workover rig companies in colorado in stock

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

The Floorhand performs the duties of general manual labor on the rig and supports and assists other members of the drilling crew during all rig operations.

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Performing rig up and down procedures, nipple up and down and care of the B.O.P. Ensuring safe and efficient rig operations to meet the company’s goals and…

2 years minimum experience as a rig hand on a production rig working floors and derricks. Starting pay is $23.00 per hour with an increase to $26.00 per hours…

Crew Member positions include Rig Trainee (no experience required), and Floor hand, Derrick hand, Relief Crew Chief, and Crew Chief, which are experience…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

Must have years of experience working multiple positions on an oil and gas drilling rig. General maintenance of drilling rig. Must be at least 18 years of age.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

Reliable means of transportation to and from rig site. The Floorhand is responsible for safely and efficiently performing a variety of physically demanding…

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

*Floor Hands - *minimum experience required 6 months. *Derrick Hands - *minimum experience required 1 year. Job Requirements: *Job requirements include but are…

The Leasehand also provides assistance to rig personnel as required. The Leasehand is responsible for keeping the rig clean, performing general maintenance and…

Previous experience as a carpenter, general laborer, roofer, landscaper, heavy equipment operator, construction, pipefitting, oil and gas, energy services,…

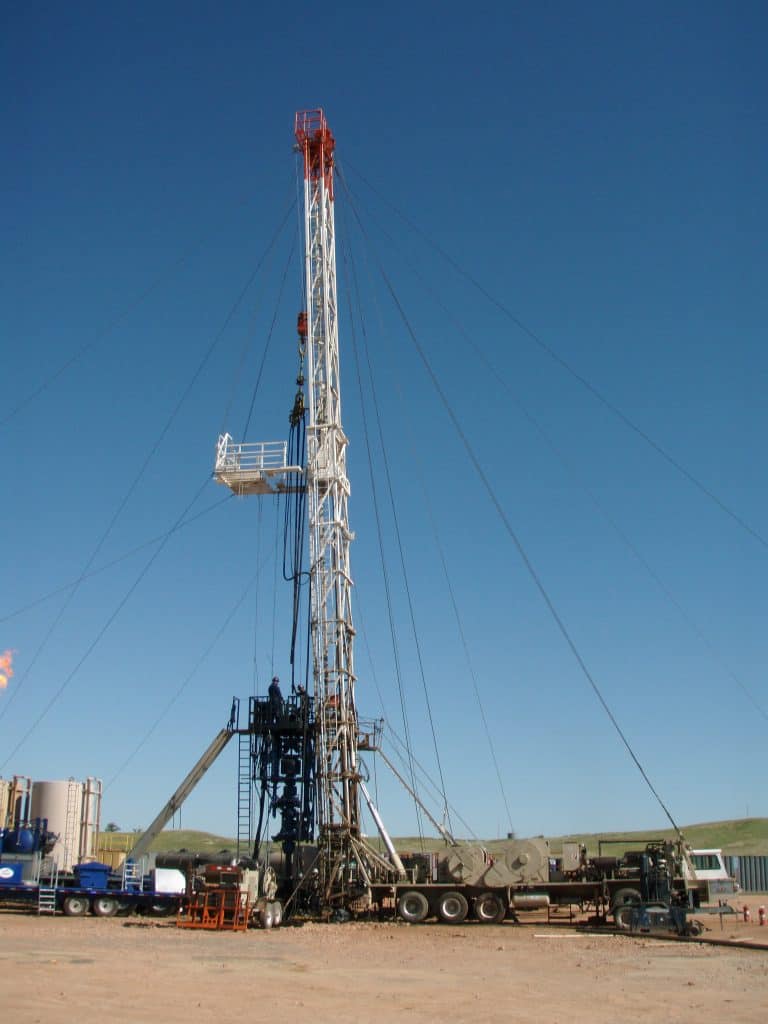

Eastern Colorado Well Service is a premier oil and gas service company in the regions we serve. Our employees provide an array of services to oil and gas producers in Colorado, Wyoming, Kansas, North Dakota and Texas. ECWS offers work-over rigs for completion and maintenance services, water hauling, heavy haul services and special rental tools for down-hole applications.

Ranger is one of the largest providers of high specification mobile rig well services, cased hole wireline services, and ancillary services in the U.S. oil and gas industry. Our advanced solutions are helping operators meet the technical and operational challenges of today’s extended reach horizontal wells. Our services facilitate operations throughout the lifecycle of a well, including the completion, production, maintenance, intervention, workover, and abandonment phases. Ranger is built for today’s oilfield with experienced crews and the latest technologies. Today’s oilfield takes more than just conventional support – it takes Ranger Energy Services.

As a drilling partner, we understand that what we do today impacts the quality, accuracy and productivity of your well, through to completion. That’s why—from engineering to wellbore placement and beyond—our industry-leading experts are designing and utilizing cutting-edge technologies that maximize production and minimize error rates, so you can meet (or exceed) the objectives you outline at the beginning of your project.

Axis is a completion and workover company built for today’s operators, as you shift into manufacturing mode while drilling ever-longer laterals. We’re advancing both goals through our core mission: optimizing completions.

For too long, well services has lagged other oil and gas sectors in innovation. Axis is changing that with integrated, data-driven services. New, purpose-engineered equipment. And a team that unites oilfield veterans with the next generation of crews and engineers through our leading-edge training culture.

If you"re located in Colorado and have your sights set on a rewarding career in the energy industry including oil & gas, pipeline, solar, wind - or even just skilled trades and craft jobs - we"ve got some great opportunities to share with you. We provide listings to career opportunities from popular employers such as Enterprise Products, Patterson-UTI, ExxonMobil, Suncor & hundreds more. Take advantage of job perks like Housing, Per Diem, Multiple rotations and beyond.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

At Brigade Energy Services, our mission is to exceed customer expectations on every job by delivering experienced and innovative well service solutions, the highest quality equipment, and personnel steeped in a disciplined team culture. We are committed to safety, integrity, process improvement, measurable performance, and operational excellence.

Our highly trained, experienced crews are backed by a complete lineup of service rigs to tackle the most challenging environments. Ensign’s service rigs are purpose-built for industry and are designed to move safely, quickly and efficiently. We plan and prepare for every multi-well program so your downtime is minimized. Our fleet has hundreds of rigs deployed worldwide and our well servicing offerings keep your well performing and producing.

The land drilling market worldwide is structured primarily as a rental market, not a sales market, where land drilling companies lease their rigs to E&P companies for an agreed period of time – weeks, months, or years – at a day-rate. The rigs are then used to drill wells and execute the E&P’s drilling programs.

Drilling opportunities are analysed and explored in order, leaving a series of dry holes, until a discovery is made. It is rare for an E&P company to actually own the rigs which they operate, but there are some exceptions such as Chesapeake, who will purchase their own fleet of rigs.

Under these rental contracts, a turnkey cost is paid by an E&P business to a middleman. This includes an insurance premium, which is returned if nothing goes wrong, but may be lost if there are difficulties. Higher specification equipment commands a larger premium.

Investors require a minimum level of return for their investment dollars in drilling operations, and typically equate cost with risk. These turnkey drilling contracts may limit risk by guaranteeing a minimum number of wells that can be drilled with the rig. The contract will also outline how the rig can be used – including the pieces of equipment, when to change pieces, temperature and pressure tolerances and the weight of mud.

The International Association of Drilling Contractors (IADC) lists 547 members in the category of Land Drilling Contractors. According to Statista, the key US land drilling contractors are: Nabors Industries Ltd, Helmerich & Payne Inc, Patterson-UTI Energy Inc, Precision Drilling Corporation and Pioneer Energy Services Corp.

Nabors operates the world’s largest land drilling rig fleet, with around 500 rigs operating in over 25 countries – in almost every significant O&G basin on the planet. It also has the largest number of high-specification rigs (including new AC rigs and refurbished SCR rigs) and custom rigs, built to withstand challenging conditions such as extreme cold, desert and many complex shale plays.

Headquartered in Tulsa, Oklahoma, H&P is a global business with land operations across the US, as well as offshore operations in the Gulf of Mexico. It is engaged primarily in the drilling of O&G wells for E&P companies, and recognised for its innovative FlexRig technology.

Patterson-UTI operates land based drilling rigs, primarily in O&G producing regions of the continental US, and western Canada. The company also provides pressure pumping services to US E&P companies and specialist technology, notably pipe handling components, to drilling contractors globally.

Precision is an oilfield services company and Canada’s largest drilling rig contractor, with over 240 rigs in operation worldwide. The Company has two segments. The Contract Drilling Services segment operates its rigs in Canada, the United States and internationally. The Completion and Production Services segment provides completion and workover services and ancillary services to O&G E&P companies in Canada and the US.

Pioneer operates a modern fleet of more than 24 top performing drilling rigs throughout onshore O&G producing regions of the US and Colombia. The company also offers production services include well servicing, wireline, and coiled tubing services – supported by 100 well-servicing rigs, and more than 100 cased-hole, open-hole and offshore wireline units.

Together these five companies dominate the US rental market. Other smaller but prominent contractors include: Parker Drilling, Unit Corp, Independence Contract Drilling, Seventy Seven Energy, Schramm and Ensign Drilling. Beyond these players, the market is highly fractured, with many “mom & pop” style drillers.

In Texas, generally considered to be the centre of US land drilling, RigData reports that there are currently 678 active rigs – split between Helmerich & Payne (160), Patterson-UTI (85), Nabors (64), Precision Drilling (39) and 77 other drillers (330).

Most new onshore rigs, both drilling and work over rigs, are built by OEMs in China. In the US, the larger vertically integrated land drillers have in-house manufacturing operations, so they will outsource some equipment construction, but assemble the new rigs at their own facilities. The leading provider of US newbuild rigs is National Oilwell Varco.

The secondary market, where existing rigs are sold, is largely auction dominated with mostly older rigs changing hands. As a rule, the big land drillers do not sell their newbuild rigs, as each has their own flagship designs.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

After a year in which dollars and oil from drilling rigs flowed freelyinto Colorado, the nine major drillers on the Front Range are slashing 2015 spending by 30 percent, about $2 billion.

The number of rigs running has already dropped by a third in five months to 44 at the end of February, according to the oil field services company Baker Hughes.

So far, the cutbacks haven’t had a severe impact on the state or on Weld County, the heart of Colorado oil country, partly the result of a diversified economy and continued big-dollar commitments by operators — even after the cuts.

“Hotels and restaurants still look to be full,” said Eric Berglund, CEO of Greeley-based Upstate Colorado Economic Development. “Beyond drilling, there is a large oil and gas industry presence here.”

There are thousands of existing wells that still need to be serviced, pipelines are being built, and gas processing and water recycling plants need employees, Berglund said.

“We haven’t seen any uptick in unemployment claims in the oil and gas sector,” said Bill Thoennes, a spokesman for the Colorado Department of Labor. “This may be something coming down the road, but we haven’t seen it yet.”

The two largest operators, Houston-based Noble EnergyInc. and Anadarko Petroleum Corp., based in The Woodlands, Texas, say they have no layoff plans.

Some of the job losses tied to the decline in rigs will end up in the unemployment reports of the rig companies based in Texas and Oklahoma, Berglund said. A rig employs about 110 people.

Statewide, the oil and gas sector employs just 1.2 percent of the workforce and losses in that sector may be offset by growth in others, said Mark Vitner, an economist with Wells Fargo Securities.

“The price of oil isn’t going up to $100 anytime soon,” Vitner said. “So we’d expect the slowdown to be more pronounced later this year. … But the industry is not going away.”

The nine operators — which, based on state data, produced at least a million barrels of oil each in 2014 — are projected to spend up to $4.6 billion in Colorado in 2015, down from $6.6 billion last year.

In addition to the spending cuts, operators are trying to improve their efficiencies — focusing on drilling in the areas with the best yields and getting better prices for materials and services.

Most operators hire oil field service companies, such as Baker Hughes and Halliburton, for drilling and hydrofracturing, or fracking, which pumps pressurized fluids into wells to crack rock and release oil.

The combination of horizontal drilling and fracking in tight shale formations has enabled Colorado to more than double its oil production in the past four years to about 82 million barrels in 2014.

The activity is centered in the Denver-Julesburg Basin, which stretches from Denver to the Wyoming border, and the Wattenberg field, within the basin.

Operators are now getting lower prices for materials and services, said Craig Rasmuson, chief operating officer of Platteville-based Synergy Resources Corp.

“The services companies are giving better prices and are willing to have smaller margins to keep operating and keep their people employed,” Rasmuson said. “We are all sharing the pain.”

Synergy is the one company among the nine big drillers planning to increase its capital spending in 2015. Company officials expect to boost spending to $180 million this year from $160 million in 2014.

“The Wattenberg continues to be one of the more attractive assets in our portfolio,” Chuck Meloy, an Anadarko vice president, said during an investor conference call Tuesday.

Noble had 10 rigs running in 2014. The company is projecting four rigs in 2015, and they will be working in northeastern Weld County— far from residential areas.

Synergy estimates that drilling near homes adds 3 to 5 percent to the cost of wells because of extra noise mitigation and landscaping requirements, Rasmuson said. On the high side, it can add 10 percent to the cost.

In addition to focusing on high-yield areas, Stover said the company will increase the length of some of its horizontal wells to as much as 9,000 feet.

Depending on the length of the well and the number of stages needed to complete it, a frack job can cost between $1 million and $1.7 million, according to figures cited by companies in their presentations.

Houston-based Carrizo Oil and Gas is cutting activity and deferring some completions, company CEO Sylvester Johnson told stock analysts in a February conference call.

Calgary-based Encana Corp., the third-largest Colorado operator, plans to spend $170 million to $200 million in 2105, about a third less than last year, said company spokesman Doug Hock.

Faced with oil at $50 a barrel, bringing on more production “just doesn’t seem to make good business sense,” Bill Barrett CEO Scot Woodall told analysts in a February call.

Bonanza Creek Energy, based in Denver, is trimming spending by 36 percent overall, with just under $400 million for its Wattenberg operation, according to a company presentation.

Quoting T. Boon Pickens, Bonanza Creek CEO Richard Carty told stock analysts “it has become cheaper to look for oil on the floor of the New York Stock Exchange than in the ground.”

Manufacturer of standard & mobile rigs & carriers for oilfield applications. Includes well servicing from 14,000 ft. to 22,000 ft., workovers from 10,000 ft. to 16,000 ft. & drilling from 6000 ft. to 10,000 ft. Specifications include brakes range from 28 in. dia. x 8 in. wide to 42 in. dia. x 12 in. wide, barrels from 12 3/4 in. x 38 in. to 18 in. x 43 in., chains from 1 1/4 in. to 1 3/4 in., clutches of 24 in. with single & 2 plate air friction outboards, shafts of 5 in. dia. to 6 1/2 in. dia. & gross weights from 63,200 lbs. to 115,000 lbs. Also includes forged steel, demountable options, mufflers with spark arrestors, dry type air cleaners, transmissions with torque converters, water splash brake cooling & up to 6 axles.

Join us Oct. 31 - Nov. 3, at the Hall 5, booth #5250 to learn how we collaborate with customers to deliver smarter well planning, optimized drilling performance, and innovative completions for production enhancement.

HalVue Real-Time Viewer is a highly efficient real-time data monitoring application that enables you to unlock an immersive real-time environment and collaborate with your team like never before.

The StrataStar™ Deep Azimuthal Resistivity service provides multilayer mapping for precise well placement in the most productive zones of the reservoir.

8613371530291

8613371530291