workover rig cost per day in stock

Workovers are the most common expenditure operators need on their oilfields. However, finding a service provider and getting their rates are not readily available in the industry. Operators would benefit from knowing the market average for a workover and gain reassurance they are getting a fair price for their services. This research is based on finding workover rigs for Zapata, Texas. The graph represents four service provider companies and their hourly rate for a workover rig.

It is important to note that due to slower oil development in recent years from the downturn in 2015 to the pandemic and downturn in 2020, smaller workover rig companies in Zapata, Texas have increasingly moved to the Permian Basin or have been acquired by larger service companies in the area. This has caused the workover rig service industry to be dominated by a few major servicers around Zapata. For Zapata, the ideal areas to look for servicers or workover rigs are Alice, Laredo, and Freer in Texas.

Hourly rates for workover rigs vary and there are always competitors for services, especially for services as common as a workover rig. The market average price for a service provider is intended to provide the oil and gas operator better insight on the cost of services around their area.

An operator who wanted bids on a workover for his well requested this vendor list and decided to get connected with Company B to get the work done. He said it was a quick decision because what he was already paying for and what he was going to pay for cost more than the rates on this list.

In order to help oil and gas operators reduce operational expenditure, Petrofly researches the servicing market to provide the most economical options for your oilfield service needs. Petrofly’s platform is the complete upstream solution and leveraging the market average is one of the unique tools operators utilize to ensure lower operational costs.

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Well work and well servicing is a complicated subject and there are a lot of moving parts. It is potentially so complex that many oil and gas companies seek to avoid it altogether when they can. A thorough understanding of the rank order of the options available, and what they can do is the key to being able to unlock tremendous value. A few ‘simple’ or fortunate’ or ‘clever’ oil and gas operations can be set up where operations are simple – drill a well, complete it, produce it to abandonment pressure and conduct abandonment. For every other situation well servicing is the key to profitable operations. This is a very general way to look at the cost of well servicing, and how it affects operations in the field. The exact details will vary from country to country, field to field, region to region and company to company.

The following general group of services are available for well work. They are listed roughly in order of cheapest to most expensive for land operations.

In shallow waters with fixed platforms or other facilities with direct well access the chain of costs and values are slightly different - the overall costs are generally higher, but the general ‘ladder of values; is different also.

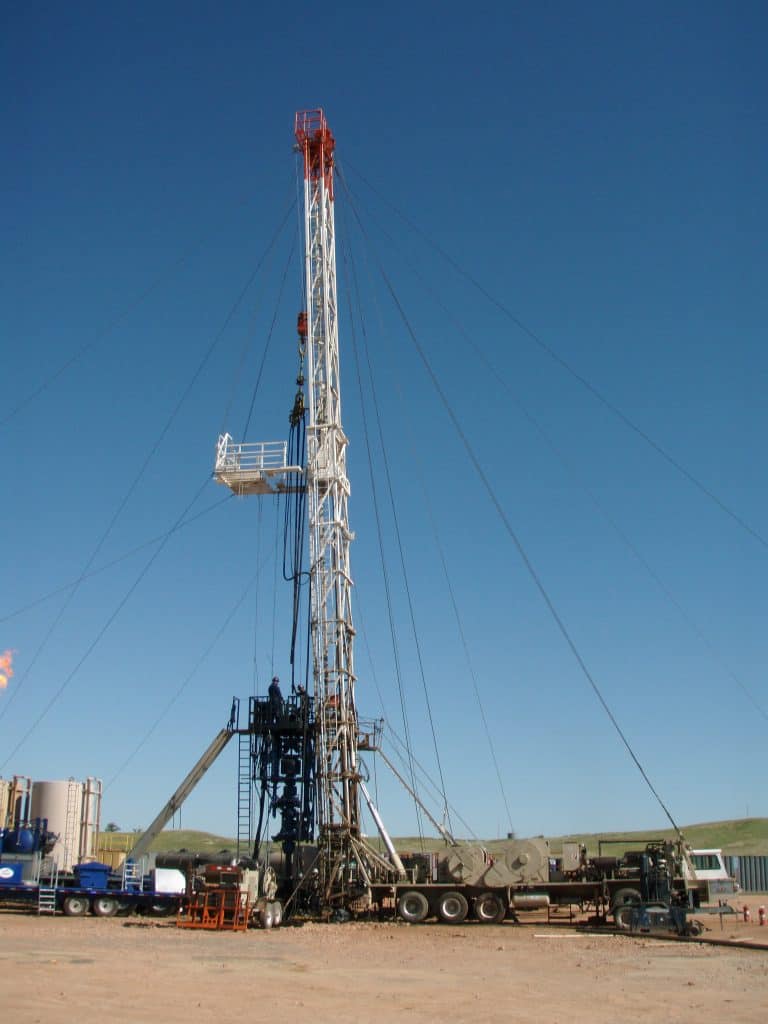

Pumping services tend to get more expensive offshore, because of the degree to which the equipment must be assembled on location. Wire based services still require assembly, but because the parts are smaller can usually be mobilized in larger ‘chunks’ thus requiring less assembly on location. On land, fluid pumping equipment is much more readily portable on trucks or trailers. Workover rigs on land are incredibly cheap in most places as measured on a per diem basis. Part of their advantage is that they arrive to location with most of their key components already assembled in/on one truck. This advantage disappears offshore where the rig must be assembled on site first.

In deep-water with subsea wellheads where there is no permanent facility available to access the well, costs are turned on their heads, and look roughly as follows:

Paying for a drilling rig or intervention vessel is the price of gaining physical access to the well. Everything else must be added to it to get physical access to the general area and then gain access to the well. There is no need for various forms of standalone pumping services because the vessel or rig will already have a cementing unit and/or the mud pumps available for that sort of work.

Performing the same operation over and over again has significant cost savings attached to it. Once the correct housing and supply arrangements are in place, and all the necessary people and equipment have been assembled, continuing to use it altogether ‘as is’ can save an enormous amount of money compared to dispersing it all and starting over again later. For land operations, this is most pronounced in areas where reservoir, surface, and operational practices allow for grouping wells together in relatively small areas, and for clustering well pads. Depending on what work is being done to the wells and how close together they are it may be possible to ‘hop’ from one well to the other without ever moving the equipment on a road or doing a complete rig-down.

This is one area where offshore operations can see tremendous improvements and synergies. Having facilities with multiple wells at a single physical location allows for extremely high levels of flexibility economies of scale if the same sorts of equipment and skills can be utilized on one well after another in succession.

Deepwater operations can benefit from this too, but not as much as ‘traditional’ fixed or surface access facilities, because the overall day rate of the rig or intervention vessel is often much higher, and the process of switching between wells is often much lengthier.

On land, you hire the unit and crew, and a small diem fee is added to the cost of employing them so they can stay in a hotel and get food when they are not working. The crews will transport themselves to and from the well and move the equipment to and from the well also.

Offshore, housing, food, and transportation to and from the wellsite must be arranged as part of the work to be performed. This involves contracting crewboat(s), work boat(s) helicopter flights, catering services, and crew quarters buildings with a galley, laundry, showers, toilets, etc. Extra space must be allocated or created at or near the wellsite facility for the extra quarters. Many of these same factors are also present in remote land locations. The nature of operations in the Sahara Desert, or the North slope of Alaska, or the Congo jungle are more like those offshore with respect to cost and access than they are to more ordinary land operations where ‘normal’ food and housing operations catering to the population of the area in general are accessible.

For deepwater, everything for offshore must be provided, but with the additional difficulty that none of it can be made permanent, because there are no permanent surface facilities. In addition, simply getting to the wellhead once you have a drillship, semi-submersible, light well intervention vessel or other type of access facility floating over the top of the well is a considerable challenge. Depending on the nature of the operations which must be conducted, the access method, and the weather and current conditions it may take a period ranging from a day or two, to several weeks before access to the well is accomplished and the well work itself can start.

The costs of conducting business in each of these 3 areas tend to scale very roughly in factors of 10. 100 wells making 50 bbls of oil each on land is a cash cow. Offshore that is a disaster, because the cost of servicing those wells is prohibitive. A more reasonable scenario is 10 wells making 500 bbls of oil each. In deepwater, a well making 500 bbls of oil a day is an abandonment candidate, if indeed it got that far along before abandonment. One well making 5,000 bbls a day is more. The direct cost of hiring (for example) a snubbing unit do not scale by factors of 10, but the overall cost of employing a snubbing unit do. As a result, different types of well servicing make sense in one area which may not make sense in another. On land in areas with ordinary access to infrastructure (not the Sahara or Alaska) operations like slickline are often so cheap that they are a routine procedure, with preventative or predictive maintenance schedules to scrape away paraffin or remove small amounts of scale. By contrast, it is completely cost prohibitive to try and attempt to perform similar work in deepwater – you either design and operate the well in such a way that paraffin and scale do not build up in the wellbore at appreciable rates, or you P&A the well. The cost of routine mitigation is simply too high. The relative cheapness of most workover rigs on land is another major factor. Many types of operations which could in theory be carried out in some other way are done with a workover rig simply because it is the most cost-effective technique, even if other methods might be faster, or involve fewer people. The relatively high cost of a rig for offshore facilities means that in most cases every effort short of getting a rig is tried first. Then a catalogue or list of operations to be conducted by a rig at a given facility will be gradually built up over time until they reach a critical level. At that point, a rig will be sent out to conduct all the operations which only it can perform, moving from one well another to save costs by making the work repeatable.

OSLO, Sept 14 (Reuters) - Rental rates for offshore oil and gas rigs could rise to $500,000 in the coming months, company executives said on Wednesday.

Daily costs to hire a rig, known as the dayrate, have already more than doubled from two years ago to some $300,000, with some top-end rates reaching close to $400,000, according to Oslo-based brokerage Pareto Securities.

Drilling companies are in a stronger position to demand higher rates to rent their equipment after several lean years led to a wave of mergers and pushed them to scrap older rigs, leaving fewer available now that demand is rebounding. read more

Updated monthly, the Offshore Rig Day Rate Trends report tracks competitive mobile offshore drilling fleet day rates and utilization across three representative rig categories. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source.

Day rates published by IHS Markit are presented in good faith based on our best understanding of the market at the time, and may be subject to adjustment. Day rates are charted as an average of the high and low for each month. Utilization is the percentage of contracted rigs out of the total competitive fleet supply. The data is updated on or about the 15th of each month. The data points used to derive the averages are available to subscribers to Petrodata"s RigBase or RigPoint market intelligence tools.

The Downstream costs services team would like to invite you to our Houston Enclave Parkway office for the Third Quarter 2022 Downstream Costs Update...

{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales

[num]","alt":"Call Sales

[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"chat","enabled":true,"desc":"Chat Now","mobdesc":"Chat","mobmsg":"Welcome! How can we help you today?"}, {"name":"share","enabled":true,"desc":"Share","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html&text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"email","url":"?subject=Offshore Rig Day Rate Index | IHS Markit&body=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

Drilling and Completion costs are very similar across all onshore plays. This report will be focused on the Permian Basin where the average drilled well costs between $6.6 MM to $8.1 MM (2014 data) and $5.0MM to $9.3MM (currently). Oil wells are developing longer laterals as technology and oil extraction improves so total cost numbers are fairly abstract without a lateral length. The most common metric to compare well costs is well cost/1,000 ft. lateral. With this metric, a 10,000" lateral well can be compared to a 7,500" lateral more accurately. It must be noted that the cost/1,000 ft. metric doesn"t account for the fixed vertical depth of the well regardless of lateral. The 2014 Permian cost/1,000 ft. was between $1.1MM and $1.4MM. Current data from six Permian producers show the cost/1,000 ft. around $970k.

Well costs have declined as companies lean out operations to adjust to a lower price oil environment. One way Permian producers have decreased costs has been utilizing one surface pad with one set of facilities for multiple wells of different depths and directions. The surface facilities of the wells are expensed amongst the various well expenditures so aggregate well costs will naturally decrease as this trend increases. Permian producers such as Resolute Energy (REN) and Centennial Resource Development (CDEV) have discovered more efficient oil extracting techniques by increasing their proppant and frack stages per 1,000" of lateral, but increases the cost of completing the well.

More expensive wells are likely to have laterals greater than 7,500" with increased costs for frack stages and proppant. Once again, allocating costs per 1,000ft. can provide more color on well costs in similar zones with differing lateral lengths.

The graph below shows how universal the drilling and completion cost structure is by showing historical total drilling and completion costsby oil play. The graph also shows how cost allocations in this report is useful for any play, and not just the Permian.

Onshore well costs can be broken into the categories Drilling, Completion, and Facilities. Drilling costs include all costs relating to the rig including the drilling crew, casing, lining, cement, drilling fluids, and others. Completion costs include well perforating crews, fracking crews, fracking proppant and fluids. Facilities costs include road construction and site preparation. Facilities expenses include the surface equipment such as storage tanks, gathering systems, artificial lift, and others. The surface equipment is where pad-drilling synergies create savings through economies of scale for upstream firms. Drilling and completion costs are recorded together in most investor presentations. Cost data and structure from US Energy Information Administration.

Rig-related costs are approximately 17% or $1.28MM of the cost of a well in the Permian. Key cost drivers are drilling efficiency, well depths, rig day rates, mud use, and diesel rates. Rig day rates are flexible in different oil environments and prices often reflect demand. Spud to total depth rates (time between well completions) have decreased recently due to technological efficiencies. EOG Resources (EOG) shows a reduction of 45% from 2014 drilling days to the third quarter of 2016, with their record on a 7,000" lateral being only 10.5 days.

Casing costs are approximately 13% or $.98MM of the well cost. Key cost drivers are steel and cement prices, dimensions of the well, and casing strings. Since the vertical well is a fixed cost for a specific zone, the fixed cost per unit (1,000ft. lateral) is decreased as laterals extend. Assuming the vertical well is $2MM, the cost per 1,000ft. on a 7,500" lateral is about $267,000, but the costs are only $200,000/1,000ft. on a 10,000" lateral. This allocation makes extending laterals cheaper than drilling a new well.

Completion fluid costs account for 19% or $1.43MM of the well cost. Key cost drivers include horsepower needed, frack stages, and pumping pressure. Frack stages are increasing per lateral foot recently which increases cost to each horizontal well, but increases barrel recovery. Resolute Energy has increased frack stages/1,000 ft. steadily over their last nine reported wells, as reported in their November investor presentation. (shown below)

Proppant Costs are 17% or $1.28MM of total well costs. Key cost drivers are the market rates for proppant, the proppant mix, amount of proppant, and proppant transport. Proppants per lateral foot have increased significantly with the goal of more oil recovered and lower decline rates. Centennial shows an increase in proppant from 1,500 lbs/ft to over 2000 lbs/ft. Resolute has also increased their proppant lbs/ft steadily over their last 9 reported wells. By allocating the proppant per foot, the lateral lengths are uniform and comparisons can be made easily. (shown below)

To show the very consistent increase in frack stages and proppant use, I put Resolute"s drilling data into a spreadsheet. In addition to Resolute"s drilling metrics, I have included the 2014 cost data from the EIA to help facilitate comparisons. All data from the Permian.

The data above is from the 2014 well design data and the last nine wells drilled by Resolute. The original data showed the total proppant and frack stages per well and I formed the metrics on a 1,000ft. basis. The unit for proppant is millions of pounds. The wells in bold are found in Resolute"s Appaloosa acreage and the standard font wells are found in the mustang acreage. Both acreages are in the Delaware Basin, but Appaloosa wells tend to have longer laterals and higher initial production rates per 1,000ft. lateral.

The frack stages/1,000ft. from the 2014 EIA data were on target for the first Resolute wells. The proppant/1,000ft. from the 2014 EIA data was lower than Resolute"s amount of proppant. This supports the conclusion that proppant/1,000ft. has increased substantially over time with the goal of increasing extraction. This trend has increased completion costs for Permian drillers.

Lease costs include the cost to acquire the acreage in use by the well. Acreage has become increasingly expensive in the Permian, and with specific focus on the Delaware Basin. I showed some recent acreage transaction prices in my Centennial Resource Development Report. With acreage in the Delaware ranging from around $20,000 to over $45,000 per acre after adjusting for current production can significantly add to a well"s cost. These costs can be mitigated through productive acreage. As well spacing decreases, the lease cost expenditure decreases. Devon Energy (DVN) has reduced well spacing in their December investor presentation to just over 7-acre spacing. The reduced well spacing from Devon Energy"s presentation was in Lea County, NM. This acreage is in the Northern Delaware Basin, with very similar pay zones. These recent trends towards more productive acreage and smaller well spacing have reduced the importance of increased lease costs when determining well costs in the Permian and Delaware Basins.

The well design data (from 2014) shows that the Wolfcamp in the Delaware Basin is significantly deeper than the Wolfcamp in the Midland Basin as seen by the total vertical depth. The difference in depth shows a real opportunity for stacked play potential with reduced spacing on acreage. The stacked play potential also increases the value of pad drilling and lowers lease costs as discussed earlier. Both trends reduce costs. EOG Resources has a good graphic to show how thick the pay zones in the Delaware Basin are.

The rest of the costs typically come from completion tools, insurance/consulting, artificial lift, and other nonrecurring expenses. All in all, the average Permian well costs between $6.6 - 8.1MM with total costs/1,000ft. between $1.1MM and $1.4MM.

On income statements, drilling and completion expenses are listed under capital expenditures. After completion, the costs of continuing production and other operating expenses are typically broken down into four line items: lease operating expenses (LOE), gathering, processing, and transportation (GPT), general and administrative (G&A), and depreciation, depletion, and amortization (DD&A). LOE includes fixed lease costs for artificial lift, well maintenance, and minor workovers. Gathering and transporting costs are charged per BOE to pay for pipeline transportation.

The cost of wells had been decreasing as oil prices decreased, yet laterals have been getting longer. New technology, efficiencies, and pad drilling are driving these costs down. Spud to total-depth rates among E&Ps have decreased which lowers the cost of labor during the drilling process for individual wells. This also helps the company drill more wells with the same rig, contributing to increased revenue. As oil prices rebound, more expensive drilling techniques are becoming more common. The Delaware Basin is still a relatively new oil field, so operators are still trying to perfect the drilling technique for the highest yielding wells. Looking ahead, Parsley Energy (PE) predicts (Q3 earnings call) service costs may increase by 10% in 2017. In this scenario, well cost would only increase by a few percent since the more elastic and responsive inputs such as rig day rates or frack crew day rates only account for about 15-20% of total well cost. Higher revenues from oil price and extraction increases should more than cover this increase as Delaware and Permian wells.

Day rate refers to all in daily costs of renting a drilling rig. The operator of a drilling project pays a day rate to the drilling contractor who provides the rig, the drilling personnel and other incidentals. The oil companies and the drilling contractors usually agree on a flat fee per contract, so the day rate is determined by dividing the total value of the contract by the number of days in the contract.

Day rate (oil drilling) is a metric that investors in the oil and gas industry watch to evaluate the overall health of the industry. The day rate makes up roughly half the cost of an oil well. Of course, the price of oil is the most important metric by far in the oil and gas industry.

That said, investors can gain insights into the oil supply and demand picture by watching metrics like day rate and rig utilization in addition to global inventories. Day rate fluctuations, which can be wide, are used by investors as an indicator of the health of the drilling market. For example, if day rates fall, investors may take it as a sign to exit oil and gas positions.

Day rates can be used to assess the current demand for oil, ultimately gleaming insight into where oil prices are headed. An increase in the price of oil increases the number of projects that can recover their extraction costs, making difficult formations and unconventional oil reserves feasible to extract. The more projects greenlit on an economic basis, the more competition there is for the finite number of oil rigs available for rent – so the day rate rises. When oil prices waver and fall, the day rate that rigs can command drops.

As an example of actual day rates – Transocean signed a contract in December 2018 with Chevron to provide drilling services. The contract is for one rig, will span five years and is worth $830 million. The effective day rate for the rig is $455,000:

Like the day rate, the rig utilization rate is a key metric for determining the overall health of the oil and gas sector. The day rate lays out a large part of the costs of drilling a well, while the utilization rate is how many wells are being used.

Investors use both of these metrics and a fall in each could signal a slowdown in oil demand. High utilization rates mean a company is using a large part of its fleet, suggesting oil demand, and ultimately, oil prices are on the rise. There is a positive correlation between oil prices and both day rates and rig utilization.

The strength of the correlation between oil prices and day rates is not consistent. The correlation is strong when oil prices and rig utilization are both high. In this situation, day rates increase almost in lockstep with prices. In an environment of rising oil prices and high utilization, the day rates in a long-term contract will shoot up even faster than short term contracts as rig operators demand a premium for being locked in on a project.

In a low price environment with falling utilization, however, the day rate may plunge much faster than the oil prices as rigs enter low bids on long contracts just to keep busy in a potential slowdown. Due to the volatility and the varying strength of the correlation, investors and traders can flip between seeing day rates as a leading or a lagging indicator for oil prices and the health of the oil and gas industry as a whole.

Oil prices are expected to remain between $60/bbl and $80/bbl into the early 2020s before rising, and offshore spending between 2019 and 2023 is projected to hit $1.5 trillion, said Steve Robertson, head of rigs and wells, during a Thursday briefing in Houston covering insights from Westwood’s RigLogix platform.

However, operators are approaching offshore projects differently as a result of the prolonged downturn. Costs were slashed and some projects went back to the drawing board.

Rig counts are also “moving in the right direction,” says Terry Childs, head of RigLogix. Drillships have seen the best improvement, rising to 64% utilization in April 2019, and the total fleet is up 9% since 2014, he said.

Since 2014, 235 rigs have been retired, including 59 last year. There are 114 rigs coldstacked. If those were removed from the supply, utilization rates would jump from 60% to 70%, Childs said, but there would still be a 210-rig surplus.

Indian jackup tenders are “generating absurdly low” day rates in the $20,000/day range, he said, while the Middle East jackup market will be the most active with the most recent high-spec rigs fetching $78,000/day to $85,000/day. Jackup demand in Southeast Asia is higher than it had been, with rates rising from $60,000/day up to around $80,000/day. Rig demand in Southeast Asia is expected to increase this year by 10.5%, he said.

The utilization rate for harsh environment semis for work offshore Norway is 100%, and there may be further competition for those rigs as operators begin drilling leases offshore Argentina, he said.

The floating rig market is looking bullish for Latin and South America and Africa, he said, citing contracts for drilling offshore Brazil as well as Guyana and its neighboring countries.

“In some areas, day rates are already hitting over $200,000, and continued demand for specific types of rigs such as ultra-deepwater jackups is good news for the industry. The fact that some operators are committing to rigs far in advance is a clear sign that they are anticipating further day rate rises,” Robertson said.

The blue bars represent the individual production of the backup ESPs installed in nine wells, and the corresponding blue line represents the cumulative production of more than 2 million barrels of oil that would have otherwise been deferred until a workover could be performed. The gray bars represent production the operator estimates would have been lost without the backup ESPs, assuming a three-month lag between primary ESP failure and the earliest date.

A White House statement following the OPEC+ decision to defy the Biden administration with an output cut for November vows to find new ways to temper OPEC’s control over energy prices. Earlier on Wednesday, members of OPEC+ said they would cut November production quotas by 2 million bpd, citing the “uncertainty that surrounds the global economic and oil market outlooks”. The decision immediately led to a more than 2% increase in Brent crude and WTI prices and goes directly against the Biden administration’s attempts to lobby Saudi Arabia for higher production to bring prices down. Shortly after the release of an OPEC+ press release detailing the output cuts, the White House said, “In light of today"s action, the Biden Administration will also consult with Congress on additional tools and authorities to reduce OPEC"s control over energy prices.”

VIENNA/LONDON, Oct 5 (Reuters) - OPEC+ agreed steep oil production cuts on Wednesday, curbing supply in an already tight market, causing one of its biggest clashes with the West as the U.S. administration called the surprise decision shortsighted.

OPEC"s de-facto leader Saudi Arabia said the cut of 2 million barrels per day (bpd) of output - equal to 2% of global supply - was necessary to respond to rising interest rates in the West and a weaker global economy..

“Today there is spare capacity that is extremely low,” Saudi Aramco CEO Amin Nasser says at a conference in London. “If China opens up, [the] economy starts improving or the aviation industry starts asking for more jet fuel, you will erode this spare capacity.”

Ya hold tight brent also uptrend now...heading toward usd100. Almost all IB said oil price will sustain at usd90 and above for next year target (2023). Daily rigs rate will increase soon at least 20 to 30%. Velesto will back to 2012/2013 glory.

The land drilling market worldwide is structured primarily as a rental market, not a sales market, where land drilling companies lease their rigs to E&P companies for an agreed period of time – weeks, months, or years – at a day-rate. The rigs are then used to drill wells and execute the E&P’s drilling programs.

Drilling opportunities are analysed and explored in order, leaving a series of dry holes, until a discovery is made. It is rare for an E&P company to actually own the rigs which they operate, but there are some exceptions such as Chesapeake, who will purchase their own fleet of rigs.

Under these rental contracts, a turnkey cost is paid by an E&P business to a middleman. This includes an insurance premium, which is returned if nothing goes wrong, but may be lost if there are difficulties. Higher specification equipment commands a larger premium.

Investors require a minimum level of return for their investment dollars in drilling operations, and typically equate cost with risk. These turnkey drilling contracts may limit risk by guaranteeing a minimum number of wells that can be drilled with the rig. The contract will also outline how the rig can be used – including the pieces of equipment, when to change pieces, temperature and pressure tolerances and the weight of mud.

Nabors operates the world’s largest land drilling rig fleet, with around 500 rigs operating in over 25 countries – in almost every significant O&G basin on the planet. It also has the largest number of high-specification rigs (including new AC rigs and refurbished SCR rigs) and custom rigs, built to withstand challenging conditions such as extreme cold, desert and many complex shale plays.

Headquartered in Tulsa, Oklahoma, H&P is a global business with land operations across the US, as well as offshore operations in the Gulf of Mexico. It is engaged primarily in the drilling of O&G wells for E&P companies, and recognised for its innovative FlexRig technology.

Patterson-UTI operates land based drilling rigs, primarily in O&G producing regions of the continental US, and western Canada. The company also provides pressure pumping services to US E&P companies and specialist technology, notably pipe handling components, to drilling contractors globally.

Precision is an oilfield services company and Canada’s largest drilling rig contractor, with over 240 rigs in operation worldwide. The Company has two segments. The Contract Drilling Services segment operates its rigs in Canada, the United States and internationally. The Completion and Production Services segment provides completion and workover services and ancillary services to O&G E&P companies in Canada and the US.

Pioneer operates a modern fleet of more than 24 top performing drilling rigs throughout onshore O&G producing regions of the US and Colombia. The company also offers production services include well servicing, wireline, and coiled tubing services – supported by 100 well-servicing rigs, and more than 100 cased-hole, open-hole and offshore wireline units.

In Texas, generally considered to be the centre of US land drilling, RigData reports that there are currently 678 active rigs – split between Helmerich & Payne (160), Patterson-UTI (85), Nabors (64), Precision Drilling (39) and 77 other drillers (330).

Most new onshore rigs, both drilling and work over rigs, are built by OEMs in China. In the US, the larger vertically integrated land drillers have in-house manufacturing operations, so they will outsource some equipment construction, but assemble the new rigs at their own facilities. The leading provider of US newbuild rigs is National Oilwell Varco.

The secondary market, where existing rigs are sold, is largely auction dominated with mostly older rigs changing hands. As a rule, the big land drillers do not sell their newbuild rigs, as each has their own flagship designs.

STEINHAUSEN, Switzerland, Oct. 14, 2022 (GLOBE NEWSWIRE) -- Transocean Ltd. (NYSE: RIG) announced today that it will report earnings for the third quarter of 2022, after the close of trading on the NYSE on Wednesday, November 2, 2022. The company will conduct a teleconference to discuss the results starting at 9 a.m. EDT, 2 p.m. CET, on Thursday, November 3, 2022. Individuals who wish to participate should dial +1 785-424-1205 and refer to conference code 260431 approximately 15 minutes prior to

The clearest sign of a turnaround is the worldwide offshore rig count, which is up 28% over the year through February, according to a report this past week from Baker Hughes. A more nuanced clue is where some of these rigs have come from. Kurt Hallead, an analyst at RBC Capital Markets, counts 25 dormant or “stacked” rigs that have been put back to offshore work over the past 15 months.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Despite the blizzards that walloped Bakken production in April, Continental not only expects to deliver on predicted production for the year, but it has raised its guidance to 210,000 barrels of oil per day.

In its most recent earnings call, Continental President and CEO Bil Berry and Chief Operating Officer Doug Lawler said the company is confident in its numbers for the full year, as well as sequential production growth each quarter.

Lawler credited the increased guidance to better than expected productivity from recently completed wells, as well as increased workover rig activity.

Continental also raised its natural gas production guidance to between 1.1 to 1.2 billion cubic feet of natural gas per day, due to strong early performance of wells in the Scoop and Stack areas of the Anadarko Basin.

The increase in workover rig activity has added to expected production expense, but the workovers are paying for themselves within two weeks, Lawler added.

“We have completed 301 workovers in the Bakken in the first quarter alone,” he said. “That is 65 more than the company’s ever done, and historically, just an outstanding job that they’re executing in the field up there, at tremendous economics.”

Lawler said the Bakken has the most opportunities for workovers that make sense, but Continental will look at its entire portfolio for such opportunities, and expects to find them in the Permian and Anadarko as well.

“We are now investment grade rated with all three major credit rating agencies,” Berry said. “With an approximately 31 percent return on capital employed projected for full year 2022.”

Continental officials also spent a good bit of time discussing the $250 million project with Summit carbon solutions, expected to be operational by 2024.

The project will sequester 10 to 12 million tons of carbon dioxide per year, Berry said. By comparison, Continental’s 2020 Scope One emissions were just 2.3 million metric tons.

“Summit is currently raising additional equity and once finalized, we expect to own approximately 25 percent of this enterprise as anequity investment,” he said. “Our investment will be funded throughout 2022 and 2023.”

The exact nature of the commercial arrangement between Continental and Summit has not yet been divulged, but Berry said ethanol is one of the lowest cost sequestration projects available with today’s technology. The project also fits well with Continentals skill sets and knowledge base.

“The emissions from ethanol plants are 97, 98 percent pure carbon dioxide and the remainder is largely water vapor, so that benefits the economics significantly, Lawler added.

As far as acquisitions go, Continental officials said they would continue to look for bolt-ons, but added the current price environment has dampened acquisitions right now.

“We have allocated an additional $100 to $125 million toward inflation, as we see inflationary pressure of up to 20 percent versus 2021,” Lawler said. “With the strength and year over year consistency of our operations, we have options when it comes to service providers and products we use to execute our program. We will continue to monitor inflation and respond accordingly, including pursuit of further operational and technical efficiencies, as well as adjusting our capital program up or down as economics dictate.”

8613371530291

8613371530291