overshot oil and gas in stock

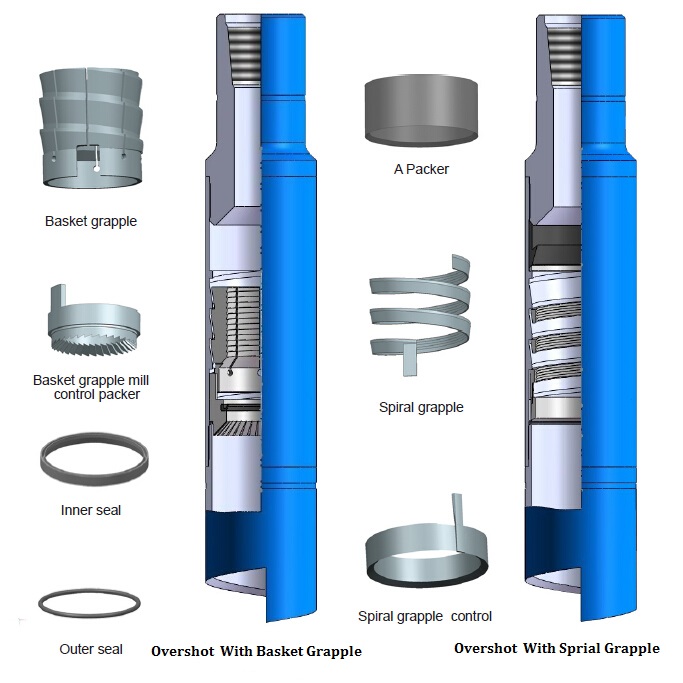

A downhole tool used in fishing operations to engage on the outside surface of a tube or tool. A grapple, or similar slip mechanism, on the overshot grips the fish, allowing application of tensile force and jarring action. If the fish cannot be removed, a release system within the overshot allows the overshot to be disengaged and retrieved.

"We believe this move has overshot," Goldman Sachs commodities strategist Damien Courvalin stated in a new note to clients. "While risks of a futurerecession are growing, key to our bullish view is that the current oil deficit remains unresolved, with demand destruction through high prices the only solver left as still declining inventories approach critically low levels."

Oil prices have been dropping in July as economists across Wall Street increasingly state that a 2023 recession is in the cards. On Tuesday, WTI Crude fell below $100 a barrel for the first time since May, placing further pressure on shares of crude sensitive stocks such as ExxonMobil, Chevron, and Transocean. Oil prices touched slightly below $96 a barrel on Wednesday, a price not seen since mid-April.

The pullback in crude oil — even if short-lived — is beginning to feed its way to relief at the gas pump for inflation battered consumers. The current average price of regular gasoline in the U.S. is $4.77 a gallon, according to Gas Buddy data, down from an all-time high of $5.03 a gallon on June 16.

“While we may see prices decline into this week, the drop could fade soon if oil prices reverse, especially with strong demand over the holiday," stated Patrick De Haan, Gasbuddy head of petroleum analysis. "For the time being, Americans are spending nearly $100 million per day less on gasoline than when prices peaked a few weeks ago, and that’s well-needed relief at a time when gas prices remain near records."

Tianhe Oil Group Co. Ltd. is a global group. We are specialized in the production of drilling tools, including R&D, production, selling, leasing, maintenance and services. Tianhe has 5 main businesses spread across the globe in more than 50 countries in the world.

Tianhe Oil Group management prioritize its people, technology, continuous improvement and building brand awareness. Our mission is to continuously strive innovation and improvement and expand our business in the oilfield. We increased the investment in technology research and development, always looking to provide our global customers with the best technical products and services.

Tianhe Oil Group strongly believes and promotes Total Quality Management, implements the ISO quality management system, HSE management system and API standards. Our manufacturing facilities are well equipped with four automated induction heat treatment lines and dozens of other types of heat treatment ovens and well furnaces (Box type, well type, carburizing heat treatment furnace) to ensure full coverage of heat treatment required by the different products.

So far, Tianhe Oil Group has established strong business relationships with over 200 international oil & gas companies in supporting the top 50 oil producing countries. For example, we have partnered with Schlumberger, Halliburton, Baker Hughes, Weatherford, Shell, NOV, etc.

It has been almost a year since I first covered Chevron (NYSE:CVX) and took a long position in April of 2021. In hindsight, I regret that I didn"t act earlier since I was aware of the favorable position that oilmajors were in even before that. If I had bought in October of 2020, when Ilaid out the strong investment thesisfor Exxon Mobil (XOM), my returns would have been even higher.

Even if it wasn"t for recent events that drove the price of oil to new highs, Chevron would havebeen a far superior investment than most large-cap U.S. companies during this period, including many of the equity market darlings in the tech sector.

But let"s ignore the historical performance and similar to one year ago, when pessimism in the oil & gas sector was very high, ignore the rear-view mirror and look to what lies ahead.

In contrast to a year ago, the outlook for Chevron and all other oil majors appears very favorable at the moment. In addition to the inflationary pressures, the full swing of the realized geopolitical risk is also feeding the share price rally. As the world becomes more polarized and deglobalization accelerates, as I predicted in the months following the pandemic, security of energy supply will be of paramount importance. Consequently, a large chunk of global energy resources will become too risky to depend on and that will favor local energy providers.

Moreover, during times of peak globalization and loose monetary and fiscal policies, the market does not care much about companies like Chevron or Exxon Mobil. On the contrary, they were seen as the legacy dinosaurs of the corporate world that should be replaced by fancy solar tiles or wind turbines. However, as inflation starts to bite and affects predominantly lower-income consumers, the overall sentiment will likely continue to shift towards security in the face of low-cost energy producers. Like it or not, the front seat here is reserved for the oil majors.

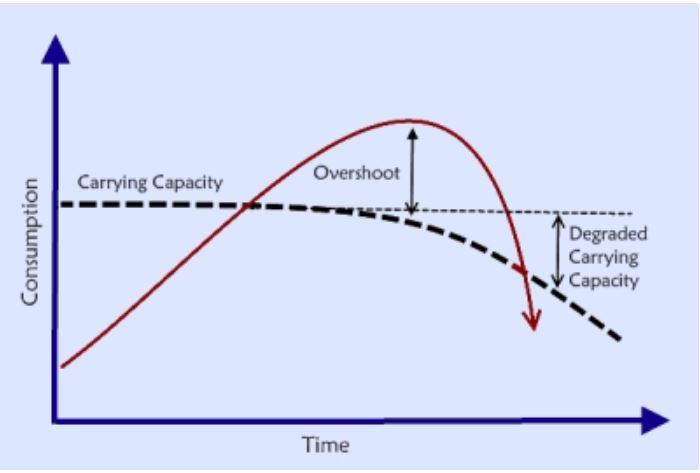

However, as this narrative gains momentum, so are the valuations in the sector. The market has a tendency to overshoot in both directions - both on the downside when the outlook is grim and on the upside when market conditions are favorable.

Having said all that, I still believe in the long-term success of Chevron as it will benefit from a push towards more energy security, while at the same time the company will invest heavily into future energies, such as hydrogen, carbon capture & storage, and renewable fuels. However, future earnings are unlikely to increase on a straight-line basis as current valuations seem to suggest.

Based on current oil prices of around $100 per barrel and the current average for the year of $92, CVX upstream earnings are likely to come within the range of $21bn to $25bn.

Based on that range and Chevron"s current price per share, the company could buyback between 20m and 30m shares by the end of 2022. As a result, the company"s EPS for 2022 could come in between $11 and $13.2 in the most optimistic scenario. These numbers do not take into account any other idiosyncratic and political risks highlighted above.

The long-term investment thesis for Chevron remains intact. Oil & gas investments will need to increase in order to provide secure energy in a more destabilized world, while higher oil & gas prices will allow the company to make the necessary investments in new technologies. However, investors should not forget that the industry is a highly cyclical one and prone to political risk. At the moment, Chevron"s valuation appears stretched and already prices in a massive improvement in earnings for 2022. Therefore, the risk-reward profile of the company is now far less appealing than it was a year ago and calls for a more cautious approach. For the time being, I will abstain from increasing my positions in the company.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

I debated on where to go next, but at the end of the day the most widely used fishing tool has to be an overshot. Some will say why not a spear? Well if you must ask, always go with the strongest fishing tool you can run to catch the fish. And if you run a spear, never plug the I.D. of your fish by breaking it off. Done with that!

The info that follows has been taken from the manuals published on overshots. I realize that paper manuals are a thing of the past, yes, yes at one time fishing tool hands carried massive catalog brief cases full of reference material. Now you have the luxury of your laptop loaded with information. If you have never sat down and read an overshot manual, now might be a good time.

The overshot is highly versatile and efficient tool. There are several different types of overshots, however each overshot is designed to engage a specific size of tubing, pipe, coupling, tool joint, drill collar or smooth OD tool.

The original overshot was developed by Bowen Oil Tools, which is now part of NOV. One thing I will point out is that in the catalogs you will see more than one assembly number for a given OD of Overshot, this came about due to the two locations developing their own variations. I found this information on NOV’s website and thought it was interesting to share.

In the early 1930s, the consequences of the stock market crash prompted S.R. Bowen to consider starting a company in Houston, where oil exploration and drilling was accelerating. In the early spring of 1934, his son Walter and a friend formed Bowen Company of Texas.

Bowen™ became a leader in innovation with the creation of the first overshot, the Series 150, in 1935. This tool set the standard for fishing equipment, and the quick acceptance of the tool assured the company partners that their business would be successful. The company continued to create new products, building a reputation for their well tool design and construction.

Currently there are several manufacturers of overshots, NOV (Bowen), Rubicon (Logan) and Applied Oil Tools (Gotco). These overshots are designated by a series number as follows:Series 10 - Sucker Rod Overshot

Overshots may be identified by one of the following, known as “type”:Full Strength (FS) - engineered to withstand all pulling, jarring and torsional strain

The basic overshot (from top down) consists of a top sub, a bowl, grapple, control, and a guide. In addition to the basic components, some overshots (Series 10 and 150) can be dressed with either a:Spiral grapple used if the fish diameter is near the maximum catch of the overshot, or a

The Series 150 Overshot features the ability to packoff on the fish. When the circulating packoff is not used, the fluid circulates down the drillpipe, aroundthe top outside of the fish, through the slip or grapple assembly, around the guide shoe and up the annulus.

When the circulating packoff is used, the annular space between the top outside of the fish and the inside of the lower part of the overshot is packed off, diverting the fluid flow down into the fish, making it easier to release and recover the fish. Packoffs usually are not high pressure devices but will often withstand sufficient pressure to establish circulation through the fish. Third party high pressure packoffs are available from various sources.

The extension can be installed between the top sub and the bowl of the Series 10, 70, and 150 overshots. It is used to extend the overshot bowl to:Allow the grapple to catch farther down on a fish that may be necked down at the top by having been pulled in two, or latched by an overshot and released several times, or to

A stop ring must be used where a fish OD reduces immediately below the catch area to allow the grapple to bite on full-size pipe.Example - catching a Hydril upset or EUE collar. If the upset of collar should pass completely through the grapple, the overshot may not be releasable.

If a stop ring is needed and the grappledoes not have a built-in stop, a stop ring can be run above the grapple, in the area between the Top Sub pin and the Grapple.

The Series 10 Sucker Rod Overshot is designed to engage and recover sucker rods, couplings, and similar items from inside tubing strings.Basket grapples are recommended for fishing for hardened and ground boxes (Sucker Rod Box).

The Series 20 Sucker Rod Overshot is a short catch tool which provides a means for engaging the exposed portion of a fish too short to be engaged with a Series 10 overshot.Uses basket grapples only

The Series 70 Short Catch Overshot is designed to engage the exposed portion of a fish too short to engage with Series 150 overshots.Uses basket grapple only

The Series 150 Releasing and Circulating Overshot is used to engage, packoff, and retrieve twisted-off lost tubing, drillpipecoupling, tool joint, casing or other similar fish.

Special Grapples:Nitraloy grapples may be available from some vendors. It is available only in the most popular sizes and is not commonly used on standard pipe.

A right hand wicker grapple converts a normal right release overshot to left hand release. This grapple is used where you expect to apply excessive right hand torque to release a packer, safety joint, etc. Note: Overshot will have to be released by left hand rotation.

Grapple Controls:Basket Grapple control packers have built in packoffs. These packoffs will hold various amounts of pressure, depending on the size of the fish and the condition of the packoff after engaging the fish.

High Pressure Packoff Assemblies:The High Pressure Packoff Assembly is an accessory to the Series 150 Overshots. It is used when high pressure circulation to the fish is required. It consists of a packoff sub with packing and packing rings and is installed between the top sub and bowl of the overshot. By running the packoff sub above the bowl, this design prevents the application of high internal pressures to the overshot bowl. The design of the High Pressure Packoff Assembly allows pressures two to three times the standard overshot packoff to be applied to the fish.

This information comes directly from the NOV manual for the Wide Catch Overshot. This is probably the first and only change to this common tool I know of in my career.

The Wide Catch Overshot provides the strongest tool available to externally engage, pack-off, and pull a fish that has been significantly worn. This tool has similar rugged design features and construction as the industry standard, Bowen Series 150 overshot, with the ability to interchange the Bottom Guide with the full range of existing components used with the standard Bowen Series 150 overshot.

In service, the Wide Catch Overshot (WCOS) takes a positive grip over a large area of fish and is capable of withstanding heavy pulling, torsion, and jarring strains without damage to the tools or the fish.

The WCOS has been designed to significantly increase the catch range of the OD of the fish to be caught, compared to the standard overshot. This enables a greater opportunity for a successful fishing operation in a reduced number of trips, thus reducing overall intervention costs for the operator. In addition to the large catch range, the WCOS has the ability to seal across very large extrusion gaps at both standard and high pressure and provide full circulation through the fish, should it be required.

New coarse threads have been introduced at the connection between the top sub and bowl to allow for quick assembly while maximizing the torsion and tensile strength.

Connections between the Top Sub/Bowl and Extension Sub have been designed to create a seal. This will prevent the connection from washing out should the overshot be required to be flowed through for a long period of time. In order to lock the Top Sub/Extension Sub to the Bowl from backing off during operation, set screws have become standard and will gall the threads should the connection break free.

The operation of all overshots is identical. The exception being that the Series 150 carries a packoff which provides circulation through the fish. First, determine that the overshot is properly assembled and dressed with the proper size grapple. Make up the overshot on the fishing string (normally it is run connected to the bottom of the bumper sub) and run it into the well. As the top of the fish is reached make sure circulation has been established to clear overshot ID of any plugging. Lower the overshot onto the top of the fish with no rotation at first. A 5,000 pound set down weight will be sufficient to engage the grapple. While lowering the overshot over the top of the fish watch for pressure build up, shut off pumps if any pressure build up is noticed. Should any back pressure be noticed, release the back pressure to allow the grapple to engage the fish. By elevating the string it can be determined, if the grapple went over and engaged the fish. If unable to work overshot over top of fish without rotation, then slowly rotate the fishing string to the right and gradually lower the overshot over the fish. Combined rotation and lowering over top of the fish are important to keep the grapple in the release position. This provides the maximum clearance between the grapple and fish. While lowering the overshot over the top of the fish, watch for torque build up and an increase in pump pressure. A pump pressure build up indicates the overshot has gone over the top of the fish thereby reducing the flow area. Stop rotation (continued rotation could dull the wickers of the grapple) enabling the grapple to set. Allow the right hand torque to slack out of the string and then pull on the string by elevating the string to set the grapple.

To release from the fish, bump down, then simultaneously rotate to the right and slowly elevate the fishing string. It is best to have a clean fishing top before running the overshot.

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

MFF Oilfield is a worldwide brand providing the best oilfield tools and equipment. Holding stock in multiple locations worldwide including in USA, Singapore, UAE, Indonesia and in multiple other locations worldwide.

Please reach us for any specific or hard to find or if you have a tight budget for your drilling program we would be glad to help provide a reasonable and reliable solution.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Oil prices have rallied to multiyear highs on surging demand, tight supply, and the crunch on natural gas. Brent crude futures, the benchmark in global energy markets, hit a three-year high of above $86 a barrel in late October. Futures for West Texas Intermediate (WTI), the U.S. benchmark, surpassed $85 a barrel, the highest since October 2014. We analyze the dynamics of the crude market below.

The key question is whether the rally in oil prices can be sustained. Rising natural gas prices and a cold winter could lead to a further increase in prices. However, this rally has extended beyond market fundamentals. Oil markets are historically volatile, and should crude overshoot current levels, a correction would likely be sharp. From a trading perspective, this isn’t the right time or price to take long positions, in our view. That is partly because many sell-side commodity traders are revising their forecast to $100 a barrel, while physical markets aren’t showing a level of tightness consistent with that.

It’s true that in the United States, inventories of crude and petroleum products have fallen below the five-year average. This indicator, however, is misleading due to the jump in inventories during the Covid-19 pandemic. It is fair to say that inventory levels are now close to those of late 2018 and early 2019. During that period, oil prices were volatile, between $40–$70 a barrel.

Our fair value model for oil shows $69 a barrel for WTI. But prices have already overshot this level, showing the steepest increase since we started our fair value analysis. In our view, for oil to continue to trade at more than $80 a barrel, inventories will need to decline in January and February — the seasonally weakest months of the year. If inventories do not decline during this winter, we believe prices of WTI in the futures market will likely converge to our fair value to reflect existing supply-demand conditions.

Why are prices overshooting? We believe it is because of concerns about shortages as the northern hemisphere heads into winter. It has little to do with oil’s physical markets. Prices of other energy sources, natural gas, and coal, have spiked due to low inventories, rising demand from China, and worries about a cold winter. The surge in global natural gas and coal prices has also lifted oil futures, partly because of expectations about rising demand for cheaper oil. There are also supply shortages for light, sweet crude in Europe.

Demand for light, sweet crude is high because of refinery dynamics, including its lower refining cost. Refineries are heavy users of energy. Complex and profitable refineries process high sulfur oil (cheaper oil) at hydrocrackers that use hydrogen generated from natural gas. Higher gas prices in Europe and Asia have raised the operational cost of these hydrocrackers. As a result, crude inventories remain low in Cushing, Oklahoma, a storage hub and delivery point for the NYMEX WTI futures contract, while more barrels are being diverted to fill the new Capline pipeline in Illinois. These dynamics have contributed to the low price spread between Brent and WTI crude.

Demand, however, remains low for heavier, sour crude. There are still unsold barrels of this oil in the Middle East, including the Upper Zakum grade crude from the United Arab Emirates. West African grades are also having a tough time as freight costs increase. In addition, China’s limited oil import quotas are having a troubling impact on oil from Angola.

The rally in the futures market has extended beyond the fundamentals of the physical markets, in our view. The Organization of Petroleum Exporting Countries and its partners (OPEC+), a 23-nation grouping led by Saudi Arabia and Russia, are sellers in the real market. They are more concerned about the physical market for oil versus the financial markets.

A colder winter could send natural gas and coal prices soaring, and this could impact crude prices as companies and manufacturers further switch to using oil. However, because we rely on physical markets, and not necessarily the weather, to forecast the trend in oil markets, we believe it is time to question the current rally. We have a neutral view on oil prices over the short term and a bearish view over the long term.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

But in doing so the organization risks tightening the market too much, sending prices sharply higher and encouraging a faster-than-expected acceleration in production from U.S. shale producers.

Saudi Arabia’s oil minister, who is OPEC’s de facto leader, has reiterated that stocks are still around 150 million barrels (MMbbl) too high and it would be premature to discuss an exit strategy or change of course.

“Almost the single metric we look at is global inventories and of course the most transparent and trustworthy is the OECD,” he said in an interview before Christmas.

OPEC, the International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) all have slightly different figures for OECD commercial crude and products stocks, but they show a similar trend.

While the specific numbers differ, mostly for definitional and methodological reasons, the data from each of the agencies shows the stock overhang compared with the five-year average has narrowed significantly. Most of the remaining overhang is concentrated in crude oil rather than refined products such as gasoline and heating oil.

OPEC seems determined to drive total stocks down to the five-year average, or very close to it, before starting to increase its own output. But that would almost certainly leave stockpiles uncomfortably low, send benchmark Brent prices well above $70 per barrel and push the market into a big backwardation.

Brent futures prices for the next six months are already trading in a backwardation of about $2 per barrel, which is consistent with a market that is already tight and undersupplied.

The six-month Brent calendar spread is trading about the 78th percentile of its historical range, up from the 22nd percentile at the same point last year. The calendar spread is watched by many physical traders as the most reliable indicator of the balance between production, consumption and inventories.

Backwardation is normally associated with a market that is undersupplied and a low and declining level of inventories, while contango is normally associated with oversupply and high/rising stocks.

The Brent market has cycled regularly between backwardation and contango over the last 25 years as it moves between periods of undersupply and oversupply. The sustained shift from contango in 2015-2016 to backwardation in late 2017 and at the start of 2018 strongly suggests the market has switched from oversupply to undersupply.

Most forecasters, including the IEA and OPEC, predict the oil market will be in a small surplus during the first-half 2018, followed by a deficit in the second.

The expected rise in stocks during the first half is one reason why OPEC and its allies think market rebalancing will not be completed until later in the year and agreed to keep their output unchanged.

Later in the year, the summer driving season in the United States and winter heating season in the northern hemisphere typically boost consumption in the second half.

History suggests that OPEC will gamble on tightening the market too much, with prices overshooting on the upside, rather than risk not tightening it enough and prices fall back.

After the past two oil market slumps, in 1997-1998 and 2008-2009, prices subsequently overshot OPEC’s formal and informal targets of $28 per barrel and $75 per barrel, respectively.

Saudi Arabia also needs higher prices to finance its ambitious social and economic transformation program and create positive sentiment around the planned sale of shares in its national oil company.

But the more prices increase, especially with Brent prices near $70 and WTI prices above $60, the more likely U.S. shale drilling and production rates will accelerate, which will tend to frustrate the objective of lowering stocks.

Dutch natural gas prices plunged as much as 21% on Monday as European countries continue to build up supplies in anticipation of the upcoming winter months.

September futures prices for Dutch natural gas saw their steepest drop since March, falling to as low as 268 euros per megawatt hour. Still, the sharp decline only brought prices down to levels seen last week, highlighting just how far the commodity has surged in recent weeks and months. Dutch natural gas prices are up more than 1,000% since last year.

Driving Monday"s decline is a mix of supply and demand dynamics that include ongoing demand destruction as various industries adapt to the surging prices and a potential recession, and Germany indicating that its gas storage facilities are reaching capacity faster than expected.

German Economy Minister Robert Habeck said he expects gas prices to start cooling down now that Germany"s gas storage facilities are 85% full, ahead of its October target. "As a result, the markets will calm and go down," Habeck said.

"European gas prices have in our view overshot fundamentals fueled by a combination of supply and demand (heat wave, nuclear outages) concerns and exceptionally poor liquidity in the market, illustrated by erratic and sparse intra-day price moves," Goldman Sachs" analyst Samantha Dart said.

A resumption of gas flows from the Nord Stream 1 pipeline could add to further natural price declines, Goldman added, though there is no indication of when that may happen as the pipeline deals with reported maintenance issues.

Goldman ultimately expects Dutch natural gas prices to fall to a range of 170 to 190 euro per megawatt hour, which would represent a sharp decline of as much as 41% from current levels.

"The longer prices remain this high, the higher the impact on demand, further reinforcing our view that storage will enter winter at comfortable levels, setting the stage for sequentially lower prices through winter," Dart said.

You are viewing Bowen or Logan Overshots for sale by Pickett Oilfield, LLC. We have an extensive range of good used or rebuilt Overshots along with the accessories. Call us for your fishing tool needs. For more information contact us by phone at sales@pickettoilfield.com.

PickettOilfield.com offers prospective buyers an extensive selection of quality new, used, and refurbished Oilfield Equipment at competitive prices, including Overshots.

Overshots are a tool used on the downhole process during the fishing operations. It engages the tube or tool on the outside surface. A Grapple or other piece of equipment that is similar attaches onto the overshot and grabs the fish.

8613371530291

8613371530291