rongsheng international in stock

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright 2019© FactSet Research Systems Inc. All rights reserved. Source: FactSet

RONGSHENG PETROCHEMICAL CO., LTD. is a China-based company principally engaged in the research, development, manufacture and distribution of chemicals and chemical fibers. The Company’s main products include aromatics, phosphotungstic acid (PTA), polyethylene terephthalate (PET) chips, terylene pre-oriented yarns (POYs), terylene fully drawn yarns (FDYs) and terylene draw textured yarns (DTYs), among others. The Company distributes its products in domestic market and to...More

Rongsheng Petro Chemical Co, Ltd. specialises in the production and marketing of petrochemical and chemical fibres. Products include PTA yarns, fully drawn polyester yarns (FDY), pre-oriented polyester yarns (POY), polyester textured drawn yarns (DTY), polyester filaments and polyethylene terephthalate (PET) slivers.

RONGSHENG PETROCHEMICAL CO., LTD. is a China-based company principally engaged in the research, development, manufacture and distribution of chemicals and chemical fibers. The Company’s main products include aromatics, phosphotungstic acid (PTA), polyethylene terephthalate (PET) chips, terylene pre-oriented yarns (POYs), terylene fully drawn yarns (FDYs) and terylene draw textured yarns (DTYs), among others. The Company distributes its products in domestic market and to overseas markets.

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright 2019© FactSet Research Systems Inc. All rights reserved. Source: FactSet

The moomoo app is an online trading platform offered by Moomoo Technologies Inc. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: Moomoo Financial Inc. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS), Futu Securities International (Hong Kong) Limited regulated by the Securities and Futures Commission of Hong Kong (SFC) and Futu Securities (Australia) Ltd regulated by the Australian Securities and Investments Commission (ASIC).

Zhejiang Rongsheng Holding Group Co., Ltd., through its subsidiaries, engages in the businesses of petrochemical, polyester, spinning, false-twisting, logistics, coal chemicals, real estate, and venture investment businesses.

Rongsheng Petrochemical was founded in 1995 and operates in China. The company engages in the sector "Plastics & Synthetic Rubber in Primary Forms" (ISIC: 2013). This industry belongs to the broader "Chemicals & Related Products" (ISIC: 20) sector. The chemical industry includes large and well-established corporations that manufacture a wide range of products across a variety of markets. Today, the chemical manufacturing sector plays an essential role ─ not only in virtually every economy across the globe, but also within the majority of sectors of those economies. The CEO of the company is Yongqing Li.

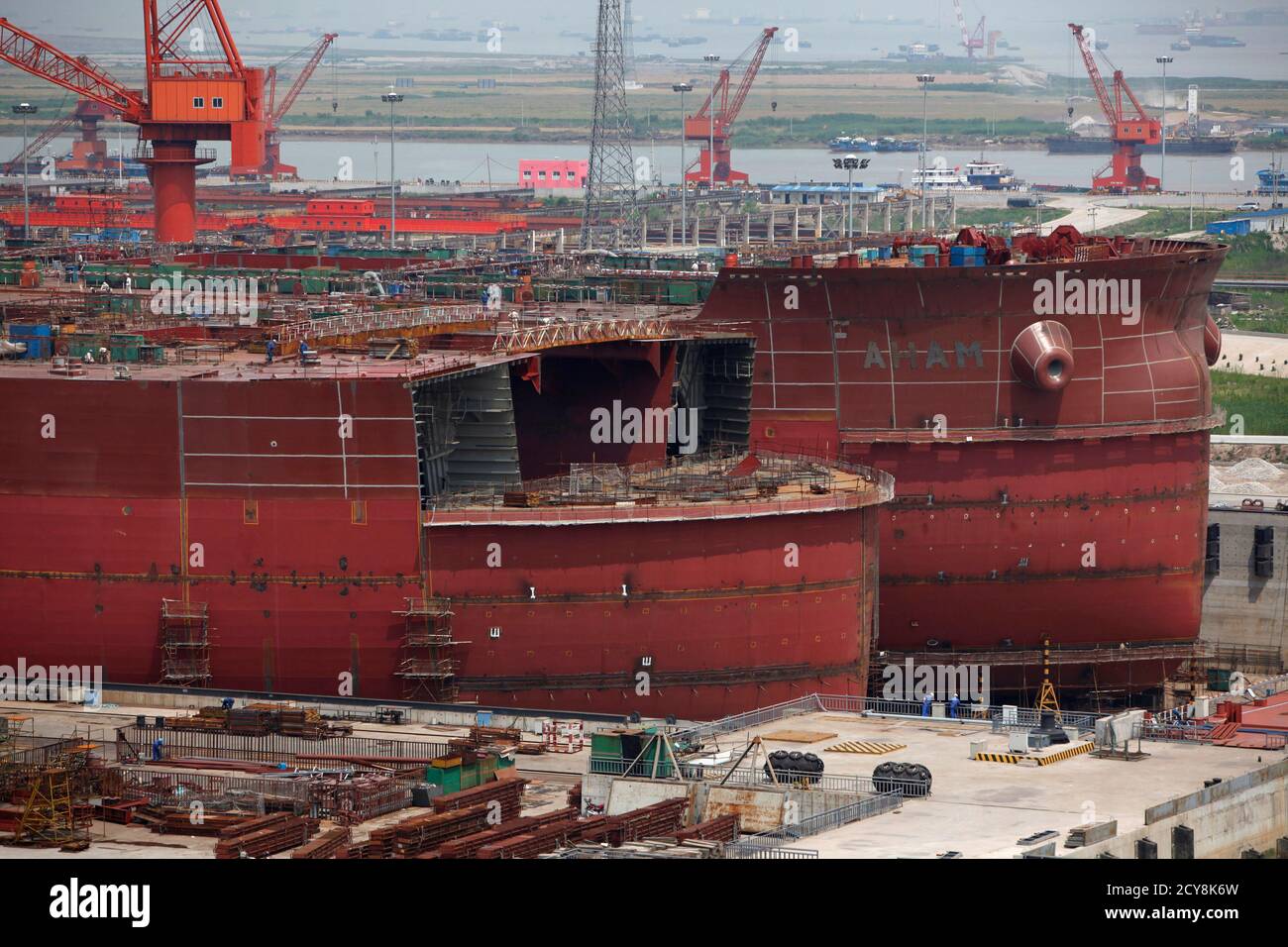

Hong Kong (September 15, 2014) - Paul Hastings, a leading global law firm, announced today that the firm advised China Rongsheng Heavy Industries Group Holdings Limited (“China Rongsheng”) in relation to the acquisition of a 60% equity interest in Central Point Worldwide Inc. (“Central Point”) by its indirectly wholly-owned subsidiary, Ocean Sino Holdings Limited.

The consideration for the acquisition is HK$2.184 billion (US$281 million), which is satisfied by the allotment and issuance of 1,400,000,000 shares by China Rongsheng.

Paul Hastings has advised China Rongsheng on its US$1.8 billion Hong Kong IPO and global offering on the Main Board of the Hong Kong Stock Exchange in 2010 and its US$180 million 7% guaranteed convertible bond issuance in 2013.

The company is headquartered in Xiaoshan District, Hangzhou, close to Hangzhou Xiaoshan International Airport and China Textile City. It is one of the leading enterprises in the Sinopec and chemical fiber industry. The company"s main business includes R&D, production and sales of various chemicals, oil products, and polyester products. The product range is rich and complete in specifications, covering various fields such as new energy, new materials, organic chemicals, synthetic fibers, synthetic resins, synthetic rubber, oil, etc., mainly including olefins and their downstream, aromatic hydrocarbons and their downstream, and oil products. The company"s main products are chemicals, oil and polyester products. The company"s honors include: Zhejiang Famous Brand Products, Outstanding Scientific and Technological Research and Development Enterprises in China"s Knitting Industry, Zhejiang Academician Expert Workstation, Zhejiang Trademark Brand Demonstration Enterprise, etc.

Shares in China Rongsheng Heavy Industries Group Holdings, the largest private shipbuilder in China, fell by 8.6 percent in Hong Kong Tuesday, after the company issued a profit warning. The shares fell by 16.4 percent Monday.

China Rongsheng Heavy dropped by HK$0.1 ($0.01) to end at HK$1.07 a share Tuesday, down by 23.6 percent from its closing price of HK$1.4 a share Friday.

"China Rongsheng Heavy has been receiving a huge amount of local government subsidies since 2010. It received over 800 million yuan in 2010 and more than 1.2 billion yuan in 2011. Because its earnings are going to drop significantly this year, the government is expected to further increase its subsidies to the company, whose main business will face a loss without them," the news report said, citing an unnamed source.

8613371530291

8613371530291