perforated pup joint function manufacturer

We are Supplier and Exporter of Perforated Pup Joints in UAE. It is usually installed between the bottom of two nipples of a completion. It allows unrestricted fluid or gas flow, which increases the accuracy and reliability of acquired downhole production data.

We supply all sizes, grades, and thread profiles to meet custom requirements. The perforated pup joints are sometimes also known as the perforated production tube. All our products have passed the ISO certification and API certifications. Our products are tested numerous times under technical guidance and are made from the best quality material.

In wells flowing large volumes, a restriction in the tubing such as a gauge hanger, could cause false pressure readings. Vibrations due to flow could also cause extensive damage to delicate gauges, therefore a perforated pup joint (approx. 10ft length) set above the bomb hanger nipple would allow flow to pass unrestricted over the gauges and hanger, thus giving a more accurate pressure/temperature recording within the

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.

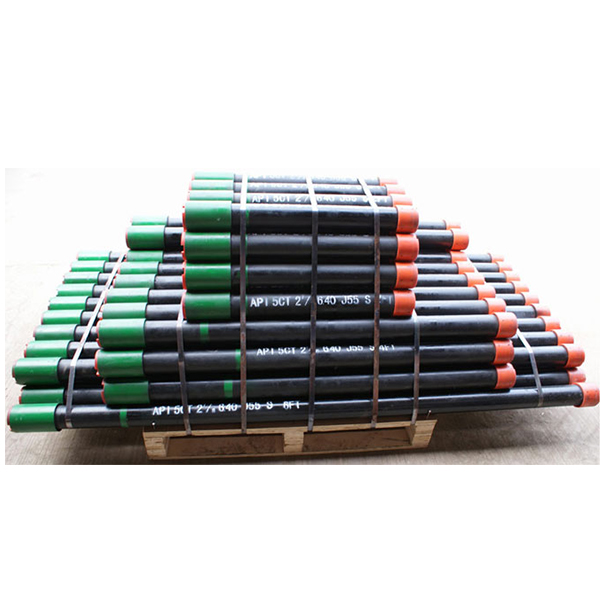

We are the largest manufacturer of API pup joints in North America. All of our pup joints are manufactured from the highest quality API seamless tubing, and per API 5CT requirements. We have dedicated heat treat, NDT, and automated threading lines to provide you with best quality pup joints with quicker turnaround times.

Failure: Deformation, fracture, surface damage and loss of original function under specific service conditions. The main forms of oil casing failure are: crushing, slipping, cracking, leakage, corrosion, adhesion, wear and the like.

Swivel Joints and Blast Saves are our widely recognized premium solutions for ensuring the best performance, endurance and quality in intelligent completion design. With dual metal-to-metal seals, they are available in a range of sizes, metallurgies and steel grades, and their upper and lower ends can be customized for many of our premium connections.

Our Swivel Joint premium connectors are designed to solve alignment problems during dual completion or intelligent completion installations. Furthermore, our Swivel Joints Torque Transmission (TT) can withstand torque in excess of the maximum make-up torque of premium connections.

Our Blast Saves are designed to protect control lines from impact or erosion generated by high pressure/high velocity wellbore fluids and particles, or when the control lines are run alongside the production tubing, in front of the perforated wellbore area. Every Blast Save module has ability to automatically align the longitudinal slots when making up the string, while reaching the optimum make-up torque value.

Manufacturer of pressure, rig concept, well intervention, drilling, down-hole and tubular products. Pressure products include centering shear and fixed bore pipe rams, blowout preventers, diverter systems, connectors, check and gate valves, chokes, actuators, flow heads, manifolds, catchers, packers, hydrate seals, casing heads, casing and tubing head spools, adapters, and hangers. Rig concept products include rig packages, derricks, masts, and skidding systems. Drilling products include electric and hydraulic top drives, makeup/breakout units, pipe handling units, cabins, operation stations, chairs, automatic drillers, anti-collision systems, and navigators, and draw works. Down-hole products include coiled tubing orienteers, drilling motors and jars, and survey and shock tools. Tabular products include drill pipe connections, collars, Kelly’s, subs and pup joints, and pipes.

In order to avoid damage to the oil casing, attention should be paid to the support of the Wholesale LTC Casing Coupling For sale during the design and manufacturing process, and the joint position of the oil casing should be paid attention to during the installation process.

Pursuant to subsection 31(1) of the Special Import Measures Act, the President of the Canada Border Services Agency initiated investigations on September 12, 2011, respecting the alleged injurious dumping and subsidizing of oil country tubular goods pup joints, made of carbon or alloy steel, welded or seamless, heat-treated or not heat-treated, regardless of end finish, having an outside diameter from 2 3/8 inches to 4 1/2 inches (60.3 mm to 114.3 mm), in all grades, in lengths from 2 feet to 12 feet (61 cm to 366 cm) originating in or exported from the People"s Republic of China.

On July 22, 2011, the Canada Border Services Agency (CBSA) received a written complaint from Alberta Oil Tool (AOT), a division of Dover Corporation (Canada) Limited of Edmonton, Alberta, (hereafter, “the Complainant”) alleging that imports of certain pup joints originating in or exported from the People"s Republic of China (China) are being dumped and subsidized and causing injury to the Canadian industry.

The Complainant provided evidence to support the allegations that certain pup joints from China have been dumped and subsidized. The evidence also discloses a reasonable indication that the dumping and subsidizing have caused injury and are threatening to cause injury to the Canadian industry producing these goods.

On September 12, 2011, pursuant to subsection 31(1) of SIMA, the President of the CBSA (President) initiated investigations respecting the dumping and subsidizing of certain pup joints from China.

Of the other producers certified to produce the like goods in Canada, only Tenaris Canada (Tenaris), of Sault Ste. Marie, Ontario, confirmed to be currently manufacturing them. Tenaris produces like goods which are premium pup joints in relatively small quantities and provided a letter supporting the complaint filed by Dover Corporation (Canada) Limited.

Oil country tubular goods pup joints, made of carbon or alloy steel, welded or seamless, heat-treated or not heat-treated, regardless of end finish, having an outside diameter from 2 3/8 inches to 4 1/2 inches (60.3 mm to 114.3 mm), in all grades, in lengths from 2 feet to 12 feet (61 cm to 366 cm) originating in or exported from the People"s Republic of China.

Pup joints are oil country tubular goods (OCTG) made from carbon or alloy steel pipes used for the exploration and exploitation of oil and natural gas. These pipes may be made by the electric resistance welded (ERW) or seamless production method, and are supplied to meet American Petroleum Institute (API) specifications 5CT or equivalent standard.1

Pup joints are primarily used for the purpose of adjusting the depth of strings or down hole tools, particularly where exact depth readings in a well are required for any given purpose, such as setting valves, packers, nipples or circulating sleeves. Pup joints are also used with down hole pumps. The number and lengths of pup joints may vary widely from well to well, depending on the various equipment and performance requirements established by engineers of the purchasing end users.

Pup joints may range from 2 feet to 12 feet in length with a permitted tolerance of plus or minus three inches. The sizes are generally 2, 4, 6, 8, 10 and 12 feet in length.

The pipe is produced in accordance with API 5CT, and may be produced using either seamless or welded (ERW) OCTG. While pup joints may be made with ERW, the Canadian market employs predominantly seamless OCTG. All pup joints produced by the Complainant are seamless products.2

Theoretically, subject pup joints may be supplied to meet any grade including and not limited to, H40, J55, K55, M65, N80, L80, L80 HC, L80 Chrome 13, L80 LT, L80 SS, C90, C95, C110, P110, P110 HC, P110 LT, T95, T95 HC, and Q125, or proprietary grades manufactured as substitutes for these specifications. The most common demand in the Canadian market is for J55 or L80 specifications.

The grade numbers define the minimum yield strength required of the grade in kilo-pounds [force] per square inch (“ksi” or 1,000 pounds per square inch). Pup joints may also be made to proprietary specifications. The Complainant makes or has the capability to produce pup joints in any of these grades.

As with all OCTG, a standard pup joint must be able to withstand outside pressure and internal yield pressures within the well. Also, it must have sufficient joint strength to hold its own weight and must be equipped with threads sufficiently tight to contain the well pressure where lengths are joined.

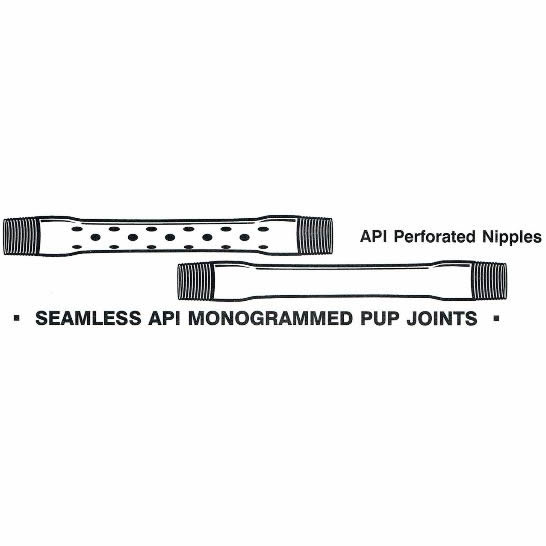

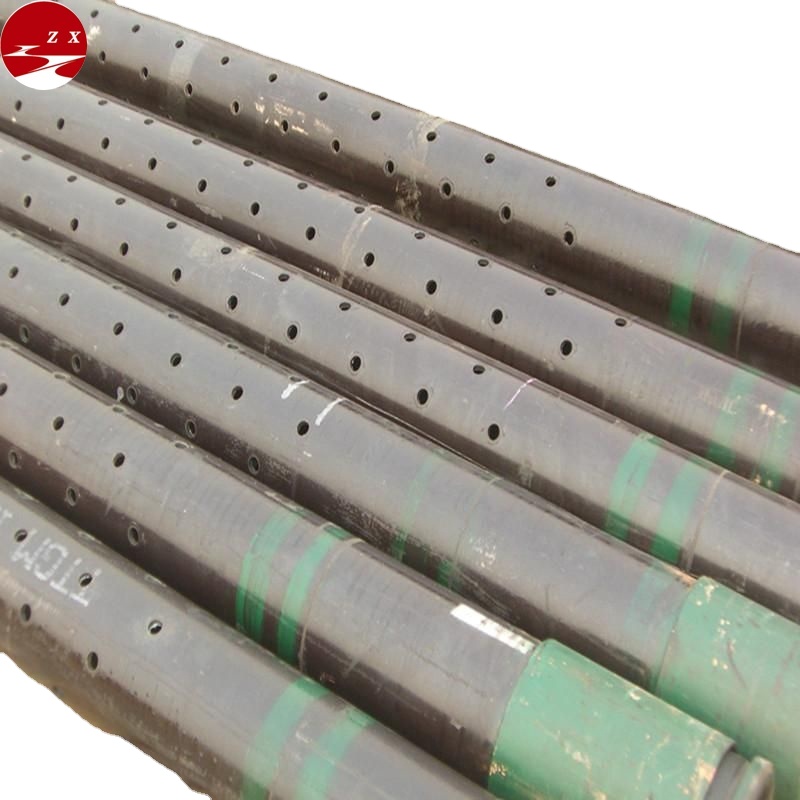

There is a small market segment for perforated pup joints. These are pup joints with holes in the body of the pup joint (usually 3/8 inch though they may have holes or slots of various sizes in the body). The product is produced with API 5CT tubing, though once perforated the product no longer conforms to an API 5CT specification, since it no longer meets the yield strength requirements. Perforated pup joints are employed to allow fluids to enter the production tubing. They can also be used to create a mud anchor. Perforated pup joints are included as goods subject to these investigations.

On March 23, 2010, the Canadian International Trade Tribunal (Tribunal) excluded ‘pup joints" as part of its finding in Inquiry No. NQ-2009-004 on Certain Oil Country Tubular Goods. In that finding, the Tribunal stated:

“The Tribunal hereby excludes pup joints, seamless or welded, heat-treated or not heat-treated, in lengths of up to 3.66 m (12 feet), from its injury finding.”3

Pup joints are manufactured in Canada by the Complainant using plain end tube as an input. For J55 grade pup joints, a length of J55 OCTG tubing is employed. For L80 grade pup joints, the input is an A-519 mechanical tube with the appropriate steel chemistry for L80 OCTG. The L80 input tube does not qualify for the API 5CT designation until it has been tested in accordance with API requirements. The Complainant performs the testing required.

The production process of the input pipe itself is virtually identical to that employed for OCTG tubing and casing. There are, however, significant subsequent costs associated with transforming the input tubing into pup joints including: cutting to length, end finishing, threading, and testing to meet the certification required.

For J55 pup joints, the Complainant produces an upset end by heating (upset forging) and butting to thicken the end of the pipe diameter for threading. J55 tubing is cut 8 inches longer than the required pup joint length to accommodate this process. In the case of L80 pup joints, the production process uses profiling rather than upset ends, and accordingly only 1/4 inch of additional length is needed to accommodate finishing. Profiling refers to machining the pipe towards the ends of the pipe so it is thicker at the far ends. This process is used instead of upsetting because upsetting a pipe with steel chemistry for an L80 grade would require the producer to heat-treat the pipe again.

Testing includes drift testing which is an assessment of the straightness within the hollow part of the tube, to ensure no bends or kinks exist after the pup joint was forged, and hydrostatic testing which assesses the pup joint"s ability to withstand internal pressure.4

Pup joints produced by the domestic industry compete directly with and have the same end uses as the subject goods imported from China. The goods produced in Canada and China are completely substitutable. Therefore, the CBSA has concluded that the pup joints produced by the Canadian industry constitute like goods to the subject goods. Pup joints can be considered as a single class of goods notwithstanding that the subject goods may be further differentiated in terms of seamless or welded.

All pup joints sold by the Complainant are sold to oilfield supply distributors who in turn sell the products to end users. The Complainant makes some sales directly to large volume end users and specialty manufacturing companies that require the product in conjunction with their own manufactured products (i.e. down hole pumps and wellheads).6

The Complainant estimated the import portion of the Canadian market using the best information available to them, recognizing that there is no publicly available information which segregates pup joints from the larger category of products which are oil country tubular goods.

The Complainant"s commercial intelligence indicates that China and the United States are the only countries that export commercially significant quantities of pup joints to Canada.

The Complainant provided estimates respecting the Canadian market for pup joints. These figures are based on their own domestic sales reports and on publicly available import data.

Detailed information regarding the volume of subject imports and domestic production cannot be divulged for confidentiality reasons. The CBSA has, however, prepared the following table to show the estimated import share of certain pup joints in Canada.

The Complainant alleged that subject goods from China have been injuriously dumped into Canada. Dumping occurs when the normal value of the goods exceeds the export price to importers in Canada. The Complainant provided information to support the allegation that the OCTG sector in China, which includes pup joints, may not be operating under competitive market conditions and as such, normal values should be determined under section 20 of SIMA. This included reference to the CBSA"s previous section 20 determinations in respect of its Certain Seamless Steel Casing and Certain Oil Country Tubular Goods final determinations on February 7, 2008 and February 22, 2010 respectively.

The Complainant provided information supporting a request that a section 20 inquiry be initiated in investigating their allegation of injurious dumping of the subject goods. Due to the lack of available information and because they believe that the conditions of section 20 exist, the Complainant did not provide any analysis regarding the domestic selling price of pup joints in China.

Estimated normal values were provided for models of pup joints that represent a major proportion of goods normally sold in Canada by the Complainant. The CBSA also noted that these products represented just over 50% of the specific products (i.e. matching grade, outside diameter and length) imported during the POI on a value basis.

The Complainant alleged that the conditions described in section 20 prevail in the OCTG sector in China, which includes pup joints. That is, the Complainant alleges that this industry sector in China does not operate under competitive market conditions and consequently, prices established in the Chinese domestic market for pup joints are not reliable for determining normal values.

With respect to the OCTG sector, which includes pup joints, the CBSA has information which demonstrates that the prices of OCTG products may be significantly affected by the GOC"s actions and as a result, prices of OCTG in China may not be substantially the same as they would be if they were determined in a competitive market.

Consequently, on September 12, 2011, the CBSA initiated a section 20 inquiry based on the information available in order to determine whether the conditions set forth in paragraph 20(1)(a) of SIMA prevail in the OCTG sector, which includes pup joints, in China. A section 20 inquiry refers to the process whereby the CBSA collects information from various sources so that the President may, on the basis of this information, form an opinion regarding the presence of the conditions described under section 20 of SIMA, in the sector under investigation.

As part of this section 20 inquiry, the CBSA sent section 20 questionnaires to all known exporters and producers of OCTG in China, as well as to the GOC requesting detailed information related to the OCTG sector which includes pup joints in China. In addition, the CBSA requested that producers in other countries, who are not subject to the present investigation, provide domestic pricing and costing information concerning pup joints.

In the event that the President forms the opinion that domestic prices of pup joints in China are substantially determined by the GOC and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be if they were determined in a competitive market, the normal values of the goods under investigation will be determined, where such information is available, on the basis of the domestic price or cost of the like goods sold by producers in any country designated by the President and adjusted for price comparability; or the selling price in Canada of like goods imported from a designated country and adjusted for price comparability.

A state-owned enterprise (SOE) may be considered to constitute “government” for the purposes of subsection 2(1.6) of SIMA if it possesses, exercises, or is vested with, governmental authority. Without limiting the generality of the foregoing, the CBSA may consider the following factors as indicative of whether the SOE meets this standard: 1) the SOE is granted or vested with authority by statute; 2) the SOE is performing a government function; 3) the SOE is meaningfully controlled by the government; or some combination thereof.

The following 11 grant programs, which were identified by the Complainant and previously investigated by the CBSA, were found to not be relevant to the pup joints investigation. The reason for their lack of relevance is that none of the exporters identified for this investigation are located in regions that would allow them to qualify for these subsidies. The affected programs are as follows:

The above-mentioned programs will not be investigated by the CBSA unless sufficient information is provided to justify their investigation. In this respect, the CBSA may further examine location-specific subsidy programs in the event that such programs are found in the areas where the identified pup joints producers are located.

SIMA refers to material injury caused to the domestic producers of like goods in Canada. The CBSA has accepted that the pup joints produced by the Complainant are like goods to those imported from China. The CBSA"s analysis primarily included information on the Complainant"s domestic sales, with a focus on the impact of the allegedly dumped and subsidized goods on their production and sale of like goods in Canada.

The Complainant alleged that the subject goods have been dumped and subsidized and that such dumping and subsidizing has caused and is threatening to cause material injury to the pup joint industry in Canada. In support of its allegations, the Complainant provided evidence of increased volumes of dumped and subsidized goods, lost sales, price erosion, price suppression, lost revenues, reduced gross margins, reduced profitability, loss of market share, loss of employment, reduced returns on investment, and underutilization of capacity.

The complaint cited the increase in subject welded casing/tubing immediately following the Tribunal finding onCertain Seamless Steel Casing, which subsequently resulted in measures against those products under the Certain Oil Country Tubular Goods finding, as evidence that in the absence of protection, the threat of injury on accessory products like pup joints will persist.

The import volumes were difficult for the Complainant to estimate, given that the subject goods would normally be imported under the same HS codes as other OCTG products. Consequently, there is no way for the Complainant to take the publicly available information which is segregated by HS code and accurately assess the value and quantity of certain pup joints imported into Canada. However, given that the Complainant knows the volume of sales they typically made to customers who now buy from Chinese sources, they were able to estimate the volume of Chinese imports.

Import data generated by the CBSA made use of ACROSS statements, which typically specify when OCTG tubing are pup joints and is thus more accurate, indicating comparable trends to those provided by the Complainant in terms of the relationship of subject imports to the total share of imports and to the overall Canadian market.

The CBSA"s analysis of Chinese pup joint imports in Q1 and Q2-2011 supports the Complainant"s position that subject goods are taking an increasing share of the Canadian market, as subject import volumes in that period increased to more than what was imported for the entire 2010 period.

The increase in Chinese imports is particularly noticeable in Q4-2010, where according to the data from FIRM,26 the two most significant lost customers identified by the Complainant began importing Chinese pup joints in substantial volumes. These two parties are in fact two of the three largest importers of Chinese origin pup joints during the July 1, 2010 to June 30, 2011 POI, accounting for over half of the value of subject imports.

The loss of sales to its largest customers in addition to other smaller customers, which cumulatively accounted for substantial portions of the Complainant"s pup joint revenue, has resulted in reduced revenues which have failed to reach those achieved in 2008.

To illustrate the downward trend in their pup joints business, the Complainant offered a comparison between the pup joints segment and the overall business of the division, to demonstrate that the pup joints segment"s decline in gross margins is not a reflection of their overall business.

In 2008, the Complainant"s pup joints business segment outperformed their total operations. Overall gross margins dipped in 2009 due to the recession but in 2010 and Q1-2011, overall gross margins have grown substantially, such that they exceed margins achieved on pup joints. Pup joint margins have conversely dropped over this same period.

The Complainant used a similar comparison of its relatively higher profitability in other oilfield products as evidence that dumped and subsidized Chinese pup joints have reduced profitability of their pup joint sales.

In contrast, the Complainant"s pup joints business reported a substantial drop in profits as a percentage of sales revenues from 2008 to 2009, with only a modest recovery in 2010 and Q1-2011, largely underperforming the division as a whole.

The Complainant alleged that their market share has steadily diminished since the emergence of Chinese pup joints in Canada after 2008. In fact, according to the CBSA"s estimate, the Complainant"s share of the Canadian market has decreased substantially since 2008.

With Q1 and Q2-2011 imports of subject goods already eclipsing the total volume of subject goods estimated by the CBSA to have been imported in all of 2010, the most recent evidence indicates that the Complainant is continuing to lose market share to alleged dumped and subsidized pup joints.

The Complainant stated that with a decline in orders for their like goods, which is attributable to the alleged dumped and subsidized imports of subject goods from China, their employment directly associated with the production of pup joints dropped considerably from 2008 to 2010.28

The Complainant is particularly concerned with its recent investment in paint and threading systems for pup joints, which was required with the transfer of certain production from facilities from its affiliate in the United States. The injury caused by the alleged dumped and subsidized pup joints will make it more difficult to recoup on this investment, given the total cost of the project.

The Complainant stated that they have the available capacity to meet considerably more Canadian demand were they not having to compete with dumped and subsidized Chinese pup joints. The Complainant reported capacity utilization declined considerably from 2008 to 2010.

The Complainant alleges that the current growing trend of lost customers in Canada through the first half of 2011 is an indication that these customers are increasingly sourcing pup joints from China.

Based on information provided in the complaint, other available information, and the CBSA"s internal data on imports, there is evidence that certain pup joints originating in or exported from China have been dumped and subsidized, and there is a reasonable indication that such dumping and subsidizing has caused or is threatening to cause injury to the Canadian industry. As a result, based on the CBSA"s examination of the evidence and its own analysis, dumping and countervailing investigations were initiated on September 12, 2011.

The CBSA has also requested costing and sales information from producers of pup joints in multiple countries. Where sufficiently available, this information may be used to determine normal values of the goods in the event that the President of the CBSA forms an opinion that the evidence in this investigation demonstrates that section 20 conditions apply in the OCTG sector, which includes pup joints, in China.

This included a review of US, Indian and European OCTG producers, segregated to examine only financial results related to OCTG tubing where available. OCTG tubing is the product segment most closely related to the pup joints subject to these investigations. Segregated financial reporting at the more specific ‘pup joint" level was not found.

Pup Joints were subject to the Certain Oil Country Tubular Goods investigation prior to their exclusion at the Tribunal. The provisional period for that investigation began November 23, 2009, so that year was largely unaffected by the investigation.

The oil and gas industry (like many others) has a lot of industry specific terminology. In many cases, this terminology is specific to the region and/or type of reserves being developed. AlphaTally is an auto-design tool producing the tallies describing the order of parts in the casing string. In this article, we will go into the basic principles and the nuances of the key parts of a casing string, particularly the key functionalities of casing joints, swellable packers, slotted/perforated liners and the ACP / stage tool. We hope this can provide insight into the workings of coals seam gas wells and the associated jargon for anyone who might be interested, regardless of background.

A well’s casing is a large metal pipe which fits to the edge of the drilled hole. This metal pipe is then cemented to the rock formation, in order to seal it. Typically, multiple holes and their associated casing, of differing diameters, are drilled and placed concentrically in order to stabilize the wellbore. Primarily, the functions of casing are as follows:Preventing the formation wall from caving into the wellbore

The physical makeup of the casing comprises of smaller pipe joints which are connected together as the casing is “ran” into the wellbore, prior to cementing. These joints are typically around 13m (40ft) for “full” joints, or can come in a variety of smaller sizes as “pup” joints. Joints are either manufactured with a male and female thread form or dual male thread forms, requiring the use of couplings to join them. The ends of a casing joint are defined by their associated thread form, defined as the pin end where the male thread form is and the box end where the female thread form is, as shown below.

Mechanically, these assemblies consist of the following parts, from shallowest depth set to deepest: ACP pup joint, float collar, stage tool, ACP. The functions of each of these parts within the respective role of the assembly is outside the scope of this article.

As the name suggests, slotted or pre-perforated liners are parts of the tubing string which are ran with holes already drilled into them. These holes allow for production of wellbore fluids. Traditionally, solid tubing was run down and small explosives were used to perforate the desired sections. However, this was found to be less suitable in coal seam gas developments, due to the efficiencies of installing a part that has already been perforated in the factory and the greater onus placed on surface area exposed . As a result, the majority of coal seam gas developments utilize pre-perforated completions (fracked completions are used where the coal permeability is not sufficiently high).

8613371530291

8613371530291