rongsheng refinery start free sample

China"s private refiner Zhejiang Petroleum & Chemical is set to start trial runs at its second 200,000 b/d crude distillation unit at the 400,000 b/d phase 2 refinery by the end of March, a source with close knowledge about the matter told S&P Global Platts March 9.

ZPC cracked 23 million mt of crude in 2020, according the the source. Platts data showed that the utilization rate of its phase 1 refinery hit as high as 130% in a few months last year.

Started construction in the second half of 2019, units of the Yuan 82.9 billion ($12.74 billion) phase 2 refinery almost mirror those in phase 1, which has two CDUs of 200,000 b/d each. But phase 1 has one 1.4 million mt/year ethylene unit while phase 2 plans to double the capacity with two ethylene units.

With the entire phase 2 project online, ZPC expects to lift its combined petrochemicals product yield to 71% from 65% for the phase 1 refinery, according to the source.

Zhejiang Petroleum, a joint venture between ZPC"s parent company Rongsheng Petrochemical and Zhejiang Energy Group, planned to build 700 gas stations in Zhejiang province by end-2022 as domestic retail outlets of ZPC.

Established in 2015, ZPC is a JV between textile companies Rongsheng Petrochemical, which owns 51%, Tongkun Group, at 20%, as well as chemicals company Juhua Group, also 20%. The rest 9% stake was reported to have transferred to Saudi Aramco from the Zhejiang provincial government. But there has been no update since the agreement was signed in October 2018.

Zhejiang Petroleum & Chemical Co Ltd, one of two new major refineries built in China in 2019, said it has started up the remaining units in the first phase of its refinery and petrochemical complex.

The company, 51% owned by private chemical group Zhejiang Rongsheng Holdings, said it has started test production at ethylene, aromatics and other downstream facilities, without giving further details.

Zhejiang Petrochemical started a first 200,000 barrels per day (bpd) crude processing unit in late May, following on from the start of a 400,000-bpd refinery owned by another private chemical major Hengli Petrochemical.

The newly started units at Zhejiang Petrochemical should include a second 200,000-bpd crude unit, a 1.2 million tonnes per year (tpy) ethylene unit and a 2 million tpy paraxylene unit, according to several industry sources with knowledge of the plant’s operations.

SINGAPORE, Oct 14 (Reuters) - Rongsheng Petrochemical, the trading arm of Chinese private refiner Zhejiang Petrochemical, has bought at least 5 million barrels of crude for delivery in December and January next year in preparation for starting a new crude unit by year-end, five trade sources said on Wednesday.

Rongsheng bought at least 3.5 million barrels of Upper Zakum crude from the United Arab Emirates and 1.5 million barrels of al-Shaheen crude from Qatar via a tender that closed on Tuesday, the sources said.

Rongsheng’s purchase helped absorbed some of the unsold supplies from last month as the company did not purchase any spot crude in past two months, the sources said.

Zhejiang Petrochemical plans to start trial runs at one of two new crude distillation units (CDUs) in the second phase of its refinery-petrochemical complex in east China’s Zhoushan by the end of this year, a company official told Reuters. Each CDU has a capacity of 200,000 barrels per day (bpd).

Zhejiang Petrochemical started up the first phase of its complex which includes a 400,000-bpd refinery and a 1.2 million tonne-per-year ethylene plant at the end of 2019. (Reporting by Florence Tan and Chen Aizhu, editing by Louise Heavens and Christian Schmollinger)

BEIJING, Aug 14 (Reuters) - Rongsheng Petrochemical , the listed arm of a major shareholder in one of China’s biggest private oil refineries, expects demand for energy and chemical products to return to normal in the country in the second half of this year.

Rongsheng expects to start trial operations of the second phase of the refining project, adding another 400,000 bpd of refining capacity and 1.4 million tonnes of ethylene production capacity in the fourth quarter of 2020.

“We expect the effects of the coronavirus pandemic on energy and chemicals to have basically faded in spite of the possibility of new waves of outbreak,” said Quan Weiying, board secretary of Rongsheng, in response to Reuters questions in an online briefing.

But Li Shuirong, president of Rongsheng, told the briefing that it was still in the process of applying for an export quota and would adjust production based on market demand. (Reporting by Muyu Xu and Chen Aizhu; Editing by Jacqueline Wong)

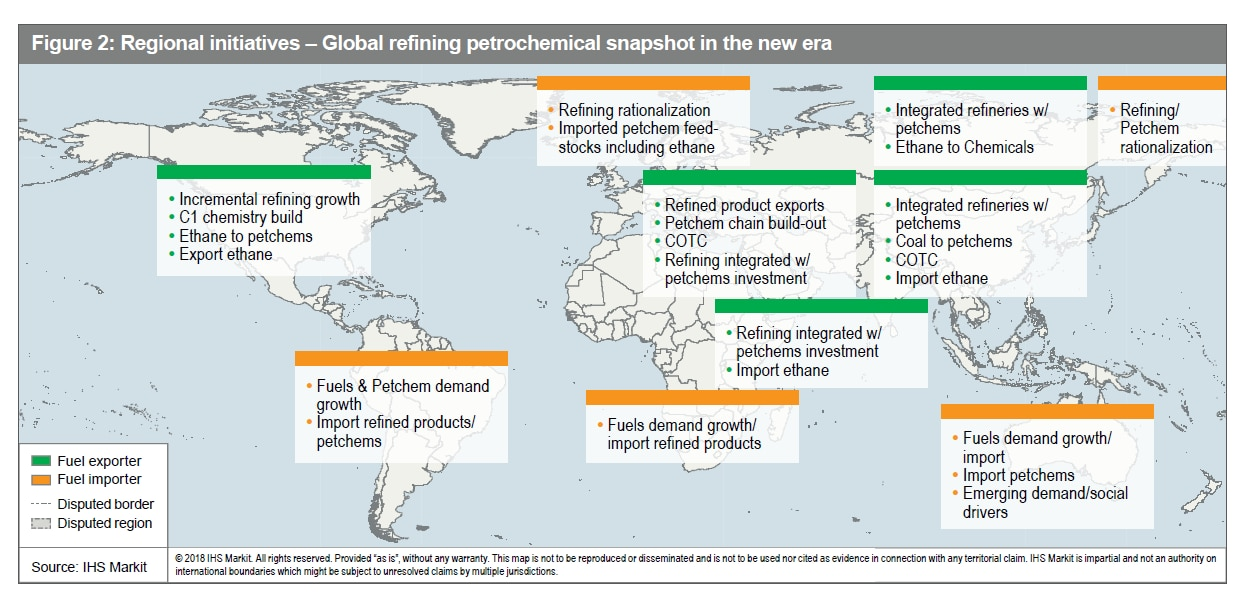

In Asia and the Middle East, at least nine refinery projects are beginning operations or are scheduled to come online before the end of 2023. At their current planned capacities, they will add 2.9 million barrels per day (b/d) of global refinery capacity once fully operational.

The scheduled expansions follow a period of reduced global refining capacity. Net global capacity declined in 2021 for the first time in 30 years, according to the IEA. The new refinery projects would increase production of refined products, such as gasoline and diesel, and in turn, they might reduce the current high prices for these products.

China’s refinery capacity is scheduled to increase significantly this year. The Shenghong Petrochemical facility in Lianyungang has an estimated capacity of 320,000 b/d, and they report that trial crude oil-processing operations began in May 2022. In addition, PetroChina’s 400,000 b/d Jieyang refinery is expected to come online in the third quarter of 2022. A planned 400,000 b/d Phase II capacity expansion also began operations earlier this year at Zhejiang Petrochemical Corporation’s (ZPC) Rongsheng facility. More information on these expansions is available in our Country Analysis Executive Summary: China.

Outside of China, the 300,000 b/d Malaysian Pengerang refinery (also known as the RAPID refinery) restarted in May 2022 after a fire forced the refinery to shut down in March 2020. In India, the Visakha Refinery is undergoing a major expansion, scheduled to add 135,000 b/d by 2023.

New projects in the Middle East are also likely to be an important source of new refining capacity. The 400,000 b/d Jizan refinery in Saudi Arabia reportedly came online in late 2021 and began exporting petroleum products earlier this year. More recently, the 615,000 b/d Al Zour refinery in Kuwait—the largest in the country when it becomes fully operational—began initial operations earlier this year. A new 140,000 b/d refinery is scheduled to come online in Karbala, Iraq, this September, targeting fully operational status by 2023. A new 230,000 b/d refinery is set to come online in Duqm, Oman, likely in early 2023.

These estimates do not necessarily include all ongoing refinery capacity expansions. Moreover, many of these projects have already been subject to major delays, and the possibility of partial starts or continued delays related to logistics, construction, labor, finances, political complications, or other factors may cause these projects to come online later than estimated. Although the potential for project complications and cancellations is always a significant risk, these projects could otherwise account for an increase of nearly 3.0 million b/d of new refining capacity by the end of 2023.

Were the extra barrels needed to satisfy unusually strong refinery demand? A desire to stockpile supply for later consumption? Or perhaps add more cushion to strategic reserves?

Rongsheng Petrochemical Co., Ltd. is a China-based company principally engaged in the research, development, manufacturing and distribution of refining products, petrochemicals and chemical fibers. Rongsheng has an annual production capability of 2 million tons of aromatic hydrocarbon, over 13 million tons of pure terephthalic acid (PTA), 2 million tons of PET, 1 million tons of POY and FDY, 0.45 millon tons of DTY. Rongsheng‘s total capability of PTA ranks the first of the world. Rongsheng persists in “Two-way of Vertical and Horizontal” development strategy and recently developed a green refining-petrochemical integrated project with a total capacity of 40 million tons per annum, via its subsidiary Zhejiang Petroleum and Chemicals Co., Ltd. (ZPC).

The startup took only about three days to complete. The liquids ethylene cracker is part of ZPC’s grassroots integrated refining and petrochemical complex which broke ground in 2016.

Stan Knez, President of TechnipFMC Process Technology, commented: “We are very pleased with the successful startup of the ZPC cracker. This is a great milestone for the complex and another example of our proven ethylene technology”.

(1) ZPC: Zhejiang Petroleum & Chemical Co., Ltd, established in Zhoushan, Zhejiang on June 18, 2015, is a mixed-ownership enterprise jointly formed by the private enterprise Rongsheng Petrochemical Co., Ltd.(holding 51% of shares), provincial state-owned enterprise Zhejiang Juhua Investment Co., Ltd.(holding 20% of shares), the private enterprises Zhejiang Tongkun Investment Co., Ltd.(holding 20% of shares) and Zhoushan Marine Comprehensive Development and Investment Co., Ltd.(holding 9% of shares), which will be the first kind of mixing economy enterprise in China in the Refinery and Petrochemical Industry. ZPC’s first phase project includes 20 million tons per year refinery and 1400 KTA Ethylene Complex.

Rongsheng Petrochemical Co., Ltd. is a China-based company principally engaged in the research, development, manufacturing and distribution of refining products, petrochemicals and chemical fibers. Rongsheng has an annual production capability of 2 million tons of aromatic hydrocarbon, over 13 million tons of pure terephthalic acid (PTA), 2 million tons of PET, 1 million tons of POY and FDY, 0.45 millon tons of DTY. Rongsheng‘s total capability of PTA ranks the first of the world. Rongsheng persists in “Two-way of Vertical and Horizontal” development strategy and recently developed a green refining-petrochemical integrated project with a total capacity of 40 million tons per annum, via its subsidiary Zhejiang Petroleum and Chemicals Co., Ltd. (ZPC).

China Merchants Energy Shipping (CMES), the energy transport unit of China Merchants Group, has signed a agreement with Rongsheng Petrochemical to form a strategic partnership.

Under the agreement, the two companies will jointly develop cooperation opportunities in the area of shipping, logistics, and financing, especially for the Rongsheng’s Zhoushan Green Petrochemical Base project, which started a trial operation recently.

Zhoushan Green Petrochemical Base project is a new integrated refinery and petrochemical project on Zhoushan Island, and it is set to become one of the world’s largest crude-to-chemicals complex.

Global Refinery-Chemicals Integration Market Status, Trends and COVID-19 Impact Report 2021, Covid 19 Outbreak Impactresearch report added by Report Ocean, is an in-depth analysis of market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography. It places the market within the context of the wider Refinery-Chemicals Integration market, and compares it with other markets., market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Refinery-Chemicals Integration market size forecast, market data & Graphs and Statistics, Tables, Bar &Pie Charts, and many more for business intelligence. Get complete Report (Including Full TOC, 100+ Tables & Figures, and Chart). – In-depth Analysis Pre & Post COVID-19 MarketOutbreak Impact Analysis &Situation by Region

Li had reason to celebrate. Saudi Arabia’s state oil company agreed to buy a stake in a refinery that his firm, Rongsheng Petrochemical Co., is building there. The high-profile deal illustrated the potential for Zhoushan and the wider Zhejiang province, in which the archipelago is located, to play an outsize role in energy markets. The local government’s ambition for a processing, storage and trading hub is spurring a rush for a piece of the pie.

One of the biggest projects in the works is Rongsheng’s energy and petrochemical complex, which will process about 400,000 barrels a day of oil and is set to start operations by the end of 2018. There are plans to double the plant’s capacity by 2020, which would elevate it to the ranks of the largest refineries in the world.

While Rongsheng is preparing to start its refinery, ENN Energy Holdings Ltd. has begun operations at a liquefied natural gas receiving terminal in Zhoushan. The project will be able to handle 3 million metric tons a year in its first phase, with annual capacity to increase to 5 million tons by 2021.

According to the European Chemical Industry Council, a trade association, global chemical output declined by 0.1% in 2020. The industry basically ended up where it started.

Now that it is breaking out chemical sales again, Shell rejoins the Global Top 50 this year after a 5-year hiatus. Rongsheng Petrochemical, which makes polyester chemicals, debuts this year. The former DowDuPont agricultural chemical business, Corteva Agriscience, made the cut as well.

The $9.4 billion petrochemical complex that Formosa Plastics is planning in St. James Parish, Louisiana, is in hot water. It faces fierce opposition both locally from community organizations worried about pollution and nationally from environmental groups that wish to stop the mounting production of plastics. Sharon Lavigne, head of the local group Rise St. James, recently received the prestigious Goldman Environmental Prize for her efforts, a sign that the Formosa project has high-profile opposition. The project also faces practical hurdles. Notably, the US Army Corps of Engineers suspended a permit for the facility in November. Formosa Plastics had better luck in Point Comfort, Texas, where it started up an ethylene cracker and low-density polyethylene unit last year.

Most large chemical companies nowadays are plunging into plastics recycling to counter public backlash, and LyondellBasell Industries is at the front of the pack. CEO Bob Patel is one of the founders of the Alliance to End Plastic Waste, formed by industry to address the recycling problem. And Lyondell has its own initiatives. It and the waste management firm Suez bought the plastics recycler Tivaco and are combining it with Quality Circular Polymers, a recycling venture Lyondell and Suez started in 2018. Quality Circular has some high-profile clients. For example, Samsonite is using its resin for a line of sustainable suitcases. Meanwhile, Lyondell continues to grow its core petrochemical business, often on the cheap. In December, the firm bought, for the bargain price of $2 billion, a 50% interest in a new ethylene cracker and two polyethylene plants that the struggling Sasol had built. Similarly, it bought into an ethylene cracker joint venture already under construction in China.

While oil companies such as Shell and BP were redefining themselves as alternative energy players in recent years, ExxonMobil stuck with petroleum. The firm was taking what it considered a realistic position. Oil and gas are cheap and convenient, it argued, and would be hard to dislodge from the energy market for the next few decades. But COVID-19 hit the oil and gas business hard. ExxonMobil racked up a gaping corporate loss of $28 billion in 2020, even as its chemical unit earned an operating profit of $2.7 billion. The company is facing shareholder pressure to change, and it is starting to respond. For example, in April, it outlined a $100 billion plan to store 100 million metric tons per year of carbon dioxide in the Gulf of Mexico. The new environmental consciousness trickles down into chemicals. At a complex in France, ExxonMobil Chemical plans to host a pyrolysis plant that breaks down waste plastics into chemical raw materials. And at its Baytown, Texas, chemical facility, it is testing a plastics recycling process. Separately, in a rare move, ExxonMobil is divesting a business, selling its Santoprene thermoplastic vulcanizate operation to Celanese for $1.15 billion.

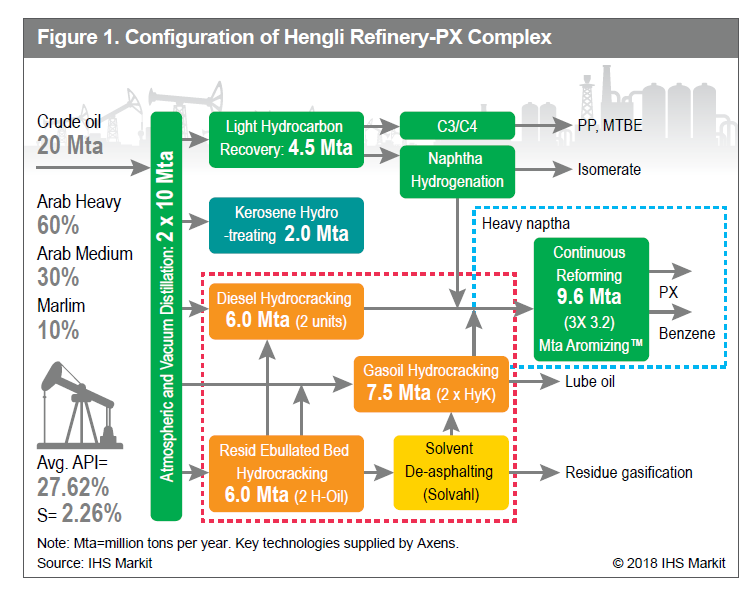

Hengli Petrochemical’s growth has been amazing. Last year, the company came out of nowhere to debut at 26 in the Global Top 50. In 2020, and despite the COVID-19 pandemic, the Chinese petrochemical maker’s chemical sales grew by a whopping 46%. Construction at an almost unbelievable pace is responsible for this growth. In 2020 alone, Hengli started two large production lines for purified terephthalic acid (PTA), a polyester raw material, in Dalian, China. The lines, which use technology from Invista, bring Hengli’s PTA capacity to 12 million metric tons (t) per year. In November, Hengli signed a licensing agreement, also with Invista, for two more PTA lines at its site in Huizhou, China. In addition, the company plans to build a plant in Dalian to make a biodegradable plastic from PTA, adipic acid, and 1,4-butanediol. Hengli says the plant will have 450,000 t of annual capacity, a large figure for a biodegradable plastic.

Recently, Evonik Industries has been favoring small acquisitions that provide access to new technology. In June, it inked an agreement to buy Infinitec Activos for an undisclosed sum. Infinitec specializes in delivery methods—such as peptide-studded gold and sapphire nanoparticles, lipid vesicles, and nanoscale alginate hydrocolloid capsules—for cosmetic ingredients. In November, Evonik bought Houston-based Porocel Group, a provider of refinery catalysts and catalyst regeneration services, for $210 million. Evonik has built a burgeoning business in lipids for the delivery of messenger RNA (mRNA) used as a COVID-19 vaccine. And it recently launched a collaboration with Stanford University to develop a degradable polymer–based system for delivering mRNA therapeutics. In more traditional industrial chemistry, the company is building a $470 million plant in Marl, Germany, for making nylon 12, a high-end polymer critical for automotive applications such as brake lines. Evonik is considering the sale of its superabsorbent polymer unit, which employs 800 people.

Shell Chemicals returns to the Global Top 50 after a 5-year hiatus because it is disclosing its chemical sales figures again. The return comes as the larger Shell organization plans massive changes that will profoundly impact both its chemical and oil businesses. Shell plans to achieve net-zero carbon emissions by 2050, meaning it will have to reduce, or offset, all its greenhouse gas emissions. It will redefine itself as something other than an oil company. Its 13 refineries will become 6 energy and chemical “parks” that will increasingly supply renewable energy and chemicals produced from alternative feedstocks. Shell is part of a consortium that will build a water electrolysis plant in Germany to make green hydrogen. The firm is replacing 16 ethylene steam cracker furnaces in Moerdijk, the Netherlands, with 8 new ones to reduce carbon emissions by 10%. Shell is collaborating with Dow to replace conventional gas-fired ethylene furnaces with electrically heated ones that run on renewable power. And it is starting to use synthetic crude oil derived from waste plastics at its ethylene cracker in Norco, Louisiana.

Many people would think of Dow and BASF as the technology giants in industrial chemistry. But Braskem, a Brazilian petrochemical maker, is a technological heavy hitter too. It is partnering with the University of Illinois Chicago on a route to ethylene based on the electrochemical reduction of carbon dioxide from flue gas. At its chlor-alkali complex in Maceió, Brazil, Braskem will host a pilot plant to make ethylene dichloride using a novel process developed by the start-up Chemetry. In this energy-saving process, called eShuttle, chloride ions react with cuprous chloride (CuCl) to form cupric chloride (CuCl2), which reacts with ethylene to form the polyvinyl chloride raw material. In Pittsburgh, Braskem recently completed a $10 million expansion of its technology and innovation center to allow work on recycling, 3D printing, and catalysis.

Indorama built itself up into one of the world’s largest chemical companies via aggressive growth in the polyester chain, both by buying businesses and by constructing massive new plants. Now the Thai company is looking to diversify. In 2020, it bought Huntsman’s intermediates and surfactant business, which makes surfactants and ethanolamines. And it is negotiating the purchase of Oxiteno, the specialty chemical arm of the Brazilian conglomerate Grupo Ultra and the second-largest producer of ethoxylates in the world. Indorama is also developing its capabilities in recycling. It is buying CarbonLITE’s polyethylene terephthalate (PET) recycling plant in Dallas and building a US PET depolymerization plant with the Canadian start-up Loop Industries.

The Dutch company has been steering away from traditional chemical sectors and toward nutrition and health. In April, DSM sold its resin and functional materials business to Covestro for $1.8 billion. The unit makes 3D-printing materials, antireflective coatings for photovoltaic panels, acrylic resins for paints, and optical fiber coatings. DSM is holding on to its engineering resin business, which makes nylon and other high-end polymers, as well as its Dyneema ultra-high-molecular-weight polyethylene fiber business. These operations make up less than 20% of DSM’s overall sales. After the Covestro transaction, DSM invested $100 million in the personal nutrition start-up Hologram Sciences. In March, it agreed to acquire Amyris’s fermentation-derived flavor and fragrance ingredient line for $150 million.

Recent years have seen Chinese petrochemical producers, often involved in the polyester supply chain, join the Global Top 50. Hengli Petrochemical is one of those firms. And now Rongsheng Petrochemical is another. The company is one of the largest producers of purified terephthalic acid in the world, with 13 million metric tons of capacity at plants in Dalian, Ningbo, and Hainan, China. It also makes polyester resin and fiber. It is an investor in Zhejiang Petrochemical, a large oil refinery and petrochemical complex that is currently starting up.

Sustainability continues to be a focus for the Austrian petrochemical maker. In June, the company signed an agreement to buy oil from Renasci Oostende Recycling, which uses a thermal process to break down postconsumer plastic. Borealis will turn this feedstock into plastics again at its complex in Porvoo, Finland. Borealis also started up a demonstration unit at its polyethylene plant in Antwerp, Belgium, to test a heat-recovery technology developed by the start-up Qpinch. The technology is modeled on the adenosine triphosphate–adenosine diphosphate cycle in biology. Separately, Borealis put its fertilizer business up for sale in February.

Sasol ended a saga in November when it started up a low-density polyethylene plant in Lake Charles, Louisiana. The unit was the last of the plants the South African company built as part of a $12.8 billion petrochemical complex. The project went $4 billion over budget, leading to the ouster of its co-CEOs. To strengthen its balance sheet, Sasol aims to divest $6 billion in assets. To that end, the company formed a joint venture with LyondellBasell Industries to run the ethylene cracker and two polyethylene plants it built in Lake Charles, essentially selling half these operations for $2 billion. Sasol is keeping alcohols, ethylene oxide and ethylene glycol, and ethoxylation plants at the site. Separately, Sasol sold its 50% interest in the Gemini HDPE high-density polyethylene joint venture with Ineos for $400 million.

New refinery start-ups in China are helping to absorb some of the crude oil from the Middle East amid an otherwise depressed market with stalled demand recovery.

Rongsheng Petrochemical, the trading arm of Zhejiang Petrochemical, has bought at least 5 million barrels of UAE’s Upper Zakum crude and Qatar’s al-Shaheen crude in a tender this week, trading sources told Reuters. According to traders who spoke to Bloomberg, Rongsheng Petrochemical has purchased at least 7 million barrels of crude from the Middle East.

The company was looking to procure oil from the Middle East as it prepares to begin trial runs at a new refinery by the end of this year, sources told Reuters.

8613371530291

8613371530291