workover rig cost per day free sample

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

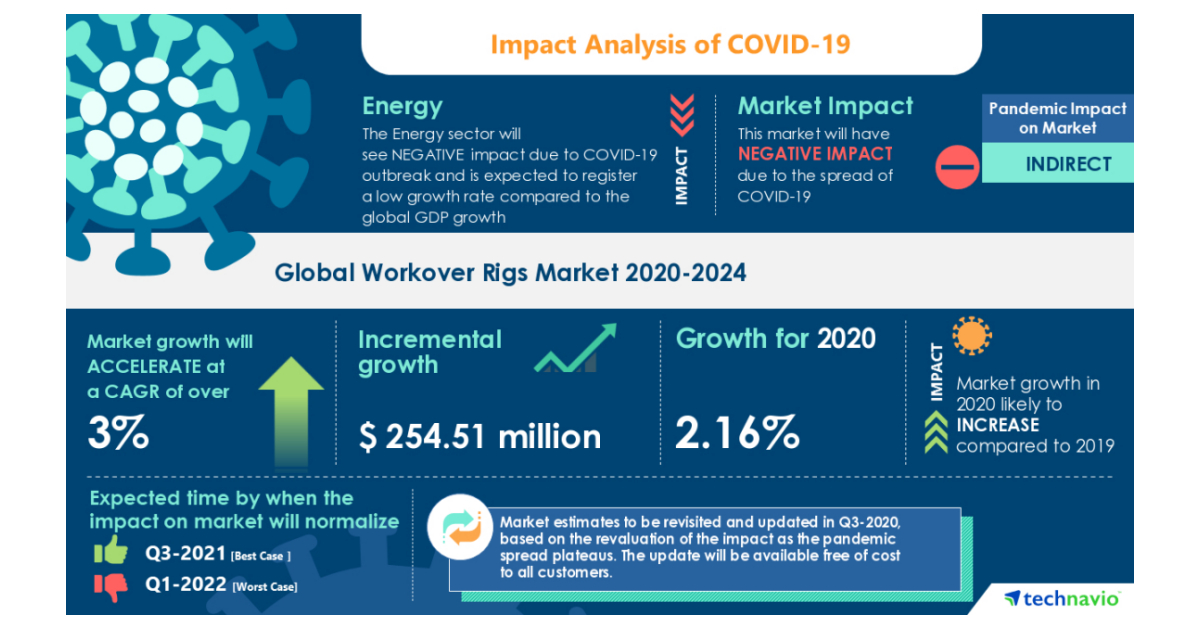

When will the market see a resumption of the top-tier rig newbuild programs that flooded the market in 2012–2014—what price point on day rates would trigger same? Platts RigData RADAR notes that day rates have indeed rebounded nicely, and especially for AC rigs.

Its sister publication, the Day Rate Report, noted the average day rate for 1500 hp rigs led the way up for all rig classes in Q1 of this year with a cumulative net day rate gain of +7% to $16,718. The average day rate for a 1,500 hp rig in 2014 was $22,564, and the top rate at peak in October 2014 was $26,000. The larger issue is that too many top tier rigs are still sidelined.

Even with recovery, the active rig count is less than half the average of 2010–2014. There were a little over 1,000 AC rigs of all sizes in the total fleet a year ago. In that year-ago snapshot, about 400 AC Class D rigs of recent vintage were cold-stacked; in the latest snapshot, that group has dwindled to 144. The ratio of all working rigs to stacked rigs has fallen from 5:1, but it remains as high as 2:1. Platts RigData estimates that the overall rig count, still dominated by Class D rigs, will need to reach about 1,200 before demand—and day rates—warrant another robust newbuild program.

Enverus provides timely information pertaining to drilling activity in the United States, and the Gulf of Mexico for the oil and gas industry. With more than 25 years of experience, Enverus reports have supplied important information on the life of the well as detailed by its permits, the actual drilling and completion activities, up through its current production profile.

With access to Enverus, you can identify new sales leads, plan visits to drilling rigs, determine market share, identify exploration trends, find available rigs, identify new production, monitor competitive activity or define sales territories. Our survey team talks with hundreds of specialists each week to verify our data as well as ensure it is fresh and as detailed as possible for your use.

Thousands of oil and gas industry professionals depend on Enverus reports for every day decision making. We strive to meet your unique needs with a variety of options offering different frequency of access and subscription costs, all made available with the end user in mind.

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

The following is a list of seasonal work gear worn by drilling rig workers. Savanna supplies rig employees with coveralls, hard hat, safety glasses & impact gloves (1 pair).

Drilling rig crews are generally made up of six (6) people: Rig Manager, Driller, Derrickhand, Motorhand, Floorhand, and Leasehand. Each crew works 12 hours shifts as the rig operates 24 hours per day, and each position is vital to the operation of the rig.

Work in the oil and gas services industry is seasonal. Because of the weight of rigs and their equipment, and the remote location of wells, these locations are often only accessible when the ground conditions can tolerate heavy loads. Therefore, wells are typically drilled and serviced in the winter when the ground is frozen solid, or in the summer, when the ground has thawed and dried sufficiently. During the spring and fall, when the ground is in a transitional state, it is too soft to move equipment on and easily damaged. For this reason, provincial governments implement “road bans” prohibiting heavy loads from operating in certain areas. During this time, rig work is slower, and many rigs are shut down and their crews sent home. Be prepared to be off for anywhere from 6 to 12 weeks without pay during this time. However, rigs that are shut down are usually in need of maintenance, and there may be opportunities for employees who would like to help in this regard. Employees may be eligible for Employment Insurance benefits during seasonal shutdowns.

To work on a drilling rig, you must be able to get to and from all of your work locations. As drilling often occurs in remote areas, having reliable transportation is considered mandatory for non-camp locations. Drilling rigs commonly operate 24 hours per day, 7 days per week with either three crews working 8 hour shifts or two crews working 12-hour shifts. Most often day crews and night crews will alternate weekly, so each crew has a chance to work during both the day and night. Most crews will work 14 days straight with 7 days off in-between. The typical living situation while working falls into three categories: Non-Camp, Full Camp and Texas Camp.

Non-Camp: When the rig site is near a town, non-camp conditions normally apply. Crews will stay in hotel rooms and receive a per day living allowance for food and accommodation. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and accommodation out of your own pocket.

Full-Camp: When a rig site is in a remote location, crews may stay in a full camp. In a full-camp all food and full accommodation is provided. Once at the camp, the crew travels to and from the rig in the crew truck. Almost all camp work is available in the winter only.

Texas Camp: These camps are typically located nearby the rig location. Crews are responsible for supplying their own bedding, cooking supplies, groceries and toiletries. While staying at a texas camp, a daily allowance is provided for food and toiletries. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and toiletries out of your own pocket.

Once you have completed your orientation, you will immediately receive any other necessary training. This involves Workplace Hazardous Materials Information System (WHMIS) and Transportation of Dangerous Goods (TDG), along with an in-depth General Safety Orientation. This training is mandatory and provided by Savanna at no cost to the employee. Job-related, hands on training is conducted in the field through Savanna’s Rig Mentoring Program.

Some well locations have sour gas (Hydrogen Sulfide or H2S) present which is extremely dangerous. All employees are required to possess a valid H2S Alive certificate regardless of whether they are working on a sour gas well. This can be obtained by signing up for and completing a one-day (8 hour) course.

Courses are available at various locations across the province. For more information, contact Energy Safety (formerly Enform) at (780) 955-7770 or visit www.enform.ca or Leduc Safety Service at (780) 955 3300 or visit www.leducsafety.com. The cost of the course is usually between $130 and $150 plus tax, and the certification is valid for three years.

While it is not mandatory to have this certification, each service rig crew is required to have two members who are certified in Standard First Aid with CPR level C. Therefore, obtaining a certification beforehand is a great way to improve your chances of being hired.

The land drilling market worldwide is structured primarily as a rental market, not a sales market, where land drilling companies lease their rigs to E&P companies for an agreed period of time – weeks, months, or years – at a day-rate. The rigs are then used to drill wells and execute the E&P’s drilling programs.

Drilling opportunities are analysed and explored in order, leaving a series of dry holes, until a discovery is made. It is rare for an E&P company to actually own the rigs which they operate, but there are some exceptions such as Chesapeake, who will purchase their own fleet of rigs.

Under these rental contracts, a turnkey cost is paid by an E&P business to a middleman. This includes an insurance premium, which is returned if nothing goes wrong, but may be lost if there are difficulties. Higher specification equipment commands a larger premium.

Investors require a minimum level of return for their investment dollars in drilling operations, and typically equate cost with risk. These turnkey drilling contracts may limit risk by guaranteeing a minimum number of wells that can be drilled with the rig. The contract will also outline how the rig can be used – including the pieces of equipment, when to change pieces, temperature and pressure tolerances and the weight of mud.

Nabors operates the world’s largest land drilling rig fleet, with around 500 rigs operating in over 25 countries – in almost every significant O&G basin on the planet. It also has the largest number of high-specification rigs (including new AC rigs and refurbished SCR rigs) and custom rigs, built to withstand challenging conditions such as extreme cold, desert and many complex shale plays.

Headquartered in Tulsa, Oklahoma, H&P is a global business with land operations across the US, as well as offshore operations in the Gulf of Mexico. It is engaged primarily in the drilling of O&G wells for E&P companies, and recognised for its innovative FlexRig technology.

Patterson-UTI operates land based drilling rigs, primarily in O&G producing regions of the continental US, and western Canada. The company also provides pressure pumping services to US E&P companies and specialist technology, notably pipe handling components, to drilling contractors globally.

Precision is an oilfield services company and Canada’s largest drilling rig contractor, with over 240 rigs in operation worldwide. The Company has two segments. The Contract Drilling Services segment operates its rigs in Canada, the United States and internationally. The Completion and Production Services segment provides completion and workover services and ancillary services to O&G E&P companies in Canada and the US.

Pioneer operates a modern fleet of more than 24 top performing drilling rigs throughout onshore O&G producing regions of the US and Colombia. The company also offers production services include well servicing, wireline, and coiled tubing services – supported by 100 well-servicing rigs, and more than 100 cased-hole, open-hole and offshore wireline units.

In Texas, generally considered to be the centre of US land drilling, RigData reports that there are currently 678 active rigs – split between Helmerich & Payne (160), Patterson-UTI (85), Nabors (64), Precision Drilling (39) and 77 other drillers (330).

Most new onshore rigs, both drilling and work over rigs, are built by OEMs in China. In the US, the larger vertically integrated land drillers have in-house manufacturing operations, so they will outsource some equipment construction, but assemble the new rigs at their own facilities. The leading provider of US newbuild rigs is National Oilwell Varco.

The secondary market, where existing rigs are sold, is largely auction dominated with mostly older rigs changing hands. As a rule, the big land drillers do not sell their newbuild rigs, as each has their own flagship designs.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

In general, to cold stack a rig is similar to "shuttering" an industrial plant; workers are let go, the hatches are battened down and the rig is completely shut down. Cold stacking a rig involves reducing the crew to either zero or just a few key individuals and "storing" the rig in a harbor, shipyard or designated area offshore. Although the duration of cold stacking can vary depending on many factors, rigs that are cold stacked are typically out of service for a significant period of time and are generally not considered to be part of marketable supply.

Typically, steps are taken to protect the cold stacked rig including the installation of monitoring systems that communicate rig status and critical systems information to locations onshore. Monitor Systems Engineering provides a comprehensive marking and monitoring system that includes GPS Position Monitoring, Intruder Monitoring, Fire and Bilge Alarm Monitoring, Anchor Winch Tension Monitoring, Solar Power Supply and an Automatic Identification System.

Cold Stacked: Also referred to as mothballing, cold stacking is a cost reduction step taken when a rig’s contracting prospects look bleak or available contract terms do not justify an adequate return on the investment needed to make the unit work ready (e.g., repairs or refurbishment). For example, a conventional GOM jackup might see its costs reduced from $30,000 per day when operational to as little as $2,000 per day when cold stacked. Cost savings primarily come from crew reductions to skeletal levels. Steps taken to protect the rig’s facilities include applying protective coatings, filling engines with protective fluids etc. With the costs of crewing up, inspection, deferred maintenance, and potentially refurbishment acting as deterrents to reactivation, cold-stacked rigs may be out of service for extended periods of time and may not be actively marketed. A return to service can be a costly proposition, often requiring tens of millions of dollars for refitting costs.

Warm stacked status means that a rig is idle but operational and is also referenced in the industry as warm stacked. A ready stacked rig typically retains most of its crew and can deploy quickly if an operator requires its services. In a ready stacked state, normal maintenance operations similar to those performed when the rig is active are continued by the crew so that the rig remains work ready.

Warm Stacked (also called Hot Stacked or Ready Stacked): a rig is deployable (warm) but idle (stacked). Warm stacked rigs are typically mostly crewed, actively marketed, and standing by ready for work if a contract can be obtained. Routine rig maintenance is continued, and daily costs may be modestly reduced but are typically similar to levels incurred in drilling mode. Therefore, rigs are generally held in a ready stacked state if a contract is expected to be obtained relatively quickly.

1: "Keeping a rig cold-stacked can cost anywhere from $1-$5mm per year, and warming up a cold-stacked rig requires a $10-$50 million investment in surveys, upgrades, and refurbishment."

2:"Will any 1977-1985 built jackup put into cold stack ever return to active service?. Re-activation costs will be high and it normally requires a buoyant market with term contracts and good dayrates to justify the expense. Also this will be exacerbated by the number of new builds that are entering the market over the next two years. Cold stacking in today"s market is essentially postponing the evil day when you have to scrap."

3: "Older rigs have been able to stay busy and earn good profits until now because there weren"t enough newbuilds to fulfill operator demand. But as demand for offshore rigs declines, crude oil prices fall, and more new rigs deliver, the days are now numbered for many old rigs in the fleet."

4:"The number of drilling programs where old, low-specification rigs are optimal is declining and new rigs are increasingly competing for this work as the offshore market slows down. Older rigs are simply not competitive with new rigs when it comes to modern drilling programs. They have been serving as a buffer pending the deliveries of new rigs (old rigs have essentially been filling the gap between supply and demand while new rigs were built). The pace of attrition has been regulated by the pace of addition."

5:"Ultimately, this scrapping will be very healthy for the offshore drilling business as it will balance supply with demand and allow drilling contractors to begin raising dayrates again. It will also free up some staff to work on the new rigs, where hiring requirements number in the tens of thousands of staff over the next few years."

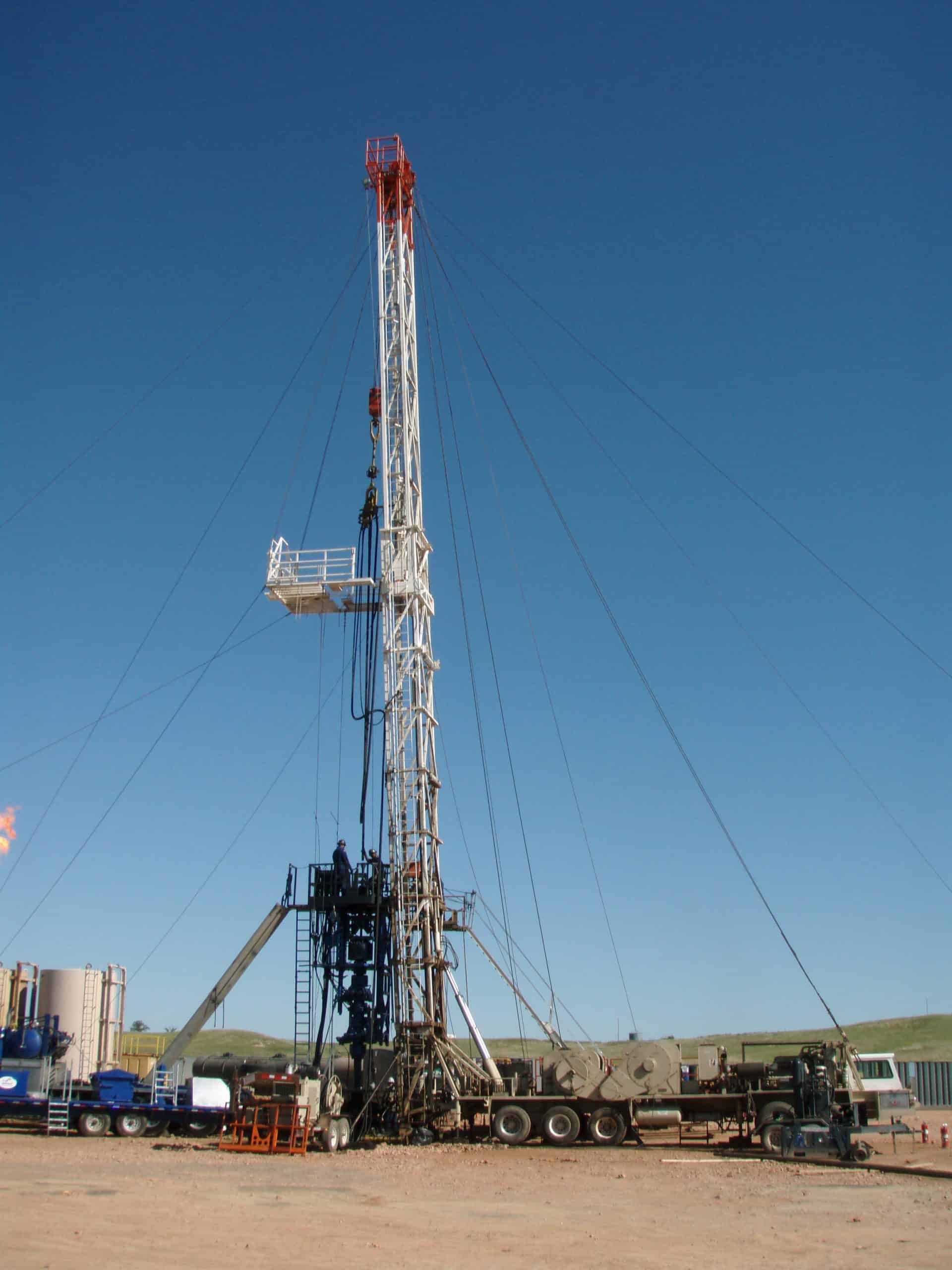

Every workover rig available is going right now in the Bakken, North Dakota’s top oil and gas regulator Lynn Helms said on Friday, during his monthly oil production report, as companies try to get wells online as quickly as possible after back-to-back blizzards idled a substantial number of four and five-well pads in Williams, Divide, and McKenzie counties.

March was a good month for production, Helms said, with a 2.8 percent increase in crude oil production from 1.089 million barrels per day to 1.12 million barrels per day. That figure is 2 percent above revenue forecast. Gas production, meanwhile, rose 4.5 percent to 3.01 billion cubic feet per day from 2.87 billion cubic feet per day in February.

Gas capture percentages were 95 percent, and this time Fort Berthold was a bright spot, with 97 percent capture. Helms said he expects continued improvement in the Fort Berthold area, with new solutions for gas capture in the works for the Twin Buttes area, which has been a problem spot.

“We saw production in the first blizzard dropped from about 1.1 million barrels a day to 750,000 a day,” Helms said. “We recovered not quite back to a million barrels a day. And then the second blizzard came in. It was heavily impactful on electrical power and infrastructure in the Bakken oil fields.”

“It took a week, or I guess within a little bit less than a week, we recovered to 700,000 and it’s taken another week, we think we’re back at about a million barrels a day.”

“Just this past week, our largest gas plant came on and that’s really enabled a lot of production to come back on,” Helms said. “So we’re back to a million barrels a day, maybe a little more. You know all of the large operators reported enormous production losses. And of course that has led to the deployment of every workover rig available being out there trying to get wells back on production.”

In his discussions with drilling contractors, Helms has learned that most drilling rigs went south to Texas and New Mexico, both of which escape winter sooner than the Bakken. Those areas hired the available workforce, too, which has added to the Bakken’s difficulty in attracting workforce.

“It’s taking around two months to train and deploy a drilling rig and crew, and very similar timeframes for frack crews,” Helms said. “So it’s just very, very slowly coming back.”

“I was reading an article today, and some of the large operators were saying, ‘Well you know we could bid up the price to hire frack crews, but all we would be doing is hiring them away from smaller companies that can’t afford to pay as much.’ So there wouldn’t be a gain in the number operating, in the number of wells completed, or really a more rapid rise in production. So it’s very much workforce limited.”

North Dakota rig counts are at 40 right now and Montana rigs are at 2, according to figures from North Dakota Pipeline Authority Justin Kringstad. Helms said the Bakken hasn’t seen those numbers since March of 2020. There are about 15 frack crews running now, a number last seen in April 2020.

“Today’s price is almost $102 a barrel for North Dakota light sweet and $106 West Texas,” Helms said. “So we’re estimating about $104 a barrel for North Dakota crude prices. That’s more than double revenue forecast. Revenue forecast was based on $50 oil, so that’s 108 percent above that.”

North Dakota is a few days away from a May 18 deadline for protests in the projected June sale, which has 15 parcels listed. If there’s a protest against one or more of the tracts, they could be pulled from the sale for further consideration.

An offshore oil rig, a floating city on the ocean, is a city that never sleeps. Looming over passing ships, it works silently around the clock, performing its functions far from the nearest coast.

Billions of barrels of oil and gas are produced by oil rigs and gas wells to meet the world’s energy demand. The oil industry is central to the world economy, and changing crude prices impact all nations.

Though you must have heard about life on this beautiful floating platform, there are a few things you might not be aware of. The first thing to note is that life on an oil rig is not a party and is, in fact, a gamble with one’s own life. Though the sentence might sound a bit exaggerated, it is not all untrue, for offshore oil rig work is harsh and unsafe.

Five hundred years ago, the oil demand was much higher than its supply. Besides collecting the oil seeping through the ground through land oil pipes and wells, oil companies started exploring beyond and developed drilling rigs to tap crude oil below the sea bed through hydraulic fracturing.

Most appliances these days are powered by conventional energy methods, which are mainly dependent on fossil fuel energy. It involves the combustion of these fuels to indirectly power factories, industries, cars, habitation sites, etc. The alternatives are natural resources such as wind, water, and solar-based power sources.

Coming to why offshore oil rigs have become a common sight, the reason lies in the effects of drilling on land. The sheer land required to maintain such an operation only compounds the problem of having an ever-expanding population without enough area.

Moreover, once an oil well is drained of all resources and capped, the rig must be dismantled and scrapped. The cost of changing location is far too great.

People have been instrumental in these massive oil rigs’ safe and efficient operations. They handle a variety of tasks- from engineering to assistive.

For instance, specialists and inspectors ensure the rig is in working order, engineers work to rectify any potential flaws, and auxiliary staff keep the entire crew fed and provide other services.

While people are fundamental to these rigs’ functioning, efforts are gradually being made to shift to a safer and more remote alternative. This way, only essential visits would be required.

Life changes dramatically for one who decides to step foot in this industry. Earlier, life on an offshore oil rig was arduous, but there have been significant changes and improved living conditions.

Oil rig workers have an 8-12 hour shift with breaks for food in the morning, noon and night. One might have to do night shifts since this industry operates 24 hours a day and seven days a week.

While this may seem tough, a two-week work session on the rig will earn the worker a holiday of almost three weeks. This is meant to compensate for the hard physical labour on the offshore platform.

And while onboard a rig, one need not worry about food, laundry or accommodation. Rooms with bunk beds are common, as it saves precious space and fosters a sense of camaraderie with one’s colleagues.

Cinema halls, televisions in every room, a fully-kitted gymnasium, indoor sports facilities like table tennis, and computers with internet are some benefits one enjoys on the rig.

But with the advent of superior mobile and broadband technology, oil rigs are well equipped to provide the staff with the various comforts of the internet, including uninterrupted and unlimited voice calls and a super-fast Wi-Fi connection.

Dangerous and heavy machinery like cranes capable of lifting heavy loads is operated at all times. Work is even carried out at extreme heights despite weather, stormy or windy climatic conditions.

Be it for a worker on the rig or off rig workers like the paramedics, housekeepers, caterers etc., life on an oil rig is exciting and exhilarating, while it also has its fair share of danger.

With newer and safer systems, the risks involved have drastically decreased. Nevertheless, caution is always advised, and the best operating practices must be followed.

Work shifts on an oil rig are dependent on your time of arrival and state of work at that point. After that, you are assigned a 12-hour shift to work on and then a 12-hour off period.

The exact time can vary since it depends on the work you specialize in. Since you are on the rig for two whole weeks with limited sources of entertainment, the company often puts you to work for longer periods, with adequate breaks in between. So, it may be possible that you stay up for nearly 16 hours and then sleep for the remaining 8 hours.

So, mealtimes are included in this period and designated relaxation times intended to improve staff welfare. To ensure no time is wasted, a roster with a detailed schedule is prepared for each crew member on board and is strictly followed.

Since your “day” might start at midnight, the oil rig follows a 24-hour operational system. This is a typical day for a worker beginning the midnight shift in this system:

We can observe that while it may seem long, the day is filled with breaks intended to give the workers a gap. Moreover, during work hours, they can take a few minutes to talk to their family on the shore, catch up with their colleagues, or prepare a snack from the ever-full pantry.

Working on an oil rig is not a simple task a layperson can attempt. The machinery used is unique to this field, the type of work is different, and the physical intensity can be challenging. This is why most oil and gas companies have a long list of qualifications and requirements for their staff.

Those who have minimal education can apply for entry-level oil rig jobs after doing a diploma or the specified course. They can become stewards, galley hands, floor hands and welders.

Workers who handle mechanical repairs, instrument installation, welding etc., need certifications in operating heavy equipment and specialized machinery.

Lastly, operations and logistical experts have to factor many variables into their computations- weather conditions, man-hour requirements, safety guidelines, physical working conditions etc.

While companies often train their employees in these skills, they also seek proactive individuals with certifications. This helps them to stand apart from the crowd and offers them prior experience in the field.

Medium helicopters have two main variants. The passenger variant handles larger groups of passengers, often used for a shift-change operation with 15 people.

Heavy-duty copters can transport large equipment, hanging loads, and passengers of up to 20 individuals. They are used for more robust and heavy-duty operations.

VTOL refers to Vertical Take-Off and Landing, meaning that the craft can rise or drop vertically without any off-centre motion. This is perfect for tight manoeuvring in locations with restricted space. There is also a lesser chance of the helicopter tail striking any equipment.

Crew members on board the transport vessel need to climb the buoyancy columns of these rigs to reach the main deck, although elevators are common in modern times.

Despite the tough lifestyle of a crew member on an oil rig, it is a satisfying opportunity to be at the forefront of an ever-evolving and complex industry. Rest assured, a select few can only handle these experts’ work. Besides the high salary, there are numerous perks for workers on an oil rig.

The pay is unparalleled, considering they handle state-of-the-art equipment that needs prior experience. There is also an opportunity to work at different locations spanning different regions and continents. For those who enjoy being at sea, this is an excellent opportunity to witness its beauty firsthand.

As work usually progresses for 2-3 weeks per shift, they receive an equal amount of time off once their shift is completed. This means you can spend time with your family once you are off-duty.

When an oil rig stops production, companies can seal the oil well and remove the platform or transform it into an artificial reef by removing only its upper section. Over the years of its operation, the rig pillars beneath the waves and mud become one with the marine ecosystem in many ways.

This practice of changing the defunct rigs into reefs in the United States began 40 years ago, after 1984. That year, the US Congress passed the National Fishing Enhancement Act, which underlined the advantages of converting rigs into reefs. The states of Alabama, Louisiana, Mississippi and Texas have rigs to reefs programs which have transformed over 500 rigs into artificial reefs.

The subsurface rig is the perfect skeleton for coral reefs, mussels, tiny fish and other marine wildlife. Rigs like Platform Holly are one of the most flourishing man-made marine habitats with diverse fish populations. However, even these reefs face dangers as oil from original wells or pipelines can still leak. In 2021, a pipeline between Elly platform and Long Beach Port in the State of California leaked. It affected the marine animals living near the artificial reef.

However, around 27 marine ecosystems would be affected if California’s artificial reefs were toppled. Also, it would cause pollution and waste generation since some platforms like the Harmony rig in Santa Barbara Channel are taller than the Eiffel Tower!

Interestingly, many oil rigs near the Gulf Of Mexico have become productive fish habitats and hotspots for diving, snorkelling and recreational fishing. Scientists and Marine Biologists wish to replicate this success in other parts of the world.

Oil rigs are close-knit communities in a way. Most oil rigs have worker bunker beds; some even offer private rooms. Showers and washrooms are also shared among the staff.

Workers on an offshore oil rig may remain on the platform for six months to one year, depending on the company they’re working for, the project type and the duration of their contract.

Offshore oil rig workers are seven times more likely to die than an average American professional. According to a report, there are usually 27.1 fatalities per 100,000 workers compared to 3 to 4 death per 100,000 employees in normal jobs.

As the work on an oil rig is never-ending, most workers must have 12-hour shifts, seven days a week for even 28 days at a time. They might have to work overtime if the project requires so or if there is an emergency.

Salaries depend on the position and company. But usually, specialised drilling engineers with sufficient experience and underground pipefitters can make around 200,000 USD every year.

Zahra is an alumna of Miranda House, University of Delhi. She is an avid writer, possessing immaculate research and editing skills. Author of several academic papers, she has also worked as a freelance writer, producing many technical, creative and marketing pieces. A true aesthete at heart, she loves books a little more than anything else.

Waste minimization has been proven to be an effective and beneficial operating procedure. You will find that there are many economically and technically feasible waste minimization techniques that can be used in production and workover operations. In fact, many oil and gas operators have implemented waste minimization techniques and have enjoyed benefits such as:

This document will provide a general overview of waste minimization techniques for wastes arising from oil and gas production and workover operations. In addition to a discussion of waste minimization techniques for these operations, the document provides case histories of successful waste minimization projects and a bibliography of useful technical references. Many of the references listed in the bibliography provide detail on the successful application the waste minimization opportunities discussed in this document.

The Railroad Commission also provides the publication Waste Minimization in the Oil Field. Waste Minimization in the Oil Field provides a general overview of waste minimization as a waste management practice and how to include it in an area-specific waste management plan. It also includes chapters on waste generation in oil and gas operations, identification of hazardous oil and gas waste, and the principles of waste minimization.Waste Minimization in the Oil Field is available from the RRC"s Waste Minimization Program.

As noted in the introduction, there are many economically and technically feasible waste minimization techniques that may be applied to production and workover operations. An operator should consider all costs, including waste management and disposal costs, when evaluating the feasibility of a waste minimization option. For example, a substitute product or chemical may cost more, but the savings in waste management and disposal costs will make the substitution cost-effective.

The best place to start waste minimization efforts for production and workover operations is in the planning stages. Preplanning can make a significant impact on the waste management requirements of the production and workover operations.

Production Site Design and Construction -One of the first opportunities for waste minimization is in the design and construction of the production site and lease roads. The site and the associated roads should be planned so that they are constructed such that stormwater runoff is diverted away from the site and that any stormwater runoff, which may be contaminated, is collected. Construction of the location and roads should be planned so that erosion is minimized. These steps will help minimize the volume of contaminated stormwater runoff to be managed. Also, the location size should be only as large as absolutely necessary. Location construction costs, including the cost of the disposition of cleared trees and vegetation, can be reduced. As well, the image of such an operation, as perceived by the general public, is enhanced.

Spill Prevention and Control: -A site should be constructed such that any releases of crude oil or produced water are contained, even if the site is not subject to the federal Spill Prevention Control and Countermeasure requirements (40 CFR Part 112). Such planning will help an operator recover most spilled crude oil and minimize the extent of soil contamination that must be remediated under Rule 91.

Site Equipment -An operator can also include in a production facility"s design tanks, separators, and other associated equipment to enhance waste minimization. Features such as drip pans, elevated flowlines, drip or spill containment devices (e.g., beneath load line connections), stock tank vapor recovery systems, and constructed storage areas for containers of chemicals and wastes are good waste minimization ideas. Many of these waste opportunities are discussed further in the following sections.

Workovers and Well Servicing -A preplanning opportunity for workover and well treatment operations is to carefully design the operation so that only the volume of chemicals necessary for the operation are brought to the site. An operator who takes this step can reduce the amount of leftover chemicals (e.g., acids) that may have to be managed as waste. Also, the potential for contamination from spills is reduced.

Product substitution is one of the easiest and most effective source reduction opportunities. Vendors are becoming more attuned to operators" needs in this area and are focusing their efforts on providing less toxic, yet effective, substitutes. Some operators have found that vendors and suppliers will start offering less toxic substitutes in response to a company establishing inventory control procedures. A few examples of effective and beneficial product substitution for production and workover operations are provided below.

Paints and Thinner -Oil-based paints and organic solvents (i.e., thinners and cleaners) are used less frequently today, nonetheless they are still used. These paints and thinners provide an excellent product substitution opportunity. Water-based paints should be used whenever feasible. The use of water-based paints eliminates the need for organic thinners, such as toluene. Organic thinners used for cleaning painting equipment are typically listed hazardous waste when spent. This substitution can eliminate a hazardous waste stream and reduce waste management costs and regulatory compliance concerns.

Lubricating Oil Purification Units -In certain situations, production and workover operations use engines that typically generate large volumes of waste lubricating oil and lubricating oil filters. A lube oil testing program combined with extended operating intervals between changes is an effective waste minimization technique. (Even though the case history is from drilling operations, the concept may be applied anywhere.)

However, an equipment modification also can effectively reduce the volume of waste lubricating oil and filters. Commercial vendors offer a device called a lube oil purification unit. These units use 1 micron filters and fluid separation chambers and are attached to the lube oil system of an engine. The unit removes particles greater than 1 micron in size and any fuel, coolant, or acids, that may have accumulated in the oil. The unit does not affect the functional additives of the lube oil. The lube oil is circulated out of the system and through the purifier. The purified lube oil is then returned to the engine"s lube oil system. Many operators have found that use of lube oil purification units has significantly reduced the need for lube oil changes, waste lube oil management, and concurrently, the cost of replacement lube oil. Also, a new engine that has been fitted with a lube oil purification unit will break in better and operate more efficiently over time, in part because bearing surfaces and piston rings seat better due to the polishing by particles less than 1 micron in size.

Chemical Metering, or Dosing, Systems -The occasional bulk addition of treating chemicals, such as inhibitors, can result in poor chemical performance and inefficient use of the chemical. A chemical dosing system that meters small amounts of the chemical into a system continuously can reduce chemical usage and improve its performance in the system. In many instances, this equipment modification can result in cost savings due to reduced chemical purchases and more efficient operation of the system.

Basic Sediment and Water, or Tank Bottoms -Many operators have used simple techniques to minimize the volume of BS&W that accumulates in tanks and sediments that accumulate in other production vessels. Devices such as circulating jets, rotating paddles, and propellers may be installed in crude oil stock tanks to roll the crude oil so that paraffin and asphaltene remain in solution (or at least suspension). Also, emulsifier can be added to the stock tank to accomplish the same result. Another method used is to circulate the tank bottoms through a heater treater to keep the paraffin and asphaltene in solution.

One operator in west Texas used an extra stock tank to collect tank bottoms from the regular crude oil stock tanks. The tank was painted black so that in the hot summer months the temperature would rise high enough to dissolve the paraffin and asphaltene, which would separate from the water. The heavy oil would then be transferred in appropriate amounts to the crude oil stock tank for sale. This simple solution reduced the ultimate volume of BS&W the operator had to manage as waste and added revenue from crude oil sales.

High Energy Ion Plating -Magnetic ion coating is a technology that has been advanced in recent years. The process uses impingement of metals such as chrome/gold alloy or pure copper. The high energy application of these metals to a steel surface causes them to penetrate the steel surface, thus forming superior adhesion and slip (low friction) properties (sort of a "metal lubricant"). The metal plating reduces friction such that valve stem packing may be tightened to essentially eliminate fugitive emissions, and the valve packing/stem unit lasts up to seven times longer than a conventional untreated unit. This technology has also been applied to polished rods and stuffing box rubbers on rod-pumps. In those applications, crude oil leakage has been essentially eliminated and the interval between stuffing box rubber changeouts significantly lengthened, resulting in cost savings, reduced soil contamination, and more efficient operation and production.

Vapor Recovery from Stock Tanks -The regulation of emissions of toxic air pollutants have become more strict since passage of the Clean Air Act Amendments in 1992. Many crude oil tank batteries may qualify as major sources, thus triggering Title V permitting, control, and monitoring requirements. A good way to avoid this situation is to install a vapor recovery system. Vapor recovery systems that use vacuum pumps are commercially available. However, one system has been designed and marketed that is simple and low-cost. That system uses only a pump and a venturi. The system uses produced water from the tank to pump through the venturi, which in turn draws a slight vacuum on the tanks. The vapors are entrained in the produced water which is sent to the separator. There the vapors are separated and returned to the production stream.

Conventional Filters -A good target for waste minimization are the conventional filters that typically comprise a large part of an operations waste stream. An operator can replace conventional filter units with reusable stainless steel filters or centrifugal filter units (spinners). These devices generate only filtrate as waste and eliminate from the waste stream the conventional filter media and filter body. Operators have found that the reduced costs of replacing lost oil, maintenance requirements, new filter purchases, and waste filter management recover the expense of installing these alternative filtering units.

If conventional filters must be used, an operator should change filters based on differential pressure across the unit. Differential pressure is a good indicator of the effectiveness of a filter unit and can be used to determine the actual need for replacement. This is a simple change that can significantly reduce waste filter generation.

Cementing "On-the-Fly" -When conducting cementing operations, a significant volume of unused premixed cement may remain after completing the job. Of course, one way to prevent excess cement is careful preplanning. However, service companies now provide systems that mix neat cement and additives on-the-fly. These systems are also referred to as automatic density control systems. The advantage of mixing on-the-fly is that the mixing process can be stopped as soon as the cementing job is complete. Also, the mixing system can be shut down if the cementing job is interrupted for some reason, thus saving the generation of a much larger volume of unusable premixed cement. The only unused cement mixture is that remaining in the mixing system. The unused neat cement and additives are not wastes and can be returned to the service company for use in the next cementing job.

Remote Monitoring of Production Operations -Although it does not appear so, the remote monitoring of production operations is a source reduction technique. Microcomputer-based monitoring of parameters such as pumping unit load, stuffing box leaks, polished rod temperature, gun barrel water level, heater treater temperature and pressure, and tank levels and temperatures can be transmitted to the field office by microwave transmission. Because the system immediately alerts the operator of any upset condition or imminent equipment failure, the operator can quickly address the problem. By doing so, the operator can avoid unnecessary waste generation. For example the operator can prevent equipment failures that would require a workover (workovers generate waste), replace stuffing box rubbers prior to failure (oil leaking from a stuffing box may contaminate soil), prevent tank overflows, and detect loss of fluid from tanks (e.g., leaks or theft). Remote monitoring systems are offered commercially and according to vendors may replace, at a comparable cost, the routine manual measurements.

Workovers Using Coiled Tubing Units -Operations using conventional workover rigs typically generate wastes that must be managed after completion of the workover. An alternative to using workover rigs is to use coiled tubing units for through tubing workovers. Over the past several years, service companies have developed suitable through tubing tools for this purpose. A coiled tubing unit workover eliminates the need for pulling tubing, displacing well fluids, and well blowdown, all of which generate wastes. When feasible, coiled tubing units are a good choice for well workovers.

Paraffin Control -Paraffin deposition can cause operational problems and result in unwanted waste generation. Paraffin deposition can cause sticking and parted rods in the well bore, plugging and rupture of surface flowlines, increased tank bottom generation, and reduced crude oil quality at the sales point. Frequently, the results are ongoing hot oil and solvent treatments, cleanups of crude oil and salt water-contaminated soils, and dissatisfied crude oil purchasers. At the bottom line, the operator realizes reduced operating efficiency, reduced revenue, and increased regulatory compliance concerns.

Several techniques exist for reducing paraffin deposition and the related problems. One technique uses a device known as a magnetic fluid conditioner, or MFC. MFC"s have been used in the oil field for some time, and not always successfully. However, in recent years, MFC technology has improved, and operators are finding success in their application. An MFC may be installed in a producing oil well (e.g., on the downhole rod pump) for which it is specifically designed. Parameters such as pump dimensions, crude oil and water characteristics, and production parameters are accounted for in the design of the MFC. The MFC works by altering the properties of the crude oil and water as it passes through the intense magnetic field of the MFC"s permanent rare earth magnet. As a result, the crude oil"s pour point, yield point, and viscosity are reduced; and the temperature at which paraffin will deposit is lowered. Also, the MFC helps to inhibit scale formation.

Another technique for controlling paraffin deposition is the application of microbes in the well. Bacteria introduced into the producing well bore and formation biodegrade the high carbon chain paraffins, which in turn improves the properties of the crude oil with respect to paraffin deposition. The authors of one technical paper (SPE 22851) suggest that microbial treatment is "potentially limited to wells that produce water, are pumping wells, and have bottom hole temperatures below 210oF." Reports in that technical paper and in other technical papers indicate microbial control of paraffin deposition is effective.

Deposition of NORM is primarily controlled by pressure and temperature changes and commingling of incompatible formation waters. Radon gas co-produced with natural gas is also a source of NORM. While the presence of NORM in reservoir water and gas cannot be eliminated, the volume of NORM-contaminated waste that is generated can be reduced through control of its deposition. Source reduction methods for NORM include: well completions or formation treatments designed to reduce water-cut and sand production; scale inhibitor squeezes that help control deposition of NORM-contaminated scale in the well and in surface equipment; chemical coating or high-energy ion plating of material surfaces at critical points in the production system to reduce the availability of nucleation points for scale formation; piping and equipment design that minimizes turbulent flow and pressure drops, thereby reducing the precipitation of scale; and segregation of incompatible formation waters that result in NORM-contaminated scale deposition (e.g., mixing of waters containing barium and sulfates will cause precipitation of barium sulfate scale).

Water Floods for Enhanced Recovery -In many instances, operators of water floods for enhanced recovery use fresh water from surface sources or from water wells. If feasible, an operator should find sources of produced water to replace fresh water injection. Adjacent operators may produce water that is compatible with the injection zone and is also economically and technically feasible to transfer between leases.

Drip Pans and Other Types of Containment -Tanks, containers, pumps, and engines all have the tendency to leak. A good housekeeping practice that can help reduce the amount of soil and water contamination that an operator has to remediate is installing containment devices. Even though a small investment is required, containment devices save money and regulatory compliance concerns in the long run. Also, they can capture valuable released chemicals that can be recovered and used. Some examples of containment include: drip pans beneath lubricating oil systems on engines; containment vessels beneath fuel and chemical storage tanks/containers; drip pans beneath the drum and container storage area (discussed in more detail in the next paragraph); and containment, such as a half-drum or bucket beneath chemical pumps and system valves/connections. Numerous companies have implemented good housekeeping programs to reduce the amount of crude oil, chemicals, products, and wastes that reach the soil or water. These companies have found these programs to be cost effective in the long run (i.e., less lost chemical and product plus reduced cleanup costs). Also, their regulatory compliance concerns and potential future liability concerns are reduced. The RRC"s Waste Minimization Program has numerous examples of containment and spill control devices, which have been proven effective. Call the program for more information.

Chemical and Materials Storage -Another important aspect of good housekeeping is the proper storage of chemicals and materials. Chemicals and materials should be stored such that they are not in contact with the ground (e.g., on wooden pallets). Preferably, the raised storage area will include secondary containment and be protected from weather. All drums and containers should be kept closed except when in use. It is very important that all chemical and material containers always be properly labeled so that their contents may be identified at any time. Also, material data safety sheets (MSDSs) and other manufacturer information should be kept on file for all stored chemicals and materials. The use of bulk storage, rather than 55-gallon drums or smaller containers is a preferable way to store chemicals and materials. Proper storage and labeling of containers allows quick and easy identification and classification of chemical or material in the event of a leak or rupture, or if disposal is necessary. In some instances, that could save hundreds of dollars in soil or waste sampling and laboratory analysis costs.

Containment of Fluids Used in Workovers -As noted in the discussion "Selection of Contractors," wastes generated by workover rigs may add to the management concerns of an operator. One of the most common problems is contamination of soil by tubing runoff and other spills on the workover rig floor. Several techniques can control this source of waste. First, a containment device beneath a raised rig floor can capture runoff and direct it to collection tanks or containers (the Waste Minimization Program offers an example). Also, heavy duty tarps (commercially available) laid over the well site will perform the same function.

Another solution to the problem of tubing runoff and spills is construction of an impermeable wellhead sump (i.e., a better cellar) during preparation for the original drilling operations. Later, when the well is completed and producing, the wellhead sump will collect any runoff or spills associated with workover operations. As well, the wellhead sump will collect any crude oil leakage from stuffing boxes, thus preventing contamination of soil around the well head. The wellhead sump is covered by a metal grate for safety. At least one firm offers a one-piece fiberglass model for about $800.

Preventive Maintenance -The companion of good housekeeping is preventive maintenance. Regularly scheduled preventive maintenance on equipment, pumps, piping systems and valves, and engines will minimize the occurrence of leaks and releases of chemicals and other materials to containment systems, or if there are no containment systems, to the environment. Numerous companies have implemented preventive maintenance programs and found them to be quite successful. The programs have resulted in more efficient operations, reduced regulatory compliance concerns, reduced waste management costs, and reduced soil and/or ground water cleanup costs.

Inventory control is one of the most effective ways to reduce waste generation, regulatory compliance concerns and operating costs. Especially, when combined with proper chemical and materials storage. An inventory control system can have a beneficial impact on an operation. An inventory control system is easy to implement, especially with the use of computer programs now available. An operator who tracks his chemicals and materials can use them more efficiently and reduce the volume of unusable chemical that must be managed as waste. (Note: Commercial chemical products that are returned to a vendor or manufacturer for reclamation or recycling are not solid wastes. Therefore, it is to the operator"s advantage to require vendors to take back empty and partially filled containers for reclamation or reuse.)

Operators should choose contractors who recognize the value of waste minimization and make efforts to apply it in their service. Contracted workover rigs are a good example of the need for waste minimization efforts by contractors. A producer can find himself dealing with unnecessary oil and gas waste if the service company"s workover rig crew does not take steps to control sources of waste such as tubing runoff, spilled chemicals, and other associated waste (e.g., thread protectors, rubber seals and cups, and pipe dope containers). An operator should select workover rig contractors who use containment devices beneath the rig floor, exercise control over chemicals and products brought on-site, and collect all associated wastes for proper management. Also, the contractor will bring on-site well maintained equipment that will not leak fuel or lubricating oil or that will need maintenance which may generate wastes.

The next preferred waste management option is recycling. Recycling is becoming a big business and more recycling options are available every day The following discussion offers some tips on recycling production and workover wastes.

Produced Water -Most produced water in Texas is injected in Class II wells. The largest proportion of produced water is injected in Class II wells that are permitted for disposal. Look for opportunities to redirect produced water to Class II wells that are permitted for enhanced recovery. Produced water that is injected for enhanced recovery is considered to be recycled. (Also, see "Reduction in Water Use.")

Tank Bottoms -Tank bottoms, or BS&W, are best managed by sending them to a crude oil reclamation plant. An operator should contact nearby RRC-permitted crude oil reclamation plants to determine if an economically feasible arrangement is possible before considering disposal options. The Waste Minimization Program can help operators locate reclamation plants in their area. Some of these plants also specialize in reclamation of waste paraffin.

Also, an operator can recycle his waste lube oil by adding it to a crude oil stock tank. Amendments to 40 CFR (Code of Federal Regulations) Part 279 (regarding standards for management of lubricating oil) provide for this option. There is a regulatory limit of 1% lube oil by volume. An important consideration in choosing this recycling option is the requirements of the crude oil purchaser and the receiving refinery. Make sure they will accept a crude oil and lube oil mixture. (Some refineries are not able to handle such mixtures, and may suffer damage to catalysts and other processes.)

Commercial Chemical Products -An operator should implement procedures that recycle any unused chemical products. Whenever a vendor is contracted to supply chemicals, the vendor should be required to take contractual responsibility for unused chemical products and the containers in which they were delivered. As noted under the source reduction opportunity, "Inventory Control," commercial chemical products that are returned for reclamation or recycling are not solid wastes. An operator that manages chemical products properly will avoid the unnecessary generation of unused chemical that must be disposed of. In many instances, those chemical wastes would be hazardous and subject to stringent regulation.

Scrap Metal and Drums -Scrap metal is a relatively easy waste to recycle. Many operators have found that scrap metal recycling companies will collect and remove materials such as tanks, drums, and other types of scrap metal from the lease at no charge to the operator. An additional consideration is regulatory requirements. Scrap metal that is recycled is not subject to hazardous oil and gas waste regulations; but it is if disposed of. For example, an old steel tank coated with lead-based paint would likely be determined hazardous if disposed of; however, if recycled it is excluded from regulation as a hazardous oil and gas waste.

The RRC"s Waste Minimization Program can help operators identify recycling options. The Texas Commission on Environmental Quality (TCEQ) publishes two useful documents: Recycle Texas and RENEW.Recycle Texas is a listing of many of the companies that take various wastes for recycling. Those wastes include many that are typical of oil and gas operations. RENEW is a waste exchange that is published quarterly. RENEW lists companies that have generated wastes and are making them available for recycling, and RENEW also lists companies that want certain wastes for recycling. Recycle Texas and RENEW are available free of charge from TCEQ and can be obtained by calling 1-800-648-3927.

Training is probably one of the best waste minimization opportunities. An operator"s efforts to minimize waste and gain the associated benefits will be only be effective if the people in the field understand waste classification and the concept of waste minimization. Also, people in the field should be empowered to implement waste minimization techniques as they are identified. Waste minimization training is becoming more common. Oil and gas associations have begun publicizing waste

8613371530291

8613371530291