7 park up power tong in stock

Tongs - Power - BJ sucker rod tong adopts advanced sucker rod or tubing technology and has a compact structure, high reliability and is safe and convenient to operate.

Tongs - Power - New Carter Tool Co. Inc., CT93R Hydraulic powered tubing tong. Complete with 2-3/8" to 3-1/2" jaw assemblies, standard motor, torque gauge assembly, pressure relief valve... More Info

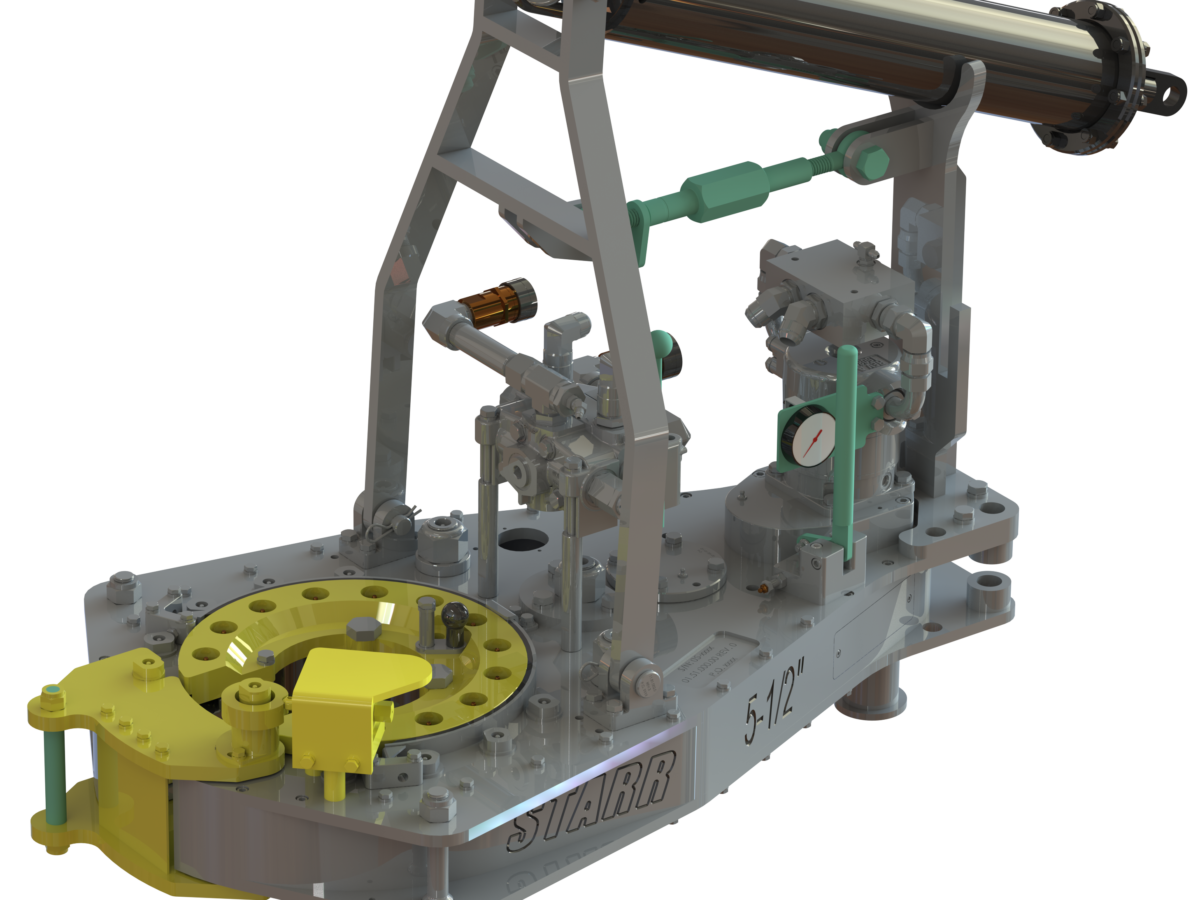

Tongs - Power - New Carter Tool Co., Inc. 5-1/2" CTSX Hydraulic Tubing Tong with heavy case and cover; complete with rigid hanger assy., suspension spring assy., front end control assy.,... More Info

Tongs - Power - New Carter Tool Co. Inc. M-Series power sucker rod tongs, complete with spring hanger assy., gate assy., front end control assy., pressure gauge assy., two 90 degree XH s... More Info

Tongs - Power - New Carter Tool Co., Inc. 4-1/2" RSX Hydraulic Tubing Tong with heavy case and cover; complete with rigid hanger assy., suspension spring assy., front end control assy., ... More Info

Tongs - Power - D D 58-93-2-R Power Tubing Tong is smaller, lighter, and faster than the Foster 5893R. The D D 58-93-2-R Tong is capable of gripping tubulars from 1 5/16" to 7" o.d. More Info

Tongs - Power - FARR TONG MODEL KT 14,000 RINEER GA37 MOTOR, LIFT VALVE ASSEMBLY TORQUE CAPACITY: 50,000 FT/LB SIZE RANGE 4 1.2-14 WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN ... More Info

Tongs - Power - FARR TONG MODEL KT20,000 STAFFA 080 MOTOR, LIFT VALVE ASSEMBLY TORQUE CAPACITY: 50,000 FT/LB SIZE RANGE: 7-20 MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READ... More Info

Tongs - Power - FARR MODEL KT5500 HYDRAULIC TUBING TONG C/W 2 SPEED RINEER MOTOR, SIZE RANGE: 2-3/8 IN. - 5-1/2 IN. OD, TORQUE RTED: 18,700 FT/LB C/W SAFETY DOOR MOST SIZES OF FARR POWER... More Info

Tongs - Power - FARR TONG MODEL KT5500 TORQUE CAPACITY: 18000 FT/LB SIZE RANGE: 2 1/16-5 1/2 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIA... More Info

Tongs - Power - FARR TONG MODEL KT5500 5 1/2 IN. TONG TORQUE CAPACITY: 18,000 FT/LB SIZE RANGE: 2 1/16-5 1/2 IN. OD, RINEER 15-13 MOTOR, HIGH TORQUE CLINCHER BACKUP TRIPLE VALVE ASSEMBLY... More Info

Tongs - Power - FARR TONG MODEL KT7585 TORQUE CAPACITY: 25000 FT/LB SIZE RANGE: 2 1/16-8 5/8 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIA... More Info

Tongs - Power - FARR TONG MODEL KT7585 8 5/8 IN. TONG TORQUE CAPACITY 25,000 FT/LB SIZE RANGE: 2 1/16-8 5/8 IN. OD, RINEER 15-15 MOTOR CLINCHER BACKUP, TRIPLE VALVE MOST SIZES OF FARR PO... More Info

Tongs - Power - FARR TONG MODEL LW9625 TORQUE CAPACITY 12000 FT/LB SIZE RANGE 2 7/8 -9 5/8 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIATE... More Info

Tongs - Power - Farrs newest tubular connection tool offers a significantly reduced rig footprint, while continuing to deliver power & uncompromising reliability. The simple design drast... More Info

Tongs - Power - Farr Canada"s newest tubular connection tool offers a significantly reduced rig footprint, while continuing to deliver power and uncompromising reliability. The simple de... More Info

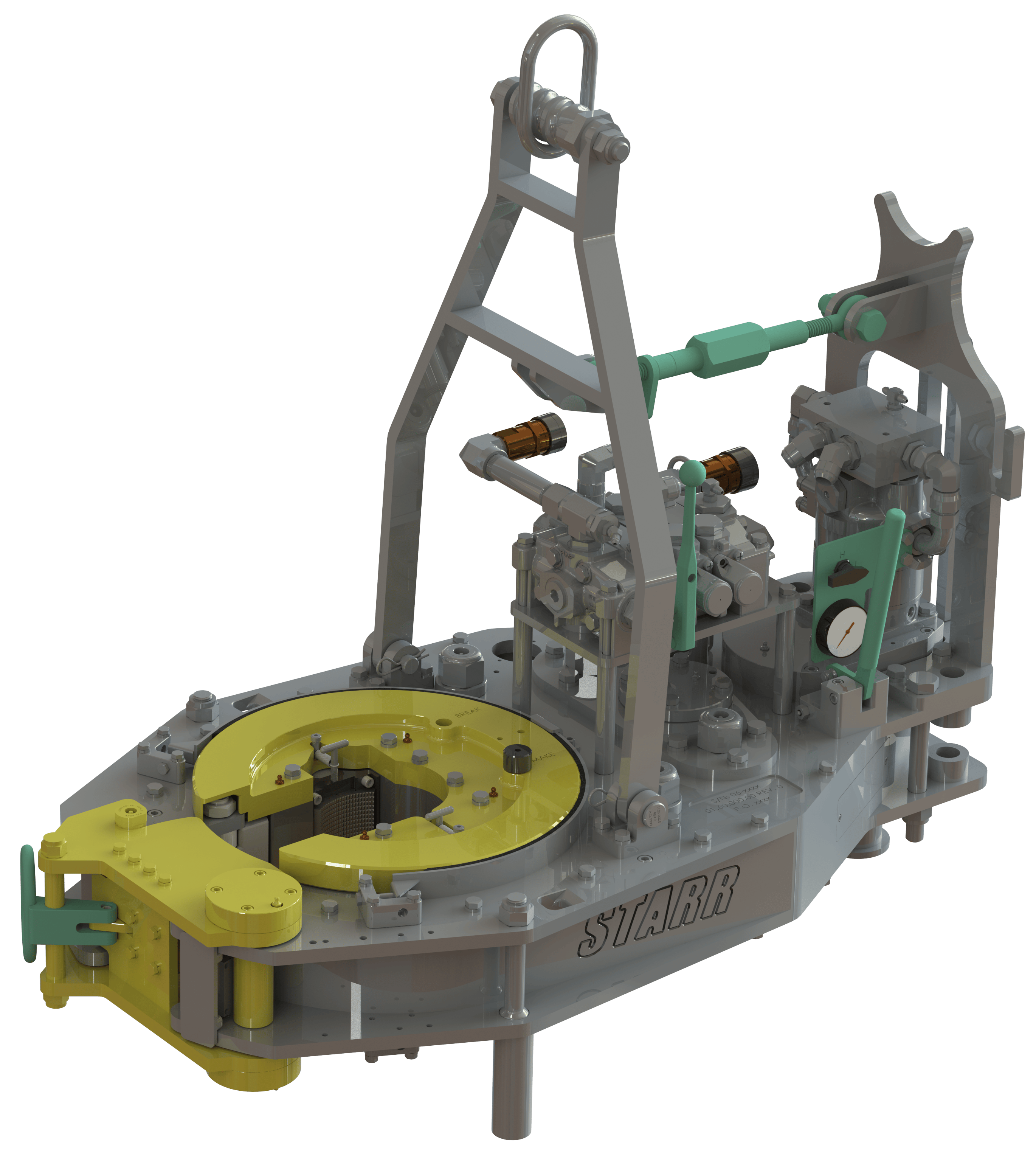

Tongs - Power - As comparable to the popular 5-1/2" Eckel HSVS, the 5-1/2" Slide Head Vector Tong has all of the same internals, but considerable external improvements.

Tongs - Power - Farr KT5500 Tubing Power Tongs w/Jaw Die Power Tongs, 5-1/2" available with or without back-ups. KT5500 18K Tongs with hydraulic Clincher Back-up TORQUE TABLE Pressure H... More Info

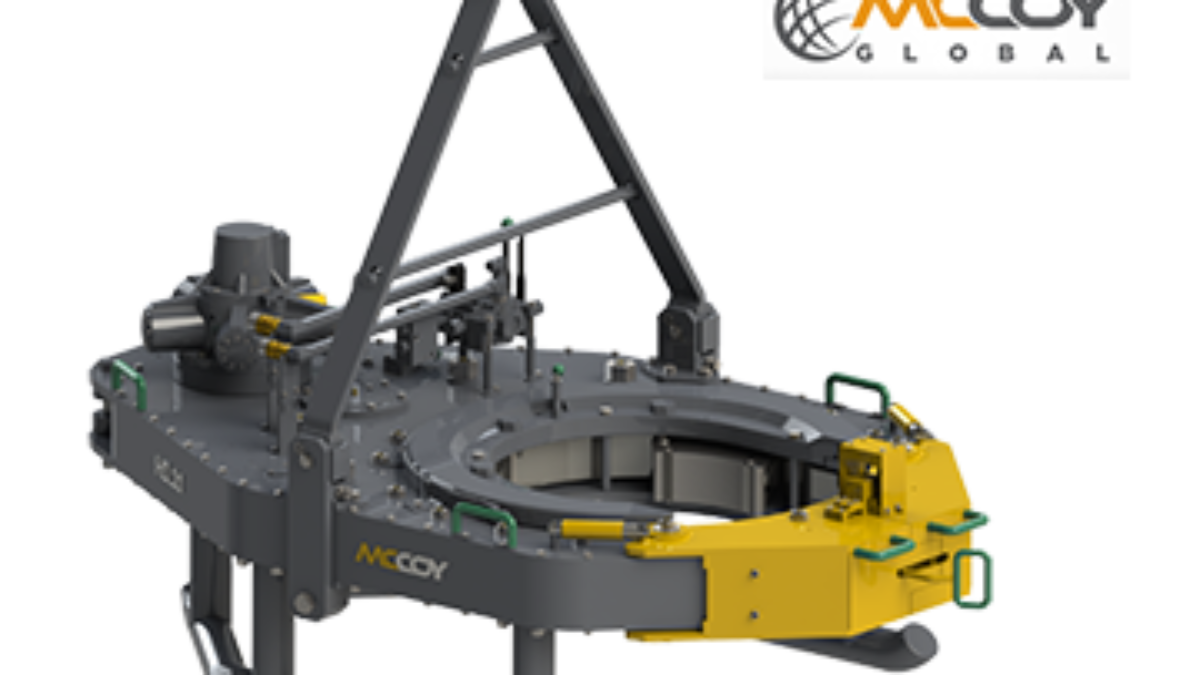

Tongs - Power - McCoy KT8625 8-5/8" Casing Tong - 25K Tong Power Tongs - (Our KT7585 Model Is Being Rebadged as KT8625. There Have Been No Design Changes to this Tong, It Still Function... More Info

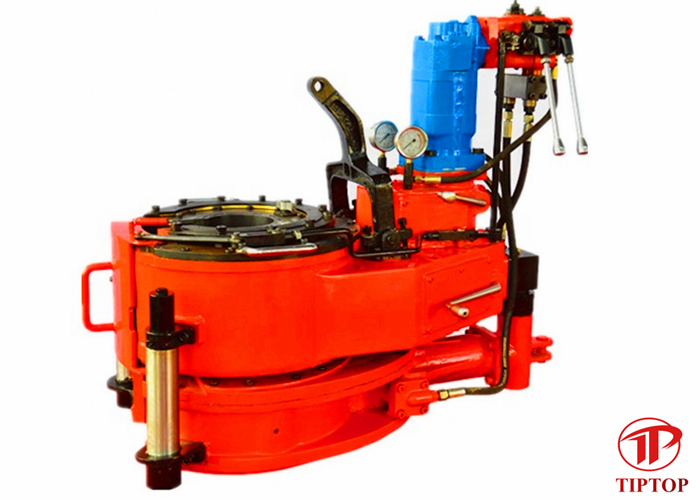

Tongs - Power - SNUBBING WORKOVER TUBING TONG, BY-DIRECTIONAL JAW SYSTEM, HIGH EFFICIENCY EATON MOTOR, 2WAY INDEPENDENT VALVE BODY, EXTENDED LEG - VARIABLE LENGTH CONFIGURATION, 2-3/8"- ... More Info

Tongs - Power - SNUBBING WORKOVER CASING - TUBING TONG, BY-DIRECTIONAL JAW SYSTEM, HIGH EFFICIENCY EATON MOTOR, 3WAY INDEPENDENT HANDLE VALVE BODY, SKID TYPE FRAME W/ 4 OPTIONAL BACKUP H... More Info

Power tongs are an essential tool in the drilling industry and are used to make up, break out, apply torque and to grip the tubular components. We are distributors for both Starr Power Tongs and McCoy Global hydraulic power tongs in multiple sizes and torque ranges from high torque to low torque that can be used to run both casing, drill pipe and tubing. When determining which power tong is best for your project, you will want to select the power tong that best fits your tubular size ranges and torque required.

All of our power tongs are available with either the McCoy\\\\\\\\\\\\\\\"s patented WinCatt data acquisition software recently updated to the MTT systems or AllTorque\\\\\\\\\\\\\\\"s computer monitoring system for all the torque and turn control system needed in today\\\\\\\\\\\\\\\"s market for the making of tubular connections. Discover our wide selection of McCoy and Starr casing tongs, tubing tongs and power tongs for sale below!

Texas International Oilfield Tools LTD. experience and knowledge is superior in Oilfield Drilling and Casing Tools. We strive for quality, excellence and your satisfaction. We are conveniently located in the hub of the oil industry in Houston, Texas; close to the airport, shipping yards and freight companies.

PTS can ensure the integrity of your connections by utilizing the CT-3000 torque turn computer system. The CT-3000 in conjunction with our trained operators can make sure the connection makeup follows compliance with the connection manufacturers specifications. We also offer the tong mounted CT 4500 for non-premium connections.

A two-speed Hydra-Shift® motor coupled with a two-speed gear train provides (4) torque levels and (4) RPM speeds. Easily shift the hydraulic motor in low speed to high speed without stopping the tong or tublar rotation, saving rig time.

A patented door locking system (US Patent 6,279,426) for Eckel tongs that allows for latchless locking of the tong door. The tong door swings easily open and closed and locks when torque

is applied to the tong. When safety is important this locking mechanism combined with our safety door interlock provides unparalleled safety while speeding up the turn around time between connections. The Radial Door Lock is patented protected in the following countries: Canada, Germany, Norway, United Kingdom, and the United States.

The WD Tri-Grip® Backup is a high performance no compromise backup that is suitable for make-up and break-out of the most demanding connections. The WD Tri-Grip®Backup features a three head design that encompasses the tubular that applies an evenly distributed gripping force. The WD Tri-Grip®is a high performance backup with no compromises that is available for specific applications that provdies exceptional gripping capabilities with either Eckel True Grit® dies or Pyramid Fine Tooth dies.

The field proven Tri-Grip® Backup features a three head design that encompasses the tubular that applies an evenly distributed gripping force. The Tri-Grip®Backup provides exceptional gripping capabilities with either Eckel True Grit® dies or Pyramid Fine Tooth dies. The hydraulic backup is suspended at an adjustable level below the power tong by means of three hanger legs and allowing the backup to remain stationary while the power tong moves vertically to compensate for thread travel of the connection.

Eckel offers several models of torque control systems that are used to monitor the torque turn values when making up tubular connections (Tubing, Casing, & Drill Pipe). Any flaws in the make-up process will be readily shown in a graph.

First, you need to find out whether your company is a qualified person for the purposes of the partial exemption. You have been primarily engaged in business for several years as a manufacturer of wooden furniture. You determine your company"s North American Industry Classification System (NAICS) code to be 337122. Since the NAICS code for your primary line of business is described within the range of 3111 to 3399, you determine that your company does qualify for the partial exemption.

The retailer will charge or collect from you at a reduced tax rate thereby saving you 3.9375 percent in sales or use tax on the purchase of your equipment.

In order to be considered a qualified person for the partial exemption, you must be primarily engaged in a line of businesses described in North American Industry Classification System (NAICS) code 3111 to 3399 for manufacturers, 541711 or 541712 if you are engaged in research and development or, beginning January 1, 2018, 22111 to 221118, and 221122 for qualifying electric power generators or distributors.

NAICS codes are used to classify business establishments by a six-digit code system. The first four digits represent the industry group, and the last two digits represent the specific industry. For example, a business that manufactures cardboard boxes will have a NAICS code of 322211:

Your business" NAICS code is that which best describes your line of business, based on either its primary revenues or primary operating expenses. If there is no six-digit NAICS code for your specific line of business, you may still qualify for the partial exemption if your business activities are reasonably described in a qualifying four-digit industry group.

It is important to remember that RTC section 6377.1 uses the 2012 edition of the NAICS codes to define a qualified person. To keep up with changes in the economy, OMB publishes a new NAICS edition every five years.

Please note: The six-digit NAICS codes for research and development were changed in the 2017 edition. In general, the 2012 NAICS codes 541711 and 541712 were replaced by 2017 codes 541713 – 541715. Again, only the 2012 NAICS codes are relevant in determining whether a person is engaged in a qualifying line of business.

The cost of qualifying property is deducted under Revenue and Taxation Code (RTC) sections 17201 and 17255 or 24356 (similar to Section 179 of the Internal Revenue Code, but subject to lower deduction thresholds for state purposes).

Establishments that are primarily engaged in research and development in biotechnology, physical engineering, and life sciences may qualify for the partial exemption. To qualify for the partial exemption, the establishment must be classified under one of the following two North American Industry Classification System (NAICS) codes: 541711, 541712.

(As noted above, the six-digit NAICS codes for research and development were changed in the 2017 edition. In general, the 2012 NAICS codes 541711 and 541712 were replaced by 2017 codes 541713 – 541715. Again, only the 2012 NAICS codes are relevant in determining whether a person is engaged in a qualifying line of business.)

On or after January 1, 2018, businesses that are primarily engaged in electric power generation or distribution may qualify for the partial exemption. To qualify for the partial exemption, the business must be primarily engaged in a line of business described under one of the following North American Industry Classification System (NAICS) codes (2012 edition).

In general, qualifying electric power generators includes businesses primarily engaged in operating power generation facilities that convert other forms of energy, such as water power, fossil fuels, nuclear power, and solar power, into electrical energy. Establishments in this industry produce electric energy and provide electricity to transmission systems or to electric power distribution systems.

For purposes of this partial exemption, solar electric power generators include those businesses that are primarily engaged in operating solar electric power generation facilities that use energy from the sun to produce electric energy. The energy produced in these businesses is provided to electric power transmission systems or to electric power distribution systems.

If you are a qualified person, your purchase of solar equipment or other electric power generating or producing equipment used to primarily run your manufacturing equipment may qualify for the exemption (see the Solar Power Equipment topic on this page).

The following are categories and examples of tangible personal property (TPP) that may be used in the generation or production and/or storage and distribution of electric power (in some cases as part of a special purpose building). As always, whether or not the sale or use of a particular item of TPP qualifies for the partial exemption is based on whether the three basic elements have been met: qualified person, qualified tangible personal property, and qualified use. (See Qualifications tab).

Equipment that converts renewable energy from sunlight into electricity, either directly using photovoltaics, indirectly using concentrated solar power, or a combination.

Energy conversion monitors and controllers, communications equipment, Supervisory Control and Data Acquisition (SCADA) equipment, protection equipment, power quality and metering equipment

Please note, beginning January 1, 2018, the definition of "qualified tangible personal property" expanded to include special purpose buildings and foundations used as an integral part of the generation or production, storage or distribution of electric power.

As a construction contractor, you are generally a consumer of materials that you furnish and install in the performance of a construction contract. Therefore, once you have obtained the required form CDTFA-230-M, Partial Exemption Certificate for Manufacturing, Research and Development Equipment" or similar form from the qualified person indicating that the partial exemption applies, you may purchase materials to be furnished and installed on the special purpose building at the partially exempt rate by issuing a form "CDTFA 230-MC, Construction Contracts-Partial Exemption Certificate for Manufacturing, Research and Development Equipment" to your suppliers.

The qualified person is responsible for issuing the CDTFA-230-M as evidence that the construction is for qualified tangible personal property. A prime or general contractor will be responsible for issuing a CDTFA-230-MC to a supplier of materials or fixtures if purchased tax-paid. In addition, if the person furnishing and installing the materials is a subcontractor, the prime or general contractor will also need to provide the subcontractor with a copy of the CDTFA-230-M issued by the qualified person. Subcontractors will need to also issue a CDTFA-230-MC to their suppliers of materials or fixtures if purchased tax-paid.

If you construct a new special purpose building or modify an existing structure that is designed and constructed, or reconstructed, for manufacturing or research and development, or, beginning January 1, 2018, for the generation or production, storage or distribution of electric power, your purchases of materials and fixtures that become part of the building, and machinery and equipment installed in the building, may qualify for the partial exemption.

All materials and fixtures that become a component part of the building will qualify for the partial exemption if no more than one-third (1/3) of the building"s total usable volume (generally Length x Width x Height) is devoted to a non-qualifying use, such as administrative purposes, parking, break rooms, etc. However, in those instances where more than one-third (1/3) of the total usable volume is devoted to a non-qualifying use, only the materials and fixtures that become a component part of the building that is used in manufacturing, processing, refining, fabricating, or recycling, or as a research or storage facility for these processes, or the generation or production, storage or distribution of electric power will be qualifying property for the partial exemption.

The building will be partitioned to have offices for management, the accounting department, and the marketing department, and areas for restrooms and break rooms. These areas will occupy an area of the building that measures 80 feet long by 60 feet wide by 40 feet tall for a total volume of 192,000 cubic feet.

XYZ Manufacturing is constructing a new facility that is designed with specifications to house its widget manufacturing equipment and other administrative departments of its business. The building will have a foundation that is 200 feet long by 100 feet wide. Based on the schematics of the building, the foundation of the manufacturing floor will be 100 feet by 100 feet and have a ceiling that is 15 feet tall to accommodate the large machinery. The offices for management, the accounting department, and the marketing department, restrooms, and break rooms will occupy the remaining floor area (100 feet by 100 feet). This area has a 10-foot ceiling. The total usable volume of the building is calculated as:

Also, the manufacturing equipment requires significantly more electrical output to run than does the area occupying the administrative functions. The qualified person must identify which electrical materials are being used for manufacturing, a qualified use, and which materials are used for the area that is a non-qualifying use. Contractors involved in the project should be instructed to only purchase materials or sell fixtures at the partial tax rate if installed in the portion of the building used in manufacturing.

If you are a qualified person, your purchase of solar panels and solar power equipment used to primarily run your manufacturing equipment may qualify for the partial exemption.

If your solar power equipment is directly connected to qualifying manufacturing equipment to power the qualifying manufacturing equipment, your purchases of solar power equipment will qualify for the partial exemption.

If your solar power equipment is tied to the local power grid and is not directly attached to qualifying manufacturing equipment, your solar power equipment may still qualify if it is designed to generate power primarily for your manufacturing equipment. The solar equipment is deemed to generate power primarily for the qualifying manufacturing equipment if the solar power equipment is designed to generate at least 50 percent of the power used by the qualifying manufacturing equipment.

To determine whether solar power equipment is used at least 50 percent in manufacturing, divide the annual amount of power consumed by qualifying manufacturing equipment by the total annual amount of power generated by the solar equipment. Please note that the power generated by the solar equipment when the facility is not operating is regarded as power that is effectively "banked" in the local power grid such that the calculation is not limited to those periods when the facility is operating.

Your solar power equipment is used 60 percent in manufacturing, (600/1000 = 0.60, or 60 percent). Therefore, the solar power equipment is used at least 50 percent in manufacturing and is eligible for the partial exemption.

If your solar power equipment is purchased as part of the construction of a qualifying special purpose building, then your solar equipment will qualify for the partial exemption regardless of the percentage of generated power that is used to power manufacturing equipment.

If you are a qualified person purchasing parts that will be used to repair qualified manufacturing or research and development equipment, you may take advantage of the partial exemption. However, the repair or replacement parts must be treated as having a useful life of one or more years for state income or franchise tax purposes. Tools and other supply items are not considered repair or replacement parts and do not qualify for the partial exemption.

You are considered engaged in truck-mixed concrete manufacturing if your line of business is most accurately described by a qualifying NAICS code (see NAICS code 327320); your NAICS code is that which best describes your line of business, based on either your primary revenues or primary operating expenses. Please note a construction contractor who owns a cement mixing truck would not generally qualify under a qualifying NAICS code.

For example, you use a pallet jack to pick up a pallet of goods that has just completed one phase of processing and take it over to another area in the building to begin a second phase of processing. Since the use of the pallet jack is at the same geographic location and it is used to move the materials between production phases, the pallet jack qualifies for the partial exemption.

Not all out-of-state retailers are registered to collect California use tax. If your supplier does not collect use tax, it is your obligation to self-report the use tax to the CDTFA. You may do so by reporting the purchase amount on your California Sales and Use Tax return or Consumer Use Tax return. There is no need to provide an unregistered, out-of-state seller with an exemption certificate.

Taxable shipping or handling charges added to sales or purchases that qualify for the partial manufacturing and research and development equipment exemption are also partially exempt. For example, a qualified person purchases manufacturing equipment and pays $80 for "shipping and handling." The actual shipping cost by the common carrier for delivery to the qualified person is $30. The $30 shipping charge is exempt from tax. Tax applies to the remaining $50 handling charge at the partial tax rate. To support the nontaxable shipping charges, the seller must keep records of the actual shipping costs.

For example, if you purchased machinery and paid tax at the rate of 7.25 percent and your purchase qualifies for the partial exemption, then the applicable tax rate for the transaction is 3.3125 percent. A refund may generally be claimed at any time within the statute of limitations (generally, within three years). If you are seeking a refund for overpaid taxes on qualifying purchases of manufacturing or research and development equipment the procedures are different depending on whether the original purchase was subject to sales tax or use tax.

SEOUL/HONG KONG (Reuters) - The sale of ING Groep"sSouth Korean unit is set to be revived after private equity-backed Tong Yang Life Insurance Co Ltdsaid it was considering whether to buy the business, which is valued at about $2.1 billion (1.3 billion pounds).

Last year, Dutch financial services firm ING failed to strike a deal with KB Financial Group Incto sell the unit after negotiating for nearly 10 months, during which KB pushed down the price to about $2.1 billion.

In a regulatory filing on Wednesday, Vogo Capital-owned Tong Yang said it was reviewing whether to buy ING’s South Korean insurance unit. Tong Yang did not say how it plans to fund the acquisition if it decides to proceed with a bid, which would be almost double the size of Tong Yang’s market value of $1.1 billion.

Last year, Tong Yang itself was in the midst of a takeover process, after South Korea"s Vogo Fund put an up to 60.7 percent stake on the block. That process attracted interest from Korea Life Insurance Co Ltdand Prudential Financial Incbut the deal fell apart after the parties failed to reach an agreement over the price, sources said.

When ING launched the Asian insurance sale in March last year, the South Korea operations had attracted interest from Metlife Inc, Prudential Financial and AIA Group Ltd, although that preliminary interest failed to translate into firm bids.

When applications demand a wide range of sizes, the 7⅝ Standard tong handles tublar sizes 2-1/16 inches to 7⅝. Its rugged design upon knowledge gained from the 5½ model and combining an extremely compact, high torque concept with added versatility. Options include either manual backup or Tri-Grip® backup. Available torque: 15,000 ft-lb

The Tri-Grip® Backup is industry standard for reliable make-up and break-out of tubular connections that are optionally supplied with Eckel tongs. Utilizing two hydraulic cylinders and a three head arrangement ensures a slip-free operation. The backup is suspended at an adjustable level below the power tong employing three hanger legs and allows the backup to remain stationary while the power tong moves vertically to compensate for the connection"s thread travel. The Tri-Grip® uses two pivoting heads and one stationary. The Eckel Tri-Grip® Backup has exceptional gripping capabilities with Rig Dies when running drill pipe or optional Eckel Wrap-Around True-Grit® dies or Pyramid Fine Tooth dies for making up other types of tubular.

Enerpoly produces low-cost, low-maintenance zinc-ion battery storage systems for durations of two to 10 hours. The Swedish battery specialist now plans to develop prototypes of a residential plug-in storage system with rechargeable zinc batteries in Europe, under an EU-funded collaborative project with Austrian startup EET.

Chinese PV manufacturer TW Solar (Tongwei Co., Ltd.) TW Solar spoke to pv magazine at the recent World Future Energy Summit (WFES) in Abu Dhabi about its strategy for the Middle East and North Africa (MENA) region and other global markets.

Scotland’s Gravitricity is developing gravity-based storage facilities in former mine shafts to stabilize electricity networks at 50 Hz, by responding to full power demand in less than a second. CEO Charlie Blair speaks to pv magazine about the ...

IBC SOLAR Energy, IBC SOLAR AG"s international project division, has concluded the realisation of two megawatt solar parks in Hungary with nominal power outputs of 51 and 45 megawatt peak (MWp). The green electricity generated corresponds to the supply of 35,000 3-person households. IBC SOLAR

The reference event in Italy, Africa and in the Mediterranean region dedicated to technologies, services and integrated solutions for energy efficiency and renewable energies, returns to the Rimini Expo Centre with a new name, new dates, a new layout and an even more international scope Italian Exhibition Group

As the US Uyghur Forced Labor Prevention Act demonstrated, companies preparing to spend big on batteries are at risk of being blindsided by supply-chain-related legislation. Here are some tips on how US developers can anticipate policy curveballs.

The first post-pandemic update on the state of the world"s off-grid solar industry has painted a picture of domination by European companies, but highlighted the potential for new startups in West Africa and an increasing use of PV as a backup to unreliable grid supplies.

The off-grid solar sector has shown resilience in the face of pandemic-related challenges, with 70 million people gaining access to electricity from early 2020 to the end of 2021. However, the ability to pay for solar energy kits has taken a hit.

The African Development Bank has announced that European and US donors will provide $20 million of concessional loans to support pay-as-you-go solar companies in sub-Saharan Africa.

The International Renewable Energy Agency’s latest annual report on the progress towards UN sustainable development goal seven estimates 670 million people will still lack electricity in 2030, and more than 2 billion will be reliant on unhealthy, polluting cooking methods.

The European Commission wants to introduce legislation to back semiconductor research and to address the immediate problem of supply chain bottlenecks by drumming up more than €43 billion, with member states and the private sector expected to contribute.

Floating PV is consolidating as a growth segment for PV demand, mainly driven by supportive policies and incentives extended by governments across the world. A major reason for this push is the limited land availability in many markets. Despite higher equipment prices compared to ground-mounted installations, developers see the opportunity to save on land and O&M costs. The output can also be as much as 30% higher than a ground-mount PV plant, depending on the site and technology used.

Tongwei has revealed plans to set up a new polysilicon facility with a production capacity of 120,000 metric tons (MT) in Leshan, in China’s Sichuan province.

Brazilian researchers have compared the environmental impact of two PV plants – one with polycrystalline solar modules mounted on fixed-tilt trackers, and another with the same modules mounted on single-axis trackers. The life cycle assessment shows the system with single-axis trackers reduced carbon gas emissions by 24%, land use by 20%, and water use by 7%.

While the first half of 2022 was one of the busiest periods on record for new wind projects in Australia, with more than 2 GW breaking ground, solar got off to a much slower start with construction on 635 MW of new PV projects getting underway. Rystad Energy’s David Dixon attributes this slowdown to high cost and supply chain challenges and a lack of available power purchase agreements.

Finnish researchers have proposed the use of solar, wind, and storage to provide desalinated seawater to restore forests. Their model predicts that an additional 10.7 TW of PV would be needed to actually do this by 2100, leading to a cumulative carbon dioxide sequestration potential of 730 gigatons.

The Bern University of Applied Sciences in Switzerland has published the initial results of a survey on the durability and performance of residential PV inverters and power optimizers over a 15-year period. They found that more than 65% of the inverters did not present yield-relevant faults by their 15th year of operation.

SJVN, a state-owned hydropower producer in India, has signed an agreement with the state government of Uttar Pradesh to set up a 700 MW solar plant in the Indian city of Kanpur.

Solyx Energy has developed a device to maximize solar self-consumption in residential homes. The sensor measures how much solar power can be fed back into the grid at different times, while a controller redirects that excess energy into an electric water heater.

Australian modular solar manufacturer 5B’s rapidly deployable Maverick technology is set for installation at a 95 MW hybrid power plant in Western Australia featuring solar, wind, and battery energy storage.

Wood Mackenzie estimates that the US microgrid market has seen a 47% increase in solar and storage capacity in 2022 compared to 2017 levels, driven by rising demand for uninterrupted services, military resilience plans, and corporate environmental, social, and corporate governance (ESG) goals.

Plans for Europe’s largest-ever PV cell and module factory are taking shape, with equipment orders placed and a projected start date in mid-2024. Enel Green Power has received €118 million ($116.36 million) in funding from the EU Innovation Fund to support the project, out of a total €600 million investment. The EU is hoping it will catalyze further investment in similar projects, and start a high-tech comeback for European solar manufacturing.

Norsun, which operates a hydroelectric-powered factory in Norway, has agreed to sell wafers to Meyer Burger, which plans to expand its annual solar cell production capacity to 3 GW by 2024.

German startup Solarnative has invested €1 million ($ 1.07 million) in a surface-mount technology production line for its new microinverter plant in Germany. It says it plans to ramp up microinverter production from May.

Cobalt is key for boosting energy density and battery life, but it comes with caveats: expensive, scarce, and linked to unethical mining practices, wild price fluctuations, and a tenuous supply chain. In recent years, battery manufacturers and automakers have intensified efforts to reduce or eliminate cobalt in lithium-ion cathodes. But sometimes, old habits die hard, as pv magazine’s Marija Maisch explains.

Discovery Battery’s new lithium iron phosphate battery system has a nominal voltage of 51.2 V and a capacity of 100 Ah. Up to six 5.12 kWh battery modules can be stacked in a single enclosure, and up to four enclosures can be connected in parallel for a total capacity of 120 kWh.

Axian has secured MGA 47.1 billion ($10.9 million) to finance the expansion of a 40 MW solar plant and a 5 MWh storage facility into a 60 MW PV project with 10 MWh of storage. The installation will become Madagascar’s largest solar park upon completion.

8613371530291

8613371530291