workover rig jobs colorado pricelist

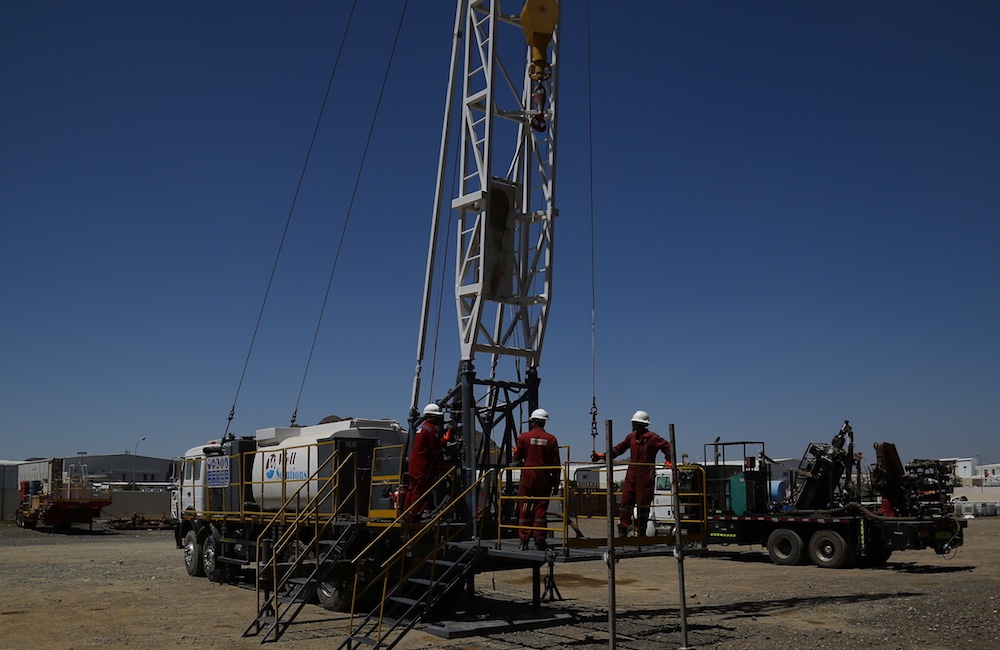

Are you looking to begin your career as a Floorhand, a Roughneck on an oil and gas drilling rig? Do you enjoy a fast-paced, team-oriented environment? If so, look no further than Precision Drilling! We are looking for High Performance candidates with grit and drive to join the Precision Family. The work is in Colorado and Wyoming, however, our neighbors from Utah, Kansas, Nevada and of course other states are also invited to apply. The entry level position at Precision is a Floorhand (Roughneck). As a Floorhand, you"ll be on the front lines ensuring we deliver High Value solutions to our customers.

As well, we are always looking for experienced candidates. If you have experience as a Motorhand, Derrickhand, Driller or Rig Manager, please also complete this application and upload your work history and certifications.

The Floorhand is responsible for safely and efficiently performing a variety of physically demanding tasks on and around the drilling rig, supporting equipment, structures, and rig systems. Responsibilities of the Floorhand include:

Performing repairs and preventative maintenance of the drilling equipment and other components of the rig while adhering to Precision maintenance standards;

A global job-placement and recruitment company specializing in the energy and manufacturing industries has opened an office in Denver on the strength of the oil and gas activity in northern Colorado.

Colorado oil production is expected to continue setting annual records for at least the next half dozen years, according to BTU Analytics. Production is forecast to jump about 39% from 2018 to 2024, when the consulting firm expects nearly 250 million barrels of oil to be extracted.

There were 855 drilling rigs operating nationwide as of Oct. 4, according to EnerCom Inc., an oil and gas consulting firm. The Permian had 415 rigs and the D-J Basin had 21, one less than the previous week.

“The recent peak was about 1,200 rigs for the whole country and that was in November 2018,” Johnson said. “The price was hovering around $70 WTI (West Texas intermediate), then dropped to the $50s.”

“The U.S. is still growing production and the D-J in particular is still growing in oil production in spite of lower prices and fewer rigs,” Johnson said. “We’re not growing as fast as we were a year ago, but we’re still growing production and any time you’re growing production, you need more infrastructure to handle it.”

Scott Prestidge with the Colorado Oil and Gas Association, a trade group, said a state law requiring new oil and gas rules to protect public health, safety and the environment will boost the need for more infrastructure such as pipelines to reduce truck emissions.

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

The Floorhand performs the duties of general manual labor on the rig and supports and assists other members of the drilling crew during all rig operations.

Performing rig up and down procedures, nipple up and down and care of the B.O.P. Ensuring safe and efficient rig operations to meet the company’s goals and…

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

The Crew Worker, under the direction of the Rig Operator, performs activities and operates hand and power tools to perform maintenance and repairs to oil or gas…

Must have years of experience working multiple positions on an oil and gas drilling rig. General maintenance of drilling rig. Must be at least 18 years of age.

Develops an understanding of all major rig components and the necessary servicing. Prior experience in oil field, heavy industry or construction is beneficial.

Previous experience as an Frac Equipment operator coiled tubing, rig, oilfield, oil & gas, Oil and gas, energy, energy services, driving tractor trailers, well…

Previous experience as an Frac operator, coiled tubing, rig, oilfield, oil & gas, Oil and gas, energy, energy services, driving tractor trailers, well services,…

Develops an understanding of all major rig components and the necessary servicing. Prior experience in oil field, heavy industry or construction is beneficial.

*Exposure to equipment noises and rig/boat/facility vibrations *. *Sweep and wash decks using a broom, brushes, mops and hose to remove oil, dirt and debris*.

Develops an understanding of all major rig components and the necessary servicing. Prior experience in oil field, heavy industry or construction is beneficial.

Develops an understanding of all major rig components and the necessary servicing. Prior experience in oil field, heavy industry or construction is beneficial.

My first assignment was to work on a casing crew, which involves putting in pipes in the ground for the drilling process. There were pipes being swung onto the rig floor to be put into the ground, people tied to the rig tower to guide the pipe in, high powered tongs that screw the pipe together, slippery wet surfaces, and drilling mud everywhere. To add to this, the work hours were outrageous. The longest my crew spent on a rig floor was 63 hours, before we were relieved. We left the casing crew because our bodies started to take a toll from the long work hours and dangerous conditions. We switched over to another line of work in the oilfield; the waterline service company. My brother lined the water pits and I laid the line from water wells to the pits.

In 2015, I started waking up with my lungs filled with phlegm. That’s when I knew enough was enough. As my family and I moved back to Colorado that year, I began a process of political awakening.

I realized that you have to stand up for your health and your rights and so I looked for ways to get involved. I started working on political campaigns, and supporting candidates who stood up for worker protections and environmental health and safety. I spent the next two years of my life dedicating myself to championing environmental justice in the Denver metro area. Finally, I began my current job as mobilization manager at Conservation Colorado. Through my political work, I have found an opportunity for upward mobility that does not compromise my health.

I have also found that my experience in the West Texas oilfield was not too different from those of oil and gas workers in Colorado.No person should have to choose between making a good living and keeping good health.And the public should know for certain that they are protected from harmful particulates and pollution. I hope that by sharing my perspective and demanding a change, we can secure a better future for workers, people, wildlife, water, and the Colorado we love.”

The oil price crash has forced producers in Colorado to slash their capital expenditure, suspend completion activities, and release rig crews, leaving just six operating rigs in the state as of May 29 - the lowest number of rigs in at least 28 years.

Lower liquidity and constrained access capital could make life for the companies operating in Colorado’s oil patch much more difficult, analysts and industry executives told Mark Jaffe of The Colorado Sun.

Due to the price collapse in early March, oil producers in the state - from Occidental Petroleum to the smaller firms - have slashed capital expenditure for Colorado operations by at least half, and many have suspended completion activities until at least the fourth quarter or until oil prices improve.

The rig count in Colorado as of May 29 numbered just six rigs, down from 31 operating rigs at the same time last year, according to data from Baker Hughes. The six rigs in Colorado last week were the fewest rigs in the state in 28 the years since Baker Hughes started reporting rig counts by state, according to The Colorado Sun.

Occidental Petroleum, which became the state’s top oil producer after it bought Anadarko last year, has slashed its capital expenditure for the Rockies to US$300 million from US$900 million, The Colorado Sun reports.

Noble Energy has suspended all completion activity, and drilling activity has been reduced to one rig in the Denver-Julesburg (DJ) Basin, the company’s President and Chief Operating Officer Brent Smolik said on the Q1 earnings call. Noble Energy plans capex of US$75 million to US$100 million for the option to complete DJ wells in the fourth quarter.

PDC Energy, based in Denver, plans capex of US$500 million-US$600 million this year, down by around 50 percent compared to its initial 2020 guidance from February 2020. The company will have one operating rig in Wattenberg and no frac fleets planned until the fourth quarter, president and CEO Barton Brookman, Jr. said on the Q1 earnings call.

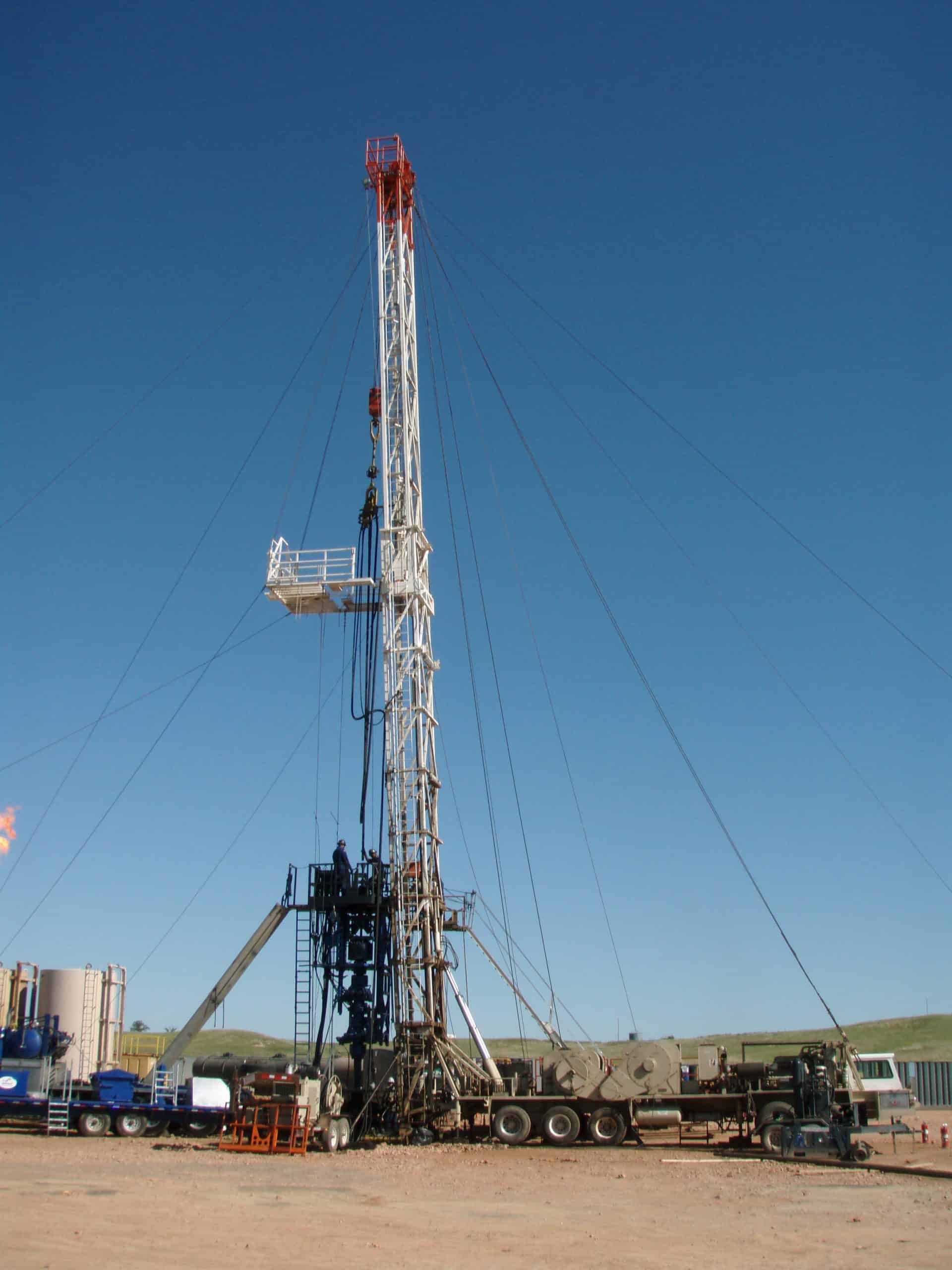

BROOMFIELD, Colorado, Dec 20 (Reuters) - In a Denver suburb, an oil drilling rig plumbs the earth near a wealthy enclave framed by snow-capped mountains. The site is quieter, cleaner and less visible than similar oil and gas operations. It might just be the future of drilling in the United States.

Oil firm Civitas Resources designed the operation to run largely on the city"s electric grid, eliminating daily runs by more than a dozen diesel fuel trucks. The electric rig has none of the soot or sulfur smell of diesel exhaust and is muffled enough that rig hands can converse without yelling.

Civitas, Colorado"s largest oil and gas producer, says it is the state"s first "carbon neutral" producer. To get there, it has eliminated some diesel-powered pumps, makes modifications to drilling and hydraulic fracturing equipment and its production sites. It also buys carbon credits to offset remaining emissions.

Colorado, among the top oil producers among U.S. states, also has some of the toughest state emissions regulations. It has told energy firms they must cut methane emissions from drilling by 2030 to less than half of 2005 levels. More drillers also face stricter mandates as President Joe Biden"s administration enacts tougher federal methane rules.

"Electrifying drilling, upgrading pneumatics and going tankless are certainly steps in the right direction," said Deborah Gordon, a senior principal in the Rocky Mountain Institute"s climate intelligence group.

Colorado"s tougher regulatory environment has partially evolved from the industry"s proximity to homes and businesses. For Civitas, that suburban life means strong local electric power supplies.

They roll into western Colorado like ’49ers chasing the promise of gold in California, or wild-eyed prospectors hightailing it to budding silver camps like Aspen in the 1880s.This time it’s a natural gas boom that has brought workers to the region from near and far.Some of them are content following the booms from place to place, migrating to the next great strike, wherever that may be, once the current field is played out.Others hope to settle into a new life in Rifle, Parachute or Grand Junction. They want to ride the boom long enough to line their pockets with cash so they can stay put once the inevitable bust comes. Whatever their aims, they are all attracted by plentiful jobs and good pay, part of a burgeoning work force directly employed by oil and gas producers. The state of Colorado, using gas and oil company payroll records, estimated there were 900 gas and oil field workers living in Garfield County in 2004 and 817 in Mesa County.The massive Mamm Creek Field south of Rifle has attracted everyone from a drill operator who fled the oil patches of Texas to build a better life for his family to a veteran drilling rig boss who endures two-week shifts and then commutes home 900 miles to be with his family in North Dakota for less than a week.Some roughnecks, the general name applied to floor hands on a drilling rig, toil in back-breaking jobs to raise enough money to go to college. Others simply see the $22 per hour starting pay as a lucrative alternative to flipping burgers or other low-paying service industry jobs in western Colorado’s tourism-based economy.Opposite ends of the spectrumScott Stiffler drove up to a drilling rig operated by a firm called Caza in September and knocked on the door of the adjacent trailer where rig manager James Barclay lives round the clock during his two-week shifts.Stiffler has worked in the oil and gas industry since 1980 in the Plains states of Kansas, Oklahoma and Texas. For the last 14 years he’s been a driller, the person who operates the controls of the machinery that drills the wells. It’s essentially second in command on a drilling rig.He said he wanted to get his family out of the Fort Worth area, where traffic and crime are mushrooming. So he and his wife packed up their two daughters, ages 12 and 14, and came to the Rifle area, where Stiffler heard there was plenty of work. Word of a big strike travels faster than a roughneck fleeing the gas field in his pickup truck at the end of a Saturday shift.He picked the right door to knock on. Barclay was short a couple of drillers at the time.”James asked me a bunch of questions. I guess I answered them to his satisfaction,” Stiffler said in a soft-spoken Texas drawl during a break on his rig recently.He got the job. His family sold their home in Fort Worth and now they’re enjoying the small-town living in Silt. Stiffler said they are renting a home but hope to find a house with a few acres to buy in the country. He’s hopeful that the drilling will continue long enough in the Rifle area to allow his family to relocate there permanently.

On the other end of the spectrum is Barclay. He’s tied to the Caza drilling rig that he has managed since 1998 and not the town of Rifle. If EnCana Oil and Gas USA, the company that Caza is drilling for, ordered that rig to a new location – in Wyoming, for example – Barclay said he would gladly go with it.For the last six years, Barclay has worked away from his home state of North Dakota. He worked for four years in Wyoming, then EnCana set its sights on the Piceance Basin of Colorado and called in all available drilling rigs. Barclay and his rig have been working south of Rifle for two years.Barclay works for 14 consecutive days, then gets seven days off. When his last shift ends he aims the pickup for Williston, N.D., a commute of about 15 hours.The 45-year-old Barclay was willing to take on the brutal schedule six years ago because work was so steady out West, but he didn’t want to uproot his family.”Sometimes it’s been hard, especially when the kids were younger,” said Sherry, James’ wife, from North Dakota. “I go down there once a year.”She would visit more often, she said, but she doesn’t like winter driving. The long commute limits James’ time at home to five days. The better part of two of his days off are spent on the road.Sherry said they have considered moving west. “It would make things a lot easier,” she said. But their friends and family, including a new grandson, are in North Dakota.Then there’s the issue of home prices in Colorado. James looked at homes around Grand Junction. They were “majorly expensive” compared to what the Barclays are used to in North Dakota.Calling all handsBarclay said his rig is always short of workers. The Mamm Creek Field isn’t the only place that’s booming. The high demand and skyrocketing prices for natural gas have spurred record activity in fields throughout the West.Jobs are plentiful just about everywhere in the gas and oil industry so a place where the boom was relatively recent, like Mamm Creek, has trouble luring workers out of the established fields. “Rifle is probably the big activity center right now,” Barclay said.A lot of people pass through. Newcomers to the industry might sign on one day, discover that roughnecking isn’t for them, and not show up again.A drilling rig operates 24 hours a day, seven days per week. There are five people to a crew, and each crew works 12-hour shifts. Crews work seven days straight, then have seven days off, when they are replaced by two other crews.So when fully staffed, each rig employs at least four crews of five workers or a minimum of 20 people. EnCana has 10 drilling rigs working the ground in the Mamm Creek Field, which includes the Grass Mesa, Hunter Mesa and Divide Creek areas. That’s down from 14 last year.Filling the 200 positions isn’t easy. “It’s pretty green here now,” Barclay said.Benjamin Garner of Denver is one of those greenhorns. He is the low man on the totem pole, working in a position known as the “worm.”

He does a lot of the dirty work, and it shows. Garner’s blue jeans will never be blue again. The jeans and his winter work coat are stained with oil and grease. While working with two other floor hands to connect a 30-foot section of drilling pipe at a well that’s being dug, Garner is doused time and again with gray, muddy water that splurts out of the drilling equipment.The 18-year-old doesn’t complain. “It’s damn good pay,” he said. It’s also hard. He said he lost 50 pounds, dropping from 255 to 205 in three months.After tasting the work and money for the last three months, he’s determined not to return to the painting and texturing jobs he worked in Denver for significantly less money.Garner, who commutes about 50 miles to the field south of Rifle from an apartment he rents in Clifton, said a big advantage for him is working with two cousins on the same crew. “They’re patient with me,” he said.One of his cousins is Derek Thompson, 21, a native of Tucson, Ariz., who has been working in the Rifle gas fields for 18 months. With their custom-cut goatees and muscular jaws, he and his older brother, Chris, 23, look more like athletes in the Winter X Games than roughnecks.Derek said Garner is like any other novice, regardless of family ties – he must catch on to the work fast or he’ll get the boot. Over 18 months in the Mamm Creek Field, Thompson estimated he’s seen 80 workers come and go from his rig.”Usually they don’t leave. The decision is made for them,” he said.Sure beats Burger KingThompson said there is a stereotype of a roughneck as a “toothless hillbilly” who only works to support an alcohol or drug habit. “It’s just not that way anymore,” he said.The work is dangerous and complicated enough on a drilling rig that a high level of concentration is necessary, Thompson said. Anyone who isn’t dependable will be run off.As a derrick man, he makes sure the proper mixture of bentonite, water and chemicals is applied to the well during drilling. The resulting drilling mud lubricates the drill bit and exports cuttings out of the drill hole.Thompson is clearly proud of the professional standards on his rig. He views the job as a career.He pulls in $65,000 per year for a midlevel position on the rig. “It’s not a Burger King job,” said Thompson, who recently bought a house with his wife in Grand Junction.Derek alerted his older brother, Chris, when a job came open on his rig six months ago. Chris had been working for a year in the fields of Wyoming but wanted to get closer to his family in Grand Junction.Chris wants to establish a recording studio, like he ran in Tucson before getting back into the oil and gas industry, on the side. He and his wife are expecting their first baby this winter. He saw working in the gas fields as the best way to get established.”It’s tough work,” he said, quickly adding that the money and the time off make it worthwhile.”You get two weeks of vacation per month. Most people get that much time of in a whole year,” said Thompson. As a motor hand he is responsible for the maintenance of six diesel engines that power the rig’s machinery. “You make more money out here than most people who graduated from college.”Veterans bank on work in RifleIt’s not just newcomers to the industry that are rolling into Rifle. Mark Balderston, a 25-year veteran of the industry, toughed out some lean times so his family could stay in Colorado.Balderston spent 19 years in the industry moving from job to job but maintaining his base in Denver. “I figured the Rockies were the place to be,” said the graduate of the School of Mines in Golden.Six years ago he relocated his family to Craig, gambling that he could find steady enough work in southwest Wyoming and Colorado to avoid moving his family again.Balderston said he first started working in the Rifle area in 1994 when a former employer started exploring for gas in the area. His decision to root his family in Craig paid off. Now as a consultant for EnCana, he supervises a crew that pumps sand and water at high velocity into the wells to fracture the rock surrounding the drill holes so the natural gas is more easily extracted. That process is the key to tapping the prolific gas reserves in the Mamm Creek Field, so his position seems secure.Balderston is thankful his gamble on steady employment in western Colorado paid off, for the sake of his kids, now ages 9 and 13.”I had to starve for a while, but I didn’t want to go to the Gulf Coast or overseas,” he said.Mike Richens, another industry veteran who said he has “done it all” in the gas and oil industry for 34 years, was willing to leave his longtime home in Durango for the promise of steady work in Rifle. He relocated with his wife 14 months ago. As a supervisor of crews that prepare wells for production, Richens said there could be enough work to last several years in the Mamm Creek Field.Richens, like Balderston, works as an independent consultant for EnCana – as do most of the upper managers in the field. It makes it easier for the company to adjust the size of the work force as conditions warrant.While Richens loves living in Colorado, he is experienced enough to know he might have to follow the boom elsewhere. And with his level of experience, he’s confident there will always be a job for him.”If this ends tomorrow I’ll be working somewhere else the next day,” Richens said.Scott Condon’s e-mail address is scondon@aspentimes.comEditor’s note: Encana Oil and Gas USA and other natural gas providers have invested millions of dollars to search out and extract natural gas from the prolific gas fields scattered around the Piceance Basin, which extends from Carbondale at the south to Maybell at the north. Pitkin County residents recently learned that the drilling boom could extend into the Thompson Creek drainage, just a few miles southwest of Carbondale. Most news coverage has focused on the politics and environmental impacts of extracting natural gas. Last month, reporter Scott Condon and photographer Paul Conrad spent a day on a rig to find out what happens at ground level. Today’s story is a profile of a handful of men who work 12-hour shifts, sometimes far from home, to drill the wells that supply gas for cooking, heating and electricity generation. It is the first in a four-part series that examines this drilling boom under way just a few miles down the road.

Colorado’s overall employment should return to pre-pandemic levels for 2022, but the state’s natural gas and oil sector will likely lag behind other industries in regaining jobs, according to a new report from the University of Colorado Boulder (CU Boulder).

Wobbekind added, however, that the CU Boulder study — the annual Colorado Business Economic Outlook (CBEO) — shows the state’s oil and gas employment level is at its lowest point in 15 years.

“The fact is that we’ve lost some of those regional headquarters,” Lewandowski said, adding that some oil and gas industry jobs simply will not return to Colorado.

An analysis that covers 10 industries statewide, the latest CBEO installment estimates that Colorado will regain 73,900 jobs in 2021. Although the 2.7% year/year increase would effectively recoup the total number of jobs the state lost during the pandemic-driven recession, the recovery will be uneven, cautioned the report’s authors. For instance, they do not expect particularly hard-hit industries such as leisure and hospitality to fully recover until 2023 or 2024.

The natural resources and mining industry, another economic sector that sustained heavy job losses in the recession, should return to net job growth for the first time in two years with a 600-job gain in 2022, predicts CBEO. The report states natural resources and mining shed 7,000 jobs in 2020, or 24.3% year/year, and should end 2021 down by a relatively modest 1,900 jobs overall.

For the purposes of CBEO, the natural resources and mining classification spans oil and gas, minerals and uranium, renewables, wind energy, solar energy, hydroelectric power, and geothermal. The Colorado Oil and Gas Association (COGA) told NGI that the state’s oil and gas industry lost about 9,000 jobs during the first year of the pandemic.

In the case of natural gas, it forecasts statewide gas output of 2 Tcf, valued at $8 billion, for 2022. Right before the pandemic, in 2019, the state produced nearly 2.06 Tcf of gas valued at $5.3 billion, according to CBEO. Colorado’s 2020 gas production slightly exceeded 2.06 Tcf, and the state will likely produce more than 1.93 Tcf in 2021, the report said.

For crude oil, the report projects Colorado will produce 160 million bbl next year — 17% lower than the record-setting 192.4 million bbl the state produced in 2019. On a value basis, the CU Boulder study anticipates $9.6 billion worth of crude output in 2022 — 4% lower than the nearly $10.2 billion figure for 2019. It notes that Colorado produced 171.5 million bbl of oil in 2020 and is on track for 147.6 million bbl this year.

“I think that it’s still quite profitable at this price level for what they’re pulling out of the ground, but the issue is how many holes they can poke,” he said, referencing recent changes to Colorado’s oil and gas regulatory system.

In 2019 Colorado’s Democrat-controlled legislative and executive branches enacted Senate Bill 19-181 to overhaul how the state’s oil and gas industry is regulated. The CU Boulder report states that the new system, which took effect in January, changes the Colorado Oil and Gas Conservation Commission (COGCC) mandate from “fostering” to “regulating” the oil and gas industry.

The overhaul reflects ongoing discord between Colorado’s energy and environmental interests, which Wobbekind said is “probably the most contentious issue in the entire state.” Biden administration plans to reduce drilling on federal leaseholds have also contributed to, as one CEO put it earlier this year, “‘a lot of acrimony and angst.’”

Besides COGCC, the Colorado Department of Public Health and Environment this year began collecting methane emissions data via aerial surveys of oil and gas wells in the DJ Basin.

Dan Haley, COGA’s CEO, told NGI that the state’s regulatory changes “have added more than $200 million to the cost of doing business in Colorado, and that number continues to climb as rulemakings continue.”

On Dec. 10, Baker Hughes Co. reported 12 rotary drilling rigs operating in Colorado — a five-unit increase year/year. During the corresponding week in 2019, however, 23 rigs were running in the state, according to NGI’s review of Baker Hughes’ historical rig data. From a broader perspective, Baker Hughes’ latest weekly rig count shows a 73% year/year increase in land rigs for the United States as a whole.

“The fact is, Colorado’s operators are producing some of the cleanest molecules of energy on the planet and we can play an important part of our global energy solution, but unnecessary red tape and constant rulemaking hinders that progress,” said Haley. “At one point, we had more rulemakings taking place in downtown Denver than we had rigs running in the state.”

Colorado"s largest oil producer has cut the number of drilling rigs it has in the state in half and is spending tens of millions less on new well development, saying state permitting has slowed so much the company can"t support its usual level of business here.

The permitting for new wells in Colorado has bogged down as the Colorado Oil & Gas Conservation Commission implements tighter well location rules, leaving Houston-based Occidental Petroleum (NYSE: OXY) without the inventory of new well sites it would normally expect, the company said Wednesday.

Occidental is reassigning one of two rigs it had working in Colorado to the Delaware Basin in Texas for the second half of the year, where it can be productively used drilling new wells.

“Colorado drilling permits we have in hand are sufficient to run a single drilling rig for the remainder of 2022,” said Rob Peterson, senior vice president and chief financial officer of Occidental, during the company’s quarterly earnings call Wednesday. “It is no longer feasible to run a multi-rig program for Colorado this year given the pace of state approvals.”

Colorado overhauled its oil and gas rules after the 2019 passage of Senate Bill 181. The COGCC enacted sweeping new rules in January 2021 that encourage lower-emissions well projects with fewer impacts to nearby residents and wildlife. The new rules required a new, more detailed permitting process that companies and COGCC staff are still sorting through.

“As we do go into next year, we’ll really be capable of getting back to that two-rig count next year, maybe more,” said Richard Jackson, president of Occidental’s onshore business.

But the COGCC’s final decision on them won’t come soon enough to warrant keeping the second drilling rig in the state in the second half of this year.

The company projects adding a total of 75 to 85 new wells in Colorado and Wyoming, with between 60 and 68, possibly more, of those expected to be in Colorado. It budgeted a little under $300 million for drilling and well completions in the region in 2022.

A sense that the slowdown in Colorado permitting is a blip for the company would make the company’s drop in focus here temporary, too, executives said.

The slowdown in Colorado permitting hasn’t affected Occidental’s output much, thanks in part to better-than-expected production from wells in the area.

Encana isn’t saying how many people will be affected by the latest cuts, or where the jobs would be cut, but the newspaper figured “another 500 people would lose their jobs this year.”

And Thursday, Houston’s Halliburton Co. (NYSE: HAL), a major oilfield service company with operations in Colorado, announced it will cut another 5,000 workers, or 8 percent of its remaining global workforce.

8613371530291

8613371530291