nabors drilling mud pump price

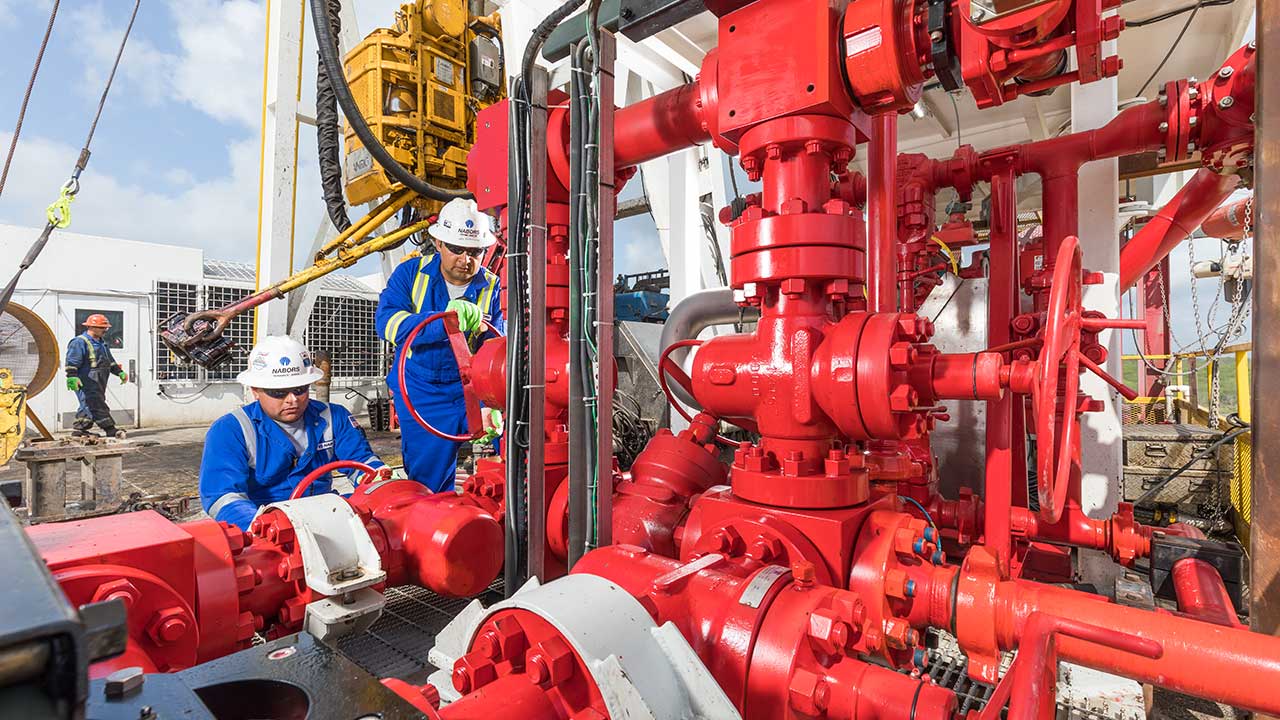

Nabors owns and operates one of the world"s largest land-based drilling rig fleets and is a provider of offshore platform rigs in the United States and numerous international markets. Nabors also provides directional drilling services, performance tools, and innovative technologies for its own rig fleet and those of third parties. Leveraging our advanced drilling automation capabilities, Nabors" highly skilled workforce continues to set new standards for operational excellence and transform our industry.

The Baoji/Bomco F1000 Triplex mud pump has a max. working pressure of 5,000PSI and a 6-3/4" liner size. This model is the first choice for the medium and deep dr... More Info

The Baoji/Bomco F1600HL Triplex mud pump has a max. working pressure of 7,5000PSI and a displacement of 46.5L/S with 6" liner size. This model is the f... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Emsco/Bomco 1600 Mud Pump, Unitized 1600 Mud Pump Powered by Two GE 752 Motors Charging Pump, Liner Flush Pump, Relief Valve, Mud Gauge, Etc. ....Call For Price More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Mud Pumps - 1 - Rebuilt Gardner Denver PZ-9 Mud Pump Package, New Caterpillar C-27, 1050 HP diesel engine. Belt-driven. comes with pulsation dampener, discharge block, precharge, li... More Info

Mud Pumps - 1 of 3 used Gardner Denver PZ-8 triplex mud pumps. This would be a good rebuildable core. We also have new, rebuilt and good used pumps and packages available for sale ... More Info

Mud Pumps - Mud Pump Parts & Complete Units: Liners, Pistons, Rubbers, Rods, Valves, Seats, Springs, Inserts (Bean, BJ, CAT, EMSCO, Ellis Williams, FMC, Failing, GASO, Gardner Denver... More Info

Designed to deliver maximum drilling performance, the PACE®-M800 rig further enhances drilling efficiencies and reduces flat time. Its simplified design enables faster, more advanced walking capabilities and quicker rig-up and rig-down times to reduce move times and lower drilling costs.

When drilling laterals at or greater than 7,500 feet, the PACE®-M800 rig’s racking capacity eliminates the need to lay down drill pipe between wells on the same pad.

It provides the required pressure to maximize rate of penetration (ROP) while running rotary steerable systems and during extended-reach laterals with conventional mud motors.

The PACE®-M800 rig also features faster, more advanced walking capabilities for multi-well pad drilling. It is ideal for drilling up to four wells per pad and moves twice as fast as the PACE®-X800 rig. Features include:

Managed Pressure Drilling (MPD) is an adaptive process used to more precisely control the annular pressure profile throughout the wellbore while drilling. Converting conventional atmospheric drilling to a closed circulating loop system enables the driller to optimize mud weight and rate of penetration (ROP), more quickly detect influx and fluid loss, and discriminate wellbore ballooning and breathing. This results in lower mud product cost, less stuck pipe, and potentially fewer casing strings.

The MPD process is executed by controlling flow conditions to maintain bottom-hole pressure according to a modeled pore pressure and fracture gradient drilling window. While the benefits of conventional MPD techniques are well known offshore, the economics of engineering, mobilization and rig-up, and additional specialized personnel requirements are not supported in cost-sensitive drilling programs such as unconventional land drilling.

Nabors’ fit-for-purpose MPD equipment and integrated rig services enables a new concept to leverage today’s advanced land rig infrastructure including drives, manifolds, tanks, pumps, and gas handling equipment. Engineering and integrating MPD capabilities into the rig with unique automated workflows unlocks advantages in capital requirements, eliminates the need for pre-job surveys and engineering, and minimizes high mobilization and rig-up costs.

Through the advanced integration and automation of MPD services, the need for third-party service providers is also eliminated. Benefits include increased safety, less HSE exposure, lower cost, reduced pad footprint, more efficient rig moves, and more transparent performance analytics. For all of these reasons, scalability of MPD services is now more cost-effective for land drilling operations.

If you are supplying pump supplies, you can find the most favorable prices at Alibaba.com. Whether you will be working with piston type or diaphragm type systems, reciprocating or centrifugal, Alibaba.com has everything you need. You can also shop for different sizes drilling mud pump price wholesale for your metering applications. If you operate a construction site, then you could need to find some concrete pump solutions that you can find at affordable rates at Alibaba.com. Visit the platform and browse through the collection of submersible and inline pump system, among other replaceable models.

A drilling mud pump price comes in different makes and sizes, and you buy the tool depending on the application. The pump used by a filling station is not the one you use to fill up your tanks. There are high flow rate low pressure systems used to transfer fluids axially. On the other hand, you can go with radial ones dealing with a low flow rate and high-pressure fluid. The mixed flow pump variety combines radial and axial transfer mechanisms and works with medium flow and pressure fluids. Depending on what it will be pumping, you can then choose the drilling mud pump price of choice from the collection at Alibaba.com.

Alibaba.com has been an excellent wholesale supplier of drilling mud pump price for years. The supply consists of a vast number of brands to choose from, comes in different sizes, operations, and power sources. You can get a pump for residential and large commercial applications from the collection. Whether you want a water pump for your home, or run a repair and maintenance business, and need a supply of dr drill mud pump prices, you can find the product you want from the vast collection at Alibaba.com.ther it is for refrigeration, air conditioning, transfer, or a simple car wash business, anything you want, Alibaba.com has it.

The Canrig® Sigma 500-ton top drive is the next generation top drive, completely reimagined to endure the harshest drilling conditions while operating with the highest continuous torque in its class. Designed to endure the harshest drilling conditions, this all-new, innovative top drive provides more power, performance and torque density than ever before, while enabling greater automation and remote-control capabilities – both at the surface and downhole.

Nabors’ SunDowner is capable of being off-loaded and assembled on an offshore platform in a single day…from sunup to sundown. The short rig-up time results in significant mobilization cost savings.

With over 20 years of experience in designing custom solutions for the oilfield industry, engineers are available to integrate top drives, catwalks, casing running tools or other equipment into any desired rig, including rigs of the future or older classes of rigs ready to see a new age of drilling

Canrig’s range of top drives allows for the selection of a hydraulic or an electric powered unit. Each motor class comes with its own set of benefits which can be reviewed to select which option is more appropriate for a particular drilling environment.

Canrig manufactures, markets and services a full range of electric top drive systems for most land and offshore rigs. This includes top drives in every size and configuration to meet any drilling application whether marine, desert, jungle or arctic environments.

Nabors’ Blue Force® mud motors are customized to specific specifications, built to withstand all drilling fluid types and temperatures, and can help reduce non-productive time.

As pad drilling solutions continue to evolve and improve, walking rigs with crane-less rig-up are quickly becoming a typical feature on location. The Canrig® PadWalker™ was created to support multi-well pad drilling.

Canrig’s wireless torque, turn and tension sensor, the TesTORK® sub, delivers high speed, precise data over a secure wireless connection. Designed for ease of use and field robustness, the TesTORK® sub meets the demands of tubular services companies and drilling contractors alike.

Nabors’ fit-for-purpose managed pressure drilling (MPD) equipment and integrated MPD-Ready® drilling rig maximizes efficiencies and makes MPD services more scalable and cost-effective for unconventional land drillers.

In addition to enhancing the safety of drill floor activities, Nabors offers a fully automated drill floor robot system that reduces the non-productive time, noise, energy consumption and emissions typically associated with manual onshore and/or offshore drilling operations.

The Canrig® climate-controlled driller’s cabin provides integrated joystick control utilizing PLC technology. Touch-screen controls provide enhanced monitoring, control of rig equipment and visibility of drilling parameters.

Nabors offers the FracView® high-resolution LWD imager in 4.75 and 6.5 in collar sizes covering borehole diameter ranges from 5.875 to 9.5 inches. FracView was the first commercially available LWD borehole imager demonstrated to operate in long horizontal wells drilled with oil-based mud.

Key FeaturesDeepView Log Viewer capable of viewing and analysis of large volume high resolution drilling dynamics and imaging data in both time and depth domain

Nabors offers the SpectraView™ LWD spectral/azimuthal gamma ray tools capable of covering borehole sizes from 5.875 to 9.5 inches. The tool measures and records naturally occurring gamma radiation from surrounding formations during wellbore drilling.

Nabors offers the FracView® high-resolution LWD imager in 4.75 and 6.5 in collar sizes covering borehole diameter ranges from 5.875 to 9.5 inches. FracView was the first commercially available LWD borehole imager demonstrated to operate in long horizontal wells drilled with oil-based mud.

Nabors’ Blue Force® mud motors are customized to specific specifications, built to withstand all drilling fluid types and temperatures, and can help reduce non-productive time.

Capable of drilling up to eight laterals from a single wellbore, Nabors’ unique coiled tubing/stem drilling rig, CDR2-AC, was designed to help a major operator more effectively work over old wells and boost production in Alaska’s Kuparuk field.

A Side-Saddle® rig is ideal for batch drilling because it can drill the surface along one row of wells, walk to the adjacent row and repeat the same tasks using the same drilling mud.

Equipped with specially trained drillers, drilling performance software and reliable measurement while drilling (MWD) telemetry, Nabors Directional-Ready™ rigs include integrated downhole equipment and directional drilling instrumentation to enable high-fidelity surveying and precise placement in productive targets of longer lateral wellbores.

Key FeaturesDrillers working on Nabors Directional-Ready™ rigs are trained in directional theory, automated HMI sequences, BHA makeup and advanced wellbore placement operations

Nabors MPD-Ready® rigs feature integrated hardware and software components, and required flow paths, to ascertain the downhole pressure environment limits and manage annular hydraulic pressure during drilling operations. All equipment skids with rig, eliminating non-productive time when moving between wells for multi-well pad drilling.

Nabors offers cementing and casing accessories, including hydroform centralizers, Multi-Lobe Torque™ (MLT®) rings, reaming shoes and cementing solutions.

Nabors’ automated tubular service technology brings significant improvements in safety, performance, reliability and efficiency during casing drilling and tubular running operations.

The SmartPLAN™ tool seamlessly manages both the operator’s and drilling contractor’s workflows to deliver digital drilling recipes that optimize efficiency and improve performance.

Proprietary automated drilling activity sequencer that optimizes rig processes. Proven to consistently improve connection times, increase one run laterals and decrease unplanned trips, the SmartDRILL™ system drives scalable cost reduction and improved drilling performance. Workflows are digitalized to improve procedural adherence and ensure that best practices are being configured for future wells.

Nabors SmartROS™ automates many repetitive drilling tasks while integrating data from both downhole tools and surface systems. Automating these functions allows the driller to follow the customer’s well plan with a higher level of precision and operational excellence.

Nabors REVit® technology features advanced top drive automation that eliminates stick slip, a common mode of vibration that limits drilling performance.

The ROCKit® Suite significantly increases rate of penetration (ROP) by rocking pipe and delivering ideal weight to bit. It promotes improved toolface control by allowing fine adjustments while still drilling ahead, reducing the need for lubricants and other friction-reducing additives. Drillers save time by quickly setting toolface orientation.

Nabors offers remote control choke technology to help operators meet the challenges of well pressure control, while reducing costs and enhancing environmental risk and wellsite safety.

This integrated offering includes rotating control devices (RCDs) for the onshore unconventional market. RCDs are utilized for pressure management during drilling for the purpose of making a seal around the drillstring while the drillstring rotates.

Nabors provides BOP installation and inspection as well as API-compliant, field-proven testing of BOP components in compliance with industry standards.

Non-Stop Driller™ is a sub-based constant circulation system that allows the continuous circulation of drill fluids downhole while making or breaking drill pipe connections, enabling improved wellbore stability and hole cleaning, reduced risks of influx and optimum drilling performance.

The SmartSLIDE™ system integrates critical downhole information needed for directional drilling and then automatically implements corrective instructions and steering logic during slide drilling operations.

Nabors’ SmartNAV™ platform is an automated directional drilling decision-making system that visualizes the downhole positions of the drill bit and the planned well path and automatically generates instructions to keep the well on course.

The PACE®-R800 rig utilizes technology optimized for drilling automation with Nabors Rigtelligent® control system. The rack and pinion technology enables the precise control of block position required for advanced automati

As lateral lengths continue to increase, drillers need a rig with more power and greater tripping speed. Nabors PACE®-M800 rig features innovative advanced technologies that provide both.

When drilling laterals at or greater than 7,500 feet, the PACE®-M800 rig’s racking capacity eliminates the need to lay down drill pipe between wells on the same pad.

With over 20 years of experience in designing custom solutions for the oilfield industry, engineers are available to integrate top drives, catwalks, casing running tools or other equipment into any desired rig, including rigs of the future or older classes of rigs ready to see a new age of drilling

Maintaining /monitoring the mud pumps and mud pits during operations. Notifying the Driller immediately of any unexplained pit level increases/decreases Verify and record drilling fluid properties at ...

Field Specialist - Directional Driller (DD)Have excellent Directional Driller experience?Do you enjoy working with cutting-edge energy equipment?Join our innovating Drilling Services Team!Our Drilling ...

Assist internal and external customers with troubleshooting of Rig Equipment (Top Drive, Catwalk, Wrench, Drawworks, VFDs, Generators, Mud Pumps, BOP) Expeditiously work to troubleshoot and resolve downtime ...

Field Specialist - Directional Driller (DD)Have excellent Directional Driller experience?Do you enjoy working with cutting-edge energy equipment?Join our innovating Drilling Services Team!Our Drilling ...

As frost on the ground gives way to spring thaw and oil prices stay low, Canadian drilling contractors are packing up rigs early in preparation for next winter. Indeed, Canada’s unseasonably warm January and February in Q1 this year precluded drillers from achieving the higher rig utilization levels normally associated with winter. These weather troubles were further compounded by oil prices dipping below $50/bbl in January, which led to shrinking budgets that handicapped the Canadian market as it did worldwide. Rig utilization rates in the region diminished accordingly as companies prepared for the worst. Nevertheless, contractors are hoping the tough economic choices they make today will pay off in winter 2016.

To shed light on the challenges faced in Canada, several industry experts shared their perspectives with DC, including representatives from Trinidad Drilling, Nabors, CanElson Drilling, Douglas-Westwoodand the Canadian Association of Oilwell Drilling Contractors (CAODC).

“In the middle of winter, we’ll probably have a crust of ground that’s 2- to 3-ft thick before you get to earth that’s not frozen,” CAODC Vice President of Operations Steven Berg said.Without that frost buildup, muskeg and other wetlands prevent contractors from mobilizing rig fleets to various oil plays around Canada.“If the rig-moving companies have to move around in the mud, the rig moves get substantially more expensive, so everybody waits until the frost is driven into the ground,” Mr Berg said.

In Canada, frost accumulation normally begins during November, when temperatures cool significantly. By December, a typical Canadian winter would have already produced a considerable amount of frozen ground, enabling companies to ramp up drilling efforts and, therefore, boost fleet utilization. The highest levels of onshore rig utilization normally occur from the beginning of January through February. When the frost melts as springtime weather takes over in March, contractors begin to cold-stack rigs during spring breakup.

In addition to the unfavorably high temperatures, operators are less likely to invest in Canada’s onshore projects in the midst of the significant decline in oil prices. The untimely downturn hit Canada when operators would normally devote spending to drilling programs in the region. “The oil producing companies start their budgets in January… If they’ve assigned capital allocations to do drilling programs in Canada, this is when they would be starting them,” Mr Berg said.

Data from the CAODC’s 2015 onshore drilling forecast, released on 22 January, projected a 20% drop in fleet utilization from 2014 levels, as well as a 41%

Due to the low utilization rates in Canada, drilling contractors are finding it even more important to remain competitive. For January and February, the CAODC reported industry average utilization rates between 40-50%, although all contractors that spoke with DC – Trinidad, Nabors and CanElson – reported higher rig utilization between 60-65%. Contractors listed technologically advanced rigs, economic value for performance and competent personnel as reasons for their positive fleet utilization rates.

working. In the current market, when operators are looking for more cost-effective drilling operations, it’s becoming more common for older, less advanced rigs to be cut first, Ms Ottman said. She explained that rigs with newer technology are seeing higher demand, even through downturns, because they drill more efficiently.

In terms of technology, rigs equipped with walking systems remain competitive due to their suitability for multiwell pads. “Some of those rigs will operate right through spring breakup,” Joe Bruce, President of Nabors Canada, said. Currently marketing 57 drilling rigs – including a range of singles, doubles and triples – around Canada, Nabors’ active rig count has fluctuated between 27 to 39 during January and February. Of its Canadian fleet, 20 have walking systems.

Nabors had planned to add two additional rigs for Canada this year, but they have been postponed, as well. “Given the circumstances right now, we’ve put a hold on those rigs,” Mr Bruce said. “We’re seeing anywhere between 15-20% reduction in dayrates, and consequently we are making adjustments to our operating cost.”

The sudden drop in commodity prices has thwarted several large operators’ goals for Canada. For example, Apache Corpoperated 91 rigs onshore North America during Q3 2014 based on an assumption of $80/bbl WTI in 2015. Now adjusting plans to account for a $50/bbl WTI price, Apache Corp CEO and President John Christmann said his company would reduce its onshore North American rig count to 27 by the end of February. Mr Christmann also indicated Apache would stop all drilling operations in Canada by March 2015.

“In Canada, we are finishing up a three-rig drilling program in the Duvernay and Montney plays this spring and will release the rigs for the remainder of the year. We plan to complete a seven-well pad in the Duvernay in Q3,” Mr Christmann said during Apache’s Q4 2014 earnings call on 12 February. “It’s simply a function of cash flow in Canada limiting how much we’re spending in Canada… Obviously, if prices change going in Q3 or Q4, you could see us decide to step back up, but for right now, the plan would be not to do anything.”

CAODC forecasts 6,612 wells will be drilled in 2015, down from 10,920 in 2014. Nabors’ Mr Bruce noted that he continues to see operators cut capital budgets and delay or cancel projects. “Because we are vulnerable to the capital investment that the companies make, that has an impact on us,” Mr Bruce said.

Mr Berg indicated the estimated average time on well for onshore Canadian drilling to be 11.6 days, with a cost range per well that varies according to geography, depth and complexity. For cost effectiveness, he continued, operators are likely to prefer drilling shallow wells in 2015. Wells in northeastern Alberta, for example, tend to require smaller rigs as they are easily accessible and have known well conditions.

What happens with the Canadian drilling market in the next couple of years will depend on whether global oil prices and winter temperatures can correlate favorably. Mr Meyers said he expects a “modest recovery” in Q3 2015, though not enough for utilization to recover to 2014 levels. CAODC predicts a 25% rig utilization level in Q3 2015 and 30% in Q4.

For offshore drilling, however, Mr Meyers said it looks like operations will continue “full speed ahead” on the East Coast of Canada. “Whether it beBP or Statoil, most of those projects continue going, and the drilling plans are in place for 2015 and 2016.” BP has four exploration licenses (ELs) for offshore Nova Scotia, with blocks adding up to almost 14,000 sq km. The blocks are located about 300 km southeast of Halifax off

Statoil has four significant discovery licenses and seven ELs near offshore Newfoundland that comprise 11,000 sq km. Statoil is also partnered with other operators in four other ELs. In November 2014, Statoil started an 18-month drilling program to appraise the Bay du Nord discovery – with potentially 300 million to 600 million bbl of recoverable oil – in the Flemish Pass Basin.

Wells drilled at the site run about 1,200-m deep. Drilling is ongoing using the Seadrill West Hercules, a sixth-generation DP3 semisubmersible. The rig was chosen due to its ability to operate in harsh environments of up to 3,000-m water depths, according to Drilling Manager Jim Beresford of Statoil Canada, Offshore Newfoundland.

While offshore drilling will seemingly continue without disruption in the short term, onshore contractors would need an economic bump in the form of increased WTI prices to recover utilization. Common thought among onshore drilling contractors is to focus on Q1 2016 for a larger recovery. The hope is for global oil prices to rebound in Q3 or Q4 2015, allowing operators to plan for bigger budgets and higher capital expenditure for the Canadian market in January 2016, weather permitting. “If the world oil price starts climbing up in the calendar year of 2015, we probably won’t reap the benefit until sometime in early Q1 of 2016 because the capital budgets for most of the major oil companies in Canada have already been submitted and approved,” Mr Berg said. “They’ve already done their forecasts for budgeting, and they’ve revised them according to what the oil prices dropped to.”

However, even without this pipeline, Mr Berg said he believes that Canadian operators will still be able to find other markets for their hydrocarbons in the long term. “If (Keystone XL) is defeated, obviously our drilling programs would be decreased accordingly until we could have our own Canadian pipeline in place to offshore the oil,” Mr Berg said. “Instead of selling to the world market through Texas, we will be flooding the world market through our eastern seaboard and our western seaboard.”

He also believes new pipelines would provide economic incentive for development and deployment of additional technological innovations in the Montney and Duvernay, which have vast shale resources similar to the Eagle Ford in the US, according to Mr Berg. He noted that Canadian companies have already introduced technologies, such as multilaterals, multiwell pads, horizontal drilling and multistage fracturing, into these plays for improved efficiency. “If the pipelines come to fruition within the next 10 years, we have all of this unlocked potential that is just sitting in the ground that we can fill those pipelines with for many years to come.”

When drilling in a tight-gas formation with natural fractures like the Montney, the potential of a gas kick entering the wellbore poses a high risk to the drilling operation. Kicks not detected in a timely manner result in a high potential of exceeding surface or subsurface pressure limitations, which may lead to catastrophic events. Moreover, failure to detect and manage a kick early and allowing it to expand can yield well control events and blowouts. Operators employ well control methods to overbalance the well and circulate out kick fluid. Early detection and proactive responses are fundamental tools for mitigating kicks.

Managed pressure drilling (MPD) methodologies are based on a closed-loop circulating system. Using a rotating control device (RCD), MPD can overcome some of the limits of conventional technology to drill through tight operating windows, reduce the likelihood of a well control event and manage wellbore stability to mitigate stuck pipe. MPD’s automation capabilities via the Microflux control system provides operators the ability to detect kicks early and to manage the pressure profile by applying surface backpressure as needed.

In a Montney horizontal well in the Altares field, the operator utilized an automated MPD control system for fully automatic kick detection and control while drilling. The operator expected abnormal pressure zones at a measured depth of 1,994 m (6, 542 ft) to 4,795 m (15,731 ft) total depth. The system was used with a light-density drilling fluid to optimize ROP, control unexpected gas influxes, avoid reservoir damage and maintain constant bottomhole pressure.

The control system detected a kick at a bit depth of 2,440-m (8,005-ft) MD when using a mud weight of 1,230 kg/cu m (77 lb/cu ft) and a constant bottomhole equivalent circulating density of 1,320 kg/cu m (82 lb/cu ft). For 15 seconds, the system monitored the discrepancy in the flow in and out before it confirmed the influx and automatically activated the dynamic well control procedure.

For the first two minutes after detection, the outflow increased from 1,000 to 1,244 L (264 to 328 gal). Meanwhile, the driller stopped rotation, picked off bottom and continued circulation at the drilling rate. The system circulated the influx out using a modified Driller’s Method and monitored the pressure balance in the wellbore until the flow returned to normal level.

The well gained only 244 L (64 gal) of drilling fluid, which was safely circulated out in 4 hours. The entire well control operation was conducted at a full circulation rate, which enabled the operator to quickly resume drilling operations. The system maintained balance with pore pressure throughout the project, and drilling reached total depth without any losses or gains into the formation or any other incidents.

Early detection and precise control of unexpected gas influxes using the automated MPD control system enabled the operator to minimize the size of the kick, which eliminated the need to shut in the well and drastically reduced the potential amount of NPT. The system circulated the potentially catastrophic kick out in 4 hours at full circulation rates for a safe and quick return to drilling to reach TD. Using a light-density drilling fluid with the MPD system enabled the operator to increase the ROP, protect against formation damage, enhance control of influxes and reduce costs of required drilling fluids. Tripping accounted for only 8.3% of the time because of the light-density drilling mud used. Drilling accounted for approximately 70% of operational time, which is significantly more than in conventional drilling operations.

Day rates have been increasing and demand for drilling rigs and services is strong. Moreover, the forward curve for future oil (and gas) prices underpins a resumption of drilling activity and profitability.

Adjusted EBITDA, which subtracts the tax loss benefit and adds back interest and impairments, was $171 million for 2021. By operating segment this divides as: contract drilling $196 million

Daily rates are heating up. For example, even a few months ago in early November 2021, a private company executive at an oil conference said, "21K on a hot rig on Friday becomes 24K on a stacked rig on Monday." Translation: $21,000/day for a ready drilling rig became $24,000/day for a cold (non-operating) drilling rig three days later.

Indeed, in the company"s 4Q21 investor call, CEO Andy Hendricks said, For the base rig we are now in the mid-20s for day rates and that is where the discussions begin. And further to that, in some cases, our total revenue per day is at or above $30,000 a day when you include the revenue from technologies and ancillary services in our contract drilling business. In pressure pumping we see further pricing improvement for both dual fuel and conventional spreads due to the lack of readily available premium equipment in the market.

As the graph above shows, the number of PTEN rigs operating follows the oil price but with a lag and not proportionately. The number has increased but not yet recovered to the pre-2020 level. This reflects public company producers" caution as they prioritize return of capital to shareholders ahead of expanding drilling.

The 2022 capital expenditure forecast is $350 million. Most of the capex will be used for rig maintenance and reactivation. This includes upgrading more rigs to Tier 1 super-spec status with ESG and sustainability capabilities. Producers prefer, and PTEN has a competitive advantage in providing, Tier 1 super-spec rigs that have more clearance under the rig floor and a third mud pump for horsepower and redundancy. (The extra clearance allows the rig to "walk" to a new location.)

A Wall Street Journal article on drilling explained that while public companies such as Devon (DVN), Continental Resources (CLR), and Pioneer (PXD) were drilling only enough to keep production flat or up 5%, private companies were increasing drilling at a faster rate. Private oil producers were running 323 rigs in February 2022, up 127% from the beginning of 2021 while rigs run by large and mid-sized public companies were up only 28% to 215.

Be aware that due to a lack of takeaway (pipeline) capacity relative to the enormous size of Appalachian gas reserves, Marcellus prices usually lag those at Henry Hub, Louisiana. This is important because much gas drilling takes place in the Marcellus and PTEN has 33 rigs there. For example, on February 16, 2022, the Henry Hub price was $4.39/MMBTU while the Appalachian price (Tennessee Zone 4) was $3.70/MMBTU.

Patterson-UTI is headquartered in Houston, Texas. Its three service segments are: a) contract drilling, b) pressure pumping, and c) directional drilling.

US competitors include Baker Hughes (BKR), Halliburton (HAL), Helmerich and Payne (HP), Liberty Oilfield Services (LBRT), Nabors Industries (NBR), and ProPetro (PUMP). Schlumberger (SLB), which exchanged its US pressure pumping business for an ownership interest in Liberty, is a global competitor.

The company"s beta is 2.82, far more volatile than the overall market, representing a company on the front lines of the turbulent oil and gas drilling sector.

Its activity is a function of both oil and gas prices as well as the intensity of drilling at any given price level, both of which can fluctuate dramatically.

8613371530291

8613371530291