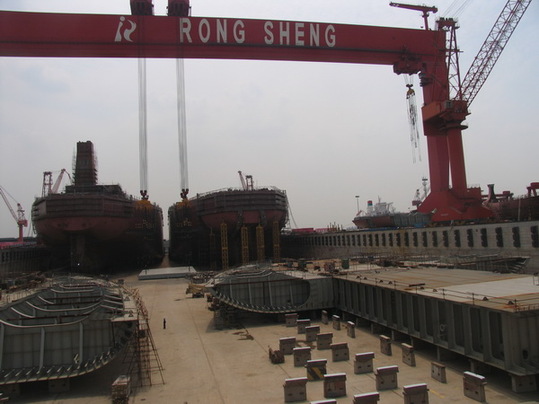

jiangsu rongsheng heavy industries group factory

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

Back in 2008, Rongsheng Heavy Industries Co failed in its bid to raise more than $2 billion from a planned IPO in Hong Kong, mainly due to the global financial crisis. But things are looking up again for the company as it is looking to list in the city this week.

Meanwhile, China"s biggest private shipbuilder Jiangsu Rongsheng Heavy Industries Co, which last year won a $484 million order to build four vessels for Oman Shipping Company, is also gaining significant exposure to the engineering machinery market via its expansion company, Rong"an Heavy Industries.

Founded by Rongsheng, Rong"an Heavy Industries was established in March of this year at the Hefei hi-tech industrial area in Anhui province. With a total investment of 60 million yuan, the new firm plans an annual output of 3 million hydraulic excavators, 1,000 crawler cranes, 5,000 tower cranes, 17,860 truck cranes and 500 rotary drilling rigs. The output is worth some 300 billion yuan. And from previously being one of the lower-ranking engineering machinery production bases in China, Hefei is now one of the largest.

"We are planning to begin operations in June next year," said Deng Hui, president of Rong"an Power Machinery Co Ltd, another Rongsheng engineering machinery market investment.

Rongsheng Heavy Industries is a large-scale heavy industry enterprise group that possesses manufacturing bases for shipbuilding and offshore engineering in Nantong, Jiangsu province. It also manufactures diesel engines in Hefei.

(24 November 2013, Hong Kong) - China Rongsheng Heavy Industries Group Holdings Limited ("China Rongsheng Heavy Industries" or the "Group"; stock code: 01101.HK), a large heavy industries group in China, is pleased to announce the delivery of its 380,000

DWT class Very Large Ore Carrier ("VLOC") "VALE LIANYUNGANG" to Vale S.A. ("Vale") recently. The vessel is the twelfth 380,000 DWT class VLOC delivered by the Group since its inception, and is the Group"s fifth delivery of VLOCs this year.

Vale is an important strategic partner of China Rongsheng Heavy Industries. The Group has formed a close and seamless partnership with Vale, and the Brazilian mining giant is a reputable firm with a strong track record in risk management. Among the 16

The 380,000 DWT class VLOC built by China Rongsheng measures 360 meters in length, 65 meters in breadth and 30.4 meters in depth, and is currently the world"s largest VLOC. The self-developed and high-tech vessel type represents the most advanced technology of VLOCs in the world. It adopts an environmentally friendly design focusing on lowering fuel consumption and reducing CO2 emission, while its operating efficiency exceeds most existing ore carriers. With Energy Efficiency Design Index ("EEDI") recorded at approximately 1.99 during sea trials, Rongsheng-built VLOCs are in line with low-carbon green product initiative and meets the benchmark requirements on emission reduction set by International Maritime Organization ("IMO"), which came into effect as of 1 January 2013.

China Rongsheng Heavy Industries Group Holdings Limited and its subsidiaries are a leading diversified large heavy industries group in China. Our headquarters is located in Hong Kong, with manufacturing bases in Nantong (Jiangsu Province) and Hefei (Anhui Province). Rongsheng Offshore & Marine was established in Singapore to promote our offshore engineering business. Our business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery. According to Clarkson Research, China Rongsheng Heavy Industries was the largest non-state-owned shipbuilder in the PRC in terms of orders on hand measured by DWT as at the end of June 2013. The Group operates the largest shipyard in the PRC and is a global leader in the manufacture of the very large ore carrier.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

The company"s shares dropped 10 percent on Wednesday after it told the Wall Street Journal that some of its contract workers had engaged in "disruptive" activities and had surrounded the entrance of its factory in Jiangsu province.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

HONG KONG, May 24, 2011 /PRNewswire-Asia/ -- China Rongsheng Heavy Industries Group Holdings Limited ("China Rongsheng Heavy Industries" or the "Group"; stock code: 01101.HK), a large heavy industries group in China, has collaborated with China National Offshore Oil Corporation ("CNOOC") to construct the world"s first-ever 3,000-meter deepwater pipe laying crane vessel ("DPV") "Ocean Pec 201". A national major science and technology project conference and a christening ceremony to celebrate the completion of the vessel were held in Rugao City, Jiangsu today.

The DPV "Ocean Pec 201" was the culmination of the first joint offshore engineering project of CNOOC and China Rongsheng Heavy Industries. The project started in May 2005 and construction of the vessel commenced in September 2008. Offshore Oil Engineering Co., Ltd. ("COOEC"), a listed company held by CNOOC, was responsible for all construction cost as well as the operation upon completion. The christening ceremony today symbolised that the construction of the DPV has completed the outfitting and testing stages and is at the final stage of trial voyage and delivery.

Guests including top management of China Rongsheng Heavy Industries and its partners together with leading officials of the local Government presided over the occasion and officiated at the ribbon-cutting ceremony. Business executives included Mr. Zhou Shouwei, Vice President of CNOOC and academician at the Chinese Academy of Engineering; Mr. Zhou Xuezhong, President of COOEC; Mr. Zhang Dehuang, Chairman of Jiangsu Rongsheng Investment Group Co. Ltd; Mr. Chen Qiang, Chief Executive Officer of China Rongsheng Heavy Industries and Mr. Chen Guorong, President of Jiangsu Rongsheng Heavy Industries Co., Ltd. Local officials included Mr. Qinyan from the Jiangsu Economic and Information Technology Commission and Ms. Chen Huijuan, Deputy Mayor of Nantong & Secretary of Rugao Municipal Committee of the Communist Party of China.

Mr. Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, ""Ocean Pec 201" is an important part of the demonstration engineering projects. It includes major equipment and ancillary engineering technology for offshore deepwater engineering projects among the major national science and technology programmes under China"s Eleventh Five-Year Plan. The entry of CNOOC in deep water exploitation creates opportunities for the offshore engineering sector in China and enhances the overall capability of the related manufacturing and metallurgy industries in China. The christening and impending trial voyage of the semi-submersible drilling rig "Ocean Pec 981" and DVP "Ocean Pec 201" highlights China"s ability to develop sophisticated equipment in the offshore engineering sector and its competitiveness in the international market."

"Ocean Pec 201" is the world"s first deepwater pipe laying crane vessel featuring 3,000-meter deepwater pipe-laying, 4,000 tonnes of lifting capacity and DP-3(1) dynamic positioning capability(2). The vessel is able to operate in any navigable area globally except for the Arctic regions. It is equipped with a series of advanced equipment including electric propulsion, VF electric drive, DP-3 dynamic positioning, "S" type deepwater dual node pipe-laying system as well as a 4,000-tonne heavy offshore crane. The vessel was designed and built in China. With a crew of 380, it is the first offshore engineering vessel in Asia and China capable of laying pipes at a water depth of 3,000 meters. The overall technology and capacity are also superior to similar vessels overseas.

Mr. Chen added, "Offshore engineering has been the major focus of the Group. We now own China"s largest offshore engineering dock equipped with China"s largest gantry crane with a lifting capacity of 1,600 tonnes. The DPV is the first collaborative project between CNOOC and China Rongsheng Heavy Industries. In the future, we expect to further strategically cooperate with CNOOC in the offshore engineering field. Upon completion of the "Ocean Pec 201", China Rongsheng Heavy Industries intends to further strengthen its design and construction capabilities, and lay a solid foundation to expand its offshore engineering business."

Mr. Chen concluded, "Looking ahead, the Group will continue to gradually expand our operating scale as stated in the prospectus and focus on high-end manufacturing and the development of large containerships to maintain our leadership in the shipbuilding engineering sector. We will also make marine engine building and offshore engineering our new growth drivers. Our aim is to develop the Group into a leading global heavy industries group and take the heavy industries in China onto the international stage."

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries" business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. China Rongsheng Heavy Industries" products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Group"s products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.

--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industries Group Holdings Ltd., the nations biggest shipyard outside state control, halted share trading on Thursday (4 July 2013) after a report the company recently pared about 8, 000 jobs. Trading of shares and all structured products related to the company was suspended pending clarification of news articles and possible inside information, Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported, citing Lei Dong, secretary to the Shanghai-based companys president, that more than half of the employees laid off were subcontractors and the rest full-time workers. Rongsheng shares slumped 10 percent on Wednesday after the company said some idled contract workers had engaged in disruptive activities by surrounding the entrance of its factory in east Chinas Jiangsu province. Chinas shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongshengs 2012 revenue.

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group.

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

Suntech Power Holdings, a solar panel maker also based in Jiangsu, is waiting to be bailed out by the government after it was crushed by falling demand and a supply glut, a source with knowledge of the matter said in March. The government wants to find a way to rescue Suntech to avoid an embarrassing collapse that damages its reputation, the source said.

China’s shipbuilding woes are partly of its own making. A global downturn in demand has hammered the sector since 2008, but a national obsession for global dominance in some industries led China to declare in the early 2000s that it wanted to be the world’s top shipbuilding nation by 2015.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Just last week Premier Li Keqiang said the government wanted to bring about orderly closures of some factories plagued by overcapacity. A statement from the State Council, or cabinet, did not specify any particular industries or companies.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

8613371530291

8613371530291