rongsheng petrochemical co pricelist

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright 2019© FactSet Research Systems Inc. All rights reserved. Source: FactSet

Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources: FactSet, Dow Jones

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day"s trading is calculated as the difference between the last trade and the prior day"s settle. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Source: FactSet

Data are provided "as is" for informational purposes only and are not intended for trading purposes. FactSet (a) does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and (b) shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Data may be intentionally delayed pursuant to supplier requirements.

Mutual Funds & ETFs: All of the mutual fund and ETF information contained in this display, with the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright 2019© Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Leading corporations around the world – including more than 35% of the Fortune 1000, plus thousands more worldwide – rely on us to help them stay ahead of financial risk quickly, accurately and cost-effectively.

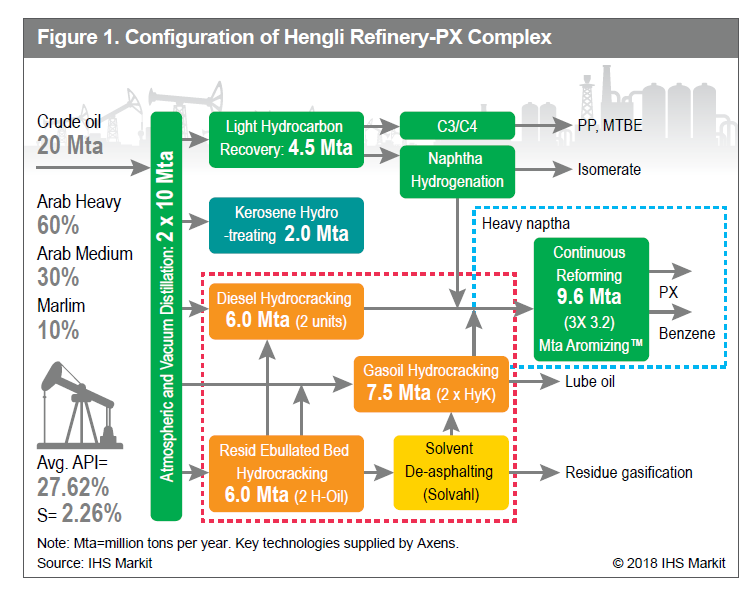

RONGSHENG PETROCHEMICAL CO., LTD. is a China-based company principally engaged in the research, development, manufacture and distribution of chemicals and chemical fibers. The Company’s main products include aromatics, phosphotungstic acid (PTA), polyethylene terephthalate (PET) chips, terylene pre-oriented yarns (POYs), terylene fully drawn yarns (FDYs) and terylene draw textured yarns (DTYs), among others. The Company distributes its products in domestic market and to overseas markets.

Leading corporations around the world – including more than 35% of the Fortune 1000, plus thousands more worldwide – rely on us to help them stay ahead of financial risk quickly, accurately and cost-effectively.

RONGSHENG PETROCHEMICAL CO., LTD. is a China-based company principally engaged in the research, development, manufacture and distribution of chemicals and chemical fibers. The Company’s main products include aromatics, phosphotungstic acid (PTA), polyethylene terephthalate (PET) chips, terylene pre-oriented yarns (POYs), terylene fully drawn yarns (FDYs) and terylene draw textured yarns (DTYs), among others. The Company distributes its products in domestic market and to overseas markets.

Standard beta is co-called levered, which means that it reflects the capital structure of the company (including the financial risk linked to the debt level). Unlevered beta (or ungeared beta) compares the risk of an unlevered company (i.e. with no debt in the capital structure) to the risk of the market. Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).

Many different betas can be calculated for a given stock. The main common variables that affect beta calculations are the time period, the reference date, the sampling frequency for closing prices and the reference index.

The calculation divides the covariance of the stock return with the market return by the variance of the market return. Beta is used very often for company valuation using the Discounted Cash Flows (DCF) method. The discount rate is calculated using the Weighted Average Cost of Capital (WACC). The WACC is essentially a blend of the cost of equity and the after-tax cost of debt. The cost of equity is usually calculated using the capital asset pricing model (CAPM), which defines the cost of equity as follows: re = rf + β × (rm - rf)

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright 2019© FactSet Research Systems Inc. All rights reserved. Source: FactSet

Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources: FactSet, Dow Jones

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day"s trading is calculated as the difference between the last trade and the prior day"s settle. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Source: FactSet

Data are provided "as is" for informational purposes only and are not intended for trading purposes. FactSet (a) does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and (b) shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Data may be intentionally delayed pursuant to supplier requirements.

Mutual Funds & ETFs: All of the mutual fund and ETF information contained in this display, with the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright 2019© Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

The moomoo app is an online trading platform offered by Moomoo Technologies Inc. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: Moomoo Financial Inc. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS), Futu Securities International (Hong Kong) Limited regulated by the Securities and Futures Commission of Hong Kong (SFC) and Futu Securities (Australia) Ltd regulated by the Australian Securities and Investments Commission (ASIC).

For further information about Moomoo Financial Inc., please visit Financial Industry Regulatory Authority (FINRA)’s BrokerCheck. Brokerage accounts with Moomoo Financial Inc. are protected by the Securities Investor Protection Corporation (SIPC). Moomoo Financial Inc. is a member of Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). It is important to understand that SIPC protects customer accounts against losses caused by the financial failure of the broker-dealer, but not against an increase or decrease in the market value of securities in customers" accounts. SIPC does not protect against market risk, which is the risk inherent in a fluctuating market. For further information about SIPC insurance coverage for accounts with Moomoo Financial Inc., see www.sipc.org or request an explanatory brochure from Moomoo Financial Inc.

Margin trading involves interest charges and heightened risks, including the potential to lose more than invested funds or the need to deposit additional collateral. Before trading on margin, customers are advised to determine whether this type of trading is appropriate for them in light of their respective investment objective, experience, risk tolerance and financial situation.

Free trading refers to $0 commissions for Moomoo Financial Inc. self-directed individual cash or margin brokerage accounts of U.S. residents that trade U.S. listed securities via mobile devices or Web. Relevant SEC & FINRA fees may apply. For details, please see Commission and Fees.

All types of investments are risky and investors may suffer losses. Past performance of investment products does not guarantee future results. Electronic trading also poses risks to investors. The responsiveness of the trading system may vary due to market conditions, system performance, and other factors. Account access and trade execution may be affected by factors such as market volatility.

No content on the website shall be considered as a recommendation or solicitation for the purchase or sale of securities, futures, or other financial products. All information and data on the website are for reference only and no historical data shall be considered as the basis for predicting future trends.

Information contained on this website is general in nature and has been prepared without any consideration of customers’ investment objectives, financial situations or needs. Customers should consider the appropriateness of the information having regard to their personal circumstances before making any investment decisions.

A broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (CRD: 283078/SEC: 8-69739), and a member in good standing of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

A broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (CRD: 298769/SEC: 8-70215), a member in good standing of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), as well as a member of Depository Trust Company (DTC), a member of National Securities Clearing Corporation (NSCC) and the Options Clearing Corporation (OCC).

A licensed entity registered with the National Futures Association (NFA) (NFA ID: 0523957) and regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

A securities dealer registered with and regulated by the Australian Securities and Investments Commission (ASIC). Futu AU holds the Australian Financial Services Licence (Licence No. 224663).

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Rongsheng Petrochemical was founded in 1995 and operates in China. The company engages in the sector "Plastics & Synthetic Rubber in Primary Forms" (ISIC: 2013). This industry belongs to the broader "Chemicals & Related Products" (ISIC: 20) sector. The chemical industry includes large and well-established corporations that manufacture a wide range of products across a variety of markets. Today, the chemical manufacturing sector plays an essential role ─ not only in virtually every economy across the globe, but also within the majority of sectors of those economies. The CEO of the company is Yongqing Li.

Government customs records for Rongsheng Petrochemical Co Ltd in Ecuador. See their import and export history, including shipments to Rodriguez Gonzalez Manuel Rodrigo, an importer based in Ecuador.

Join ImportGenius to see the import/export activity of every company in Ecuador. Track your competitors, get freight forwarding leads, enforce exclusivity agreements, learn more about your overseas factories, and much more. Instant signup.

8613371530291

8613371530291