rongsheng petrochemical annual report 2018 for sale

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright © FactSet Research Systems Inc. All rights reserved. Source: FactSet

Zheng); Zheng January 20, 2021 Report, the Rongsheng No

Controlling shareholder Share lock-up July 18, 2018 36 months

There was no non-operating occupation of funds of the listed company by the controlling shareholder and other related parties during the reporting period.

of Finance on December 7, 2018. According to the transition provisions of relevant old and new standards, no adjustment shall be made to the information of

Rongsheng acceptance ure/detail?plate=szse&orgId=9900015

borrower amount funding date in the reporting procedures

Zhejiang Rongsheng Holding Group Co., Ltd. non-state-owned 61.46% 6,222,789,981 2,092,063,766 0 6,222,789,981

Explanation of the relationship or concerted action and Li Guoqing are nephews of Li Shuirong, Chairman of the Board of Directors of Zhejiang Rongsheng Holding Group Co., Ltd., and Xu

Zhejiang Rongsheng Holding Group Co., Ltd. 6,222,789,981 RMB ordinary shares 6,222,789,981

to Eligible Investors by 20 Rongsheng 14922 August 31, August 31, September interest. The

Rongsheng G2 0 2020 2020 2, 2024 interest shall be

Petrochemical Co., Ltd. paid once a year,

with annual sources

annual output of loans,

19 Rongsheng G1 1,000,000,000 2 years 994,614,150.95 1,002,893,069.59 48,854,246.58 2,452,683.83 1,054,200,000.00

20 Rongsheng G1 1,000,000,000 4 years (2 + 2) 995,452,830.20 1,029,248,500.45 47,700,000.04 1,211,525.65 47,747,169.81 1,030,412,856.33

20 Rongsheng G2 1,000,000,000 995,405,660.39 1,011,504,472.60 47,834,246.60 1,172,688.86 47,994,339.62 1,012,517,068.44

Petrochemical Base (phase income in the central budget for the construction of ecological

Petrochemical 29,402,156,939.81 -686,974,859.07 -685,867,384.15 609,487,159.99 25,364,168,603.77 598,708,284.15 598,708,284.15 1,717,207,655.03

Petrochemical Petrochemical Rural Commercial Petrochemical Petrochemical Rural Commercial

* China’s Zhejiang Petrochemicals, which is owned by Rongsheng Group, has been awarded a quota to import 5 million tonnes of crude oil this year, a statement from the Zhoushan Bureau of Commerce in Zhejiang province said on Thursday.

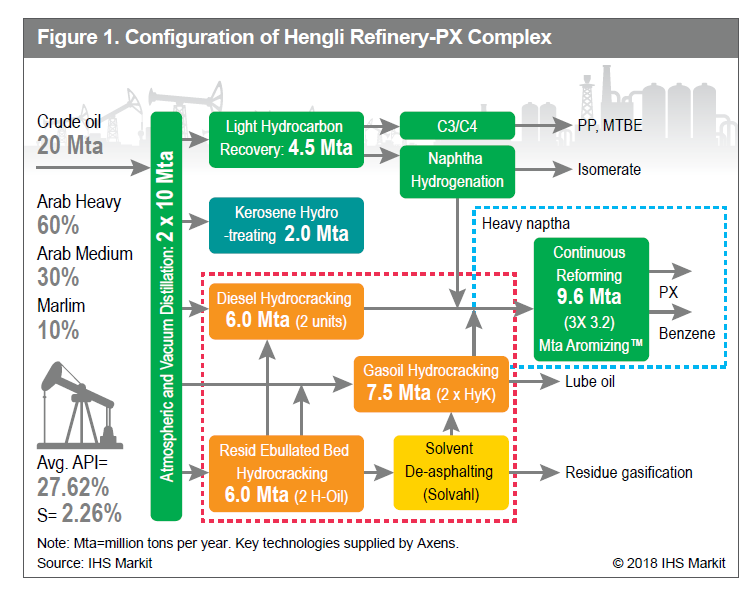

* In April, Chinese private chemical producer Hengli Group won import quotas of 400,000 barrels per day (bpd), the largest ever for a private refiner, as it challenges the country’s smaller independent plants in an oversupplied Chinese fuel market. (Reporting by Josephine Mason, Meng Meng and Aizhu Chen Editing by Susan Fenton)

A coalescing of factors has led to arrested growth across the chemicals sector this year, with the brand value of the top 25 most valuable chemicals brands contracting by 8% on average, according to the latest report by Brand Finance - the world"s leading independent brand valuation consultancy.

SABIC (down 7% to US$4.0 billion) is committed to its vision of becoming the world’s largest petrochemical company by 2030, undertaking several strategic partnerships over the last year and aligning with the chemical arm of oil and gas leader Saudi Aramco. The brand has strategically aligned with the UN’s Sustainable Development Goals (SDG) and developed more open and creative collaborations with other companies, NGOs, academia, and governments to better meet the expectations of customers and stakeholders.

Zhejiang-based Rongsheng Petrochemical (up 14% to US$1.6 billion) is the sector’s fastest growing brand after seeing profits more than triple in the past year, bolstered by the launch of its 400,000 barrel-per-day Zhejiang Petrochemical Co (ZPC).

MOSCOW (MRC) -- As already announced at the end of 2018, BASF will proceed with expanding global capacities for methane sulfonic acid (MSA) to 50,000 metric tons per year. This involves a higher double-digit million euro investment in constructing a new methane sulfonic acid plant at the Ludwigshafen site, as per the company"s press release.

As MRC wrote previously, BASF, the world"s petrochemical major, restarted its No. 1 steam cracker on September 30, 2019, following a maintenance turnaorund. The plant was shut for maintenance in mid-August, 2019. Located at Ludwigshafen in Germany, the No. 1 cracker has an ethylene production capacity of 235,000 mt/year and a propylene production capacity of 125,000 mt/year.

According toMRC"s ScanPlast report, Russia"s estimated PE consumption totalled 1,904,410 tonnes in the first eleven months of 2019, up by 6% year on year. Shipments of all PE grades increased. PE shipments increased from both domestic producers and foreign suppliers. The PP consumption in the Russian market was 1,161,830 tonnes in January-November 2019, up by 7% year on year. Deliveries of all grades of propylene polymers increased, with the homopolymer PP segment accounting for the largest increase.

BASF is the leading chemical company. It produces a wide range of chemicals, for example solvents, amines, resins, glues, electronic-grade chemicals, industrial gases, basic petrochemicals and inorganic chemicals. The most important customers for this segment are the pharmaceutical, construction, textile and automotive industries. BASF generated sales of around EUR63 billion in 2018.

*Core financials are calculated as reported financials less Inventory gain/ (loss) and less extraordinary items, if any to reflect operations before any

Inventory gains/losses in a period result from the movement in prices of raw materials and products from the end of the previous reported period to the

end of the current reported period. The cost of sales is impacted by inventory gains/losses wherein inventory gains decrease the cost of sales and inventory

* IVL through its indirect subsidiary acquired the 50% stake of PTIP from PTIRS in 2018. The first tranche of 24% was acquired in May 2018 (approx. THB

Investments in subsidiaries and other equity security as at 31 December 2018 and 2017, and dividend income from those investments for the years then ended were as follows:

Investments in joint ventures as at 31 December 2018 and 2017 and share of net profits (losses) of joint ventures for the years then ended were as follows:

M&G USA Corp. and its affiliated debtors (“M&G”) on 28 March 2018 to acquire the integrated PTAPET plant currently under construction in Corpus Christi, Texas (the “Corpus Christi Project”), along

Financial Associated Press, January 12 - Rongsheng Petrochemical announced that the 40 million T / a refining and chemical integration project (phase II) of Zhejiang Petrochemical, a holding subsidiary, was fully put into operation. Up to now, the oil refining, aromatics, ethylene and downstream chemical products units in phase II of the project have been fully put into commissioning, and the whole process has been opened. The company will further improve the commissioning of relevant process parameters and improve the production and operation level.

8613371530291

8613371530291