workover rig companies in louisiana price

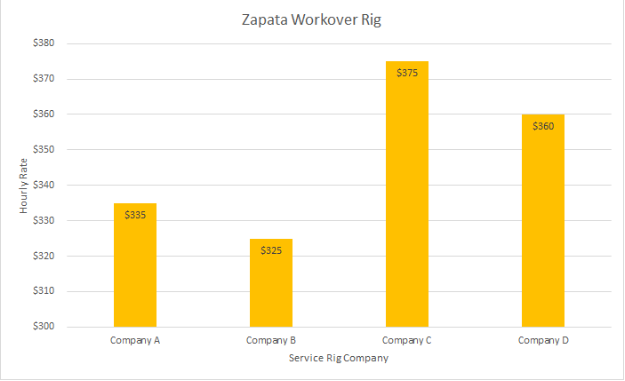

Workovers are the most common expenditure operators need on their oilfields. However, finding a service provider and getting their rates are not readily available in the industry. Operators would benefit from knowing the market average for a workover and gain reassurance they are getting a fair price for their services. This research is based on finding workover rigs for Zapata, Texas. The graph represents four service provider companies and their hourly rate for a workover rig.

It is important to note that due to slower oil development in recent years from the downturn in 2015 to the pandemic and downturn in 2020, smaller workover rig companies in Zapata, Texas have increasingly moved to the Permian Basin or have been acquired by larger service companies in the area. This has caused the workover rig service industry to be dominated by a few major servicers around Zapata. For Zapata, the ideal areas to look for servicers or workover rigs are Alice, Laredo, and Freer in Texas.

The hourly rates found are $335, $325, $375, and $360 creating an average rate of $349. Company names are replaced with Company A, B, C, and D. These companies were located in Freer and Alice for this research because the market synopsis revealed they offered more affordable rates than the servicers in Zapata.

Hourly rates for workover rigs vary and there are always competitors for services, especially for services as common as a workover rig. The market average price for a service provider is intended to provide the oil and gas operator better insight on the cost of services around their area.

An operator who wanted bids on a workover for his well requested this vendor list and decided to get connected with Company B to get the work done. He said it was a quick decision because what he was already paying for and what he was going to pay for cost more than the rates on this list.

In order to help oil and gas operators reduce operational expenditure, Petrofly researches the servicing market to provide the most economical options for your oilfield service needs. Petrofly’s platform is the complete upstream solution and leveraging the market average is one of the unique tools operators utilize to ensure lower operational costs.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Axis is a completion and workover company built for today’s operators, as you shift into manufacturing mode while drilling ever-longer laterals. We’re advancing both goals through our core mission: optimizing completions.

For too long, well services has lagged other oil and gas sectors in innovation. Axis is changing that with integrated, data-driven services. New, purpose-engineered equipment. And a team that unites oilfield veterans with the next generation of crews and engineers through our leading-edge training culture.

Top Drilling Company is a free list download the contains the drilling operators that have drilling rigs located in the US. Included in the list are company names, telephone, Linkedin URL and websites. The top drilling company list includes drilling companies that operate in Texas, Oklahoma, New Mexico, Louisiana and Western Canada. Check out our rig locator page.

Helmerich & Payne, Inc. (H&P) is a top drilling company in US that began in 1920, when Walter “Walt” Helmerich II—a thrill-seeking aviator from Chicago, and William “Bill” Payne—a hard-working microbiologist from Shawnee, Oklahoma, met on a Star 29 cable rig in South Bend, Texas. From this unlikely pairing was born a partnership, a deep friendship and the oil and gas drilling company that still bears their names.

Fast forward 100 years, Helmerich & Payne continues to lead the drilling industry through a commitment to innovation and unmatched reliability. And by expanding our drilling operations to meet the increasing demands of a complex and globalized industry, we’ve established ourselves as an industry trailblazer and trusted partner.

Patterson-UTI (NASDAQ: PTEN) is a top drilling company in US that pushes the boundaries of innovation so you can embrace new possibilities. With expertise and scale in major operational areas, we provide a diverse network of drilling and pressure pumping services, directional drilling, rental equipment and technology to forge your path to success. Our oilfield solutions deliver results that lead your business into the next generation of oil and gas.

We have a fleet of fit for purpose land-based drilling rigs and significant pressure pumping horsepower, as well as a leading position in directional drilling and wellbore placement services that are positioned in the most active plays throughout the U.S. With headquarters in Houston, Texas and regional offices throughout our operating areas, let’s team up to advance your business.

Nabors is a top drilling company in US and Canada that owns and operates one of the world’s largest land-based drilling rig fleets and is a provider of offshore platform rigs in the United States and numerous international markets. Nabors also provides directional drilling services, performance tools, and innovative technologies for its own rig fleet and those of third parties. Leveraging our advanced drilling automation capabilities, Nabors’ highly skilled workforce continues to set new standards for operational excellence and transform our industry.

Precision is a top drilling company in US has a reputation for operating safely, lowering customer risks and costs, developing people, generating financial growth and attracting investment. Precision Drilling Corporation is an integrated oilfield drilling and energy service company providing services to the oil and gas industry. The Company provides oilfield rentals, well services, catering services, and drilling services through its several business units.

ENSIGN IS A GLOBAL ENTERPRISE, PROVIDING A UNIQUE EDGE IN OILFIELD SERVICES. We’ve grown to be one of the world’s largest and technologically advanced oilfield service providers. Premium services include contract drilling, directional drilling, underbalanced and managed pressure drilling, rental equipment, well servicing and production services. Established in 1987, our operations now extend from Canada and the United States to Latin America, the Middle East and Australia.

As the largest privately-held domestic land drilling contractor in the United States, Cactus provides competent, motivated personnel utilizing premium equipment to meet and exceed the drilling requirements of our customers. We are committed to delivering consistent and dependable results for each of our clients, while protecting the environment and ensuring the safety of everyone affected by our operations. It is the vision and objective of our employees to provide maximum value for our customers… and to be the “Contractor of Choice”.

Since 1977 SCANDRILL, INC. has provided land contract drilling services to independent and major oil and gas exploration companies. Headquartered in Houston with Operations offices in Tyler, Odessa and Yukon, the company’s 30 NORSEMAN Series™ rigs are drilling in the ARK-LA-TEX, Oklahoma and Permian Basin, which includes the Midland and Delaware Basins of West Texas and New Mexico.

Savanna Group of Companies is a top drilling company in US & Canada is a wholly owned subsidiary of Total Energy Services Inc. Savanna offers a complimentary suite of oilfield services. Savanna Drilling, Savanna Well Servicing and our rentals divisions work in unison to provide well-balanced, well-centred programs. From spud to release and beyond, Savanna’s group of divisions work together to ensure customers receive the best possible equipment, people, and value to deliver results and maximize value.

Independence Contract Drilling is a premium land drilling services provider. From our corporate headquarters in Houston, Texas, we develop and assemble our ShaleDriller® series rig design based on E&P operator feedback and field requirements. ShaleDrillers are designed for safe and efficient drilling operations on large, multi-well drilling locations. They are designed to move fast and are capable of walking in multiple directions. The ShaleDriller series rigs are AC programmable, energy efficient BiFuel, and custom designed to be best in class for the development of our clients’ most demanding and financially impactful exploration and development programs. We excel in shale plays and other areas where completions require long horizontal sections, drilling quickly and accurately to minimize nonproductive time for our clients. We also excel where multi-well pads offer the option to walk between well bores and provide the opportunity to plan 3-hour release-to-spud times.

AKITA Drilling Ltd. is a top drilling company in US & Canada was formed in January of 1993 through a Plan of Arrangement with our predecessor, ATCO Drilling Ltd. At its inception, AKITA operated 26 drilling rigs in Canada. In addition to Canadian operations, AKITA also conducted drilling operations in the United States.

In 2000, AKITA re-established significant operations in Canada’s northern territories. As technology evolved, we were among the earliest adopters of pad rigs, including their use in the development of heavy oil and shale gas resources. This quickly became a market strength for AKITA, and today pad rigs make up approximately half of our deep capacity fleet. In 2018, AKITA Drilling Ltd. and Xtreme Drilling Corp. combined the two companies through a Plan of Arrangement to create a leading intermediate North American land drilling contractor. The combined company, operating under the AKITA Drilling name, has a fleet of 40 high-spec drilling rigs with operations in major resource basins in the US and Canada.

NorAm Drilling has in its 15-year history established a solid foothold in US drilling market, with significant operating experience in Louisiana, New Mexico and Oklahoma, but is now primarily focusing on the Permian Basin in Texas, where approximately 60% of the proven reserves in the U.S is located.

Due to the modern high specification rigs and a track record with high drilling efficiency and safe operation for the customers, NorAm Drilling was among the first land-drilling companies to have all rigs reactivated after the market disruption caused by Covid in 2020.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Several oil and gas service businesses in Louisiana have filed for bankruptcy protection in recent weeks amid an economic downturn spurred by the coronavirus pandemic and low crude oil prices.

Two businesses near Lafayette, one in Houma and another in Kenner filed for bankruptcy, all of which appear to be oil and gas services companies. Dozens more Louisiana businesses are owed money by the companies filing for bankruptcy, records show.

In recent weeks, the Louisiana Oil and Gas Association has said about half its 460 member companies have told the organization that bankruptcy was on the table as an option to survive the economic downturn.

Hundreds of wells in Louisiana have been shut-in since the coronavirus pandemic began. Wells are shut in for various reasons, one of which could be lack of production. Operators aren"t required by the state to disclose why the decision was made.

Crude oil futures briefly fell below $0 several weeks ago as demand for fuels plummeted amid stay-at-home orders across the globe to control the spread of the coronavirus. Storage became an issue for a glut of oil on the market. With some countries agreeing since then to limit oil production and world economies gradually reopening, the price of U.S. benchmark oil has rebounded about 20% in the past 30 days to about $40 per barrel.

In early June, there were fewer than 300 oil rigs running across the U.S., the lowest in recent history. During the most dire point of the 2014 to 2016 oil bust, there were still about 400 rigs operating. If there"s less oil and gas extraction, there"s less demand for related services — the majority of Louisiana companies tied to the oil and gas sector.

"We are going to get hit hard," said Gifford Briggs, president of the Louisiana Oil and Gas Association. "If you"re not drilling wells, it doesn"t matter what kind of debt you have, there"s not enough business."

None of the companies filing in recent weeks had filed for bankruptcy before, despite the significant downturn in the industry in 2016.In Carenco, Professional Pumping Services LLC filed for Chapter 7 bankruptcy, a liquidation of the business and auction of assets to pay off any debts. The Lafayette-area pumping services business has fewer than 100 creditors. It had $3.5 million in assets, much of which was specialty equipment, with only $756,139 in liabilities. Typically debt outweighs assets in a bankruptcy case. A significant slice of unsecured creditors were employees of the company owed unpaid wages.

Broussard-based C&B Sales and Services is owed more than $66,150 as an unsecured creditor of Professional Pumping Services; Lafayette-based Deep South Chemical is owed $17,124; and Belle Chasse-based River Rental Tools is owed $37,169.

The owner of Professional Pumping Services did not respond to requests for comment.Franklin-based SMI Companies Global Inc. filed for Chapter 11 bankruptcy, which means the company seeks to reorganize debt and continue doing business. The company has fewer than 100 creditors, but it owes more than $1.5 million with less than $21,000 in assets.

Lafayette-based Aluminum & Stainless Inc. is owed more than $31,200; Gonsolulin Engineering in New Iberia is owed $29,000; Lafayette Paint & Supply Inc. is owed $18,155; and Broussard-based NI Welding Supply is owed more than $102,780, records show.

Calls for comment to the CEO of SMI Companies Global were not returned.Chester J. Marine LLC, based in Houma, filed for Chapter 11 bankruptcy seeking to reorganize the business. It has fewer than 50 creditors and more than $1 million in assets with less than $400,000 in liabilities.

Chester J. Marine"s CEO declined to comment when reached by phone.Regional Valve Corp. in Kenner filed for Chapter 11 bankruptcy. It also has fewer than 50 creditors, which are owed more than $1.2 million. The company has less than $1 million in assets.

The largest unsecured creditors for Regional Valve Corp. included several business loans from $100,000 due to LoanMe and other alternative lenders such as more than $100,000 to Green Note Capital, another $18,600 to FundWorks LLC and an $80,000 line of credit from On Deck.

Acadiana Business Today: Cajun musician, paramedic Jamie Bergeron under fire for his "All Lives Splatter" online posts; Can EatLafayette save struggling restaurants?

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MJCU3NS2MBNBFATPGEU7BOLGMQ.jpg)

Over the past month, oil prices have trended downward. On August 26th, prices closed at $93.06. On August 29th, prices hit a high of $97.01. Since then, prices have fallen steadily. On September 23rd, prices closed at $78.74.

The September 23rd Baker Hughes rig count report shows the active rig count is steady. Baker Hughes reports 764 active drilling rigs in the US. One month ago, the total active rig count was 765, and one year ago, it was 521 rigs.

The oil rig count is currently 602 rigs, compared to 605 one month ago, and 421 one year ago. The gas rig count is 160, compared to 158 one month ago and 99 last September.

TCI Business Capital is a leading provider of accounts receivable factoring for oilfield service companies. Factoring is a type of financing many companies use to get immediate cash for their open receivables.

If your oilfield services company is being held back by slow cash flow, or if you need money to meet those daily expenses, call TCI Business Capital at 800-707-4845, or contact us via the web.

Houston-based Hercules Offshore Inc. will cut 50 jobs offshore Louisiana as it pulls several of its drilling rigs from the Gulf of Mexico. The layoffs are the latest in a wave of industry cuts amid low oil prices.

Hercules Offshore, which operates rigs in the shallow waters of the Gulf, plans to make the job cuts Nov. 21, just before Thanksgiving Day, according to a notice filed with state workforce officials. The cuts, which affect offshore rig support workers, will be permanent.

Hercules Offshore filed for Chapter 11 bankruptcy protection in August after selling four of its shallow-water drilling rigs earlier in the year, part of its effort to scale back and cut costs as low oil prices erode its balance sheet. The company has cut more than 1,800 jobs in recent months.

The company told Louisiana workforce officials it will shut down multiple rigs in the Gulf of Mexico, bring them onshore and leave them unmanned as it weathers the low price environment, a process known in the industry as "cold stacking."

The company made local headlines in July 2013 when one of its rigs caught fire off the Louisiana coast after a blowout occurred during drilling operations. No one was injured, though the fire raged for two days before the damaged well stopped flowing. Walter Oil & Gas Corp., also based in Houston, was operating the rig at the time.

More and more companies want to drill for oil in Louisiana. The number of applications to get permits is quickly rising after a slow-down amid COVID closures in 2020.

With fewer people driving around, and demand down, about 26 rigs were operating in 2020. This year, there are nearly double running in the state, and requests are coming in for more.

"The industry saw a recovery in demand, they saw an increase in the price they were getting, so they started drilling more," said Patrick Courreges, communications director for the Louisiana Department of Natural Resources.

"We saw in 2020 when demand went way down, the economy was kind of shuttering," Courreges said. "You had the depths of the COVID lockdown and shut things down like that."

"As the prices recovered, as they are able to get more for the product, they are able to open back up, they are able to expand again, they are able to start drilling again, and be able to make a living doing it and pay their people," Courreges explained.

"If you see effects from this, you are probably talking about a couple of months down the line before they really had a chance to respond," Courreges said.

(The Center Square) — The so-called Inflation Reduction Act of 2022 approved by the U.S. House on Friday could bring some relief to Louisiana parishes that rely on oil and gas leases to fund coastal restoration work, though industry experts contend the legislation will create higher costs for consumers.

The IRA includes provisions to require four oil and gas lease sales in the Gulf of Mexico that could generate millions in revenues for states through the Gulf of Mexico Energy Security Act, which was created by Congress in 2006 to share leasing revenues with Alabama, Louisiana, Mississippi and Texas for coastal conservation, restoration and hurricane protection.

The development comes as the Department of Interior is vetting a draft plan for proposed lease sales for the outer continental shelf for the next five years, which will replace an Obama-era plan that was implemented in 2017 and expired in July.

The proposed plan is raising concerns from lawmakers and coastal communities that rely on GOMESA funds because it stipulates "no more than 10 potential sales in the Gulf of Mexico" that could be "further refined and targeted, based on public input and analysis" to "include fewer lease sales, including no lease sales." Public comment on the proposal runs until Oct. 6.

The potential to end offshore drilling is consistent with President Biden’s campaign promises and the delay in renewing the five-year plan means no new leases would be possible without congressional action until it’s finalized, said Gifford Briggs, Gulf Coast region director for the American Petroleum Institute.

"Many of these projects in the Gulf of Mexico are 5-7 years" in the making, he said, which means without new leases GOMESA revenues would begin to die off around 2027 or 2028.

Briggs noted that "there’s also a lot of jobs from Louisiana’s standpoint that are tied up in that 7 year window" that would go away without a new plan that includes new leases.

The most recent 2022 GOMESA disbursements from the Office of Natural Resources Revenue included nearly $34.8 million for Alabama, $111.8 million for Louisiana, $36.7 million for Mississippi and $68.8 million for Texas. While the bulk of the funding goes to the states, large sums are also distributed directly to coastal parishes or counties.

GOMESA funds helped restore 1,080 acres of barrier islands in Terrebonne and LaFourche parishes, such as Trinity Island-East in the Isles Dernieres refuge.

In 2022, Terrebonne Parish received $1.6 million, money Terrebonne Coastal Restoration Director Mart Black said goes toward paying off a bond that has funded critical coastal preservation and hurricane protection work in the community.

Combined with funds from a BP oil spill settlement, the funding has gone toward critical work preserving coastal wetlands, rebuilding barrier islands, constructing levees and constructing water controls to prevent saltwater intrusion that kills freshwater bayous, he said.

"In a decade or so if there are no more leases for offshore drilling, things could be a little tough," Black said, adding that pending legislation in Congress could add wind energy revenues to GOMESA and lift a cap on revenue sharing with states. "We want to increase those revenues, it’s important to us."

While the IRA could help toward that end after being approved by the House as it is now, it would come with $739 billion in taxes that will ultimately drive up expenses for Americans, according to API.

The bill includes a tax of 16.4 cents for each barrel of crude oil and imported petroleum, a new 15% minimum tax on billion-dollar corporations, new taxes on U.S. oil and natural gas companies, increased rental fees for onshore leases and tax credits for electric vehicles, all of which will come at a cost to taxpayers.

"The IRA could open the door to more federal onshore and offshore lease sales and expand credits for carbon capture, which is encouraging for the oil and natural gas industry," Lem Smith, API vice president for federal regulations, wrote in an analysis this week.

But "IRA policies that raise taxes and discourage ongoing investment in U.S. oil and natural gas are ill-advised," he wrote. "Amid a global energy crisis, too many provisions fail to address the questions many American families are asking."Updated Information

BATON ROUGE — Employment in Louisiana’s oil and gas industry has been declining since 2014 and took another big hit during the COVID-19 pandemic, with layoffs of 7,500 more workers.

The high-paying jobs have not come back yet even though world oil prices have rebounded to pre-pandemic levels. And as President Joe Biden pushes to accelerate a shift to renewable energy sources, oil and gas workers from Lafayette to Houma are feeling increasingly uneasy about the future.

Loren Scott, an economist who does consulting work for the industry, said Louisiana has about 27,000 jobs in oil and gas extraction, or 7,500 fewer than in January 2020. That number reflects those working in oil and gas exploration and production.

Even with the rebound in crude oil prices over the last few months, the South Louisiana oil patch remains “one of the few sectors of the economy that did not show any improvement” in jobs, Scott said.

Gary Wagner, an economics professor at the University of Louisiana at Lafayette, said that an array of businesses that support the oil and gas industry also have lost jobs, and adding these in brings the total job losses to at least 24,000 since the peak in 2014.

Patrick Courreges, the communications director at the Louisiana Department of Natural Resources, said the industry suffered last year as Americans cut back on travel and worked from home. That’s because many of the refined products, like gasoline, are for transportation.

Courreges said that as oil prices dropped, rigs in production and drilling permits trended down. And when consumer demand fell with the spread of the virus, the industry took a beating like never before.

As the economy reopens and Americans adjust to “the new normal,” he said, the industry is showing some signs of recovery. Since the state’s fiscal year started last July 1, Louisiana received $4.2 million from leasing state lands to oil and gas companies and issuing water bonds. The numbers were closer to $2.5 million for the previous fiscal year, he said.

Lafayette is a center for the service industries that support drilling in the Gulf of Mexico. It hit peak employment in support activities for mining in 2014 at 20,724. That number was down to 8,642 in 2020.

Wagner said he does not think oil prices will rise much more over the next two years. But even if they rose more, he does not think Louisiana would see an increase in jobs — or that the industry will ever be quite as important to the state as it once was.

In the mid-1980s, 35% of the state’s economy was directly related to oil and gas. “That’s huge,” he said. “That was probably the highest in the country.”

Wagner said it is more costly to extract oil from the Gulf of Mexico than it is to drill for it on land in other parts of the country. Total oil and gas production has gone up in the United States over the last decade, but Louisiana’s share of the pie has declined.

Scott said, however, that the industry made a major technological breakthrough in 2019, learning how to drill safely at spots deep in the Gulf with higher water pressures. That prompted some industry officials to think that drilling was set to take off there in 2020.

But a sale of oil and gas leases in the Gulf drew little activity as the pandemic started in March 2020, and the Trump administration canceled another sale in August.

The Biden administration also canceled a lease sale last month after it declared a temporary moratorium on selling new leases in the Gulf while it decides on its energy and environmental policies.

That has added to the tension to the industry, as has Biden’s proposal to remove tax credits from the oil industry and provide additional ones to solar and wind-power companies.

By expanding use of renewable resources, the country could support its economy through “green growth” initiatives. The World Economic Forum says that renewable energy is now cheaper than coal-fired power plants, and half of solar and wind installations undercut fossil fuels in price in 2019.

Sales are soaring at electric car companies like Tesla, General Motors and Ford also are planning to move beyond gasoline engines. GM announced earlier this year that its plans to be carbon neutral by 2040, providing electric vehicles and sourcing renewable energy.

“Yes, renewables are the future," he added, "it’s just how long in the future and how fast can we get there without putting a lot of people out of work that can’t find a new job.”

Incorporated in 2001, Falcon Drilling, LLC is a mobile, fast and cost-effective top hole drilling company that services major and independent oil and gas companies. We specialize in disposal wells, shallow horizontal wells, shallow oil wells and top hole drilling.

Since we drilled our first Marcellus well in 2007, we now operate a fleet of drilling rigs capable of drilling up to 12,000 feet utilizing a 24 inch casing or smaller. Currently, we have rigs running in the Marcellus serving all well designs. Our primary operating area is in the Marcellus Shale and Utica Shale territories of Pennsylvania, West Virginia and Ohio.

Our commitment to working safe is paramount. We provide extensive oversight, training and guidance to each employee in the field every day on the job. Returning home safely each night to those most important to each one of us is the best motivation. We are an active member of PICS and each of our employees has completed the industry standard SafeLand program.

When will the market see a resumption of the top-tier rig newbuild programs that flooded the market in 2012–2014—what price point on day rates would trigger same? Platts RigData RADAR notes that day rates have indeed rebounded nicely, and especially for AC rigs.

Its sister publication, the Day Rate Report, noted the average day rate for 1500 hp rigs led the way up for all rig classes in Q1 of this year with a cumulative net day rate gain of +7% to $16,718. The average day rate for a 1,500 hp rig in 2014 was $22,564, and the top rate at peak in October 2014 was $26,000. The larger issue is that too many top tier rigs are still sidelined.

Even with recovery, the active rig count is less than half the average of 2010–2014. There were a little over 1,000 AC rigs of all sizes in the total fleet a year ago. In that year-ago snapshot, about 400 AC Class D rigs of recent vintage were cold-stacked; in the latest snapshot, that group has dwindled to 144. The ratio of all working rigs to stacked rigs has fallen from 5:1, but it remains as high as 2:1. Platts RigData estimates that the overall rig count, still dominated by Class D rigs, will need to reach about 1,200 before demand—and day rates—warrant another robust newbuild program.

8613371530291

8613371530291