creative commons mud pump oil and gas pricelist

If you ended up on this page doing normal allowed operations, please contact our support at support@mdpi.com. Please include what you were doing when this page came up and the Ray ID & Your IP found at the

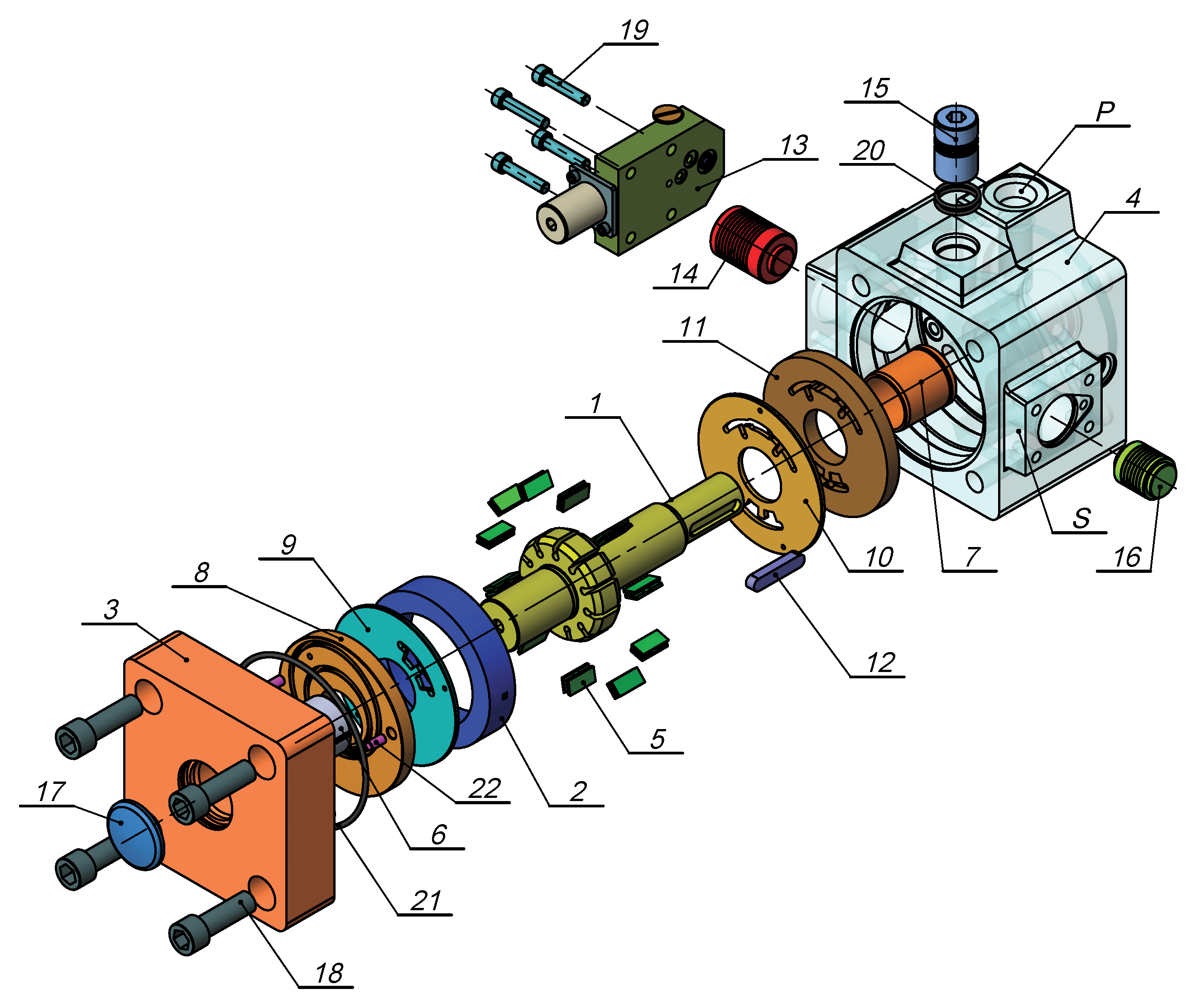

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

The recent fall in the price of oil to below $50 per barrel threatens to shut off the more expensive oil production facilities. That means shale oil, which in the United States typically has a US$70 per barrel breakeven point. Therefore, the newcomers to the oil market have created market forces that threaten their own survival. The US does not produce enough oil for its own needs and the rest of the world has grown rich supplying that shortfall. Existing suppliers are not prepared to cut their production in order to enable American domestic producers to meet all of the US’s energy needs. Therefore if the US is ever going to achieve energy independence, American oil producers need to cut their costs to the level at which they can profit at lower prices. Their one hope is to exploit the very factor that made non-conventional oil extraction possible in the first place — technological innovation.

When an oil company starts to develop an oil field, it does so on the basis of market forecasts and cost projections. Investors and lenders make their own predictions about global oil requirements before investing money in these enterprises. The startup costs for new wells, especially in the field of shale oil extraction, are so great that the bulk of the costs of production occur before extraction even begins. An unexpected fall in the price of oil does not specifically shut down existing production; rather it prevents, or postpones the development of new reserves.

Oil companies and their backers are faced with a dilemma because oil wells are not so easy to mothball. Production requires specialist workers and supplies. If an oil field becomes unprofitable, a closed well would leave behind unpaid bills and bankrupted business owners. The contractual obligations of the extracting company mean that calls for compensation could drive the business into bankruptcy. Thus, established oil wells continue in production, but exploration and development (E&P) of new wells is postponed. As a result of the failure to replace exhausted wells, the North Dakota rig count has plummeted to 135, the lowest level since 2010.

Furthermore, the establishment of a support network in areas of the country not traditionally known for oil production means that there are many times more businesses investors and workers with a stake in the continuation of oil production than those directly involved with extraction. During the boom years new towns were created and small settlements were expanded at breathtaking speed. Those newly established communities of restaurateurs, teachers and municipal workers are not just going to pack up and go back to where they came from. A sudden stop to production would produce bankruptcies far beyond the oil sector. Fortunately, the suppliers of extraction equipment have also had to compete to win business. Although oil producers might not have bothered to investigate innovative techniques and machinery during boom times, they are more likely to pay attention to cost cutting innovations now.

Computers, smart phones and flat screen TVs are three examples of how expansion of production, economies of scale and the advancement of innovation bring prices crashing down. The innovators that first created the possibility of fracking have not been idle over the past decade. The technology surrounding non-conventional oil extraction has continued to be refined and the costs of drilling and processing equipment have fallen steadily. The oil price crash may not create a new market for innovation, but will rapidly accelerate the advancement of technology that was already underway.

The shale oil industry experienced a Gold Rush mentality during the dash to expand, which ground to a halt in October 2014. Whereas the boom years belonged to the risk takers and the high payers, the low cost era will be dominated by accountants and engineers. Executives need to justify their high pay and protect their profit-linked bonuses, and their usual method for preserving their income is to lay off manual labourers. This phase of cost cutting has already begun: Schlumberger, the world’s largest oilfield services company decided to slash their workforce by 9,000; Weatherford International, another major oilfield services operation cut their 60,000 staff by 14,000 in 2014 and has announced a further round of redundancies lopping 5,000 more from the payroll in 2015. Globally an estimated 100,000 oil workers were laid off. However, Schlumberger and Weatherford International do not intend to wind up their businesses. Like many they will turn to technology to replace their lost workforce with automation.

Cost-saving technologies include more efficient exploration methods, onsite automation systems and intelligent production monitoring software. Big players in the oil services industry have been keeping ahead of the pack with big R&D budgets. Likewise some promising smaller companies which invested in R&D during boom times are seizing opportunities in reducing oil extraction and production costs. One NASDAQ-listed company, Recon Technology, Ltd. (RCON) especially shines in this regard. Recon has developed a patented fracking method called “Frac BHD” which slashes the costs of extracting oil from shale through horizontal drilling, as well as an assortment of highly automated systems which increase production and distribution efficiency. As such, Recon Technology earned the distinction of being the first non-nationalized Chinese oil company listed on a US stock exchange.

Recon Technology is an independent company, but it benefited from associations with state-owned Chinese oil companies including giants Sinopec and China National Petroleum Corporation. These government-owned oil producers follow firm 5-year plan commitments. The Chinese government is determined to develop fracking and catch up with westerners at a lower price point. This goal enabled Recon to pursue R&D efforts to make their own fracking system cheaper, while expanding operations into the oil frontiers of Turkmenistan and Kazakhstan.

Recon has built up its business by proving that shale oil extraction in China is commercially viable. They endeavored to create profitable extraction in a location that was previously thought to be unviable. The company’s initial methods incorporated the Frac-Point completion system produced by the American oil services company, Baker Hughes. Sinopec now has 1,100 shale oil wells, where previously China had none.

Recon examined the specific challenges of fracking in China to develop their Frac BHD system, which the company predicts will be even more economical once it hits the market in March 2015. Frac BHD is a multi-stage stimulation system, as is Frac-Point. The equipment is used in open-hole horizontal well fracturing and Recon claims that Frac BHD maximizes reservoir productivity and saves well completion time. The new Chinese system incorporates safety features to reduce the incidences of setting accidents, thus speeding average well completion time and slashing costs further.

Schlumberger has a system called “HIWAY”, which includes mixing fibers into the grit that blasts out shale oil and gas. The addition of fibers keeps newly blasted channels open and reduces the need for redrilling. Halliburton‘s “RapidFrac” system cuts water needs for fracking in half and is a much faster process to implement than the methods that are currently widely used in the industry. Lower water needs reduce the amount of supply trucks going to a fracking site and less water forced into the ground reduces hazards and targets resources more accurately, thus reducing both costs and environmental impact.

Haliburton’s UniStim employs water pumped out of the ground locally rather than freshwater that needs to be trucked or piped in to the work site. A Canadian company, GasFrac, has eliminated the use of water in fracking entirely. It employs a propane-based gel. The Colorado School of Mines is developing a method termed “cryogenic fracturing.” This involves causing fissures through contact with liquid nitrogen. Frackers are also reducing costs by using gas or solar power instead of diesel for drilling rigs and pumps.

The example of Recon Technologies is striking, because they introduced technology from Baker Hughes into China to Sinopec, and later came up with a comprehensive system including fracking as well as an assortment of intelligent software solutions which monitor and control pumps and pipelines, thus reducing human error, waste and expenses. Striking as well is the fact that the US upstream sector [exploration and production] is no stranger to sourcing foreign components: for years US land drilling rigs have incorporated key Chinese components such as triplex mud pumps at a substantial saving. Today the US oil industry is realizing that beyond cheaper hardware the next saving opportunity lies in advances including more automation: intelligent control systems requiring less physical workforce, less downtime and improving yields of existing wells. Exploiting cost-cutting technology will make US shale oil production profitable again, but the industry needs to evolve quickly to survive the Saudi onslaught on oil prices. In fact, the price pressure on US producers could get even worse and so the vital importance of developing cost-cutting technologies becomes more imperative. A trend of cheaper unconventional extraction is already underway and the shale oil fight back has begun.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

An oil well is a drillhole boring in Earth that is designed to bring petroleum oil hydrocarbons to the surface. Usually some natural gas is released as associated petroleum gas along with the oil. A well that is designed to produce only gas may be termed a gas well. Wells are created by drilling down into an oil or gas reserve that is then mounted with an extraction device such as a pumpjack which allows extraction from the reserve. Creating the wells can be an expensive process, costing at least hundreds of thousands of dollars, and costing much more when in hard to reach areas, e.g., when creating offshore oil platforms. The process of modern drilling for wells first started in the 19th century, but was made more efficient with advances to oil drilling rigs during the 20th century.

Wells are frequently sold or exchanged between different oil and gas companies as an asset – in large part because during falls in price of oil and gas, a well may be unproductive, but if prices rise, even low production wells may be economically valuable. Moreover, new methods, such as hydraulic fracturing (a process of injecting gas or liquid to force more oil or natural gas production) have made some wells viable. However, peak oil and climate policy to fossil fuels has made fewer and fewer of these wells and expensive techniques viable.

However, the large number of neglected or poorly maintained wellheads is a large environmental issue: they may leak methane emissions or other toxic emissions into local air, water or soil systems. This pollution often becomes worse when wells are abandoned or orphaned – where wells no longer are economically viable, and no longer are maintained by a company. A 2020 estimate by Reuters suggested that there were at least 29 million abandoned wells internationally, creating a significant source of greenhouse gas emissions causing climate change.

The ancient records of China and Japan are said to contain many allusions to the use of natural gas for lighting and heating. Petroleum was known as burning water in Japan in the 7th century.

According to Kasem Ajram, petroleum was distilled by the Persian alchemist Muhammad ibn Zakarīya Rāzi (Rhazes) in the 9th century, producing chemicals such as kerosene in the alembic (al-ambiq),kerosene lamps.Arab and Persian chemists also distilled crude oil in order to produce flammable products for military purposes. Through Islamic Spain, distillation became available in Western Europe by the 12th century.

Some sources claim that from the 9th century, oil fields were exploited in the area around modern Baku, Azerbaijan, to produce naphtha for the petroleum industry. These places were described by Marco Polo in the 13th century, who described the output of those oil wells as hundreds of shiploads. When Marco Polo in 1264 visited Baku, on the shores of the Caspian Sea, he saw oil being collected from seeps. He wrote that "on the confines toward Geirgine there is a fountain from which oil springs in great abundance, in as much as a hundred shiploads might be taken from it at one time."

In 1846, Baku (settlement Bibi-Heybat) the first ever well was drilled with percussion tools to a depth of 21 metres (69 ft) for oil exploration. In 1846–1848, the first modern oil wells were drilled on the Absheron Peninsula north-east of Baku, by Russian engineer Vasily Semyonov considering the ideas of Nikolay Voskoboynikov.

Ignacy Łukasiewicz, a Polishpharmacist and petroleum industry pioneer built one of the world"s first modern oil wells in 1854 in Polish village Bóbrka, Krosno Countyoil refineries.

In North America, the first commercial oil well entered operation in Oil Springs, Ontario in 1858, while the first offshore oil well was drilled in 1896 at the Summerland Oil Field on the California Coast.

The earliest oil wells in modern times were drilled percussively, by repeatedly raising and dropping a cable tool into the earth. In the 20th century, cable tools were largely replaced with rotary drilling, which could drill boreholes to much greater depths and in less time.Kola Borehole used a mud motor while drilling to achieve a depth of over 12,000 metres (12 km; 39,000 ft; 7.5 mi).

Until the 1970s, most oil wells were vertical, although lithological and mechanical imperfections cause most wells to deviate at least slightly from true vertical (see deviation survey). However, modern directional drilling technologies allow for strongly deviated wells which can, given sufficient depth and with the proper tools, actually become horizontal. This is of great value as the reservoir rocks which contain hydrocarbons are usually horizontal or nearly horizontal; a horizontal wellbore placed in a production zone has more surface area in the production zone than a vertical well, resulting in a higher production rate. The use of deviated and horizontal drilling has also made it possible to reach reservoirs several kilometers or miles away from the drilling location (extended reach drilling), allowing for the production of hydrocarbons located below locations that are either difficult to place a drilling rig on, environmentally sensitive, or populated.

For an injection well, the target is selected to locate the point of injection in a permeable zone, which may support disposing of water or gas and /or pushing hydrocarbons into nearby production wells.

The target (the end point of the well) will be matched with a surface location (the starting point of the well), and a trajectory between the two will be designed. There are many considerations to take into account when designing the trajectory such as the clearance to any nearby wells (anti-collision) or if this well will get in the way of future wells, trying to avoid faults if possible and certain formations may be easier/more difficult to drill at certain inclinations or azimuths.

When the well path is identified, a team of geoscientists and engineers will develop a set of presumed properties of the subsurface that will be drilled through to reach the target. These properties include pore pressure, fracture gradient, wellbore stability, porosity, permeability, lithology, faults, and clay content. This set of assumptions is used by a well engineering team to perform the casing design and completion design for the well, and then detailed planning, where, for example, the drill bits are selected, a BHA is designed, the drilling fluid is selected, and step-by-step procedures are written to provide instruction for executing the well in a safe and cost-efficient manner.

With the interplay with many of the elements in a well design and making a change to one will have a knock on effect on many other things, often trajectories and designs go through several iterations before a plan is finalised.

The well is created by drilling a hole 12 cm to 1 meter (5 in to 40 in) in diameter into the earth with a drilling rig that rotates a drill string with a bit attached. After the hole is drilled, sections of steel pipe (casing), slightly smaller in diameter than the borehole, are placed in the hole. Cement may be placed between the outside of the casing and the borehole known as the annulus. The casing provides structural integrity to the newly drilled wellbore, in addition to isolating potentially dangerous high pressure zones from each other and from the surface.

With these zones safely isolated and the formation protected by the casing, the well can be drilled deeper (into potentially more-unstable and violent formations) with a smaller bit, and also cased with a smaller size casing. Modern wells often have two to five sets of subsequently smaller hole sizes drilled inside one another, each cemented with casing.

Drilling fluid, a.k.a. "mud", is pumped down the inside of the drill pipe and exits at the drill bit. The principal components of drilling fluid are usually water and clay, but it also typically contains a complex mixture of fluids, solids and chemicals that must be carefully tailored to provide the correct physical and chemical characteristics required to safely drill the well. Particular functions of the drilling mud include cooling the bit, lifting rock cuttings to the surface, preventing destabilisation of the rock in the wellbore walls and overcoming the pressure of fluids inside the rock so that these fluids do not enter the wellbore. Some oil wells are drilled with air or foam as the drilling fluid.

The generated rock "cuttings" are swept up by the drilling fluid as it circulates back to surface outside the drill pipe. The fluid then goes through "shakers" which strain the cuttings from the good fluid which is returned to the pit. Watching for abnormalities in the returning cuttings and monitoring pit volume or rate of returning fluid are imperative to catch "kicks" early. A "kick" is when the formation pressure at the depth of the bit is more than the hydrostatic head of the mud above, which if not controlled temporarily by closing the blowout preventers and ultimately by increasing the density of the drilling fluid would allow formation fluids and mud to come up through the annulus uncontrollably.

The pipe or drill string to which the bit is attached is gradually lengthened as the well gets deeper by screwing in additional 9 m (30 ft) sections or "joints" of pipe under the kelly or topdrive at the surface. This process is called making a connection. The process called "tripping" is when pulling the bit out of hole to replace the bit (tripping out), and running back in with a new bit (tripping in). Joints can be combined for more efficient tripping when pulling out of the hole by creating stands of multiple joints. A conventional triple, for example, would pull pipe out of the hole three joints at a time and stack them in the derrick. Many modern rigs, called "super singles", trip pipe one at a time, laying it out on racks as they go.

This process is all facilitated by a drilling rig which contains all necessary equipment to circulate the drilling fluid, hoist and turn the pipe, control downhole, remove cuttings from the drilling fluid, and generate on-site power for these operations.

In a cased-hole completion, small holes called perforations are made in the portion of the casing which passed through the production zone, to provide a path for the oil to flow from the surrounding rock into the production tubing. In open hole completion, often "sand screens" or a "gravel pack" is installed in the last drilled, uncased reservoir section. These maintain structural integrity of the wellbore in the absence of casing, while still allowing flow from the reservoir into the wellbore. Screens also control the migration of formation sands into production tubulars and surface equipment, which can cause washouts and other problems, particularly from unconsolidated sand formations of offshore fields.

After a flow path is made, acids and fracturing fluids may be pumped into the well to fracture, clean, or otherwise prepare and stimulate the reservoir rock to optimally produce hydrocarbons into the wellbore. Finally, the area above the reservoir section of the well is packed off inside the casing, and connected to the surface via a smaller diameter pipe called tubing. This arrangement provides a redundant barrier to leaks of hydrocarbons as well as allowing damaged sections to be replaced. Also, the smaller cross-sectional area of the tubing produces reservoir fluids at an increased velocity in order to minimize liquid fallback that would create additional back pressure, and shields the casing from corrosive well fluids.

In many wells, the natural pressure of the subsurface reservoir is high enough for the oil or gas to flow to the surface. However, this is not always the case, especially in depleted fields where the pressures have been lowered by other producing wells, or in low permeability oil reservoirs. Installing a smaller diameter tubing may be enough to help the production, but artificial lift methods may also be needed. Common solutions include downhole pumps, gas lift, or surface pump jacks. Many new systems in the last ten years have been introduced for well completion. Multiple packer systems with frac ports or port collars in an all in one system have cut completion costs and improved production, especially in the case of horizontal wells. These new systems allow casings to run into the lateral zone with proper packer/frac port placement for optimal hydrocarbon recovery.

A schematic of a typical oil well being produced by a pumpjack, which is used to produce the remaining recoverable oil after natural pressure is no longer sufficient to raise oil to the surface

The production stage is the most important stage of a well"s life; when the oil and gas are produced. By this time, the oil rigs and workover rigs used to drill and complete the well have moved off the wellbore, and the top is usually outfitted with a collection of valves called a Christmas tree or production tree. These valves regulate pressures, control flows, and allow access to the wellbore in case further completion work is needed. From the outlet valve of the production tree, the flow can be connected to a distribution network of pipelines and tanks to supply the product to refineries, natural gas compressor stations, or oil export terminals.

As long as the pressure in the reservoir remains high enough, the production tree is all that is required to produce the well. If the pressure depletes and it is considered economically viable, an artificial lift method mentioned in the completions section can be employed.

Workovers are often necessary in older wells, which may need smaller diameter tubing, scale or paraffin removal, acid matrix jobs, or completing new zones of interest in a shallower reservoir. Such remedial work can be performed using workover rigs – also known as pulling units, completion rigs or "service rigs" – to pull and replace tubing, or by the use of well intervention techniques utilizing coiled tubing. Depending on the type of lift system and wellhead a rod rig or flushby can be used to change a pump without pulling the tubing.

Enhanced recovery methods such as water flooding, steam flooding, or CO2 flooding may be used to increase reservoir pressure and provide a "sweep" effect to push hydrocarbons out of the reservoir. Such methods require the use of injection wells (often chosen from old production wells in a carefully determined pattern), and are used when facing problems with reservoir pressure depletion, high oil viscosity, or can even be employed early in a field"s life. In certain cases – depending on the reservoir"s geomechanics – reservoir engineers may determine that ultimate recoverable oil may be increased by applying a waterflooding strategy early in the field"s development rather than later. Such enhanced recovery techniques are often called "tertiary recovery".

Orphan, orphaned or abandoned wells are oil or gas wells that have been abandoned by fossil fuel extraction industries. These wells may have been deactivated because of economic viability, failure to transfer ownerships (especially at bankruptcy of companies), or neglect and thus no longer have legal owners responsible for their care. Decommissioning wells effectively can be expensive, costing millions of dollars,climate change mitigation reduces demand and usage of oil and gas, its expected that more wells will be abandoned as stranded assets.

Orphan wells are an important contributor of greenhouse gas emissions causing climate change. Wells are an important source of methane emissions through leakage through plugs, or failure to plug properly. A 2020 estimate of US abandoned wells alone was that methane emissions released from abandoned wells produced greenhouse gas impacts equivalent of 3 weeks US oil consumption each year.

Abandoned wells also have the potential to contaminate land, air and water around wells, potentially harming ecosystems, wildlife, livestock, and humans.

Natural gas, in a raw form known as associated petroleum gas, is almost always a by-product of producing oil.reservoir to the surface, similar to uncapping a bottle of soda where the carbon dioxide effervesces. If it escapes into the atmosphere intentionally it is known as vented gas, or if unintentionally as fugitive gas.

Unwanted natural gas can be a disposal problem at wells that are developed to produce oil. If there are no pipelines for natural gas near the wellhead it may be of no value to the oil well owner since it cannot reach the consumer markets. Such unwanted gas may then be burned off at the well site in a practice known as production flaring, but due to the energy resource waste and environmental damage concerns this practice is becoming less common.

Often, unwanted (or "stranded" gas without a market) gas is pumped back into the reservoir with an "injection" well for storage or for re-pressurizing the producing formation. Another solution is to convert the natural gas to a liquid fuel. Gas to liquid (GTL) is a developing technology that converts stranded natural gas into synthetic gasoline, diesel or jet fuel through the Fischer–Tropsch process developed in World War II Germany. Like oil, such dense liquid fuels can be transported using conventional tankers or trucking to users. Proponents claim GTL fuels burn cleaner than comparable petroleum fuels. Most major international oil companies are in advanced development stages of GTL production, e.g. the 140,000 bbl/d (22,000 m3/d) Pearl GTL plant in Qatar, scheduled to come online in 2011. In locations such as the United States with a high natural gas demand, pipelines are usually favored to take the gas from the well site to the end consumer.

Wells with subsea wellheads, where the top of the well is sitting on the ocean floor under water, and often connected to a pipeline on the ocean floor.

appraisal wells are used to assess characteristics (such as flow rate, reserve quantity) of a proven hydrocarbon accumulation. The purpose of this well is to reduce uncertainty about the characteristics and properties of the hydrocarbon present in the field.

water injectors injecting water into the formation to maintain reservoir pressure, or simply to dispose of water produced with the hydrocarbons because even after treatment, it would be too oily and too saline to be considered clean for dumping overboard offshore, let alone into a fresh water resource in the case of onshore wells. Water injection into the producing zone frequently has an element of reservoir management; however, often produced water disposal is into shallower zones safely beneath any fresh water zones.

aquifer producers intentionally producing water for re-injection to manage pressure. If possible this water will come from the reservoir itself. Using aquifer produced water rather than water from other sources is to preclude chemical incompatibility that might lead to reservoir-plugging precipitates. These wells will generally be needed only if produced water from the oil or gas producers is insufficient for reservoir management purposes.

gas injectors injecting gas into the reservoir often as a means of disposal or sequestering for later production, but also to maintain reservoir pressure.

The cost of a well depends mainly on the daily rate of the drilling rig, the extra services required to drill the well, the duration of the well program (including downtime and weather time), and the remoteness of the location (logistic supply costs).

Onshore wells can be considerably cheaper, particularly if the field is at a shallow depth, where costs range from less than $4.9 million to $8.3 million, and the average completion costing $2.9 million to $5.6 million per well.

The total cost of an oil well mentioned does not include the costs associated with the risk of explosion and leakage of oil. Those costs include the cost of protecting against such disasters, the cost of the cleanup effort, and the hard-to-calculate cost of damage to the company"s image.

Frank, Alison Fleig (2005). Oil Empire: Visions of Prosperity in Austrian Galicia (Harvard Historical Studies). Harvard University Press. ISBN 0-674-01887-7.

Kaiser MJ (2019). Decommissioning forecasting and operating cost estimation : Gulf of Mexico well trends, structure inventory and forecast models. Cambridge, MA: Gulf Professional Publishing. doi:10.1016/C2018-0-02728-0. ISBN 978-0-12-818113-3. S2CID 239358078.

Allison E, Mandler B (14 May 2018). "Abandoned Wells. What happens to oil and gas wells when they are no longer productive?". Petroleum and Environment. American Geosciences Institute.

"Crude Oil and Natural Gas Drilling Activity". Energy Information Administration. U.S. Energy Information Administration. 21 May 2019. Retrieved 4 November 2019.

Center, Petrogav International Oil & Gas Training (2020-07-02). The technological process on Offshore Drilling Rigs for fresher candidates. Petrogav International.

"Trends in U.S. Oil and Natural Gas Upstream Costs" (PDF). Energy Information Administration. U.S. Energy Information Administration. 2016. Retrieved 4 November 2019.

Texas at the turn of the twentieth century depended upon farming, lumber, and cattle ranching for its basic economy. While oil was drilled in Texas in the late 1890’s and early 1900, it did not produce enough to have any significance to the state’s economy. The Spindletop discovery changed everything on January 10, 1901, when oil was struck.

Spindletopis an oil field built on top of a salt dome located near Beaumont, Texas which mainly produced lumber. On that history-making day, the Spindletop gusher raged for 9 days gushing 100,000 barrels of oil per day. As a result, Texaco and Gulf Oil, now part of Chevron Corporation, were founded for the development of oil production at Spindletop.

, a Pulitzer Prize author and energy authority, claimed that the Spindletop discovery guided America into the golden age of oil. Before Spindletop, oil was mainly used as a lubricant and for burning oil lamps. The volume of the Spindletop oil made it economically feasible to use petroleum in the mass consumption of fuel.The Spindletop well, a discovery that created the greatest oil boom in America – exceeding the nation’s first oil discovery well in 1859 in Pennsylvania.

Oil has been around for hundreds of years. As far back as 1543, Spanish conquistadors used crude oil for caulking their ships and waterproofing their boots. Native American Indians drank crude oil in an attempt to cure digestive problems.

Prior to 1901, many speculated that oil was under Spindletop Hill. This was due to its vast bubbling gas seepages which ignited when lit, and the fact of having numerous sulfur springs.

In 1892, George W. Carroll,George W. O’Brien, and Patillo Higgins created the Gladys City Oil, Gas, and Manufacturing Company to do Spindletop Hill’s exploratory drilling. However, after drilling numerous dry holes, their investors lost confidence in their oil explorations.

Patillo Higgins, a one-armed mechanic and self-taught geologist, was one of the few at the time who believed that U.S. industries would soon switch fuels from coal to oil. Higgins believed thatSpindletop Hill, just four miles south of the town of Beaumont had oil. This was in spite of contrary conventional wisdom at the time. The hill formed over a million years was a result of a huge underground salt dome that moved towards the surface. Higgins had a gut feeling that by drilling down from the top of the salt dome would produce oil. Local geologists were skeptical of Higgins beliefs.

Then, Patillo Higgins quit the company to team up with Captain Anthony F. Lucas, a leading salt dome formations expert. In 1899, Lucas signed a lease agreement with the Gladys City Company and a later partnership contract with Patillo Higgins. However, after Lucas drilled to 575 feet, he ran out of money.

Lucas found additional investors James M. Guffey and John H. Galey from Pittsburgh, Pennsylvania. Their investment reduced Lucas to only a one-eighth share while Higgins was completely left out. In addition to funding, Guffey and Galey’s main contribution was bringing in AlandCurt Hamillfrom the Corsicana oilfieldwho were drilling mud experts.

Finally, on January 10, 1901, Lucas drilled to a depth of 1,139 feet and struck oil. What later become known as the “Lucas Geyser” and the “Lucas Gusher”, the gusher blew over 100 feet in the air at a rate of 100,000 barrels per day. After nine days, the gusher was finally brought under control.

According to Lamar University in Texas, the significance of the Spindletop gusher producing 100,000 barrels a day compared to the total annual Texas oil production in 1900 of only 836,000 barrels. This meant Spindletop could produce more than the previous year’s oil production in Texas in just 9 days. In addition, Spindletop produced nearly 40% of the total annual oil production of the entire U.S. in 1901.

The Spindletop-Gladys City Boomtown Museum states that:The oilfield produced 3.59 million barrels in its first year and an incredible 17.4 million barrels the next.

At the time, Spindletop became the largest gusher in the world. As a result, the little town of Beaumont turned into an oil-fueled boomtown. Its population of 8,500 quickly tripled in a month and grew to 50,000 within a year.

Besides local population growth, land values rose rapidly. In addition, by 1903, 285 wells were operating and more than 500 oil related companies were created.

As the first oilfield in the U.S. Gulf Coast, Spindletop inspired further drilling and oil discoveries in the region. Drilling in other salt fields proved to be very successful. In a short time, the Gulf Coast became a major oil region.

During that time, Texaco and Gulf Oil grew into major oil producers. Ironically, Standard Oil was completely shut out of Texas by its state antitrust laws. Standard Oil had a major monopoly in the eastern states petroleum industry. Even companies affiliated with Standard Oil were banned from Texas due to alleged improper business practices. In spite of these banishments, Standard Oil was still able to build refineries in the region because no other U.S. companies could.

Lucas first spudded in a well in October of 1900. He used a heavier, more efficient rotary type bit. In essence, Lucas popularized rotary drilling technology. Over the next three months, Lucas drilled along with the Hamill brothers trying to overcome difficult oil sands. The sand made the hole susceptible to cave-ins. Curtis Hamill solved the problem by pumping mud instead of water into the hole to flush out the drill cuttings. The mud stuck to the sides of the hole which prevented cave-ins. This was a revolutionary solution for drilling into sand. Drilling mud has been used globally ever since.

Finally, on January 10th mud started bubbling from the hole. Frightened drillers ran as six tons of four-inch drilling pipe shot out of the hole. When the well blew, Curtis Hamill was working on top of the rig. He fought for his life getting down in time. Then it calmed down for a few minutes as mud, then gas, and finally oil spurted out. That’s when Curtis Hamill returned to shut off the derrick floor machinery.

The resulting stream traveling over 1,139 feet underground blew an oil stream over 100 feet high. It took nine days to finally cap it. The flow averaged 100,000 barrels per day.

When it was capped on January 19, a large pool of oil surrounded it. When word got out, thousands of onlookers, speculators, and oilmen eventually transformed the town of Beaumont into a city.

Sidenote: Drilling companies have continuously used ingenuity to solve wellbore and drilling problems. For those interested, here are our articles aboutturbodrilling, jet drilling and wellbore cleanups.

For the first time in history, the biggest oil gusher flowed. In eight months, six more successful wells flourished on lands owned by the Gladys City Company.

Nearby land prices skyrocketed. One land seller tried to sell for the past three years at $150, then sold it for $20.000. The buyer quickly resold it within 15 minutes for $50,000. One of the wells drilled on an investment of $10,000 sold for $1,250,000.

Multi-million dollar land deals spread like wildfire. By the end of 1901, over $235 million was invested in Texas oil. But not every investment was successful. Some became instant millionaires while others lost everything.

A second boom began in 1925 when the Yount-Lee Oil Company struck oil at a depth of 5,400 feet at its McFaddin No. 2 well. In 1927, 21 million barrels were produced during its peak year. More than 72 million barrels were produced over the first 10 year period mainly from nearby areas of the McFaddin field.

, a Texas oilman co-authored the 1952 book ‘Spindletop: the True Story of the Oil Discovery That Changed the World’. He proclaimed that the Spindletop discovery “affected the entire world”.

The huge volumes of oil caused prices to drop from $2 to less than 25 cents a barrel. Causing fuels to become cheaper helped revolutionize American transportation and industries. Pipelines, storage facilities, and major refineries were built around Spindletop including Beaumont, Sabine Pass, Port Arthur, and the Orange areas.

Gulf Oil Corporation(1901 to 1981), the Texas Company (later Texaco), Sun Oil Company (Sunoco), Humble (later Exxon Company and now ExxonMobil Corporation), and Magnolia Petroleum Company (also now ExxonMobil)arejust a few of the many major oil companies spawned by the Spindletop discovery.

The 1950’s experienced another oilfield boom when sulphur was produced by the Texas Gulf Sulphur Company (later TexasGulf). It produced oiluntil 1975.

From 1963 through 1966, deep-seated oil production accomplished depths as low as 9,000 feet. The Spindletop old field lasted into the 1990s by yielding little production in the form of salt brine and stripper wells.

The sheer number of Spindletop wells eventually led to a quick decline in oil production. Oil production in 1902 yielded 17.5 million barrels. By early 1904, the Spindletop wells only produced 10,000 barrels per day. While the deposits from its shallow Miocene caprockdiminished, the oilfield didn’t dry out yet.

In 1925, a second boom came with the Yount-Lee Oil Company drilling into the salt dome down to 5,400 feet. Several other discoveries in the area on the flanks of the salt dome also produced some success. Land prices rose to $200,000 for a one-acre tract, a lot of money during that time period.

In 1941, a pink stone monument was raised near the original site of the Lucas Gusher commemorating the Spindletop discovery. However, due to the removal of oil, brine, and sulphur, the Spindletop dome surface subsided causing the monument to be moved to the Lamar University campus at Beaumont. The Spindletop/Gladys City Boomtown Museum now houses the Spindletop Monument.

The Spindletop Oil Discovery changed Texas and U.S. history because of the vast volumes of oil. This drove oil prices down from $2 a barrel to less than 25 cents. The doors opened for mass production of fuels which revolutionized transportation and industry in the U.S. This brought about the Industrial Revolution.

The automobile industry along with the entire United States should thank the Spindletop Oil Discovery for lifting the economy into prosperity which still remains today.

Steven is a diligent researcher and journalist who covers tech, marketing, real estate and energy. Currently residing in Panama, he helps the global dissemination of accurate information – he also authors and edits for Wikipedia in his spare time!

Oil prices hit a 6-year high this week as talks between OPEC and its allies (collectively known as OPEC+) broke down. The intergovernmental organization was expected to establish higher output targets among its member nations to meet the increasing global demand for oil, but talks were abandoned after Saudi Arabia and the United Arab Emirates failed to resolve a dispute over oil production levels.

Though oil is always a tricky market, it has been especially difficult to navigate during the pandemic. “OPEC+ took historic measures in April 2020 and removed nearly 10 million barrels per day of production in an effort to support prices as demand for petroleum-products plummeted,” CNBC reports. “Since then, the group has been slowly returning barrels to the market, while meeting on a near monthly basis to discuss output policy.”

However, even with the increasing supply, oil prices have risen 57 percent in 2021 as the surge in demand has outpaced production. And now that talks about raising output have broken down, many analysts are predicting even higher prices.

“With no increase in production, the forthcoming growth in demand should see global energy markets tighten up at an even faster pace than anticipated,” analysts at TD Securities wrote in a note to clients. “The summer breakout in oil prices is set to gather steam at a fast clip.”

Indeed, higher oil prices have already been evident at the pumps. “Over the Fourth of July weekend, people experienced the highest gasoline prices in roughly seven years,” the Washington Examiner reports, “with a national average of more than $3 per gallon, according to AAA.”

Now, if it seems odd that this one group has so much power over the oil industry, well, it should. Though the rhetoric of “managing production levels” and “coming to a diplomatic agreement” may sound innocuous, the reality is that the whole thing is a thinly veiled cartel consisting of 13 of the world"s largest oil-exporting countries, headed up by Saudi Arabia.

Officially, the mission of OPEC (the Organization of the Petroleum Exporting Countries) is “to coordinate and unify the petroleum policies of its Member Countries and ensure the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the petroleum industry.”

In practice, what this means is that the organization coordinates restrictions in oil production among its member nations so that global oil prices can be artificially increased. Though they do not have complete control over the global oil market, they do have a fair amount of influence, commanding roughly 80 percent of the world’s proven oil reserves.

Regrettably, the extent of this influence means that oil prices (and subsequently gas prices) are dictated far more by geopolitics than by supply and demand. So, whereas free markets would lead to a greater abundance of oil and hence lower prices, the artificial scarcity imposed by the cartel means that consumers have to pay more.

Now, one of the funny things about this whole topic is that, at least for me, the moment I hear the word “cartel” my mind goes to Mexican drug cartels. I picture gangsters with guns, drug lords, black markets, and all sorts of nefarious practices. I think about how gangs establish “territories” and use force to eliminate their competition.

But if you think about it, there are many kinds of cartels that governments actually support or even facilitate (just substitute the word jurisdiction for territory). Of course, the government is more professional about it, and they have a perceived legitimacy. But economically, the results are strikingly similar.

After all, a cartel is just “an association of manufacturers or suppliers with the purpose of maintaining prices at a high level and restricting competition.” If we’re being honest, this is an accurate description of the American medical system, the taxi industry, Canada’s dairy industry, and numerous other industries. Though these systems operate very differently from one another, they all serve to restrict competition with the result of artificially inflating prices.

So as our gas prices are yet again subject to the whims of politicians, perhaps we should take a moment to reflect on the fact that cartels are as much a problem here at home as they are in the global oil market. And in light of that reflection, it’s worth asking ourselves if we really want to live in a world where competition is forcibly stifled so that a few producers can benefit at the expense of everyone else.

This file contains additional information such as Exif metadata which may have been added by the digital camera, scanner, or software program used to create or digitize it. If the file has been modified from its original state, some details such as the timestamp may not fully reflect those of the original file. The timestamp is only as accurate as the clock in the camera, and it may be completely wrong._error0

The Colorado Plateau contains numerous sedimentary basins, each of which contains many organic-rich layers. We find petroleum and natural gas in these areas due to the region"s geologic history. Mud with relatively high organic matter content tends to accumulate in shallow continental seas and coastal marine environments. Such environments were found on and off in the Southwest through geologic time. Oil and gas reservoirs (rocks where oil accumulates) in the Southwest range from Devonian to Eocene in age. Gas is produced in the Colorado Plateau as a byproduct of oil extraction and from gas reservoirs in porous rock.

The history of the Southwest"s sedimentary basins extends back to the Cambrian period, when a broad shallow sea covered much of the area. Thick sequences of carbonate rocks accumulated in these basins. During the Carboniferous and Permian, sea levels dropped and tectonic changes reshaped the landscape, causing these basins to shrink. As land emerged and weathered into silt and sand, layers of sandstones and organic-rich shales were deposited, preserving organic material on the seabed. Evaporites (for example, salt and gypsum) were also deposited when shallow seawater in the basins evaporated. With time, pressure, and heat, organic material in the shale was changed into petroleum and gas, and the organic-rich shales became source beds for hydrocarbons. Later deposition of non-marine sandstones in the Mesozoic created reservoirs for oil (basically, porous rocks where oil can accumulate).

Areas of oil and gas production in the southwestern United States. The Great Plains and the Colorado Plateau are both major fuel-producing regions. Map by Andrielle Swaby, originally published in The Teacher-Friendly Guide to the Earth Science of the Southwestern US.

The Paradox Basin of southeast Utah and southwest Colorado produces oil and gas, as well as a variety of other mineral resources. The basin contains a thick sequence of Paleozoic and Mesozoic sediments. Shallow marine carbonate rocks of Devonian, Mississippian, and Pennsylvanian age act as primary reservoirs for the basin"s oil. The source rock for this oil is largely organic-rich shale that is interbedded with the Pennsylvanian carbonates; the shale accumulated from the eroded sediments of the Ancestral Rockies that were uplifted immediately to the east. As oil migrated into the overlying sandstone, it ultimately pooled in reservoirs trapped under a variety of impermeable sedimentary deposits such as gypsum, anhydrite, limestone, and dolomite.

The Paradox Basin contains substantial quantities of evaporites, particularly halite (salt), which greatly influenced the structure of petroleum traps in the basin. These evaporites formed during an interval of repeated basin restrictions during Pennsylvanian and Permian sea level fluctuations. The salt structures beneath the surface of the basin explain the geographic distribution of many oil and gas reservoirs in the Paradox Basin. Impermeable rocks pushed up by salt domes became caprock underneath which oil was trapped. Occasionally, such salt domes may pierce the surface. One such salt dome is the Onion Creek salt diapir, part of the Pennsylvanian Paradox Formation.

Collapsed salt domes are also responsible for many of the region"s landscape features. For example, the name "Paradox Basin" came from the paradoxical observation that the Dolores River cuts across instead of flowing down the landscape. The river is superimposed upon a buried salt anticline (an upside-down-U-shaped fold in the rock) that collapsed, leaving a long, dry valley now occupied by the river.

Grabens (in this photo, the long valleys) in the Needles District of Canyonlands National Park, Utah. These grabens are formed by the movement of evaporites in the Paradox Formation. Photo by Neal Herbert, National Park Service (flickr, public domain).

The San Juan Basin of northwest New Mexico and southwest Colorado contains important reservoir rocks for oil and gas, primarily late Cretaceous marine sandstones associated with the Western Interior Seaway. The basin"s reservoir rocks also include late Cretaceous fluvial sandstones and coals associated with the filling of the Seaway, Jurassic aeolian sandstones, and limestones and sandstones in the shallow marine Pennsylvanian-age Paradox Formation. Source rocks in the San Juan Basin are equally varied, including organic-rich marine shales from the Paradox Formation and the Mancos and Lewis shales of the Western Interior Seaway.

Specialized satellite image showing methane leaking from a pipeline (indicated by the blue and lavender patch) in the Four Corners region. The pipeline was later fixed. Image and information source: NASA/JPL-Caltech.

The Piceance Basin, located in northwest Colorado, and the Uinta Basin, located in northeast Utah, also contain a wide variety of fossil fuel-bearing deposits dating from the late Paleozoic to the early Cenozoic. These two basins share much of their geological history; they are effectively part of the same east-west trending basin that developed across the Utah-Colorado state boundary during the Late Cretaceous.

The Rangely oil field, near the boundary between the Uinta and Piceance basins, has been producing oil since the 1940s. Oil was discovered at the site in 1901, but the field was not developed until after World War II due to its remoteness. Since development began there, Rangely has produced nearly 800 million barrels of oil, and it was the most prolific oil field in Colorado for many years. The oil at Rangely comes primarily from the late Pennsylvanian and early Permian Weber Sandstone, which includes permeable and porous cross-bedded aeolian dune deposits. The source for this oil is probably Carboniferous strata deep in the Uinta Basin, or the shales of the early Permian Phosphoria Formation. Some oil has also been produced from the late Cretaceous Mancos Shale, deposited as part of the Western Interior Seaway. Today, carbon dioxide (CO2) is injected into the field to increase pressure in the depleted reservoir and enable more oil extraction.

Drill rig near Piceance Creek, Rio Blanco County, Colorado, 2009. Photo by Jeff Foster (flickr, Creative Commons Attribution 2.0 Generic license, image cropped and resized).

Diagram of solution mining to create a salt cavern. A pumphouse pumps water into an underground salt dome. The water dissolves the salt, and the brine (salty water) is pumped back out, creating a salt cavern (a large cavity) in the salt dome. Modified from original by Wade Greenberg-Brand for the [email protected] project.

TEHRAN- National Iranian Drilling Company (NIDC) dug and completed digging operation of 82 oil and gas wells during the first eight months of the current Iranian calendar year (March 20-November 20), according to an official with the company.

Saeed Akbari, the acting director of NIDC’s digging operation department, said the drilled wells consisted of 23 development/appraisal wells, 57 workover wells, and two exploratory wells.

After the U.S. reimpostion of sanctions against Iran, indigenizing the know-how for the manufacturing of the parts and equipment applied in different industrial sectors is one of the major strategies that the Islamic Republic has been strongly following up to reach self-reliance and nullify the sanctions.

Oil, gas, and petrochemical industries have outstanding performances in this due, with indigenizing the knowledge for manufacturing many parts and equipment that were previously imported.

National Iranian Drilling Company managed to indigenize the knowledge for manufacturing 6,000 drilling equipment in collaboration with domestic manufacturers and engineers in the previous Iranian calendar year (ended on March 19).

The equipment indigenized by NIDC includes drilling mud pumps, blowout preventers, traction motors, draw-works, drilling fluid recycling systems, mission centrifugal pumps, top drives, and drilling rig slow circulation rate pressure systems.

In order to indigenize the technology to manufacture these parts, NIDC inked six research deals with domestic universities and knowledge-based companies.

At the beginning of the current Iranian year, NIDC Managing Director Abdollah Mousavi had said that his company’s performance will be more outstanding in this year, which is named the year of surge in production.

The official’s saying has already come true, as his company managed to indigenize the know-how for manufacturing some significant parts, and also in completing the digging operations sooner than the schedule.

Holding 70 onshore and offshore drilling rigs as well as equipment and facilities for offering integrated technical and engineering services, the National Iranian Drilling Company accounts for a major part of drilling exploration as well as appraisal/development wells in Iran.

Six downhole dynamic drilling parameters that are measured and calculated during experimental simulations are weight on bit (WOB), torque on bit (TOB), downhole pressure, rate of penetration (ROP), rotary speed and bit axial displacement (vibrations). In addition to these parameters, four surface parameters are monitored and these include choke pressure, return fluid mass flow rates, volume flow rates, and density. Two experimental runs are conducted to ensure repeatable and consistent results. The results from these experiments have been compared and found consistent with Aldred et al. (1998) field reports on drilling parameters’ response to kick.

Aldred et al. (1998) reports focused on the performance of annular pressure while drilling tools, along with other BHA tools, for monitoring drilling performance and making proactive decisions during drilling operations. These tools were utilized in the Eugene Island field in the Gulf of Mexico where the formation consisted of sequences of shales and target sands that were likely depleted by previous production. The drilling contractor, anadrill, utilized series of downhole tools, including the compensated dual resistivity, multi-axis vibrational cartridge, integrated weight on bit, and annular pressure while drilling for this well. Thus, drilling parameters including downhole torque and weight on bit, axial and torsional vibrations, ROP, annulus pressure, equivalent circulating density (ECD) were being measured. When kick was taken in a 12¼-in hole section, their measurements started to drop in response to kick. These deviations can be observed in Fig. 5, i.e. ROP, WOB, annulus pressure, torques, vibrations, and ECD dropped due to kick. These responses in drilling parameters indicating kick occurrence are found to have consistent responses with the experimental results that are being presented in this section.

The effects of kick on drilling parameters, such as WOB and bottomhole pressures for both experimental runs are shown in Figs. 6, 7, 8 and 9. Figures 6 and 7 show the effects of kicks on WOB for both Run_1 and Run_2, respectively. It is observed from both curves that the WOB decreases in magnitude after the kick is initiated. The moment when the kick is injected into the drilling system is consistent with the moment when the downhole and output pressures surge by an average of 25–45 psi above the initial downhole pressure, as shown in Figs. 8 and 9 of Run_1 and Run_2, respectively.

The kick effects on the rate of penetration (ROP) can be observed in Figs. 10 and 11 of Run_1 and Run_2, respectively. As shown from point A to point B of the no-kick region 1, the ROP value is 0.055 in/s (1.4 mm/s). As soon as kick occurs (i.e. gas injection into the wellbore) the ROP drops to about 0.04 in/s (1.02 mm/s) from point B to B′, which represents about a 27% drop. From point B′ to point C, the ROP remains constant in this kick region. When the air injection ceases at point C, the ROP increases to about 0.058 in/s (1.5 mm/s) for Run_1 and 0.055 in/s (1.4 mm/s) for Run_2 from point C to C′. This may be explained by the upthrust force, which creates an air jet between the bit and the core rock specimen, thus lifting the bit and causing minimal bit–rock interactions.

The effects of kick on the mass flow rate of the mud return for Run_1 and Run_2 are shown in Figs. 12 and 13, respectively. The mass flow rate responds instantaneously to gas influx entering the flow meter as shown by a surge in the mass flow rate of the return mud. The continuous injection of compressed air (influx) into the wellbore then causes erratic readings of the mass flow rate that, by observation, is on average higher in magnitude than the pre- and post-gas kick readings. The observed increase in the mass flow rate may be due to the increased mass velocity of the fluid caused by gas influx.

Additionally, the effects of kick on fluid density are shown in Fig. 14. The fluid density is observed to drop in magnitude due to the gas influx. This can be explained by the low-density fluid (air) injected into the wellbore mud decreasing the bulk density of the return mud. Since the volume flow rate is determined by dividing the mass rate by the combined fluid density, the volume flow rate increases due to gas kick; this effect is shown in Fig. 15.

The minimal bit–rock interactions created by the upthrust jet during air injection into the wellbore for Run_1 and Run_2 may also explain the reason for the increase in rotary speed. The rotary speed is calculated from the relative displacement data acquired from the laser sensor projection on a rotating disc by means of counting the number of spikes created by the three grooves located on the plate 120° apart, as shown in Fig. 16. These grooves are recorded as spikes in the bit–rock axial displacement data as the tool rotates during drilling. These spikes can be noted in Figs. 17, 18 and 19 for Run_1 and Figs. 20, 21 and 22 for Run_2 of the axial bit displacements versus time graphs. The rotary speed for each test condition, is thus calculated by the following procedures a) to c) and the results are summarized in Table 3:

The rotary speed (RPM) calculation can be determined by counting the number of spikes between the 2-s period and then calculate the average of spikes per 1-min revolution.

Figures 17, 18, 19, 20, 21 and 22 represent 2-s data from each testing region of the test specimen core rock for Run_1 and Run_2. Figures 17, 18, and 19 show the bit axial displacement data for NKR-1, KR, and NKR_2, respectively for Run_1 while Figs. 20, 21, and 22 show the same for Run_2. It can also be observed that the intensity of the noise in the bit-rock displacement data completely dampens out as the test specimen undergoes drilling with no-kick and when kick is injected. These dampening effects show the indication of kick, which is evident by a dramatic reduction in axial bit–rock displacements during the kick.

The effects of kick on TOB are also explored, as TOB can be a significant downhole parameter candidate for early kick indicator. Although no direct measurement of TOB is currently installed on the drilling system, Reyes (20

8613371530291

8613371530291