workover rig companies in colorado free sample

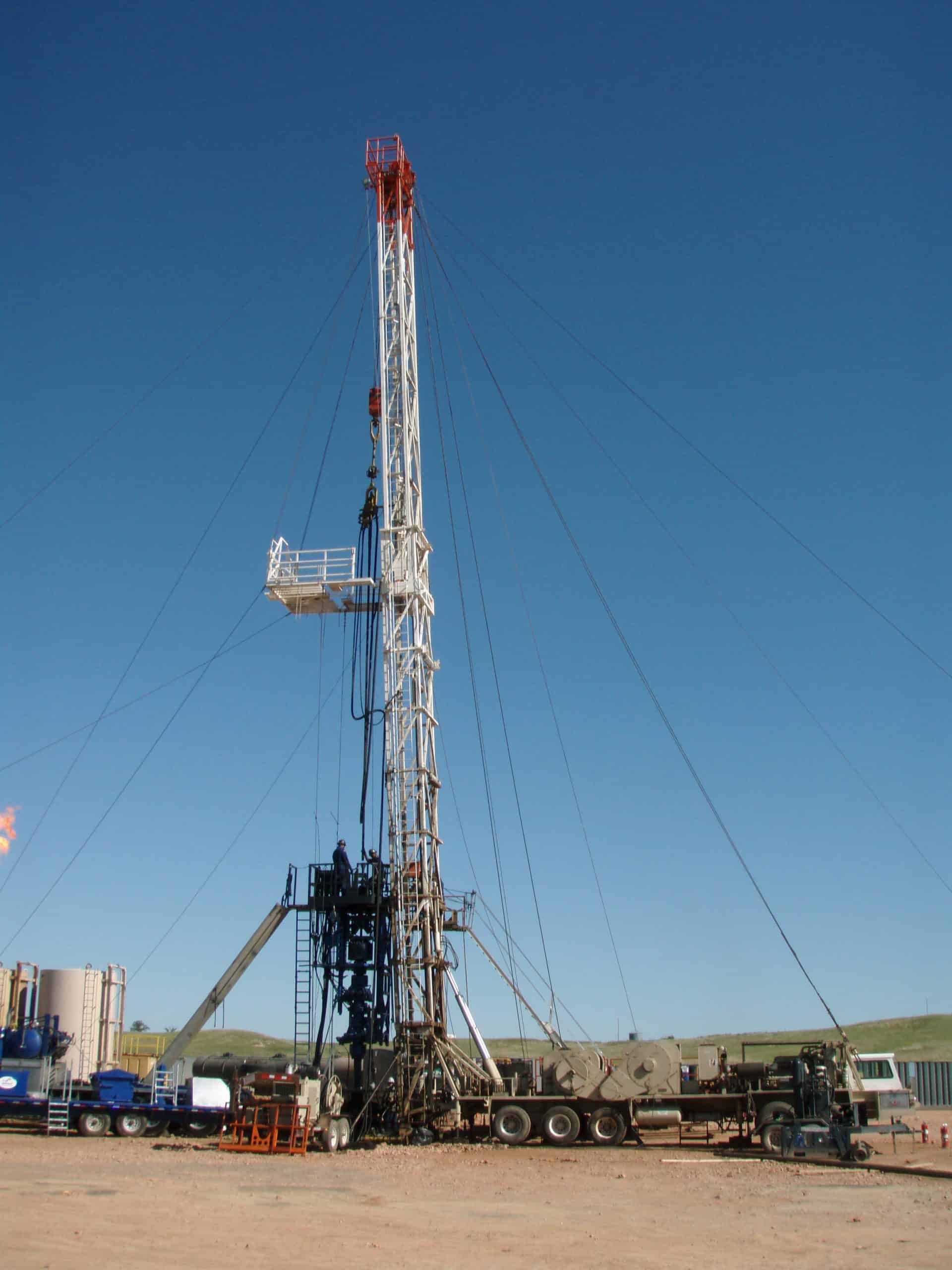

Wellsite Services, Inc. is your full-service, independently owned wellsite supervision service company providing quality workover rig and completions supervision, contract pumping, water pipeline management, coordination and logistics, and sampling for commercial oil and gas customers on the Front Range in Northern Colorado and Southern Wyoming. We take care to assign competent, experienced wellsite supervisors to each project recognizing each operation is unique in complexity and variability.

As field and office veterans in oil and gas for over 20 years, we understand the importance of providing quality and experienced wellsite supervisors to every project, backed by our commitment to Environmental, Health, and Safety (EHS) compliance. From the vetting and hiring process, formal training and ongoing mentorship, and every other aspect of our business, we conduct ourselves with integrity and a strong ethical commitment to our team, customers, and community.

At Wellsite Services, we believe in doing everything the right way, the first time, and not taking shortcuts. Let us help your operation and identify the most optimal and specialized wellsite supervision services to effectively address the challenges and manage your wellsite. We look forward to working with you.

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

The Floorhand performs the duties of general manual labor on the rig and supports and assists other members of the drilling crew during all rig operations.

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Performing rig up and down procedures, nipple up and down and care of the B.O.P. Ensuring safe and efficient rig operations to meet the company’s goals and…

2 years minimum experience as a rig hand on a production rig working floors and derricks. Starting pay is $23.00 per hour with an increase to $26.00 per hours…

Crew Member positions include Rig Trainee (no experience required), and Floor hand, Derrick hand, Relief Crew Chief, and Crew Chief, which are experience…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

Must have years of experience working multiple positions on an oil and gas drilling rig. General maintenance of drilling rig. Must be at least 18 years of age.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

Reliable means of transportation to and from rig site. The Floorhand is responsible for safely and efficiently performing a variety of physically demanding…

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

*Floor Hands - *minimum experience required 6 months. *Derrick Hands - *minimum experience required 1 year. Job Requirements: *Job requirements include but are…

The Leasehand also provides assistance to rig personnel as required. The Leasehand is responsible for keeping the rig clean, performing general maintenance and…

Previous experience as a carpenter, general laborer, roofer, landscaper, heavy equipment operator, construction, pipefitting, oil and gas, energy services,…

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Eastern Colorado Well Service is a premier oil and gas service company in the regions we serve. Our employees provide an array of services to oil and gas producers in Colorado, Wyoming, Kansas, North Dakota and Texas. ECWS offers work-over rigs for completion and maintenance services, water hauling, heavy haul services and special rental tools for down-hole applications.

Top Drilling Company is a free list download the contains the drilling operators that have drilling rigs located in the US. Included in the list are company names, telephone, Linkedin URL and websites. The top drilling company list includes drilling companies that operate in Texas, Oklahoma, New Mexico, Louisiana and Western Canada. Check out our rig locator page.

Helmerich & Payne, Inc. (H&P) is a top drilling company in US that began in 1920, when Walter “Walt” Helmerich II—a thrill-seeking aviator from Chicago, and William “Bill” Payne—a hard-working microbiologist from Shawnee, Oklahoma, met on a Star 29 cable rig in South Bend, Texas. From this unlikely pairing was born a partnership, a deep friendship and the oil and gas drilling company that still bears their names.

Fast forward 100 years, Helmerich & Payne continues to lead the drilling industry through a commitment to innovation and unmatched reliability. And by expanding our drilling operations to meet the increasing demands of a complex and globalized industry, we’ve established ourselves as an industry trailblazer and trusted partner.

Patterson-UTI (NASDAQ: PTEN) is a top drilling company in US that pushes the boundaries of innovation so you can embrace new possibilities. With expertise and scale in major operational areas, we provide a diverse network of drilling and pressure pumping services, directional drilling, rental equipment and technology to forge your path to success. Our oilfield solutions deliver results that lead your business into the next generation of oil and gas.

We have a fleet of fit for purpose land-based drilling rigs and significant pressure pumping horsepower, as well as a leading position in directional drilling and wellbore placement services that are positioned in the most active plays throughout the U.S. With headquarters in Houston, Texas and regional offices throughout our operating areas, let’s team up to advance your business.

Nabors is a top drilling company in US and Canada that owns and operates one of the world’s largest land-based drilling rig fleets and is a provider of offshore platform rigs in the United States and numerous international markets. Nabors also provides directional drilling services, performance tools, and innovative technologies for its own rig fleet and those of third parties. Leveraging our advanced drilling automation capabilities, Nabors’ highly skilled workforce continues to set new standards for operational excellence and transform our industry.

Precision is a top drilling company in US has a reputation for operating safely, lowering customer risks and costs, developing people, generating financial growth and attracting investment. Precision Drilling Corporation is an integrated oilfield drilling and energy service company providing services to the oil and gas industry. The Company provides oilfield rentals, well services, catering services, and drilling services through its several business units.

ENSIGN IS A GLOBAL ENTERPRISE, PROVIDING A UNIQUE EDGE IN OILFIELD SERVICES. We’ve grown to be one of the world’s largest and technologically advanced oilfield service providers. Premium services include contract drilling, directional drilling, underbalanced and managed pressure drilling, rental equipment, well servicing and production services. Established in 1987, our operations now extend from Canada and the United States to Latin America, the Middle East and Australia.

As the largest privately-held domestic land drilling contractor in the United States, Cactus provides competent, motivated personnel utilizing premium equipment to meet and exceed the drilling requirements of our customers. We are committed to delivering consistent and dependable results for each of our clients, while protecting the environment and ensuring the safety of everyone affected by our operations. It is the vision and objective of our employees to provide maximum value for our customers… and to be the “Contractor of Choice”.

Since 1977 SCANDRILL, INC. has provided land contract drilling services to independent and major oil and gas exploration companies. Headquartered in Houston with Operations offices in Tyler, Odessa and Yukon, the company’s 30 NORSEMAN Series™ rigs are drilling in the ARK-LA-TEX, Oklahoma and Permian Basin, which includes the Midland and Delaware Basins of West Texas and New Mexico.

Savanna Group of Companies is a top drilling company in US & Canada is a wholly owned subsidiary of Total Energy Services Inc. Savanna offers a complimentary suite of oilfield services. Savanna Drilling, Savanna Well Servicing and our rentals divisions work in unison to provide well-balanced, well-centred programs. From spud to release and beyond, Savanna’s group of divisions work together to ensure customers receive the best possible equipment, people, and value to deliver results and maximize value.

Independence Contract Drilling is a premium land drilling services provider. From our corporate headquarters in Houston, Texas, we develop and assemble our ShaleDriller® series rig design based on E&P operator feedback and field requirements. ShaleDrillers are designed for safe and efficient drilling operations on large, multi-well drilling locations. They are designed to move fast and are capable of walking in multiple directions. The ShaleDriller series rigs are AC programmable, energy efficient BiFuel, and custom designed to be best in class for the development of our clients’ most demanding and financially impactful exploration and development programs. We excel in shale plays and other areas where completions require long horizontal sections, drilling quickly and accurately to minimize nonproductive time for our clients. We also excel where multi-well pads offer the option to walk between well bores and provide the opportunity to plan 3-hour release-to-spud times.

AKITA Drilling Ltd. is a top drilling company in US & Canada was formed in January of 1993 through a Plan of Arrangement with our predecessor, ATCO Drilling Ltd. At its inception, AKITA operated 26 drilling rigs in Canada. In addition to Canadian operations, AKITA also conducted drilling operations in the United States.

In 2000, AKITA re-established significant operations in Canada’s northern territories. As technology evolved, we were among the earliest adopters of pad rigs, including their use in the development of heavy oil and shale gas resources. This quickly became a market strength for AKITA, and today pad rigs make up approximately half of our deep capacity fleet. In 2018, AKITA Drilling Ltd. and Xtreme Drilling Corp. combined the two companies through a Plan of Arrangement to create a leading intermediate North American land drilling contractor. The combined company, operating under the AKITA Drilling name, has a fleet of 40 high-spec drilling rigs with operations in major resource basins in the US and Canada.

Schlumberger"s emissions digital manager talks about integrating emissions with operations data to reduce emissions, stay in compliance and improve performance.

The global oilfield services market size was USD 267.82 billion in 2019 and is projected to reach USD 346.45 billion by 2027, exhibiting a CAGR of 6.6% during the forecast period.

Oilfield service (OFS) plays a crucial role in the upstream service of the oil & gas industry, predominantly in offshore assets. The oilfield equipment and services include all products and services used for the production and exploration process in the upstream sector. The companies engaged in the business offer services related to manufacturing, maintenance, and equipment repair used in oil extraction and transportation. The services considered for successful field operations include locating energy sources, drilling and formation evaluation, energy data management, geological sciences, and many others.

Reducing the cost of oilfield services and increasing the production output are the key factors attributed to the growth of the global market. In addition, the range of customized packages offered by major upstream service companies results in cost savings up to millions for the operators. Increasing shale gas extraction from hydraulic fracturing and other stimulation procedures are also projected to fuel the demand for such services. The rising demand for oil & gas from offshore areas is driving the oilfield service industry during the forecast period.

The ongoing outbreak of the COVID-19 pandemic has impacted the oil & gas industry considerably by disrupting global financial and commodity markets, a dramatic downfall in demand which has hampered the operations and supply chain of the oil & gas industry. Various oil & gas companies worldwide had to shut down their exploration projects and services as countries approached lockdown to deal with the pandemic. For instance, the International Energy Agency reported that oil demand is likely to decrease by 29 million barrels per day (BPD) in April 2020 and by 23.1 million BPD in the 2nd quarter. The Russia-Saudi oil price war owing to COVID-19 has become an obstacle, resulting in slashed production output and financial loss. However, other members of the OPEC countries have established a more flexible business model and better market opportunities for B2B and B2C customers. In addition, this trade war has raised economic conflicts, resulting in a massive price drop and disruption of the supply chain, which hampered the investment scenario, production cuts, and mostly the demand. Hence, it is projected to hamper the long-term impact in the oil & gas industry during the forecasted period.

The oil production from the offshore sector is projected to be the fastest-growing segment during the forecast period, owing to increasing investment in the subsea oil & gas industry and growing energy demand. For instance, as per data published by Statista in 2020, global demand for crude oil (including biofuels) in 2019 amounted to 100.1 million barrels per day and is projected to decrease to 91.7 million barrels per day in 2020. Growing investment in the offshore sector helps to boost market growth. For instance, As per the World Investment Report in 2019, the offshore greenfield investment increased to USD 93.3 billion from USD 61.5 billion in 2018. Hence, the growing investment scenario in the offshore sector is spurring the demand for OFS, in turn, aiding the market.

The increasing number of oil & gas discoveries and technological advancements for higher production yield in oilfield reserves can have an excellent impact on market growth. For instance, Alaska in the U.S., Golan Heights in Israel, Alpine high in West Texas, oil discoveries in the Stabroek block Tilapia, Yellowtail (oil), and Haimara (gas-condensate), an offshore gas discovery with the Lang Lebah-1RDR2 exploration well and among other discoveries.

As per Energy Information Administration (EIA) 2020, In the 2nd quarter of 2020, China and Brazil are leading with each having 3 new oil & gas discoveries, followed by Egypt, Norway, U.S., and Mexico, with each having 2 discoveries. Moreover, 23 oil and gas discoveries were made in Q2 2020 across the globe. Of these, 15 are oil discoveries, and the remaining 8 are gas discoveries. Hence, the growing number of offshore discoveries is promoting the development of the market.

Shale gas is another form of natural gas which are trapped within shale formations. These gases, which are trapped in a shale formation, cannot flow into the well due to its low permeability. However, advancements in technology such as directional drilling and hydraulic fracturing technology have helped increase shale gas production from such critical reservoirs. Shale exploration requires a wide range of equipment and services in the oilfield. For instance, China has the largest shale reserves, and a considerable percentage of its production comes from its Sichuan Basin located in the Chongqing area. The country is planning to escalate its production up to 30 bcm/per year by 2020, and 80-100 bcm/per year by 2030, with the help of advanced tools for drilling and techniques adopted by shale gas exploration.

Production and exploration activities are set to increase in the coming years owing to rising energy demand and lucrative investment opportunities in the oil & gas industry. For instance, in July 2019, i3 Energy PLC awarded an oilfield service contract to Baker Hughes GE to carry out drilling at Liberator and Serenity assets in the North Sea. Conventional onshore oil is projected to account for a major share in total oil production worldwide. As per the DNV-GL Energy-Transition-Outlook, oil production is projected to increase by 83 million barrels per day (Mbpd) in 2022. Moreover, unconventional onshore oil production is doubling to around 22 Mbpd by 2035, which accounted for nearly 30% of all global crude oil production. Hence, increasing production and exploration activities in the oil & gas industry is projected and expected to drive market growth in the forthcoming years.

The oil & gas industry is experiencing inflexibility in crude oil prices, and this is attributed to the variations in demand & supply of crude oil. This fluctuation disrupts the market demand significantly, besides intensifying competition between the U.S., OPEC countries, and non-OPEC countries. The higher price of oil results in delays in the upcoming projects and investments, which suspends the drilling projects resulting in a downfall in the oilfield services. Thus, volatility in crude oil prices is anticipated to hamper the market growth.

Based on type, the market is classified into equipment rental, field operation, and analytical services. The equipment rental segment holds a significant market share and is expected to grow at a slow pace owing to the increasing demand for field optimization and analytical services. The field operation segment is increasing its market share due to a wide number of services deployed on the field for executing the project. The analytical services segment is estimated to grow owing to a wide range of applications in real-time analytics, software solutions, monitoring services, routine quality control, and sample analysis, among other services, which helps to increase the production output from the existing field.

Based on the service segment, the market is segmented into geophysical, drilling, completion & workover, production, and processing & separation segment. The production segment is estimated to hold a larger portion of market share owing to the growing initiative for oil recovery and well testing in the current oil & gas fields. Various types of oilfield services are covered under this segment, namely, artificial lift system, floating production vessels, support vessels, well testing services, subsea equipment, Christmas tree, enhanced oil recovery, digital oilfield, and other production services.

The drilling segment is estimated to hold the second-largest market share owing to an increase in offshore well drilling to explore, extract, store, and process petroleum and natural gas. The segment is further analyzed by much granular level covering services such as offshore drilling, oil country tubular goods (OCTG), directional drilling services, drilling fluids, well casing, well cementing, drill bits, drilling rigs, logging while drilling (LWD), measurement while drilling (MWD), managed pressure drilling (MPD), waste management, and other drilling services.

The completion and workover segment is estimated to grow in the forecast period due to the wide scope of application of hydraulic fracturing services and wireline logging services in the oilfield. Production and exploration of oil & gas resources and provision of solution for stimulation performance evaluation, water shutoff determination, tubing, and multiple casing integrity in oil wells, accelerates the completion and workover segment. Other significant services analyzed under this segment are well intervention, completion fluid, sand control, and mud logging.

Processing and separation services play a crucial role in the OFS industry. These services are estimated to grow significantly in the projected period owing to the wide scope of oil, water, and gas treatment across the industry to improve the recovery and minimize the environmental impact of hydrocarbon production. The key services covered under this segment are water treatment, oil treatment, gas treatment, solid treatment, and other services.

The geophysical segment is projected to grow owing to its efficient technologies and solutions in petroleum field development and oil and gas transportation. Advancement of technology has enabled high-quality illumination of the subsurface for conventional and unconventional reservoirs at much lower costs. Hence, the growing demand for investment in the oil & gas industry propels the demand for the OFS market in the projected period.

Based on the application, the market is segmented into onshore and offshore. The offshore segment is expected to be the fastest-growing segment during the forecast period, owing to growing investment in subsea oil & gas assets. Various oil field service providers are investing deeply in offshore assets to increase their well productivity, reservoir performance, and overall life cycle of the well. The onshore location requires more reliable and flexible equipment and services, which boosts the demand for this market.

North America is projected to hold the largest market shares in the global market, which is further followed by the Asia Pacific and Europe, respectively. The trend is anticipated to remain the same during the projected period, with significant activities expected to happen in offshore assets in the Gulf of Mexico and the North Sea, which drives the demand for oilfield services. In January 2017,Schlumberger limited had completed the acquisition of Peak Well System, which is a specialist in the design and development of advanced downhole tools for flow control, well intervention, and well integrity. Globally, the United States accounted for almost 50% of the new well drilled in the year 2017, followed by China and other Asian countries.

Europe is also estimated to hold a larger portion of market share and is projected to increase in the forecasted period. In Norway, the operating cost of an oil well has reduced by 30% from 2014 to 2017, which results in the cost incurred for drilling an exploratory well offshore was half in 2017 compared to 2014. The unit operating cost in the UK Continental Shelf has declined by around 50% in the last two to three years, and it is projected to fall further in the coming years.

Increasing production & exploration activities to cater to the growing energy demand is projected to boost the Asia Pacific market. Countries like China, Thailand, Indonesia, Malaysia, and Myanmar, have witnessed an abrupt increase in production & exploration activities coupled with discoveries of oil & gas reserves. In February 2019, Repsol, a global energy company, had announced the largest gas discovery in Indonesia, which holds an estimation of over 2 trillion cubic feet (TCF) of recoverable resources. Hence, growing investment for exploring new oilfields and discoveries drives the demand for the oilfield service industry.

The market in the Middle East and Africa holds substantial market potential to explore the untapped capacity for hydrocarbon development and non-complex formations to effectively drill the wells, which drive the oilfield services market growth in the coming years. Countries in Middle East & Africa, which include UAE, Saudi Arabia, Kuwait, Bahrain, and among other countries, are the members of the Organization of the Petroleum Exporting Countries (OPEC), hence thereby focused on attaining the production targets set by the organization. Other prominent countries engaged in the market across the region are Oman, Algeria, Qatar, and Nigeria.

The market is consolidated owing to the strong portfolio of services and a remarkable distribution network of major companies in developed and emerging countries. Currently, Schlumberger Limited, Halliburton Company, Baker Hughes, and Weatherford hold the major portion of market share in 2019. In March 2017, Baker Hughes had introduced a new adaptive drill bit called the TerrAdapt. This drill bit uses automation to mitigate down-hole dysfunctions and improve drilling operations. This is projected to lead to the healthy growth of the market by 2027. The other key players, such as hydratight, Muntajat, Protiviti Inc., ESG Solutions, Cyntech, Fugro, Hytera, Geokinetics, and other small players, have entered the market for providing innovative oilfield services to various end-users.

August 2020 –DOF Subsea has announced four new contracts with Petrobras, worth USD 110 million. The contract includes three vessels from the DOF fleet to be mobilized to perform flexible pipeline, risers, and subsea equipment inspection in the Campos, Santos, and Espírito Santos basins, and the Marlin field.

August 2020 –Solstad Offshore ASA has received several contract extensions in Brazil with Equinor and Total. Equinor Brazil has extended the contracts for the Sea Brasil and Far Scotsman platform supply vessels (PSV) by one year until December 2021 and by six months until May 2022, respectively.

September 2020 –Subsea 7 had achieved a contract at offshore Trinidad and Tobago. The contract caters to the project management, engineering, procurement, installation, and pull-in of one subsea rigid flowline and flexible riser together with flexible flowlines and the associated subsea infrastructure and umbilical system. The installation activities are scheduled by 2021.

The market research report provides an elaborative analysis of the global market research, dynamics, and competitive landscape. Various key insights presented in the report are the latest technology, recent industry developments, mergers & acquisitions, the regulatory scenario in crucial countries, macro, and microeconomic factors, SWOT analysis, and key retail oilfield services market trends, competitive landscape, and company profiles of major players.

By using this site, you are agreeing to security monitoring and auditing. For security purposes, and to ensure that the public service remains available to users, this government computer system employs programs to monitor network traffic to identify unauthorized attempts to upload or change information or to otherwise cause damage, including attempts to deny service to users.

Unauthorized attempts to upload information and/or change information on any portion of this site are strictly prohibited and are subject to prosecution under the Computer Fraud and Abuse Act of 1986 and the National Information Infrastructure Protection Act of 1996 (see Title 18 U.S.C. §§ 1001 and 1030).

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

8613371530291

8613371530291