workover rig companies in louisiana pricelist

Our fleet is comprised of professionally maintained rigs that are strategically located to provide completions, workovers, and more for our customers throughout the Ark-La-Tex. If you need a team of experts to improve production over the life cycle of your well, Maverick Well Service provides high quality workmanship, valuable insight, and peace of mind to each of our customers.

Ready to request services to maximize value throughout the life of your well site in the Ark-La-Tex region? The expert crew at Maverick Well Service is standing by and prepared to help you handle everything from conventional operations to the most technically demanding reservoir challenges you may face. Contact us today!

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Our skilled and knowledgeable leadership team applies their decades of collective experience to every aspect of the Louisiana oil drilling process. Our partners in the oil and gas drilling industry of Louisiana have benefited tremendously from our commitment to innovation and optimal efficiency. As an independent drilling contractor, we place a high premium on safety for our employees, your employees, and the surrounding environment. By ensuring the well-being of everyone involved in our operations, we are able to reduce costly downtimes and minimize the risk of injury on every oil drilling site.

The crew at Basin Drilling have worked in some of the most challenging yet productive oil and gas regions in the country, including areas like the Permian Basin, Odessa, Texas, and Midland, Texas. We provide our oil and gas drilling contractor services to our Louisiana partners to secure for them the same profitability and operational efficiency that we provide our partners everywhere.

We’re excited to start your operations on the path toward innovation, safety, and maximum profitability. If you are looking for an independent drilling contractor for the oil and gas industry of Louisiana, reach out to Basin Drilling today.

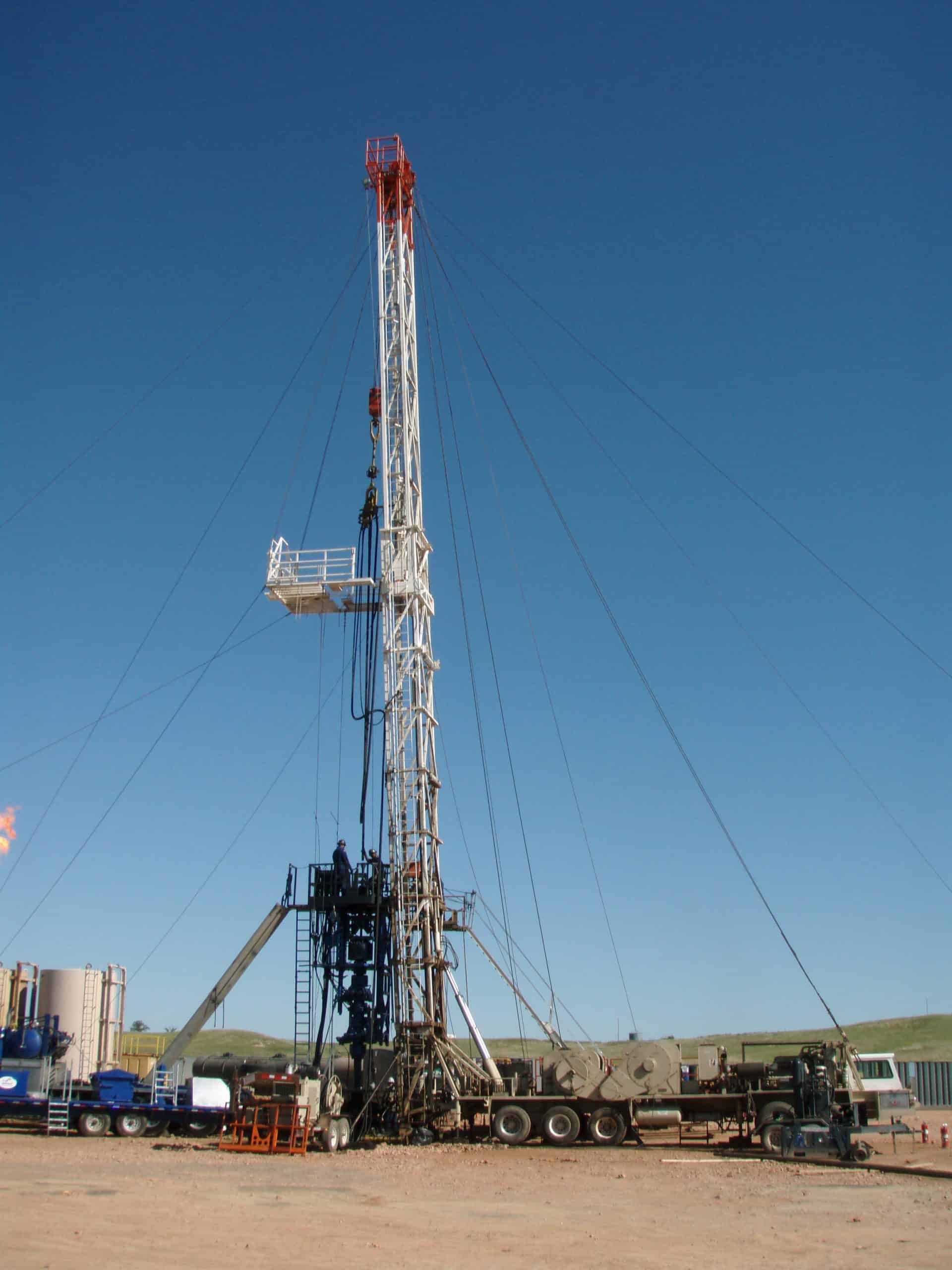

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

No New Competition [See Question 7 on Statistical Review]. All respondents said that competition had not increased QTQ, and they were not anticipating it would, given lower oil prices.Mid-Tier Well Service Manager: “We worry about the small local companies undercutting prices but we are not seeing anything now.”

2015 Rates Under Pressure [See Question 8 on Statistical Review]. Five of the eight respondents said 2015 would see further reductions in demand and hourly rates and even labor rates if the price of oil did not rise. One respondent said that “iron would start laying down” if oil prices did not rise. One respondent said he expects that work demand would come back up after a couple of months as everyone adjusted.Manager for Mid-Tier Well Service Company: “As a company, we have backed off our growth budget for 2015 and our capex has been nixed. We implemented a 10% reduction in our rates. We are just going to lower rates not wages, because we can buy equipment and leave it sit, but if you do that with people, they starve.”

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Several oil and gas service businesses in Louisiana have filed for bankruptcy protection in recent weeks amid an economic downturn spurred by the coronavirus pandemic and low crude oil prices.

Two businesses near Lafayette, one in Houma and another in Kenner filed for bankruptcy, all of which appear to be oil and gas services companies. Dozens more Louisiana businesses are owed money by the companies filing for bankruptcy, records show.

In recent weeks, the Louisiana Oil and Gas Association has said about half its 460 member companies have told the organization that bankruptcy was on the table as an option to survive the economic downturn.

Hundreds of wells in Louisiana have been shut-in since the coronavirus pandemic began. Wells are shut in for various reasons, one of which could be lack of production. Operators aren"t required by the state to disclose why the decision was made.

Crude oil futures briefly fell below $0 several weeks ago as demand for fuels plummeted amid stay-at-home orders across the globe to control the spread of the coronavirus. Storage became an issue for a glut of oil on the market. With some countries agreeing since then to limit oil production and world economies gradually reopening, the price of U.S. benchmark oil has rebounded about 20% in the past 30 days to about $40 per barrel.

In early June, there were fewer than 300 oil rigs running across the U.S., the lowest in recent history. During the most dire point of the 2014 to 2016 oil bust, there were still about 400 rigs operating. If there"s less oil and gas extraction, there"s less demand for related services — the majority of Louisiana companies tied to the oil and gas sector.

"We are going to get hit hard," said Gifford Briggs, president of the Louisiana Oil and Gas Association. "If you"re not drilling wells, it doesn"t matter what kind of debt you have, there"s not enough business."

None of the companies filing in recent weeks had filed for bankruptcy before, despite the significant downturn in the industry in 2016.In Carenco, Professional Pumping Services LLC filed for Chapter 7 bankruptcy, a liquidation of the business and auction of assets to pay off any debts. The Lafayette-area pumping services business has fewer than 100 creditors. It had $3.5 million in assets, much of which was specialty equipment, with only $756,139 in liabilities. Typically debt outweighs assets in a bankruptcy case. A significant slice of unsecured creditors were employees of the company owed unpaid wages.

Broussard-based C&B Sales and Services is owed more than $66,150 as an unsecured creditor of Professional Pumping Services; Lafayette-based Deep South Chemical is owed $17,124; and Belle Chasse-based River Rental Tools is owed $37,169.

The owner of Professional Pumping Services did not respond to requests for comment.Franklin-based SMI Companies Global Inc. filed for Chapter 11 bankruptcy, which means the company seeks to reorganize debt and continue doing business. The company has fewer than 100 creditors, but it owes more than $1.5 million with less than $21,000 in assets.

Lafayette-based Aluminum & Stainless Inc. is owed more than $31,200; Gonsolulin Engineering in New Iberia is owed $29,000; Lafayette Paint & Supply Inc. is owed $18,155; and Broussard-based NI Welding Supply is owed more than $102,780, records show.

Calls for comment to the CEO of SMI Companies Global were not returned.Chester J. Marine LLC, based in Houma, filed for Chapter 11 bankruptcy seeking to reorganize the business. It has fewer than 50 creditors and more than $1 million in assets with less than $400,000 in liabilities.

Chester J. Marine"s CEO declined to comment when reached by phone.Regional Valve Corp. in Kenner filed for Chapter 11 bankruptcy. It also has fewer than 50 creditors, which are owed more than $1.2 million. The company has less than $1 million in assets.

The largest unsecured creditors for Regional Valve Corp. included several business loans from $100,000 due to LoanMe and other alternative lenders such as more than $100,000 to Green Note Capital, another $18,600 to FundWorks LLC and an $80,000 line of credit from On Deck.

Acadiana Business Today: Cajun musician, paramedic Jamie Bergeron under fire for his "All Lives Splatter" online posts; Can EatLafayette save struggling restaurants?

Over the past month, oil prices have trended downward. On August 26th, prices closed at $93.06. On August 29th, prices hit a high of $97.01. Since then, prices have fallen steadily. On September 23rd, prices closed at $78.74.

The September 23rd Baker Hughes rig count report shows the active rig count is steady. Baker Hughes reports 764 active drilling rigs in the US. One month ago, the total active rig count was 765, and one year ago, it was 521 rigs.

The oil rig count is currently 602 rigs, compared to 605 one month ago, and 421 one year ago. The gas rig count is 160, compared to 158 one month ago and 99 last September.

TCI Business Capital is a leading provider of accounts receivable factoring for oilfield service companies. Factoring is a type of financing many companies use to get immediate cash for their open receivables.

If your oilfield services company is being held back by slow cash flow, or if you need money to meet those daily expenses, call TCI Business Capital at 800-707-4845, or contact us via the web.

BATON ROUGE — Employment in Louisiana’s oil and gas industry has been declining since 2014 and took another big hit during the COVID-19 pandemic, with layoffs of 7,500 more workers.

The high-paying jobs have not come back yet even though world oil prices have rebounded to pre-pandemic levels. And as President Joe Biden pushes to accelerate a shift to renewable energy sources, oil and gas workers from Lafayette to Houma are feeling increasingly uneasy about the future.

Loren Scott, an economist who does consulting work for the industry, said Louisiana has about 27,000 jobs in oil and gas extraction, or 7,500 fewer than in January 2020. That number reflects those working in oil and gas exploration and production.

Even with the rebound in crude oil prices over the last few months, the South Louisiana oil patch remains “one of the few sectors of the economy that did not show any improvement” in jobs, Scott said.

Gary Wagner, an economics professor at the University of Louisiana at Lafayette, said that an array of businesses that support the oil and gas industry also have lost jobs, and adding these in brings the total job losses to at least 24,000 since the peak in 2014.

Patrick Courreges, the communications director at the Louisiana Department of Natural Resources, said the industry suffered last year as Americans cut back on travel and worked from home. That’s because many of the refined products, like gasoline, are for transportation.

Courreges said that as oil prices dropped, rigs in production and drilling permits trended down. And when consumer demand fell with the spread of the virus, the industry took a beating like never before.

As the economy reopens and Americans adjust to “the new normal,” he said, the industry is showing some signs of recovery. Since the state’s fiscal year started last July 1, Louisiana received $4.2 million from leasing state lands to oil and gas companies and issuing water bonds. The numbers were closer to $2.5 million for the previous fiscal year, he said.

Lafayette is a center for the service industries that support drilling in the Gulf of Mexico. It hit peak employment in support activities for mining in 2014 at 20,724. That number was down to 8,642 in 2020.

Wagner said he does not think oil prices will rise much more over the next two years. But even if they rose more, he does not think Louisiana would see an increase in jobs — or that the industry will ever be quite as important to the state as it once was.

In the mid-1980s, 35% of the state’s economy was directly related to oil and gas. “That’s huge,” he said. “That was probably the highest in the country.”

Wagner said it is more costly to extract oil from the Gulf of Mexico than it is to drill for it on land in other parts of the country. Total oil and gas production has gone up in the United States over the last decade, but Louisiana’s share of the pie has declined.

Scott said, however, that the industry made a major technological breakthrough in 2019, learning how to drill safely at spots deep in the Gulf with higher water pressures. That prompted some industry officials to think that drilling was set to take off there in 2020.

But a sale of oil and gas leases in the Gulf drew little activity as the pandemic started in March 2020, and the Trump administration canceled another sale in August.

The Biden administration also canceled a lease sale last month after it declared a temporary moratorium on selling new leases in the Gulf while it decides on its energy and environmental policies.

That has added to the tension to the industry, as has Biden’s proposal to remove tax credits from the oil industry and provide additional ones to solar and wind-power companies.

By expanding use of renewable resources, the country could support its economy through “green growth” initiatives. The World Economic Forum says that renewable energy is now cheaper than coal-fired power plants, and half of solar and wind installations undercut fossil fuels in price in 2019.

Sales are soaring at electric car companies like Tesla, General Motors and Ford also are planning to move beyond gasoline engines. GM announced earlier this year that its plans to be carbon neutral by 2040, providing electric vehicles and sourcing renewable energy.

“Yes, renewables are the future," he added, "it’s just how long in the future and how fast can we get there without putting a lot of people out of work that can’t find a new job.”

More and more companies want to drill for oil in Louisiana. The number of applications to get permits is quickly rising after a slow-down amid COVID closures in 2020.

With fewer people driving around, and demand down, about 26 rigs were operating in 2020. This year, there are nearly double running in the state, and requests are coming in for more.

"The industry saw a recovery in demand, they saw an increase in the price they were getting, so they started drilling more," said Patrick Courreges, communications director for the Louisiana Department of Natural Resources.

"We saw in 2020 when demand went way down, the economy was kind of shuttering," Courreges said. "You had the depths of the COVID lockdown and shut things down like that."

"As the prices recovered, as they are able to get more for the product, they are able to open back up, they are able to expand again, they are able to start drilling again, and be able to make a living doing it and pay their people," Courreges explained.

"If you see effects from this, you are probably talking about a couple of months down the line before they really had a chance to respond," Courreges said.

(The Center Square) — The so-called Inflation Reduction Act of 2022 approved by the U.S. House on Friday could bring some relief to Louisiana parishes that rely on oil and gas leases to fund coastal restoration work, though industry experts contend the legislation will create higher costs for consumers.

The IRA includes provisions to require four oil and gas lease sales in the Gulf of Mexico that could generate millions in revenues for states through the Gulf of Mexico Energy Security Act, which was created by Congress in 2006 to share leasing revenues with Alabama, Louisiana, Mississippi and Texas for coastal conservation, restoration and hurricane protection.

The development comes as the Department of Interior is vetting a draft plan for proposed lease sales for the outer continental shelf for the next five years, which will replace an Obama-era plan that was implemented in 2017 and expired in July.

The proposed plan is raising concerns from lawmakers and coastal communities that rely on GOMESA funds because it stipulates "no more than 10 potential sales in the Gulf of Mexico" that could be "further refined and targeted, based on public input and analysis" to "include fewer lease sales, including no lease sales." Public comment on the proposal runs until Oct. 6.

The potential to end offshore drilling is consistent with President Biden’s campaign promises and the delay in renewing the five-year plan means no new leases would be possible without congressional action until it’s finalized, said Gifford Briggs, Gulf Coast region director for the American Petroleum Institute.

"Many of these projects in the Gulf of Mexico are 5-7 years" in the making, he said, which means without new leases GOMESA revenues would begin to die off around 2027 or 2028.

Briggs noted that "there’s also a lot of jobs from Louisiana’s standpoint that are tied up in that 7 year window" that would go away without a new plan that includes new leases.

The most recent 2022 GOMESA disbursements from the Office of Natural Resources Revenue included nearly $34.8 million for Alabama, $111.8 million for Louisiana, $36.7 million for Mississippi and $68.8 million for Texas. While the bulk of the funding goes to the states, large sums are also distributed directly to coastal parishes or counties.

GOMESA funds helped restore 1,080 acres of barrier islands in Terrebonne and LaFourche parishes, such as Trinity Island-East in the Isles Dernieres refuge.

In 2022, Terrebonne Parish received $1.6 million, money Terrebonne Coastal Restoration Director Mart Black said goes toward paying off a bond that has funded critical coastal preservation and hurricane protection work in the community.

Combined with funds from a BP oil spill settlement, the funding has gone toward critical work preserving coastal wetlands, rebuilding barrier islands, constructing levees and constructing water controls to prevent saltwater intrusion that kills freshwater bayous, he said.

"In a decade or so if there are no more leases for offshore drilling, things could be a little tough," Black said, adding that pending legislation in Congress could add wind energy revenues to GOMESA and lift a cap on revenue sharing with states. "We want to increase those revenues, it’s important to us."

While the IRA could help toward that end after being approved by the House as it is now, it would come with $739 billion in taxes that will ultimately drive up expenses for Americans, according to API.

The bill includes a tax of 16.4 cents for each barrel of crude oil and imported petroleum, a new 15% minimum tax on billion-dollar corporations, new taxes on U.S. oil and natural gas companies, increased rental fees for onshore leases and tax credits for electric vehicles, all of which will come at a cost to taxpayers.

"The IRA could open the door to more federal onshore and offshore lease sales and expand credits for carbon capture, which is encouraging for the oil and natural gas industry," Lem Smith, API vice president for federal regulations, wrote in an analysis this week.

But "IRA policies that raise taxes and discourage ongoing investment in U.S. oil and natural gas are ill-advised," he wrote. "Amid a global energy crisis, too many provisions fail to address the questions many American families are asking."Updated Information

The war in Ukraine has limited Russian oil and gas supplies and has the potential to cause a major shift in the world’s energy market. No one knows how long Russia intends to wage war in Ukraine or how much of its crude will be affected by sanctions or for how long. The uncertainty caused by the supply disruption has driven crude prices to multi-year highs. And anxieties persist that surging oil prices may rise so high that demand destruction will damage the global economy and cause a worldwide recession. However, Russia’s invasion of Ukraine is creating a new market for U.S. LNG producers, as product flows to Europe to replace Russian natural gas. The longer the conflict persists, the more entrenched U.S. LNG will become.

Fig. 1. Drilling activity in the U.S. increased steadily through the first seven months of 2022, but the rig count slowed and began to plateau in August and September. Image: Pioneer Natural Resources Company.

ESG impact. Although the U.S. petroleum industry faces continued pressure from President Biden and environmental groups about the imperative of reducing fossil fuel usage to slow GHG emissions, the drive for rapid implementation has lessened. However, the transition to renewables and clean energy alternatives has created an unprecedented reduction of investment in hydrocarbon-based energy, in favor of developing green resources. During 2021, global oil and gas discoveries hit their lowest level in 75 years. Total global discovered volumes in 2021 were calculated at 4.7 Bboe, the lowest tally since 1946. This trend is predicted to continue in 2022. A data-based comparison shows a significant reduction in recoverable oil resources that will drive commodity prices higher and further damage global energy security.

U.S. production surges. Despite a sizeable drop in recoverable resources, U.S. oil production remains on track for a record in 2023, even as output grows more slowly than anticipated amid increased costs and labor shortages in America’s shale fields. Output is expected to expand at an average 840,000 bopd next year, down from a prior forecast of 860,000 bopd, according to the EIA. While production is still seen reaching an all-time high in 2023, the government revised its forecast slightly lower to 12.7 MMbopd. The current, annual, U.S. record average is 12.3 MMbopd, set in 2019.

At the start of the year, production in the U.S. (11.7 MMbopd), Saudi Arabia (10.2 MMbopd) and Russia (11.0 MMbopd) was running at nearly full capacity. Brent and WTI were trading at $86.51/bbl and $83.22, respectively. When Russia invaded Ukraine on Feb. 24, 2022, the EU and international community reacted quickly by boycotting Russian supply. The embargo quickly pushed prices up, and in June, Brent was trading for $122.71/bbl and WTI hit $114.84/bbl, the highest price since August 2008. Prices retreated in July, down to $111.93/bbl for Brent and $101.62/bbl for WTI, due to rising interest rates and fear of economic recession, despite restricted Russian supply.

Demand to lessen. The global surge in the cost of fuel is starting to weigh on demand, according to Vitol Group, the world’s largest independent oil trader. Consumers are being impacted by the run-up in gasoline, diesel and other oil products said Mike Muller, head of Vitol Asia. There is clear evidence of economic stress being caused by high oil and natural gas prices, according to Muller.

The Baker Hughes rotary rig count stood at 588 units during the week ending Jan. 7, 2022. U.S. drilling activity climbed steadily for the next seven months, although it slowed in July and August, reaching 760 in the week ending Sept. 2, Fig. 1. Although the 172-rig increase represents a Jan.-Sept. increase of 29%, U.S. shale operators have resisted ramping-up drilling activity and remained relatively disciplined with their capital expenditures. The speed at which new rigs have been deployed to the field is considerably less than in previous up-price cycles. Most U.S. shale companies are still being conservative, as priorities remain focused on protecting balance sheets and generating free cash flow.

This conservative approach, along with high oil prices, has enabled shale companies to reduce their debt burdens in the second quarter, signaling room for them to pay dividends, buy back shares or make acquisitions. A metric commonly used to measure companies’ ability to pay down their borrowings has widely improved among oil and gas producers, as they repurchase some bonds and pile up cash amid ballooning profits.

Net debt reported by a group of independent operators, including ConocoPhillips and Pioneer Natural Resources, averaged less than 0.6 times their annual earnings before items such as interest and taxes in the second quarter, down from 1.7 times a year earlier. Many companies have reached their debt target. Energy companies have made great strides toward repairing and reinforcing their balance sheets and are in a much stronger position to handle another downturn in commodity prices.

With WTI trading between $85/bbl and $95/bbl, U.S. shale producers are on course to generate $200 billion this year, enough to make the industry debt-free by 2024 and potentially fund a pivot toward more natural gas production (Deloitte). High oil prices and disciplined capital spending mean U.S. shale producers are on track for their most profitable year on record, part of a global trend that will see the oil and gas industry generate a record $1.4 trillion of free cash flow. After paying down debt and rewarding shareholders, U.S. producers will likely focus more on natural gas production, due to high demand and prices around the world. Producers will also make record profits from U.S. LNG operations. They are expected to generate $59 billion this year, double last year’s amount and easily recouping the $45 billion of losses from 2013 to 2020.

Fig. 2. As shown in this all-time U.S. drilling chart, activity for the last two years has grown slowly but steadily since bottoming out during 2020. If the forecast holds, U.S. drilling will be up nearly 50% in 2022, compared to the low point two years ago. Chart:©World Oil.

Due to sustained higher oil prices, World Oil forecasts a noticeable uptick in drilling activity for the remainder of the year, projecting 18,600 total wells for 2022—a 34% increase from the 2021 count of 13,877, Table 1. Total footage is projected to increase from 191.5 MMft in 2021 to 256.4 MMft in 2022—an increase of 34%. During 2022, 8,769 wells are estimated to have been drilled during the first six months, while 9,831 are expected to spud in the second half of the year, for a half-to-half increase of 12.1%. A 14.9% increase in footage is expected in the last six months.

Oil prices have been rising since the start of 2021, bolstered by restricted Russian supplies and recovering demand. However, upstream M&A activity, which typically follows oil prices, remains well below pre-pandemic levels. The total count and value of U.S. upstream deals during the first eight months of 2021 were down 30% and 46%, respectively, from the same period in 2019.

While the ongoing capital discipline of operating companies is the primary reason behind the slowdown in upstream M&A activity, limited visibility of buyers into the carbon profile of sellers’ assets is a growing factor. Companies pursuing their net-zero goals are either looking to acquire low-carbon-intensity barrels or divest the high-intensity ones, implying that there might be an acreage consolidation or portfolio restructuring on the horizon (Deloitte). But a large resource size and an attractive offering price may not be enough to elicit a response from a buyer focused on meeting its net-zero targets. Therefore, M&A activities would need not only to be financially accretive, but also to support ESG goals.

Devon Energy agreed to acquire Validus Energy for $1.8 billion in cash, to expand in the Eagle Ford shale play in South Texas. The deal will add to Devon’s cash flow and earnings in the first year, and boost its variable dividend by up to 10%, based on current oil futures prices. Devon also said the transaction will enable the acceleration of the return of cash to investors via its existing $2 billion stock buyback program. Buying Validus will add 42,000 net acres adjacent to Devon’s existing leasehold in the Eagle Ford. Validus’s production is approximately 35,000 boed, with volumes expected to increase to 40,000 boed over the next year.

EQT to buy Marcellus assets. EQT Corp, the largest U.S. natural gas producer, agreed to acquire THQ Appalachia, a privately held company, in a $5.2 billion deal to expand holdings in the Marcellus shale. The company purchased the assets from Alta Resources for $2.9 billion. It also acquired Chevron’s assets in Appalachia for $735 million in 2020. THQ Appalachia produces nearly 800 MMcfgd in West Virginia. The company has about 11 years of inventory at maintenance capital levels. EQT is expected to produce the equivalent of 5.5 Bcfd this year.

Fig. 3. Drilling levels in the U.S. Gulf of Mexico will be up about 8.5%, compared to 2021’s activity. Second-half 2022 drilling will be up only slightly from the first half. Image: Transocean.

Heading into 2022, most operators expected pricing to increase for nearly all service lines but seismic. Labor, tubulars, fracturing/stimulation, and transportation were the areas of greatest concern. A modest 15% expected pricing to remain stable, including nearly 39% for completion equipment, 35% for other services, and 33% for drilling. Further pricing concessions were expected by a modest few for seismic services and tubulars.

Further pricing increases are expected in the second half of 2022, with limited availability of OCTG and casing potentially curtailing spending revisions. Overall spending in OFS is expected to remain about 25% below 2019 levels until 2025. With margins at the mercy of another price cycle and reduced spending, many OFS companies are crafting a new strategy for the future of energy. With a broadening decarbonization mandate across industries, companies have an opportunity to lead the way for customers by fully re-engineering traditional OFS business models and solutions outside the traditional oilfield services and to other industries.

Many large service providers have diversified beyond core services. One large company has restructured its business by launching cloud and edge computing services, whose rate of growth is expected to outpace that of their O&G business in a few years. Similarly, Halliburton and Baker Hughes are partnering with start-ups and academic institutions, through their Halliburton Labs and Baker Hughes Energy Innovation Center, respectively, to accelerate technology development for diverse energy and industrial applications.

However, digitalization will only help to a certain extent. Providing integrated solutions for decarbonizing upstream projects, implementing subscription-based revenue models or diversifying into the low-carbon space, such as hydrogen and CCUS, are key to future growth.

The number of licensed blocks and total acreage fell to near all-time lows, as the sector struggles to shake off the effects of the Covid-19 pandemic and the ensuing oil market crash (Rystad). Only 21 leasing rounds were completed globally through August this year, half of the 42 rounds held in the first eight months of 2021. The acreage awarded so far this year has shrunk to a 20-year low of 320,000 km2. Global leasing rounds are expected to total 44 this year, 14 less than in 2021 and the lowest level since 2000.

Global spending on exploration has been falling in recent years, as oil and gas companies seek to limit risk by focusing on core producing assets and regions with guaranteed output, aiming to streamline their operations and build a more resilient business amid market uncertainty and the threat of a recession. The political landscape is also contributing to the decrease in license awards, with many governments pausing or halting leases and encouraging companies to wrap up exploration activity within already awarded blocks. This trend is likely to continue, as governments are less eager to invest in fossil fuel production and instead look ahead to a net zero future.

The onshore exploration sector is a significant contributor to the decline in awarded acreage. Total onshore acreage awarded in leasing activity has plummeted from more than 560,000 km2 in 2019 to a mere 115,000 km,2 so far this year. Offshore leased acreage hit a high point in 2019 before dropping off a cliff in 2020 and has remained relatively flat in the past two years. Concluded leasing rounds have dropped significantly in the U.S., driven primarily by the cancellation of Lease Sales 259 and 261 in the Gulf of Mexico and Cook Inlet in Alaska.

Employment in the U.S. oilfield services and equipment sector rose by an estimated 6,865 jobs to 648,914 in August, according to data from the Bureau of Labor Statistics and analysis by the Energy Workforce & Technology Council. Gains in August make OFS employment the highest since the Covid-19 pandemic began, but they are still off the pre-pandemic mark in February 2020 of 706,528. Overall, U.S. employers added 315,000 jobs, down from July numbers but still representing a strong pace of growth.

Fig. 4. Symbolized by this picturesque wellsite close to Signal Peak bluff in the Midland basin, near Big Spring, Texas (Howard County), drilling in the Permian region is at its highest level since 2019. Image: Latshaw Drilling Company.

North American spending is forecast to increase 33% from 2021 levels, which is an acceleration from 20.6% growth projected in a December survey and builds on the modest 1% increase experienced in 2021, according to James West, senior managing director at Evercore ISI. The increase is driven by a 1,260 bps acceleration in the U.S. to 36% growth, which more than offset a 2.8% decline in spending in 2021 excluding the historical capex of distressed companies that have since been acquired or privatized. Private and independent operators are leading the recovery, with capex accelerating by 1,440 bps and 1,550 bps from the December survey to 56% and 42%, respectively, and also accelerating from 41% and 5% growth in 2021. More modest growth of 25% and 19% are anticipated from the majors and NOCs, both of which contracted further in 2021.

While the majors have more than offset declines in 2021 despite recent divestitures—with Evercore’s projected 2022 spending nearly 7% above 2020 levels—spending from the NOCs remains 25% lower, to account for less than 1% of total U.S. spending (vs. almost 2% in 2020). Overall, the majors account for almost 30% of U.S. capex, down from 36% in 2020, while the independents, including privates, account for 70% of all spending, up from 62%. U.S. capex is on track to recover within 25% of pre-pandemic levels and approach levels last seen in 2009 before the start of the oil shale revolution.

There could be modest upside to NAM spending in in the second half of 2022, with current spot prices above the $84/Bbl WTI and $5.18/MMbtu HH average basis for establishing 2022 budgets. While half of survey respondents would maintain their budget, regardless of changes in the oil and gas price, one-third are willing to flex capex higher for rising cash flow. However, Evercore believes upside is likely to remain muted, as activity could be constrained by the availability of goods, services and labor.

Operators have been highly disciplined over the past year, as commodity prices increased. Yet, a new round of consolidation may drive spending higher, if commodity prices stabilize at a significantly higher range and confidence in the duration of the cycle increases. From a lower base, Evercore believes the set-up is positive for growth in 2023 and beyond.

The EIA’s Short-Term Energy Outlook, published September 2022, reports that STEO is subject to heightened uncertainty resulting from Russia’s full-scale invasion of Ukraine and how sanctions affect Russia’s oil production. Also contributing to uncertainty is the production decisions of OPEC+, the rate at which U.S. oil and natural gas production rises, and other contributing factors. Less robust economic activity in the STEO forecast could result in lower-than-expected energy consumption.

Oil price forecast. Russia’s full-scale invasion of Ukraine has resulted in shifting trade patterns, leaving Europe to find substitutes for Russia’s oil. This change has driven up the price of Brent contracts to a level high enough to reduce Asia’s imports of Brent and to retain more oil in Europe. EIA forecasts the spot price of Brent crude will average $98/bbl in the fourth quarter of 2022 and $97/bbl in 2023. The possibility of petroleum supply disruptions and slower-than-expected crude oil production growth continues to create the potential for higher oil prices, while the possibility of slower-than-forecast economic growth creates the potential for lower prices.

Fig. 5. With plenty of drilling occurring in North Dakota during the last 12 to 15 years, and many wells like this one put onstream, there is a concern that the Bakken’s sweet spot has reached maximum infill development. Image: ConocoPhillips.

Crude production forecast. U.S. crude oil production is forecast to average 11.8 MMbopd in 2022 and 12.6 MMbopd during 2023, which would set a record for the most U.S. oil output during a year. The current record is 12.3 MMbopd, set in 2019.

Natural gas prices. In August, the Henry Hub spot price averaged $8.80/MMBtu, up from $7.28/MMBtu in July. Natural gas prices rose in August because of continued strong demand for natural gas in the electric power sector, which has kept natural gas inventories below their five-year (2017–2021) average. EIA expects HH price to average $9/MMBtu in in the fourth quarter of 2022 and then fall to an average $6/MMBtu in 2023, as U.S. natural gas production rises.

Natural gas production. Dry natural gas production has been rising relatively steadily since the first quarter of 2022, when it averaged 94.6 Bcfd. EIA forecasts U.S. natural gas production to average 99.0 Bcfd during fourth-quarter 2022 and then rise to 100.4 Bcfd in 2023.

Given the restricted Russian supply, demand recovery and resulting increase in crude prices, operators working the various U.S. plays plan to noticeably increase drilling activity for the remainder of 2022. Overall, activity in the Texas shale plays will improve in the second half of the year, with the exception of District 7B, District 8 and District 8A, which will suffer slight second-half losses. However, drilling on the Texas side of the Haynesville is projected to improve 26% on a y-o-y basis. Gulf of Mexico activity will increase 8.4%, but a decline of 70% is forecast offshore California, both on a y-o-y basis.

Gulf of Mexico. Higher oil prices should help boost activity slightly in the GOM, and it appears that offshore operators are poised to resume limited development in 2022-2023 after last year’s decline, Fig. 3. World Oil’s survey results and federal officials’ predicted well counts show a slight increase during second-half 2022. World Oil forecasts that GOM activity totaled 63 wells in the first half of the year, with another 65 scheduled to be drilled during second-half 2022. The projected 128-well total will be 8.4% higher than 2021’s figure of 118. Footage drilled should be up 6.6% on a y-o-y basis.

Texas. Most of the shale plays in the Lone Star State are gaining ground during 2022. On a half-over-half basis, World Oil predicts Texas wells will gain 11.6%, with the 2022 total being 39% more than the 2021 figure. In the Permian basin (Fig. 4), District 8 will be up 8% in the second half, buts its total will be 26% higher than wells drilled in 2021. Districts 7C and 8A will enjoy much-improved drilling activity, with gains of 33% and 172% respectively, compared to their 2021 totals.

The Eagle Ford forecast is also good, with District 1 forecast to improve 30% in the second half and up 64% on a y-o-y basis. District 2 will experience a 4% gain in activity in the second half, and is also projected to be up 26% on a y-o-y basis. District 4 in the Eagle Ford will experience a 47% increase between the two halves and post a massive 157% gain from 2021’s level. The reason that District 4 is surging is more gas-related activity. Of the 12 Railroad Districts, 10 are forecast to experience gains, with only two losing ground on a half-over-half basis. Again, more gas drilling is a factor, especially in RRC 6, with the Haynesville up 36% y-o-y.

DUC wells decline. According to EIA’s July 2022 tally, the DUC total stood at 4,277, a reduction of 1,680 wells since July 2021, a reduction of 28%. In the Permian basin, operators have completed 1,092 DUC wells during the July 2022-July 2021 interval, a reduction of 48%. All other regions declined too, with the exception of the Haynesville, which added 80 DUC wells up to 477, a y-o-y increase of 20%.

Oklahoma. Although the SCOOP and STACK plays are not as prolific as the Permian or Eagle Ford, acreage in Kingfisher, Canadian, Blaine, and Grady counties continues to attract interest for hydrocarbon development. But the region’s inconsistent geology and less-than-ideal shale formations have produced unpredictable results, reducing ROI. However, with higher oil prices, the plays have become more attractive, and we predict a major increase in Oklahoma’s activity. World Oil forecasts companies will drill 79% more wells in 2022 than last year’s total. Total footage will also surge forward 75%, with operators making 15.7 MMft of hole.

Louisiana. In the state’s northern portion, we forecast operators developing Haynesville shale gas will drill 25% more wells in 2022, than they did in 2021, with total footage up approximately 17%. With natural gas prices at near-record highs, the increase in activity could continue, similar to the Haynesville play in Texas RRC District 6. Despite near-record high natural gas prices, DUCs in the Haynesville were up to 477 in July, a jump of 20%. In the mature, shallow oil plays of southern Louisiana, we expect operators to drill 46% more wells compared to last year. Well footage is expected to increase 29% on a y-o-y basis.

North Dakota. The Bakken is running out of steam. Although transportation issues remain a challenge in this oil-rich shale play, a greater concern is that the sweet spot has reached maximum infill development, Fig. 5. However, higher oil prices will help negate the cost of drilling the 21,100-ft wells. Considering these factors, along with data from state officials and World Oil operator surveys, we forecast that drilling will be up a disappointing 4%, with footage increasing 2.9%, y-o-y, in the Peace Garden State.

Northeast (Pa./W.V./Ohio). In the Northeast, Marcellus activity is on an upward trend, similar to other U.S. shale plays, Fig. 6. Improving natural gas prices and increased LNG exports from Dominion Energy’s massive Cove Point facility are helping drive activity higher in the region. According to survey results, operators tapping the high-quality reservoir in Pennsylvania will increase the number of wells drilled this year by 18%, compared to the number drilled in 2021. Total footage for 2022 is forecast to jump 16.5%.

In Ohio, operators working the Utica play plan to focus on growth and capitalize on higher gas prices, with this year’s total well count expected to finish 30% higher than last year’s level. Footage is forecast to increase 31%. In West Virginia, World Oil forecasts operators will drill 84 more wells than the number spudded in 2021, up 62%. We also forecast a 64% surge in total footage in the Mountain State. Despite surging gas prices, operators working the shale fields of Appalachia were able to reduce the region’s DUC count by only eight wells in July on a y-o-y basis, a reduction of just 11%.

Midwest (Illinois/Kansas). There are approximately 32,100 oil and gas wells, 10,500 Class II injection wells and 1,750 gas storage wells producing from 650 fields in Illinois. These wells are controlled by 1,500 operators. There is oil production in 40 of the 102 counties, mainly in the southern part of the state. Drilling will surge, with a 61% increase in wells forecast for 2022, compared to 2021’s level. Although the wells are relatively shallow, they provide work for the oilfield community and the drilling crews. We forecast a 59% jump in total footage.

In Kansas, much of the shallow drilling in the Hugoton basin appears to stay below the Baker Hughes rig count radar. But according to the Kansas Corporation Commission, drilling in the Sunflower State is projected to increase 24% in 2022, compared to the 1,005 drilled in 2021. Total footage is forecast to jump 24%.

Rocky Mountains. The Denver Julesburg basin has experienced a constant decline since production peaked in November 2019. Reversing this trend will depend on the capital allocation from major operators in the region. The DJ basin accounted for 7% of oil and 6.6% of natural gas production in the Lower 48 in 2021 (GlobalData). While other U.S. basins have increased their rig count with the rise in commodity prices. Operators, like Oxy and Chevron, are earning better returns from investments in other basins, but could grow production in the DJ by completing their DUC backlog.

In Colorado, officials continue to attempt to ban, or severely limit, drilling in the state. In 2019, the state passed Senate Bill 118, “which fundamentally altered the oil and gas industry’s future in the state,” according to Colorado Governor Jared Polis. However, it appears companies intend to push back and continue operations on existing leases, as World Oil expects operators in Colorado to drill 40% more wells in 2022, compared to activity during 2021. Total footage is projected to increase by 40% on a y-o-y basis.

In 2019, a federal judge ordered a halt to exploration on 300,000 acres in Wyoming, saying the government must account for its cumulative effect on climate change. The ruling came in a lawsuit filed by a pair of environmental groups, challenging the BLM’s decision to lease federal lands for energy development in the state. Given that nearly 50% of all lands in Wyoming are owned by the federal government, a ban on federal leasing would decimate the natural gas industry and Wyoming’s economy. Despite the ongoing lawsuit, operators working in the state plan to increase drilling activity by 24% in 2022. World Oil predicts footage will increase 25%.

Canadian Overseas Petroleum received a resource report prepared by Ryder Scott that confirmed its deep oil discovery on lands in Converse and Natrona counties, Wyoming. The report confirms the deep discovery has total original oil in place of 993.5 MMbbl. This supports the company’s conclusion that the Frontier 2 and Dakota discoveries are large stratigraphic oil accumulations encompassing the reserves at the company’s Cole Creek field. The report outlines 118 horizontal well locations to exploit the identified Frontier 2 and Dakota reserves. COPL plans to drill one Frontier 1 well and two horizontal Frontier 2 wells as part of its 2022-2023 drilling campaign, commencing in fourth-quarter 2022.

Acreage in New Mexico has become as desirable as land on the Texas side of the Permian basin. Increased completion efficiencies in the Bone Springs formation will help support activity, as drilling in the Land of Enchantment is forecast to increase 23% on a half-over-half basis and 30% y-o-y for 2022. Total footage will increase 33% y-o-y.

In California, we expect onshore operators to spud four fewer wells in 2022, compared to 2021. But with no new discoveries, operators working the Golden State are forced to survive by maintaining less-attractive heavy oil fields and residual acreage from long-ago discoveries. However, considering the mature nature of these fields, onshore footage is forecast to climb 15% (y-o-y), suggesting deeper total depths as operators squeeze out more oil from these old fields. Drilling offshore California will drop dramatically, with only three wells expected in 2022, a y-o-y decline of 70%. Accordingly, footage is forecast to drop 65%.

In Alaska, the U.S. DOJ filed a brief defending the Willow project, an energy development within the NPRA on Alaska’s North Slope that has been halted by litigation. The Biden administration announced it would review the Willow plan, approved in 2020 by the Trump administration, for consistency. The project is proposed by ConocoPhillips, and if approved, the project will provide 100,000 bopd, $10 billion in revenue for state, local and federal governments during its lifespan, 2,000 construction jobs, and 300 permanent jobs. It appears the prospect of opening new acreage is having the desired effect. Offshore work will surge 109% in 2022, 12 more than spud in 2021. Onshore activity on the North Slope is projected to increase 67%, with total footage up 67%.

Others. Activity in non-core producing states will also enjoy a jump in activity. Drilling will increase on a y-o-y basis in Alabama, Arkansas, Montana, Nebraska and New York.

For the latest global offshore drilling market report, oil drilling market forecast, and top offshore drilling companies profiles, please see Global Offshore Drilling Market Report 2018-2022, or request your

Schlumberger is currently topping the list of the world’s top offshore drilling companies. It is the biggest offshore drilling contractor (in terms of revenue) not just in the US but across the world has a history of science and technology innovation, backed by strategic mergers and acquisitions. From conventional to application-specific systems for geothermal wells, rigs, jack-ups, unconventional plays and more, Schlumberger’s drilling services are designed to trim down the installation time and enhance safety.

Schlumberger supplies the industry’s most comprehensive range of products and services, from exploration through production and integrated pore-to-pipeline solutions for hydrocarbon recovery that optimize reservoir performance.

As part of Newsweek’s ‘Green Rankings’, Schlumberger was ranked 118th out of 500 large eco-conscious companies. In its own speciality, the company is the 3rd ranked offshore driller out of 31 entries.

Halliburton serves the upstream oil and gas sector throughout the lifecycle of the reservoir, from locating reserves and managing geological data, to drilling evaluation, well construction, completion and production optimization through the life of the field. Offshore drilling services offered by Halliburton include horizontal and directional drilling, measurement-while-drilling, logging-while-drilling, multilateral systems, underbalanced applications and rig site information systems.

Fluor Corporation is a MNC engineering and construction firm, the largest such entity in the ‘Fortune 500’ rankings, with a listing of 149. The company specializes in engineering, procurement, and construction management services for drilling and production resources at offshore fields and other energy assets. Fluor was involved in the development of some major offshore areas such as the Enfield oil field in Australia, Nasr/Al-Nasr field development in Abu Dhabi, UAE, the Ku-Maloob-Zaap field in Mexico, and the Bohai Bay field in China.

Baker Hughes specializes in drilling, production, and completion services for oil, gas and other energy industries. Offshore drilling systems offered by Baker Hughes include directional drilling services, measurement-while-drilling, coiled tubing and re-entry, logging-while-drilling, casing/liner drilling systems, drilling optimization, and remote drilling. Who Dat field in the Gulf of Mexico and the Skuld offshore field in the Norwegian Sea are some of the major offshore oil fields wherein the company offers its deep-water drilling services.

Transocean Ltd. is the world’s largest provider of offshore contract drilling services across the globe. With 140 mobile offshore drilling units, four ultra-deepwater new build units, and five high-specification jack-ups, the company’s fleet is considered one of the most versatile and modern in the world owing to its significant emphasis on technically demanding sections of the offshore drilling business.

The company’s operations are geographically dispersed in terms of oil and gas exploration. As its drilling rigs are mobile assets that can be moved according to prevailing market conditions, the company operates comfortably in a single market scenario as well as internationally. More recently, Transocean has shown great resolve in dealing with the oil crash and the industry’s general lethargy and is poised to have a dominant 2018.

For more than 25 years, UK-based Ensco Plc has been bringing energy to the world as an international provider of offshore drilling services in the oil and petroleum industry. Ensco has a significant presence in the most strategic offshore basins across six continents. On Oct 6, 2017, Ensco acquired the Houston-based offshore driller Atwood Oceanics in an all-stock deal. The company has made timely acquisitions to grow into a dominating offshore drilling company, and the acquisition of Atwood has incremented the organization’s brand value.

In 2017, things were a bit uncertain for the Bermuda-based offshore drilling company Seadrill. The company used a Chapter 11 bankruptcy filing to get its balance sheet in order. Bankruptcy risk for Seadrill grew considering a crushing industry downturn and billions of dollars in debt that had to be serviced. However, the company has the most capable, newest fleets of drilling vessels in operation and a strong track record of efficient and safe procedures that make it an ideal partner for several oil producers.

Post declaration of bankruptcy, Seadrill sports a strong balance sheet. The investors are thinking smartly and keeping Seadrill on their radar, to engage once again after the company emerges from bankruptcy completely sometime in 2018. If things go right for Seadrill, 2018 is poised to be an excellent year.

Noble Corporation, one of the leading offshore drilling companies for the oil and gas sector, has had an incredibly difficult time along with its competitors since the start of the oil crash, but has made many noticeable improvements in recent times. The company owns and operates one of the most versatile, modern, and technically advanced fleets in the offshore drilling industry.

Noble’s offshore fleet spells versatility. This affords the company the best vantage point, of all the other big drillers, to fight for and win contracts. This is strategy one for Noble in 2018.

The US based public limited company operates a fleet of 28 offshore drilling units, comprising of 14 drillships and six semisubmersibles along with 14 jack-ups. These machinery are focused squarely on ultra-deepwater and high-specification jack-up drilling jobs, applicable across both emerging and established regions worldwide.

Diamond Offshore Drilling incorporated on April 12, 1989 and traces its foundation to the earliest days of the offshore drilling sector. Today, the company operates in the waters of six continents, supplying comprehensive drilling services to the global energy industry. Configured to attain the optimum balance of performance and flexibility, Diamond Offshore’s fleet has amassed its reputation on more than four decades of real-world drilling experience. The company’s diverse fleet includes 14 jack-ups, 30 semisubmersibles, and one dynamically positioned drillship.

Rowan is one of the best-positioned companies in the offshore drilling industry in terms of both tackling weather weaknesses and taking advantage of the improved industry conditions. The company has the only UDW fleet in the industry composed of all seventh-generation rigs, which delivers extra performance and safety features as requested by customers. The company is financially powerful and has adequate cash to handle its commitments until 2023.

Rowan’s fleet comprises of 23 offshore drilling jackup rigs and 4 UDW drillships. An additional 5 jackup rigs are also listed as part of its JV with Saudi Aramco.

The majority of the company’s 2017 revenue was generated from the following partnerships: 29% : Saudi Aramco, 17% : Anadarko Petroleum, 14% : Cobalt International Energy, 7% : Repsol and ConocoPhillips.

For detailed information about the global offshore drilling market size, offshore oil and gas industry statistics, and top offshore drilling companies, take a look at Technavio’s FREE!

The company operates both in deep waters and shallow, using hi-tech drilling fleet including the ultra-deepwater DP drillships Saipem 12000 and Saipem 10000 and the fifth-generation semi-submersible drilling units Scarabeo 7 and Scarabeo 5.

Weatherford International, domiciled in Switzerland and operationally based in Houston is one of the leading offshore drilling companies and suppliers of a wide range of equipment and services for the oil and gas drilling industry, operating in nearly 100 countries. Their drilling business is on its way to becoming a standalone independent drilling contractor. Today, the company operates with a fleet of 115 rigs and 6000+ people. By and large, it is a new breed service company that provides the industry more efficient operations, extended products and services and greater geographic diversity.

Weatherford is listed in the ‘Euronext Vigeo World 120 index’, an exclusive categorization comprising of 120 of the most advanced companies in the European, North American and APAC regions.

Weatherford was pursuing a groundbreaking OneStim JV with Schlumberger that would have elevated the company’s game considerably. However, as of Jan-2018, this JV has been scrapped.

Currently, Weatherford’s shares are trading at an eight year low. However, these shares have massive gain potential, thus, the company is a favorite at the stock markets.

With many successful refurbishments and new building projects, the Aberdeen, Scotland-based Stena Drilling has been a pioneer in many areas of technological innovation and developments in the offshore drilling companies list. The company operates globally with three midwater drilling rigs and four ultra deepwater drillships. Stena Drilling has been successful in obtaining commercial contracts for a majority of its fleet at attractive rates, thereby securing a prime source of cash flow.

In 2018, Stena Drilling secured a highly lucrative contract to work the giant Samo prospect, located off the coast of Gambia, Africa. This offshore project is expected to churn out 825 million barrels of oil annually.

With nearly five decades of experience in offshore drilling operations, China Oilfield Services Limited (COSL),one of the largest offshore drilling companies in China, is a versatile offshore oilfield service solution provider with sought-after integrated functions and bundled service chain in China and other countries worldwide. The company works in the four major business segments including drilling services, marine, transportation services, geophysical services and well services, covering the exploration, production and development phase of the oil and gas industry.

Nabors Industries, is the largest land drilling company in the US and one of the top international land drilling contractors, with a fleet of more than 200 land drilling rigs operating in significant oil, gas, and geothermal drilling markets worldwide. The company is also grabbing substantial market share in offshore drilling services through dozens of its offshore, barge and jack-up rigs as well as a wide range of complementary oilfield engineering, management, and logistics services, making it one of the leading offshore drilling companies in the world.

As a supplier of offshore platform workover and drilling rigs, Nabors is highly commended for its jack-up and platform rigs, both of which are nestled on the bleeding edge of innovation.

The offshore fleet of the Norwegian company Fred. Olsen Energy with subsidiaries consists of five mid-water semi-submersible drilling rigs and two ultra-deepwater units. Three of its semi-submersible drilling rigs are operating on the Norwegian Continental Shelf.

8613371530291

8613371530291