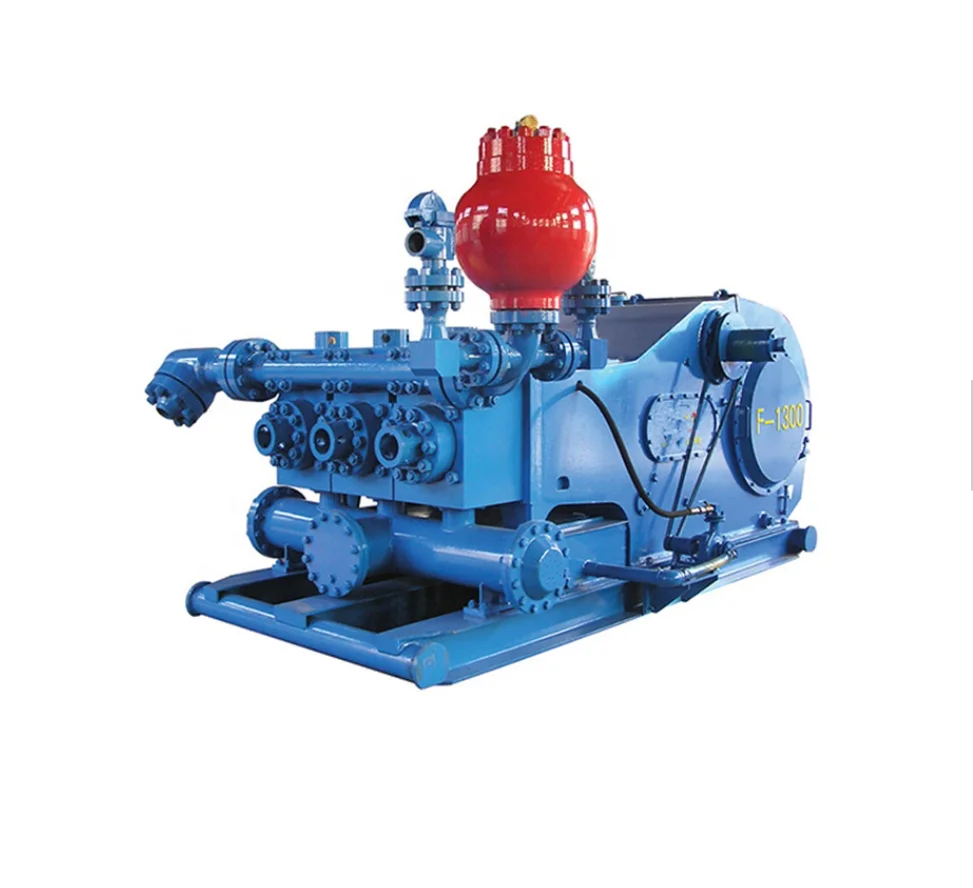

oil rig mud pump manufacturers free sample

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

A wide variety of oil drilling mud pumps options are available to you, such as 1 year, not available and 2 years.You can also choose from new, used oil drilling mud pumps,As well as from energy & mining, construction works , and machinery repair shops. and whether oil drilling mud pumps is 1.5 years, 6 months, or unavailable.

A wide variety of single cylinder mud pump options are available to you, such as 1 year, not available and 2 years.You can also choose from new, used single cylinder mud pump,As well as from energy & mining, construction works , and machinery repair shops. and whether single cylinder mud pump is 1.5 years, 6 months, or unavailable.

Continental Emsco Drilling Products, Inc., which consisted of Emsco drilling machinery and Wilson mobile rigs, was purchased by National-Oilwell, Inc on July 7, 1999. To our knowledge, no pumps have been manufactured and sold under the Emsco brand name since National-Oilwell acquired them.

Fairbanks Morse pumps are currently manufactured in Kansas City, Kansas. Fairbanks Morse is a division of Pentair ever since August, 1997 when Pentair purchased the General Signal Pump Group.

Gaso pumps are manufactured by National Oilwell Varco. Gaso was acquired as "Wheatley Gaso" by National-Oilwell in the year 2000. At the time, Wheatley Gaso was owned by Halliburton.

Skytop Brewster pumps are no longer available as new pumps. Skytop Brewster(Cnsld Gold), a unit of Hansen PLC"s Consolidated Gold Fields subsidiary, was acquired while in bankruptcy by National-Oilwell, Inc. in November, 1999.

The drilling operations app was designed specifically for the mud pump area in the drill rig, and covers relevant safety topics, including drilling mud level, drilling equipment safety, pipe pressure, drilling process and more.

The oil and gas rig equipment app can be customized for different drilling rig locations. Once the drilling equipment and rig floor have been inspected, users can sign off on the results electronically.

I’ve run into several instances of insufficient suction stabilization on rigs where a “standpipe” is installed off the suction manifold. The thought behind this design was to create a gas-over-fluid column for the reciprocating pump and eliminate cavitation.

When the standpipe is installed on the suction manifold’s deadhead side, there’s little opportunity to get fluid into all the cylinders to prevent cavitation. Also, the reciprocating pump and charge pump are not isolated.

The suction stabilizer’s compressible feature is designed to absorb the negative energies and promote smooth fluid flow. As a result, pump isolation is achieved between the charge pump and the reciprocating pump.

The isolation eliminates pump chatter, and because the reciprocating pump’s negative energies never reach the charge pump, the pump’s expendable life is extended.

Investing in suction stabilizers will ensure your pumps operate consistently and efficiently. They can also prevent most challenges related to pressure surges or pulsations in the most difficult piping environments.

Sigma Drilling Technologies’ Charge Free Suction Stabilizer is recommended for installation. If rigs have gas-charged cartridges installed in the suction stabilizers on the rig, another suggested upgrade is the Charge Free Conversion Kits.

When choosing a size and type of mud pump for your drilling project, there are several factors to consider. These would include not only cost and size of pump that best fits your drilling rig, but also the diameter, depth and hole conditions you are drilling through. I know that this sounds like a lot to consider, but if you are set up the right way before the job starts, you will thank me later.

Recommended practice is to maintain a minimum of 100 to 150 feet per minute of uphole velocity for drill cuttings. Larger diameter wells for irrigation, agriculture or municipalities may violate this rule, because it may not be economically feasible to pump this much mud for the job. Uphole velocity is determined by the flow rate of the mud system, diameter of the borehole and the diameter of the drill pipe. There are many tools, including handbooks, rule of thumb, slide rule calculators and now apps on your handheld device, to calculate velocity. It is always good to remember the time it takes to get the cuttings off the bottom of the well. If you are drilling at 200 feet, then a 100-foot-per-minute velocity means that it would take two minutes to get the cuttings out of the hole. This is always a good reminder of what you are drilling through and how long ago it was that you drilled it. Ground conditions and rock formations are ever changing as you go deeper. Wouldn’t it be nice if they all remained the same?

Centrifugal-style mud pumps are very popular in our industry due to their size and weight, as well as flow rate capacity for an affordable price. There are many models and brands out there, and most of them are very good value. How does a centrifugal mud pump work? The rotation of the impeller accelerates the fluid into the volute or diffuser chamber. The added energy from the acceleration increases the velocity and pressure of the fluid. These pumps are known to be very inefficient. This means that it takes more energy to increase the flow and pressure of the fluid when compared to a piston-style pump. However, you have a significant advantage in flow rates from a centrifugal pump versus a piston pump. If you are drilling deeper wells with heavier cuttings, you will be forced at some point to use a piston-style mud pump. They have much higher efficiencies in transferring the input energy into flow and pressure, therefore resulting in much higher pressure capabilities.

Piston-style mud pumps utilize a piston or plunger that travels back and forth in a chamber known as a cylinder. These pumps are also called “positive displacement” pumps because they literally push the fluid forward. This fluid builds up pressure and forces a spring-loaded valve to open and allow the fluid to escape into the discharge piping of the pump and then down the borehole. Since the expansion process is much smaller (almost insignificant) compared to a centrifugal pump, there is much lower energy loss. Plunger-style pumps can develop upwards of 15,000 psi for well treatments and hydraulic fracturing. Centrifugal pumps, in comparison, usually operate below 300 psi. If you are comparing most drilling pumps, centrifugal pumps operate from 60 to 125 psi and piston pumps operate around 150 to 300 psi. There are many exceptions and special applications for drilling, but these numbers should cover 80 percent of all equipment operating out there.

The restriction of putting a piston-style mud pump onto drilling rigs has always been the physical size and weight to provide adequate flow and pressure to your drilling fluid. Because of this, the industry needed a new solution to this age-old issue.

As the senior design engineer for Ingersoll-Rand’s Deephole Drilling Business Unit, I had the distinct pleasure of working with him and incorporating his Centerline Mud Pump into our drilling rig platforms.

In the late ’90s — and perhaps even earlier — Ingersoll-Rand had tried several times to develop a hydraulic-driven mud pump that would last an acceptable life- and duty-cycle for a well drilling contractor. With all of our resources and design wisdom, we were unable to solve this problem. Not only did Miller provide a solution, thus saving the size and weight of a typical gear-driven mud pump, he also provided a new offering — a mono-cylinder mud pump. This double-acting piston pump provided as much mud flow and pressure as a standard 5 X 6 duplex pump with incredible size and weight savings.

The true innovation was providing the well driller a solution for their mud pump requirements that was the right size and weight to integrate into both existing and new drilling rigs. Regardless of drill rig manufacturer and hydraulic system design, Centerline has provided a mud pump integration on hundreds of customer’s drilling rigs. Both mono-cylinder and duplex-cylinder pumps can fit nicely on the deck, across the frame or even be configured for under-deck mounting. This would not be possible with conventional mud pump designs.

Centerline stuck with their original design through all of the typical trials and tribulations that come with a new product integration. Over the course of the first several years, Miller found out that even the best of the highest quality hydraulic cylinders, valves and seals were not truly what they were represented to be. He then set off on an endeavor to bring everything in-house and began manufacturing all of his own components, including hydraulic valves. This gave him complete control over the quality of components that go into the finished product.

The second generation design for the Centerline Mud Pump is expected later this year, and I believe it will be a true game changer for this industry. It also will open up the application to many other industries that require a heavier-duty cycle for a piston pump application.

The report covers comprehensive information about market trends, volume (Units) and value (US$ Mn) projections, competition and recent developments and market dynamics in the global mud pumps market for the study period of 2013 to 2026.

The global mud pumps market is expected to reach a little over US$ 1,085 Mn over the forecast period, registering a CAGR of 4.4%. Growth in drilling activities in the oil & gas Industry to increase hydrocarbon production and ease of the mud circulation operation in drilling holes are some of the factors expected to lay a robust foundation for the growth of the global mud pumps market.

Mud pumps can be classified on the basis of the number of pistons into duplex, triplex and quintuplex, which consist of two, three and five pistons respectively. The triplex segment is expected to dominate the mud pumps market in terms of value as well as volume during the entire forecast period.

Triplex mud pumps find extensive usage in circulating drilling fluid with high pressure for deep oil well drilling application. These usage characteristics make them preferable for use, primarily in onshore and offshore oil well drilling applications.

Mud pumps are widely utilized in the oil & gas industry. On the basis of the mode of operation, mud pumps can be classified as electric and fuel engine mud pumps.

Fuel engine mud pumps use petroleum oils as the key liquefying agent. These types of mud pumps release hazardous gases into the environment. In order to contain the hazardous impact of fuel engine mud pumps on the environment, regulatory authorities are compelling manufacturers and consumers to opt for electric mud pumps, which do not emit volatile organic compounds and operate with low noise and low vibration. Electric mud pumps offer smooth operations in drilling rigs and are environment-friendly, which is why they dominate the market for mud pumps.

The electric mud pumps segment is projected to grow with a 4.5% CAGR during the forecast period in view of the tightening emission control regulations and is expected to create an absolute $ opportunity worth US$ 134 Mn between 2018 and 2026.

Among all the applications analyzed in this global mud pumps market study, the onshore application of mud pumps is expected to register about 1.43X growth in terms of value between 2018 and 2026. The offshore application of mud pumps is projected to register moderate growth during the entire forecast period, led by land oil field discoveries.

In terms of incremental $ opportunity, onshore and offshore segments are expected to compete within large margins. The onshore application of mud pumps is expected to occupy over an 86% share in terms of value by the end of 2026.

Increasing oil-well exploration activities, stable economic conditions and consistent growth in oil well drilling rig sales in the region are expected to drive the demand for mud pumps in the region.

The comparatively well-established production sector in the region and increasing oil and gas industry and hydrocarbon consumption will create a healthy platform for the growth of the mud pumps market. Some regions including China and Europe are expected to gain traction in the latter half of the forecast period, owing to the anticipated growth of the oil & gas industry in these regions. North America is expected to register above-average 1.1X growth in the market. All the other regions are anticipated to exhibit moderate growth during the same period.

The global mud pumps market is consolidated with limited market players holding considerable double-digit market shares as of 2017. Globally, the top 12 players in the mud pumps market collectively hold between 53% and 58% of the market share.

Over the past few years, the mud pumps market has witnessed significant technological advancement from the competition perspective. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global mud pumps market.

In 2018, National Oil Varco signed a deal with Dubai Saudi Armaco to form a joint venture for the manufacturing of onshore rigs and equipment in Saudi Arabia

In 2015, Flowserve opened a new pump manufacturing plant in Coimbatore, India. Through this new facility, the company aims to provide pump products for the oil and gas industry in Asia Pacific

Some of the key players involved in this market study on the global mud pumps market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

The ‘GlobalMud Pumps Market Price, Size, Share, Trends, Growth, Report and Forecast 2023-2028’ by Expert Market Research gives an extensive outlook of the global mud pumps market, assessing the market on the basis of its segments like type, operation, application, and major regions.

The need for mud pumps has increased along with the growing demand for minerals, oil, and gas. The market for mud pumps is anticipated to grow throughout the forecast period due to increased offshore mining activities and the globally expanding population. With the advantages it offers, the mud pumps market is expected to grow quickly. The market would be further boosted by rising demand for directional and horizontal drilling as well as the mud pump’s capacity to handle high-pressure drilling activities.

Due to technological advancements, mud pumps operate more efficiently and without producing harmful carbon emissions. Electric mud pumps are in higher demand, which may create new prospects for market expansion. The performance of mud pumps is influenced by the pump design along with a variety of other elements like pipelines, panel boards, and electricity. For maximum efficiency, manufacturers are therefore concentrating on improvements to the overall pumping system, which is aiding the mud pumps market.

Mud pumps are attracting attention as an innovative component of offshore drilling equipment as every hour, mud pumps help reach deeper levels, saving the rig operator time and money. In on-shore drilling, for instance, 7500-psi mud pump systems are becoming common.

Mud pumps are a particular kind of piston/plunger-driven pump that can use drilling fluids while under high pressure. Mud pumps are typically used in conjunction with other pumps and are a crucial component of heavy drilling techniques. These pumps assist in returning the drilling fluid to the surface after it has passed past the drill bit.

Triplex pumps are likely to hold a significant mud pumps market share since triplex pumps are lighter and more efficient than duplex pumps. Triplex mud pumps are widely used to circulate high-pressure drilling fluid for deep oil well drilling applications. They are more advantageous for use, especially in onshore and offshore oil well drilling applications, due to these applications.

The electrically powered mud pump market is expanding quickly due to its environmental advantages over fuel engine pumps. The mud pumps market value is anticipated to increase as a result of the increased exploration operations being carried out in all regions of the world to satisfy the growing demand for energy and minerals. In nations including the United States, Canada, China, and Argentina, shale gas exploration has expanded, which will raise the demand for oil rigs and consequently mud pumps.

The use of oil rigs, equipment, and mud pumps is being accelerated by operators in nations like the United States who are also relocating to isolated areas in Alaska. Old pumps are now being replaced by many governments, and oil and gas production businesses in Europe and the United States have noticed a continuous growth in this trend, thus aiding the market growth of mud pumps.

The mud motor is a progressive cavity positive displacement pump used in oil and gas drilling operations, fishing, etc. The global mud motor market is expected to reach USD 2028.46 million by 2026. The demand for mud motors is expected to grow due to increased fishing activities, demand for boating, and rising oil and drilling operations. In addition, demand for Horizontal Directional Drilling (HDD) and the development of unconventional hydrocarbons resources is expected to bolster the mud motor market.

A mud motor or a drilling motor is a positive displacement drilling motor that uses the drilling fluid’s hydraulic horsepower to drive the drill bit. Mud motors find extensive applications to reduce bearing load and provide an adjustable penetration rate, among other advantages.

It is expected that the global mud motor market will reach USD 2028.46 million by 2026. It is anticipated to register a CAGR of 4.7% during the forecast period (2021–2026).

Positive displacement and turbine are the two key motor types used in mud motors. Positive displacement motors (PDMs) find application in directional drilling projects and are primary components in bottom-hole drilling assemblies. Thus, the positive displacement segment is expected to register growth during the forecast period. Selection of the correct downhole motor is crucial in designing the buttonhole assembly (BHA) with mud motors to overcome cost-intensive challenges such as wellbore crookedness, string failures, and improper build rate. Technologically- and mechanically-advanced PDMs provide enhanced performance; for instance, a reduced-length positive displacement motor with an equidistant power section stator can provide superior motor performance and reliability at high operating temperatures.

Mud motors are available in several diameters; for the sake of this study, we have classified them as <100mm, 100mm–200mm, and >200mm. A motor’s power is inversely proportional to the square of its diameter also its torque is directly proportional to the cube of its diameter. Thus, the diameter is an important aspect in mud motor selection as it affects the motor’s torque and power.

Mud motors are classified into drilling and vertical. Lateral, curve, RSS, and air applications are included under the umbrella of vertical applications. With the applications of mud motors in metalworking, woodworking, and construction, the drilling segment is expected to gain significant traction and register a CAGR of 4.9% during the forecast period. According to Reports Monitor, the drilling segment was valued at USD 1,169.07 million in 2018, which is projected to grow to a value of USD 1,710.49 million by 2026.

Oil, natural gas, boating, and fishing are the key end-use sectors considered in this study on the mud motors market. Mud motors are used in drilling oil and natural gas wells. Thus, the demand for mud motors is expected to trail the growth of the oil and gas industry. According to the Organization of the Petroleum Exporting Countries (OPEC) global oil demand was pegged at 95.4 mb/d in 2016 and is projected to reach 102.3 mb/d by 2022. These figures underscore the potential that mud motors possess in the oil industry.

To better assess the global mud motors market, we have studied it across four key regions, namely North America, Europe, Asia Pacific, and Latin America, and the Middle East & Africa (LAMEA)

With energy demand, specifically oil and gas, North America has long emerged as the most eminent region in the global market. In 2017, North America’s demand for gas was pegged at 15.8 mboe/d in 2015, is estimated to reach 18.6 mboe/d by 2030.

It signals the region’s vast potential in the mud motors market expected to remain strong in the coming years. The mud motors market was valued at USD 173.37 million in 20XX and is expected to grow to USD 279.50 million by 2026 with an anticipated CAGR of 5.1% during the forecast period.

Consolidation and restructuring of South-East Asia’s oil and gas industry, alongside increasing expenditure on upstream activities will accrue a substantial share for the region’s mud motors market. For instance, in Malaysia, Petroleum Nasional Berhad (Petronas), a state-owned corporation, has allocated USD 6.6 billion for upstream expenditure.

The Latin American mud pumps market is expected to witness significant growth in the coming years as the region possesses ultra-deepwater salt formations and undiscovered oil resources. For instance, it is estimated that over 100 exploration wells are anticipated to drill in Latin America outside Brazil in the next five years due to potential undiscovered oilfields in Guyana, Trinidad, and Colombia.

National Oilwell Varco, SlimDril International, Whole Solutions Inc., Downhole Drilling Services, LLC, Enteq Upstream, Newsco International Energy Services Inc., LORD Corporation, SOKOL, Beaver Dam Mud Runners, COPPERHEAD MUD MOTORS, and TomaHawk Downhole, LLC are among the key players operating in the mud motors market.

National Oilwell Varco, SlimDril International, Whole Solutions Inc., Downhole Drilling Services, LLC, Enteq Upstream, Newsco International Energy Services Inc., LORD Corporation, SOKOL, Beaver Dam Mud Runners, COPPERHEAD MUD MOTORS, and TomaHawk Downhole, LLC are among the operating in the mud motors market.,

In geotechnical engineering, drilling fluid, also called drilling mud, is used to aid the drilling of boreholes into the earth. Often used while drilling oil and natural gas wells and on exploration drilling rigs, drilling fluids are also used for much simpler boreholes, such as water wells. One of the functions of drilling mud is to carry cuttings out of the hole.

The three main categories of drilling fluids are water-based muds (WBs), which can be dispersed and non-dispersed; non-aqueous muds, usually called oil-based muds (OBs); and gaseous drilling fluid, in which a wide range of gases can be used. Along with their formatives, these are used along with appropriate polymer and clay additives for drilling various oil and gas formations.

Water-based mud (WBM): Most water-based mud systems begin with water, then clays and other chemicals are added to create a homogeneous blend with viscosity between chocolate milk and a malt. The clay is usually a combination of native clays that are suspended in the fluid while drilling, or specific types of clay processed and sold as additives for the WBM system. The most common type is bentonite, called "gel" in the oilfield. The name likely refers to the fluid viscosity as very thin and free-flowing (like chocolate milk) while being pumped, but when pumping is stopped, the static fluid congeals to a "gel" that resists flow. When adequate pumping force is applied to "break the gel," flow resumes and the fluid returns to its free-flowing state. Many other chemicals (e.g. potassium formate) are added to a WBM system to achieve desired effects, including: viscosity control, shale stability, enhance drilling rate of penetration, and cooling and lubricating of equipment.

Oil-based mud (OBM): Oil-based mud has a petroleum based fluid such as diesel fuel. Oil-based muds are used for increased lubricity, enhanced shale inhibition, and greater cleaning abilities with less viscosity. Oil-based muds also withstand greater heat without breaking down. The use of oil-based muds has special considerations of cost, environmental concerns such as disposal of cuttings in an appropriate place, and the exploratory disadvantages of using oil-based mud, especially in wildcat wells. Using an oil-based mud interferes with the geochemical analysis of cuttings and cores and with the determination of API gravity because the base fluid cannot be distinguished from oil that is returned from the formation.

Synthetic-based fluid (SBM) (Otherwise known as Low Toxicity Oil Based Mud or LTOBM): Synthetic-based fluid is a mud in which the base fluid is a synthetic oil. This is most often used on offshore rigs because it has the properties of an oil-based mud, but the toxicity of the fluid fumes are much less. This is important when the drilling crew works with the fluid in an enclosed space such as an offshore drilling rig. Synthetic-based fluid poses the same environmental and analysis problems as oil-based fluid.

On a drilling rig, mud is pumped from the casing, where it emerges from the top. Cuttings are then filtered out with either a shale shaker or the newer shale conveyor technology, and the mud returns to the mud pits. The mud pits allow the drilled "fines" to settle and the mud to be treated by adding chemicals and other substances.

The returning mud may contain natural gases or other flammable materials which will collect in and around the shale shaker / conveyor area or in other work areas. Because of the risk of a fire or an explosion if they ignite, special monitoring sensors and explosion-proof certified equipment is commonly installed, and workers are trained in safety precautions. The mud is then pumped back down the hole and further re-circulated. After testing, the mud is treated periodically in the mud pits to ensure it has desired properties that optimize and improve drilling efficiency and borehole stability.

Drilling fluid carries the rock excavated by the drill bit up to the surface. Its ability to do so depends on cutting size, shape, and density, and speed of fluid traveling up the well (annular velocity). These considerations are analogous to the ability of a stream to carry sediment. Large sand grains in a slow-moving stream settle to the stream bed, while small sand grains in a fast-moving stream are carried along with the water. The mud viscosity is an important property, as cuttings will settle to the bottom of the well if the viscosity is too low.

Most drilling muds are thixotropic (viscosity increases when static). This characteristic keeps the cuttings suspended when the mud is not flowing during, for example, maintenance.

High density fluids may clean holes adequately even with lower annular velocities (by increasing the buoyancy force acting on cuttings) but may have a negative impact if mud weight exceeds that needed to balance the pressure of surrounding rock (formation pressure), so mud weight is not usually increased for hole cleaning.

For effective solids controls, drill solids must be removed from mud on the 1st circulation from the well. If re-circulated, cuttings break into smaller pieces and are more difficult to remove.

If formation pressure increases, mud density should be increased to balance pressure and keep the wellbore stable. The most common weighting material is barite. Unbalanced formation pressure will cause an unexpected influx (also known as a kick) of formation fluids into the wellbore possibly leading to a blowout from pressurized formation fluid.

In practice, mud density should be limited to the minimum necessary for well control and wellbore stability. If too great it may fracture the formation.

Mud column pressure must exceed formation pressure, in this condition mud filtrate invades the formation, and a filter cake of mud is deposited on the wellbore wall.

Depending on the mud system in use, a number of additives can improve the filter cake (e.g. bentonite, natural & synthetic polymer, asphalt and gilsonite).

Chemical composition and mud properties must combine to provide a stable wellbore. Weight of the mud must be within the necessary range to balance the mechanical forces.

In shales, mud weight is usually sufficient to balance formation stress, as these wells are usually stable. With water base mud, chemical differences can cause interactions between mud & shale that lead to softening of the native rock. Highly fractured, dry, brittle shales can be extremely unstable (leading to mechanical problems).

Various chemical inhibitors can control mud / shale interactions (calcium, potassium, salt, polymers, asphalt, glycols and oil – best for water sensitive formations)

Lubrication based on the coefficient of friction.("Coefficient of friction" is how much friction on side of wellbore and collar size or drill pipe size to pull stuck pipe) Oil- and synthetic-based mud generally lubricate better than water-based mud (but the latter can be improved by the addition of lubricants).

Drilling fluids also support portion of drill-string or casing through buoyancy. Suspend in drilling fluid, buoyed by force equal to weight (or density) of mud, so reducing hook load at derrick.

Hydraulic energy provides power to mud motor for bit rotation and for MWD (measurement while drilling) and LWD (logging while drilling) tools. Hydraulic programs base on bit nozzles sizing for available mud pump horsepower to optimize jet impact at bottom well.

Mud loggers examine cuttings for mineral composition, visual sign of hydrocarbons and recorded mud logs of lithology, ROP, gas detection or geological parameters.

Mud should have thin, slick filter cake, with minimal solids in filter cake, wellbore with minimal cuttings, caving or bridges will prevent a good casing run to bottom. Circulate well bore until clean.

Mud low viscosity, mud parameters should be tolerant of formations being drilled, and drilling fluid composition, turbulent flow - low viscosity high pump rate, laminar flow - high viscosity, high pump rate.

Water-based drilling mud most commonly consists of bentonite clay (gel) with additives such as barium sulfate (barite), calcium carbonate (chalk) or hematite. Various thickeners are used to influence the viscosity of the fluid, e.g. xanthan gum, guar gum, glycol, carboxymethylcellulose, polyanionic cellulose (PAC), or starch. In turn, deflocculants are used to reduce viscosity of clay-based muds; anionic polyelectrolytes (e.g. acrylates, polyphosphates, lignosulfonates (Lig) or tannic acid derivates such as Quebracho) are frequently used. Red mud was the name for a Quebracho-based mixture, named after the color of the red tannic acid salts; it was commonly used in the 1940s to 1950s, then was made obsolete when lignosulfonates became available. Other components are added to provide various specific functional characteristics as listed above. Some other common additives include lubricants, shale inhibitors, fluid loss additives (to control loss of drilling fluids into permeable formations). A weighting agent such as barite is added to increase the overall density of the drilling fluid so that sufficient bottom hole pressure can be maintained thereby preventing an unwanted (and often dangerous) influx of formation fluids

Freshwater mud: Low pH mud (7.0–9.5) that includes spud, bentonite, natural, phosphate treated muds, organic mud and organic colloid treated mud. high pH mud example alkaline tannate treated muds are above 9.5 in pH.

Water based drilling mud that represses hydration and dispersion of clay – There are 4 types: high pH lime muds, low pH gypsum, seawater and saturated salt water muds.

Low solids mud: These muds contain less than 3–6% solids by volume and weight less than 9.5 lbs/gal. Most muds of this type are water-based with varying quantities of bentonite and a polymer.

Oil based mud: Oil based muds contain oil as the continuous phase and water as a contaminant, and not an element in the design of the mud. They typically contain less than 5% (by volume) water. Oil-based muds are usually a mixture of diesel fuel and asphalt, however can be based on produced crude oil and mud

"Mud engineer" is the name given to an oil field service company individual who is charged with maintaining a drilling fluid or completion fluid system on an oil and/or gas drilling rig.mud engineer, or more properly drilling fluids engineer, is critical to the entire drilling operation because even small problems with mud can stop the whole operations on rig. The internationally accepted shift pattern at off-shore drilling operations is personnel (including mud engineers) work on a 28-day shift pattern, where they work for 28 continuous days and rest the following 28 days. In Europe this is more commonly a 21-day shift pattern.

In offshore drilling, with new technology and high total day costs, wells are being drilled extremely fast. Having two mud engineers makes economic sense to prevent down time due to drilling fluid difficulties. Two mud engineers also reduce insurance costs to oil companies for environmental damage that oil companies are responsible for during drilling and production. A senior mud engineer typically works in the day, and a junior mud engineer at night.

The cost of the drilling fluid is typically about 10% (may vary greatly) of the total cost of drilling a well, and demands competent mud engineers. Large cost savings result when the mud engineer and fluid performs adequately.

The compliance engineer is the most common name for a relatively new position in the oil field, emerging around 2002 due to new environmental regulations on synthetic mud in the United States. Previously, synthetic mud was regulated the same as water-based mud and could be disposed of in offshore waters due to low toxicity to marine organisms. New regulations restrict the amount of synthetic oil that can be discharged. These new regulations created a significant burden in the form of tests needed to determine the "ROC" or retention on cuttings, sampling to determine the percentage of crude oil in the drilling mud, and extensive documentation. No type of oil/synthetic based mud (or drilled cuttings contaminated with OBM/SBM) may be dumped in the North Sea. Contaminated mud must either be shipped back to shore in skips or processed on the rigs.

Clark, Peter E. (1995-01-01). "Drilling Mud Rheology and the API Recommended Measurements". SPE Production Operations Symposium. Society of Petroleum Engineers. doi:10.2118/29543-MS. ISBN 9781555634483.

Mud pumps are the pumps deployed in the oil and gas industry, mainly to circulate drilling fluids and other kinds of fluids in and out of the drilled wells for exploration. The mud pumps transfer the fluids at a very high pressure inside the well using the piston arrangement. The number of pistons decides the displacement and efficiency of working of the mud pumps, originally only dual piston pumps and three-piston pumps were used, but the technological advancements have seen pumps with five and six pistons to come up. Currently the triplex pumps which have three pistons are used, but the duplex pumps having two pumps are still deployed in the developing countries.

Based on its types, global mud pump market can be segmented into duplex, triplex, and others. The triplex mud pumps will dominate the mud pump marking in the given forecast period owing to its advantages and ongoing replacement of duplex pumps with triplex pumps. Based on operation, the global mud pumps market can be segmented into electric and fuel engine.

The electric mud pumps will dominate the market during the given forecast period due to the advantage of eliminating the harmful carbon emission which is done in the case of fuel engine pumps. Based on its application, the global mud pumps market can be segmented into oil & gas, mining, construction, and others.

The major market driver for the global mud pumps market is the increasing exploration activities taking place in various regions of the world to satisfy the increased energy demand. The number of drilled wells has increased in recent years, which has certainly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

Key market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to reduce the carbon emissions, which will certainly decrease the demand for oil & gas and therefore will have a negative impact on the growth of the global mud pumps market.

Some of the notable companies in the global mud pump market are Mud King Products, Inc. Gardner Denver Pumps, Weatherford, Schlumberger, National Oilwell Varco, China National Petroleum Corporation, Flowserve Corporation, MHWirth, American Block, Herrenknecht Vertical Gmbh, Bentec GmbH Drilling & Oilfield Systems, Drillmec Inc, Sun Machinery Company, Shale Pumps, and Dhiraj Rigs.

The global mud pump market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Owing to the well-established production sector and stable exploration industry North America holds the largest market for the mud pumps. The onshore exploration activities of oil & gas have increased at a good rate in the North America region, which has certainly boosted the growth of the mud pumps market in the region.

The demand from Europe and Asia Pacific has also increased due to exploration activities in both the regions owing to the increased energy demand. The energy demand specifically in the Asia Pacific has increased due to the increased population and urbanization. The Middle East and Africa also hold significant opportunities for the mud pumps market with increased exploration activities in the given forecast period.

In August 2018, Henderson which is a leading company in sales and service of drilling rigs, and capital drilling equipment in Texas signed a contract with Energy Drilling Company for the purchase and upgrade of oil field equipment’s which included three 1600hp × 7500psi mud pumps. This will be the first refurbishment completed at Henderson’s new service center and rig yard.

In January 2018, Koltek Energy Services launched the 99-acre facility for the testing of the oil field equipment in Oklahoma. This will allow the oil field equipment manufacturers to test their equipment at any given time. The company has deployed the MZ-9 pump which has a power rating of 1000Hp.

8613371530291

8613371530291