nantong rongsheng shipyard supplier

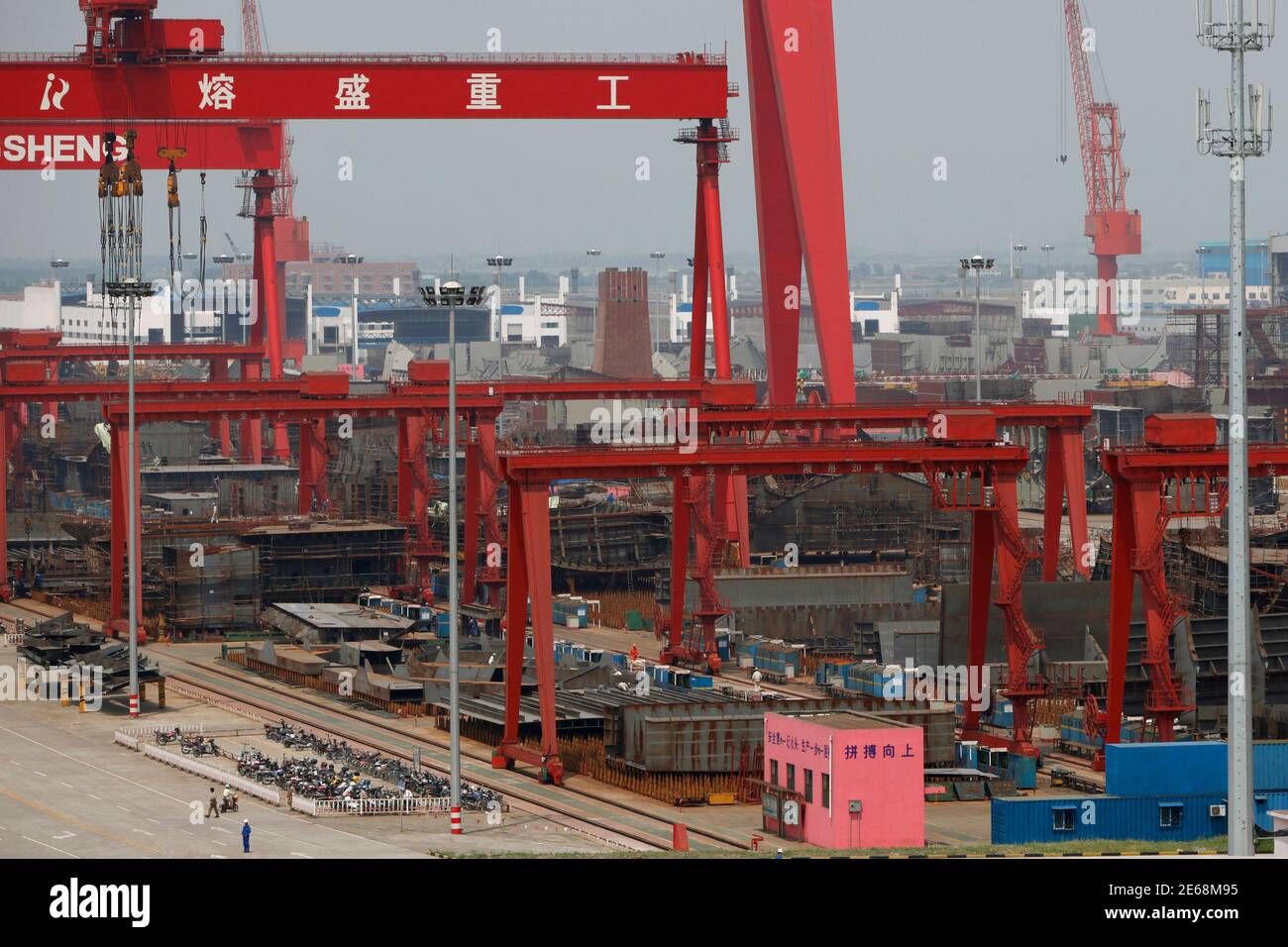

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group.

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.” (Reporting by Yimou Lee in HONG KONG and Koh Gui Qing in BEIJING; Editing by Neil Fullick)

The workers from the Nantong shipyard owned by the troubled Rongsheng Heavy Industries have been on strike since Sunday after the company announced that they had to go on forced leave for a week.

The workers" strike comes after Rongsheng reported a loss of 49 million yuan (U.S.$8 million) in the first quarter of 2013, citing "the most difficult time yet" in the two recent quarters, shipping website SinoShip News said.

"The shipyard is in the middle of a transformation. We are confident and capable of solving issues in the process of the transformation," the official was quoted as saying.

"In recent days, some workers who failed to get an (employment) offer have organized disruptive activities to our production by surrounding the entrance of our Nantong production base," the Wall Street Journal newspaper quoted Lei as saying in the statement.

Lei Dong, secretary to Rongsheng"s president, told the paper the layoffs are not a sign of financial trouble at the shipbuilder, but were rather the result of "restructuring," saying more than half the employees who were laid off were subcontractors and the remainder full-time employees.

A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. Credit: Reuters/Aly Song/Files

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group (1101.HK).

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China (3988.HK) starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.”

The No 4 dock at Jiangsu Rongsheng Heavy Industries Co Ltd"s Nantong shipbuilding base on May 26, 2012. With a dimension of 139.5*580m,the dock is equipped with a 1600-T gantry crane, the world"s largest. [Photo/chinadaily.com.cn]

China Rongsheng Heavy Industries Group Holdings Ltd, the nation"s largest private shipbuilder, may seek "cooperation with one or two ship builders" in 2013 or 2014, grasping the opportunity emerging from an industry recession, according to Xu Yifei, assistant president of Jiangsu Rongsheng.

In response to this round of recession, Rongsheng has been actively upgrading technology and design. It has also put more focus on the offshore engineering sector to further diversify its business.

Rongsheng is setting up its offshore engineering company in Singapore, aiming to take advantage of Singapore"s technology and existing market to deepen its penetration in the global offshore engineering market, according to Xu.

The company entered the marine engineering sector years ago. China"s first deepwater pipe-laying crane vessel, known as Hai Yang Shi You 201, was built by Rongsheng. The vessel can lay pipes at depths of 3000 meters and lift 4000 metric tons and will operate at the South China Sea"s Liwan 3-1 gas field.

Rongsheng"s president, Chen Qiang, said in an earlier interview that he hoped orders from marine engineering will make up about 40 percent of the company"s new orders this year.

Rongsheng Heavy Industries Group Holdings Ltd, China"s largest private shipyard, said on Friday it predicted net losses in the first half of this year amid media reports that suppliers and subcontractors were taking matters into their own hands.

Some media reports said that suppliers removed equipment from its Nantong production base to use for collateral security, and subcontractors absconded without paying wages.

BEIJING (Reuters) - China is handing out new subsidies for buying ships to help its beleaguered shipbuilders, confounding a government pledge to reduce support for sectors with over-capacity in order to reform the economy. The central government will set aside "special funds" that give shippers subsidies of 1,500 yuan per gross ton -- a unit of measure for the volume of vessels -- to replace old models with new and greener ones, a government statement said. The scheme will run until the end of 2015. The subsidies are only valid for ships scrapped one to 10 years ahead of mandatory retirement dates, the statement said. The state subsidies are the latest given to Chinese shipbuilders, which are fighting falling demand and excess capacity. It suggests the government is loath to see a big industry that is also a big employer wither. Yet by extending more aid to a sector foundering on excess investment, Beijing appears to be contradicting a promise to solve the problem of excess capacity by restricting credit and ending state support. China"s cement, steel and solar panel industries are also fighting over-capacity. Some analysts have said China may find it hard to withdraw support for all sectors and companies with over-capacity, especially if they are also big providers of jobs, such as China Rongsheng Heavy Industries Group <1101.HK>, the country"s biggest private ship manufacturer. Despite state subsidies of up to 1.3 billion yuan a year from 2010 to 2012, Rongsheng is struggling to survive. It reportedly laid off 8,000 workers earlier this year and is appealing for more government aid. Its financial woes have hollowed out Rugao, a town in eastern China and Rongsheng"s manufacturing base. The new subsidies were first announced on Dec 5 but made public only on Monday on the government website. The statement was made jointly by the Finance Ministry, the Transport Ministry, the Ministry of Industry and Information Technology and the National Development and Reform Commission, a powerful economic planning agency. (Reporting by Koh Gui Qing; Editing by Larry King)

The Ceremony was held at the shipyard of China Rongsheng Heavy Industries Group Holdings Limited (01101.HK), the builder of this vessel. Choosing China Rongsheng as the first destination of his first China visit, the new CEO and Vale demonstrated a strong faith in a long term cooperation between the two groups. This new VLOC is the first VLOC of a few to be delivered in the coming two years.

The ceremony was held at the Nantong production base of China Rongsheng Heavy Industries, right beside the dock. The new vessel was named as “VALE CHINA”. Present at the ceremony were Mr. Murilo Ferreira, newly appointed Vale CEO, Mr Hugueney and Mrs Hugueney, the Brazilian ambassador and his wife, Mr Zhang Jisheng, the deputy general secretary of Jiangsu Province, Mr Chen Qiang, CEO of China Rongsheng and top executives from Rugao Government.

In 2008, China Rongsheng Heavy Industries signed shipbuilding contracts for twelve 400,000 DWT VLOCs with Vale, with a contract value of US$1.6 billion. The work under the contracts set three world records in carrying dead weight tonnage of single bulk carriers, total dead weight tonnage of orders and total contract value. The Group currently has orders for 16 VLOCs on hand and with the other four placed byOman Shipping Company.

The visit of Mr. Murilo Ferreira shows Vale’s great trust in China Rongsheng, a positive foundation for future cooperation between Vale and Rongsheng. In the first half of 2011, China Rongsheng excelled it peers in the gloomy shipbuilding market by obtaining a series of shipbuilding contract, including a large order of ten 205,000DWT bulk carriers. Ship owners showed their support and trust to China Rongsheng and the new orders further enhanced China Rongsheng’s leading position in bulk carrier building market.

China Rongsheng is a leading large-scale heavy industry enterprise group. It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, covering wide services ranging from shipbuilding, offshore engineering, power engineering, engineering machinery and etc. Until Dec.With the vision of “cultivate world first-class employees and create world first-class enterprise”, the spirit of “integrity-based, the pursuit of excellence”, and the responsibility of revitalizing national industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

8613371530291

8613371530291