workover rig companies in williston nd price

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

$3000 SIGN ON BONUS. Overtime available - 60-70 hours per week. Exceptionally clean and state of the art shop. Diesel engine repair: 1 year (Required).

The Crew Worker, under the direction of the Rig Operator, performs activities and operates hand and power tools to perform maintenance and repairs to oil or gas…

Looking for experienced Floorhands for Workover Rigs in North Dakota. Full benefits, competitive pay with desirable schedule of TWO WEEKS ON / TWO WEEKS OFF.

*Floor Hands - *minimum experience required 6 months. *Derrick Hands - *minimum experience required 1 year. Job Requirements: *Job requirements include but are…

Manages tools on the workover rig floor and assists in daily maintenance. Picks up/lays down pipe and latches tubing in elevators. This is a full-time position.

Installs / disassembles (rig up/rig down) of wireline and pressure control equipment in accordance with original equipment manufacturer’s standards including…

Communicates with customer and/or the delegated well site representative, rig crew and field support staff. Plans, directs, supervises, and evaluates the work…

Monitor daily rig or rigless well operations. Gas storage wells workover candidate"s evaluation. Design and generate programs for workovers, abandonments, and…

As a rig hand, you will need to safely complete tasks and operations as the onsite supervisor instructs. You will be responsible for all aspects of maintaining…

Crew Member positions include Rig Trainee (no experience required), and Floor hand, Derrick hand, Relief Crew Chief, and Crew Chief, which are experience…

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Provide technical expertise to trouble-shoot major operational problems, such as blow out, rig on fire or serious accident that may occur during the operations.

Deliver and rig up berms for containment; and rig down and return berms to Safety Solutions. Able to rig-up and use a wide range of safety and rescue equipment…

YP - The Real Yellow PagesSM - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. These factors are similar to those you might use to determine which business to select from a local Yellow Pages directory, including proximity to where you are searching, expertise in the specific services or products you need, and comprehensive business information to help evaluate a business"s suitability for you. “Preferred” listings, or those with featured website buttons, indicate YP advertisers who directly provide information about their businesses to help consumers make more informed buying decisions. YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page.

Description: The WorkoverRigCrew Member (Derricks and Floors) works as part of a team to ensure all daily operational activities are performed in accordance with our policies and procedures to ensure the safety of our people and service delivery to our customers. Safety...

12 hours ago...Operate and run frac equipment Pre- and post-trip inspectionsRig-up/down high- and low-pressure blending equipment Operate and... ...OPERATOR REQUIREMENTS: Class A CDL required Experience inoiland gas preferred Must be able to pass a pre-employment drug...

18 days ago...detail in a fast paced environment PREFERRED ~3-5 years related experience ~ General of products to be sold and purchased in theOiland Gas industry ~ Tubular Running Services experience or knowledge ~ Ability to interpret and follow a variety of instructions...

3 days ago...with one of the most diversified portfolios of energy assets in the United States totaling more than 71,000 miles of natural gas, crudeoil,natural gas liquids and refined products pipelines with associated terminalling, storage and fractionation facilities in 38 states....

more than 2 months ago...RigFloor Hand for Drilling Noble Inc. is the premiereoilfield service company that derives from our original company, Noble Casing, Inc. Noble Casing, Inc. was established in Williston, ND in 2009 with the goal to become the premiere casing company in the Bakken...

2 days ago...be performing repair & maintenance of products and tools for theoiland gas industry. The R&M Technician will be working within a supportive... ...loading/unloading when sending/receiving equipment to/from therigsite. Operate overhead cranes and fork lifts. Perform slinging...

1 day ago...be performing repair & maintenance of products and tools for theoiland gas industry. The R&M Technician will be working within a supportive... ...loading/unloading when sending/receiving equipment to/from therigsite. Operate overhead cranes and fork lifts. Perform slinging...

11 hours ago...services in the field Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen understanding... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

19 days ago...Manager, perform a number of tasks associated with the operation,rig-up / down of equipment & tools and related equipment in the shop,... ...Characteristics • Experience in field service repair oroilfield repair • Strong oral and written communication skills •...

21 days ago...service tools in the field Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

2 days ago...policy matters. Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen understanding... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

20 days ago...enable the transition to a lower carbon world. Overview: TheRigMechanic maintains machinery and mechanical equipment such as... ...safety and environmental impact and requirements associated withoiland gas operations · Have knowledge of (EMS) operations and...

8 days ago...concepts and policy matters. Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

18 days ago...service tools in the field Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

26 days ago...products and provision of associated services to customers in theoiland gas industry. The role will include field operations and... ...ChemWatcher to optimize product usage and inventory. Visit workoverrigswhen rods, pumps, and tubing are pulled from the well as needed....

1 day ago...control valves, drilling systems, flow back equipment, and otheroiland gas-related items. Service Techs are required to inspect,... ...certification, Overhead Crane operation, Operate Testing Equipment,Rigging,each of which will be completed in accordance with current...

4 days ago...service tools in the field Must be proficient in calculating basicoilindustry volumes, pressures and forces Have a keen... ...Able to work effectively on pulling units as well as drillingrigsPerform maintenance & repairs on company owned rental equipment...

2 days ago...global energy industry. Job Duties: Under direct supervision,rigsup and rigs down cementing service equipment on work locations to... ...and Essential Preventative Maintenance. Given the nature ofoilfield service work, the ability to communicate effectively with...

17 days ago...Nabors Drilling Solutions provides hardware and software products tooiland gas companies to improve the safety and efficiency of the... ...electrical hardware Manage personal truck inventory and report onriginventory Any other task that relates to operations of...

5 days ago...that specializes in the drilling and production of unconventionaloiland natural gas assets. Our client has a reputation for efficient... .... JOB SCOPE: Will support team covering WorkoverRigs(14), Coil Tubing Units and Frac in the Williston Basin (Williston...

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

No New Competition [See Question 7 on Statistical Review]. All respondents said that competition had not increased QTQ, and they were not anticipating it would, given lower oil prices.Mid-Tier Well Service Manager: “We worry about the small local companies undercutting prices but we are not seeing anything now.”

2015 Rates Under Pressure [See Question 8 on Statistical Review]. Five of the eight respondents said 2015 would see further reductions in demand and hourly rates and even labor rates if the price of oil did not rise. One respondent said that “iron would start laying down” if oil prices did not rise. One respondent said he expects that work demand would come back up after a couple of months as everyone adjusted.Manager for Mid-Tier Well Service Company: “As a company, we have backed off our growth budget for 2015 and our capex has been nixed. We implemented a 10% reduction in our rates. We are just going to lower rates not wages, because we can buy equipment and leave it sit, but if you do that with people, they starve.”

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Western well service is a locally owned company and family orient! We are hiring all positions from tool pushers , operators , R/O , Derrick Hands , floor hands , and trainees. HR rate depends on experience. Willing too lift heavy equipment and work long HRS. If interested please contact

Most analysts don’t think high oil prices will spark a surge in drilling new wells in North Dakota and Montana’s Bakken, though rig counts are up a little bit in each state. That’s due to logistics with natural gas takeaway, along with the view by most of the Bakken’s top producers that this is a mature play, with about 10 years of inventory left.

Higher oil prices, however, have been prompting some companies to restart marginal wells that had been uneconomical at past prices in Montana at least.

Montana Petroleum Association President Alan Olson told the Williston and Sidney Herald that most of the wells in question are conventional oil wells located in central Montana. These are not Bakken wells, and they are not horizontally drilled. These are conventional oil wells.

“I mean we only produce like 1,500 barrels a day in central Montana, right?” He said. “And you know less than 2,000 barrels a day in north central Montana. So, I mean, one of our refineries in Montana, in Yellowstone County, refined about 60,000 barrels a day. Ninety-eight percent of that is Canadian crude.”

There also are no pipelines running to the west, due to mountainous terrain in the way, so any oil headed west from the Bakken gets shipped out on rail cars, which adds a bit to the cost of sending our oil production barrels that way.

Lack of workers and supply chain logistics remain challenges in both Montana and North Dakota, Olson added, and are likely to hold things back when it comes to restarting marginal wells, as well as drilling new ones.

“One of the things we’re facing here is, we can’t get work over rigs, because there aren’t any crews,” Olson said. “And trying to get capital to work with, I mean, with the comments coming out of the Biden administration it’s hard to get capital.”

Montana has two rigs going right now, according to Olson. During the pandemic, there were no rigs at all on the Montana side of the Bakken. Kraken oil started a rig up as prices finally began to rise and for a long time had the state’s only rig.

The latest activity report from the Montana Board of Oil and Gas lists CWT Operating with two wells it is drilling in Roosevelt County and Lustre Oil Company with one well it is drilling in Valley.

A spokesman with the Montana Board of Oil and Gas said the rigs right now are being operated by Forza in Toole County and Kraken in Richland and Roosevelt counties.

North Dakota’s trend with marginal wells, however, is unclear. Oil and Gas Division spokeswoman Katie Haarsager told the Williston Herald the state is seeing increased workover rig activity, which would be associated with returning marginal wells to production, but the state isn’t tracking such wells and doesn’t require reports on such wells.

“We will know more May/June, as that will show us production for March/April, and we can see which wells officially produced for the month,” she said.

Job Service North Dakota announced six oil companies are looking for workers to man fracking crews in the new year, said Cindy Sanford, customer service office manager of Job Service"s Williston branch. She said she couldn"t reveal the names of the companies due to confidentiality clauses, but she said the companies are looking to hire 45 to 65 workers per crew. On the low end, that could bring 300 hires to the Bakken, she said.

"It"s getting busier in our offices, as far as not only with job seekers but also the companies," said Phil Davis, the agency"s western area director. "We are seeing more of the service rigs - not so much the drilling rigs - but our service rigs and workover rigs, jobs are coming back there, which is a great thing."

Oil companies announced in October they would post positions for workers in the Bakken as oil prices climbed to an 18-month high in December. Oil on the New York Mercantile rang out Thursday at $53.83, almost a 50 percent increase over last year. That"s down from an all-time high of $136.29, which was set July 3, 2008, but almost double the 10-year low - barrels of oil went for less than $27 in early 2016.

After peaking in June 2014, oil prices started to fall off, causing oil companies to lay off workers and take rigs offline. As of Thursday, North Dakota"s rig count was 39. That"s down from its all-time high of 218 in May 2012, but the count has been on a slight increase over the past several months.

The recent job postings in western North Dakota mostly are for service or workover rigs, which are used to complete a well and install the pump after drilling is done.

November"s increase from October for all job openings for Stark County, where oil jobs once were abundant before the bust, was 140, while Williams County, the heart of fracking, saw a 50-job increase.

The December numbers are expected to come out Wednesday, Davis said. He added companies are looking for workers who have more skills than the crews hired when the oil boom began in the early 2010s, which saw a lot of "greenhorns" come to North Dakota, he said.

Davis couldn"t say whether the job openings meant the oil industry could turn around since it went bust in recent years, but he did say it was exciting to see the jobs come back.

VWCT is an industry leader in the well control business with over 200 years combined experience providing well intervention training to oil and gas workers.

The International Association of Drilling Contractors (IADC) will remain the accrediting agency that provides certification to students who complete any well control classes.

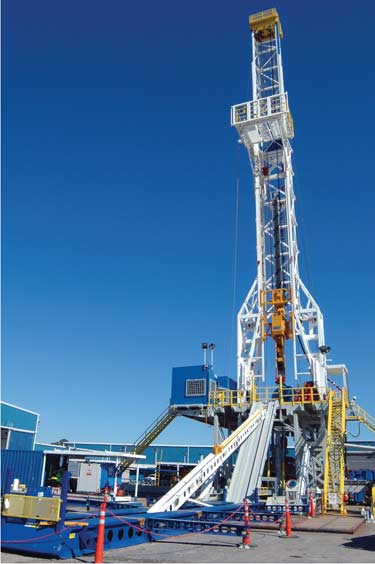

TrainND Northwest offers a realistic training experience using a full-size drilling, production & workover simulator with advanced 3-dimensional graphics.

Addresses practical well control skills, with a focus on detecting a kick and shutting in the well, for assistant drillers and drillers. Designed to meet industry guidelines, this course addresses well control principles and theories of well control and presents a variety of well control methods. (2-year certification)

Designed to meet industry guidelines, this course addresses more advanced principles and theories of well control and presents a variety of well control methods. Designed for toolpushers, superintendents, drilling foremen, and company men and focused on well kill procedures. (2-year certification)

This course curriculum is designed for service company equipment operators primarily responsible in coiled tubing operational processes of well control. The curriculum identifies a body of knowledge and a set of job skills that can be used to provide well control training for coiled tubing operations personnel. Here are some applicable coiled tubing company positions or job responsibilities: Supervisor, Engineer, Coiled Tubing Operator. (2-year certification)

Designed for service company equipment operators who are primarily responsible for the workover operational processes of well control. (2-year certification)

This IADC WellSharp™ course curriculum is designed for Oil and Gas Operator Representatives who are primarily responsible for the oversight of coiled tubing, snubbing, wireline, and workover operational processes of well control. This curriculum identifies a body of knowledge and a set of job skills that can be used to provide well control training for Oil and Gas Operator Representative. IADC recommends that well site supervisory and office-based personnel who are primarily involved in the operational decision-making process for well control and/or involved in design of well barriers attend this course.Price: $1450 pp

Designed to meet industry guidelines, this course addresses more advanced principles and theories of well control and presents a variety of well control methods. It identifies a body of knowledge and a set of job skills necessary to meet IADC WellSharp™ learning objectives. For well site supervisory and office-based personnel who are primarily involved in the decision-making process for well control and/or involved in the design of well barriers. It identifies a body of knowledge and a set of job skills that can be used to provide surface stack well control knowledge and skills development for drilling and workover operations.

Include in the email the course you intend to take and the date, your full name, company (or self/consultant), and how you intend to pay. If a company wishes to be invoiced, please include the company contact person for billing.

*This training is facilitated by Vorenkamp Well Control Training in partnership with TrainND Northwest, registrations and payments will be collected by Vorenkamp Well Control.

Contact Us Contact Us (701) 385-4060 sales@americanwellinc.com North Dakota 50101 Highway 52 North Kenmare, ND 58746 P.O. Box 124, Kenmare, ND 58746 9:00am - 5:00pm ( Mon - Fri ) Sat, Sun & Holidays CLOSED Drill Out Drilling Out is a reverse process in petroleum engineering that is used to enter a b...

Incremental activity gains in the Williston Basin helped nudge the U.S. rig count two units higher to 695 for the week ended Friday (April 22), updated numbers from oilfield services provider Baker Hughes Co. (BKR) show.

One oil-directed rig and one natural gas-directed rig were added overall in the United States for the week. Two rigs were added on land, along with one offshore (not in Gulf of Mexico), while one rig exited from inland waters for the period, according to the BKR numbers, which are partly based on data from Enverus.

Total domestic horizontal rigs increased by three for the week, partially offset by a one-rig decline in directional drilling. The 695 active U.S. rigs as of Friday compares with 438 rigs running in the year-earlier period.

The Canadian rig count eased two units lower to 101 as of Friday, up from 55 in the year-earlier period. Changes included declines of one oil-directed rig and one natural gas-directed unit.

Broken down by major drilling region, the Williston led with an increase of two rigs week/week, raising its count to 36, versus 15 a year ago. The Ardmore Woodford, Cana Woodford and Eagle Ford Shale added one rig each, the BKR data show.

Counting by state, North Dakota added two rigs week/week, mirroring the change in the Williston, while Alaska added one rig overall. Wyoming saw a one-rig decline for the period, according to BKR.

Upstream oil and gas employment in Texas gained 4,300 jobs in March, which brought the statewide headcount to 184,700, according to arecent report from the Texas Independent Producers and Royalty Owners (TIPRO).

The trade group noted the sharp jump in Permian Basin drilling permits issued in February. Exploration and production (E&P) companies also have begun to respond to “higher commodity prices and the call to increase domestic production to address global supply shortages.”

TIPRO, which uses data from the U.S. Bureau of Labor Statistics Current Employment Statistics report, added that the state upstream headcount was up 21,700 jobs year/year. The annual increase included 18,100 more oilfield services and 3,600 more E&P-related jobs, the organization said.

The Williston City Commission has awarded up to $167,000 in STAR Fund incentives for four business expansions at its meeting on Tuesday, January 26, 2021. The projects included Baja Auto Sales, Circle T Transport and Construction, Prizm Company and Pronghorn Well Service, LLC.

All of the projects utilized the Williston STAR Fund/Bank of North Dakota Flex PACE Program to purchase property for their developments. The Flex PACE may be used to purchase real property and equipment or cover selected capital needs. The Flex PACE combines funds from the PACE Fund and Williston STAR Fund at a 2:1 ratio to buy down the interest rate on businesses’ loan.

Tricia Anderson, Pronghorn Well Service co-owner, said the funds will help them purchase a building and land for equipment storage and maintenance. Pronghorn provides workover rig and oilfield services.

“Having a shop will provide our company a central location to hire new employees, hold safety meetings and training and repair equipment,” said Anderson. “Our hands-on work is out in the oilfield, but we are super excited for the growth potential this grants us.

Keith Olson, Director of the Small Business Development Center in Williston, worked with the owners of all four projects. He said it’s nice to see the Flex PACE program help the local business base grow and expand.

“Most have been working on finding the right space and we have worked with them over the past few years waiting for the right opportunity to buy,” explained Olson. “Flex really helps make it happen when they finally find the purchase that works for them. It is great to see such diverse projects early in the year and from a wide variety of industries.”

“Survival during the pandemic has been challenging,” Anderson admitted. “With a lot of prayer, we have made it through. We are thankful every day for our continued opportunities.”

Baja Auto Sales -up to $32,000 from the Flex PACE Interest Buydown program to purchase the lot at 1014 2nd Street West. Baja is going to relocate its used car lot and detail business to the new, larger location.

Circle T Transport and Construction–up to $42,000 from the Flex PACE Interest Buydown program to purchase a larger shop at 5825 Hamilton Lane. Circle T is a family-owned business that offers a variety of hauling services plus snow removal and mowing.

Prizm Company – The dance school is purchasing property to diversify and grow its business. Prizm received up to $41,000 from the Flex PACE Interest Buydown program to purchase property at 5003 2nd Avenue West. The new location will house a daycare in the residence and a dance studio in the pole barn.

Pronghorn Well Service, LLC – the company has workover rigs and winch trucks to haul oilfield equipment. Pronghorn is purchasing a shop and property at 4914 21st Avenue Northwest for equipment storage and maintenance. They will receive up to $52,000 from the Flex PACE Interest Buydown program to purchase the building.

The North Dakota oil boom refers to the period of rapidly expanding oil extraction from the Bakken Formation in the state of North Dakota that lasted from the discovery of Parshall Oil Field in 2006, and peaked in 2012,Great Recession, the oil boom resulted in enough jobs to provide North Dakota with the lowest unemployment rate in the United States from 2008 to at least 2014.gross domestic product (GDP) in 2001, rose steadily with the Bakken boom, and had a per capita GDP 29% above the national average by 2013.

By October 2020, total oil rig count in the state had fallen dramatically. According to the North Dakota Department of Mineral Resources, the total oil rig count in the state had fallen from 58 active rigs on October 3, 2019, to only 11 active rigs on October 3, 2020, a reduction of over 80 percent.

By 2012, income from oil royalties was reportedly paying many local mineral owners $50,000 to $60,000 per month, and some more than $100,000 per month. Bruce Gjovig, head of the UND Center for Innovation Foundation in Grand Forks, estimated that the boom was creating 2,000 millionaires per year in North Dakota. By 2010, the average income in Mountrail County more than doubled to $52,027, putting the county into the top 100 richest counties in the United States.

The Bakken boom propelled North Dakota into the top ranks of oil-producing states. By 2007, North Dakota ranked 8th among the states in oil production. In 2008, the state overtook Wyoming and New Mexico; in 2009 it outproduced Louisiana and Oklahoma; and in 2011 and 2012 it surpassed California and Alaska respectively. By 2012, North Dakota was exceeded only by Texas in oil production.

In addition to severance taxes, the state of North Dakota owns extensive mineral rights, which are leased by competitive bidding. In fiscal year 2010, the State Land Department reported that mineral income on its land earned $265 million for the North Dakota school trust fund, and that the trust fund had grown to $1.3 billion.

The federal government is also a major owner of mineral rights in the region, and leases the rights to companies in competitive bidding. In a January 2013 federal lease sale, the top bid was $19,500 per acre for a lease on one tract in North Dakota. Of the lease sale and royalties from the federal tracts, the federal government keeps 52 percent, and passes 48 percent on to the state of North Dakota.

The industrialization and population boom put a strain on roads, water supplies, sewage systems, and government services in the area. Some counties increased in population by almost double from 20,000 to 40,000.

The boom also brought with it increases in crime and social problems.man camps for housing them. Law enforcement agencies reported sharp increases in offenses, particularly violent crime,missing and murdered Indigenous women crisis.

The boom brought dramatic increases in the infrastructure of Western North Dakota. The oil boom"s effect on families is the subject of the Academy Award-nominated documentary short film,

The oil boom in North Dakota experienced a brief decline in 2014 after the Saudi Arabian oil industry increased its output and the price of crude oil fell from $108 to $40.

By October 2020, total oil rig count in North Dakota had fallen. According to the North Dakota Department of Mineral Resources, the total oil rig count in the state had fallen from 58 active rigs on October 3, 2019, to only 11 active rigs on October 3, 2020, a reduction of over 80 percent.

Sankararaman, Darshana; Medhora, Narottam (29 January 2015). "UPDATE 2-Helmerich & Payne may cut 2,000 jobs as it idles rigs". Reuters. Archived from the original on 14 February 2015. Retrieved 3 October 2020.

Gebrekidan, Selam (8 March 2012). "Shale boom turns North Dakota into No. 2 oil producer". Reuters. Archived from the original on 21 September 2013. Retrieved 17 April 2012.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

8613371530291

8613371530291