rongsheng heavy industries group pricelist

HONG KONG, Nov 12 (Reuters) - China Rongsheng Heavy Industries Group Holdings Ltdpriced its initial public offering at HK$8.00 per share, raising $1.8 billion, IFR reported on Friday.

Rongsheng, which plans to use the proceeds for its shipbuilding and offshore engineering business, had set a marketing range of HK$7.30-10.10 per share for the offering.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

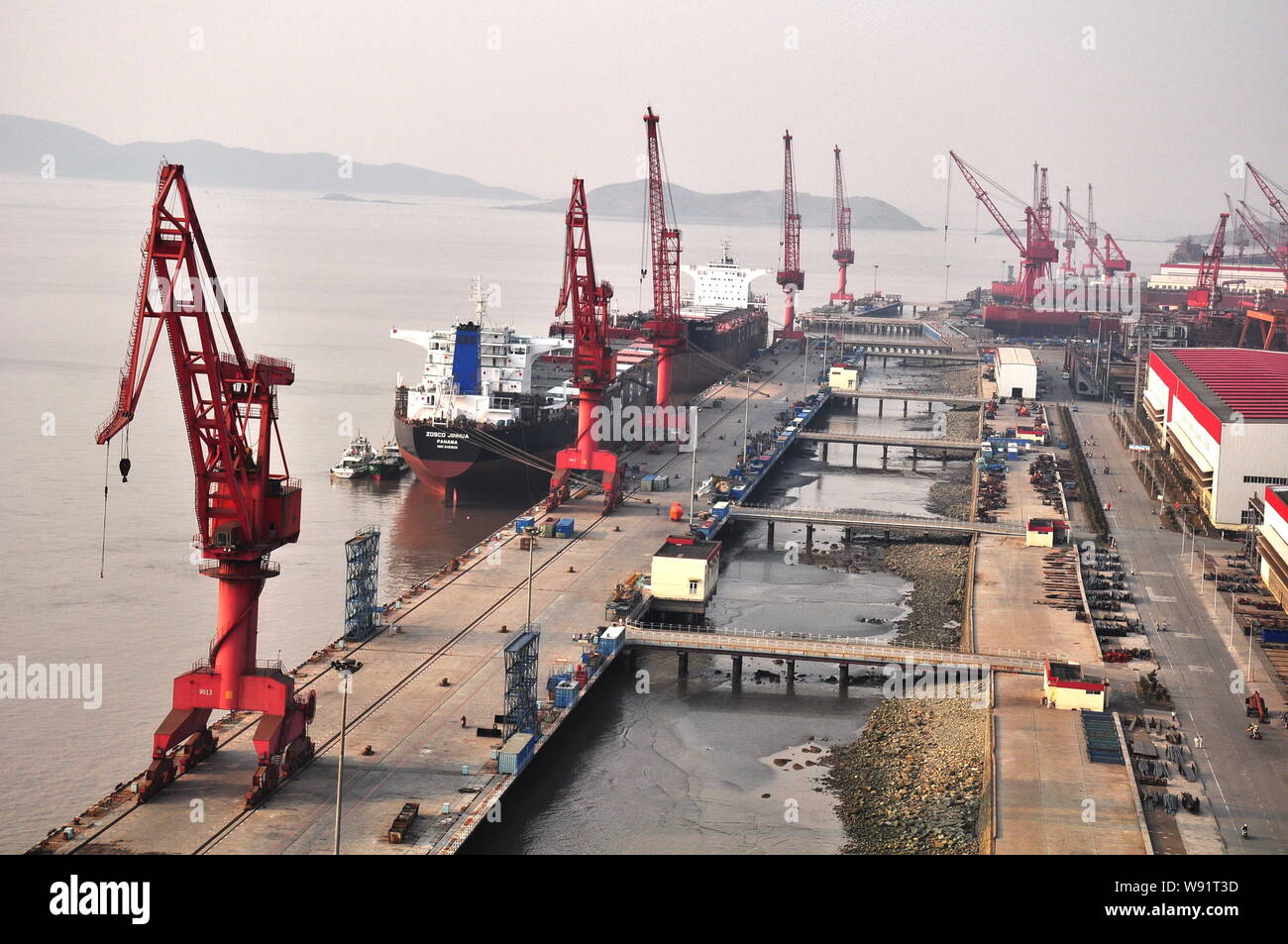

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

The company is expected to post a net loss this year based on unaudited accounts for 11 months ended Nov. 30, China Rongsheng said in a stock exchange filing today. It didn’t disclose any numbers.

First-half profit of the company plunged 82 percent as a global overcapacity and lower charter rates deterred shipowners from ordering more vessels. China Rongsheng is setting up a new offshore-energy equipment unit as it seeks contracts for oil rigs and tender barges to offset slowing ship demand.

China Rongsheng dropped 1.5 percent to HK$1.35 as of 2 p.m. in Hong Kong trading. The city’s benchmark Hang Seng Index rose 0.2 percent. The forecast was released during the lunchtime trading break.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA RONGSHENG HEAVY INDUSTRIES GROUP HOLDINGS LIMITED

China Rongsheng Heavy Industries Group Holdings Limited announced unaudited consolidated earnings guidance for the twelve months ended December 31, 2012. For the period, the company expected to incur a net loss as compared with the published net profit for the year ended 31 December 2011. The company believes that the net loss is primarily attributable to the decline in the shipbuilding market during the eleven months ended 30 November 2012, which led to the sharp decrease in the orders and prices of vessels compared with the same period last year.

The company said that the struggles of its shipbuilding arm, Jiangsu Rongsheng Heavy Industries, had been hampering efforts to expand in energy services

China Rongsheng Heavy Industries Group Holdings Limited [1101.HK] has announced that it has signed a memorandum of understanding that will see its shipbuilding business, Jiangsu Rongsheng Heavy Industries, sold to an undisclosed potential purchaser.

According to the company, the depressed shipbuilding market had led to operational difficulties at Jiangsu Rongsheng Heavy Industries, while its highly-leveraged state was also interfering with the company"s efforts to expand in oil and gas exploration elsewhere.

"The Potential Transaction shall adjust and optimize the assets and business of the Group, and divest the relevant assets and liabilities of the shipbuilding business and offshore engineering business, which shall help to ease the debt burden of the Group, enhance the flexibility of fund utilization, better implement the strategy of business transformation and transformation into an energy service provider focusing in the oil and natural gas market," said the company.

It was reported in 2012 that in the face of market difficulties, China Rongsheng Heavy Industries had turned its focus to building containerships with a "green design" as one its key products.

The two- and three-wheeler segment is getting electrified faster than cars and heavy vehicles. Auto component firms have noticed this trend and are finding ways to stay relevant.30 Dec, 2022, 10.43 AM IST

Strategists at Goldman Sachs Group Inc. expect Asia’s equity leadership to shift from Southeast Asia and India to markets like China and Korea next year, while Societe Generale SA says Taiwan’s tech-heavy market is also at an inflection point. Jefferies Financial Group Inc. has echoed similar views.27 Nov, 2022, 09.34 AM IST

The government said it had vetoed the takeover of the chip factory of the Dortmund-based company Elmos by Silex, a Swedish company that is a subsidiary of Chinese group Sai Microelectronics.10 Nov, 2022, 09.57 AM IST

KKR to invest $400 mn in Serentica Renewables, $100 mn from Sterlite Group cos. Platform will aim at industrial decarbonisation efforts. Formal announcement later today. Serentica will be looking to deliver round-the-clock clean for large-scale, energy-intensive industrial customers like steel, auto, manufacturing. In India this segment consumes 70 GW of energy, predominantly coal and gas.08 Nov, 2022, 05.07 PM IST

Sany Heavy Industry India, subsidiary of one of China"s fastest-growing manufacturing companies, Sany Group, has announced inauguration of its first integrated crawler crane production line at Chakan near Pune.24 Apr, 2012, 05.08 PM IST

China Rongsheng Heavy Industries Group, China"s largest private shipbuilder, issued a surprise warning that it expects to post an annual net loss for 2012 on sharp declines in orders and prices of new vessels after the shipping industry took a downward turn during the year.

Rongsheng was hit by an insider dealing scandal last year involving a company owned by its major shareholder, Zhang Zhirong, who stepped down as chairman last month and was replaced by chief executive officer, Chen Qiang.

Shares of Rongsheng ended down 1.5 percent on Monday and have lost 37 percent of their value this year, underperforming a 22 percent gain on the Hang Seng Index.

In August, Rongsheng reported its sharpest fall in half-year profit, down 82 percent, to 215.8 million yuan ($34.65 million)on a dearth of new orders, putting further pressure on its stretched balance sheet.

In an uncertain profit outlook, the shipbuilder"s estimated free cash flow in 2013-14 was unlikely to be enough to lower net debt, Citi said in a research report on Dec. 10. Rongsheng had net debt of about 17 billion yuan, it added.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

"The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company"s conservative sales strategy under the current trough stage of the shipbuilding market," China Rongsheng said in a statement to the Hong Kong stock exchange.

Workers at Rongsheng"s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company"s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: "The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders."

Hong Kong: Chen Qiang, ceo of Rongsheng Heavy Industries, said after the company’s shareholders meeting that global newbuilding price have reached bottom, and will not decline further.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

China Rongsheng Heavy Industries Group, China"s largest private shipbuilder, issued a surprise warning that it expects to post an annual net loss for 2012 on sharp declines in orders and prices of new vessels after the shipping industry took a downward turn this year.

Rongsheng admitted to Xinhua that it had terminated the contracts of those workers on low production utility rate due to a lack of new orders this year. But it denied withholding their wages.

Meanwhile, the China Shipbuilding Industry Corp (CSIC) has signalled an interest in taking over Rongsheng, subject to an attractive offer, according to a report by Chinese business newspaper 21st Century Business Herald, which quoted a source at CSIC.

Rongsheng was cast into the limelight in 2008 after it won a $1.6 billion order from Brazilian iron ore miner Vale for a dozen 400,000-deadweight-tonne very large ore carriers.

8613371530291

8613371530291