rongsheng refinery capacity for sale

SINGAPORE, Oct 14 (Reuters) - Rongsheng Petrochemical, the trading arm of Chinese private refiner Zhejiang Petrochemical, has bought at least 5 million barrels of crude for delivery in December and January next year in preparation for starting a new crude unit by year-end, five trade sources said on Wednesday.

Rongsheng bought at least 3.5 million barrels of Upper Zakum crude from the United Arab Emirates and 1.5 million barrels of al-Shaheen crude from Qatar via a tender that closed on Tuesday, the sources said.

Rongsheng’s purchase helped absorbed some of the unsold supplies from last month as the company did not purchase any spot crude in past two months, the sources said.

Zhejiang Petrochemical plans to start trial runs at one of two new crude distillation units (CDUs) in the second phase of its refinery-petrochemical complex in east China’s Zhoushan by the end of this year, a company official told Reuters. Each CDU has a capacity of 200,000 barrels per day (bpd).

Zhejiang Petrochemical started up the first phase of its complex which includes a 400,000-bpd refinery and a 1.2 million tonne-per-year ethylene plant at the end of 2019. (Reporting by Florence Tan and Chen Aizhu, editing by Louise Heavens and Christian Schmollinger)

BEIJING, Aug 14 (Reuters) - Rongsheng Petrochemical , the listed arm of a major shareholder in one of China’s biggest private oil refineries, expects demand for energy and chemical products to return to normal in the country in the second half of this year.

Rongsheng expects to start trial operations of the second phase of the refining project, adding another 400,000 bpd of refining capacity and 1.4 million tonnes of ethylene production capacity in the fourth quarter of 2020.

“We expect the effects of the coronavirus pandemic on energy and chemicals to have basically faded in spite of the possibility of new waves of outbreak,” said Quan Weiying, board secretary of Rongsheng, in response to Reuters questions in an online briefing.

But Li Shuirong, president of Rongsheng, told the briefing that it was still in the process of applying for an export quota and would adjust production based on market demand. (Reporting by Muyu Xu and Chen Aizhu; Editing by Jacqueline Wong)

China"s private refiner Zhejiang Petroleum & Chemical is set to start trial runs at its second 200,000 b/d crude distillation unit at the 400,000 b/d phase 2 refinery by the end of March, a source with close knowledge about the matter told S&P Global Platts March 9.

"The company targets to commence the phase II project this year, and run both the two phases at above 100% of their capacity, which will lift crude demand in 2021," the source said.

ZPC cracked 23 million mt of crude in 2020, according the the source. Platts data showed that the utilization rate of its phase 1 refinery hit as high as 130% in a few months last year.

Started construction in the second half of 2019, units of the Yuan 82.9 billion ($12.74 billion) phase 2 refinery almost mirror those in phase 1, which has two CDUs of 200,000 b/d each. But phase 1 has one 1.4 million mt/year ethylene unit while phase 2 plans to double the capacity with two ethylene units.

ZPC currently holds about 6 million cu m (37.74 million barrels) in crude storage tanks, equivalent to 47 days of the two plants" consumption if they run at 100% capacity.

With the entire phase 2 project online, ZPC expects to lift its combined petrochemicals product yield to 71% from 65% for the phase 1 refinery, according to the source.

Zhejiang Petroleum, a joint venture between ZPC"s parent company Rongsheng Petrochemical and Zhejiang Energy Group, planned to build 700 gas stations in Zhejiang province by end-2022 as domestic retail outlets of ZPC.

Established in 2015, ZPC is a JV between textile companies Rongsheng Petrochemical, which owns 51%, Tongkun Group, at 20%, as well as chemicals company Juhua Group, also 20%. The rest 9% stake was reported to have transferred to Saudi Aramco from the Zhejiang provincial government. But there has been no update since the agreement was signed in October 2018.

Abu Dhabi National Oil Company signed an agreement with Rongsheng Petrochemical of China to explore domestic and international opportunities as it seeks to sell more products to customers in East Asia.

"The strategic co-operation with Adnoc will ensure that our ZPC project, which will have a refining capacity of up to 1m barrels per day of crude, has adequate supplies of feedstock," Li Shuirong, chairman of the Rongsheng Group, said.

Saudi Aramco today signed three Memoranda of Understanding (MoUs) aimed at expanding its downstream presence in the Zhejiang province, one of the most developed regions in China. The company aims to acquire a 9% stake in Zhejiang Petrochemical’s 800,000 barrels per day integrated refinery and petrochemical complex, located in the city of Zhoushan.

The first agreement was signed with the Zhoushan government to acquire its 9% stake in the project. The second agreement was signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, who are the other shareholders of Zhejiang Petrochemical. Saudi Aramco’s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical’s large crude oil storage facility to serve its customers in the Asian region.

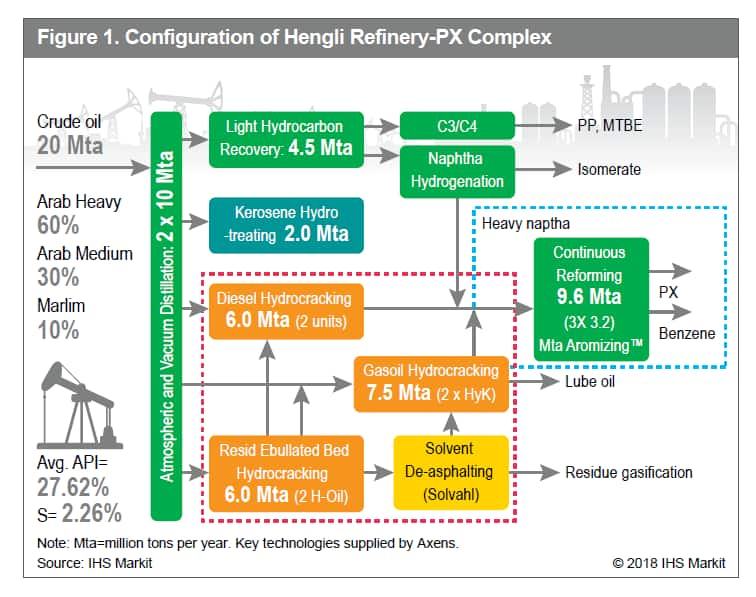

Phase I of the project will include a newly built 400,000 barrels per day refinery with a 1.4 mmtpa ethylene cracker unit, and a 5.2 mmtpa Aromatics unit. Phase II will see a 400,000 barrels per day refinery expansion, which will include deeper chemical integration than Phase I.

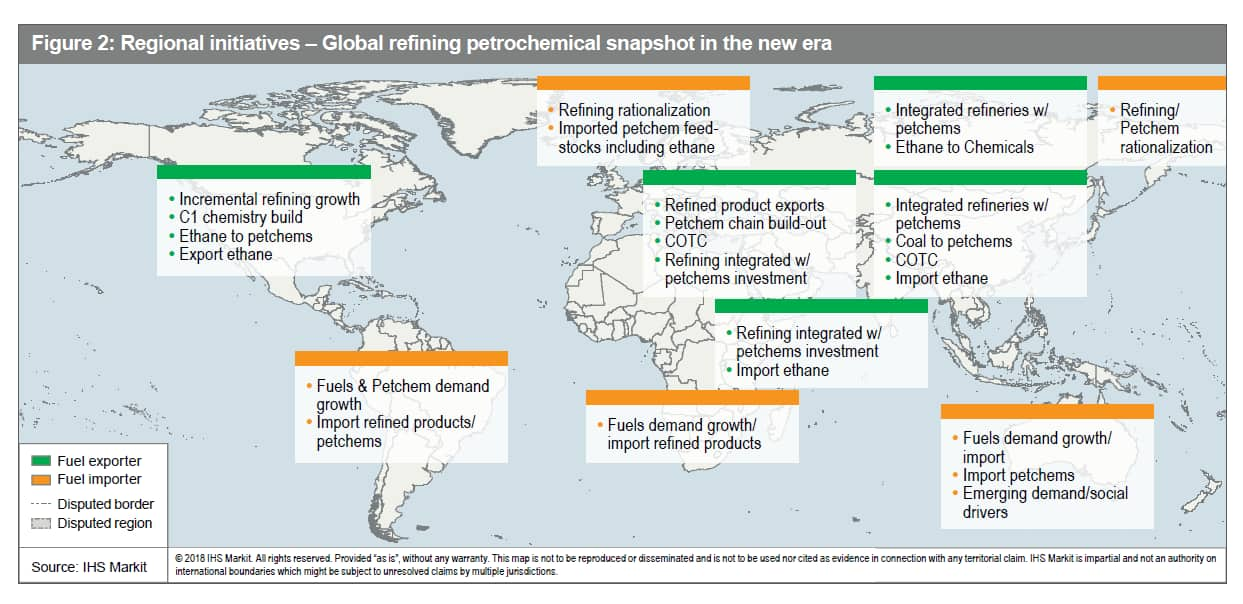

This year, China is expected to overtake the United States as the world’s largest oil refining country.[1] Although China’s bloated and fragmented crude oil refining sector has undergone major changes over the past decade, it remains saddled with overcapacity.[2]

Privately owned unaffiliated refineries, known as “teapots,”[3] mainly clustered in Shandong province, have been at the center of Beijing’s longtime struggle to rein in surplus refining capacity and, more recently, to cut carbon emissions. A year ago, Beijing launched its latest attempt to shutter outdated and inefficient teapots — an effort that coincides with the emergence of a new generation of independent players that are building and operating fully integrated mega-petrochemical complexes.[4]

China’s “teapot” refineries[5] play a significant role in refining oil and account for a fifth of Chinese crude imports.[6] Historically, teapots conducted most of their business with China’s major state-owned companies, buying crude oil from and selling much of their output to them after processing it into gasoline and diesel. Though operating in the shadows of China’s giant national oil companies (NOCs),[7] teapots served as valuable swing producers — their surplus capacity called on in times of tight markets.

Four years later, the NDRC adopted a different approach, awarding licenses and quotas to teapot refiners to import crude oil and granting approval to export refined products in exchange for reducing excess capacity, either upgrading or removing outdated facilities, and building oil storage facilities.[10] But this partial liberalization of the refining sector did not go exactly according to plan. Swelling with new sources of feedstock that catapulted China into the position of the world’s largest oil importer, teapots increased their production of refined fuels and, benefiting from greater processing flexibility and low labor costs undercut larger state rivals and doubled their market share.[11]

Meanwhile, as teapots expanded their operations, they took on massive debt, flouted environmental rules, and exploited taxation loopholes.[12] Of the refineries that managed to meet targets to cut capacity, some did so by double counting or reporting reductions in units that had been idled.[13] And when, reversing course, Beijing revoked the export quotas allotted to teapots and mandated that products be sold via state-owned companies, it trapped their output in China, contributing to the domestic fuel glut.

2021 marked the start of the central government’s latest effort to consolidate and tighten supervision over the refining sector and to cap China’s overall refining capacity.[14] Besides imposing a hefty tax on imports of blending fuels, Beijing has instituted stricter tax and environmental enforcement[15] measures including: performing refinery audits and inspections;[16] conducting investigations of alleged irregular activities such as tax evasion and illegal resale of crude oil imports;[17] and imposing tighter quotas for oil product exports as China’s decarbonization efforts advance.[18]

The politics surrounding this new class of greenfield mega-refineries is important, as is their geographical distribution. Beijing’s reform strategy is focused on reducing the country’s petrochemical imports and growing its high value-added chemical business while capping crude processing capacity. The push by Beijing in this direction has been conducive to the development of privately-led mega refining and petrochemical projects, which local officials have welcomed and staunchly supported.[20]

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

As China’s independent oil refining hub, Shandong is the bellwether for the rationalization of the country’s refinery sector. Over the years, Shandong’s teapots benefited from favorable policies such as access to cheap land and support from a local government that grew reliant on the industry for jobs and contributions to economic growth.[22] For this reason, Shandong officials had resisted strictly implementing Beijing’s directives to cull teapot refiners and turned a blind eye to practices that ensured their survival.

But with the start-up of advanced liquids-to-chemicals complexes in neighboring provinces, Shandong’s competitiveness has diminished.[23] And with pressure mounting to find new drivers for the provincial economy, Shandong officials have put in play a plan aimed at shuttering smaller capacity plants and thus clearing the way for a large-scale private sector-led refining and petrochemical complex on Yulong Island, whose construction is well underway.[24] They have also been developing compensation and worker relocation packages to cushion the impact of planned plant closures, while obtaining letters of guarantee from independent refiners pledging that they will neither resell their crude import quotas nor try to purchase such allocations.[25]

To be sure, the number of Shandong’s independent refiners is shrinking and their composition within the province and across the country is changing — with some smaller-scale units facing closure and others (e.g., Shandong Haike Group, Shandong Shouguang Luqing Petrochemical Corp, and Shandong Chambroad Group) pursuing efforts to diversify their sources of revenue by moving up the value chain. But make no mistake: China’s teapots still account for a third of China’s total refining capacity and a fifth of the country’s crude oil imports. They continue to employ creative defensive measures in the face of government and market pressures, have partnered with state-owned companies, and are deeply integrated with crucial industries downstream.[26] They are consummate survivors in a key sector that continues to evolve — and they remain too important to be driven out of the domestic market or allowed to fail.

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities in support of ADNOC’s 2030 growth strategy.

The companies will examine opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates (UAE) and the supply of liquified natural gas (LNG) to Rongsheng.

Under the terms of the deal, the companies will also study chances to increasing the volume and variety of refined product sales to Rongsheng as well as ADNOC’s participation as the China firm’s strategic partner in refinery and petrochemical projects. This could include an investment in Rongsheng’s downstream complex.

In return, Rongsheng will also look at investing in ADNOC’s downstream industrial ecosystem in Ruwais, UAE, including a proposed gasoline-to-aromatics plant as well as reviewing the potential for ADNOC to supply LNG to Rongsheng for use within its own complexes in China.

Rongsheng’s chairman Li Shuirong added that the cooperation will ensure that its project, which will have a refining capacity of up to 1 million bbl/day of crude oil, has adequate supplies of feedstock.

The eastern province, which is home to 37 oil refineries with a total capacity of 130 million tons annually, wants these mostly privately owned oil refineries to shut down and sell their state-approved refining quota to a new company — Shandong Yulong Petrochemical Ltd. — based on Yulong Island, a manmade island off the coastal city of Longkou.

A total of 1,428 hectares (3,528 acres) of land on Yulong Island will be handed over to the project at a total cost of cost 5.87 billion yuan ($827 million), part of which will be spent on expanding the manmade island, according to a report on the project’s environmental impact released by the local government on March 9. The first phase of the project will involve 20 million tons of refining capacity and 3 million tons of ethylene production annual. The goal is for Yulong Petrochemical to eventually have around 40 million tons of refining capacity.

How many refineries have agreed to join the new venture and when, if ever, the new company will begin operations is unclear. The Shandong government has given the plan the go-ahead, but approval hasn’t yet been received from the country"s top economic planner, which allocates refining capacity quotas and must give the green light to every new oil-refining project.

The provincial government decided in 2018 to reduce the region’s refining capacity by 40 million tons to around 90 million tons by 2025, as profit margins continue to shrink, declining to 3.5% last year. However, nationwide refining overcapacity is set to rise further this year to 170 million tons, according to research from the CNPC Economics & Technology Research Institute.

A refinery’s success relies on stable downstream demand, which for Chinese refineries usually comes from their shareholders. Hengli Petrochemical, which has 20 million tons of annual capacity, is majority owned by Hengli Group Co. Ltd., which specializes in producing chemical fibers for which refined oil is a key ingredient. Zhejiang Rongsheng Holding Group, which invests in petrochemical, logistics and real estate businesses, holds a 51% stake in Zhejiang Petrochemical, a refinery with 40 million tons of capacity.

Abu Dhabi, UAE – November 12, 2019: The Abu Dhabi National Oil Company (ADNOC) announced, today, it has signed a broad Framework Agreement with China’s Rongsheng Petrochemical Co., Ltd. (Rongsheng) to explore domestic and international growth opportunities which will support the delivery of its 2030 smart growth strategy.

The agreement will see both companies explore opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates, and the supply and delivery of liquified natural gas (LNG) to Rongsheng.

The agreement was signed by His Excellency Dr. Sultan Al Jaber, UAE Minister of State and ADNOC Group CEO, and Li Shuirong, Chairman of Rongsheng Group.

H.E. Dr. Al Jaber said: “This Framework Agreement builds on the existing crude oil supply relationship between ADNOC and Rongsheng, which we are keen to enhance. The agreement covers domestic and international growth opportunities across a range of sectors, which have the potential to open new markets for our growing portfolio of products and attract investment to support our downstream and gas expansion plans.

Under the terms of the Framework Agreement, ADNOC and Rongsheng will explore opportunities for increasing the volume and variety of refined products sales to Rongsheng as well as ADNOC’s active participation as Rongsheng’s strategic partner in refinery and petrochemical opportunities, including an investment in Rongsheng’s downstream complex. In return Rongsheng will also explore potential investments in ADNOC’s downstream industrial ecosystem in Ruwais, including the proposed Gasoline Aromatics Plant (GAP) and the potential for ADNOC to supply and deliver liquified natural gas (LNG) for utilization by Rongsheng within its production complexes in China.

Shuirong said: “This Framework Agreement is a key milestone in Rongsheng Petrochemical’s strategic international expansion. ADNOC is an important trading partner, and we are confident of the win-win benefits of this partnership, particularly in realizing opportunities in the downstream space in Asia.

“The strategic cooperation with ADNOC will ensure that our ZPC project, which will have a refining capacity of up to 1 million barrels per day (mbpd) of crude, has adequate supplies of feedstock. Our valued partnership will enable Rongsheng Petrochemical to continue its expansion into the international oil market and we are confident Rongsheng Petrochemical will achieve enhanced market share and recognition in the global marketplace.”

Rongsheng Petrochemical Co., Ltd. is one of the leading companies in China’s petrochemical and textile industry. In recent years, Rongsheng has been committed to developing both vertically and horizontally across the value chain, investing massively in multiple high-value oil and gas projects. Amongst them, Zhejiang Petroleum & Chemical Co., Ltd. (ZPC), in which Rongsheng has a controlling interest, is a 40 million tons per annum mega integrated refining and chemical project. Once operational, ZPC will be one of the largest-scale plants in the world.

China is the world"s second-largest oil consumer, and Chinese energy companies have steadily increased their participation in ADNOC’s Upstream and Downstream operations. At the same time, ADNOC has identified China as an important growth market for its crude oil and petrochemical products, as it moves towards boosting its oil production capacity to 4 million barrels per day (mbpd) by the end of 2020 and 5mbpd in 2030 and accelerates the implementation of its downstream expansion and international investment strategies.

In Asia and the Middle East, at least nine refinery projects are beginning operations or are scheduled to come online before the end of 2023. At their current planned capacities, they will add 2.9 million barrels per day (b/d) of global refinery capacity once fully operational.

In the International Energy Agency’s (IEA) June 2022 Oil Market Report, the IEA expects net global refining capacity to expand by 1.0 million b/d in 2022 and by an additional 1.6 million b/d in 2023. Net capacity additions reflect total new capacity minus capacity that has closed.

The scheduled expansions follow a period of reduced global refining capacity. Net global capacity declined in 2021 for the first time in 30 years, according to the IEA. The new refinery projects would increase production of refined products, such as gasoline and diesel, and in turn, they might reduce the current high prices for these products.

China’s refinery capacity is scheduled to increase significantly this year. The Shenghong Petrochemical facility in Lianyungang has an estimated capacity of 320,000 b/d, and they report that trial crude oil-processing operations began in May 2022. In addition, PetroChina’s 400,000 b/d Jieyang refinery is expected to come online in the third quarter of 2022. A planned 400,000 b/d Phase II capacity expansion also began operations earlier this year at Zhejiang Petrochemical Corporation’s (ZPC) Rongsheng facility. More information on these expansions is available in our Country Analysis Executive Summary: China.

Outside of China, the 300,000 b/d Malaysian Pengerang refinery (also known as the RAPID refinery) restarted in May 2022 after a fire forced the refinery to shut down in March 2020. In India, the Visakha Refinery is undergoing a major expansion, scheduled to add 135,000 b/d by 2023.

New projects in the Middle East are also likely to be an important source of new refining capacity. The 400,000 b/d Jizan refinery in Saudi Arabia reportedly came online in late 2021 and began exporting petroleum products earlier this year. More recently, the 615,000 b/d Al Zour refinery in Kuwait—the largest in the country when it becomes fully operational—began initial operations earlier this year. A new 140,000 b/d refinery is scheduled to come online in Karbala, Iraq, this September, targeting fully operational status by 2023. A new 230,000 b/d refinery is set to come online in Duqm, Oman, likely in early 2023.

These estimates do not necessarily include all ongoing refinery capacity expansions. Moreover, many of these projects have already been subject to major delays, and the possibility of partial starts or continued delays related to logistics, construction, labor, finances, political complications, or other factors may cause these projects to come online later than estimated. Although the potential for project complications and cancellations is always a significant risk, these projects could otherwise account for an increase of nearly 3.0 million b/d of new refining capacity by the end of 2023.

July 25, 2022 [Green Car Congress] – The International Energy Agency (IEA) estimates that global refining capacity decreased by 730,000 barrels per day (b/d) in 2021—the first decline in global refining capacity in 30 years.

In the United States, refining capacity has decreased by about 1.1 million b/d since the start of 2020, contributing 184,000 b/d to the global decline in 2021. Global demand for refined products dropped substantially in 2020 as a result of the COVID-19 pandemic. Less petroleum demand and the associated lower petroleum product prices encouraged refinery closures, reducing global refining capacity, particularly in the United States, Europe, and Japan. However, the US Energy Information Administration (EIA) notes that a number of new refinery projects are set to come online during 2022 and 2023, increasing capacity.

As global demand for petroleum products returned closer to pre-pandemic levels through 2021 and early 2022, the loss of refinery capacity contributed to higher crack spreads—the difference between the price of a barrel of crude oil and the wholesale price of petroleum products—which serve as one indicator of the profitability of refining.

After Russia began its full-scale invasion of Ukraine in late February 2022, the impacts of reduced global refining capacity were exacerbated. Associated sanctions on Russia—with more than 5 million b/d in crude oil processing capacity—disrupted exports of Russia’s refined products into the global market, and will likely continue to do so as import bans in the European Union and United Kingdom come into full force.

Constraints on global refinery capacity have been contributing to higher crack spreads in the first half of 2022, and they are likely to continue contributing to high crack spreads through at least the end of this year.

In its June 2022 Oil Market Report, the IEA expects net global refining capacity to expand by 1.0 million b/d in 2022 and by an additional 1.6 million b/d in 2023. New refining capacity growth includes several high-profile, high-capacity refinery projects underway, particularly in China and the Middle East, which could add more than 4.0 million b/d of new capacity over the next two years.

High-capacity refineries require access to reliable sources of crude oil inputs to maintain higher utilization and to a sufficiently large pool of potential customers to supply. Many of these new refineries are located in coastal areas and have easy access to export refined products that are not consumed domestically.

The most global refining capacity under development is in China. Chinese capacity is scheduled to increase significantly this year because of the start of at least two new refinery projects and a major refinery expansion.

The first new refinery is the private Shenghong Petrochemical facility in Lianyungang, which has an estimated capacity of 320,000 b/d and reported trial crude oil-processing operations beginning in May 2022. The second new refinery is PetroChina’s 400,000 b/d Jieyang refinery, in the southern Guangdong province, which is expected to come online in the third quarter of 2022 (3Q22). A planned 400,000 b/d Phase II capacity expansion also began operations earlier in 2022 at Zhejiang Petrochemical Corporation’s (ZPC) Rongsheng facility.

Although these projects are the most imminent new capacity expansions in China, the country is expected to continue increasing its refining and petrochemical processing capacity through a number of additional projects expected to come online by 2030. Most noteworthy among these additional expansions are the 300,000 b/d Huajin and the 400,000 b/d Yulong refinery projects, which both have target start dates in 2024.

Outside of China, the 300,000 b/d Malaysian Pengerang refinery restarted in May 2022 after a fire forced the refinery to shut down in March 2020. The refinery’s return is likely to decrease petroleum product prices and increase supply, particularly in south and southeast Asian markets.

Substantial refinery capacity was also added in the Middle East during the past year. The 400,000 b/d Jizan refinery in Saudi Arabia reportedly came online in late 2021 and began exporting petroleum products earlier this year. More recently, the 615,000 b/d Al Zour refinery in Kuwait—the largest in the country when it becomes fully operational—began initial operations earlier this year and the facility’s operators expect to increase production through the end of 2022.

A new 140,000 b/d refinery is scheduled to come online in Karbala, Iraq, this September, targeting to be fully operational by 2023. A new 230,000 b/d refinery operated by a joint venture between state-owned-firms OQ (of Oman) and Kuwait Petroleum International is set to come online in Duqm, Oman, likely in early 2023.

More than 2 million b/d of new refining capacity construction is expected to come online to support markets in the Indian Ocean basin in 2022. At the same time, a handful of major projects are also planned in the Atlantic basin. The 650,000 b/d Dangote Industries refinery in Lagos, Nigeria, set to be the largest in the country when completed, may come online in late 2022 or 2023. The refinery would most likely meet Nigeria’s domestic petroleum product demand as well as demand in nearby African countries, and it would also reduce demand for gasoline and diesel imports into the region from Europe or the United States.

In Mexico, state-owned refiner Pemex has been building a 340,000 b/d refinery in Dos Bocas, which hosted an inauguration ceremony on 1 July, even though the refinery is still under construction and is unlikely to begin producing fuels until at least 2023.

TotalEnergies is planning to restart its 222,000 b/d Donges refinery along the Atlantic Coast of France in May 2022, after closing the facility in late 2020, and some reports indicate the facility has begun importing crude oil for processing.

In addition to major new refinery projects, other facilities are also moving forward with capacity expansions at existing refineries—particularly in India. HPCL’s Visakha Refinery is undergoing a major expansion, estimated at 135,000 b/d, which is scheduled to come online by 2023. A number of other similar expansions are underway in India that may come into effect in 2024 or later.

Although no projects to build new refineries in the United States are currently planned, major refinery expansions are underway at a handful of Gulf Coast refineries, most notably ExxonMobil’s Beaumont, Texas refinery, which plans to increase its capacity by 250,000 b/d by 2023.

Facilities along the Gulf Coast currently account for 54% of all US domestic refining capacity. They supply fuels for US domestic petroleum consumption, but they are also substantial exporters into the Atlantic basin market, particularly into Central and South America and also into Europe.

If the projects mentioned above were to come online according to their present timelines, global refinery capacity would increase by 2.3 million b/d in 2022 and by 2.1 million b/d in 2023.

EIA cautions that the estimate is not necessarily a complete list of ongoing refinery capacity expansions. Moreover, many of these projects have also already been subject to major delays, and the possibility of partial starts or continued delays related to logistics, construction, labor, finances, political complications, or other factors may cause these projects to come online later than currently estimated.

The United States has the most complex and efficient refining industry in the world, but we also have less refining capacity than we used to. After more than two decades of growth in which the United States became the world’s largest refiner by volume, our industry has contracted. We’ve lost 1.1 million barrels of daily refining capacity over the course of the global pandemic with at least seven facilities shuttering, closing units or beginning the transition away from petroleum processing.

With a global energy crunch underway, much focus has been placed on crude oil supply and demand. And while this is the primary driver of our current price challenges, it’s not the only factor. Refining matters too. Crude oil has no utilitarian value until it runs through a refinery and gets processed into fuels like wholesale gasoline, diesel and jet fuel. Because of this, it’s not an overstatement to say that energy security requires a strong refining sector.

Where the issue of refining capacity is concerned, it’s important to understand what refining capacity is, why we’ve lost capacity in the United States and how policies can advance the competitiveness of our refineries in the global market. Let’s take a look:

How much refining capacity does the United States have?At the start of 2020, the United States had the largest refining industry in the world by a stretch, with 135 operable petroleum refineries and total refining capacity of 19 million barrels per day. Today, we have 128 operable refineries with total crude distillation capacity of 17.9 million barrels per day—a loss of 1.1 million barrels.

In this same period of time, the world lost a total of 3.3 million barrels of daily refining capacity. Roughly 1/3 of these losses occurred in the United States. With this realignment, and planned refinery openings and capacity expansions in Asia, trade press reports suggest China will overtake the United States as the country with the most refining capacity by year’s end.

Is COVID the only reason why the U.S. is losing refining capacity?No. A combination of factors is responsible for the United States’ loss of refining capacity. Choices to convert or shutter refineries are made very carefully—factoring in present and projected future fuel demand, the political environment as well as facility locations and their individual market access. Political and financial pressure to move away from petroleum derived fuels, costs associated with federal and state regulatory compliance and facilities’ singular economic performance all inform these decisions. The sharp drop in fuel demand over the course of the pandemic certainly sped up the timeframe for refining contractions, closures and transitions, but many of these moves were already planned or underway, something Chevron CEO Mike Wirth acknowledged in a recent interview.

Even if that wasn’t the case, reopening a refinery is a major effort. It would require significant lead time to inspect machinery and attain necessary operating permits. Staff would need to be reassembled and/or recruited and trained. And the facilities themselves would need to be reintegrated with supply chains. A hypothetical restart is not a quick-turn project, and the investment cannot be based on short-term data.

How is lost refining capacity affecting fuel prices and production?Less refining capacity means less maximum fuel production globally. As a result of tighter supply, fuel purchasers are willing to pay more for refined products. They have increased bids to buy and secure finished fuel which has pushed prices up throughout the global market.

In regions that have been most affected by refining capacity losses—such as the U.S. West Coast and Mid-Atlantic—the loss of local petroleum fuel production is contributing to higher prices and affecting regional demand for imports of gasoline, diesel and jet fuel from the global market. Because of infrastructure limitations and an uncompetitive shipping environment, economic access to domestic crude oil and refined products is limited.

Even with less capacity, United States refiners are working around the clock to produce fuel for consumers. Our refining sector is unmatched in terms of utilization. Nationally, and even with some regions undergoing planned facility maintenance, American refiners are running at 93% capacity. Along the Gulf Coast, utilization is 95%, and on the East Coast, 98%.

What does lost capacity say about the future of liquid fuels?In much of the world, demand for liquid fuels is almost back to pre-pandemic levels. Refining capacity is not. This mismatch has created a shortfall in refined product that has been exacerbated by the sudden decrease in oil and refined product from Russia and China’s decision to stop contributing fuel to the global market. New capacity is coming, though it is intended to satisfy demand growth in Asia, the Middle East and Africa, rather than replace what’s recently been lost. In these markets, roughly three million barrels of new daily capacity will come online by the end of 2022, with an additional 1.3 million barrels per day to follow in 2023.

Capacity expansions at existing refineries—rather than new facility construction—are underway in the United States as well, primarily aimed at increasing refinery throughput of U.S. light sweet crude oil.

The U.S. refining sector has experienced significant capacity losses over the last few years for reasons beyond COVID, though the pandemic certainly did fast-track decisions to repurpose or shutter facilities. Restarting those facilities is not an option in most cases as they have already been dismantled, converted or are in the conversion process. In other cases, returning idled capacity to safe operation would be so labor intensive and time consuming that any market impact would be years out.

Refiners remain focused on maximizing the production of fuelsfrom our operable facilities, ensuring that the capacity we do have isrunning efficiently and cost effectively to supply U.S. consumersand meet global energy demand.

Saudi Aramco signed three Memoranda of Understanding (MoUs) on Friday to purchase a 9 percent stake in Chinese Zhejiang Petrochemical"s integrated refinery and petrochemical complex in the city of Zhoushan, and to invest in a retail fuel network in the eastern region of China, the Saudi state-run energy giant announced.

The first agreement was signed with the Zhoushan government to acquire its 9 percent share in the 800,000-barrels-per-day integrated refinery and petrochemical complex, according to the company"s statement.

According to the press release, phase I of the project will include a newly-built 400,000-barrels-per-day refinery with a 1.4 million-metric-tons-per-annum (mmtpa) ethylene cracker unit, and a 5.2 mmtpa aromatics unit. Phase II will see a 400,000-barrels-per-day refinery expansion, which will include deeper chemical integration than phase I, it said.

Image: The agreement was signed by His Excellency Dr. Sultan Al Jaber, UAE Minister of State and ADNOC Group CEO, and Li Shuirong, Chairman of Rongsheng Group. Photo: courtesy of Abu Dhabi National Oil Company.

The Abu Dhabi National Oil Company (ADNOC) has entered into a framework agreement with China-based Rongsheng Petrochemical to look out for domestic and international expansion opportunities.

The deal will see ADNOC and Rongsheng explore opportunities in the sales of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the UAE, and the supply and delivery of LNG to Rongsheng.

Under the terms of the agreement, both the companies will look out for opportunities to expand the volume and range of refined products sales to Rongsheng in addition to ADNOC’s participation as Rongsheng’s strategic partner in refinery and petrochemical opportunities, including funding in Rongsheng’s downstream complex.

On the other hand, the China-based company will also explore possible investments in ADNOC’s downstream industrial ecosystem in Ruwais, including the proposed Gasoline Aromatics Plant, GAP, and the possibility for ADNOC to supply and deliver LNG for utilisation by Rongsheng within its production factories in China.

Rongsheng Group chairman Li Shuirong said: “The strategic cooperation with ADNOC will ensure that our ZPC project, which will have a refining capacity of up to 1 million barrels per day (mbpd) of crude, has adequate supplies of feedstock.

“Our valued partnership will enable Rongsheng Petrochemical to continue its expansion into the international oil market and we are confident Rongsheng Petrochemical will achieve enhanced market share and recognition in the global marketplace.”

As the shift in oil demand from Covid-19 turned the tables of regional levels of fuel production and exports, China succeeded in overtaking the USA as the world’s biggest oil refiner in 2020. As China began to ramp up its refining capacity throughout the pandemic, the US Energy Information Administration (EIA) published data showing thatChina processed more crude oil than the U.S.for much of 2020.

Oil refineries across the U.S. have been losing momentum in response to the Covid-19 pandemic. At the end of last year, Royal Dutch Shell Plc ground production at its Convent refinery in Louisiana to a halt. This same facility had 35 times the refining capacity of China when it opened in 1967, showing how dramatically the tables have turned over the past couple of decades.

Oil refineries have also been impeded this year by the severe storm that hit the state of Texas in February. During the storm, oil refining fell to its lowest levels since 2008. This was largely due to frozen pipelines which forced producers to halt activities.Refinery crude runs fell by 2.6 million bpdthroughout the week to 12.2 million bpd.

Meanwhile, in November, China was processing around1.2 million bpd of crude oil. Much of this new refining work was taking place in the new unit at Rongsheng Petrochemical’s giant Zhejiang facility in northeast China.

China is not the only Asian giant to invest in refining over the next decade. Just a few weeks ago,India announced plan to invest $4.5 billion in a Panipat refinery expansionby September 2024. This would increase Panipat’s capacity by two-thirds to 500,000 bpd.

Only slightly behind China, as the world’s third largest oil importer and consumer, India is striving to increase its oil refining capacity by 60 percent to meet the country’s increasing oil demand. This comes as Prime Minister Narendra Modi has pledged to improve India’s manufacturing sector.

State-owned Indian Oil Corporation (IOC) has also announced plans to build a new refinery at Nagapattinam in the southern state of Tamil Naduat a cost of $4.01 billion. The IOC subsidiary Chennai Petroleum Corporation Limited is expected to develop the refinery. The project is aimed at meeting the demand of petroleum products across southern India.

While U.S. refining activities are expected to pick up before the end of the year, a dramatically increased oil refining capacity in China, as well as new projects in India, suggest that the face of the industry could change over the next decade. As oil demand wanes in the U.S. and continues to increase across Asia, many Asian countries will be seeking out refined products from closer to home to meet their needs.

8613371530291

8613371530291