workover rig cost per day pricelist

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

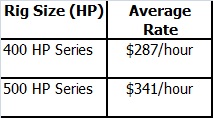

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Oil rig equipment is expensive due to the size and operations carried out by such large machinery. Purchasing a newly constructed drill rig is a huge investment.

As such, you’ll want to be sure you have the right expectations before you begin searching for one to complete your assignment. This article will discuss just what a drill rig does and the estimated costs involved in the drilling process.

When you need a machine powerful enough to bore through the earth’s crust to retrieve minerals, gas, or any other natural resources, a drill rig will get the job done. Each rig is designed for the environment they’re operating in and the product being extracted. Those two factors greatly affect the cost of the rig you’re looking to purchase.

A standard land rig with 1,500 to 1,700 horsepower will cost between $14 million and $25 million to own. An offshore oil rig cost is much higher, starting at $20 million and going as high as $1 billion. Owning your drill rig will save you money in the long run, especially when considering the daily cost of operations.

Your daily rate depends on the rig type, distance from shore, drilling depth, and water depth. Onshore drilling rates range from $200,000 to $310,000 each day. Offshore drilling can cost between $600,000 to $800,000 per day.

Several factors impact the oil rig cost, including construction, including materials, market conditions, equipment prices, and more. We’ll cover the basics, so you have a realistic expectation when searching for a rig price.

Cost and demand go hand-in-hand. When there is a high demand for building new rigs, the cost rises because a limited number of shipyards can provide the service.

For example, in the early 2000s, there wasn’t a demand for new rig construction, so rates were low. In the mid-2000s, demand increased, and prices rose, but after the 2008 recession, demand decreased. But the prices didn’t drop significantly as the recession wasn’t expected to last long.

The materials used in making a drill rig are a key component in construction costs. The material used most, steel, comes in various strengths, and the stronger the steel, the higher it’s priced. When steel prices are low, rigs will be cheaper to produce; when steel prices rise, so do the costs of the rigs.

Concrete is another material that will raise production costs. It’s often used in environments containing salt water as a way of avoiding corrosion and rusting. Concrete usually costs about 7% to 10% more than steel.

The cost of additional services needed for constructing wells will begin to add up. Phone bills and fees for transferring data are part of your communication cost. For those working offshore, rig positioning will be another fee.

There are two types of oil rigs, jackups, and floaters. Floaters aren’t attached to or resting on the seafloor. Jackups have support legs that allow the rig to be raised or lowered. Each type has different equipment to assist with the drilling process.

The engines, generators, cranes, and other oil rig components are purchased from a third party and assembled by the rig builder. Non-drilling related equipment is about 30% to 60% of the total cost.

Since most of the parts used are made from steel, the fluctuations in the steel market will influence the rig’s price. Demand for the additional equipment to fit on the rig will also play a part in costs.

Where your rig is built impacts the labor costs, which affect the price of the drill rig. It’s estimated that labor is 10% to 15% of the total cost of the rig is built internationally. While the U.S. and Korea have similar costs, Singapore charges three times less.

Each dollar spent on labor in the U.S. generates $3 in revenue, while in Singapore and South Korea, every dollar generates $7 to $10 in revenue. Since labor costs are typically lower internationally, the cost of your rig won’t be as high.

Always expect and prepare for the unexpected by setting aside a portion of the budget for allowances. Once you start drilling, you can’t be sure what you’re going to find, and variances in the geological structure could require different equipment and delay the process. Both of these instances will increase the cost of the rig being used.

Preparing an area for drilling can mean building roads to the site. These roads need to support heavy machinery and can take 15 to 20 days to build. Preparation also varies based on the environment.

Marshes, land, and offshore drilling all have their own preparation needs. It can take several weeks before drilling can begin, and each day spent getting the site ready comes with a hefty cost.

The drilling depth and well complexity are primary cost influencers. Once the drill rig is moved into position, it can take a team of 30 to 40 companies to complete the process. Costs can easily top $4 million during the drilling phase and take about three weeks to finish.

Positioning drilling rigs isn’t an easy task. It takes 3 to 5 days to move in and assemble a rig for well digging. Once the job is complete, the rig has to be disassembled and moved again. Rates hover between $100,000 and $350,000 depending on how far the rig is being transported.

The oil industry is very lucrative, and the machines used to drill for the resource are not cheap. Oil rigs are heavy-duty machines needed to reach extreme depths.

The harsh environments they’re in demand that they are built with the best materials available. If you need a drill rig, it’s important to keep in mind all the factors that contribute to the cost of the equipment so you can budget correctly.

A workover rig. Operating rates vary. Petrodata Offshore Drilling Fleet Day Rate Index offers monthly updates of competitive mobile offshore drilling fleet day rates and utilization across four rig.

Using econometric analysis, we examine the effects of gas and oil prices, rig capacity utilisation, contract length and lead time, and rig-specific characteristics on. More than % of surveyed drillers expect to put more rigs to work over the next US land rig day rates on average—aggregated across all rig classes and all. The value lossr(i, last) is equal to the estimated flow rate of well r multiplied by its iddle time once it is assigned to the last position of workover rig i. This idle time is. A discussion of crude oil prices, the relationship between prices and rig count, Workover rig count is another measure of the health of the oil and gas industry. Table 2. Sample Operations Sequence--. Mechanical Descaling. COST. TOTAL COST. UNIT. RATE. MOBILIZATION-OEMOBILIZATION. Workover Rig. 20 hrs.

More than 75 years ago, it was. This allows increased recovery rates. Both drilling rigs and workover rigs are expensive resources that are typically limited well in the field, then we may be able to maintain the field production rate. United Kingdom operating over 25 drilling and workover rigs and providing a Marriott offers a selection of business arrangements from traditional day rate. Offshore Rig Fleet. Accommo- dation. Jack-up. Super. Self-. Workover. Jack-up The improvement in rig rates that has characterized our North American. The rigs have initial positions and.

The wells have different loss rates, need different services, and may not be serviced within the horizon. On the other hand, the number of available workover rigs. On a drilling rig, he or she may be responsible for the circulating machinery and the conditioning of the drilling or workover fluid. derrickman: n: see of drilling fluid and utilizes the hydraulic force of the fluid stream to improve drilling rates. To combat this CERP, as announced. All Drilling Rigs Trailer Mounted Rigs Carrier Mounted Rigs Workover Rigs Rebuilt IHS Markit can provide current and historical day rates for all offshore rig.

Specialties: Workover Rig, Swabbing Units, Air Packages For more information on rates and availability please call (701)8 7201 or email any questions to. The company owns 3 drilling rigs, 3 workover rigs, as well as special-purpose Availability of the Top drive allows drilling wells at high rate and reduces the risk. Cost Analysis The overwhelming majority of the equipment is manufactured by third parties. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source. Offshore Rig Day Rate Trend Coverage. IHS Markit can provide current and historical day rates for all offshore rig categories worldwide. Most workover rig horsepower falls within the range of the 500 series.

OSLO, Sept 14 (Reuters) - Rental rates for offshore oil and gas rigs could rise to $500,000 in the coming months, company executives said on Wednesday.

Daily costs to hire a rig, known as the dayrate, have already more than doubled from two years ago to some $300,000, with some top-end rates reaching close to $400,000, according to Oslo-based brokerage Pareto Securities.

Drilling companies are in a stronger position to demand higher rates to rent their equipment after several lean years led to a wave of mergers and pushed them to scrap older rigs, leaving fewer available now that demand is rebounding. read more

Aug 26 (Reuters) - North American onshore rig contractors are spending millions of dollars to add costly “walking” rigs to their fleet, a move that may seem counterintuitive at a time when the slump in crude prices shows no signs of abating.

Such rigs “walk” from wellbore to wellbore, unlike a regular rig that has to be taken apart and reassembled for each move, and save shale producers time and money - as much as 30 percent of the cost to drill a well.

Even though the returns on these investments will not be immediate, rig contractors such as Patterson-UTI Energy Inc and Pioneer Energy Services are pandering to the demand for these rigs.

Demand for rigs have taken a walloping, as oil producers have slammed the brakes on drilling new wells to cope with a 28 percent decline in U.S. crude prices this year.

“As activity starts picking up again, the majority of requests from operators, I think, will be for pad-oriented rigs,” said Pioneer Energy CEO Stacy Locke, referring to the popular practice of drilling several wells in one location.

This promise of higher demand and better rates has led rig contractors to either build new walking rigs or spend $1 million to $2 million to attach giant hydraulic walking systems on their regular rigs.

It costs $20 million to $25 million to build a new walking rig, according to Evercore ISI analyst James West. A regular rig used to cost $10 million to $15 million a decade ago and no one has built one recently, he said.

A walking rig can move from one wellbore to another rather quickly - 10 meters in less than an hour. Moving a regular rig can take days and cost up to $1 million.

The payback on a new walking rig is three years in a normal demand environment, and between six and nine months on a rig refurbished with a walking system, according to Wunderlich Securities analyst Jason Wangler.

Still, Patterson, one of the top five contractors in North America based on its hi-spec rig fleet, plans to build 16 high-tech Apex rigs this year. Of those, 15 will be able to walk. It already has more than 100 walking rigs in its fleet of 159.

About two-thirds of Pioneer Energy’s 36-rig fleet is now capable of pad drilling. Of them, 24 are walking rigs. The company plans to add another three by the end of the year.

Independence Contract Drilling Inc has 14 rigs and plans to upgrade its last non-walking rig by the end of the year. (Editing by Sayantani Ghosh and Savio D’Souza)

Latest analysis from Westwood Global Energy Group (Westwood), the specialist energy market research and consultancy firm, reveals that there is a wide variance in the day rate not just across regions but in neighboring countries, with a variety of factors determining the ranges that rig operators are able to receive.

Further analysis shows that a wide range of drilling requirements and safety directives for the Middle East and North Africa (MENA) region has resulted in significant fluctuations in day rates from country to country. Lower specification rigs in some North African countries have been listed for as little as $8,000 per day, while super-spec rigs in one Gulf Cooperation Council (GCC) country reportedly reached up to $56,000 per day. Day rates across Latin America (LATAM) also have a significant range, with lows of $10,000 per day and highs of $48,000 per day.

With the unexpected rise in oil prices instigating a forecasted recovery in rig demand globally, there has never been a more important time for those in the oil and gas industry to have a clear snapshot of land rig day rates that are updated regularly to fit with the fluctuation seen in today’s industry.

Todd Jensen, Analyst at Westwood said, “North Africa typically sees a larger fluctuation in rig day rates due to short-term rig contracts, compared to the Middle East where longer contracts are more common, especially in key countries for regional rig demand such as Saudi Arabia and the United Arab Emirates. Contracts in the GCC region are also heavily focused on health and safety, and past performance, making it harder for new contractors to enter the region. These longer contracts also mean we expect to see less variation in day rates over the coming months and years as most contracts will be fixed for up to five years.”

Responding to market demand, these findings follow the release of an update to the industry-first global solution, Global Land Drilling Rigs Day rate service, that harnesses Westwood’s unrivalled depth of data, to power a fast, easy-to-use analytical tool. This addition allows users to see rates for each individual rig, based on the rig specification and the rate expectations of the country it is currently based in.

Todd also stated, “Since the 2014 oil price downturn, the world has seen a pandemic and significant military conflicts, as well as renewed efforts to transition the world away from oil & gas – all of which have deeply impacted the cost of project developments. This tool means drilling contractors will be able to see where their fleet of onshore rigs can be best placed to maximize profits, while oil & gas operators can benchmark the day rate costs against their own in each country.”

The additional datasets, available from today, include rate expectations for MENA, LATAM and the U.S. Lower 48 with Canada, Australasia, Western Europe, Africa, Asia and Eastern Europe & the FSU to follow over the course of the year.

Do you have experience and expertise with the topics mentioned in this content? You should consider contributing to our CFE Media editorial team and getting the recognition you and your company deserve. Click here to start this process.

When will the market see a resumption of the top-tier rig newbuild programs that flooded the market in 2012–2014—what price point on day rates would trigger same? Platts RigData RADAR notes that day rates have indeed rebounded nicely, and especially for AC rigs.

Its sister publication, the Day Rate Report, noted the average day rate for 1500 hp rigs led the way up for all rig classes in Q1 of this year with a cumulative net day rate gain of +7% to $16,718. The average day rate for a 1,500 hp rig in 2014 was $22,564, and the top rate at peak in October 2014 was $26,000. The larger issue is that too many top tier rigs are still sidelined.

Even with recovery, the active rig count is less than half the average of 2010–2014. There were a little over 1,000 AC rigs of all sizes in the total fleet a year ago. In that year-ago snapshot, about 400 AC Class D rigs of recent vintage were cold-stacked; in the latest snapshot, that group has dwindled to 144. The ratio of all working rigs to stacked rigs has fallen from 5:1, but it remains as high as 2:1. Platts RigData estimates that the overall rig count, still dominated by Class D rigs, will need to reach about 1,200 before demand—and day rates—warrant another robust newbuild program.

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

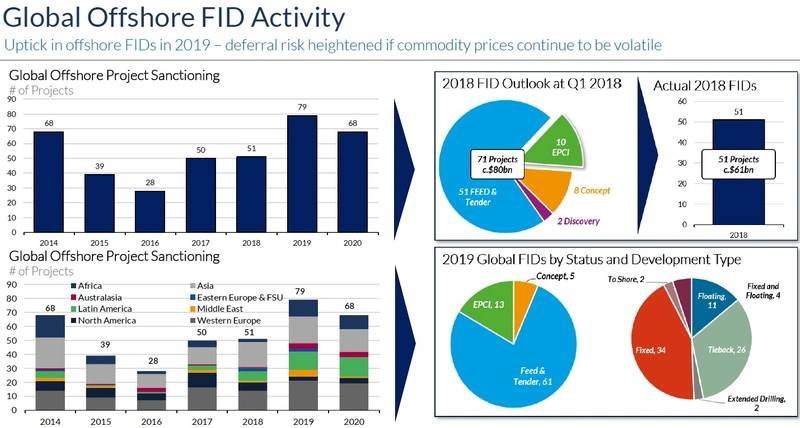

Oil prices are expected to remain between $60/bbl and $80/bbl into the early 2020s before rising, and offshore spending between 2019 and 2023 is projected to hit $1.5 trillion, said Steve Robertson, head of rigs and wells, during a Thursday briefing in Houston covering insights from Westwood’s RigLogix platform.

However, operators are approaching offshore projects differently as a result of the prolonged downturn. Costs were slashed and some projects went back to the drawing board.

Rig counts are also “moving in the right direction,” says Terry Childs, head of RigLogix. Drillships have seen the best improvement, rising to 64% utilization in April 2019, and the total fleet is up 9% since 2014, he said.

Since 2014, 235 rigs have been retired, including 59 last year. There are 114 rigs coldstacked. If those were removed from the supply, utilization rates would jump from 60% to 70%, Childs said, but there would still be a 210-rig surplus.

Indian jackup tenders are “generating absurdly low” day rates in the $20,000/day range, he said, while the Middle East jackup market will be the most active with the most recent high-spec rigs fetching $78,000/day to $85,000/day. Jackup demand in Southeast Asia is higher than it had been, with rates rising from $60,000/day up to around $80,000/day. Rig demand in Southeast Asia is expected to increase this year by 10.5%, he said.

The utilization rate for harsh environment semis for work offshore Norway is 100%, and there may be further competition for those rigs as operators begin drilling leases offshore Argentina, he said.

The floating rig market is looking bullish for Latin and South America and Africa, he said, citing contracts for drilling offshore Brazil as well as Guyana and its neighboring countries.

“In some areas, day rates are already hitting over $200,000, and continued demand for specific types of rigs such as ultra-deepwater jackups is good news for the industry. The fact that some operators are committing to rigs far in advance is a clear sign that they are anticipating further day rate rises,” Robertson said.

Workovers are the most common expenditure operators need on their oilfields. However, finding a service provider and getting their rates are not readily available in the industry. Operators would benefit from knowing the market average for a workover and gain reassurance they are getting a fair price for their services. This research is based on finding workover rigs for Zapata, Texas. The graph represents four service provider companies and their hourly rate for a workover rig.

It is important to note that due to slower oil development in recent years from the downturn in 2015 to the pandemic and downturn in 2020, smaller workover rig companies in Zapata, Texas have increasingly moved to the Permian Basin or have been acquired by larger service companies in the area. This has caused the workover rig service industry to be dominated by a few major servicers around Zapata. For Zapata, the ideal areas to look for servicers or workover rigs are Alice, Laredo, and Freer in Texas.

Hourly rates for workover rigs vary and there are always competitors for services, especially for services as common as a workover rig. The market average price for a service provider is intended to provide the oil and gas operator better insight on the cost of services around their area.

An operator who wanted bids on a workover for his well requested this vendor list and decided to get connected with Company B to get the work done. He said it was a quick decision because what he was already paying for and what he was going to pay for cost more than the rates on this list.

In order to help oil and gas operators reduce operational expenditure, Petrofly researches the servicing market to provide the most economical options for your oilfield service needs. Petrofly’s platform is the complete upstream solution and leveraging the market average is one of the unique tools operators utilize to ensure lower operational costs.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time d94a2288d76f819e65e1cc71545d07c7 63.210.148.230 10/22/2022 10:40 AM UTC

Day rate refers to all in daily costs of renting a drilling rig. The operator of a drilling project pays a day rate to the drilling contractor who provides the rig, the drilling personnel and other incidentals. The oil companies and the drilling contractors usually agree on a flat fee per contract, so the day rate is determined by dividing the total value of the contract by the number of days in the contract.

Day rate (oil drilling) is a metric that investors in the oil and gas industry watch to evaluate the overall health of the industry. The day rate makes up roughly half the cost of an oil well. Of course, the price of oil is the most important metric by far in the oil and gas industry.

That said, investors can gain insights into the oil supply and demand picture by watching metrics like day rate and rig utilization in addition to global inventories. Day rate fluctuations, which can be wide, are used by investors as an indicator of the health of the drilling market. For example, if day rates fall, investors may take it as a sign to exit oil and gas positions.

Day rates can be used to assess the current demand for oil, ultimately gleaming insight into where oil prices are headed. An increase in the price of oil increases the number of projects that can recover their extraction costs, making difficult formations and unconventional oil reserves feasible to extract. The more projects greenlit on an economic basis, the more competition there is for the finite number of oil rigs available for rent – so the day rate rises. When oil prices waver and fall, the day rate that rigs can command drops.

As an example of actual day rates – Transocean signed a contract in December 2018 with Chevron to provide drilling services. The contract is for one rig, will span five years and is worth $830 million. The effective day rate for the rig is $455,000:

Like the day rate, the rig utilization rate is a key metric for determining the overall health of the oil and gas sector. The day rate lays out a large part of the costs of drilling a well, while the utilization rate is how many wells are being used.

Investors use both of these metrics and a fall in each could signal a slowdown in oil demand. High utilization rates mean a company is using a large part of its fleet, suggesting oil demand, and ultimately, oil prices are on the rise. There is a positive correlation between oil prices and both day rates and rig utilization.

The strength of the correlation between oil prices and day rates is not consistent. The correlation is strong when oil prices and rig utilization are both high. In this situation, day rates increase almost in lockstep with prices. In an environment of rising oil prices and high utilization, the day rates in a long-term contract will shoot up even faster than short term contracts as rig operators demand a premium for being locked in on a project.

In a low price environment with falling utilization, however, the day rate may plunge much faster than the oil prices as rigs enter low bids on long contracts just to keep busy in a potential slowdown. Due to the volatility and the varying strength of the correlation, investors and traders can flip between seeing day rates as a leading or a lagging indicator for oil prices and the health of the oil and gas industry as a whole.

Tulsa-based drilling expert Helmerich & Payne (H&P) is getting more bang for its buck, as North American pricing improves for the super-spec FlexRig fleet.

In the North American Solutions segment, efforts earlier this year to “achieve more sustainable contract economics continue and will accumulate further as pricing improves” for the high-tech FlexRigs, Lindsay said. “Our scale and technology enhance profitability in the U.S., and these advantages are also providing a pathway to grow internationally, both of which will ultimately lead to improved economic returns for all our stakeholders over time.”

As expected, H&P ended June with 175 rigs operating in North America, which represented modest growth, he said. However, the company brought in more revenue per rig.

“Fiscal discipline, together with additional contractual churn, allowed us to re-contract rigs without incurring additional reactivation costs and redeploy them at significantly higher rates,” he noted. “Our rapidly improving contract economics are primarily driven by H&P’s value proposition to customers in a tight market for readily available super-spec rigs…

“Capital discipline by many among the land drillers, combined with supply chain and labor constraints, are governing the drilling industry’s cadence of reactivating idle super-spec rigs at scale,” the CEO said. “This will likely perpetuate the supply-demand tightness for super-spec rigs, leading to further improvements in our contract economics.”

The Gulf of Mexico segment also is providing a “steady contribution,” with pricing inching higher. On the international front, activity also continues to tick higher, “with the potential for further improvements in our South American operations in the coming quarters,” Lindsay said.

Smith said the margin expansion experienced in the latest quarter was “frankly needed to sustain our capital-intensive and technologically demanding business in the long term. We anticipate further improvements in the coming quarters as our contracts in our North America Solutions segment continue to reprice at higher levels.”

In the North America Solutions segment, revenue improved by $1,950/day, or 8% sequentially, to $26,500/day. Direct margins increased $2,850/day, up 37% to $10,600. Still, the solid gains continued to be negatively impacted by the costs associated with reactivating rigs. H&P spent close to $7 million to reactivate rigs in the quarter, costs that were down by about half sequentially.

For fiscal 4Q2022, North America Solutions direct margins are forecast to be $185-205 million, which would include $6 million to reactivate rigs. H&P expects to exit September running 176 contracted rigs in North America, up one from the latest period.

“On our earnings call last February and again in April, we discussed how rig pricing needed to reach $30,000/day,” Lindsay said. “In our third fiscal quarter, we had roughly 20% of our fleet average revenue per day at or above that level.

“This is a great start, but we also recognize that pricing needs to move further to achieve gross margins of 50% or greater to generate returns that fully reflect the value we deliver to customers with our FlexRig fleet and complementary technology solutions.”

Inflationary pressures this year, combined with supply chain constraints, “are increasing consumable inventory costs,” Smith said. Higher costs also are impacting supply chain access to parts and materials. To that end, H&P has been proactive in inventory planning and its vendor relationships to alleviate issues and avoid material impacts to operations.

Around 70-75% of daily costs are labor-related, Smith noted. To ensure it has a solid workforce, the company implemented a wage rate increase last December. The turnover rates for the work crews have remained consistent with historical rates, the CFO said.

Net income was $18 million (16 cents/share) from operating revenue of $550 million in the fiscal third quarter, compared with a year-ago loss of $56 million (minus 53 cents). Operating revenue climbed year/year to $550 million from $332 million.

U.S. natural gas producers are operating more drilling rigs now compared with the beginning of the COVID-19 pandemic in early 2020. Rig counts had generally been falling through 2019, and in March 2020—around the start of the pandemic—106 natural gas-directed rigs were active, according to data from Baker Hughes Company. The number of natural gas-directed rigs decreased throughout the first half of 2020 and fell to 68 rigs by late July 2020, the fewest in Baker Hughes’s history back to 1987. Since then, the rig count has been generally increasing and reached pre-COVID levels in January 2022. The number of gas-directed rigs has averaged 160 rigs so far in August.

As drilling activity increases, we expect that dry natural gas production will rise. Our August Short-Term Energy Outlook (STEO) estimates that dry natural gas production in the United States averaged 96.4 billion cubic feet per day in (Bcf/d) in July 2022. We expect U.S. dry natural gas production to generally increase through the end of 2023, averaging about 100.3 Bcf/d in December 2023.

Most of the growth in natural gas-directed rigs has been concentrated in the Haynesville region where the rig count increased by over 50% between March 2020 and July 2022. As natural gas prices remain elevated, drilling in the Haynesville region remains economical, even though Haynesville wells are relatively deeper and more expensive to develop. In addition, the Haynesville region’s greater well productivity and its proximity to liquefied natural gas export terminals and major industrial natural gas consumers along the U.S. Gulf Coast draws operators to the region.

Rig activity in the Appalachia region has returned to similar levels to those at the beginning of the COVID-19 pandemic, at around 50 natural gas-directed rigs. Production growth in the Appalachia region over the past 10 years has been aided by improved productivity from wells drilled, pipeline buildouts, and increased takeaway capacity. However, regional transportation capacity limits are now reducing overall drilling activity in the region.

Unlike in the Appalachia region, where natural gas is produced from wells targeting natural gas, most of the natural gas production in the Permian region is associated gas produced from oil wells. As a result, producers in the Permian region respond to fluctuations in the crude oil price when planning their deployment of rigs. Crude oil prices and oil-directed rigs both generally declined in 2020 as the effects of the COVID-19 pandemic continued throughout the year. In 2021, the West Texas Intermediate (WTI) price increased steadily, averaging $68 per barrel (b) for the year compared with $39/b in 2020, and has continued to increase in 2022, averaging above $100/b in the first half of the year. Over the same period, the number of oil-directed rigs operating in the region has also been generally rising, although the rig count is still 15% lower than the early March 2020 pre-COVID count of 405 rigs.

Henry Hub spot price:The Henry Hub spot price fell 34 cents from $9.29 per million British thermal units (MMBtu) last Wednesday to $8.95/MMBtu yesterday.

Henry Hub futures prices:The September 2022 NYMEX contract expired Monday at $9.353/MMBtu, up 2.3 cents from last Wednesday. The October 2022 NYMEX contract price decreased to $9.127/MMBtu, down 17 cents from last Wednesday to yesterday. The price of the 12-month strip averaging October 2022 through September 2023 futures contracts climbed 4 cents to $7.394/MMBtu.

Select regional spot prices:Natural gas spot prices were mixed this report week (Wednesday, August 24 to Wednesday, August 31), declining at most locations east of the Rocky Mountains and increasing west of the Rockies. Of the major pricing hubs, the largest week-over-week price decline was 73 cents at Algonquin Citygate and the largest increase was $6.11 at SoCal Citygate.

The price at SoCal Citygate in Southern California increased $6.11 from $9.76/MMBtu last Wednesday to $15.87/MMBtu yesterday. The price at PG&E Citygate in Northern California rose 18 cents, up from $10.04/MMBtu last Wednesday to $10.22/MMBtu yesterday. The price at Malin, Oregon, the northern delivery point into the PG&E service territory, rose 81 cents from $8.44/MMBtu last Wednesday to $9.25/MMBtu yesterday. A massive heat wave over the western United States is building and the National Oceanic and Atmospheric Administration (NOAA) forecasts extreme heat over the Labor Day weekend. This report week, temperatures in Riverside, California, inland from Los Angeles, averaged 82°F, nearly 3°F above normal, and 2°F more than last week’s average, which resulted in 13 more cooling degree days (CDD) than last week. Yesterday, temperatures reached a daily high of 109°F and averaged 90°F, or 11°F above normal.

While increasing by less than 3%, or 0.1 billion cubic feet per day (Bcf/d), week over week, natural gas consumption in California’s electric power sector was higher at the end of the report week than at the beginning. According to data from PointLogic, consumption in the electric power sector averaged 2.8 Bcf/d from Monday to yesterday, which compares with an average 2.1 Bcf/d from last Thursday to Sunday, an increase of 36% (0.7 Bcf/d) over the course of the week.

The California Independent System Operator (CAISO) has extended its statewide Flex Alert for a second consecutive day, calling on consumers to voluntarily conserve electricity consumption on September 1 from 4:00 p.m. to 9:00 p.m. This alert follows Southern California Gas’ (SoCalGas) curtailment watch for SoCalGas and San Diego Gas & Electric (SDG&E) service territories that include Riverside, Imperial, and San Diego counties. As a result of low supplies into the Southern System, effective August 30 and until further notice, non-core customers on the Southern System may be required to reduce or stop their natural gas use and SoCalGas and SDG&E are urging customers to align natural gas usage with deliveries.

At the Algonquin Citygate, which serves Boston-area consumers, the price went down 73 cents from $9.16/MMBtu last Wednesday to $8.43/MMBtu yesterday. At the Transco Pipeline Zone 6 trading point for New York City, the price decreased 40 cents from $8.83/MMBtu last Wednesday to $8.43/MMBtu yesterday. In the Appalachia region, the Tennessee Zone 4 Marcellus spot price decreased 34 cents from $8.46/MMBtu last Wednesday to $8.12/MMBtu yesterday, and the price at Eastern Gas South in southwest Pennsylvania fell 38 cents from $8.48/MMBtu last Wednesday to $8.10/MMBtu yesterday. Although natural gas consumption in the Northeast increased by 7% (1.1 Bcf/d) week over week, according to data from PointLogic, net natural gas flows out of the region fell by 6% (0.8 Bcf/d), contributing to lower prices. Various pipeline maintenance events on Tennessee Gas Pipeline are restricting south-bound flows out of the Northeast region.

Demand:Total U.S. consumption of natural gas rose by 3.9% (2.7 Bcf/d) compared with the previous report week, according to data from PointLogic. Natural gas consumed for power generation climbed by 5.9% (2.2 Bcf/d) week over week. Weekly average temperatures were higher than normal across much of the United States, from the West Coast to the Midcontinent, and in the Northeast. Industrial sector consumption increased by 0.6% (0.1 Bcf/d) week over week. In the residential and commercial sectors, consumption increased by 3.2% (0.3 Bcf/d). Natural gas exports to Mexico increased 2.2% (0.1 Bcf/d). Natural gas deliveries to U.S. LNG export facilities (LNG pipeline receipts) averaged 11.0 Bcf/d, 0.4% lower than last week.

LNG export terminals:An LNG vessel discharged a cargo of approximately 3 Bcf at the Everett LNG Facility, near Boston, Massachusetts, operated by Constellation, according to shipping data provided by Bloomberg Finance, L.P.

According to Baker Hughes, for the week ending Tuesday, August 23, the natural gas rig count decreased by 1 rig from a week ago to 158 rigs. The Haynesville and the Permian each added one rig, two rigs were dropped in the Eagle Ford, and one rig was dropped in an unspecified producing region. The number of oil-directed rigs increased by 4 rigs from a week ago to 605 rigs. The Ardmore Woodford and the Permian each added two rigs, two rigs were added in unspecified producing regions, and two rigs were dropped in the Cana Woodford. The total rig count now stands at 765 rigs, which is 257 more than the same week last year.

The rig count in the Permian Basin fell by 4 to 347 this week. Rigs in the Eagle Ford stayed the same at 72. Oil and gas rigs in the Permian are 104 above where they were this time last year.

At 12:33 p.m. ET, oil prices were trending up on the day despite a positive jobs report, with the overall oil market still tight, although prices were down on the week. WTI was trading at $89.63 on the day—up $1.09 per barrel (+1.03%) on the day, but down $10 per barrel on the week. The Brent benchmark traded at $95.27 per barrel, up $1.15 (+1.22%) on the day, but down nearly $15 per barrel on the week.

The number of total active drilling rigs in the United States fell by 1 this week, after the 14 rig increase in the week prior, according to new data from Baker Hughes published on Friday.

U.S. drillers have added 77 rigs since Russia invaded Ukraine. The invasion triggered financial sanctions on one of the world’s largest oil producers that have disrupted exports.

The rig count in the Permian Basin fell by 1 this week, to 342 while rigs in the Eagle Ford rose by 1. Oil and gas rigs in the Permian are now 109 above where they were this time last year.

At 8:19 a.m. ET, oil prices were trending down on the day. WTI was trading at $113.30—down $0.78 per barrel (-0.68%) on the day but up nearly $1 per barrel on the week. The Brent benchmark traded at $117.00 per barrel, down $0.35 (-0.30%) on the day but up $5.50 on the week, with Brent reclaiming its price position over WTI.

8613371530291

8613371530291