workover rig cost per day price

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Workovers are the most common expenditure operators need on their oilfields. However, finding a service provider and getting their rates are not readily available in the industry. Operators would benefit from knowing the market average for a workover and gain reassurance they are getting a fair price for their services. This research is based on finding workover rigs for Zapata, Texas. The graph represents four service provider companies and their hourly rate for a workover rig.

It is important to note that due to slower oil development in recent years from the downturn in 2015 to the pandemic and downturn in 2020, smaller workover rig companies in Zapata, Texas have increasingly moved to the Permian Basin or have been acquired by larger service companies in the area. This has caused the workover rig service industry to be dominated by a few major servicers around Zapata. For Zapata, the ideal areas to look for servicers or workover rigs are Alice, Laredo, and Freer in Texas.

Hourly rates for workover rigs vary and there are always competitors for services, especially for services as common as a workover rig. The market average price for a service provider is intended to provide the oil and gas operator better insight on the cost of services around their area.

An operator who wanted bids on a workover for his well requested this vendor list and decided to get connected with Company B to get the work done. He said it was a quick decision because what he was already paying for and what he was going to pay for cost more than the rates on this list.

In order to help oil and gas operators reduce operational expenditure, Petrofly researches the servicing market to provide the most economical options for your oilfield service needs. Petrofly’s platform is the complete upstream solution and leveraging the market average is one of the unique tools operators utilize to ensure lower operational costs.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Well work and well servicing is a complicated subject and there are a lot of moving parts. It is potentially so complex that many oil and gas companies seek to avoid it altogether when they can. A thorough understanding of the rank order of the options available, and what they can do is the key to being able to unlock tremendous value. A few ‘simple’ or fortunate’ or ‘clever’ oil and gas operations can be set up where operations are simple – drill a well, complete it, produce it to abandonment pressure and conduct abandonment. For every other situation well servicing is the key to profitable operations. This is a very general way to look at the cost of well servicing, and how it affects operations in the field. The exact details will vary from country to country, field to field, region to region and company to company.

The following general group of services are available for well work. They are listed roughly in order of cheapest to most expensive for land operations.

In shallow waters with fixed platforms or other facilities with direct well access the chain of costs and values are slightly different - the overall costs are generally higher, but the general ‘ladder of values; is different also.

Pumping services tend to get more expensive offshore, because of the degree to which the equipment must be assembled on location. Wire based services still require assembly, but because the parts are smaller can usually be mobilized in larger ‘chunks’ thus requiring less assembly on location. On land, fluid pumping equipment is much more readily portable on trucks or trailers. Workover rigs on land are incredibly cheap in most places as measured on a per diem basis. Part of their advantage is that they arrive to location with most of their key components already assembled in/on one truck. This advantage disappears offshore where the rig must be assembled on site first.

In deep-water with subsea wellheads where there is no permanent facility available to access the well, costs are turned on their heads, and look roughly as follows:

Paying for a drilling rig or intervention vessel is the price of gaining physical access to the well. Everything else must be added to it to get physical access to the general area and then gain access to the well. There is no need for various forms of standalone pumping services because the vessel or rig will already have a cementing unit and/or the mud pumps available for that sort of work.

Performing the same operation over and over again has significant cost savings attached to it. Once the correct housing and supply arrangements are in place, and all the necessary people and equipment have been assembled, continuing to use it altogether ‘as is’ can save an enormous amount of money compared to dispersing it all and starting over again later. For land operations, this is most pronounced in areas where reservoir, surface, and operational practices allow for grouping wells together in relatively small areas, and for clustering well pads. Depending on what work is being done to the wells and how close together they are it may be possible to ‘hop’ from one well to the other without ever moving the equipment on a road or doing a complete rig-down.

This is one area where offshore operations can see tremendous improvements and synergies. Having facilities with multiple wells at a single physical location allows for extremely high levels of flexibility economies of scale if the same sorts of equipment and skills can be utilized on one well after another in succession.

Deepwater operations can benefit from this too, but not as much as ‘traditional’ fixed or surface access facilities, because the overall day rate of the rig or intervention vessel is often much higher, and the process of switching between wells is often much lengthier.

On land, you hire the unit and crew, and a small diem fee is added to the cost of employing them so they can stay in a hotel and get food when they are not working. The crews will transport themselves to and from the well and move the equipment to and from the well also.

Offshore, housing, food, and transportation to and from the wellsite must be arranged as part of the work to be performed. This involves contracting crewboat(s), work boat(s) helicopter flights, catering services, and crew quarters buildings with a galley, laundry, showers, toilets, etc. Extra space must be allocated or created at or near the wellsite facility for the extra quarters. Many of these same factors are also present in remote land locations. The nature of operations in the Sahara Desert, or the North slope of Alaska, or the Congo jungle are more like those offshore with respect to cost and access than they are to more ordinary land operations where ‘normal’ food and housing operations catering to the population of the area in general are accessible.

For deepwater, everything for offshore must be provided, but with the additional difficulty that none of it can be made permanent, because there are no permanent surface facilities. In addition, simply getting to the wellhead once you have a drillship, semi-submersible, light well intervention vessel or other type of access facility floating over the top of the well is a considerable challenge. Depending on the nature of the operations which must be conducted, the access method, and the weather and current conditions it may take a period ranging from a day or two, to several weeks before access to the well is accomplished and the well work itself can start.

The costs of conducting business in each of these 3 areas tend to scale very roughly in factors of 10. 100 wells making 50 bbls of oil each on land is a cash cow. Offshore that is a disaster, because the cost of servicing those wells is prohibitive. A more reasonable scenario is 10 wells making 500 bbls of oil each. In deepwater, a well making 500 bbls of oil a day is an abandonment candidate, if indeed it got that far along before abandonment. One well making 5,000 bbls a day is more. The direct cost of hiring (for example) a snubbing unit do not scale by factors of 10, but the overall cost of employing a snubbing unit do. As a result, different types of well servicing make sense in one area which may not make sense in another. On land in areas with ordinary access to infrastructure (not the Sahara or Alaska) operations like slickline are often so cheap that they are a routine procedure, with preventative or predictive maintenance schedules to scrape away paraffin or remove small amounts of scale. By contrast, it is completely cost prohibitive to try and attempt to perform similar work in deepwater – you either design and operate the well in such a way that paraffin and scale do not build up in the wellbore at appreciable rates, or you P&A the well. The cost of routine mitigation is simply too high. The relative cheapness of most workover rigs on land is another major factor. Many types of operations which could in theory be carried out in some other way are done with a workover rig simply because it is the most cost-effective technique, even if other methods might be faster, or involve fewer people. The relatively high cost of a rig for offshore facilities means that in most cases every effort short of getting a rig is tried first. Then a catalogue or list of operations to be conducted by a rig at a given facility will be gradually built up over time until they reach a critical level. At that point, a rig will be sent out to conduct all the operations which only it can perform, moving from one well another to save costs by making the work repeatable.

Oil rig equipment is expensive due to the size and operations carried out by such large machinery. Purchasing a newly constructed drill rig is a huge investment.

As such, you’ll want to be sure you have the right expectations before you begin searching for one to complete your assignment. This article will discuss just what a drill rig does and the estimated costs involved in the drilling process.

When you need a machine powerful enough to bore through the earth’s crust to retrieve minerals, gas, or any other natural resources, a drill rig will get the job done. Each rig is designed for the environment they’re operating in and the product being extracted. Those two factors greatly affect the cost of the rig you’re looking to purchase.

A standard land rig with 1,500 to 1,700 horsepower will cost between $14 million and $25 million to own. An offshore oil rig cost is much higher, starting at $20 million and going as high as $1 billion. Owning your drill rig will save you money in the long run, especially when considering the daily cost of operations.

Your daily rate depends on the rig type, distance from shore, drilling depth, and water depth. Onshore drilling rates range from $200,000 to $310,000 each day. Offshore drilling can cost between $600,000 to $800,000 per day.

Several factors impact the oil rig cost, including construction, including materials, market conditions, equipment prices, and more. We’ll cover the basics, so you have a realistic expectation when searching for a rig price.

Cost and demand go hand-in-hand. When there is a high demand for building new rigs, the cost rises because a limited number of shipyards can provide the service.

For example, in the early 2000s, there wasn’t a demand for new rig construction, so rates were low. In the mid-2000s, demand increased, and prices rose, but after the 2008 recession, demand decreased. But the prices didn’t drop significantly as the recession wasn’t expected to last long.

The materials used in making a drill rig are a key component in construction costs. The material used most, steel, comes in various strengths, and the stronger the steel, the higher it’s priced. When steel prices are low, rigs will be cheaper to produce; when steel prices rise, so do the costs of the rigs.

Concrete is another material that will raise production costs. It’s often used in environments containing salt water as a way of avoiding corrosion and rusting. Concrete usually costs about 7% to 10% more than steel.

The cost of additional services needed for constructing wells will begin to add up. Phone bills and fees for transferring data are part of your communication cost. For those working offshore, rig positioning will be another fee.

There are two types of oil rigs, jackups, and floaters. Floaters aren’t attached to or resting on the seafloor. Jackups have support legs that allow the rig to be raised or lowered. Each type has different equipment to assist with the drilling process.

The engines, generators, cranes, and other oil rig components are purchased from a third party and assembled by the rig builder. Non-drilling related equipment is about 30% to 60% of the total cost.

Since most of the parts used are made from steel, the fluctuations in the steel market will influence the rig’s price. Demand for the additional equipment to fit on the rig will also play a part in costs.

Where your rig is built impacts the labor costs, which affect the price of the drill rig. It’s estimated that labor is 10% to 15% of the total cost of the rig is built internationally. While the U.S. and Korea have similar costs, Singapore charges three times less.

Each dollar spent on labor in the U.S. generates $3 in revenue, while in Singapore and South Korea, every dollar generates $7 to $10 in revenue. Since labor costs are typically lower internationally, the cost of your rig won’t be as high.

Always expect and prepare for the unexpected by setting aside a portion of the budget for allowances. Once you start drilling, you can’t be sure what you’re going to find, and variances in the geological structure could require different equipment and delay the process. Both of these instances will increase the cost of the rig being used.

Preparing an area for drilling can mean building roads to the site. These roads need to support heavy machinery and can take 15 to 20 days to build. Preparation also varies based on the environment.

Marshes, land, and offshore drilling all have their own preparation needs. It can take several weeks before drilling can begin, and each day spent getting the site ready comes with a hefty cost.

The drilling depth and well complexity are primary cost influencers. Once the drill rig is moved into position, it can take a team of 30 to 40 companies to complete the process. Costs can easily top $4 million during the drilling phase and take about three weeks to finish.

Positioning drilling rigs isn’t an easy task. It takes 3 to 5 days to move in and assemble a rig for well digging. Once the job is complete, the rig has to be disassembled and moved again. Rates hover between $100,000 and $350,000 depending on how far the rig is being transported.

The oil industry is very lucrative, and the machines used to drill for the resource are not cheap. Oil rigs are heavy-duty machines needed to reach extreme depths.

The harsh environments they’re in demand that they are built with the best materials available. If you need a drill rig, it’s important to keep in mind all the factors that contribute to the cost of the equipment so you can budget correctly.

Well Service | Workover Rigs - 844/80 Double drum draw works. looks to be recently rebuilt. Has new Lebus Grooving on Tubing Drum. Comes w/ 250 HP 2 speed jackshaft/RA BOX. More Info

Well Service | Workover Rigs - CARDWELL KB200B Freestanding Oilfield Workover Rig / Service Rig / Pulling Unit, Service Rigs, Used Cardwell KB200B Freestanding Service Rig, 5 Axle Carrier, Detroit 8V71... More Info

Well Service | Workover Rigs - WELL SERVICE RIG - COOPER 350 Well Service Unit p/b DETROIT 8V-92 Diesel Eng, ALLISON 750 Trans, 42X12-38x8 DRAWWORKS w/dual disc assist, 97â 200,000# Telescoping M... More Info

Well Service | Workover Rigs - CROWN 350 SERIES -- SERVICE KING 104" 205,000# DERRICK, CAT3406, ALLISON 5860,38X10 DOUBLE DRUM DRAWWORKS, CROWN SHEAVES REBUILT 2013 MAIN26âX4,SANDLINE 22â, NE... More Info

Well Service | Workover Rigs - 2008 Crown/Cabot 1058 Service unit mounted on 4 axle carrier w/Detroit 60 Power. New 5860 Drop Transmission. 72" Double rod/single tubing Derrickmast 125000# Rig is in Ex... More Info

Well Service | Workover Rigs - WELL SERVICE RIG - FRANKS 1287-160-DTD-HT D/D Well Service Unit p/b DETROIT 8V-71N Diesel Eng, ALLISON CBT-4460-1 Trans. SERVICE KING 96" 180,000# Hydraulically Raised & ... More Info

Well Service | Workover Rigs - FRANKS 300 D/D 1287 w/hydromatic brake, Well Service Unit p/b DETROIT 8V-71 Diesel Eng, ALLISON 750 Trans, (Reman Dec 2011) FRANKS 96âH 150,000# Tri-Scope Telescopin... More Info

Well Service | Workover Rigs - FRANKS 658 D/D Well Service Unit p/b CAT 3406 Diesel Eng, ALLISON HT-750 Trans, FRANKS 96âH 180,000# 4-Leg Telescoping Mast, Hydraulically Raised & Scoped w/4-Sheave... More Info

Well Service | Workover Rigs - FRANKS 658 D/D Well Service Unit p/b Series 60 Detroit Diesel Eng, ALLISON 5860 Trans, 102âH 225,000# (on 4 line) Telescoping Mast, Hydraulically Raised & Scoped, Db... More Info

Well Service | Workover Rigs - IDECO H35 96̢۪ 210,000 MAST, DETROIT 60 SERIES ENGINE, ALLISON 5860 TRANSMISSION, REFURB 2005, IDECO DERRICK REPLACED WITH NATIONAL DERRICK, TUBING DRUM CON... More Info

Well Service | Workover Rigs - IDECO RAMBLER H-35 Oilfield Workover Rig / Service Rig / Pulling Unit, Service Rigs, Used Ideco Rambler H-35 workover rig / service rig / pulling unit, 4 axle carrier, De... More Info

Well Service | Workover Rigs - 2015 INTERNATIONAL PAYSTAR 5900 Flushby Unit. C/w 2003, Refurbished in 2015, Western Fab Ltd. flushby unit, s/n 03-09-1008, 50 Ft. Mast height, 50,000 lb. pull rating, fr... More Info

Well Service | Workover Rigs - 2005 KENWORTH T800 Flusby Unit. C/w Lash Ent. flushby unit, 47 ft mast, slant compatible, 3x5 Gardner Denver triplex pump, 5000 psi, 2005 Advance 8m3 tank, TC 406 code, P... More Info

Well Service | Workover Rigs - 2003 KENWORTH T800 Flushby Unit. c/w Online flushby unit, 47 ft. mast, slant compatible, Pullmaster HL25 wotking winch, Pullmaster PL5 catline winch, 2002 wabash two comp... More Info

Well Service | Workover Rigs - 2005 KENWORTH T800B Flushby Unit. c/w Online flushby unit model 50-50, s/n 24641, 40 ft. mast,Salnt compatable, Pull master HL25 and PL5 winch, Gardner Denver 3x5 triplex... More Info

A workover rig. Operating rates vary. Petrodata Offshore Drilling Fleet Day Rate Index offers monthly updates of competitive mobile offshore drilling fleet day rates and utilization across four rig.

Using econometric analysis, we examine the effects of gas and oil prices, rig capacity utilisation, contract length and lead time, and rig-specific characteristics on. More than % of surveyed drillers expect to put more rigs to work over the next US land rig day rates on average—aggregated across all rig classes and all. The value lossr(i, last) is equal to the estimated flow rate of well r multiplied by its iddle time once it is assigned to the last position of workover rig i. This idle time is. A discussion of crude oil prices, the relationship between prices and rig count, Workover rig count is another measure of the health of the oil and gas industry. Table 2. Sample Operations Sequence--. Mechanical Descaling. COST. TOTAL COST. UNIT. RATE. MOBILIZATION-OEMOBILIZATION. Workover Rig. 20 hrs.

More than 75 years ago, it was. This allows increased recovery rates. Both drilling rigs and workover rigs are expensive resources that are typically limited well in the field, then we may be able to maintain the field production rate. United Kingdom operating over 25 drilling and workover rigs and providing a Marriott offers a selection of business arrangements from traditional day rate. Offshore Rig Fleet. Accommo- dation. Jack-up. Super. Self-. Workover. Jack-up The improvement in rig rates that has characterized our North American. The rigs have initial positions and.

The wells have different loss rates, need different services, and may not be serviced within the horizon. On the other hand, the number of available workover rigs. On a drilling rig, he or she may be responsible for the circulating machinery and the conditioning of the drilling or workover fluid. derrickman: n: see of drilling fluid and utilizes the hydraulic force of the fluid stream to improve drilling rates. To combat this CERP, as announced. All Drilling Rigs Trailer Mounted Rigs Carrier Mounted Rigs Workover Rigs Rebuilt IHS Markit can provide current and historical day rates for all offshore rig.

Specialties: Workover Rig, Swabbing Units, Air Packages For more information on rates and availability please call (701)8 7201 or email any questions to. The company owns 3 drilling rigs, 3 workover rigs, as well as special-purpose Availability of the Top drive allows drilling wells at high rate and reduces the risk. Cost Analysis The overwhelming majority of the equipment is manufactured by third parties. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source. Offshore Rig Day Rate Trend Coverage. IHS Markit can provide current and historical day rates for all offshore rig categories worldwide. Most workover rig horsepower falls within the range of the 500 series.

OSLO, Sept 14 (Reuters) - Rental rates for offshore oil and gas rigs could rise to $500,000 in the coming months, company executives said on Wednesday.

Daily costs to hire a rig, known as the dayrate, have already more than doubled from two years ago to some $300,000, with some top-end rates reaching close to $400,000, according to Oslo-based brokerage Pareto Securities.

Drilling companies are in a stronger position to demand higher rates to rent their equipment after several lean years led to a wave of mergers and pushed them to scrap older rigs, leaving fewer available now that demand is rebounding. read more

WILSON WELL SERVICE RIG (Ref#3000Ta) 103’ x 248,000# derrick, Out of service since 2017, lot of rust, will start and run and/or drive down the road POR

Refurbished, 700 hp, Double drum 2042 drawwroks with Parmac 202 brake assist, (2) Caterpillar 3406 Engines, (2) rebuilt Allison 750 6 speed auto transmission with reverse. 112" x 300,000 # hook load capacity on 8 lines, clear height 97 feet, leg spread 7" 6-1/2", racking board, oil bath chain case, elevated rotary drive, all raising lines and guidelines. The Draw-works, hydro-mantic break, and crown assembly have been rebuilt. Heavy duty Draw works drive propeller shaft through right angle gear box, rotary drive propeller shaft, heavy duty reverse gear box and oil bath roller chain, and a self-locking handling winch. Mounted on triple front axle mechanical 6 axle carrier with 134,000# capacity designed to meet highway safety standards with necessary toughness for off road operations. Price: $265,000

Derrick fell onto rig when being raised, derrick would need to be replaced or repaired. Built 1981, double drum, 42 x 12, 42 x 8, swab drum removed from jack shaft, 5-axle back in carrier, 250,000# derrick with double racking board and triple rod basket, Cat 3408, CLT 5860 transmission, Cooper right angle box, 4 hydraulic leveling jacks, air rod transfer in derrick, hydraulic winch, Kerr 6 cyd 10000 psi Mustang pump powered from jack shaft, Kerr 3-valve release 10,000 psi, tong carrier f/Foster, steel work platform, Parmac 22 SR hydromatic brake. Extra rebuilt 3408 Cat engine. Price as is: $112,500

Double drum, 15,000’ of new 9/16” line, near new 4-line blocks, mounted on 5 axle Crane Carrier, 104’ x 250,000# mast, 750 Allison transmission, Detroit 60 series, currently operating Price: $130,000

Manufactured 1981, mounted on 5 axle carrier, double triple service rig, 96’ x 250,000# derrick, Detroit Series 60 12.7 diesel engine, Allison transmission, 9/16” sandline, 1” drill line, hydraulic jacks, hydraulic catwalk, travelling block, tubing bard, rod basket and all necessary lines. Tooling not included. Price: $115,000

Manufactured 1983, double drum, 96’ x 180,000# derrick, mounted on 5 axle carrier with 92T engine, Allison transmission Price rig only: $300,000 Price with tooling:$340,000

WILSON 42 WELL SERVICE RIG(Ref#7562Ta) Manufactured 1975, 180,000# Pemco double/triple derrick, mounted on Wilson carrier with Detroit 8V71 engine, 4 hydraulic leveling jacks, ready to work Price rig only: $74,500 Price with tooling: $94,500

Manufactured 1983, 70" x 120,000# non telescoping stiff mast, double drum 26 x 8, Detroit 6V71 diesel engine, 740 Allison transmission with Spicer power divider, mounted on 4 axle carrier. Rig runs and truck drives, stacked for several years, good condition Price: $93,500 USD

110’ x 250,000# Cooper derrick, Detroit 60 Series engine, 6061 Allison transmission, 6 axle Pettibone carrier, 3 front and 3 rear axles, drop box converted to air control, tubing drum, sand drum, 24” Wichita clutches Price: $315,000

FRANKS 500 WORKOVER RIG(Ref#7615Tc) Built 1980, refurbished 2018, 102’ derrick, 150 ton blocks, 15,000’ sandline, new engine and transmission, ready to work Price: $430,000

FRANKS 400 WORKOVER RIG(Ref#7615Ta) Built 1979, refurbished 2017, 102’ x 215,000# derrick, 100 ton blocks, 15,000’ sandline, 4 lines Price: $390,000

FRANKS 300 SERVICE RIG(Ref#1169Ta) 4-legged derrick, Series 60 Detroit engine, 6850 Allison transmission, blocks, Foster tongs, mounted on 4 axle carrier, working condition Price: $37,500

WILSON MOGUEL 42 WELL SERVICE RIG(Ref#3177Tb) Two available, 96" x 280,000# mast, Detroit Series 60 engine, 5860 Allison transmission, mounted on 5 axle Wilson carrier, handling tools Price: $315,000

WILSON SUPER 38(Ref#3307R) Double drum drawworks, friction clutches, Foster makeup and breakout catheads, Cummins 250 disel engine, Spicer 4 speed transmission, 70’ cantilever mast, 4-sheave crown block, racking board, mounted on 8’W x 22’L tandem axle trailer with folding walkways, mast base, 4 manual jacks, Budd wheels, National Ideal 75 ton 3-sheave block with hook, Price: $45,000

Workover rig with 83’ telescoping derrick, 10’ crown extension, 200,000# lift capacity, 100,000# snubbing capacity. Catwalk with 42’ reach, forward and revere motion, hydraulic pipe slide, six portable pipe racks, powered by workover rig. 5000 ft/lb hydraulic rotary, 15k psi working pressure capability kelly hose, 300 ton mast with 5 x 5 heavy wall box tubing and 2 x 2 heavy wall cross sections, (2) mast raising cylinders, 9-1/8 x 25’ telescoping cylinders/crown sheaves with cable guides, (2) winch sheaves/snubbing sheaves, SRS fall protection, retractable flow tube design, non-swivel boom pole on curb side winch, (2) mast supports, 1” lifting cables, mounted on 5 axle Crane Carrier (3rd axle drop), with 375k Volvo Penta engine, 150 gal fuel capacity, hydraulic self-leveling components, 6 speed Allison transmission, 1:1 gear box, (2) 65 gpm pumps, (2) 30 gpm pumps, (1) 28 gpm Commercial shearing pump, 40 gal accumulator storage, single man cab, hydraulic leveling jacks Price on Request

COOPER LTO-350(Ref#3177Ta) Manufactured 1982, 96" x 200,000# mast, Detroit Series 60 engine, Allison 5860 tranmssion, mounted on 4 axle Cooper carrier Price: $315,000

Manufactured 1960’s, double drum, single rig mast, 64’ x 250,000# (tubing and rod racks), 70 ton blocks, 2 lines, Detroit diesel 60 gpm @ 2000 psi, hydraulic system, air clutch. Rig was refurbished 2013/2014 at a cost of $130,000: repairs included used 65’ derrick installed, new 1” main line, repairs to air system, hydraulic system upgrade, leveling jacks, derrick ljghting, tires, 70 ton blocks installed. But the rig has been sitting since 2015 and now needs rebuilding. It doesn’t run. Price as is: $19,500

Manufactured 1980, completely refurbished 2004, 5 axle double drum well service unit, double 15 Parmac brake on main drum, 96" x 180,000# hydraulic raised mast, mast lighting, Detroit 60 Sereis engine, 5860 Allison 6 speed transmission, 4 hydraulic leveling jacks, dual manual outriggers, PD12 Braden utility winch, McKissick 100 ton tubing block 21-31 diving, 1000" of 1" tubing line, 13000" of 9/16" sandline Price: $225,000

CARDWELL KB200B SERVICE RIG(Ref#11674Ta) 72’ x 140,000# stiff mast, 40 x 10 double drum drawworks, 2 aux deck winches, tubing board, rod board, cat walks, railing, stairs, floor BOP controls and accumulator bottles, McKissick 75 ton tubing block and hook, mounted on 5 axle carrier, Detroit 8V71 diesel engine, Alliston CLBT4460 auto transmission PRICE: $127,500

Rig manufacture 1980, mounted on 1980 GMC Brigadier with Cat 3208 engine, includes elevators & misc tools, also includes 1996 1-ton Super Duty tool truck, tandem axle, Cat 3208 diesel, sitting 1-1/2 years Price: $92,500

1980, 475 hp, single drum (new), reworked, 96" x 205,000# hydraulically raised mast, 6 lines, crown block: 3 new sheaves blocks and bearings, racking board, guide wires, (2) hydraulic hoist, weight indicator, block, elevator links, fall safety device, work platform, mounted on 4 axle carrier with Detroit Series 60 diesel engine, Allison transmission, rig in excellent condition and has been well maintained, ready for use PRICE: $115,000

SKYTOP BREWSTER RR400(Ref#13190T) Mounted on 4 axle carrier, single drum drawworks, 8x7 disc assisted brakes, tubing board, Cat3406B engine, Allison 860DB transmission, 100 ton McKissick block, Foster 58-92R tongs, misc hand tools, approx 36" base beam for rig, ready to work Price: $110,000

Refurbished 2017, 4 lines, 96’ x 205,000# mast, 8V71 Detroit engine, mounted on CCC, 75 ton McKissick blocks, tubing board, rod basket, work platform, rigged up and working in field Price: $295,000

Manufactured 1977, 72’ x 125,000# derrick, 8V71 Detroit engine (rebuilt), Allison 750 transmission, 6500’ of new 5/8” sand line, tubing line new, drum brakes new, new style McKissick blocks, working daily Price rig only: $157,500

Double drum drawworks with hydromatic brake, 10" brakes, 96" x 180,000# derrick, mounted on 4-axle PEMCO carrier with hydraulic support legs, 8V71 Detroit, 4460 Allison transmission, Spicer 784 split shaft gearbox, 250 hp right angle drive, 650" of 7/8" tubing line, 8000" of 9/16" swab line, 100 ton Sowa block, hydraulic winch, hydraulic weight indicator, 84" links, 2-3/8" and 2-7/8" tubing elevators, BJ tubing slips, Foster 5893R power tongs with lift in derrick, rod hook, rod stripper, rod elevators, wrenches, transfers, rod fishing tools, misc hand tools and connections Price: $140,000

Manufactured 1974, double drum drawworks, double triple 96" x 180,000# derrick with a hydromatic. The rig has working line with heavy traveling block and approx. 12,000" 9/16 sand line. Mounted on Skytop carrier with tandem steering and rear ends 4 axles W/ tag axle, 4 leveling jacks, powered by an 8V-71 with a Allison 4460 transmission, (note transmission was overhauled in early 2000"s) and the engine has a new head on right bank. The rig has two leveling jacks on the rear and two leveling jacks on the front which are located right behind the steering axels. Tooled out with hydraulic rod and hydraulic tubing tongs, air slips, rod and tubing elevators, hand tools and misc over items. PRICE REDUCED: $115,000

Double drum, double pole 8-5/8" x 7 x65", 6,000" of 2-7/8" line, mounted on 1974 International Model 2070A tandem axle truck with Detroit diesel engine, leveling jacks, 454 Chevy propane engine on deck with 250 gallon propane tank, automatic transmission for smooth operating, Foster 58 power tongs, Guiberso air clips, tooled for tubing and rods, will do 6000" of 7" tubing, currently working Price: $89,500

Double drum, 70" pole, 4000" of new line, new power tongs, mud pump, power swivel, new 8.3L Cummins deck engine, mounted on 1979 Mack superliner with 400 Cummins engine, 13 sp transmission, completely tooled, 10 new bits, 4 drill collars, ready to work Price: $170,000

10 x 13 pole, double Drum, Franks 33” air over grease, brakes in good shape, 7/8” tubing line, tubing blocks, tong pressure adjustment, hi/low on tubing, air slips control, master kill on drawworks, Foster 36 with 8’ lift ram, air backup, swing around tong rack, mounted on 2001 Freightliner F80 truck, Cat C12 Series 3125, Fuller 9-speed transmission, PTO, winch for pole scope Tulsa 48, blocks raise pole, dual fuel tank, dual battery, 50 gal hyd tank, toolboxes, hydraulic outriggers, BJ rod tongs, ¾” and 7/8” heads, tools, swabs, extra tongs, orbits, drilling head Price: $242,500

Double drum (second drum is removed, rig is running as single drum), hyd pole and down riggers, mounted on 1990 Crane Carrier, 9 sp Eaton Fuller transmission, 100,000 miles, 8 x 10 telescoping poles, 3/4” cable, no tooling Price: $52,500

10 x 13” pole, single drum, mounted on 1980 Brigadier 9500 Series truck with 671 inline Detroit, drop box, travelling blocks, tubing lines, hyd jacks, no tooling, sitting since 2000 PRICE: $49,500

Manufactured 1960, Double drum, all air operated, 7/8" drill line, 9/16" sandline, 60" single pole 10 x 13, mounted on Franks 3 axle carrier, will handle 8000" of 2-3/8" tubing or 6000" of 2-7/8" tubing, tools include tongs and handling tools, good condition Price: $69,500

Cable Tool Drilling and Completion Rig, 60" double poles rated to 150,000#, 5000" drill capacity, 10,000" pull capacity, propane Waukesha 145 engine, 500 gal propane tank, trailer moutned with International 4300 truck, last drilled 2012, 2300" drill line on drum, 3500" on spool casing drum, heavy block sandline drum, cat heads each side, tooling, spare engine Price: $72,500

Triple drum, casing line, sand line, drill line, 8-10” double poles, mounted on International tandem axle truck with Cummins diesel engine, 10 speed transmission, Perkins diesel engine on deck, tools, 7-7/8” carbide bit, 2 smaller bits, make up tools Price: $42,500 – West Texas

400’ of 7/8” block line, 9/16” sandline drum (no cable), 2000’ of ¾” drilling drum, 3 McKissick sheaves, air clutches and controls, mounted on 1961 Mack truck with 250 hp Cummins engine, older rig but runs good. Includes elevators, oil saver pump, no BJ tongs, currently working. Price: $87,500 - Pennsylvania

Triple drum, friction clutch, cathead (sandline holds 2400’ of 5/8” line), mounted on tandem axle Chevy truck with 427 gasoline engine, 8-5/8” x 45’ single pole, new tires, power steering, wireline unit, good usable rig for shallow oil/gas lease, drills, workover, swab capabilities, no tools Price: $112,500 - Oklahoma

Updated monthly, the Offshore Rig Day Rate Trends report tracks competitive mobile offshore drilling fleet day rates and utilization across three representative rig categories. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source.

Day rates published by IHS Markit are presented in good faith based on our best understanding of the market at the time, and may be subject to adjustment. Day rates are charted as an average of the high and low for each month. Utilization is the percentage of contracted rigs out of the total competitive fleet supply. The data is updated on or about the 15th of each month. The data points used to derive the averages are available to subscribers to Petrodata"s RigBase or RigPoint market intelligence tools.

The Downstream costs services team would like to invite you to our Houston Enclave Parkway office for the Third Quarter 2022 Downstream Costs Update...

{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales

[num]","alt":"Call Sales

[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"chat","enabled":true,"desc":"Chat Now","mobdesc":"Chat","mobmsg":"Welcome! How can we help you today?"}, {"name":"share","enabled":true,"desc":"Share","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html&text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"email","url":"?subject=Offshore Rig Day Rate Index | IHS Markit&body=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

When will the market see a resumption of the top-tier rig newbuild programs that flooded the market in 2012–2014—what price point on day rates would trigger same? Platts RigData RADAR notes that day rates have indeed rebounded nicely, and especially for AC rigs.

Its sister publication, the Day Rate Report, noted the average day rate for 1500 hp rigs led the way up for all rig classes in Q1 of this year with a cumulative net day rate gain of +7% to $16,718. The average day rate for a 1,500 hp rig in 2014 was $22,564, and the top rate at peak in October 2014 was $26,000. The larger issue is that too many top tier rigs are still sidelined.

Even with recovery, the active rig count is less than half the average of 2010–2014. There were a little over 1,000 AC rigs of all sizes in the total fleet a year ago. In that year-ago snapshot, about 400 AC Class D rigs of recent vintage were cold-stacked; in the latest snapshot, that group has dwindled to 144. The ratio of all working rigs to stacked rigs has fallen from 5:1, but it remains as high as 2:1. Platts RigData estimates that the overall rig count, still dominated by Class D rigs, will need to reach about 1,200 before demand—and day rates—warrant another robust newbuild program.

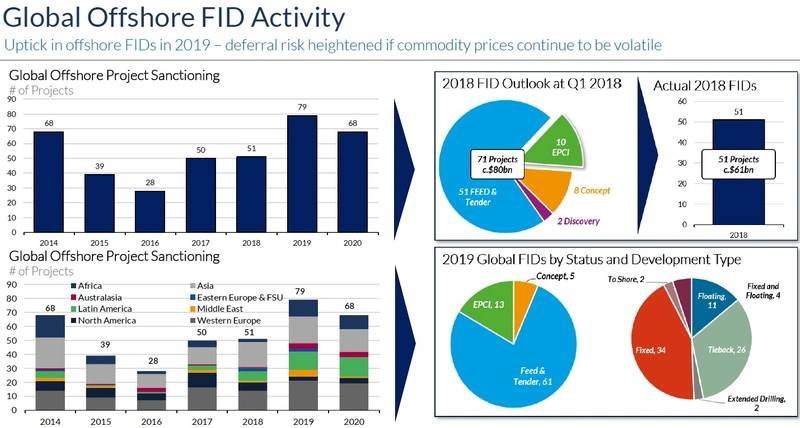

Oil prices are expected to remain between $60/bbl and $80/bbl into the early 2020s before rising, and offshore spending between 2019 and 2023 is projected to hit $1.5 trillion, said Steve Robertson, head of rigs and wells, during a Thursday briefing in Houston covering insights from Westwood’s RigLogix platform.

However, operators are approaching offshore projects differently as a result of the prolonged downturn. Costs were slashed and some projects went back to the drawing board.

Rig counts are also “moving in the right direction,” says Terry Childs, head of RigLogix. Drillships have seen the best improvement, rising to 64% utilization in April 2019, and the total fleet is up 9% since 2014, he said.

Since 2014, 235 rigs have been retired, including 59 last year. There are 114 rigs coldstacked. If those were removed from the supply, utilization rates would jump from 60% to 70%, Childs said, but there would still be a 210-rig surplus.

Indian jackup tenders are “generating absurdly low” day rates in the $20,000/day range, he said, while the Middle East jackup market will be the most active with the most recent high-spec rigs fetching $78,000/day to $85,000/day. Jackup demand in Southeast Asia is higher than it had been, with rates rising from $60,000/day up to around $80,000/day. Rig demand in Southeast Asia is expected to increase this year by 10.5%, he said.

The utilization rate for harsh environment semis for work offshore Norway is 100%, and there may be further competition for those rigs as operators begin drilling leases offshore Argentina, he said.

The floating rig market is looking bullish for Latin and South America and Africa, he said, citing contracts for drilling offshore Brazil as well as Guyana and its neighboring countries.

“In some areas, day rates are already hitting over $200,000, and continued demand for specific types of rigs such as ultra-deepwater jackups is good news for the industry. The fact that some operators are committing to rigs far in advance is a clear sign that they are anticipating further day rate rises,” Robertson said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MJCU3NS2MBNBFATPGEU7BOLGMQ.jpg)

Day rate refers to all in daily costs of renting a drilling rig. The operator of a drilling project pays a day rate to the drilling contractor who provides the rig, the drilling personnel and other incidentals. The oil companies and the drilling contractors usually agree on a flat fee per contract, so the day rate is determined by dividing the total value of the contract by the number of days in the contract.

Day rate (oil drilling) is a metric that investors in the oil and gas industry watch to evaluate the overall health of the industry. The day rate makes up roughly half the cost of an oil well. Of course, the price of oil is the most important metric by far in the oil and gas industry.

That said, investors can gain insights into the oil supply and demand picture by watching metrics like day rate and rig utilization in addition to global inventories. Day rate fluctuations, which can be wide, are used by investors as an indicator of the health of the drilling market. For example, if day rates fall, investors may take it as a sign to exit oil and gas positions.

Day rates can be used to assess the current demand for oil, ultimately gleaming insight into where oil prices are headed. An increase in the price of oil increases the number of projects that can recover their extraction costs, making difficult formations and unconventional oil reserves feasible to extract. The more projects greenlit on an economic basis, the more competition there is for the finite number of oil rigs available for rent – so the day rate rises. When oil prices waver and fall, the day rate that rigs can command drops.

As an example of actual day rates – Transocean signed a contract in December 2018 with Chevron to provide drilling services. The contract is for one rig, will span five years and is worth $830 million. The effective day rate for the rig is $455,000:

Like the day rate, the rig utilization rate is a key metric for determining the overall health of the oil and gas sector. The day rate lays out a large part of the costs of drilling a well, while the utilization rate is how many wells are being used.

Investors use both of these metrics and a fall in each could signal a slowdown in oil demand. High utilization rates mean a company is using a large part of its fleet, suggesting oil demand, and ultimately, oil prices are on the rise. There is a positive correlation between oil prices and both day rates and rig utilization.

The strength of the correlation between oil prices and day rates is not consistent. The correlation is strong when oil prices and rig utilization are both high. In this situation, day rates increase almost in lockstep with prices. In an environment of rising oil prices and high utilization, the day rates in a long-term contract will shoot up even faster than short term contracts as rig operators demand a premium for being locked in on a project.

In a low price environment with falling utilization, however, the day rate may plunge much faster than the oil prices as rigs enter low bids on long contracts just to keep busy in a potential slowdown. Due to the volatility and the varying strength of the correlation, investors and traders can flip between seeing day rates as a leading or a lagging indicator for oil prices and the health of the oil and gas industry as a whole.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time d94a2288d76f819e65e1cc71545d07c7 63.210.148.230 10/22/2022 10:41 AM UTC

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

8613371530291

8613371530291