nantong rongsheng shipyard manufacturer

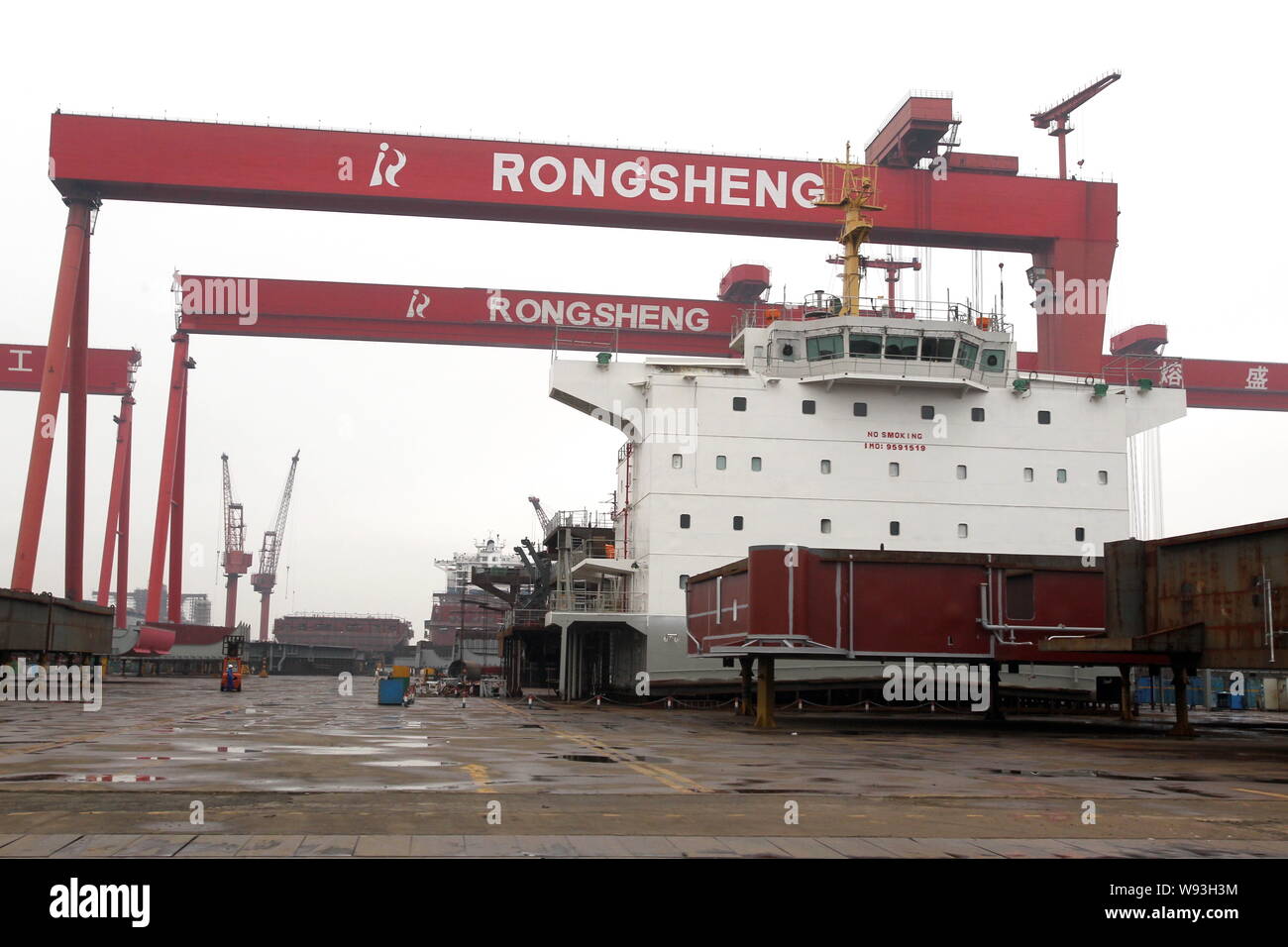

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

As orders for new ships began to dry up, China in 2013 issued a three-year plan urging financial institutions to support the shipbuilding industry. Ship owners placing orders for China-made vessels, engines and some parts should get better funding, the State Council said. A third of the more than 1,600 shipyards in China could shut down in the next five years, an industry association predicted earlier.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industries Group Holdings Ltd., the nations biggest shipyard outside state control, halted share trading on Thursday (4 July 2013) after a report the company recently pared about 8, 000 jobs. Trading of shares and all structured products related to the company was suspended pending clarification of news articles and possible inside information, Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported, citing Lei Dong, secretary to the Shanghai-based companys president, that more than half of the employees laid off were subcontractors and the rest full-time workers. Rongsheng shares slumped 10 percent on Wednesday after the company said some idled contract workers had engaged in disruptive activities by surrounding the entrance of its factory in east Chinas Jiangsu province. Chinas shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongshengs 2012 revenue.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

"Chinese shipyards of all sizes have been hit hard in the past two years, and they often lack the technology and bank loans needed to produce the sophisticated vessels sought in many new orders," Li said.

COSCO Shipping Heavy Industry, China"s third-largest shipbuilder by output, plans to reduce the number of its offshore construction shipyards from five to two by 2020.

Under the plan, shipyards in Nantong, Zhoushan and Dongguan will be closed. Shipyards in Qidong and Dalian will remain open as they also build polar ships, drilling platforms and cattle carriers, reports China Daily.

Declining international oil and shipbuilding prices, growing costs for materials and labor have become factors squeezing shipyards" earning ability globally," a COSCO spokesman said.

Established in December 2016, the company was formed out of the previous COSCO Shipyard Group, COSCO Shipbuilding Industry and China Shipping Industry. COSCO Shipyard and China Shipping Industry all reported financial losses last year. http://maritime-executive.com/article/cosco-to-close-three-shipyards

Wison Offshore & Marine today announced that the world’s first barge-based Floating Storage and Regasification Unit (FSRU), for which the company provided EPC services for Exmar, has undocked from Wison’s dry-dock in Nantong, China, marking another major milestone for this project. Upon the undocking, topside installation has been completed, which paves the way for successful delivery.

Rugao port is adding infrastructure whereby it will be able to handle up to 800,000 teu a year. The river port in Jiangsu province near Rongsheng shipyard is building four 5,000 dwt terminals, two 10,000 dwt terminals and one 20,000 dwt terminal. There will also be a 400,000 sq m container yard with all work likely to be finished by the end of 2014. [SinoShipNews 24/07/13]Upload News

As hard times continue in the shipbuilding industry, former giant Rongsheng is in deep financial trouble. The company hopes a move into the energy sector can change its fortunes, but analysts are skeptical.

Amid dark times in the global shipbuilding industry, another of China"s major players appears to be on the verge of bankruptcy. China Rongsheng Heavy Industries Group used to be the largest private shipbuilder in the country, but is now seeking potential buyers to help get it out of deep financial problems.

In the past few months, many workers have left Rongsheng"s plant in Nantong, East China"s Jiangsu Province, which stopped production after it delivered a ship to Brazilian iron ore giant Vale in January, Caixin magazine reported on March 9.

The once-busy plant in Nantong used to have as many as 30,000 workers, but now "only several thousand of them are still there," a Rongsheng employee who declined to be named told the Global Times on Tuesday.

The employee has been working at Rongsheng for more than five years, but said he will also be leaving the company soon. Having watched the ups and downs of Rongsheng, he said he will not be staying in the shipbuilding industry either. "It has been such a sad story for the industry," he said.

No more plain sailingRongsheng was founded by entrepreneur Zhang Zhirong in 2005, when the shipbuilding industry was booming. The initial designed annual capacity of the plant in Nantong was as much as 3.5 million dead weight tons, nearly the same as the total annual capacity of State-owned China State Shipbuilding Corp at that time, according to the Caixin report.

But the global shipbuilding industry found itself in a severe recession when the world economy was hit by the financial crisis in 2008. Many private shipbuilders went bankrupt in the ensuing years, but even then few people thought the same fate would befall Rongsheng.

Many shipbuilders became very cautious about accepting new orders under these circumstances, given the huge amounts of capital needed to build a ship. But Rongsheng did the opposite and increased its orders. The Caixin report said that Rongsheng gained the most orders among all shipbuilders in China from 2010 to 2012.

"Good order figures may have helped the financing, but Rongsheng should have been more cautious about expanding during an overall industry downturn," Wang Danqing, a partner at Beijing-based ACME Consultancy, told the Global Times on Tuesday.

The Rongsheng employee said that poor management has also been a major factor behind Rongsheng"s predicament. Deliveries of many of the orders have been delayed, giving ship buyers the option of abandoning the order and claiming compensation.

Seeking a way outRongsheng has been trying to diversify in order to get over the current difficulties, and is now preparing for a move into the energy sector. The company announced on Friday that its board of directors had agreed to change its name to China Huarong Energy Co, according to a filing with the Hong Kong bourse.

Wang Shaojian, Rongsheng"s chief financial officer, told the media he was "confident" in the prospects for Rongsheng in the energy sector. The company has already started making moves in this regard. In August 2014, it announced that it had acquired a 60 percent stake in a subsidiary of New Continental Oil & Gas (HK) Co in Kyrgyzstan, giving Rongsheng equity in an oil field in the country.

Wu noted that Rongsheng may lack the expertise and talent required for the oil industry, adding that it will have to compete with even bigger rivals in the sector.

Rongsheng is also trying to streamline its business. It said in a filing on Tuesday that it has signed a memorandum with a potential buyer for it to acquire Rongsheng"s shipbuilding and ocean engineering business, as well as its debts.

Yangzijiang Shipbuilding declined to comment on the matter when contacted by the Global Times on Wednesday. Rongsheng also declined to comment, saying that it is now in a "quiet period," prior to further announcements.

The workers from the Nantong shipyard owned by the troubled Rongsheng Heavy Industries have been on strike since Sunday after the company announced that they had to go on forced leave for a week.

The workers" strike comes after Rongsheng reported a loss of 49 million yuan (U.S.$8 million) in the first quarter of 2013, citing "the most difficult time yet" in the two recent quarters, shipping website SinoShip News said.

"The shipyard is in the middle of a transformation. We are confident and capable of solving issues in the process of the transformation," the official was quoted as saying.

"In recent days, some workers who failed to get an (employment) offer have organized disruptive activities to our production by surrounding the entrance of our Nantong production base," the Wall Street Journal newspaper quoted Lei as saying in the statement.

Lei Dong, secretary to Rongsheng"s president, told the paper the layoffs are not a sign of financial trouble at the shipbuilder, but were rather the result of "restructuring," saying more than half the employees who were laid off were subcontractors and the remainder full-time employees.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

The No 4 dock at Jiangsu Rongsheng Heavy Industries Co Ltd"s Nantong shipbuilding base on May 26, 2012. With a dimension of 139.5*580m,the dock is equipped with a 1600-T gantry crane, the world"s largest. [Photo/chinadaily.com.cn]

China Rongsheng Heavy Industries Group Holdings Ltd, the nation"s largest private shipbuilder, may seek "cooperation with one or two ship builders" in 2013 or 2014, grasping the opportunity emerging from an industry recession, according to Xu Yifei, assistant president of Jiangsu Rongsheng.

In response to this round of recession, Rongsheng has been actively upgrading technology and design. It has also put more focus on the offshore engineering sector to further diversify its business.

Rongsheng is setting up its offshore engineering company in Singapore, aiming to take advantage of Singapore"s technology and existing market to deepen its penetration in the global offshore engineering market, according to Xu.

The company entered the marine engineering sector years ago. China"s first deepwater pipe-laying crane vessel, known as Hai Yang Shi You 201, was built by Rongsheng. The vessel can lay pipes at depths of 3000 meters and lift 4000 metric tons and will operate at the South China Sea"s Liwan 3-1 gas field.

Rongsheng"s president, Chen Qiang, said in an earlier interview that he hoped orders from marine engineering will make up about 40 percent of the company"s new orders this year.

8613371530291

8613371530291