power tong companies in alberta pricelist

Universe Machine Corporation"s driving mission is to manufacture, modify or repair steel products for the oilfield, petrochemical and forestry industries. The company has been providing these services since 1965 and owes its success to a highly skilled workforce and a commitm…

At Ed"s Valve Servicing (Red Deer) Ltd., we"re known for quality workmanship. After 25 years of service in the Red Deer area, we understand that there"s no substitute for hard work and accuracy.

Pathmaker is an expanding Tubular Running Service company developed Industry professionals with remarkable TRS experience and expertise. We are family owned and operated and have been proudly serving Alberta and British Columbia Industry for over 40 years.

Dash Energy Services Ltd. provides complete tubular services, integral and conventional power tongs, CRT"s, computer torque monitoring, thread washing, 12 GPS equipped units and more, all provided with professional, competent service.;Dash Energy Services Ltd. has been in busine…

Ace Power Tongs & Energy Services serves Western Canada with computer torque monitoring, thread washing, CRT"s, integral and power tongs, GPS equipped units and more. Click our name to learn more about us.;Your choice for a complete tong, casing and tubing program is Ace Power …

When you need to put down or remove pipes for an oil drilling rig, trust Bitz Power Tongs Ltd. to handle the work. We have a variety of power tong trucks in Edson, Alberta, to meet the needs of your project. Our Canadian-owned and locally operated power tong and laydown unit com…

TriMark Tubular Ltd. delivers high-quality oil country tubular goods (OCTG) used for drilling and completions, plus gathering and transmission lines. We hold one of the largest inventories of OCTG and linepipe in Western Canada. TriMark provides complementary engineering experti…

Hill"s Power Tongs has provided Alberta with "First Class Tools All The Way - Any Time Night or Day", since 1975. Offering: Integral tongs and Computer torque monitoring We are certified: ISnetworld, ComplyWorks and COR. Offering 24 hour service. Please call or email.

Pro Torque Connection Technologies Ltd. offers a full line of casing running services: conventional and integral power tong equipment, Volant casing running tools, computer torque monitoring, casing crews, and thread supervision and inspection. We also offer top drive and iron r…

An oilfield service company, Hybrid Energy Services relies on the latest technology to create accountability and reduce liability for its clients. They offer a wide range of services, including the following: computer-analyzed torque monitoring, wireless torque sub, electroni…

Drifters Casing Service is a local leader for drilling and completions work in Grande Prairie, Whitecourt, and other areas in Alberta. You can count on us to provide services 24 hours per day as required.

Pathmaker is an expanding Tubular Running Service company developed Industry professionals with remarkable TRS experience and expertise. We are family owned and operated and have been proudly serving Alberta and British Columbia Industry for over 40 years.

Dash Energy Services Ltd. provides complete tubular services, integral and conventional power tongs, CRT"s, computer torque monitoring, thread washing, 12 GPS equipped units and more, all provided with professional, competent service.;Dash Energy Services Ltd. has been in busine…

An oilfield service company, Hybrid Energy Services relies on the latest technology to create accountability and reduce liability for its clients. They offer a wide range of services, including the following: computer-analyzed torque monitoring, wireless torque sub, electroni…

Drifters Casing Service is a local leader for drilling and completions work in Grande Prairie, Whitecourt, and other areas in Alberta. You can count on us to provide services 24 hours per day as required.

Tubular Optimization Services has always believed in providing exceptional global casing & tubing field running services while maintaining our customer"s invested tubular interests as our top priority. Specializing in premium connections, fiberglass lined, coated, chrome alloy a…

Universe Machine Corporation"s driving mission is to manufacture, modify or repair steel products for the oilfield, petrochemical and forestry industries. The company has been providing these services since 1965 and owes its success to a highly skilled workforce and a commitm…

At Ed"s Valve Servicing (Red Deer) Ltd., we"re known for quality workmanship. After 25 years of service in the Red Deer area, we understand that there"s no substitute for hard work and accuracy.

Ace Power Tongs & Energy Services serves Western Canada with computer torque monitoring, thread washing, CRT"s, integral and power tongs, GPS equipped units and more. Click our name to learn more about us.;Your choice for a complete tong, casing and tubing program is Ace Power …

When you need to put down or remove pipes for an oil drilling rig, trust Bitz Power Tongs Ltd. to handle the work. We have a variety of power tong trucks in Edson, Alberta, to meet the needs of your project. Our Canadian-owned and locally operated power tong and laydown unit com…

TriMark Tubular Ltd. delivers high-quality oil country tubular goods (OCTG) used for drilling and completions, plus gathering and transmission lines. We hold one of the largest inventories of OCTG and linepipe in Western Canada. TriMark provides complementary engineering experti…

Hill"s Power Tongs has provided Alberta with "First Class Tools All The Way - Any Time Night or Day", since 1975. Offering: Integral tongs and Computer torque monitoring We are certified: ISnetworld, ComplyWorks and COR. Offering 24 hour service. Please call or email.

Pro Torque Connection Technologies Ltd. offers a full line of casing running services: conventional and integral power tong equipment, Volant casing running tools, computer torque monitoring, casing crews, and thread supervision and inspection. We also offer top drive and iron r…

In your work you rely on having suppliers who use the best equipment to complete your jobs. Among the most important pieces of equipment required for oil drilling and completions are power tongs. Drifters Casing Service is a local provider of power tongs services in Grande Prairie and Whitecourt areas with a reputation for expertise and reliability.

Eckel.Eckel is the one of the world’s leading power tong manufacturers. Each Eckel tong must pass a comprehensive compliance checklist so it’s ready to meet requirements in the field.

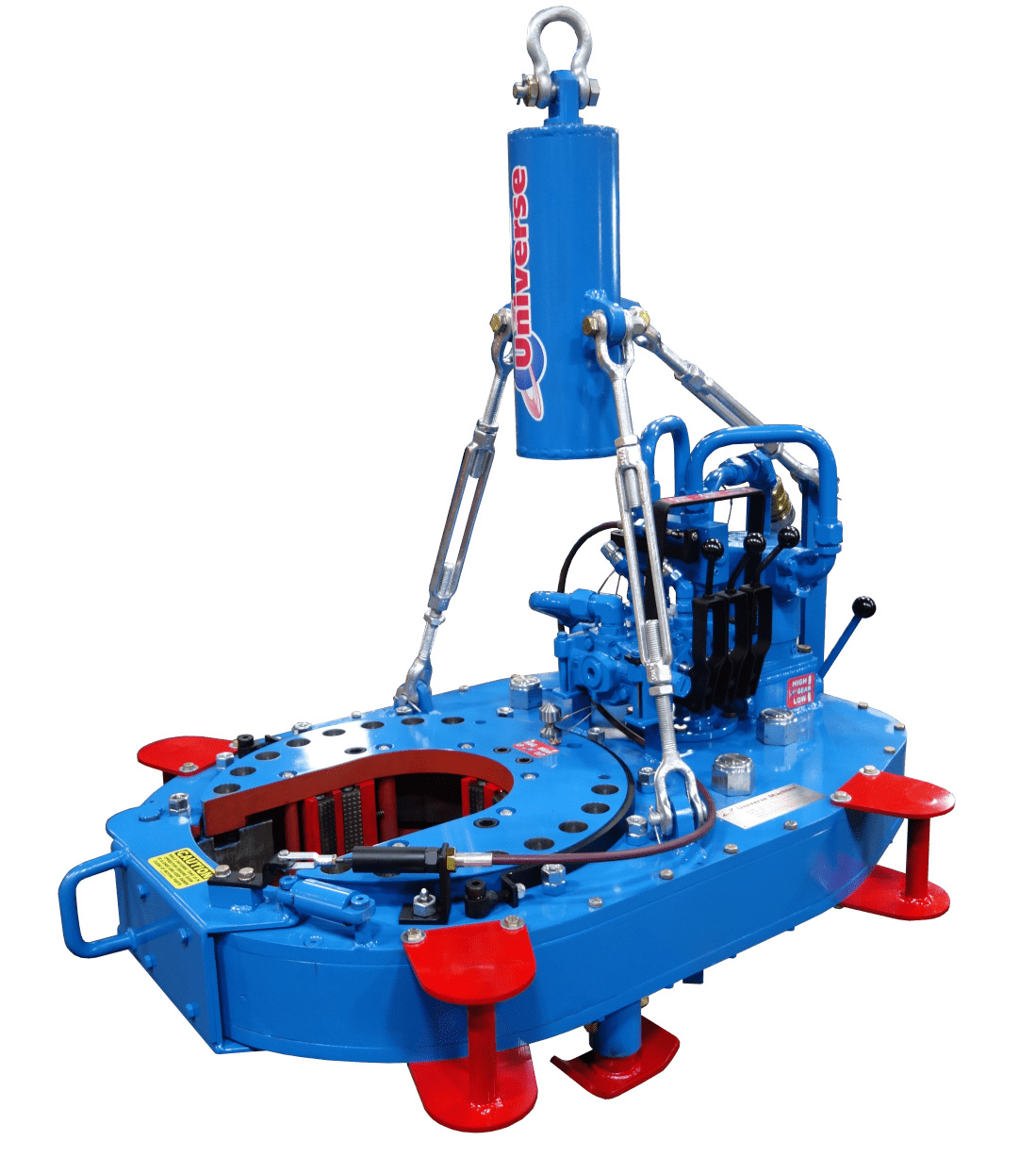

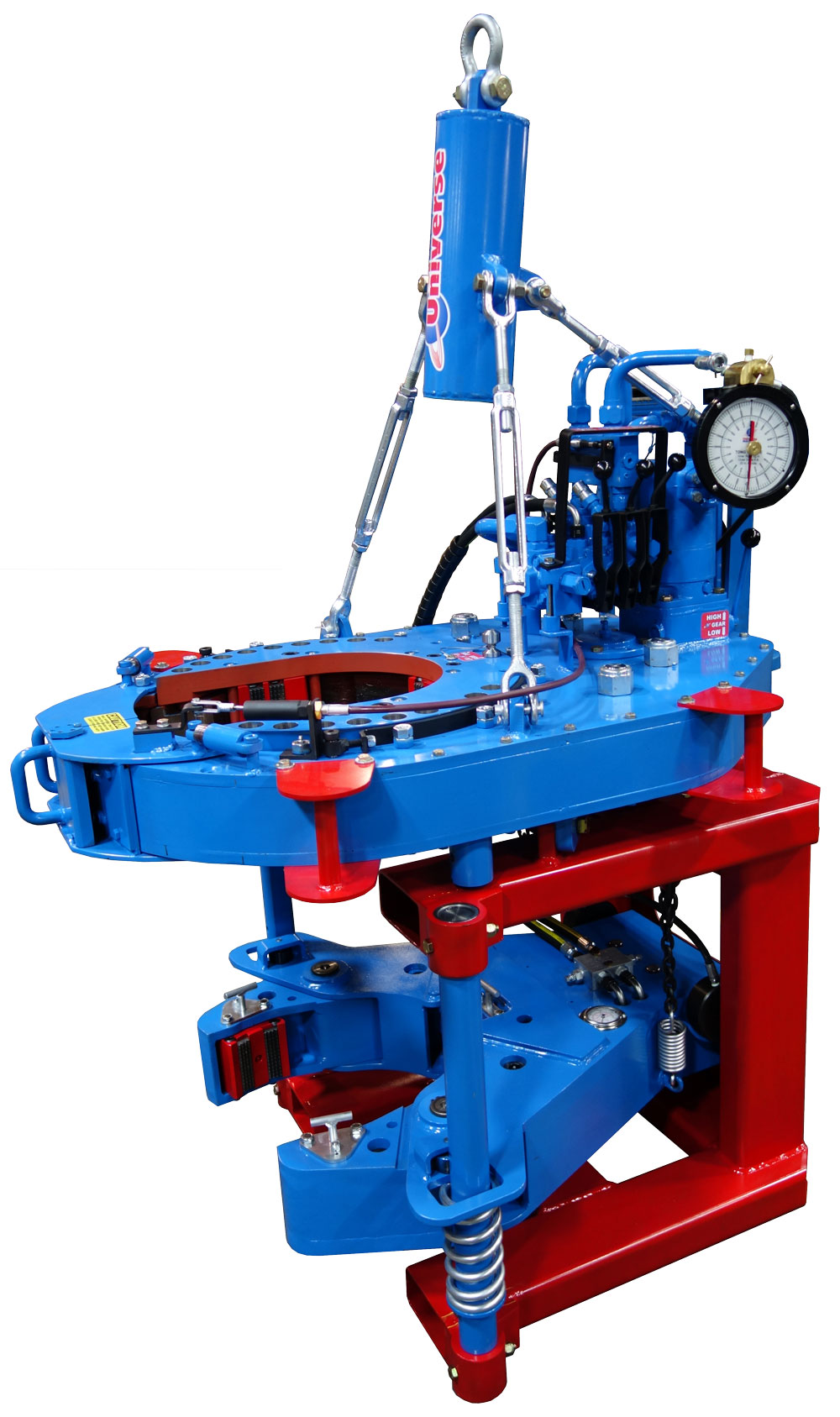

Universe. Since 1965, Universe Machine Corporation has supplied trustworthy steel products for the oilfield industry. Their quality standard system ensures that each power tong meets your application requirements.

We have many sizes of power tongs to fit the size of your pipe, from 2-3/8″ to 13- 3/8″. And our power tongs equipment offers a wide torque range to suit the job.

In addition to power tongs in Grande Prairie, we provide all other casing and tubing services you may need, including integral tubing tongs. You can also monitor your equipment with WinCatt Computer Torque Monitoring that we can provide and monitor on your behalf. All equipment can be used in drilling and completions work.

We’re your provider of oil field drilling and completions services that require power tongs and related oilfield equipment. Since 2000, our locally-owned and operated company has helped companies like yours get the work done right. Contact us for more information.

Torque range at 2200 PSI/15.2 MPA High gear 2,400 ft.lbs/3,254 Nm “Low gear 12,000 ft.lbs./16,272 Nm” Maximum RPM at 50 GPM/189 LPM High: 86 RPM Low: 17 RPM Hydraulic Requirements 50 GPM @ 1,000 PSI 189 LPM @ 6.9 Mpa 20 GPM @ 2,200 PSI 75 LPM @ 15.2 Mpa Length 47 inches/119.38 cm Overall Width 31 inches/78.74 cm Space Required on Pipe 8 inches/20.32 cm Maximum elevator diameter Unlimited (Tong comes off pipe) Center line of pipe to center line of anchor handle 34 inches/86.36 cm Weight (approximate) 1,050 lbs./476.7 kg

Edcon Power Tongs and Oilfield Services Ltd. is an Alberta owned company comprised of local, experience and committed individuals who work as a team to provide services to the oil and gas industry.

Our purpose shall be to consistently provide value added reliable services by performing the following for our customers; casing and tubular running with integral power tongs and Casing Running Tools, computer torque monitoring, thread washing and inspection services.

The foundation of our services’ capabilities is based on a total committed safety program. We will not compromise the safety of our employees or others for the sake of corporate and personal gain.

The owners and employees of Edcon Power Tongs and Oilfield Services Ltd will always operate with the highest of integrity and honesty. High values, personal service and ethics are the cornerstone of our company as we provide for our families and our community.

Dressing percentage is one of many factors affecting the value of a slaughter animal. A basic knowledge of dressing percentage is important in understanding slaughter cattle pricing systems and pricing variability. This module explains why dressing percentage is important and discusses the factors that affect it.

Dressing percentage is calculated by dividing the warm carcass weight by the shrunk live weight of the animal and expressing the result as a percentage. For example, suppose that an animal delivered to the packing plant weighs 1300 pounds. After being killed, the hide, head, feet and gut are removed. The warm carcass then weighs 767 pounds. The dressing percent of this animal would be 767 divided by 1300 multiplied by 100 equalling 59%. This "59%" represents the meat and skeletal portion of an animal compared to its live weight. Note that the animal is weighed after transportation to the packing plant so that live weight is a shrunk weight. Also note that the carcass is weighed warm as opposed to cold. The dressing percentage for a cold carcass can be 2.0 percentage point lower than the warm carcass dressing percentage for the same carcass.

The industry is interested in animal dressing percentage because it establishes the weight upon which payment is calculated for animals sold on a live weight basis. For example, a 0.5% difference in the dressing percentage between steer A and B shown in Table 1, results in a $12.02 difference in price per animal. The higher yielding animal is worth an extra $0.92 per cwt on a live weight basis.

A higher dressing percentage will not always yield higher dollar returns, so dressing percentages should be considered in relation to other carcass quality factors. For example, suppose a yield grade (YG) 3 steer carcass – one with the lowest grader-estimated lean meat yield of 53% or less - had a dressing percentage that is 1.5% higher than a YG1 steer carcass. However, because the industry does not want over-fat carcasses, showed by the YG 3rating, prices will be discounted. Therefore for the YG3 steer, even though the dressing percentage is higher and the carcass weight is heavier, the total return could be less. See Table 2 below for an example.

Dressing percentages are highly variable because they are influenced by factors such as live weight, fat level, age,gender, diet, breed, distance trucked, and the type of market where cattle are sold.

Dressing percentages increase as live weight or as fat depth increases in feedlot cattle. As feedlot cattle approach finishing weights and condition, the amount of body fat increases at a faster rate than other body components including muscle, bone, hide, viscera or internal organs, and gut contents. Body fat is deposited within the body cavity, within the muscle or meat – called marbling, - and immediately under the hide. Since much of this body fat stays with the carcass at slaughter, increasing body fat results in higher dressing percentages.

Meaningful comparisons of dressing percentages among breeds are difficult to make without knowing the reasons for the differences. For example, one breed may typically have a higher dressing percentage because that breed tends to carry more finish at a given weight. If body fat is trimmed off, then the dressing percentage may be similar to other breeds.Dairy cattle commonly yield three percentage points less in dressing percentage than beef cattle. Dairy cattle tend to lack both finish and muscularity, and therefore, have a lower dressing percentage.

While dressing percentage differences can be related to mature size, there are other factors such as the weight of the hide, head, feet and viscera, which all have an impact. Breeds such as Hereford or Simmental, which tend to have a heavier hide, head, feet and viscera will have a lower dressing percentage since these body parts are excluded from the carcass weight. By contrast, Angus or Limousin breeds tend to have higher dressing percentages because of the relatively smaller portion of their live weight composed of hide, head, feet and viscera.

Heifers usually have a 1.5 to 2.0 percentage point lower dressing percentage than steers at a similar fat level. As a whole, heifers tend to carry more waste fat in the udder, around the internal organs and on the carcass than do steers.The difference in dressing percentage between steers and heifers narrows as heifers become fatter than steers. Since heifers mature earlier, they are usually marketed 100 to 150 pounds lighter than steers.

There is a risk that heifers are pregnant at the time of slaughter. Pregnant heifers have a lower dressing percentage than open heifers. The drop in dressing percentage relates to the size of the fetus, the uterus and embryonic tissue and fluids.

At similar weights, steers have more heart and lung and abdominal and kidney fat than bulls. Steers can be expected to have a lower dressing percentage than bulls at similar external fat levels because fat distribution on steers and bulls are different.

Cattle on a high roughage diet, such as hay, silage or pasture, have a lower dressing percentage than cattle on a high proportion grain diet, even if the cattle are marketed at very similar fat levels. At the Lethbridge Research Station,the entire digestive tract of slaughtered steers was weighed. Gut fill, as a percent of live weight, was higher in steers on a hay diet than steers on a grain diet. In this trial, steers on the grain diet had an 8% higher dressing percentage than steers on the hay diet. But when carcass weights were based on body weights, excluding gutfills, there was no difference between steers on either diet.

Other studies have compared Charolais-, Hereford- and Limousin-cross dairy steers on either fast gaining (mostly grain)or slow gaining (mostly roughage) rations. Dressing percentages averaged 2 percentage points higher for the steers on fast gaining rations. Similarly, another study indicated that compared heifers fed ground alfalfa hay (with or without barley grain) and heifers fed a 90% barley grain diet, dressing percentages increased with the grain level fed.

Similarly, another study, that compared heifers fed ground alfalfa hay (with or without barley grain) and heifers fed a 90% barley grain diet, showed dressing percentages increased with the grain level fed.

A study at the University of Alberta also fed bulls and steers a diet containing either 20, 50 or 80% roughage and slaughtered the cattle at either 990 or 1265 pounds live weight. Researchers found that dressing percentages decreased with increasing roughage levels in the diet. The reasons for the decrease were the increased gut fill and reduced amounts of carcass fat with higher roughage levels. Study results are shown in Table 4 below.

The Pembina Forage Association marketed 18 steers weighing from 995 to 1220 pounds directly off a grass pasture. The steers had been on pasture for approximately 100 days. All carcasses graded A1 except for one carcass, which was discounted for being a dark cutter. The dressing percentages varied from 52.9 to 56.9% with the average being 54.5%. If feedlot finished steer carcasses dress from 57 to 59%, then this data suggests there can be a 3.5 percentage point reduction in dressing percentages of carcasses marketed directly from pasture.

The number of days an animal spends in the feedlot on a high grain diet influences the dressing percentage. The feedlot industry suggests that even after a minimum 60 days in the feedlot, dressing percentages will be 2% lower than for the more ideal 90 days.

Cull cows marketed directly after weaning a calf may dress out between 48 and 51%. These same cows, after a 60-day high-energy feeding period, could have a dressing percentage as high as 53 to 55%.

Dressing percentages will vary by 1.5 to 3 percentage point throughout the year. The period of highest dressing percentages occurs from May through August. This is a period when feedlot conditions are dry, when calves have been on feed for an extended time, and when calves have a light hair coat. Dressing percentages start declining in September as cattle hair coats thicken and more tag accumulates. Also, yearlings that have been in the feedlot for only 60 to 80 days start coming to market in the late fall. The lowest dressing percentages tend to occur in December and January. Marketings during this period consist mainly of yearlings that have been in the feedlot for less than 100 days, and which have a heavy hair coat and accumulated tag. Dressing percentages increase through March and April as animals shed their winter hair coat and last year"s calves begin coming to market. Last year"s calves have been on higher grain diets for periods greater than 150 days. Any weather conditions that affect the hair coat of an animal can have an impact on that animal"s dressing percentage. For example, rainy weather can dramatically lower dressing percentages, especially if the hair coat is thick.

The dressing percentage of cattle marketed in Canada will differ from that of similar animals marketed in the United States. The US carcass weight includes the weight of the kidney, pelvic and heart fat, which is not included in the Canadian carcass weight. Dressing percentages for equivalent animals are, therefore, 2.5 to 3.0% higher in the United States than in Canada.

Cattle marketed in the United States, with a typical grade split of 30% Choice, 70% Select to 50% Choice, 50% Select will have a dressing percentage of 2.5 percentage points higher than Canadian grade A1/A2 and 3.0 percentage points higher than Canadian grade A2/A3.

Marketing procedures affect beef carcass yields. A feedlot that is 30 km from a packing plant can have higher dressing percentages than a feedlot 400 km from the plant. The difference in dressing percentages will be related to the difference in shrinkage that occurs while the animals are being transported. If the shrinkage is only gut shrinkage and not tissue or carcass shrinkage, then the difference in dressing percentages is not important for animals sold on a railgrade basis.

Studies at the Lacombe Research Station demonstrated that slaughter weight steers and heifers that fast for 48 or 72 hours prior to slaughter had warm carcass yields nearly 1.0 to 1.5% lower than equivalent cattle slaughtered after a 24-hour fast. This weight loss was attributed to losses in carcass lean, fat and water. Management practices such as quiet, efficient sorting and loading, limiting time in transit, loading trucks to recommended weight, and proper delivery timing at the plant will help reduce the interval that cattle are without feed, and lessen the stress level for long haul animals. This ultimately increases the value of the animal.

Other factors may affect carcass yield, but these are controlled by the packing plant rather than the feedlot, and therefore, the producer price is not directly influenced by these practices. For example, intermittent cold water spray chilling of the carcass can reduce carcass shrink age by 0.7 to 1.5%. Shrouding carcasses can reduce the loss to evaporation by 0.75 to 2.0%. Even carcass spacing within coolers and the feeding of an electrolyte solution to the animal prior to slaughter has shown to influence carcass shrinkage.

The factors affecting dressing percentage are summarized in Table 5. The results will vary, but the numbers provide a general indication of the influence of these factors. Although the dressing percentage and carcass weight of A2 and A3 grades tends to be higher than for A1 grade, this does not necessarily mean a higher return for the animal. Dressing percentages are highly variable, and influenced by factors such as days on feed, the season and the market where an animal is sold. Producers should analyze sale weights from feedlots to better understand how these factors influence dressing percentages.

Note: Dressing percentages given above decline by 2 percentage points for livestock on feed 60 days, by one percentage point for cattle on feed 80 days and are unchanged when cattle are on feed 100 days.

On average, dressing percentages are 0.75 percentage points lower in March, April, September and October; and are 1.5 percentage points lower in November, December, January and February.

Johnson, R.D., M.C. Hunt, D.M. Allen, C.L. Kastner, R.J. Danler, and C.C. Shrock. 1988. Moisture uptake during washing and spray chilling of Holstein and beef type steer carcasses. J. Anim. Sci. 66:2180-2184.

Jones, S.D.M., M.A. Price, and G.W. Mathison. 1978. The effects of dietary roughage level on the growth and productivity of intensively fed bulls. 57th Annual University of Alberta Feeders Day Report, p. 22-25.

Jones, S.D.M., J.A. Newman, A.K.W. Tong, A.H. Martin, and W.M. Robertson. 1984. Feedlot performance, carcass composition and efficiency of muscle gain in bulls and steers of difference mature size slaughtered at similar levels of fatness. Can. J. Anim. Sci. 64:621.

Jones, S.D.M., A.L. Schaeffer, A.K.W. Tong, and B.C. Vincent. 1988. The effects of fasting and transportation on beef cattle. 2. Body component changes, carcass composition and meat quality. Livestock Prod"n Sci. 20:25-35.

Schaeffer, A.L., S.D.M. Jones, A.K.W. Tong and B.A. Young. 1989. Effect of transport and electrolyte supplementation on ion concentration, carcass yield and quality in bulls. Can. J. Anim. Sci. In press.

The fire investigation at the Bow on Tong building will continue today with a delicate process due to the structural instability of building as well as its status with Provincial and Municipal designation with the Alberta Register of Historic Places.

The portion of 2 Avenue South between 3 Street and 4 Street remains closed, due to heavy equipment being used. Residents are asked to please avoid the area at this time.

In addition to the fire investigation, the City of Lethbridge has been working with the Province, representatives from Alberta Culture – Historic Resources and members of the Lethbridge Historical Society, on next steps to preserve any remaining historical elements.

The fire investigation at the Bow on Tong building will continue today with a delicate process due to the structural instability of building as well as its status with Provincial and Municipal designation with the Alberta Register of Historic Places.

The portion of 2 Avenue South between 3 Street and 4 Street remains closed, due to heavy equipment being used. Residents are asked to please avoid the area at this time.

In addition to the fire investigation, the City of Lethbridge has been working with the Province, representatives from Alberta Culture – Historic Resources and members of the Lethbridge Historical Society, on next steps to preserve any remaining historical elements.

This article is about the price of crude oil. For information about derivative motor fuels, see gasoline and diesel usage and pricing. For detailed history of price movements since 2003, see World oil market chronology from 2003.

The price of oil, or the oil price, generally refers to the spot price of a barrel (159 litres) of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS).

The global price of crude oil was relatively consistent in the nineteenth century and early twentieth century.OPEC oil embargo targeting nations that had supported Israel during the Yom Kippur War: 329 resulting in the 1973 oil crisis, the Iranian Revolution in the 1979 oil crisis, and the financial crisis of 2007–2008, and the more recent 2013 oil supply glut that led to the "largest oil price declines in modern history" in 2014 to 2016. The 70% decline in global oil prices was "one of the three biggest declines since World War II, and the longest lasting since the supply-driven collapse of 1986."

The 2020 Russia–Saudi Arabia oil price war resulted in a 65% decline in global oil prices at the beginning of the COVID-19 pandemic.record-high energy prices were driven by a global surge in demand as the world recovered from the COVID-19 recession.

According to Our World in Data, in the nineteenth and early twentieth century the global crude oil prices were "relatively consistent."1973 and 1979 oil crises. In 1980, globally averaged prices "spiked" to US$107.27.

Historically, there have been a number of factors affecting the global price of oil. These have included the Organization of Arab Petroleum Exporting Countries led by Saudi Arabia resulting in the 1973 oil crisis, the Iranian Revolution in the 1979 oil crisis, Iran–Iraq War (1980–1988), the 1990 Invasion of Kuwait by Iraq, the 1991 Gulf War, the 1997 Asian financial crisis, the September 11 attacks, the 2002–2003 national strike in Venezuela"s state-owned oil company Petróleos de Venezuela, S.A. (PDVSA), Organization of the Petroleum Exporting Countries (OPEC), the 2007–2008 global financial collapse (GFC), OPEC 2009 cut in oil production,Arab Spring 2010s uprisings in Egypt and Libya, the ongoing Syrian civil war (2011–present), the 2013 oil supply glut that led to the "largest oil price declines in modern history" in 2014 to 2016. The 70% decline in global oil prices was "one of the three biggest declines since World War II, and the longest lasting since the supply-driven collapse of 1986."2020 Russia–Saudi Arabia oil price war resulted in a 65% decline in global oil prices at the beginning of the COVID-19 pandemic.

Structural drivers affecting historical global oil prices include are "oil supply shocks, oil-market-specific demand shocks, storage demand shocks", "shocks to global economic growth",

Oil prices are determined by global forces of supply and demand, according to the classical economic model of price determination in microeconomics.International Energy Agency, high oil prices generally have a large negative impact on global economic growth.

In response to the 1973 oil crisis, in 1974, the RAND Corporation presented a new economic model of the global oil market that included four sectors—"crude production, transportation, refining, and consumption of products" and these regions—United States, Canada, Latin America, Europe, the Middle East and Africa, and Asia.

A system dynamics economic model of oil price determination "integrates various factors affecting" the dynamics of the price of oil, according to a 1992

A 2019 Bank of Canada (BOC) report, described the usefulness of a structural vector autoregressive (SVAR) model for conditional forecasts of global GDP growth and oil consumption in relation to four types of oil shocks.econometrician and macroeconomist Christopher A. Sims in 1982 as an alternative statistical framework model for macroeconomists. According to the BOC report—using the SVAR model—"oil supply shocks were the dominant force during the 2014–15 oil price decline".

By 2016, despite improved understanding of oil markets, predicting oil price fluctuations remained a challenge for economists, according to a 2016 article in the Journal of Economic Perspectives , which was based on an extensive review of academic literature by economists on "all major oil price fluctuations between 1973 and 2014".

A 2016 article in the Oxford Institute for Energy Studies describes how analysts offered differing views on why: 10 following "four years of relative stability at around US$105 per barrel".: 41 A 2015 World Bank report said that the low prices "likely marks the end of the commodity supercycle that began in the early 2000s" and they expected prices to "remain low for a considerable period of time".: 4

A 2020 Energy Economics article confirmed that the "supply and demand of global crude oil and the financial market" continued to be the major factors that affected the global price of oil. The researchers using a new Bayesian structural time series model, found that shale oil production continued to increase its impact on oil price but it remained "relatively small".

In North America the benchmark price refers to the spot price of West Texas Intermediate (WTI), also known as Texas Light Sweet, a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange"s oil futures contracts. WTI is a light crude oil, lighter than Brent Crude oil. It contains about 0.24% sulfur, rating it a sweet crude, sweeter than Brent.light crude as traded on the New York Mercantile Exchange (NYMEX) for delivery at Cushing, Oklahoma.Cushing, Oklahoma, a major oil supply hub connecting oil suppliers to the Gulf Coast, has become the most significant trading hub for crude oil in North America.

In Europe and some other parts of the world, the price of the oil benchmark is Brent Crude as traded on the Intercontinental Exchange (ICE, into which the International Petroleum Exchange has been incorporated) for delivery at Sullom Voe. Brent oil is produced in coastal waters (North Sea) of UK and Norway. The total consumption of crude oil in UK and Norway is more than the oil production in these countries.LPG, LNG, natural gas, etc. trade globally including Middle East crude oils.

There is a differential in the price of a barrel of oil based on its grade—determined by factors such as its specific gravity or API gravity and its sulfur content—and its location—for example, its proximity to tidewater and refineries. Heavier, sour crude oils lacking in tidewater access—such as Western Canadian Select—are less expensive than lighter, sweeter oil—such as WTI.

The Energy Information Administration (EIA) uses the imported refiner acquisition cost, the weighted average cost of all oil imported into the US, as its "world oil price".

Oil prices in USD, 1861–2015 (1861–1944 averaged US crude oil, 1945–1983 Arabian Light, 1984–2015 Brent). Red line adjusted for inflation, blue not adjusted.

The price of oil remained "relatively consistent" from 1861 until the 1970s.Daniel Yergin"s 1991 Pulitzer prize-winning book : 599 Yergin states that the role of Organization of the Petroleum Exporting Countries (OPEC)—which had been established in 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela: 499cartel known as the "Seven Sisters"—five of which were headquartered in the United States—had been controlling posted prices since the so-called 1927 Red Line Agreement and 1928 Achnacarry Agreement, and had achieved a high level of price stability until 1972, according to Yergin.

There were two major energy crisis in the 1970s: the 1973 oil crisis and the 1979 energy crisis that affected the price of oil. Starting in the early 1970s—when domestic production of oil was insufficient to satisfy increasing domestic demands—the US had become increasingly dependent on oil imports from the Middle East.Yom Kippur War and the 1979 Iranian Revolution, was without precedent.Yom Kippur War, a coalition of Arab states led by Egypt and Syria attacked Israel.: 570 During the ensuing 1973 oil crisis, the Arab oil-producing states began to embargo oil shipments to Western Europe and the United States in retaliation for supporting Israel. Countries, including the United States, Germany, Japan,: 607 as the newly formed Organization of Petroleum Exporting Countries (OPEC) doubled the price of oil.: 607

During the 1979 oil crisis, the global oil supply was "constrained" because of the 1979 Iranian Revolution—the price of oil "more than doubled",The Economist.

The 1980s oil glut was caused by non-OPEC countries—such as the United States and Britain—increasing their oil production, which resulted in a decrease in the price of oil in the early 1980s, according to World Bank report.: 10

In 1983, the New York Mercantile Exchange (NYMEX) launched crude oil futures contracts, and the London-based International Petroleum Exchange (IPE)—acquired by Intercontinental Exchange (ICE) in 2005— launched theirs in June 1988.

The price of oil reached a peak of c. US$65 during the 1990 Persian Gulf crisis and war. The 1990 oil price shock occurred in response to the Iraqi invasion of Kuwait, according to the Brookings Institution.

Starting in 1999, the price of oil rose significantly. It was explained by the rising oil demand in countries like China and India.financial crisis of 2007–2008 took hold.: 46

By May 2008, The United States was consuming approximately 21 million bpd and importing about 14 million bpd—60% with OPEC supply 16% and Venezuela 10%.financial crisis of 2007–2008, the price of oil underwent a significant decrease after the record peak of US$147.27 it reached on 11 July 2008. On 23 December 2008, WTI crude oil spot price fell to US$30.28 a barrel, the lowest since the financial crisis of 2007–2008 began. The price sharply rebounded after the crisis and rose to US$82 a barrel in 2009.

On 31 January 2011, the Brent price hit $100 a barrel briefly for the first time since October 2008, on concerns that the 2011 Egyptian protests would "lead to the closure of the Suez Canal and disrupt oil supplies".

From 2004 to 2014, OPEC was setting the global price of oil.: 10 —by July 2008 the price of oil had reached its all-time peak of US$147 before it plunged to US$34 in December 2008, during the financial crisis of 2007–2008.: 46 Some commentators including speculation in futures markets.

By 2014, production from unconventional reservoirs through hydraulic fracturing in the United States and oil production in Canada, caused oil production to surge globally "on a scale that most oil exporters had not anticipated" resulting in "turmoil in prices."Ambrose Evans-Pritchard, in 2014–2015, Saudi Arabia flooded the market with inexpensive crude oil in a failed attempted to slow down US shale oil production, and caused a "positive supply shock" which saved consumers about US$2 trillion and "benefited the world economy".

During 2014–2015, OPEC members consistently exceeded their production ceiling, and China experienced a marked slowdown in economic growth. At the same time, U.S. oil production nearly doubled from 2008 levels, due to substantial improvements in shale "fracking" technology in response to record oil prices. A combination of factors led a plunge in U.S. oil import requirements and a record high volume of worldwide oil inventories in storage, and a collapse in oil prices that continues into 2016.World Bank, the collapse in the price of oil was the third largest since 1986.

The 2010s oil glut—caused by multiple factors—spurred a sharp downward spiral in the price of oil that continued through February 2016.North Sea oil and gas industry was financially stressed by the reduced oil prices, and called for government support in May 2016.Deloitte LLP—the audit and consulting firm—with global crude oil at near ten-year low prices, 35% of listed E&P oil and gas companies are at a high risk of bankruptcy worldwide.

By December 2018, OPEC members controlled approximately 72% of total world proved oil reserves, and produced about 41% of the total global crude oil supply.United States sanctions against Iran, OPEC"s third-biggest oil producer, were set to be restored and tightened in November.

The price of oil dropped in November 2018 because of a number of factors, including "rising petro-nations’ oil production, the U.S. shale oil boom, and swelling North American oil inventories," according to Market Watch.

The 1 November 2018 U.S. Energy Information Administration (EIA) report announced that the US had become the "leading crude oil producer in the world" when it hit a production level of 11.3 million barrels per day (bpd) in August 2018, mainly because of its shale oil production.

In 2020, the economic turmoil caused by the COVID-19 recession, included severe impacts on crude oil markets,2020 Russia–Saudi Arabia oil price warCOVID-19 pandemic, which lowered demand for oil because of lockdowns around the world.

The IHS Market reported that the "COVID-19 demand shock" represented a bigger contraction than that experienced during the Great Recession during the late 2000s and early 2010s.COVID-19 pandemic.2020 Russia–Saudi Arabia oil price war was launched, in which Saudi Arabia and Russia briefly flooded the market, also contributed to the decline in global oil prices.Gulf War.

By April 2020 the price of WTI dropped by 80%, down to a low of about $5.negative on 20 April 2020, the first time to happen since the New York Mercantile Exchange began trading in 1983.Bloomberg report on slumping oil prices—citing the EIA among others—said that, with the increasing number of virus cases, the demand for gasoline—particularly in the United States—was "particularly worrisome", while global inventories remained "quite high".

With the price of WTI at a record low, and 2019 Chinese 5% import tariff on U.S. oil lifted by China in May 2020, China began to import large quantities of US crude oil, reaching a record high of 867,000 bpd in July.

According to a January 2020 EIA report, the average price of Brent crude oil in 2019 was $64 per barrel compared to $71 per barrel in 2018. The average price of WTI crude oil was $57 per barrel in 2019 compared to $64 in 2018.futures contracts dropped below $0 for the first time in history,2020 Russia–Saudi Arabia oil price warCOVID-19 pandemic, which lowered demand for oil because of lockdowns around the world.U.S. Energy Information Administration (EIA) reported that global oil inventories remained "quite high" while demand for gasoline—particularly in the United States—was "particularly worrisome."record-high energy prices were driven by a global surge in demand as the world quit the economic recession caused by COVID-19, particularly due to strong energy demand in Asia.

The ongoing 2019–2021 Persian Gulf crisis, which includes the use of drones to attack Saudi Arabia"s oil infrastructure, has made the Gulf states aware of their vulnerability. Former US President "Donald Trump"s "maximum pressure" campaign led Iran to sabotage oil tankers in the Persian Gulf and supply drones and missiles for a surprise strike on Saudi oil facilities in 2019."

The oil prices were seen rising to hit $71.38 per barrel in March 2021, marking the highest since the beginning of the pandemic in January 2020.Saudi Arabia"s Aramco oil facility by Yemen’s Houthi rebels.United States said it was committed to defending Saudi Arabia.

On 5 October 2021, crude oil prices reached a multiyear high but retreated by 2% the following day. The price of crude was on the rise since June 2021, after a statement by a top US diplomat that even with a nuclear deal with Iran, hundreds of economic sanctions would remain in place.

The high price of oil in late 2021, which resulted in US gasoline pump prices that rose by over $1 a gallon—a seven-year high—added pressure to the United States, which has extensive reserves of oil and has been one of the world"s largest producers of oil since at least 2018.

By mid-January 2022, Reuters raised concerns that an increase in the price of oil to $100—which seemed to be imminent—would worsen the inflationary environment that was already breaking 30-year-old records.European Union (EU) embargo of Russian seaborne oil, in response to the Russian invasion of Ukraine in February, 2022, was one—but not the only—factor in the increase in the global price of oil, according to The Economist.Strategic Petroleum Reserve (SPR).

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a financial instrument, oil futures in which they agree on a contract basis, to buy or sell oil at a set date in the future. Crude oil is stored in salt mines, tanks and oil tankers.

Investors can choose to take profits or losses prior to the oil-delivery date arrives. Or they can leave the contract in place and physical oil is "delivered on the set date" to an "officially designated delivery point", in the United States, that is usually Cushing, Oklahoma. When delivery dates approach, they close out existing contracts and sell new ones for future delivery of the same oil. The oil never moves out of storage. If the forward market is in "contango"—the forward price is higher than the current spot price—the strategy is very successful.

Scandinavian Tank Storage AB and its founder Lars Jacobsson introduced the concept on the market in early 1990.Wall Street giants, such as Morgan Stanley, Goldman Sachs, and Citicorp—turning sizeable profits simply by sitting on tanks of oil.

From June 2014 to January 2015, as the price of oil dropped 60% and the supply of oil remained high, the world"s largest traders in crude oil purchased at least 25 million barrels to store in supertankers to make a profit in the future when prices rise. Trafigura, Vitol, Gunvor, Koch, Shell and other major energy companies began to book oil storage supertankers for up to 12 months. By 13 January 2015 At least 11 Very Large Crude Carriers (VLCC) and Ultra Large Crude Carriers (ULCC)" have been reported as booked with storage options, rising from around five vessels at the end of last week. Each VLCC can hold 2 million barrels."

In 2015 as global capacity for oil storage was out-paced by global oil production, and an oil glut occurred. Crude oil storage space became a tradable commodity with CME Group— which owns NYMEX— offering oil-storage futures contracts in March 2015.

By 5 March 2015, as oil production outpaces oil demand by 1.5 million bpd, storage capacity globally is dwindling.Energy Information Administration, U.S. crude-oil supplies are at almost 70% of the U. S. storage capacity, the highest to capacity ratio since 1935.

In 2020, rail and road tankers and decommissioned oil pipe lines are also being used to store crude oil for contango trade.LNG carriers and LNG tanks can also be used for long duration crude oil storage purpose since LNG can not be stored long term due to evaporation. Frac tanks are also used to store crude oil deviating from their normal use.

In their May 2019 comparison of the "cost of supply curve update" in which the Norway-based Rystad Energy—an "independent energy research and consultancy"—ranked the "worlds total recoverable liquid resources by their breakeven price", they listed the "Middle East onshore market" as the "cheapest source of new oil volumes globally" with the "North American tight oil"—which includes onshore shale oil in the United States—in second place.

Rystad reported that the average breakeven price for oil from the oil sands was US$83 in 2019, making it the most expensive to produce, compared to all other "significant oil producing regions" in the world.International Energy Agency made similar comparisons.

Peak oil is the period when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. It relates to a long-term decline in the available supply of petroleum. This, combined with increasing demand, will significantly increase the worldwide prices of petroleum derived products. Most significant will be the availability and price of liquid fuel for transportation.

The US Department of Energy in the Hirsch report indicates that "The problems associated with world oil production peaking will not be temporary, and past "energy crisis" experience will provide relatively little guidance."

Global annual crude oil production (including shale oil, oil sands, lease condensate and gas plant condensate but excluding liquid fuels from other sources such as natural gas liquids, biomass and derivatives of coal and natural gas) increased from 75.86 million barrels (12.1 million cubic metres) in 2008 to 83.16 million bbl (13.2 million m3) per day in 2018 with a marginal annual growth rate of 1%.Coronavirus disease 2019 pandemic.

The rising oil prices could negatively impact the world economy.modern agriculture techniques, a fall in global oil supplies could cause spiking food prices in the coming decades.increase in food prices in 2007–08 may be the increase in oil prices during the same period.

Bloomberg warned that the world economy, which was already experiencing an inflationary "shock", would worsen with oil priced at $100 in February 2022.International Monetary Fund (IMF) described how a combination of the "soaring" price of commodities, imbalances in supply and demand, followed by pressures related to the Russian invasion of Ukraine, resulted in monetary policies being tightened by central banks, as some inflation in some countries broke 40-year-old record highs.

A major rise or decline in oil price can have both economic and political impacts. The decline on oil price during 1985–1986 is considered to have contributed to the fall of the Soviet Union.resource curse, such as authoritarian rulediversionary war. The reduction in food prices that follows lower oil prices could have positive impacts on violence globally.

The macroeconomics impact on lower oil prices is lower inflation. A lower inflation rate is good for the consumers. This means that the general price of a basket of goods would increase at a bare minimum on a year to year basis. Consumer can benefit as they would have a better purchasing power, which may improve real gdp.

It has also been argued that the collapse in oil prices in 2015 should be very beneficial for developed western economies, who are generally oil importers and aren"t over exposed to declining demand from China.

While President Trump said in 2018, that the lower price of oil was like a "big Tax Cut for America and the World",current account deficits widen because "their exports pay for fewer imports".

According to a U.S. Commodity Futures Trading Commission (CFTC) 29 May 2008 report the "Multiple Energy Market Initiatives" was launched in partnership with the United Kingdom Financial Services Authority and ICE Futures Europe in order to expand surveillance and information sharing of various futures contracts. Part 1 is "Expanded International Surveillance Information for Crude Oil Trading."Business Week reported that the surge in oil prices prior to the financial crisis of 2008 had led some commentators to argue that at least some of the rise was due to speculation in the futures markets.speculation had not caused significant changes in oil prices and that the increase in oil prices between January 2003 and June 2008 [were] largely due to fundamental supply and demand factors.": 3 The report found that the primary reason for the price increases was that the world economy had expanded at its fastest pace in decades, resulting in substantial increases in the demand for oil, while the oil production grew sluggishly, compounded by production shortfalls in oil-exporting countries.: 3

The report stated that as a result of the imbalance and low price elasticity, very large price increases occurred as the market attempted to balance scarce supply against growing demand, particularly from 2005 to 2008.: 14 The report forecast that this imbalance would persist in the future,: 4 leading to continued upward pressure on oil prices, and that large or rapid movements in oil prices are likely to occur even in the absence of activity by speculators.: 4

The use of hedging using commodity derivatives as a risk management tool on price exposure to liquidity and earnings, has been long established in North America. Chief Financial Officers (CFOS) use derivatives to dampen, remove or mitigate price uncertainty.

According to John England, the Vice-chairman Deloitte LLP, "Access to capital markets, bankers" support and derivatives protection, which helped smooth an otherwise rocky road, are fast waning...The roughly 175 companies at risk of bankruptcy have more than $150 billion in debt, with the slipping value of secondary stock offerings and asset sales further hindering their ability to generate cash."

To finance exploration and production of the unconventional oil industry in the United States, "hundreds of billions of dollars of capital came from non-bank participants [non-bank buyers of bank energy credits] in leveraged loans] that were thought at the time to be low risk.

According to a 2012 article in Oil and Gas Financial Journal, "the combination of the development of large resource plays in the US and the emergence of business models designed to ensure consistent dividend payouts to investors has led to the development of more aggressive hedging policies in companies and less restrictive covenants in bank loans."

At the fifth annual World Pensions Forum in 2015, Jeffrey Sachs advised institutional investors to divest from carbon-reliant oil industry firms in their pension fund"s portfolio.

On February 10, 2020, oil reached its lowest level in over a year, with the pandemic a major reason. WTI fell 1.5 percent to $49.57, the lowest since January 2019, and Brent dropped 2.2 percent to $53.27, the lowest since December 2018.

With worldwide demand continuing to decline due to COVID-19, oil fell for a fifth straight week at the end of March and any actions taken by Saudi Arabia or Russia would be inconsequential.

In the first quarter, the percentage loss was the worst ever, 66.5 percent for WTI and 65.6 percent for Brent. Then on April 2, WTI jumped 24.7 percent to $25.32 and Brent rose 21 percent to $29.94, the biggest percentage increase in a single day ever, in anticipation of significant production cuts.

On April 20, the front month contract for WTI fell below zero, an unprecedented event. With the contract for May delivery expiring on April 21, the contract for June delivery became the new front month contract; on April 22 after settling at $13.78, WTI was the lowest since the 1990s.

In December 2020 demand appeared likely to rise in China, and a pandemic relief package appeared more likely in the United States, while COVID-19 vaccines became available. WTI ended December 15 the highest since February, and Brent reached the highest since March.

WTI and Brent finished the first week of February 2021 at the highest since January 2020. COVID-19 vaccines were a big reason for positive economic news.

On August 9 COVID-19 restrictions in China and other parts of Asia threatened to slow demand. WTI reached its lowest level since May.Delta variant a major reason.a COVID lockdown in Austria and the possibility of more lockdowns in Europe, oil fellOmicron variant concerns caused more losses later in November.

Jacobs, Trent. "OPEC+ Moves to End Price War With 10 Million B/D Cut". pubs.spe.org. Journal of Petroleum Technology. Archived from the original on 10 April 2020. Retrieved 10 April 2020. (early March) In the ensuing weeks West Texas Intermediate (WTI) prices fell to a low of around $20, marking a record 65% quarterly drop

Kelly, Stephanie; Sharafedin, Bozorgmehr; Samanta, Koustav (23 December 2021). "Global oil"s comeback year presages more strength in 2022". Reuters. Retrieved 19 January 2022.

Kilian, Lutz; Lee, Thomas K. (April 2014). "Quantifying the speculative component in the real price of oil: The role of global oil inventories". Journal of International Money and Finance. 42: 71–87. doi:10.1016/j.jimonfin.2013.08.005. ISSN 0261-5606. S2CID 17988336.

Morecroft, John D. W.; van der Heijden, Kees A. J. M. (26 May 1992). "Modelling the oil producers — Capturing oil industry knowledge in a behavioural simulation model". European Journal of Operational Research. Modelling for Learning. 59 (1): 102–122. doi:10.1016/0377-2217(92)90009-X. ISSN 0377-2217. Retrieved 27 October 2020.

Baffes, John; Kose, M. Ayhan; Ohnsorge, Franziska; Stocker, Marc (March 2015). The Great Plunge in Oil Prices: Causes, Consequences, and Policy Responses (PDF). World Bank Group (Report). Policy Research Notes (PRNs). p. 61. Retrieved 26 October 2020.

Mabro, Robert (2006). Oil in the 21st century: issues, challenges and opportunities. Organization of Petroleum Exporting Countries. Oxford Press. p. 351. ISBN 9780199207381.

Eguchi, Yujiro (1980). "Japanese Energy Policy". International Affairs. 56 (2): 263–279. doi:10.2307/2615408. ISSN 0020-5850. JSTOR 2615408. Retrieved 27 October 2020.

MacEachen, Allan J. (28 October 1980), Budget 1980 (PDF), Ottawa, ON, retrieved 27 October 2020, re introduction of Canada"s National Energy Program..."ever since the oil crisis of 1973 industrial countries have had to struggle with the problems of inflation and stubbornly high rates of unemployment. In 1979 the world was shaken by a second major oil shock. For the industrial world this has meant a sharp renewal of inflationary forces and real income losses. For the developing world this second oil shock has been a major tragedy. Their international deficits are now three to four times the sum they receive in aid from the rest of the world.... They are not just Canadian problems. ...they are world-wide problems. At the Venice Summit and at meetings of Finance Ministers of the IMF and OECD, we have seen these new themes emerge."

Hamilton, J. (2009). "Causes and consequences of the oil shock of 2007–2008" (PDF). Brookings Institution. Archived from the original (PDF) on 14 November 2011. Retrieved 20 January 2016.

"CFTC Announces Multiple Energy Market Initiatives". CFTC. Release: 5503-08. 29 May 2008. Archived from the original on 1 June 2008. Retrieved 1 June 2008.

Williams, James L. (n.d.). "History and Analysis of Crude Oil Prices". WTRG Economics. London, Arkansas. Archived from the original on 2 January 2008. Retrieved 6 March 2020.

Saefong, Myra P.; Beals, Rachel Koning (16 November 2018). "Oil prices suffer sixth weekly loss in a row". Market Watch. "Rising petro-nations" oil production, the U.S. shale oil boom, swelling North American oil inventories and, not least, too high oil prices curbing emerging market oil demand growth were the factors which calmed the bullish market mood" in October, pulling the price of Brent from above $85 a barrel to below $75," said Norbert Ruecker, head of macro and commodity research at Julius Baer, in a note.

"U.S. monthly crude oil production exceeds 11 million barrels per day in August". U.S. Energy Information Administration (EIA). Today in Energy. 1 November 2018. Retrieved 12 January 2019.

Saefong, Myra P.; Beals, Rachel Koning (30 November 2018). "Oil prices drop 22% in November for biggest monthly loss in a decade". Market Watch. Retrieved 12 January 2019.

"OPEC daily basket price stood at $59.48 a barrel". OPEC. Vienna, Austria. 10 January 2019. Retrieved 12 January 2019. The OPEC Reference Basket of Crudes (ORB) is made up of the following: Saharan Blend (Algeria), Girassol (Angola), Djeno (Congo), Oriente (Ecuador), Zafiro (Equatorial Guinea), Rabi Light (Gabon), Iran Heavy (Islamic Republic of Iran), Basra Light (Iraq), Kuwait Export (Kuwait), Es Sider (Libya), Bonny Light (Nigeria), Arab Light (Saudi Arabia), Murban (UAE) and Merey (Venezuela).

"Rystad Energy ranks the cheapest sources of supply in the oil industry" (Press release). 9 May 2019. Archived from the original on 29 January 2020. Retrieved 29 January 2020.

Jensen, Nathan; Wantchekon, Leonard (1 September 2004). "Resource Wealth and Political Regimes in Africa". Comparative Political Studies. 37 (7): 816–841. doi:10.1177/0010414004266867. ISSN 0010-4140. S2CID 154999593.

Ross, Michael L. (1 April 2001). "Does Oil Hinder Democracy?". World Politics. 53 (3): 325–361. doi:10.1353/wp.2001.0011. ISSN 1086-3338. S2CID 18404.

Hendrix, Cullen S. (19 October 2015). "Oil prices and interstate conflict". Conflict Management and Peace Science. 34 (6): 575–596. doi:10.1177/0738894215606067. ISSN 0738-8942. S2CID 155477031.

Ross, Michael L.; Voeten, Erik (14 December 2015). "Oil and International Cooperation". International Studies Quarterly. 60: 85–97. doi:10.1093/isq/sqv003. ISSN 0020-8833.

Saggu, A. & Anukoonwattaka, W. (2015), Commodity Price Crash: Risks to Exports and Economic Growth in Asia-Pacific LDCs and LLDCs, United Nations ESCAP, SSRN 2617542

Price, Kevin (1 November 2012). "Hedging Is An Effective Risk Management Tool For Upstream Companies". London: Oil and Gas Financial Journal. Retrieved 17 February 2016.

Dizard, John (9 January 2015). "Lesson from history on perils facing oil and gas investors". Financial Times. Archived from . Retrieved 17 February 2016.

Williams, James L. (2 January 2008). "History and Analysis -Crude Oil Prices". WTRG Economics. London, Arkansas. Archived from the original on 2 January 2008. Retrieved 27 October 2020.

Larkin Products L.L.C. is a leader in the manufacture of low to medium pressure screwed connection tubing and casing heads as well as a variety of stuffing boxes, ball valves, lubricated plug valves, check valves, polished rod clamps, pumping tees, transition fittings, and drilling and adapter flanges.

The U.S. Energy Information Administration (EIA) is the statistical and analytical agency within the U.S. Department of Energy. EIA collects, analyzes, and disseminates independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment. EIA is the Nation"s premier source of energy information and, by law, its data, analyses, and forecasts are independent of approval by any other officer or employee of the U.S. Government.

BP is one of the world"s leading international oil and gas companies. We operate or market our products in more than 80 countries, providing our customers with fuel for transportation, energy for heat and light, retail services and petrochemicals products for everyday items.

Established in 1819, ESCP Europe is the world"s first business school and has educated generations of leaders and forward-thinkers. With its five urban campuses in Paris, London, Berlin, Madrid, and Torino, ESCP Europe has a true European identity which enables the provision of a unique style of business education and a global perspective on management issues.

Triple-crown accredited (EQUIS, AMBA, AACSB), ESCP Europe welcomes 4,000 students and 5,000 executives from 90 different nations every year, offering them a wide range of general management and specialised programmes. The School"s alumni network has 40,000 members in 150 countries and from 200 nationalities.

At ESCP Europe London campus, the Research Centre for Energy Management (RCEM) is dedicated to rigorous and objective empirical research on issues related to energy management, finance, and policy, in order to support decision-making by both government and industry.

The Institute of Energy Economics, Japan was established in June 1966 and certified as an incorporated foundation by the Ministry of International Trade and Industry in September that year. The aim of its establishment is to carry on research activities specialized in the area of energy from the viewpoint of the national economy as a whole in a bid to contribute to sound development of the Japanese energy-supplying and energy-consuming industries and to the improvement of people"s life in the country by objectively analyzing energy problems and providing basic data, information and reports necessary for the formulation of policies. With the diversification of social needs during the three and a half decades of its operation, IEEJ has expanded its scope of research activities to include such topics as environmental problems and international cooperation closely related to energy. In October 1984, the Energy Data and Modeling Center (EDMC) was established as an IEEJ-affiliated organization to carry out such tasks as the development of energy data bases, building of various energy models and econometric analyses of energy. In July 1999, EDMC was merged into IEEJ and began operating as an IEEJ division under the same name, i.e., the Energy Data and Modeling Center.

The University of Stavanger, Norway, has about 9200 students and 1300 staff. As member of the European Consortium of Innovative Universities (ECIU), the university aims at being a regional driving force through research activities, new forms of teaching and learning, and knowledge transfer.

The Stavanger region has been Norway’s hub for innovative industry for several decades and this is reflected in the university´s emphasis on technology and programmes of professional study.

Within the Faculty of Science and Technology, research related to the oil and gas industry has an international reputation. The Department of Industrial Economics, Risk Management and Planning has consistently been among Norway’s most prolific research groups. Their main research areas are risk analysis and management, industrial and petroleum economics, fisheries and aquaculture and societal safety.

The Faculty of Public Affairs at Carleton University was established in 1997 to bring together an array of academic departments, schools and institutes that address the broad areas of politics, policy and governance, international affairs, media and socie

8613371530291

8613371530291