dead weight safety valve free sample

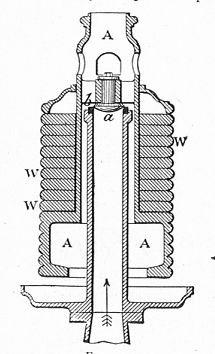

afety valve consists of a valve seat where the pressure in the boiler or pressure vessel when it exceeds the normal working pressure lifts the valve seat with its weight. The excess pressure fluid therefore escapes through the pipe to the atmosphere, until the pressure reaches its normal value. It is the simplest type of safety valve; it is suitable for stationary boilers and pressure vessels only, because it cannot withstand the jerks and vibration of mobile boilers or pressure vessels. Another disadvantage of this valve is the heavy weight required to balance the pressure. Hence, it is not suitable for high pressure boilers.

In 2023, the sales of Pressure Relief Valve in Global Market is expected to reach US$ 4,509.8 Mn. and is projected to expand steadily at a CAGR of 4.6% to reach a market valuation of close to US$ 7,070.9 Mn by 2033.

In recent past valve costs have increased globally, which can be attributed to growing tariffs from the North American region, particularly the US. Leading players from the European and American regions have facilities in both high- and low-income nations. In contrast, labor-intensive production processes like the creation of rough castings for valves and valve components take occur in low-cost manufacturing nations like China. These processes include design, research and development, and testing. Due to low prices and quality maintenance, OEMs are able to do so. However, growing US government tariffs on steel and aluminum imports from China have had a substantial negative influence on pressure relief valve profit margins and costs.

However, the rapid growing industrialization and increasing safety precaution are the factors that are expected to fuel the market growth of Pressure relief valves across the globe during the assessment period, the Pressure relief valve market is expected to experience demand growth with CAGR of 4.6% during the forecasted period.

From 2017 to 2022, the Global Pressure Relief Valve Market expanded at a CAGR of around 2.4%. The advancement in product technology to connect the valves digitally enables end users to monitor pressure in various applications digitally which has generated significant demand from the various industry sector during the forecasted period.

Numerous applications where pressure levels are crucial for continuous and efficient machinery performance demand for the utilization of pressure relief valves. These include the various sectors operating with steam, air, gas, or liquid such as oil and gas, power generation and the petrochemicals industry. Multiphase applications and chemical processing systems both have high installation rate of pressure relief valves. With rapid development industrial sector & expansion of oil & Gas pipelines across the developing as well as developed economies the demand for PRV is also expected to expand, Persistence Market Research expects the market to expand at a 4.6% CAGR through 2033.

Both emerging and advanced regions have seen a surge in oil and gas consumption. In order to meet the rising demand and supply for oil and gas, industries are concentrating on expanding their production facilities through onshore and offshore exploration. Since the oil and gas sector is one of the key end uses for the global pressure relief valves market thus expanding oil & gas Sector is generating lucrative opportunity for the demand growth of PRVs in upcoming period.

Furthermore, growing regulation for use of pressure relief valves in power generation sector is further set to create opportunities for the market. For instance, there are currently about 50 nuclear reactors under development. By safeguarding turbines, super heaters, and boilers to enable the stations to operate at prescribed pressures, pressure relief valves play a crucial part in the successful and safe operations of nuclear facilities.

Manufacturing businesses will be significantly and directly impacted by the Asia Pacific region"s volatile and uncertain markets. The operational costs of the manufacturing processes, which are the main concern of manufacturers, will be directly impacted by rising tariffs and raw material costs used to manufacture valves. Rising raw material costs immediately impact the integrity of the supply chain and the selling price of a product. Manufacturers in the Asia Pacific region are becoming increasingly concerned about the steady growth in cost of the raw materials used to make pressure relief valves. This is expected to, restrain the market"s expansion for pressure relief valves.

With an absolute dollar opportunity of around US$ 600.0 Mn, North America is expected to be the most lucrative market for pressure relief valves suppliers. U.S is leading the North American market, and is expected to witness a 1.5X growth during 2023-2033. The market for pressure relief valves has recently experienced considerable growth in sales as a result of growing industrialisation and advancements in urban waste water management systems. Apart from that U.S. is also second largest importer & Exporter of Pressure relief valves, which makes it a targeting region for the manufacturers & Suppliers.

In 2023, the German Pressure Relief Valve market is likely to hold around 25% of the market by value share in Europe. Germany"s extensive remanufacturing capabilities are likely to play a crucial part in development of industrial growth. Sales growth for pressure relief valves is anticipated to be boosted in the upcoming years as manufacturers are planning to invest more in safety & developments of industrial Sites.

With a CAGR of 5.9%, India is expected to lead the South Asian market throughout the assessment period and experience significant expansion. Pressure relief valve demand is anticipated to increase as a result of India"s low production and labour costs, as well as less regulations & certifications required for PRVs, which are encouraging various industry players, including oil & gas, pharmaceutical, chemical, and textile manufacturers, to expand their manufacturing facilities in India.

By the end of the assessment period, spring-loaded pressure relief valves will hold a value share of over 40% of the market for pressure relief valves worldwide. Due to its broad range of applications and other technological advantages over other valves, this valve is widely utilized. The design and use of pressure relief valves is covered by a number of international codes and standards, the most popular of which being the ASME (American organization for mechanical engineers) Boiler and Pressure Vessel Code, also known as ASME code. Despite the fact that this code varies by region.

In 2023, the demand for pressure relief valves is primarily driven by the Medium Pressure segment in Set Pressure segment of the market. By the end of the forecast period, it is projected that pressure relief valves with a medium pressure range will still be widely utilized in a variety of end use sectors. The market for medium pressure relief valves is expected to continue expanding due to rising end-use sectors including oil and gas, chemical, and others.

The global pressure relief valves market size was valued at $4.4 billion in 2021, and is projected to reach $7 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031.Pressure relief valve (PRV) is also called as a relief valve. Pressure vessels and other equipment are protected by pressure relief valve from being subjected to pressures that exceed their design limits. The valve is used to control or limit the pressure built inside the equipment which may cause equipment or instrument failure, or fire. The pressure is relieved by allowing the pressurized fluid to flow from an auxiliary passage out of the system.

The shutdown of industrial and manufacturing facilities, along with supply chain disruptions, has led to a decrease in demand for pressure relief valves. Additionally, the decrease in oil and gas prices has also affected the market. However, as economies begin to recover and industries start to reopen, the demand for pressure relief valves is expected to increase.

Pressure relief valve are used in the oil & gas industry for drilling and workover operations, which, in turn, increase demand for pressure relief valve, and is anticipated to boost growth of the pressure relief valve market. According to a report on North America Midstream Infrastructure through 2035 published in June 2018 by ICF International Inc., total investments in oil & gas infrastructure are projected to range between $685 billion and $895 billion from 2018 to 2035. In addition, pharmaceuticals and food & beverages industries are largely saturated in developing countries including European Union, such as the U.S. and China. Pressure relief valve have an important role in manufacturing of different types of medical devices and support key players to give opportunity during this pandemic situation. For instance, according to the India Brand Equity Foundation (IBEF), the food & beverage processing industry has emerged as a high-profit and high-growth sector, owing to its immense growth potential. Moreover, rise in number of industrial infrastructure projects in developing countries is driving the demand of pressure relief valves market. For instance, the government of China spent $10 billion on a new oil & gas refinery project, Guangdong refinery, which is expected to be completed by March 2022. Such instances are expected to drive the growth of the market. There are many domestic manufacturers present in places, which is expected to hamper growth of the pressure relief valve market. Domestic manufacturers provide pressure relief valve ranging from $100 to $200. However, key players offer pressure relief valve ranging from $100 to $2500. Hence, customer focuses more on adopting pressure relief valve from domestic manufacturers, which, in turn, hinders the pressure relief valves industry growth.

The demand for pressure relief valve decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut-down production of pressure relief valve for the end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the pressure relief valve market significantly during the pandemic. The major demand for pressure relief valve was previously noticed from giant manufacturing countries including China, U.S., Germany, Italy, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for pressure relief valve. This is expected to lead to re-initiation of manufacturing industry at their full-scale capacities, which is likely to help the pressure relief valve market to recover by end of 2022.

Emerging economies such as the India, China, and Egypt, are investing more in hydrocarbon projects, to produce more oil & gas exploration, which is expected to provide lucrative opportunities for growth of the pressure relief valve market. Rise in demand for oil & other energy and renewable resources is anticipated to drive growth of the pressure relief valve market. The government of Egypt invested around $2.5 billion in construction of a new oil refinery project to process hydrocarbons. All such instances are anticipated to provides lucrative opportunities for the pressure relief valves market growth.

The global pressure relief valve market is segmented on the basis of valve type, pressure, end user, and region. Based on valve type, the market is divided into spring loaded, pilot loaded, dead weight and p and t actuated. Based on pressure, the market is divided into low, medium and high. Based on end user industry, the market is divided into oil & gas, chemical, power generation, food & beverage, manufacturing and water & wastewater.

Region wise, the global pressure relief valve market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By valve type: The pressure relief valve market is categorized into spring loaded, pilot loaded, dead weight and p&t actuated. There are types of spring loaded valves conventional spring loaded and balanced spring-loaded both are used to minimizes the effects of backpressure on the equipment. pilot loaded relief valve" refers to a form of diaphragm valve in which the opening of the main valve is controlled by a smaller integral spring-operated valve; the main valve is typically kept closed by system pressure, so no external supply is required. A deadweight safety valve has a valve seat where the weight of the seat is lifted when the pressure in the boiler or pressure vessel exceeds the usual working pressure. Pressure and Temperature relief valves, also known as p&t valves, which are emergency safety limit devices that will stop or release too much heated water and pressure. Pilot operated is expected to exhibit the largest revenue contributor during the forecast period. P&T Actuated is expected to exhibit the highest CAGR share in the valve type segment in during the pressure relief valves market forecast period.

By pressure: The pressure relief valve market is classified into low, medium and high. Pressure relief valve up to 300 psig are considered in the low segment. Pressure relief valve from 301-800 psig are considered in the medium segment. Pressure relief valve above 800 psig are considered in the high segment. Low segment is expected to exhibit largest revenue during forecast period, and also expected to exhibit highest CAGR share in pressure segment in pressure relief valve market during forecast period.

By end user industry: The pressure relief valve market is divided into oil & gas, chemical, power generation, food & beverage, manufacturing and water & wastewater. Pressure relief valve are used in the oil & gas industry for safety against pressure spikes specifically for downhole and subsea oil equipment. In the chemical industry to protect sensitive analytical equipment from over-pressurization. Electrical power industries adopt pressure relief valve for functions such as steam control, boiler circulation, and condensation systems. Food & beverages industry includes processing of raw agricultural produce into processed food & beverages. Pressure relief valves in food & beverages processing are used for transportation of raw or processed food during the industrial processes. Pressure relief valve are used in the automotive industry to use automated valves for storing and transporting gas, liquid, or slurry. Pressure relief valve are used in the automotive industry to control the flow of gas in engines. Power Generation is expected to exhibit largest revenue share in the end-user segment in the pressure relief valves market share during forecast period. The water and wastewater segment is expected to exhibit largest CAGR during forecast period.

By region: The pressure relief valve market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in pressure relief valve market share. And LAMEA is expected to exhibit highest CAGR during forecast period.

The major players profiled in the pressure relief valve market include AGF Manufacturing, Inc., Alfa Laval, Curtis-Wright Corp, Emerson Electric Co., General Electric, Goetze KG Armaturen, IMI PLC, Mercury Manufacturing Company Limited, The Weir Group PLC, and Watts Water Technology, Inc.

Major companies in the market have adopted acquisition and product launchas their key developmental strategies to offer better products and services to customers in the pressure relief valve market.

In February 2020, Curtiss-Wright Corporation, a leading provider of pressure safety and release valves, has acquired Dyna-Flo, a well-known designer and manufacturer of linear and rotary control valves, isolation valves, actuators, and level and pressure control systems for the chemical, petrochemical, and oil and gas markets, for $62 million. The acquired business will operate within commercial/industrial segment of Curtiss-Wright.

In April 2022, Lamot Valve & Arrestor has launched its new product: the Model L11E Weight-Loaded Pressure Relief Valve. The valve includes an option to add calibrated weights in 0.5 using increments, giving the operator the flexibility to adjust the set pressure of this valve from the top of the tank and eliminating the need to remove and retest in the shop on a test stand. It can be used as a stand-alone vent to the atmosphere pressure relief valve or can be used in addition to existing pressure relief valves to add additional flow capacity.

In December 2020, Consolidated, a Baker Hughes subsidiary, has launched its new 1900 series dual media (DM) spring-loaded safety relief valve (SRV) with patented trim. The new series is designed to perform on both liquid and gas media and has dual certification (liquid and gas) nameplate capacity stamping in accordance with ASME (American Society of Mechanical Engineers) and BPVC (Boiler and Pressure Vessel) Code Case 2787. The 1900 DM series is the first and only spring-loaded safety relief valve in the industry that is "dual certified." Dual certified means the valve is both vapor/gas and liquid flow certified without making any modifications or adjustments to the relief device when switching fluids during the flow testing.

In November 2020, Danfoss has launched its new 65bar safety valve, SFA 10H, that offers reduced capacity, high reliability, and high-pressure for applications with CO2 and synthetic oils. The design and manufacturing of this product focuses on preventing leaks, providing perfect reseating after release, and keeping a stable set pressure over time.

In April 2020, Baker and Hughes has launched the 2900 series gen II pilot pressure relief valve (PRV). This innovative product has a full-nozzle main valve that easily threads in and out to save maintenance expenses while protecting the main valve body from corrosive service under normal operating circumstances.

Key Benefits For StakeholdersThis report provides a quantitative analysis of the pressure relief valves market overview, segments, current trends, estimations, and dynamics of the pressure relief valves market analysis from 2021 to 2031 to identify the prevailing pressure relief valves market opportunities.

The report includes the pressure relief valves market outlook and analysis of the regional as well as global pressure relief valves market trends, key players, market segments, application areas, and market growth strategies.

8613371530291

8613371530291