saudi aramco rongsheng pricelist

Saudi Aramco today signed three Memoranda of Understanding (MoUs) aimed at expanding its downstream presence in the Zhejiang province, one of the most developed regions in China. The company aims to acquire a 9% stake in Zhejiang Petrochemical’s 800,000 barrels per day integrated refinery and petrochemical complex, located in the city of Zhoushan.

The first agreement was signed with the Zhoushan government to acquire its 9% stake in the project. The second agreement was signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, who are the other shareholders of Zhejiang Petrochemical. Saudi Aramco’s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical’s large crude oil storage facility to serve its customers in the Asian region.

Saudi Aramco CEO, Amin Nasser said: “The agreements demonstrate our commitment to the Chinese market and help enhance the strategic integration of our downstream network in Asia. They will further strengthen our relationship with China and the Zhejiang province, setting the stage for more cooperation in the future.”

Plans for a joint Saudi Arabia-China refining and petrochemical complex to be built in northeast China that were shelved in 2020 are now being discussed again, according tosources close to the deal. The original deal for Saudi Aramco and China’s North Industries Group (Norinco) and Panjin Sincen Group to build the US$10 billion 300,000 barrels per day (bpd) integrated refining and petrochemical facility in Panjin city was signed in February 2019. However, in the aftermath of the enduring low prices and economic damage that hit Saudi Arabia as a result of the Second Oil Price War it instigated in the first half of 2020 against the U.S. shale oil threat, Aramco pulled out of the deal in August of that year.

The fact that this landmark refinery joint venture is back under serious consideration underlines the extremely significant shift in Saudi Arabia’s geopolitical alliances in the past few years – principally away from the U.S. and its allies and towards China and its allies. Up until the 2014-2016 Oil Price War, intended by Saudi Arabia to destroy the then-nascent U.S. shale oil sector, the foundation of U.S.-Saudi relations had been the deal struck on 14 February 1945 between the then-U.S. President Franklin D. Roosevelt and the Saudi King Abdulaziz. In essence, but analyzed in-depth inmy new book on the global oil markets,this was that the U.S. would receive all of the oil supplies it needed for as long as Saudi had oil in place, in return for which the U.S. would guarantee the security both of the ruling House of Saud and, by extension, of Saudi Arabia.

After the end of the 2014-2016 Oil Price War, Saudi Arabia had not only lost the upper hand in global oil markets that it had established alongside other OPEC member states with the 1973 Oil Embargo but it had also prompted a catastrophic breach of trust with its former allies in Washington. Consequently, the U.S. changed the effective terms of 1945 to: the U.S. will safeguard the security both of Saudi Arabia and of the ruling House of Saud for as long as Saudi not only guarantees that the U.S. will receive all of the oil supplies it needs for as long as Saudi has oil in place but also that Saudi Arabia does not attempt to interfere with the growth andprosperity of the U.S. shale oil sector. Shortly after that (in May 2017), the U.S. assured the Saudis that it would protect them against any Iranian attacks, provided that Riyadh also bought US$110 billion of defense equipment from the U.S. immediately and another US$350 billion worth over the next 10 years. However, the Saudis then found out that none of these weapons were able to prevent Iran from launchingsuccessful attacksagainst its key oil facilities in September 2019, or several subsequent attacks.

Concomitant with this weakening of relations between Saudi Arabia and the U.S. came a drift towards Russia first and then China. Given the reputational damage done to the perceived power of Saudi Arabia and its OPEC brothers by their inability to destroy or disable the growing threat from U.S. shale oil to their former dominance in the global oil markets, their attempts to pull oil prices back up to levels at which they could begin to repair thedamage done to their economiesby the 2014-2016 Oil Price War towards the end of 2016 also failed. At that point, fully cognisant of the enormous economic and geopolitical possibilities that were available to it by becoming a core participant in the crude oil supply/demand/pricing matrix, Russia agreed to support the OPEC production cut deal in what was to be called from then-on ‘OPEC+’, albeit in its own uniquely self-serving and ruthless fashion, again analyzed in-depth inmy new book on the global oil markets.

Given Russia’s significant leverage in the Middle East by dint of its pivotal position in making the OPEC deal credible in terms of being able to affect global oil prices, China also began to more aggressively leverage its own power with the group and in the region by dint of its being the world’s biggest net importer of crude oil and its increasing use of checkbook diplomacy. Nowhere were the two elements more in evidence than in China’s offer to buy the entire 5 percent stake of Aramco in a private placement. This was designed to enable Saudi Crown Prince Mohammed bin Salman to save face, given hisunsuccessful attempts from 2016 to 2020to persuade serious Western investors to have any significant part in the company’s initial public offering. Shortly after the offer was made,China was referred toby Saudi’s then-vice minister of economy and planning, Mohammed al-Tuwaijri, as: “By far one of the top markets” to diversify the funding basis of Saudi Arabia. He added that: “We will also access other technical markets in terms of unique funding opportunities, private placements, panda bonds and others.” In a similar vein, andjust last year, Saudi Aramco’s chief executive officer, Amin Nasser, said: “Ensuring the continuing security of China’s energy needs remains our [Saudi Aramco’s] highest priority — not just for the next five years but for the next 50 and beyond.”

Between the end of the 2014-2016 Oil Price War and now, there have been multiple high-level visits back and forth between Saudi Arabia and China, beginning most notably with the trip of high-ranking politicians and financiers fromChina in August 2017 to Saudi Arabia, which featured a meeting between King Salman and Chinese Vice Premier, Zhang Gaoli, in Jeddah. During the visit, Saudi Arabia first mentioned seriously that it was willing to consider funding itself partly in Chinese yuan, raising the possibility of closer financial ties between the two countries. At these meetings, according to comments at the time from then-Saudi Energy Minister, Khalid al-Falih, it was also decided that Saudi Arabia and China would establish a US$20 billion investment fund on a 50:50 basis that would invest in sectors such as infrastructure, energy, mining, and materials, among other areas. The Jeddah meetings in August 2017 followed a landmark visit to China by Saudi Arabia’s King Salman in March of that year during which around US$65 billion of business deals were signed in sectors including oil refining, petrochemicals, light manufacturing, and electronics.

Later, the first discussions about the joint Saudi-China refining and petrochemical complex in China’s northeast began, with a bonus for Saudi Arabia being that Aramco was intended to supply up to 70 percent of the crude feedstock for the complex that was to have commenced operation in 2024. This, in turn, was part of a multiple-deal series that also included three preliminary agreements to invest in Zhejiang province in eastern China. The first agreement was signed to acquire a 9 percent stake in the greenfield Zhejiang Petrochemical project, the second was a crude oil supply deal signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, and the third was with Zhejiang Energy to build a large-scale retail fuel network over five years in Zhejiang province.

This latest Aramco-Norinco-Panjin Sincen deal, though, carries with it even broader ramifications of a much more overtly testing nature for U.S. President Joe Biden in terms of where he draws the line on supposed allies blurring trade considerations and security considerations. All Chinese companies function as part of the State apparatus – without any exception – and Norinco has the added troubling element for the U.S. that it is one of China’s major defense contractors, specializing in the full range of research, development, and production of military equipment, technology, systems, and weapons. This runs alongside ongoing concerns from Washington about Saudi Arabia’s on again-off again agreement with Russia tobuy its S-400 missile defense system, and much more recent news in December 2021 that Saudi Arabia is now actively manufacturing itsown ballistic missiles with the help of China.

Saudi Aramco signed three Memoranda of Understanding (MoUs) on Friday to purchase a 9 percent stake in Chinese Zhejiang Petrochemical"s integrated refinery and petrochemical complex in the city of Zhoushan, and to invest in a retail fuel network in the eastern region of China, the Saudi state-run energy giant announced.

Saudi Aramco"s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical"s large crude oil storage facility to serve its customers in the Asian region, according to the statement.

Saudi Aramco and Zhejiang Energy plan to build a large-scale retail network over the course of the next five years in the province, the statement added. The retail business will be integrated with the Zhejiang Petrochemical complex as an outlet for the facility"s refined products.

Saudi Aramco CEO Amin Nasser said the agreements demonstrate the company"s commitment to the Chinese market and would help enhance the strategic integration of its downstream network in Asia.

Saudi Aramco has further advanced its downstream investments in China with the creation of a $10 billion refining joint venture with China"s North Industries Group (Norinco) and Panjin Sincen, and preliminary agreements to acquire a 9% stake in the greenfield Zhejiang Petrochemical refinery and petchems complex in eastern China.

The Saudi oil company has signed a deal to form Huajin Aramco Petrochemical Co Ltd, which will build a 300,000 b/d integrated refining and petrochemical complex in northeast China, expected to start operations in 2024, along with a 1.5 million mt/year ethylene cracker and a 1.3 million mt/year PX unit, Aramco said in a statement Friday.

The joint venture is a follow-up to a preliminary agreement signed in March 2017 between Saudi energy minister Khalid al-Falih and Norinco to build a refining, chemicals and retail network in Panjin.

It will significantly expand Aramco"s footprint in China"s downstream industry. The latest agreement was signed during a high profile tour by Saudi Crown Prince Mohammed bin Salman to key Asian business partners. Earlier this week, the Saudi delegation promised to invest $100 billion in India"s infrastructure and energy sectors including a multi-billion dollar refinery.

Aramco said it will supply up to 70% of the crude feedstock for the complex in Panjin, in northeast China"s Liaoning province. Downstream investments give the oil producer a captive market for its crude exports. Saudi Aramco will hold a 35% stake in Huajin Aramco Petrochemical, with Norinco Group and Panjin Sincen holding 36% and 29% respectively.

"Our participation in the integrated refining and petrochemical project in Panjin will strengthen our collaborative efforts to enhance energy security, revitalize key growth sectors and industries in Liaoning and also meet rising demand for products and goods in China"s northeast region," Saudi Aramco"s chief executive Amin Nasser said.

Aramco said it also plans to establish a fuel retail business through a joint venture with North Huajin and Liaoning Transportation Construction Investment Group.

Zhejiang Petrochemical, established in 2015, is a joint venture between textile companies Rongsheng Holding (51%) and Tongkun Group (20%) as well as chemicals company Juhua Group (20%).

The stake was first announced in October 18, 2018, with a source close to the project saying the Saudi oil company had agreed to supply around 5 million mt (36.65 million barrels) of crude oil to the plant in 2019.

"Saudi Aramco"s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical"s large crude oil storage facility to serve its customers in the Asian region," Aramco said.

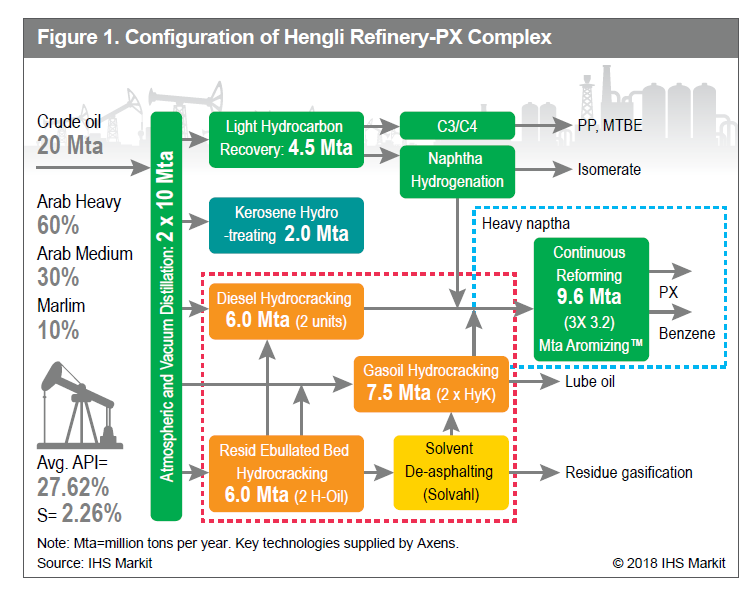

Phase I of the project will include a new 400,000 b/d refinery with a 1.4 million mt/year ethylene cracker and a 5.2 million mt/year aromatics unit, Aramco said. Phase II will see a 400,000 b/d refinery expansion.

Currently, Saudi Aramco has equity stakes in the 280,000 b/d Fujian Refining and Petrochemical Co (FREP) and the marketing firm Sinopec SenMei (Fujian) Petroleum Company (SSPC). FREP is a joint venture between state-owned Sinopec, the Fujian provincial government, Saudi Aramco and ExxonMobil, each holding a 25% stake. It mainly processes Saudi crude.

Oil products from FREP are mainly sold in China"s domestic market through SSPC, which is owned by Sinopec (55%), Saudi Aramco (22.5%) and ExxonMobil (22.5%).

(Yicai Global) Feb. 25 -- The national petroleum and oil giant of Saudi Arabia will purchase a minority stake in Zhejiang Petrochemical along with two other deals to expand its downstream business in eastern China.

Saudi Arabian Oil Company, also known as Saudi Aramco, penned three memorandums of understanding in eastern Zhejiang province, one of them with the Zhoushan municipal government involving a purchase of a 9 percent stake in ZP, the Asian division of the Dhahran-based parent posted on its official WeChat account on Feb. 23.

The deals show Saudi Aramco"s commitment to the Chinese market and will help to enhance the strategic integration of its downstream business network in Asia, Amin Nasser, the president and chief executive of Saudi Aramco said in the post.

Saudi Aramco will provide ZP with crude oil for refining in the latter"s new plant in Zhoushan for the long-term while making use of ZP"s large storage facilities to serve customers in Asia. ZP aims to provide 6 million tons of refined oil each year at the project in its hometown with with an investment of CNY173 billion (USD25.8 billion). The target firm can process 800,000 barrels of crude oil a day, Saudi Aramco"s post added.

Saudi Aramco also agreed with Zhejiang Provincial Energy Group to establish a large refined oil retail network in Zhejiang province within five years to integrate resources and make the Chinese firm into a competitive distribution channel.

Founded in 2015, ZP has a mixed ownership structure. Privately owned Rongsheng Petrochemical has a 51 percent stake while the two state-owned shareholders include Zhejiang Juhua Investment with a 20 percent stake as well as Zhoushan Ocean Comprehensive Development and Investment with a 9 percent stake.

DUBAI, Aug 14 (Reuters) - State oil giant Saudi Aramco (2222.SE) on Sunday reported its highest quarterly profit since the company went public in 2019, boosted by higher oil prices and refining margins.

Aramco joins oil majors such as Exxon Mobil Corp (XOM.N) and BP (BP.L) that have reported strong or record breaking results in recent weeks after Western sanctions against major exporter Russia squeezed an already under-supplied global market causing a surge in crude and natural gas prices. read more

The company expects "oil demand to continue to grow for the rest of the decade despite downward economic pressures on short-term global forecasts," CEO Amin Nasser said in Aramco"s earnings report.

Nasser, speaking to reporters on an earnings call, voiced concern over a lack of global investment in hydrocarbons that has led to "very limited" spare capacity. He said Aramco stands ready to raise oil output to its maximum sustained capacity of 12 million barrels per day should the Saudi government ask.

Aramco said its average total hydrocarbon production was 13.6 million barrels of oil equivalent per day in the second quarter. The company is working to increase production from multiple energy sources, including renewables and blue hydrogen as well as oil and gas, as it works on both energy security and climate goals, Nasser said.

Capital expenditure increased by 25% to $9.4 billion in the quarter compared to the same period in 2021. Aramco said it continued to invest in growth, expanding its chemicals business and developing prospects in low-carbon businesses.

The Saudi stock market, up 11% this year, is very promising for company listings in the near future, Nasser said, adding that there is "some expectation" that Aramco might list some entities within the firm.

Aramco is working to merge two energy trading units, with Aramco Trading Co to absorb Motiva Trading, ahead of a potential initial public offering of the business, sources have said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RSD2HKGJB5NZ7FX5GAFZGEO6GU.jpg)

SINGAPORE/BEIJING/DUBAI (Reuters) - Saudi Arabia is set to expand its market share in China this year for the first time since 2012, with demand stirred up by new Chinese refiners pushing the kingdom back into contention with Russia as top supplier to the world"s largest oil buyer.

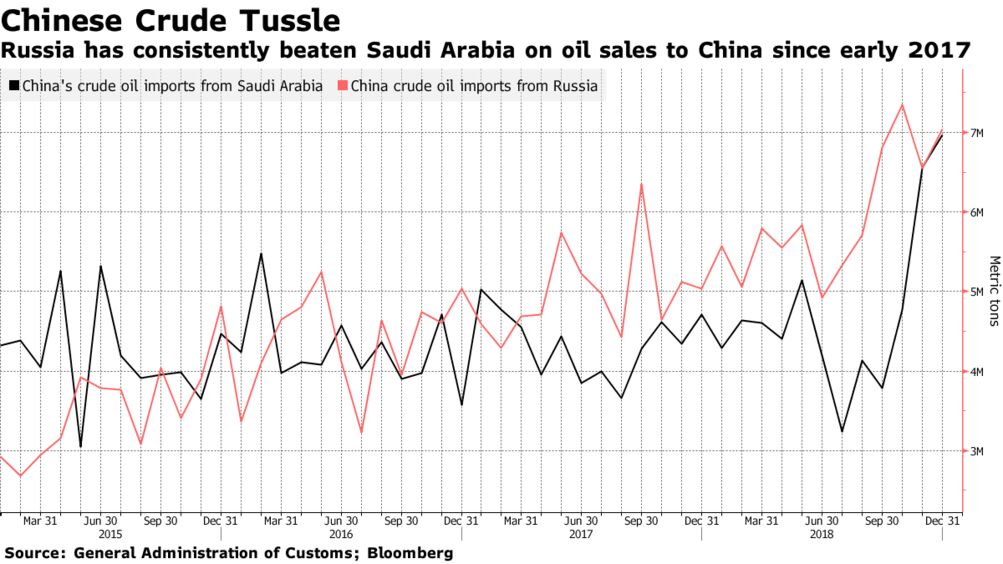

Saudi Arabia, the biggest global oil exporter, has been surpassed by Russia as top crude supplier to China the past two years as private "teapot" refiners and a new pipeline drove up demand for Russian oil.

Now fresh demand from new refineries starting up in 2019 could increase China"s Saudi oil imports by between 300,000 barrels per day (bpd) and 700,000 bpd, nudging the OPEC kingpin back towards the top, analysts say.

Saudi Aramco said last week it will sign five crude supply agreements that will take its 2019 contract totals with Chinese buyers to 1.67 million bpd.

"With the recent crude oil supply agreements and potential increase of refinery capacity, the Saudis could overtake the Russians and reclaim (the) crown as the biggest crude exporter to China," Rystad Energy analyst Paola Rodriguez-Masiu said.

Saudi Arabia has already gained ground this year. China imported 1.04 million bpd of Saudi crude in the first 10 months of 2018, China customs data showed. This is equivalent to 11.5 percent of total Chinese imports, up from 11 percent in 2017, Reuters calculations showed.

Saudi"s market share in China could jump to nearly 17 percent next year, if buyers requested full contractual volumes, analysts from Rystad Energy and Refinitiv said, while growth in Russian oil supply to China could slow.

The biggest boost to Saudi exports to China comes from contracts inked with new refineries starting up this year and next, owned by companies other than state oil giants Sinopec or PetroChina.

Beijing-based consultancy SIA Energy expects Saudi crude imports to rise by just 300,000 bpd in 2019, raising its market share to 13.7 percent, but leaving it behind Russia.

"We expect lower Saudi crude demand from Hengli and Rongsheng as it is unlikely for them to run their refineries at full rate in 2019," analyst Seng Yick Tee said.

Still, a source familiar with Aramco"s export plans said there is tremendous appetite from China"s independents, and that it needed to be more aggressive in its marketing strategy.

Aramco"s first deal with Hengli was to supply 20 million barrels of crude, about 55,000 bpd, in 2018, said a senior source with direct knowledge of the deal.

Hengli is designed to process 90 percent Saudi crude, a mix of Arab Medium and Arab Heavy, while the remaining 10 percent is Brazilian Marlim crude. Rongsheng"s plant is identical to Hengli, the industry sources said.

Aramco is also supplying PetroChina"s refinery in China"s southwestern Yunnan province with about 4 million barrels a month of crude via a pipeline from Myanmar between July and November, Eikon data showed, although sources said talks for Saudi Arabia to acquire a stake in the refinery have stalled.

Saudi Aramco"s Chief Executive Amin Nasser said on Monday the company will push to expand its market share in China and is still looking for new refining deals there despite OPEC"s likely limits on output next year.

Saudi Aramco will supply up to 70 percent of the oil required at its 300,000-bpd joint venture refinery in Malaysia with Petronas. Between China and Malaysia alone, Saudi Arabia will have to increase exports to Asia by more than 500,000 bpd next year.

Between balancing global supplies and increasing market in Asia, Aramco may decide to "forgo market share in other markets like the United States, where the surge in domestic production will make it difficult for the Saudis to retain market share anyway," Rystad"s Rodriguez-Masiu said.

Saudi"s oil shipments to the United States have risen recently to above 1 mln bpd, but U.S. output is also increasing, said the source familiar with Saudi Aramco"s export plans.

"You need to lessen the inventories in the U.S.," the source said, adding that Aramco will likely divert oil supply from the United States to Asia to meet rising demand there.

Saudi Aramco has signed agreements to acquire a 9% stake in the Zhejiang petrochemical project in the Chinese province of Zhejiang for an undisclosed price.

The Arabian company has signed a second agreement with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, the other shareholders of Zhejiang Petrochemical, the holding company of the Chinese petrochemical project.

Saudi Aramco said that its involvement in the project will come with a long-term crude supply agreement and the ability to use Zhejiang Petrochemical’s large crude oil storage facility to cater to its customers in Asia.

Saudi Aramco CEO Amin Nasser said: “The agreements demonstrate our commitment to the Chinese market and help enhance the strategic integration of our downstream network in Asia. They will further strengthen our relationship with China and the Zhejiang province, setting the stage for more cooperation in the future.”

Last week, Saudi Aramco entered into a joint venture agreement with NORINCO Group and Panjin Sincen to develop a fully integrated refining and petrochemical complex in Panjin in another Chinese province Liaoning.

The joint venture, called Huajin Aramco Petrochemical is expected to invest over $10bn to build what will be a 300 thousand barrel per day refinery, equipped with a 1.5 million metric tons per annum (mmtpa) ethylene cracker and a 1.3 mmtpa PX unit.

With gas prices remaining high, Americans continue to scrutinize the oil production and prices in OPEC countries, particularly oil-rich Saudi Arabia. The White House criticized OPEC in October when it reduced oil production shortly before Saudi Arabia’s decision to raise oil prices for the U.S. while lowering prices for European markets.

The Saudi government has had complete ownership of the largest oil refinery in the United States, which is Motiva’s refinery in Port Arthur, Texas, since May 2017. Before then, Saudi Arabia held partial ownership of the refinery dating back to 1989.

This refinery is directly operated by a company called Motiva. Saudi Arabia owns Motiva and its refinery in Port Arthur through Saudi Aramco, commonly shortened to just Aramco, the EIA, Motiva and Saudi Aramco confirm.

But the Saudi government hasn’t always owned the Port Arthur refinery. It was built in the early 1900s, and has been owned and operated by a number of different companies since.

Aramco, and therefore Saudi Arabia, didn’t become involved with Port Arthur until 1989, when it entered a partnership with Texaco to jointly operate three refineries, including the Port Arthur refinery. Aramco and Texaco each owned half of a subsidiary company that later became Motiva, which they used to control the three refineries.

Eventually, Shell joined the Motiva partnership and Texaco dropped out, and the refinery’s ownership remained a 50-50 split between Aramco and Shell until the two sides opted to dissolve their partnership in May 2017.

Aramco and Shell opted to separate their joint assets, according to press releases from Shell, Aramco and Motiva. As a result of this split, Aramco kept the Motiva brand and the refinery in Port Arthur, while Shell held onto the other two refineries previously operated by Motiva. Shell still operates one of these refineries today, and it shuttered the other in 2020.

Port Arthur is the only American refinery that Aramco or any other Saudi Arabian company owns, according to the EIA’s list of 127 oil refineries located in the United States. Of those 127 refineries, 103 are American-owned.

LONDON: Saudi Arabia and the Gulf region have seen a significant shift in the concept of city building with modernized infrastructure plans taking into account ways to improve people’s lives and experiences as opposed to “purely a functional response,” according to a UK-based architecture expert.

“Particularly in Saudi Arabia, you’re seeing a lot more use of those types of facilities, because there’s a lot more encouragement to sort of knock down both physical and figurative walls within the Kingdom. And I think that’s a very good thing, as it’s only a matter of time before you will begin to see, and you’re already seeing it, much more engagement from Saudis in their own country,” he told Arab News in a recent exclusive interview.

HOK, which has been engaged with the Kingdom since the 1970s, has designed several iconic projects, including the 80-story PIF Tower, which is the tallest of the five structures that make up the financial plaza of the King Abdullah Financial District and symbolizes “the dawn of a new era of financial leadership” within the Saudi capital.

The US-based firm, which was founded in 1955 in Missouri, began to officially expand its footprint in the Middle East in the early 1980s, and the first major project where the company brought a lot of its talent to complex designs was in Saudi Arabia. It was King Khalid Airport, King Saud University and King Fahd University of Petroleum and Minerals in Dhahran that changed the way it operated as a firm, Hajjar explained.

“Those were sort of the first two institutes of higher education within the Kingdom that really propelled Saudi on the international stage that they began developing this fundamental infrastructure, and as a result, HOK was instrumental in delivering that, as well as the airport,” he said.

The company also developed other high-profile projects, among them King Abdullah University of Science and Technology and King Abdullah Petroleum Studies and Research Center in Saudi Arabia. Others included the National Assembly building and the Central Bank headquarters in Kuwait, Abu Dhabi National Oil Company corporate headquarters, Dubai Marina, and the masterplan for Dubai Expo 2020.

Saudi Vision 2030 “is incredibly ambitious, and because of that, it raises the bar significantly in terms of what is it that’s going to drive that economy, post-oil, or post-hydrocarbon, because that is going to happen, and this diversification of the economy,” he said.

HOK, which has been engaged with the Kingdom since the 1970s, has designed several iconic projects, including the 80-story PIF Tower, (left) which is the tallest of the five structures that make up the financial plaza of the King Abdullah Financial District and symbolizes ‘the dawn of a new era of financial leadership’ within the Saudi capital.

These also differ from new developments such as the NEOM megacity project or Diriyah Gate, which is the birthplace of the first Saudi state and now everything is leveraging off that historic core as they begin to build out from there, he said.

The big challenge with Saudi Arabia is it is so geographically diverse from one region to the next, so how do you begin bringing those cultures together within the Kingdom and ensure “the richness that occurs in one region should be introduced to the richness from another in order to create this fantastic mosaic that is the Kingdom of Saudi Arabia,” he said.

Saudi Arabian Oil Company (Saudi Aramco), one of the world"s top oil exporters, will continue to boost its downstream presence in China, after it formalized plans to build a 300,000-barrel-per-day refining and petrochemical complex along with Norinco Group and Panjin Sincen in Panjin, Northeast China"s Liaoning province, in February.

"This is a clear demonstration of Saudi Aramco"s strategy to move beyond a buyer-seller relationship to one where we can make significant investments to contribute to China"s economic growth and development," said Amin H. Nasser, president and CEO of Saudi Aramco.

It has also announced a plan to acquire a 9 percent stake in Zhejiang Petrochemical, an 800,000-bpd integrated refinery and petrochemical complex, controlled by private Chinese chemical group Zhejiang Rongsheng Holding Group.

The projects in Liaoning and Zhejiang have the potential to increase Saudi Aramco"s participated refining capacity to over 1 million bpd in China alone.

Figures from Bloomberg Intelligence reveal that Russia surpassed Saudi Arabia to become the largest crude oil exporter to China in 2016. Last year, China imported 71.49 million metric tons of oil from Russia while imports from Saudi Arabia were 56.73 million tons.

China is a strategic partner for Saudi Aramco and one of the most important customers globally, and the company is looking at both the export of oil and integration down the value chain in the Chinese market, he said.

"Integration with refining is what Saudi Aramco and our partners are looking at, and these opportunities will help to expand our presence in China, achieving a better balance between our upstream and downstream business segments, considering how much we export to China," said Nasser.

Nasser said the potential acquisition of petrochemical maker Saudi Basic Industries Corp, or SABIC, would also help the company strengthen its downstream sector in China.

Saudi Aramco aims to buy a controlling stake in SABIC, possibly the entire 70 percent owned by the Public Investment Fund - the kingdom"s top sovereign wealth fund.

"Part of the company"s strategy is to allocate 2 to 3 million bpd of crude to petrochemicals and expand our chemicals business globally," Nasser said. "China"s demand growth offers exciting opportunities for Saudi Aramco and its partners."

The coronavirus pandemic is upending the energy industry and pushing its top players to make big changes. That includes Saudi Aramco, the world’s largest and most profitable oil producer.

The dramatic crash in prices this year is weighing on Saudi Arabia’s state oil giant, which relies on pumping crude to generate the cash it needs to pay dividends to investors and finance a big chunk of government spending.

Now, Aramco may be forced to do what was once unthinkable: abandon deals and sell assets. First on the block could be its plan to build a network of refineries in the world’s biggest markets in a bid to extract more value from each barrel of crude it pumps.

Deals to get into the refining business in China and India — two of the world’s biggest energy consumers — appear to have been put on hold in recent weeks. On Wednesday, media reports suggested that Aramco would also delay the expansion of a major refinery in the United States.

“It is fair to say that there is a re-evaluation of everything at the moment,” said an Aramco source familiar with business strategies regarding the projects.

The realignment of priorities could have long term consequences for the company and the Saudi kingdom, given the politically sensitive nature of some projects.

The big problem for Aramco is the outlook for oil prices, with Brent crude futures, the global benchmark, still 33% lower than they started the year. Between April and June, Aramco’s net profit plunged more than 73% to $6.6 billion as lockdowns necessitated by the pandemic sharply reduced demand for energy products.

Those dividends were a central part of the pitch to investors during its initial public offering in December, and are a crucial reason Aramco is still worth $1.9 trillion, making it the world’s second most valuable public company behind Apple

The company is also expected to make payouts to the Saudi government, which relies on oil income to fund heavy social and military spending. The crash in oil prices could force Crown Prince Mohammed bin Salman to scale backhis Vision 2030 plan to reduce Saudi Arabia’s dependence on crude exports, which had included several massive tourism projects and the construction of a futuristic city.

The Wall Street Journal reports that Aramco is also reviewing a $6.6 billion investment to add petrochemical output at its Motiva refinery in Texas, and that a natural gas collaboration with Sempra Energy also faces scrutiny.

Aramco has announced the creation of a new division that will reassess the company’s portfolio starting this month, aiming to promote “resilience, agility and ability to respond to changing market dynamics.” Nasseri said he expects a large number of projects to be tabled as a result.

Should Aramco bail on these projects, it could dramatically alter the company’s longer term business plans. Deals with China and India aimed to lock down buyers in huge markets, while helping Aramco diversify its business beyond pumping huge amounts of crude, a strategy pursued by other large oil firms.

In a speech in July, Reliance Chairman Mukesh Ambani noted that deal had not progressed as expected due to “unforeseen circumstances in the energy market.” But he reiterated that Reliance’s relationship with Aramco spans two decades, adding that the process would likely be completed by early 2021.

Abandoning past agreements is one of the only options available to Aramco. It cannot just pump more oil due to its membership in OPEC, which agreed to record production cuts in April. While OPEC is starting to increase output again, the cartel and its allies still plan to produce 7.7 million barrels per day less than they were prior to the cutbacks through the end of this year.

A major pivot to more sustainable energy in the vein of BP, which recently announced a 10-fold increase in annual low carbon investments by 2030, is also unlikely given Aramco’s integration with the Saudi state.

“Saudi is an oil state and Aramco is an oil company,” Nasseri said. Aramco is more likely to position itself as a “reliable and sustainable source of fossil fuels” while appetite remains.

State oil giant Saudi Aramco reported a soaring 90% rise in second-quarter profit on Sunday, beating analyst expectations and propelled by higher oil prices, volumes sold and refining margins.

The company expects "oil demand to continue to grow for the rest of the decade, despite downward economic pressures on short-term global forecasts," Aramco chief executive Amin Nasser said in the earnings report.

Aramco shares have risen over 25% this year as oil and natural gas prices have scaled multi-year highs after Western sanctions against major exporter Russia squeezed an already under-supplied global market.

“But while there is a very real and present need to safeguard the security of energy supplies, climate goals remain critical, which is why Aramco is working to increase production from multiple energy sources - including oil and gas, as well as renewables, and blue hydrogen." said Nasser.

Capital expenditure increased by 25% to $9.4 billion in the second quarter compared to the same period in 2021. Aramco said it continued to invest in growth, expanding its chemicals business and developing prospects in low-carbon businesses.

8613371530291

8613371530291