rongsheng shipyard map made in china

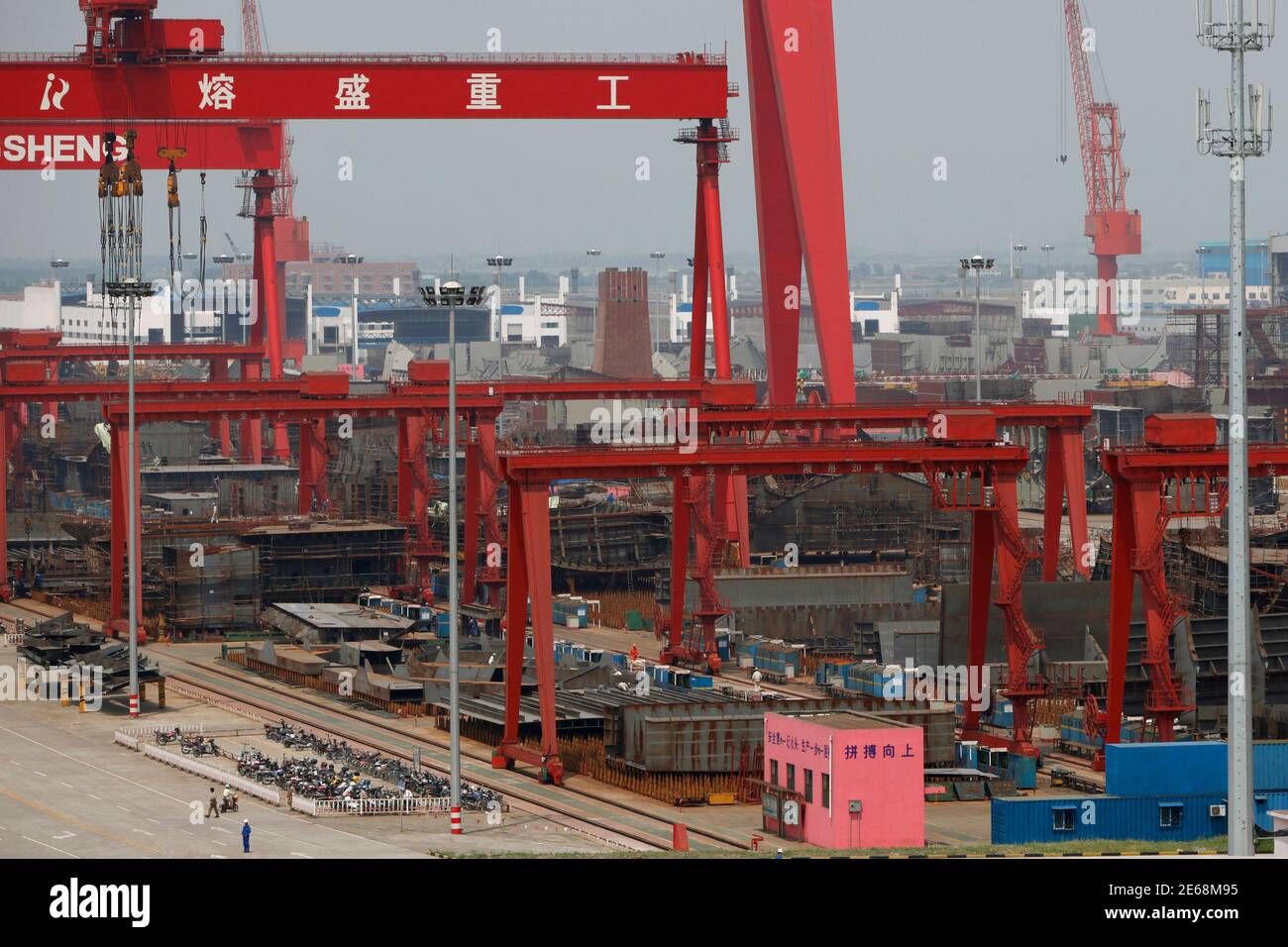

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

COSCO Shipping Heavy Industry, China"s third-largest shipbuilder by output, plans to reduce the number of its offshore construction shipyards from five to two by 2020.

Under the plan, shipyards in Nantong, Zhoushan and Dongguan will be closed. Shipyards in Qidong and Dalian will remain open as they also build polar ships, drilling platforms and cattle carriers, reports China Daily.

Declining international oil and shipbuilding prices, growing costs for materials and labor have become factors squeezing shipyards" earning ability globally," a COSCO spokesman said.

Established in December 2016, the company was formed out of the previous COSCO Shipyard Group, COSCO Shipbuilding Industry and China Shipping Industry. COSCO Shipyard and China Shipping Industry all reported financial losses last year. http://maritime-executive.com/article/cosco-to-close-three-shipyards

Rugao port is adding infrastructure whereby it will be able to handle up to 800,000 teu a year. The river port in Jiangsu province near Rongsheng shipyard is building four 5,000 dwt terminals, two 10,000 dwt terminals and one 20,000 dwt terminal. There will also be a 400,000 sq m container yard with all work likely to be finished by the end of 2014. [SinoShipNews 24/07/13]Upload News

Beijing has made its naval forces the cornerstone of its military modernization. China is actively pursuing the role of a global military power able to project its force to any corner of the earth, and the US may not have the sheer industrial capacity to compete. "It is easier for China to increase its fleet numbers as it is the world"s biggest shipbuilder. They have immense shipyard capacities, which the US lacks, as its commercial shipbuilding has been thrown into disarray over the past decades," says Vasily Kashin, Far East researcher at the Russian Academy of Sciences.

The 2016 Annual Report to Congress: Military and Security Developments Involving the People�s Republic of China reported that "Shipyard expansion and modernization has increased China�s shipbuilding capacity and capability for all types of military projects, including submarines, surface combatants, naval aviation, and sealift assets. China�s two largest state-owned shipbuilders�the China State Shipbuilding Corporation and the China Shipbuilding Industry Corporation�collaborate in shared ship designs and construction information to increase shipbuilding efficiency. China continues to invest in foreign suppliers for some propulsion units, but is becoming increasingly self-sufficient. China is the top ship-producing nation in the world... "

China is the leading shipbuilding country in the world. As of the end October 2010, China"s production completion of shipbuilding was 50.90 million deadweight tons (dwt), an increase of 58.4%, and new orders of the industry were 54.62 million dwt or 2.9 times that of the same period last year, respectively. China�s �White List� of shipbuilders, first released in September 2014 as a guide to the yards which the Chinese government wished to support, listed 71 builders which together delivered 90% of Chinese output. The first "white list" included 51 shipyards that it deems worthy of favourable policy support.

The State-Owned Shipbuilders include two main group: CSSC & CSIC. These two Groups are both large and under supervision of the State Council. There are also other group such as CSC group, AVIC group and etc� The Private Shipbuilders include some big shipbuilders which are listed in the stock exchange such as Yangzijiang Shipbuilding Group, RongSheng Heavy Industry and some others such as New Times, MingDe, HanTong and etc�

China overtakes Korea as the world"s top shipbuilder in the first half of 2010 and kept ahead in terms of three major industry indicators, including new orders, order backlogs and delivery. China�s shipbuilding industry is expected to be left with a handful of 30 shipbuilding enterprises with demand for yard facilities not exceeding 60m dwt by end-2015. At its peak, China�s shipbuilding sector witnessed more than 3,000 shipyards at the start of 2010, leading to a severe yard capacity glut and sending thousands of yards out of business as newbuilding orders plunged.

As at end-2015, China�s total shipyard capacity was estimated at 65m dwt, down from around 80m dwt in 2012. But the current capacity is still too excessive, and China�s shipbuilding industry needs to �slim down� further by removing another 30% or more of capacity. The 30% reduction in yard capacity from 65m dwt would translate to around 19.5m dwt. Since 2015, more than 20 large to medium sized Chinese shipbuilders had either declared bankrupt or stopped production altogether.

Wang Qi, director of Shanghai Waigaoqiao Shipbuilding (SWS), subsidiary of state-owned China State Shipbuilding Corp (CSSC), observed that China needed to prevent the emergence of speculative private yards, which he referred to them as �cancer cells� of the industry. �If the market starts to recover and you have this influx of speculative yards, they will throw the demand-supply equation off balance again,� Wang was reported saying. Ni Tao, deputy general manager of state-owned Cosco Shipyard Group, concurred that private yards can �open and close as they like�, unlike state-owned yards that carry national responsibility and are needed for any nation.

In October 2013 the State Council issued The Guidance on the Resolution of Seriously Excessive Capacity. The reform focused on the five industries with seriously excessive capacity such as the steel, cement, electrolytic aluminum, glass and shipbuildingindustries and the State Council designed the �road map� to resolve the problem of excess production capacity for the next five years. Brokerage researchers believed that with the implementation of the above guidance, the shipbuilding industry would usher into a profound adjustment, and a large number of companies with weak competitiveness and low value-added technology were expected to disappear. Theindustry agglomeration gradually increased. Meanwhile, the shipbuilding industry would develop into the marine engineering with high technology and high added value. Thus,China Shipbuilding Industry and other companies would clearly benefit.

The dual-use industrial base was a critical component of China"s strategic high-tech economic plans. Currently, its leading dual use sectors include shipbuilding, aviation, space, nuclear, electronics and IT infrastructures. The shipbuilding industry has made particular progress in modernizing its design and manufacturing capabilities and in transfering commercial shipbuilding practices to naval construction. Chinese shipbuilding was domestically and globally competitive, and seems to be profitable - indeed, it was the only sector in the defense industry that was adding productive capacity, i.e., new shipyards and more workers.

As Richard A. Bitzinger, Associate Professor, Asia-Pacific Center for Security Studies, has noted "Following an initial period of basically low-end commercial shipbuilding - such as bulk carriers and container ships - China"s shipyards have since the mid-1990s progressed toward more sophisticated ship design and construction work. In particular, moving into commercial shipbuilding began to bear considerable fruit beginning in the late 1990s, as Chinese shipyards modernized and expanded operations, building huge new dry-docks, acquiring heavy-lift cranes and computerized cutting and welding tools, and more than doubling their shipbuilding capacity. At the same time, Chinese shipbuilders entered into a number of technical cooperation agreements and joint ventures with shipbuilding firms in Japan, South Korea, Germany, and other countries, which gave them access to advanced ship designs and manufacturing technologies - in particular, computer-assisted design and manufacturing, modular construction techniques, advanced ship propulsion systems, and numerically controlled processing and testing equipment. As a result, military shipbuilding programs collocated at Chinese shipyards have been able to leverage these considerable infrastructure and software improvements when it comes to design, development, and construction."

Three types of firms make up China"s shipbuilding industry: 1) large state owned enterprises [SOEs] with mega-size production and technology capacity; 2) small private shipbuilding enterprises in the coastal provinces; and 3) joint ventures of foreign and domestic companies. Two mega parenting conglomerates dominate China"s shipbuilding industry. CSSC (China State Shipbuilding Corporation) which has headquaters in Shanghai, controls about 30 shipyards in the east and the south including those in Anhui, Guangdong, Jiangxi and Shanghai. CSIC (China Shipbuilding Industry Corporation) which is based in Beijing controls about 48 shipyards in the north and the west with a focus on major ports in Liaoning and Tianjin as well as operating 28 science, design and research units.

Hong Kong: As is common for Chinese firms that have suffered embarrassing financial setbacks, a famous name in shipbuilding is mulling a change in brand and focus. China Rongsheng Heavy Industries, the largest private shipbuilder in China, is considering changing its name to China Huarong Energy Company.

Rongsheng has been one of the highest profile casualties from the shipbuilding downturn. Earlier reports had suggested that the Hong Kong-listed entity would be restructured with state-run yard conglomerate CSSC coming in to help it out. [30/10/14]

The No 4 dock at Jiangsu Rongsheng Heavy Industries Co Ltd"s Nantong shipbuilding base on May 26, 2012. With a dimension of 139.5*580m,the dock is equipped with a 1600-T gantry crane, the world"s largest. [Photo/chinadaily.com.cn]

China Rongsheng Heavy Industries Group Holdings Ltd, the nation"s largest private shipbuilder, may seek "cooperation with one or two ship builders" in 2013 or 2014, grasping the opportunity emerging from an industry recession, according to Xu Yifei, assistant president of Jiangsu Rongsheng.

In response to this round of recession, Rongsheng has been actively upgrading technology and design. It has also put more focus on the offshore engineering sector to further diversify its business.

Rongsheng is setting up its offshore engineering company in Singapore, aiming to take advantage of Singapore"s technology and existing market to deepen its penetration in the global offshore engineering market, according to Xu.

The company entered the marine engineering sector years ago. China"s first deepwater pipe-laying crane vessel, known as Hai Yang Shi You 201, was built by Rongsheng. The vessel can lay pipes at depths of 3000 meters and lift 4000 metric tons and will operate at the South China Sea"s Liwan 3-1 gas field.

Rongsheng"s president, Chen Qiang, said in an earlier interview that he hoped orders from marine engineering will make up about 40 percent of the company"s new orders this year.

The world coal and iron ore trade demand depends very much on the biggest purchaser China. Coal import increased to 100 million tons in 2009 and tends to rise upwards until 2020. In 2009, iron ore import demand to China reached 2/3 of the world’s iron ore trade. The second biggest purchaser in the world is India that is looking for new suppliers in Russia and Latin America seeking to fill increased needs. Despite the fact that bulker market shows recovery signals since the end of 2009 the nearest future of shipbuilders focused on bulker carriers is not yet safe. During the first four months of 2010, it contracted 185 new bulk carriers (15 million dwt). Though prices of new building incentives have fallen by 30% the order book for 2010-2014 is overfilled: 3286 new bulkers (43.6% of existing bulker fleet) totalling 287.1 million dwt (59.7%)(CESA AR, 2010). This means that shipyards of China, S. Korea, Japan and new players focused on production of bulkers should turn to the building of other ship types. Consequently, the competition among high added value shipbuilders should be more intense.

Such a danger as “tenth wave” is poising now over the global shipbuilding industry. What shipyards of what countries will survive it? It might be that some countries will decide to reduce shipbuilding capacity or even close it before their shipyards collapse.

Productivity is influenced by technology, facilities, management competence, work organization, work practice, the level of workers’ skills and motivation. The level of the shipyard’s technology is one of the most important factors influencing the cost competitiveness, especially for the large enterprise.

Technology benchmark provided by T. Lamb shows very interesting results forcing to think what is more valuable for the shipyards competing in the market. It compares typical production elements such as steelwork and outfitting production, other pre-erection, ship construction, layout & environment, design & drafting, and organisation/operating of the main shipbuilding countries/regions. The highest overall level has Japan (4.43), the second – S. Korea (4.00), then Europe (3.4), and the lowest is of China (2.88) (Lamb, 2007). Is China a winner just because of low labour price? Or is Chinese labour cost lower because of small investment? Another reason impacting (more specifically – distorting) the competitiveness of shipyards is State support that goes to increasing of the national shipbuilding capacity. For example, over the past decade Korea almost quadrupled its production capacities while Japan and Europe kept stable production volumes. Since 1998 to 2009, S. Korean shipbuilding capacity grew by 10.8 million CGT and Chinese - by 7.9 million CGT (ECORYS SCS, 2009). China and S. Korea continues to follow a highly aggressive expansion path. Under Chinese "Shipbuilding industry adjustment promotion plan" the government has defined provision of operating funds to shipyards and expansion of financial support to owners who order export ships. Not only these countries but also new players such as Brazil, Turkey, India, etc provide huge amounts of support and financial assistance to their domestic producers by using various forms of subsidies including investment aid, loans and payment guarantees to shipbuilders, suppliers, governmental bailouts, subsidies on ship prices for domestic ocean going ships’ buyers, mandatory requirements to order ships at domestic yards and subsidized loans for domestically built ships, direct loans and debt guarantees to ship-owners, etc.

In such conditions, keeping a competitive edge of European shipyards becomes more and more complicate. Despite of the reduced order book Europe chooses quality and excellence over the low costs as the main strategic point of further development of the shipbuilding industry.

8613371530291

8613371530291