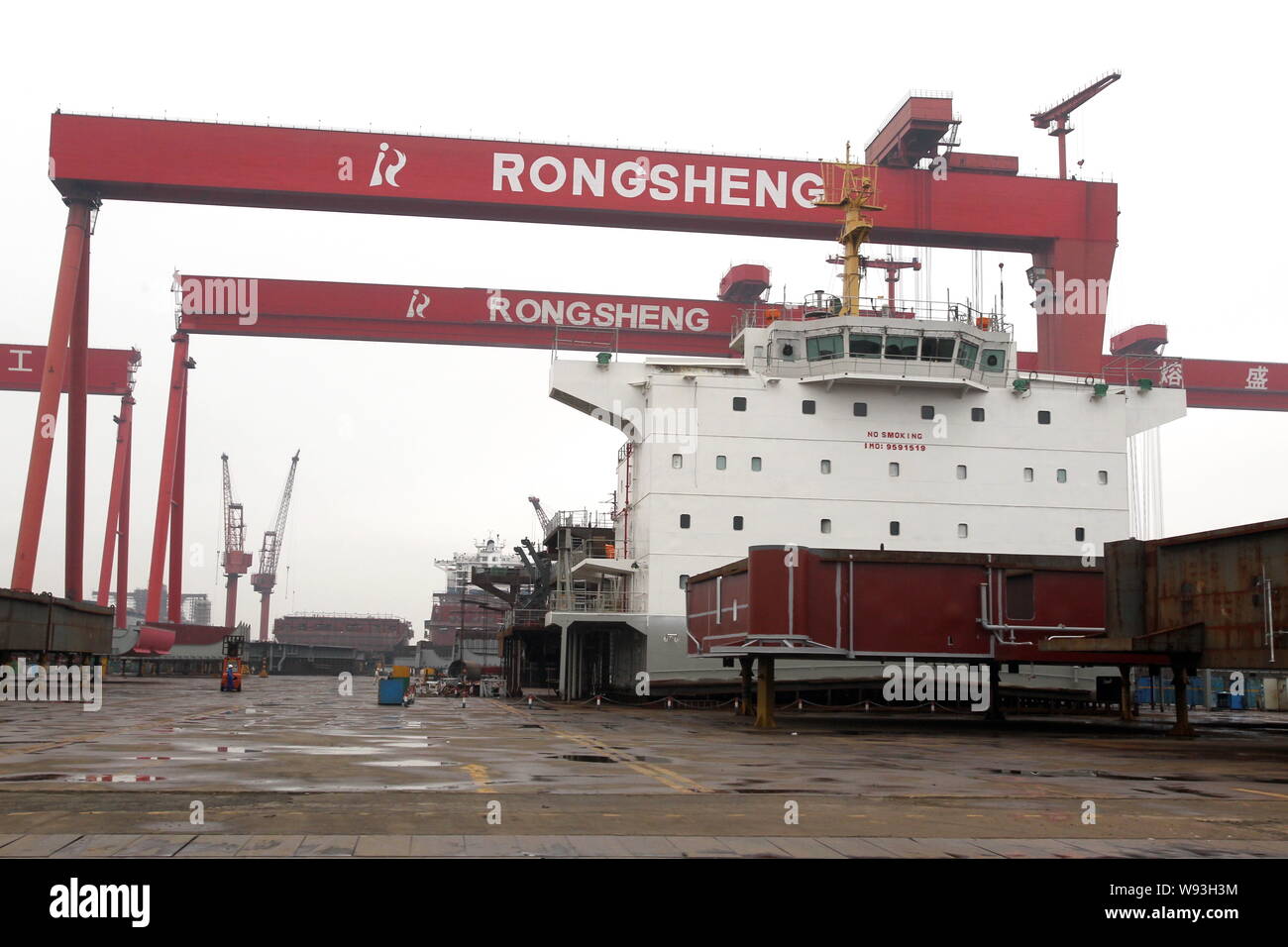

jiangsu rongsheng heavy industries group manufacturer

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

(Beijing) – Piles of rusty steel bars and old ship parts are virtually all that"s left of a sprawling shipyard in the eastern city of Rugao, where Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people.

Once China"s largest shipbuilder, Rongsheng is on the verge of bankruptcy. Orders have dried up and banks are refusing credit. Questions have been raised about the shipyard"s business practices, including allegations of padded order books. And Rongsheng is apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms, sources told Caixin.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

"The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company"s conservative sales strategy under the current trough stage of the shipbuilding market," China Rongsheng said in a statement to the Hong Kong stock exchange.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year.

Dryships has four dry bulk carriers on order at the company"s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

FURTHER OVERSEAS REGULATORY ANNOUNCEMENT ON THE AUDITED FINANCIAL INFORMATION OF JIANGSU RONGSHENG HEAVY INDUSTRIES FOR THE YEAR ENDED 31 DECEMBER 2013

This announcement is issued by China Rongsheng Heavy Industries Group Holdings Limited (the "Company") in accordance with Rules 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

Reference is made to the announcement of the Company dated 21 March 2012 in respect of the issue of medium-term notes by its subsidiary, Jiangsu Rongsheng Heavy Industries Co., Ltd. (江 蘇熔盛重工有限公司 ) (a company indirectly owned by the Company as to approximately

96.09%) ("Jiangsu Rongsheng Heavy Industries") in the People"s Republic of China (the "PRC") and the announcement of the Company dated 25 April 2014 in respect of the audited financial information of Jiangsu Rongsheng Heavy Industries and its subsidiaries for the year ended 31 December 2013, which have been prepared in accordance with the PRC Generally Accepted Accounting Principles (the "Audited Annual Financial Information").

PRC, Jiangsu Rongsheng Heavy Industries has published an announcement on the websites of www.chinabond.com.cn and www.chinamoney.com.cn to provide further information with respect to the Audited Annual Financial Information, the key content of which is set out below.

For the year ended 31 December 2013, Jiangsu Rongsheng Heavy Industries and its subsidiaries recorded an operating loss and a total loss of approximately RMB6,971 million and RMB6,944 million, respectively, and a net loss of approximately RMB6,851 million.

The net loss incurred for the year ended 31 December 2013 was primarily due to the decrease in revenue as a result of the conservative sales strategy of Jiangsu Rongsheng Heavy Industries under the current trough stage of the shipbuilding market, and provisions for impairment on

various items. Such losses may lead to adverse effects on the production and operation, financial position and repayment capacity of Jiangsu Rongsheng Heavy Industries. Jiangsu Rongsheng Heavy Industries has been proactively adopting measures to improve operational performance and financial position, and to mitigate liquidity pressure. Those measures include but are not limited to: negotiating with principal banks for the renewal and extension of loans and banking facilities; obtaining financial support from a shareholder of its parent-holding company; controlling administrative costs through human resources optimization and reduction of middle to senior level management"s remuneration, and suppressing capital expenditure; negotiating for better payment terms and revising up prices of certain existing shipbuilding orders; redesigning operation flow and controlling costs for existing shipbuilding orders; maximizing sales efforts and obtaining the appropriate project-based financing; establishing strategic cooperation with key suppliers with a view to reduce the costs of supplies.

8613371530291

8613371530291