendra Modi has pledged to improve India’s manufacturing sector.

State-owned Indian Oil Corporation (IOC) has also announced plans to build a new refinery at Nagapattinam in the southern state of Tamil Naduat a cost of $4.01 billion. The IOC subsidiary Chennai Petroleum Corporation Limited is expected to develop the refinery. The project is aimed at meeting the demand of petroleum products across southern India.

While U.S. refining activities are expected to pick up before the end of the year, a dramatically increased oil refining capacity in China, as well as new projects in India, suggest that the face of the industry could change over the next decade. As oil demand wanes in the U.S. and continues to increase across Asia, many Asian countries will be seeking out refined products from closer to home to meet their needs.

China"s privately owned Hengyi Petrochemical said it plans to invest $13.65 billion to expand its oil refining and petrochemicals complex in Brunei. The company already has a 160,000 barrel per day refinery in Brunei as well as petchem facilities that produce benzene and paraxylene. The complex started operations in late 2019 (IOD Nov.6"19). The planned second phase of the project will add 280,000 b/d of refining capacity, 2 million tons per year of paraxylene capacity, 1.65 million tons/yr of ethylene, and 1 million tons/yr of PET. Construction will take around three years, Hengyi said in a stock exchange filing. Brunei is well placed to import crude oil from Middle East producers and export refined products and petchems throughout southeast Asia. Industry insiders told Energy Intelligence that privately owned Chinese refining and petchem companies that don"t have a close relationship with the country"s government may look to invest in Southeast Asia because it is difficult for them to obtain crude oil import quotas and permission to expand production capacity at home. "Many downstream plastics, textiles and rubber producers have already left China for Southeast Asia to build new plants,” said a petchems analyst at China"s state-controlled Sinopec. "Crude oil import quotas are a big hurdle and you need a lot of approvals to build refineries in China," said a crude oil trader. These overseas plants avoid the high import tariffs that the US has slapped on petchems produced in China. However, private companies that do have close ties with Beijing are not expected to invest in overseas capacity, preferring to focus instead on China"s huge domestic market. Hengli and Rongsheng, for example, have been accelerating refining/petchem expansion plans in China (IOD Aug.13"20). China has a surplus of refining capacity and its domestic oil products market is oversupplied (IOD Sep.3"20). This has made Beijing reluctant to approve new refineries and petchem plants or expand crude oil import quotas. Most small independent refineries, also known as teapots, have used up their annual crude oil imports quotas for this year and could not import any more crude, even if oil prices fell to very low levels. Dawn Lee, Beijing

8613371530291

8613371530291