workover rig companies in williston nd pricelist

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

$3000 SIGN ON BONUS. Overtime available - 60-70 hours per week. Exceptionally clean and state of the art shop. Diesel engine repair: 1 year (Required).

The Crew Worker, under the direction of the Rig Operator, performs activities and operates hand and power tools to perform maintenance and repairs to oil or gas…

Looking for experienced Floorhands for Workover Rigs in North Dakota. Full benefits, competitive pay with desirable schedule of TWO WEEKS ON / TWO WEEKS OFF.

*Floor Hands - *minimum experience required 6 months. *Derrick Hands - *minimum experience required 1 year. Job Requirements: *Job requirements include but are…

Manages tools on the workover rig floor and assists in daily maintenance. Picks up/lays down pipe and latches tubing in elevators. This is a full-time position.

Installs / disassembles (rig up/rig down) of wireline and pressure control equipment in accordance with original equipment manufacturer’s standards including…

Communicates with customer and/or the delegated well site representative, rig crew and field support staff. Plans, directs, supervises, and evaluates the work…

Monitor daily rig or rigless well operations. Gas storage wells workover candidate"s evaluation. Design and generate programs for workovers, abandonments, and…

As a rig hand, you will need to safely complete tasks and operations as the onsite supervisor instructs. You will be responsible for all aspects of maintaining…

Crew Member positions include Rig Trainee (no experience required), and Floor hand, Derrick hand, Relief Crew Chief, and Crew Chief, which are experience…

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Provide technical expertise to trouble-shoot major operational problems, such as blow out, rig on fire or serious accident that may occur during the operations.

Deliver and rig up berms for containment; and rig down and return berms to Safety Solutions. Able to rig-up and use a wide range of safety and rescue equipment…

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

No New Competition [See Question 7 on Statistical Review]. All respondents said that competition had not increased QTQ, and they were not anticipating it would, given lower oil prices.Mid-Tier Well Service Manager: “We worry about the small local companies undercutting prices but we are not seeing anything now.”

2015 Rates Under Pressure [See Question 8 on Statistical Review]. Five of the eight respondents said 2015 would see further reductions in demand and hourly rates and even labor rates if the price of oil did not rise. One respondent said that “iron would start laying down” if oil prices did not rise. One respondent said he expects that work demand would come back up after a couple of months as everyone adjusted.Manager for Mid-Tier Well Service Company: “As a company, we have backed off our growth budget for 2015 and our capex has been nixed. We implemented a 10% reduction in our rates. We are just going to lower rates not wages, because we can buy equipment and leave it sit, but if you do that with people, they starve.”

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Every workover rig available is going right now in the Bakken, North Dakota’s top oil and gas regulator Lynn Helms said on Friday, during his monthly oil production report, as companies try to get wells online as quickly as possible after back-to-back blizzards idled a substantial number of four and five-well pads in Williams, Divide, and McKenzie counties.

March was a good month for production, Helms said, with a 2.8 percent increase in crude oil production from 1.089 million barrels per day to 1.12 million barrels per day. That figure is 2 percent above revenue forecast. Gas production, meanwhile, rose 4.5 percent to 3.01 billion cubic feet per day from 2.87 billion cubic feet per day in February.

Gas capture percentages were 95 percent, and this time Fort Berthold was a bright spot, with 97 percent capture. Helms said he expects continued improvement in the Fort Berthold area, with new solutions for gas capture in the works for the Twin Buttes area, which has been a problem spot.

But production is not going to look as rosy in April, Helms said, and may not look great in May either, given the time it will take to repair electrical distribution infrastructure. Load limits remain in place because of wet conditions, and that is a condition that might go on for a while, given the recent flooding issues caused by rain.

“We saw production in the first blizzard dropped from about 1.1 million barrels a day to 750,000 a day,” Helms said. “We recovered not quite back to a million barrels a day. And then the second blizzard came in. It was heavily impactful on electrical power and infrastructure in the Bakken oil fields.”

“It took a week, or I guess within a little bit less than a week, we recovered to 700,000 and it’s taken another week, we think we’re back at about a million barrels a day.”

One of the biggest of problems was that so many natural gas processing plants were knocked out of service, some for nine hours and others for well over a week.

“Just this past week, our largest gas plant came on and that’s really enabled a lot of production to come back on,” Helms said. “So we’re back to a million barrels a day, maybe a little more. You know all of the large operators reported enormous production losses. And of course that has led to the deployment of every workover rig available being out there trying to get wells back on production.”

Last weekend in Williams County, a dozen four and five-well pads along Highway 2, headed toward Ray, remained idle. They appeared to be without electricity, with some poles still clearly broken and lines laying down on the ground.

In his discussions with drilling contractors, Helms has learned that most drilling rigs went south to Texas and New Mexico, both of which escape winter sooner than the Bakken. Those areas hired the available workforce, too, which has added to the Bakken’s difficulty in attracting workforce.

“It’s taking around two months to train and deploy a drilling rig and crew, and very similar timeframes for frack crews,” Helms said. “So it’s just very, very slowly coming back.”

“There have not been any new frack fleets constructed since before the pandemic,” Helms said. “So the iron that’s out there is starting to show some wear and tear, some age, and, at some point, we’re going to have to see capital deployed to bring that iron back on.”

“I was reading an article today, and some of the large operators were saying, ‘Well you know we could bid up the price to hire frack crews, but all we would be doing is hiring them away from smaller companies that can’t afford to pay as much.’ So there wouldn’t be a gain in the number operating, in the number of wells completed, or really a more rapid rise in production. So it’s very much workforce limited.”

North Dakota rig counts are at 40 right now and Montana rigs are at 2, according to figures from North Dakota Pipeline Authority Justin Kringstad. Helms said the Bakken hasn’t seen those numbers since March of 2020. There are about 15 frack crews running now, a number last seen in April 2020.

Prices, however, have been well ahead of revenue forecasts, pushed in part by sanctions against Russia, which attempt to choke a major source of financial capital for the invasion of Ukraine, as well as continued supply chain issues and lower than expected production from OPEC.

“Today’s price is almost $102 a barrel for North Dakota light sweet and $106 West Texas,” Helms said. “So we’re estimating about $104 a barrel for North Dakota crude prices. That’s more than double revenue forecast. Revenue forecast was based on $50 oil, so that’s 108 percent above that.”

“And of course the market did not like the signal that it got this week or late last week of the cancellation of the offshore lease sales in the Alaskan lease sales,” Helms said.

“For example, the RMPs, or the resource management programs, and the records of decision from Corps of Engineers and Forest Service weren’t filed along with information about why various quarterly lease sales were canceled,” Helms said. “And why some of the tracts were chosen that were chosen to be in this latest lease sale.”

North Dakota is a few days away from a May 18 deadline for protests in the projected June sale, which has 15 parcels listed. If there’s a protest against one or more of the tracts, they could be pulled from the sale for further consideration.

Rig Operator Well Name & Number Current Location County File No API Start Date Next Location fullCounty twp rng sec qq lat lng geometry

Rig Operator Well Name & Number Current Location County File No API Start Date Next Location fullCounty twp rng sec qq lat lng geometry

DISCLAIMER AND TERMS OF USE: HISTORICAL DATA IS PROVIDED “AS IS” AND SOLELY FOR INFORMATIONAL PURPOSES – NOT FOR TRADING PURPOSES OR ADVICE. NORTHDAKOTARIGSMAP.COM WILL NOT BE LIABLE FOR ANY DAMAGES RELATING TO YOUR USE OF THE DATA PROVIDED.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BXI5H6BWUBBTVB7UPFGND4GIZI.jpg)

When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

YP - The Real Yellow PagesSM - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. These factors are similar to those you might use to determine which business to select from a local Yellow Pages directory, including proximity to where you are searching, expertise in the specific services or products you need, and comprehensive business information to help evaluate a business"s suitability for you. “Preferred” listings, or those with featured website buttons, indicate YP advertisers who directly provide information about their businesses to help consumers make more informed buying decisions. YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page.

Incremental activity gains in the Williston Basin helped nudge the U.S. rig count two units higher to 695 for the week ended Friday (April 22), updated numbers from oilfield services provider Baker Hughes Co. (BKR) show.

One oil-directed rig and one natural gas-directed rig were added overall in the United States for the week. Two rigs were added on land, along with one offshore (not in Gulf of Mexico), while one rig exited from inland waters for the period, according to the BKR numbers, which are partly based on data from Enverus.

Total domestic horizontal rigs increased by three for the week, partially offset by a one-rig decline in directional drilling. The 695 active U.S. rigs as of Friday compares with 438 rigs running in the year-earlier period.

The Canadian rig count eased two units lower to 101 as of Friday, up from 55 in the year-earlier period. Changes included declines of one oil-directed rig and one natural gas-directed unit.

Broken down by major drilling region, the Williston led with an increase of two rigs week/week, raising its count to 36, versus 15 a year ago. The Ardmore Woodford, Cana Woodford and Eagle Ford Shale added one rig each, the BKR data show.

Counting by state, North Dakota added two rigs week/week, mirroring the change in the Williston, while Alaska added one rig overall. Wyoming saw a one-rig decline for the period, according to BKR.

Upstream oil and gas employment in Texas gained 4,300 jobs in March, which brought the statewide headcount to 184,700, according to arecent report from the Texas Independent Producers and Royalty Owners (TIPRO).

The trade group noted the sharp jump in Permian Basin drilling permits issued in February. Exploration and production (E&P) companies also have begun to respond to “higher commodity prices and the call to increase domestic production to address global supply shortages.”

TIPRO, which uses data from the U.S. Bureau of Labor Statistics Current Employment Statistics report, added that the state upstream headcount was up 21,700 jobs year/year. The annual increase included 18,100 more oilfield services and 3,600 more E&P-related jobs, the organization said.

Under direct supervision, responsibilities are to learn the job role for the Directional Drilling (DD) service line and the processes, tools, software and equipment used in DD to develop the proficiencies ...

and decisive manner Working above the drilling floor, on the monkey board, guiding the drill pipe during the tripping-in/tripping-out process, ensuring to wear proper safety equipment. Other ...

and decisivemanner Otherduties as required by the Rig Manager Minimum Qualifications: Ability to perform essential functions of this position with or without reasonable accommodations. Previous ...

as required by the Driller, Derrickhand or Rig Manager Minimum Qualifications: Ability to perform essential functions of this position with or without reasonable accommodations Ability to ...

as required by the Driller, Derrickhand or Rig Manager Minimum Qualifications: Ability to perform essential functions of this position with or without reasonable accommodations Ability to ...

Under general supervision, provides on-site supervision of the Measurement-While-Drilling (MWD) process, including tool preparations, data acquisition, log generation and Quality Control (QC) and delivery ...

Under strict supervision, provides on-site supervision of the Measurement-While-Drilling (MWD) process, including tool preparations, data acquisition, log generation and Quality Control (QC) and delivery ...

The first responsibility is to warmly welcome customers to BDS and model our professional, service-oriented business culture while providing them with the highest quality of service, and product knowledge ...

Under broad direction, uses operational business knowledge to make tactical/operational decisions and coordinate the movement of equipment, materials, and personnel within a Natural Work Area (NWA) in ...

Under direct supervision, rigs-up and rigs-down of service equipment, learns to complete documents, reports, and forms in support of the service performed, and may conduct training in the operation of ...

Petroleum Experience believes in safety first. We"ve put all necessary policies in place to ensure we"re doing everything we can to protect people, the environment, and property. All consultants have completed training including Well Control, OSHA 10-Hour or a Safeland accredited course, and a H2S course. Petroleum Experience is also a member of ISNet, PEC, and Avetta. We also enroll all our employees in our random drug and alcohol testing program.

CountryUnited StatesCanadaAbkhaziaAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBaker IslandBangladeshBarbadosBelarusBelgiumBelizeBeninBermudaBhutanBoliviaBosnia and HerzegovinaBotswanaBrazilBritish Virgin IslandsBruneiBulgariaBurkina FasoBurundiCambodiaCameroonCape VerdeCayman IslandsCentral African RepublicChadChileChinaClipperton IslandColombiaComorosCongoCook IslandsCosta RicaCroatiaCubaCyprusCzech RepublicDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland IslandsFaroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHondurasHong KongHowland IslandHungaryIcelandIndiaIndonesiaIranIraqIrelandIsle of ManIsraelItalyIvory CoastJamaicaJapanJarvis IslandJerseyJohnston AtollJordanKazakhstanKenyaKingman ReefKiribatiKosovoKuwaitKyrgyzstanLaosLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacauMacedoniaMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesiaMidway AtollMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNagorno-KarabakhNamibiaNauruNavassa IslandNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorth KoreaNorthern CyprusNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian territoriesPalmyra AtollPanamaPapua New GuineaParaguayPeruPhilippinesPitcairn IslandsPolandPortugalPuerto RicoQatarReunionRomaniaRussiaRwandaSaint BarthélemySaint HelenaSaint Kitts and NevisSaint LuciaSaint MartinSaint Pierre and MiquelonSaint Vincent and the GrenadinesSamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSlovakiaSloveniaSolomon IslandsSomaliaSomalilandSouth AfricaSouth KoreaSouth OssetiaSpainSri LankaSudanSurinameSvalbardSwazilandSwedenSwitzerlandSyriaTaiwanTajikistanTanzaniaThailandTimor-LesteTogoTokelauTongaTransnistriaTrinidad and TobagoTunisiaTurkeyTurkmenistanTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States Minor Outlying IslandsUnited States Virgin IslandsUruguayUzbekistanVanuatuVatican CityVenezuelaVietnamVirgin IslandsWake IslandWallis and FutunaWestern SaharaYemenZambiaZimbabwe

Oil prices have been sinking for months. And while that"s good news for most Americans, what happens to towns like Williston, N.D., that have built an entire economy around the oil industry?

"They said things aren"t good, that oil prices are low, and they aren"t going to be drilling as many wells," said John Roberts, who was recently laid off as a crew van driver for Schlumberger. "They gave me 24 hours to leave my house."

Roberts is the first of what many fear will be waves of layoffs in the U.S. oil patch as firms respond to the recent and largely unexpected plunge in crude prices.

Arthaud, a North Dakota native who"s been active in the state"s oil industry since the late 1970s, said he isn"t particularly concerned for his company, which employees some 2,000 people repairing oil field equipment, increasing the oil flow at wells, and trucking oil out of the fields to nearby rail hubs.

He"s been through this several times before, and instead of laying people off, he plans on using the downturn to hire employees away from other firms that aren"t as prepared to deal with it.

But the effects of less drilling are likely to hit the entire area hard. As drilling companies cut back, there will eventually be less work for companies that provide ancillary services like fracking or trucking.

That"s a big number for an area with a relatively small population. It could also be scary for a region that"s been growing so rapidly over the last few years, and building infrastructure to handle the boom.

In neighboring Watford City, Mayor Brent Sanford used a personal example to illustrate the growth: When his daughter was born in 2000, there were three other babies born in the county that year. Now there are 90 kids in her class.

"I hear about people getting laid off, but there are still so many people everywhere," said Josslyn Dodds, owner of a local pharmacy. "There are so many people who have made this place their home."

Mayor Howard Klug said the city is looking at refining, tourism or returning to its agricultural roots if the oil boom dries up. But he doesn"t see that happening.

Cache Trucking, established in 2004 in Cache Valley Utah by Pete and John Isom, began with a primary focus on transportation services. Service areas covered northern and southern Utah, western Wyoming, and northern Nevada. Primary operations included rock supply and road construction.

In 2009 Cache Trucking added oil-field operation services and oversight for liquid gathering projects in western Wyoming. Oil-production services grew steadily to include oil-production equipment, transport, hydrovac operations, and crane work.

In 2012 Cache Trucking moved its headquarters to Williston, North Dakota. Andrew and Jacob Isom joined as partners, and well-services became the primary focus. Operations in Williston started with 10 employees. From 2012 to present, Cache Trucking has operated and supported essentially every aspect of oil-well completion and production services. During that time, company operations developed two major divisions: Workover Rig Well Service (well completion as well as production) and Swab Rig Well Service. Company services also include roustabout, rental equipment, and consultation services.

Ownership’s strategy since inception has been to provide predictable high-quality services, grow with minimal debt using strategic asset acquisitions, adapt with change, learn all aspects of the industry being served, and never say “I Can’t”.

In 2015 oil prices dropped from $100/barrel to as low as $26/barrel. Cache Trucking’s focus on efficiency, diversity, and minimal debt allowed the company to weather the downturn and emerge equipped for growth.

From 2015 to the present, prudence, efficiency, and experienced employees have spurred continued growth for Cache Trucking LLC. Currently Cache Trucking operates five workover rigs, four swab rigs, a 5-truck fleet focused on rig moves. In addition, Cache Trucking boasts rental services, a robust safety program, and employs 70 personnel. Our divisions focus on providing the best well-service in the Williston Basin.

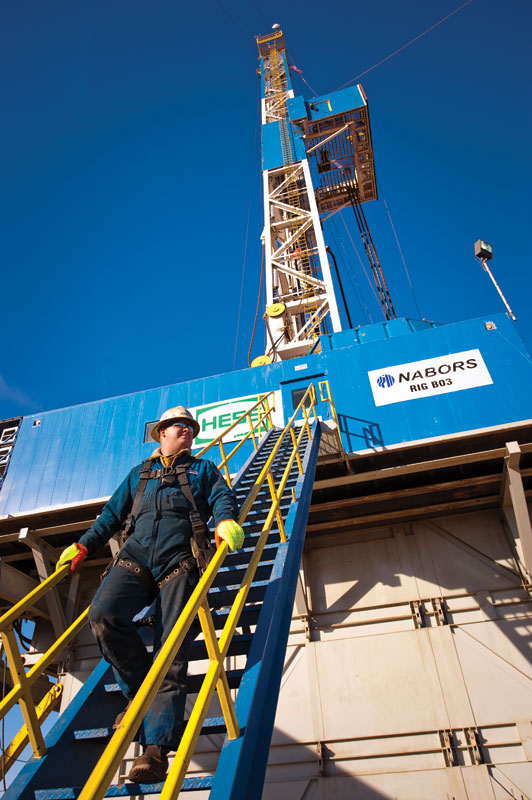

Sun Well Service has become the premier workover rig provider in the Williston Basin by helping our customers exceed their drilling and production goals by operating more efficiently and effectively. With over 27 years of experience, we have earned a reputation of providing top quality equipment and personnel and a commitment to safety, ongoing training, and proven processes.Twenty-seven years ago, Sun Well Service was started based on a commitment to high quality personnel and the latest and most innovative equipment and processes. We vowed to provide the highest level of customer service and to prioritize worker safety.Sun Well Service started with three rigs and has grown to operate fourteen rigs as of September 2010. As the company continues to outperform the market, it is clear Sun Well Service will continue to grow and expand. During our 29 years of service we have grown to 14 rigs. The future will be no different. Our strategic planning process has resulted in the decision to significantly grow capacity, with 3 more workover rigs coming in the 3rd quarter 2008, along with 4 new mud pumps, 3 new power swivels and 3 5000 lb BOP"s. We are confident that Sun Well Service will outperform the market due to our ongoing commitment to and investment in personnel and equipment.

Sun Well Service proudly serve the highly successful booming oil and gas market of the Williston Basin. Reports indicate that the Bakken Play alone could produce an additional 300 billion barrels of oil and billions of cubic feet of gas reserves. The Three Forks formation promise more production as well. Due to new technology and expertise, numerous companies are reporting 100 percent success on their Williston Basin wells. Sun Well Service and its employees are proud to be a part of this highly successful market. Regional experts have commented that “Sun Well has an excellent reputation for quality work, well-trained staff and quality assets. They have captured significant local market share and have been able to overcome the competition.”Illustrating innovation, Sun Well Service received national recognition for plugging a well in the middle of Lake Sakakawea for the federal government. Sun Well Service has a long and storied history performing special plugging and abandonment services.Sun Well Service maintains a variety of equipment in its inventory to meet your well servicing and workover requirements including equipment rental. Browse our inventory of equipment and configuration details to find the equipment you need to get the job done.Rigs

Blackmetal Fab LLC is a locally owned and operated business in the heart of Oil Country. Preston Bolstad moved to the Williston North Dakota area in 2006 from Montana, where he was born and raised. He began working as a welder/mechanic for a workover rig company. In 2011 Preston established Blackmetal Fab to primarily service Well Maintenance Companies and has since expanded to serve industrial, commercial and residential customers with in the surrounding areas.

With over 15 years of experience, we make every effort to provide the highest level of customer service and will take the time to ensure you receive exactly what you are asking for. We pride ourselves on primarily using local supplies for materials used, while still providing quality work for fair prices. Williston is a blue collar, hardworking town and we strive to provide quality tools and service that stand up to and share the hard working spirit the locals hold. Even with the frigid, brutal winter season, the work never stops and neither do we. We know how tough it gets out in the oilfield first hand, and we have engineered our products to work just as hard. Check out our shop today to see what we offer and what we can do for you.

8613371530291

8613371530291