rongsheng shipyard free sample

You can use this royalty-free editorial photo "Ship is being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east China"s Jiangsu province, 12 October 2012" for personal and non-commercial purposes according to the Standard License. This stock image may be used to illustrate stories in newspaper and magazine articles and blog posts. Please note that editorial stock photos may not be used in advertising or promotional material.

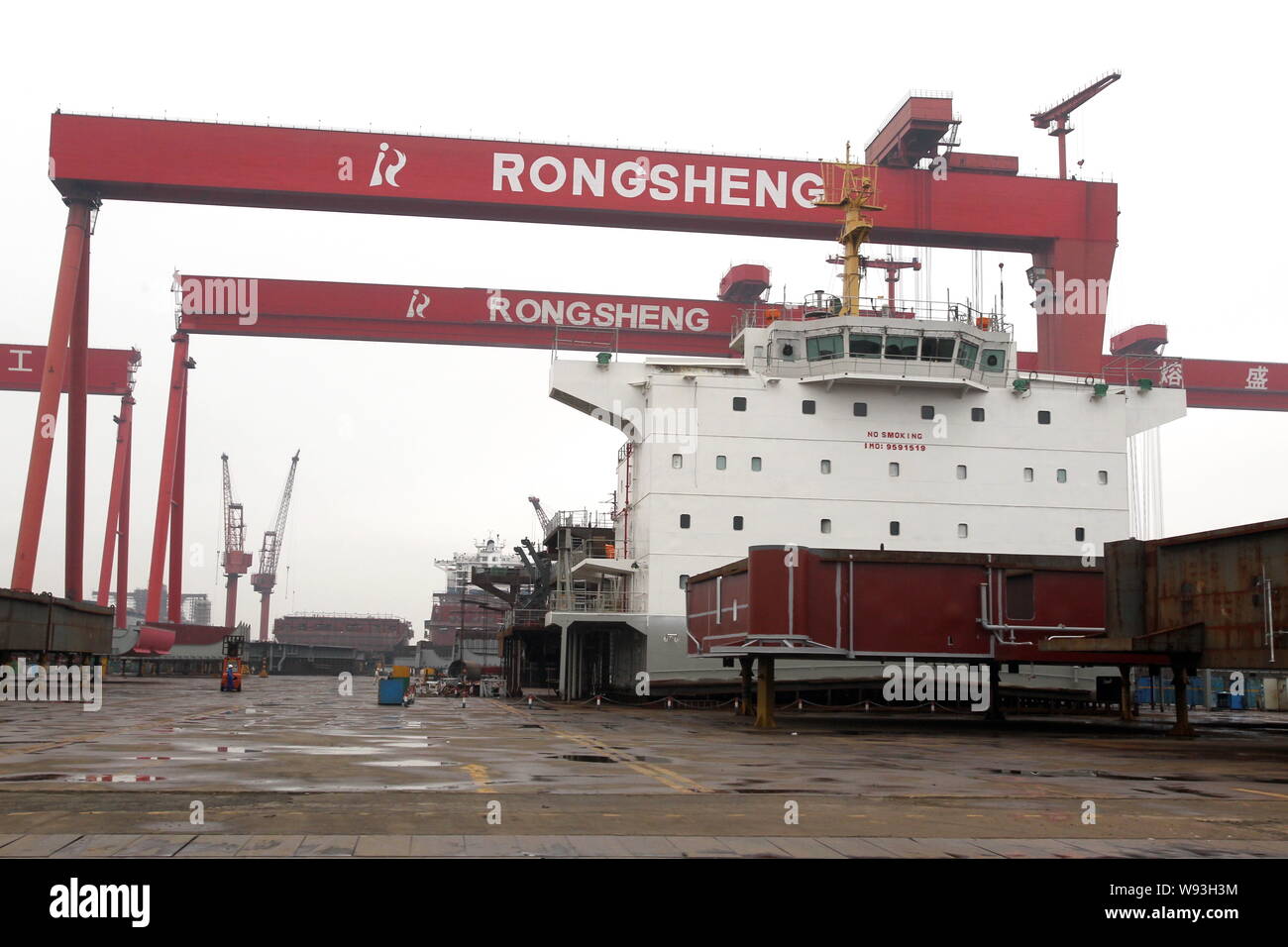

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The shipyard, located in the Yangtze River Delta, was founded in 2006, and became the largest private shipbuilder in China, churning out giant valemaxes at its four large dry-docks, before a massive financial collapse forced it to cease operations in 2014.

Broking sources in China tell Splash that the yard’s former chief operating officer David Luan is now preparing to officially reopen the yard, to be known as SPS Shipyard, a reference to ShipParts.com, a business he created in 2015 after quitting Rongsheng.

SPS Shipyard will start to market cape and kamsarmax slots from next week with next available slots being from Q3 2025 onwards. Luan has yet to reply to questions sent by Splash earlier today.

The world coal and iron ore trade demand depends very much on the biggest purchaser China. Coal import increased to 100 million tons in 2009 and tends to rise upwards until 2020. In 2009, iron ore import demand to China reached 2/3 of the world’s iron ore trade. The second biggest purchaser in the world is India that is looking for new suppliers in Russia and Latin America seeking to fill increased needs. Despite the fact that bulker market shows recovery signals since the end of 2009 the nearest future of shipbuilders focused on bulker carriers is not yet safe. During the first four months of 2010, it contracted 185 new bulk carriers (15 million dwt). Though prices of new building incentives have fallen by 30% the order book for 2010-2014 is overfilled: 3286 new bulkers (43.6% of existing bulker fleet) totalling 287.1 million dwt (59.7%)(CESA AR, 2010). This means that shipyards of China, S. Korea, Japan and new players focused on production of bulkers should turn to the building of other ship types. Consequently, the competition among high added value shipbuilders should be more intense.

Such a danger as “tenth wave” is poising now over the global shipbuilding industry. What shipyards of what countries will survive it? It might be that some countries will decide to reduce shipbuilding capacity or even close it before their shipyards collapse.

Productivity is influenced by technology, facilities, management competence, work organization, work practice, the level of workers’ skills and motivation. The level of the shipyard’s technology is one of the most important factors influencing the cost competitiveness, especially for the large enterprise.

Technology benchmark provided by T. Lamb shows very interesting results forcing to think what is more valuable for the shipyards competing in the market. It compares typical production elements such as steelwork and outfitting production, other pre-erection, ship construction, layout & environment, design & drafting, and organisation/operating of the main shipbuilding countries/regions. The highest overall level has Japan (4.43), the second – S. Korea (4.00), then Europe (3.4), and the lowest is of China (2.88) (Lamb, 2007). Is China a winner just because of low labour price? Or is Chinese labour cost lower because of small investment? Another reason impacting (more specifically – distorting) the competitiveness of shipyards is State support that goes to increasing of the national shipbuilding capacity. For example, over the past decade Korea almost quadrupled its production capacities while Japan and Europe kept stable production volumes. Since 1998 to 2009, S. Korean shipbuilding capacity grew by 10.8 million CGT and Chinese - by 7.9 million CGT (ECORYS SCS, 2009). China and S. Korea continues to follow a highly aggressive expansion path. Under Chinese "Shipbuilding industry adjustment promotion plan" the government has defined provision of operating funds to shipyards and expansion of financial support to owners who order export ships. Not only these countries but also new players such as Brazil, Turkey, India, etc provide huge amounts of support and financial assistance to their domestic producers by using various forms of subsidies including investment aid, loans and payment guarantees to shipbuilders, suppliers, governmental bailouts, subsidies on ship prices for domestic ocean going ships’ buyers, mandatory requirements to order ships at domestic yards and subsidized loans for domestically built ships, direct loans and debt guarantees to ship-owners, etc.

In such conditions, keeping a competitive edge of European shipyards becomes more and more complicate. Despite of the reduced order book Europe chooses quality and excellence over the low costs as the main strategic point of further development of the shipbuilding industry.

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group.

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.” (Reporting by Yimou Lee in HONG KONG and Koh Gui Qing in BEIJING; Editing by Neil Fullick)

Rongsheng/ China, Apr 7 (ONA)---Oman Shipping Company (OSC) took delivery of its 4th Very Large Ore Carrier (VLOC) "VALE SHINAS" in China, which will be used in the transportation of iron ore from Brazil to Sohar, Oman.Firstly, the pelletising plant and a fleet of Very Large Ore Carriers (VLOC) have created a "virtual iron ore mine" in the Sultanate," added Beluco.Marcos Beluco, Country Manager of Vale Oman said the total investment of Vale"s industrial complex in Liwa had exceeded $2 billion, which includes the construction of the jetty built by Sohar Industrial Port Company and the construction of four Very Large Ore Carriers by Oman Shipping Company named Vale Liwa, Vale Sohar, Vale Shinas and Vale Saham.This terminal is one of the first ports in the world to receive Very Large Ore Carriers (VLOCs) that boast a capacity of 400,000 tons and are responsible for transporting the world"s purest iron ore from Brazil to the shores of the Sultanate.Five of Vale"s very large crude carriers (VLCCs) will be converted to very large ore carriers (VLOCs) at the Yulian Shipyard and at the Huraung Dan Dong Shipyard in China.Vale has also ordered 12 very large ore carriers with capacity of 400,000 tons from the Rongsheng Shipbuilding and Heavy Industries shipyard in China.With the addition of this 1,380 meter long and 25 meter deep jetty, the Port of Sohar will join a handful of ports in the world with the capability to receive Very Large Ore Carriers of 400,000 DWT.

(Beijing) – Piles of rusty steel bars and old ship parts are virtually all that"s left of a sprawling shipyard in the eastern city of Rugao, where Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people.

Once China"s largest shipbuilder, Rongsheng is on the verge of bankruptcy. Orders have dried up and banks are refusing credit. Questions have been raised about the shipyard"s business practices, including allegations of padded order books. And Rongsheng is apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms, sources told Caixin.

8613371530291

8613371530291