china rongsheng heavy industries group holdings pricelist

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

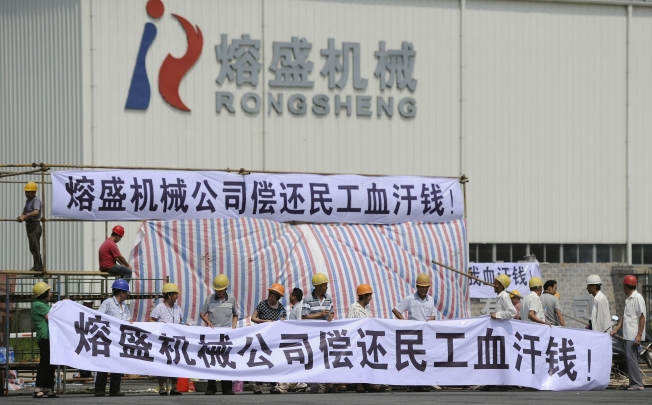

Trading of shares and all structured products related to the company was suspended pending clarification of “news articles and possible inside information,” Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported yesterday, citing Lei Dong, secretary to the Shanghai- based company’s president, that more than half of the employees laid off were subcontractors and the rest full-time workers.

Rongsheng shares slumped 10 percent yesterday after the company said some idled contract workers had engaged in “disruptive” activities by surrounding the entrance of its factory in east China’s Jiangsu province. China’s shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongsheng’s 2012 revenue.

“Rongsheng’s move reflects the bad market,” said Lawrence Li, an analyst at UOB-Kay Hian Holdings Ltd. in Shanghai. “More small-to-medium sized shipyards, especially those that lack government support, may take the same actions or even close down.”

Rongsheng spokesman William Li declined to comment on the Journal report. Four calls to Lei’s office at Rongsheng went unanswered. Rongsheng Chairman Chen Qiang also declined to comment today.

Rongsheng had as many as 38,000 workers including its own employees and contract staff at the peak of the industry boom a few years ago, UOB-Kay Hian’s Li said.

The order book at China’s shipbuilders fell 23 percent at the end of May from a year earlier, according to data from the China Association of the National Shipbuilding Industry. Yards have reduced down-payment requirements, with some slashing their rates to as little as 2.5 percent of contract value compared with 20 percent before 2010, according to UOB-Kay Hian.

Economic growth in China has held below 8 percent for the past four quarters, the first time that has happened in at least 20 years. The nation’s clampdown on excessive short-term borrowing sent the overnight repurchase rate to a record 13.91 percent last month, forcing at least 22 companies including China Development Bank Corp., a backer of the shipping industry, to cancel or delay bond sales.

China Rongsheng posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, according to data compiled by Bloomberg. It had short-term debt of 19.3 billion yuan as of the end of 2012, the data show.

Rongsheng received orders to build a total of 16 Valemax vessels from Brazilian miner Vale SA and Oman Shipping Co. and had delivered 10 as of April. The commodity ships, among the biggest afloat, are about twice the size of the capesize vessels that have traditionally hauled iron ore from Brazil to China.

The company’s cash conversion cycle, a gauge of days required to convert resources into cash, more than doubled to 582 last year from 224 in 2011, the data show. China Rongsheng shares have fallen 15 percent this year in Hong Kong, compared with a 11 percent decline for the benchmark Hang Seng Index.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Investors have turned cautious on the industry after it was dealt a heavy blow by the economic downturn, with orders shrinking last year and the sector yet to fully recover.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

HONG KONG, Nov 26 (Reuters) - China Rongsheng Heavy Industries Group, the country’s largest private shipbuilder, said its chairman had stepped down just three months after the company posted its sharpest fall in half-year net profit.

Listed in November 2010, Rongsheng was hit by an insider dealing scandal involving a firm owned by Zhang ahead of the $15.1 billion bid for Canadian oil firm Nexen Inc by China offshore oil and gas producer CNOOC.

Rongsheng said earlier this month that investment firm Well Advantage, controlled by Zhang, had agreed to pay $14 million as part of a settlement deal with the U.S. Securities and Exchange Commission (SEC).

In August, Rongsheng posted an 82 percent drop in half-year profit on a dearth of new orders and warned economic uncertainties would continue to weigh on the global shipping market.

Zhang Zhirong has also resigned as chairman of Glorious Property Holdings Ltd, the property developer said, as part of a series of executive changes at the company.

As part of the changes at China Rongsheng, the company said that Zhang De Huang was retiring and had resigned as an executive director and as vice chairman of the board.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

--File--Zhang Zhirong (R), Chairman of Glorious Property Holdings Limited, is pictured during a groundbreaking ceremony in Nantong city, east Chinas Jiangsu province, 18 December 2008. China Rongsheng Heavy Industries Group Holdings Ltd., which hasnt announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe. Chinas biggest shipbuilder outside state control tumbled 16 percent on Monday (30 July 2012) in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rongs Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by Cnooc Ltd. The SEC also won a court order freezing about $38 million of the traders assets. The investigation may deter customers from placing orders, Jon Windham, an analyst at Barclays Plc., said by phone. Rongsheng, based in Shanghai, has tumbled 86 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said that first- half profit probably dropped significantly because of falling prices and slowing orders.

War, pandemic and sluggish markets hit the world’s billionaires this year. There are 2,668 of them on Forbes’ 36th-annual ranking of the planet’s richest people—87 fewer than a year ago. They’re worth a collective $12.7 trillion—$400 billion less than in 2021. The most dramatic drops have occurred in Russia, where there are 34 fewer billionaires than last year following Vladimir Putin’s invasion of Ukraine, and China, where a government crackdown on tech companies has led to 87 fewer Chinese billionaires on the list.

America still leads the world, with 735 billionaires worth a collective $4.7 trillion, including Elon Musk, who tops the World’s Billionaires list for the first time. China (including Macau and Hong Kong) remains number two, with 607 billionaires worth a collective $2.3 trillion.

Alexander Otto owns a stake in Otto Group and is majority shareholder and CEO of ECE Group, a commercial real estate firm focused on shopping centers.

KEEP IN TOUCH MARINE NEWSChinaYour e-Paper-newsflash on: >> Economics & Trade >> Shipping Companies >> Shipbuilding >> China Portsin the Asia-Europe trade soon afterdelivery in April. The remainder, alsoaround 366m long and 48.2m wide, andhaving a maximum speed of 23.7k, willbe delivered this year and next.According to Lloyds List Intelligence,the last two will be delivered in January2013 and March 2013.As Hanjin provides vessels in theCKYH Alliance"s loop 1 and loop 6(there is no loop 5 yet), which currentlydeploy nine vessels averaging10,400TEU and ten vessels averaging9,081TEU respectively, they will,presumably, be used to upgrade these.Alternatively, they could be used inloop five, when it is re-introduced,although there appears little need forthis at present. Given Europe"slanguishing economy, there is unlikelyto be need for any additional capacitythis year, which underlines thedifficulty faced by carriers with ULCVsdue for delivery in 2012. (Source: JOC)>> ShipbuildingChinese ShipbuildingIndustry at a turningpoint>>Shanghai: Under troubled market,Chinese shipbuilding industry appearsto make alterations according tochanging times and circumstances.Chinese shipbuilders are active in upgradingcommercial ship, as well aswinning orders for offshore facilities,high-value vessels, green ship, etc,according to the China Association ofthe National Shipbuilding Industry(CANSI).For instance, Shanghai WaigaoqiaoShipbuilding (SWS) inked four180,000-dwt eco-friendly bulkers fromU-Ming Marine Transport, whichreduced fuel consumption by 15%. Also,Yantai CIMC Raffles Offshore bookedan order for one semi-submersible riglast month.This represents that Chinese marineindustry takes actions against recentdepression in the market, changes indemand and new environmentalregulations. Moreover, Chinesegovernment makes up and carries outpolicies which boost domestic demand.Statistics reported from CANSI said,during January-February period, 57numbers of China"s major shipbuildingand shipbuilding-related companies seedecreased revenue by 7.3% to US$5.33billion year-on-year, while net profitfell to US$288.37 million, down by26.2%.Meanwhile, faced with depressed bulkermarket by February this year, acumulative 22 vessels of 1.18m dwtbulkers have been cancelled, 0.8% oforderbook as of the end of February and61.1% of overall orders cancelled in2011. During the same period, China"smajor yards" ship repair stood at 512vessels, down by 1% year-on-year.Major yards have declined overallrevenue and average net profit by 15%and 35% each.CANSI analyzed that slow recovery inglobal economy and newbuilding pricebeing unlikely to hike caused largescalestructuring of Chineseshipbuilding industry. Despite anestimated 70m-dwt delivery for 2012,relatively slow ordering activity wouldkeep orderbook sliding.Also, most of newbuildings scheduledfor delivery this year had been orderedin low-margin after global financialcrisis in 2008. Thus, shipbuilders wouldsee decrease in earnings. (Source: Asiasis)Rongsheng plans todeliver 10 giant oreships to Vale this year>>Hangzhou: China Rongsheng HeavyIndustries Group Holdings, thecountry"s largest non-state-ownedshipbuilder, said it planned to deliver 10very large vessels to Brazilian mininggiant Vale this year.Rongsheng delivered the first of the 12very large ore carriers (VLOCs), thelargest bulk carrier in the world, orderedby Vale in November but the secondand third were delayed to March orApril from last year, chief executiveChen Qiang told reporters at a resultsbriefing.Vale"s plan to cut transport costs with afleet of giant "Valemax" (VLOCs) raninto trouble in January after Chinarefused to allow the 400,000deadweight ton (dwt) vessels to dock atits ports, triggering concerns that Valemay have to delay or cancel its VLOCorders. But Chen said most of theVLOCs ordered by Vale will bedelivered this year. "There maybeleaving one to be delivered next year, atmost," he added.Rongsheng also has orders to build fourVLOCs for Oman Shipping Co, whichwill charter the ships to Vale.The shipbuilder, which has been hit byrising yuan and a supply glut amid ashipping industry downturn, posted aflat net profit of US$272.97 million for2011. It missed consensus forecast ofUS$384.07 million from 11 analystspolled by Thomson Reuters I/B/E/S.There had been delay delivery of morethan 10 vessels last year due to theEuropean debt crisis and revenue fromEuropean clients fell 34 percentagepoints to 19 % of total in 2011, Chensaid.Rongsheng obtained orders for 39 newvessels worth US$1.8 billion in 2011,down from orders for 46 vessels worthUS$2.26 billion the previous year.However, it outperformed the industryas new orders received by Chineseshipbuilders decreased more than 58%to 29.3 million dwt last year."The market will continue to be toughin the first half and should improve inthe second half as the Europe debt crisiseases," Chen said.Rongsheng will actively seek upgradingand restructuring of its productofferings to help counter the currentmarket downturn, he added. (Source: Reuters)© 2012 SONSEC GMS (HK) Ltd. – Hong Kong (P.R. China) - 3 -

KEEP IN TOUCH MARINE NEWSChinaYour e-Paper-newsflash on: >> Economics & Trade >> Shipping Companies >> Shipbuilding >> China PortsYangzijiang plansrebirth as “All-aroundMaritime Group”>>Nanjing: China"s JiangsuYangzijiang Shipbuilding plans to bereborn as an "All-around MaritimeGroup", by business diversification inorder to make a long-term development.China"s one of largest private-ownedYangzijiang has divided its businessesinto three different group - Mainbusiness (shipbuilding), Base business(offshore, large-size steel structure andship repair) and Supplementarybusiness (ship lease, real estate andfinancing) - for the last five years.As for the offshore business,Yangzijiang established joint venturecompanies each in Singapore and Chinawith Qatar company. The Qatar firmwould firstly place an order for twodrilling platforms at the JVs, withtechnical matters under discussion.Yangzijiang plans to expand its shiprepairing capacity of 200,000 ldt to600,000 ldt, 15 vessels in terms ofVLCC), by having the whole JiangsuHuayuan Metal Processing andJingjiang City Dunfeng Ship Dismantleunder its arm. During December 2011,Yangzijiang has acquired additional80% shares of Jiangsu Huayuan, whichis a parent company of Dungfeng ShipDismantle, with US$38 million)invested.Other businesses such as ship lease, realestate and financing are activelyoperated now.Chairman Ren Yuanlin, Yangzijiangsaid that Yangzijiang will focus onshipbuilding business as well, while itdiversifies and expand into otherbusinesses, which would be a win-winfor every business. (Source: Simic)Jiangnan Shipyardpenned order for twoice-class bulkers>>Shanghai: Diana Shipping of Greecehas penned a US$58 million order toconstruct a pair of ice-class panamaxbulkers at China Shipbuilding TradingCo and Jiangnan Shipyard under CSSCumbrella.The New York-listed owner says itexpects the 76,000-dwt ice-class vesselsto hit the water in the fourth quarter of2013.Brokers say the US$29 million price tagrepresents a “modest” US$1 milliondiscount when compared to the currentmarket average for similarnewbuildings and is US$6 millionabove than what an owner might pay forfive-year-old panamax second-hand.The orders appears to reflect a growingappetite for modern ice-class vessels ina market overburdened with ageingtonnage that has become increasinglydifficult to trade due largely to theglobal capacity glut.There has been an increase of interest inbuilding ice-class bulk carriers of late,with recent orders including a quartet ofice-class 1A 76,000-dwt panamaxesordered by compatriot owner DryShipsat a cost of US$34 million a piece atRongsheng Heavy Industries in Chinafor delivery in 2014. (Source: Asiasis)>> China PortsGuangxi to spend US$2.21bn to reach 160mtonnes port capacity>>Nanning: Guangxi AutonomousRegion plans to spend US$2.21 billionon waterway traffic projects this yearwith Beibu Gulf port capacity to beincreased to 160 million tonnes, whileXijiang River"s cargo capacity to rise100 million tonnes, Xinhua reports.This year, Guangxi plans to build theNo 403 to No 407 berth at the port ofFangcheng and the No 3 and No 4 berthin the Beihai"s Tieshan port area.Meanwhile, Guangxi will alsoaccelerate construction at the port ofQinzhou"s Jingujiang River navigationalchannel and the No 1 to No 3 berth atDalanping port area.Fangcheng port"s berth project will takeup 41 % of the total investment. Beihaiport"s berth project will take up 78 %.Qinzhou"s Jingujiang river navigationalchannel will account for 8.5 %.Dalanping port area"s berth project willtake up 3.9 %.In the meanwhile, Guangxi plans tocomplete the construction of XijiangRiver"s distribution network, portNanning"s Niuwan operation area phase1 of the project and the port of Laibin"sBingang operation area in phase 2 of theproject this year. (Source: Simic)China MerchantsHoldings 2011 profitdown 5.2%>>Hong Kong: Chinese port operatorChina Merchants Holdings(International) Co. said its 2011 netprofit fell 5.3% due to risingadministrative expenses and financecosts, MarketWatch reports.The blue chip company, a unit of stateownedChina Merchants Group, said itsnet profit for the 12 months ended Dec.31 was US$717.22 million, down fromUS$757.14 million a year earlier.Revenue rose 63% to US$1.22 billionfrom US$748 million.The company recommended a finaldividend of US$0.0876, down fromUS$0.10 a year earlier. ChinaMerchants is the largest containerterminal operator by volume inShenzhen, mainland China"s secondbiggestport by volume after Shanghai.(Source: MarketWatch)------------------------------------------------Not happy with us?In that case we have to improve our servicequality and hope to see you back soon …UNSUBSCRIBEEdited and published by:SONSEC GMS (HK) Ltd. – Hong Kong (P.R. China)www.sonsec.cominfo@sonsec.comNote: This e-paper / newsletter is free ofcharge and was permitted and subscribed toby you or a third party underwww.sonsec.com or at prior notification.© 2012 SONSEC GMS (HK) Ltd. – Hong Kong (P.R. China) - 4 -

8613371530291

8613371530291