gas powered mud pump free sample

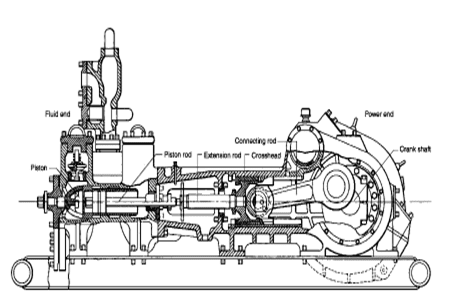

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

Created specifically for drilling equipment inspectors and others in the oil and gas industry, the Oil Rig Mud Pump Inspection app allows you to easily document the status and safety of your oil rigs using just a mobile device. Quickly resolve any damage or needed maintenance with photos and GPS locations and sync to the cloud for easy access. The app is completely customizable to fit your inspection needs and works even without an internet signal.Try Template

Powered by Honda GX120 Commercial Engine gas. Replaced by newer model 338G-96. AMT 2" Diaphragm pumps features 2-stage, 44 to 1 gear reduction with a large diameter output gear and heavy duty ball bearing construction. Often referred to as Mud pumps, mudhog or Sludge pumps, diaphragm pumps are designed to pump mud, slurry, sewage, and thick water liquids that have the ability to flow. AMT IPT Diaphragm pumps are available with a choice of drivers to meet your application requirements. Phelps HoneyWagon Wastecorp

Honda gasoline engines. Built-in molded polyurethane flapper/check valve assures self-priming to 20 feet after initial prime. Heavy duty gear box is designed to operate pumps at 60 strokes per minute. Each unit includes a 2" NPT steel suction strainer, two 2" NPT nipples, and wheel kit with 10" semi-pneumatic transport wheels for portability. Pumps are designed for use with non-flammable liquids which are compatible with pump component materials. Mud Trash pumps Suction and discharge port size cannot be reduced.

Suction and discharge port size cannot be reduced. Due to positive pumping action of diaphragm pumps, by all mfr"s, the discharge is recommended to only be 25FT long unless oversized. Discharge can not be restricted. There is no relief valve.

Specifically designed for drilling companies and others in the oil and gas industry, the easy to use drilling rig inspections app makes it easy to log information about the drill rigs, including details about the drill rigs operators, miles logged and well numbers. The inspection form app covers everything from the mud pump areas and mud mixing area to the mud tanks and pits, making it easy to identify areas where preventative maintenance is needed. The drilling rig equipment checklist also covers health and safety issues, including the availability of PPE equipment, emergency response and preparedness processes, and other critical elements of the drilling process and drill press equipment.

Mud pumps are the pumps deployed in the oil and gas industry, mainly to circulate drilling fluids and other kinds of fluids in and out of the drilled wells for exploration. The mud pumps transfer the fluids at a very high pressure inside the well using the piston arrangement. The number of pistons decides the displacement and efficiency of working of the mud pumps, originally only dual piston pumps and three-piston pumps were used, but the technological advancements have seen pumps with five and six pistons to come up. Currently the triplex pumps which have three pistons are used, but the duplex pumps having two pumps are still deployed in the developing countries.

Based on its types, global mud pump market can be segmented into duplex, triplex, and others. The triplex mud pumps will dominate the mud pump marking in the given forecast period owing to its advantages and ongoing replacement of duplex pumps with triplex pumps. Based on operation, the global mud pumps market can be segmented into electric and fuel engine.

The electric mud pumps will dominate the market during the given forecast period due to the advantage of eliminating the harmful carbon emission which is done in the case of fuel engine pumps. Based on its application, the global mud pumps market can be segmented into oil & gas, mining, construction, and others.

The major market driver for the global mud pumps market is the increasing exploration activities taking place in various regions of the world to satisfy the increased energy demand. The number of drilled wells has increased in recent years, which has certainly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

Key market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to reduce the carbon emissions, which will certainly decrease the demand for oil & gas and therefore will have a negative impact on the growth of the global mud pumps market.

Some of the notable companies in the global mud pump market are Mud King Products, Inc. Gardner Denver Pumps, Weatherford, Schlumberger, National Oilwell Varco, China National Petroleum Corporation, Flowserve Corporation, MHWirth, American Block, Herrenknecht Vertical Gmbh, Bentec GmbH Drilling & Oilfield Systems, Drillmec Inc, Sun Machinery Company, Shale Pumps, and Dhiraj Rigs.

The global mud pump market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Owing to the well-established production sector and stable exploration industry North America holds the largest market for the mud pumps. The onshore exploration activities of oil & gas have increased at a good rate in the North America region, which has certainly boosted the growth of the mud pumps market in the region.

The demand from Europe and Asia Pacific has also increased due to exploration activities in both the regions owing to the increased energy demand. The energy demand specifically in the Asia Pacific has increased due to the increased population and urbanization. The Middle East and Africa also hold significant opportunities for the mud pumps market with increased exploration activities in the given forecast period.

In August 2018, Henderson which is a leading company in sales and service of drilling rigs, and capital drilling equipment in Texas signed a contract with Energy Drilling Company for the purchase and upgrade of oil field equipment’s which included three 1600hp × 7500psi mud pumps. This will be the first refurbishment completed at Henderson’s new service center and rig yard.

In January 2018, Koltek Energy Services launched the 99-acre facility for the testing of the oil field equipment in Oklahoma. This will allow the oil field equipment manufacturers to test their equipment at any given time. The company has deployed the MZ-9 pump which has a power rating of 1000Hp.

The report covers comprehensive information about market trends, volume (Units) and value (US$ Mn) projections, competition and recent developments and market dynamics in the global mud pumps market for the study period of 2013 to 2026.

The global mud pumps market is expected to reach a little over US$ 1,085 Mn over the forecast period, registering a CAGR of 4.4%. Growth in drilling activities in the oil & gas Industry to increase hydrocarbon production and ease of the mud circulation operation in drilling holes are some of the factors expected to lay a robust foundation for the growth of the global mud pumps market.

Mud pumps can be classified on the basis of the number of pistons into duplex, triplex and quintuplex, which consist of two, three and five pistons respectively. The triplex segment is expected to dominate the mud pumps market in terms of value as well as volume during the entire forecast period.

Triplex mud pumps find extensive usage in circulating drilling fluid with high pressure for deep oil well drilling application. These usage characteristics make them preferable for use, primarily in onshore and offshore oil well drilling applications.

Mud pumps are widely utilized in the oil & gas industry. On the basis of the mode of operation, mud pumps can be classified as electric and fuel engine mud pumps.

Fuel engine mud pumps use petroleum oils as the key liquefying agent. These types of mud pumps release hazardous gases into the environment. In order to contain the hazardous impact of fuel engine mud pumps on the environment, regulatory authorities are compelling manufacturers and consumers to opt for electric mud pumps, which do not emit volatile organic compounds and operate with low noise and low vibration. Electric mud pumps offer smooth operations in drilling rigs and are environment-friendly, which is why they dominate the market for mud pumps.

The electric mud pumps segment is projected to grow with a 4.5% CAGR during the forecast period in view of the tightening emission control regulations and is expected to create an absolute $ opportunity worth US$ 134 Mn between 2018 and 2026.

Among all the applications analyzed in this global mud pumps market study, the onshore application of mud pumps is expected to register about 1.43X growth in terms of value between 2018 and 2026. The offshore application of mud pumps is projected to register moderate growth during the entire forecast period, led by land oil field discoveries.

In terms of incremental $ opportunity, onshore and offshore segments are expected to compete within large margins. The onshore application of mud pumps is expected to occupy over an 86% share in terms of value by the end of 2026.

Increasing oil-well exploration activities, stable economic conditions and consistent growth in oil well drilling rig sales in the region are expected to drive the demand for mud pumps in the region.

The comparatively well-established production sector in the region and increasing oil and gas industry and hydrocarbon consumption will create a healthy platform for the growth of the mud pumps market. Some regions including China and Europe are expected to gain traction in the latter half of the forecast period, owing to the anticipated growth of the oil & gas industry in these regions. North America is expected to register above-average 1.1X growth in the market. All the other regions are anticipated to exhibit moderate growth during the same period.

The global mud pumps market is consolidated with limited market players holding considerable double-digit market shares as of 2017. Globally, the top 12 players in the mud pumps market collectively hold between 53% and 58% of the market share.

Over the past few years, the mud pumps market has witnessed significant technological advancement from the competition perspective. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global mud pumps market.

In 2015, Flowserve opened a new pump manufacturing plant in Coimbatore, India. Through this new facility, the company aims to provide pump products for the oil and gas industry in Asia Pacific

Some of the key players involved in this market study on the global mud pumps market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

Pumps tend to be one of the biggest energy consumers in industrial operations. Pump motors, specifically, require a lot of energy. For instance, a 2500 HP triplex pump used for frac jobs can consume almost 2000 kW of power, meaning a full day of fracking can cost several thousand dollars in energy costs alone!

So, naturally, operators should want to maximize energy efficiency to get the most for their money. Even a 1% improvement in efficiency can decrease annual pumping costs by tens of thousands of dollars. The payoff is worth the effort. And if you want to remotely control your pumps, you want to keep efficiency in mind.

In this post, we’ll point you in the right direction and discuss all things related to pump efficiency. We’ll conclude with several tips for how you can maintain pumping efficiency and keep your energy costs down as much as possible.

In simple terms, pump efficiency refers to the ratio of power out to power in. It’s the mechanical power input at the pump shaft, measured in horsepower (HP), compared to the hydraulic power of the liquid output, also measured in HP. For instance, if a pump requires 1000 HP to operate and produces 800 HP of hydraulic power, it would have an efficiency of 80%.

Remember: pumps have to be driven by something, i.e., an electric or diesel motor. True pump system efficiency needs to factor in the efficiency of both the motor AND the pump.

Consequently, we need to think about how electrical power (when using electric motors) or heat power (when using combustion engines) converts into liquid power to really understand pump efficiency.

Good pump efficiency depends, of course, on pump type and size. High-quality pumps that are well-maintained can achieve efficiencies of 90% or higher, while smaller pumps tend to be less efficient. In general, if you take good care of your pumps, you should be able to achieve 70-90% pump efficiency.

AC motors can achieve 90%+ efficiency when converting electrical to mechanical energy. Combustion engines are much less efficient, with typical efficiency ratings coming in at ~20% for gasoline and ~40% for diesel. Your choice of engine or motor type will depend on the availability and cost of fuel or electricity in your area.

Now that we have a better understanding of the pump efficiency metric, let’s talk about how to calculate it. The mechanical power of the pump, or the input power, is a property of the pump itself and will be documented during the pump setup. The output power, or hydraulic power, is calculated as the liquid flow rate multiplied by the "total head" of the system.

IMPORTANT: to calculate true head, you also need to factor in the work the pump does to move fluid from the source. For example, if the source water is below the pump, you need to account for the extra work the pump puts in to draw source water upwards.

*Note - this calculation assumes the pump inlet is not pressurized and that friction losses are minimal. If the pump experiences a non-zero suction pressure, or if there is significant friction caused by the distance or material of the pipe, these should be factored in as well.

You"ll notice that the elevation head is minimal compared to the discharge pressure, and has minimal effect on the efficiency of the pump. As the elevation change increases or the discharge pressure decreases, however, elevation change will have a greater impact on total head.

Obviously, that’s a fair amount of math to get at the pump efficiency, considering all of the units conversions that need to be done. To avoid doing these calculations manually, feel free to use our simple pump efficiency calculator.

Our calculations use static variables (pump-rated horsepower and water source elevation) and dynamic variables (discharge flow and pressure). To determine pump efficiency, we need to measure the static variables only once, unless they change.

If you want to measure the true efficiency of your pump, taking energy consumption into account, you could add an electrical meter. Your meter should consist of a current transducer and voltage monitor (if using DC) for electrical motors or a fuel gauge for combustion. This would give you a true understanding of how pump efficiency affects energy consumption, and ultimately your bank account.

Up until this point, we’ve covered the ins and outs of how to determine pump efficiency. We’re now ready for the exciting stuff - how to improve pump efficiency!

One of the easiest ways to improve pump efficiency is to actually monitor pumps for signs of efficiency loss! If you monitor flow rate and discharge (output power) along with motor current or fuel consumption, you’ll notice efficiency losses as soon as they occur. Simply having pump efficiency information on hand empowers you to take action.

Another way to increase efficiency is to keep pumps well-maintained. Efficiency losses mostly come from mechanical defects in pumps, e.g., friction, leakages, and component failures. You can mitigate these issues through regular maintenance that keeps parts in working order and reveals impending failures. Of course, if you are continuously monitoring your pumps for efficiency drops, you’ll know exactly when maintenance is due.

You can also improve pump efficiency by keeping pumps lubricated at all times. Lubrication is the enemy of friction, which is the enemy of efficiency (“the enemy of my enemy is my friend…”).

A fourth way to enhance pump efficiency is to ensure your pumps and piping are sized properly for your infrastructure. Although we’re bringing this up last, it’s really the first step in any pumping operation. If your pumps and piping don’t match, no amount of lubricant or maintenance will help.

In this post, we’ve given you the full rundown when it comes to calculating and improving pump efficiency. You can now calculate, measure, and improve pump efficiency, potentially saving your business thousands of dollars annually on energy costs.

For those just getting started with pump optimization, we offer purpose-built, prepackaged solutions that will have you monitoring pump efficiency in minutes, even in hazardous environments.

A mud motor (or drilling motor) is a progressive cavity positive displacement pump (PCPD) placed in the drill string to provide additional power to the bit while drilling. The PCPD pump uses drilling fluid (commonly referred to as drilling mud, or just mud) to create eccentric motion in the power section of the motor which is transferred as concentric power to the drill bit. The mud motor uses different rotor and stator configurations to provide optimum performance for the desired drilling operation, typically increasing the number of lobes and length of power assembly for greater horsepower. In certain applications, compressed air, or other gas, can be used for mud motor input power. Normal rotation of the bit while using a mud motor can be from 60 rpm to over 100 rpm.

Normal mud motor construction consists of a top sub, which connects the mud motor to the drill string; the power section, which consists of the rotor and stator; the transmission section, where the eccentric power from the rotor is transmitted as concentric power to the bit using a constant-velocity joint; the bearing assembly which protects the tool from off bottom and on bottom pressures; and the bottom sub which connects the mud motor to the bit.

A mud motor is described in terms of its number of stages, lobe ratio and external diameter. Stages are the number of full twists that the stator makes from one end to the other and the lobe ratio is the number of lobes on the stator, to the number of lobes on the rotor (the stator always has one more lobe than the rotor). A higher number of stages indicates a more powerful motor. A higher number of lobes indicates a higher torque output (for a given differential pressure), a lower number of lobes indicates a reduction in the torque produced but a faster bit rotation speed.

The use of mud motors is greatly dependent on financial efficiency. In straight vertical holes, the mud motor may be used solely for increased rate of penetration (ROP), or to minimize erosion and wear on the drill string, since the drill string does not need to be turned as fast.

The majority of mud motor use is in the drilling of directional holes. Although other methods may be used to steer the bit to the desired target zone, they are more time-consuming, which adds to the cost of the well. Mud motors can be configured to have a bend in them using different settings on the motor itself. Typical mud motors can be modified from 0 degrees to 4 degrees with approximately six increments in deviation per degree of bend. The amount of bend is determined by rate of climb needed to reach the target zone. By using a measurement while drilling (MWD) tool, a directional driller can steer the bit to the desired target zone.

The PCPD stator, which is a major component of the pump, is usually lined with an elastomer. Most of PCPD pump failures are due to this elastomer part. However, the operating conditions

The mud motor may be sensitive to fouling agents. This means that certain types of drilling fluids or additives may ruin the motor or lower its performance. One particular example, as mentioned above, would be the use of oil based mud with the mud motor. Over time the oil degrades the elastomers and the seals in the motor.

n: 1. steel pipe placed in an oil or gas well to prevent the wall of the hole from caving in, to prevent movement of fluids from one formation to another and to aid in well control.

n: a pump with an impeller or rotor, an impeller shaft, and a casing, which discharges fluid by centrifugal force. An electric submersible pump is a centrifugal pump.

n: a method of improved oil recovery in which chemicals dissolved in water are pumped into a reservoir through injection wells to mobilize oil left behind after primary or secondary recovery and to move it toward production wells.

n: a device with an orifice installed in a line to restrict the flow of fluids. Surface chokes are part of the Christmas tree on a well and contain a choke nipple, or bean, with a small-diameter bore that serves to restrict the flow. Chokes are also used to control the rate of flow of the drilling mud out of the hole when the well is closed in with the blowout preventer and a kick is being circulated out of the hole. See choke manifold.

n: the control valves, pressure gauges, and chokes assembled at the top of a well to control flow of oil and/or gas after the well has been drilled and completed. It is used when reservoir pressure is sufficient to cause reservoir fluids to rise to the surface.

n: the movement of drilling fluid out of the mud pits, down the drill stem, up the annulus, and back to the mud pits. See normal circulation, reverse circulation.

n: the equipment for transporting and using coiled tubing, including a reel for the coiled tubing, an injector head to push the tubing down the well, a wellhead blowout preventer stack, a power source (usually a diesel engine and hydraulic pumps), and a control console. A unique feature of the unit is that it allows continuous circulation while it is being lowered into the hole. A coiled tubing unit is usually mounted on a trailer or skid.

n: low-solids fluid or drilling mud used when a well is being completed. It is selected not only for its ability to control formation pressure, but also for the properties that minimize formation damage.

n: 1. a mechanism used to transmit power from the engines to the pump, the drawworks, and other machinery on a drilling rig. It is composed of clutches, chains and sprockets, belts and pulleys, and a number of shafts, both driven and driving. v: to connect two or more power producing devices, such as engines, to run driven equipment, such as the drawworks.

n: a device that raises the pressure of a compressible fluid such as air or gas. Compressors create a pressure differential to move or compress a vapor or a gas.

n: generally, the first string of casing in a well. It may be lowered into a hole drilled into the formations near the surface and cemented in place; it may be driven into the ground by a special pile driver (in such cases, it is sometimes called drive pipe). Its purpose is to prevent the soft formations near the surface from caving in and to conduct drilling mud from the bottom of the hole to the surface when drilling starts. Also called conductor pipe, drive pipe.

n: a weight applied to compensate for existing weight or force. On pumping units in oil production, counterweights are used to offset the weight of the column of sucker rods and fluid on the upstroke of the pump, and the weight of the rods on the downstroke.

n: an arm keyed at right angles to a shaft and used for changing radius of rotation or changing reciprocating motion to circular motion or circular motion to reciprocating motion. On a beam pumping unit, the crank is connected by the pitman to the walking beam, thereby changing circular motion to reciprocating motion.

n pl: the fragments of rock dislodged by the bit and brought to the surface in the drilling mud. Washed and dried cuttings samples are analyzed by geologists to obtain information about the formations drilled.

8613371530291

8613371530291