homeowner safety valve company reviews quotation

BBB Business Profiles are provided solely to assist you in exercising your own best judgment. BBB asks third parties who publish complaints, reviews and/or responses on this website to affirm that the information provided is accurate. However, BBB does not verify the accuracy of information provided by third parties, and does not guarantee the accuracy of any information in Business Profiles.

When considering complaint information, please take into account the company"s size and volume of transactions, and understand that the nature of complaints and a firm"s responses to them are often more important than the number of complaints.

Avoid the headache, hassle and costly repair bills caused by a water or sewer emergency on your property, or an in-home plumbing problem. A single call to Safety Valve takes care of it all.

New to Safety Valve? Enter your address below to check eligibility. Already a customer? Log in to manage your account. You must register first if you haven"t done so.

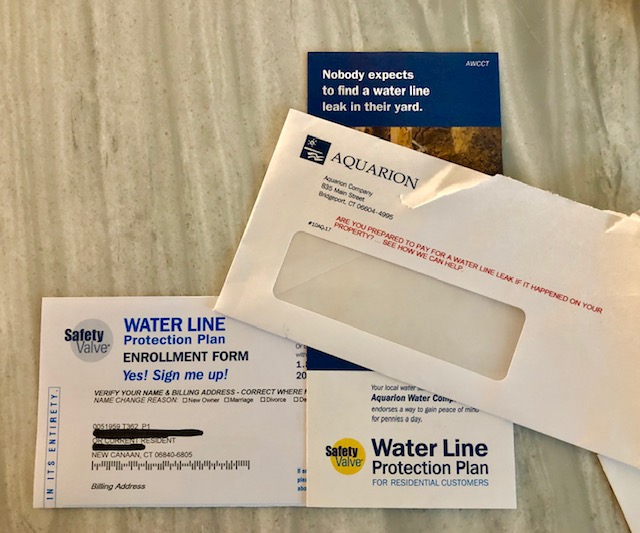

Weeks ago, Aquarion Water Company must have come a’calling—and since I am visitor-proof, they left an urgent notice on our doorknob. By the way, nothing says *urgent* like a white luggage tag on the front door. I was instructed to contact the company immediately regarding a water leak on our property.

Aquarion refused to be ignored, sending a big white van to pay me a visit. They really stepped it up from the white door tag. This time, the dog alerted me to the vehicular presence in the driveway, and that is where I met my fate. I perp-walked out to the technician feeling rather guilty. After a boots-on-the-ground consultation, I was asked a question that no one in New Canaan is prepared to answer in the affirmative: Do you have water line safety valve insurance?

Ummm, no. You mean those silly letters that I throw away every month and say, “Ha, what sucker buys safety valve insurance?” It was made very clear why the insurance is worth the investment and it was painful. All of the sudden, I had become the New Canaan version of Diane Keaton’s character from “Baby Boom,” and was quite literally, drowning in homeownership hell.

That said, I was quoted up to $10,000 if my leak hide-and-seek project was major. This was not what I had bargained for when I threw away all of those safety valve insurance mailers.

As a homeowner, you are responsible for the water line from your home to the street. Over time, your water line will start to crack, deteriorate, or clog. To protect yourself from a costly replacement process, get a water line protection plan from Safety Valve. If something goes wrong while you have a plan, all you have to do is call us, and we will take care of the repairs! Learn more about our plans by calling 1-800-719-1613 or visit our website at

Service Line Warranties of America (SLWA), a HomeServe USA company operating out of Pennsylvania, offers protection plans for your home’s heating, cooling, water, sewer, gas, and electrical lines. This company is separate from local utilities, and the service contracts it provides will cover damage to utility lines that home insurance and local municipalities won’t. Keep reading this review to learn more about plans, coverage, and pricing.

Although this company doesn’t offer coverage for individual electrical appliances like refrigerators or freezers, it will cover the main electrical system inside your home.

There does not appear to be any add-on or customizable options with this home warranty company—you may only choose from the warranty plans that the company offers in your location. However, you can purchase packages that combine the company’s heating and cooling plans in some locations.

Note: Service Line Warranties offers discounts in some locations. For example, in this zip code, the company offers the first year of its Exterior Septic/Sewer Line plan for 50% off—it would normally be $12.48 a month. Purchasing a combo plan, if one is available in your area, may also save you money over purchasing both plans separately.

The company will dispatch one of its contractors to repair or replace the faulty part, as long as it’s covered by your plan. There’s no need to pay the technician—you will only need to sign off on the service line repairs, and Service Line Warranties will pay the contractor.

Service Line Warranties of America has been an accredited business with the Better Business Bureau (BBB) for 14 years, and it maintains an A+ rating based on its handling of customer complaints. Despite its rating, Service Line Warranties of America has a mix of positive and negative reviews, as any good home warranty company will have. Here is what some of the company’s customers had to say.

Service Line Warranties of America is the official provider for the National League of Cities Service Line Warranty Program, and the NLC Service Line Warranty Program is administered by SLWA parent, Utility Service Partners, Inc. Service Line Warranties of America and Utility Service Partners are part of HomeServe USA Corp, a company providing home repair solutions in the United States and Canada.

The This Old House Reviews Team gives Service Line Warranties of America a 6.97/10. Service Line Warranties provides coverage for plumbing, sewer, gas, and electric systems and charges low premiums and no service call fees. The maximum caps on repair payouts are high and the claims process is simple. However, the company only covers some of your home’s systems and is available in only a few states.

Our team rated more than 50 home warranty companies and found that American Home Shield is the best on the market. Its extensive plan options, nationwide availability, and five decades of experience make it a worthwhile investment for homeowners.

The This Old House Reviews Team backs up our home warranty ratings and recommendations with adetailed rating methodologyto objectively score each provider. We conduct research by speaking with company representatives, requesting quotes, analyzing sample contracts from each company, and conducting focus groups and consumer surveys. We then score each provider against our review standards for coverage, value, trustworthiness and transparency, availability, and customer service to arrive at a final score out of 100.

One of the fastest-growing insurers and a company with a 50-year history of protecting families, Mercury Insurance. They offer service line protection as an add-on to its home insurance policies. $10,000 of coverage is paired with an affordable $500 deductible to provide coverage for a broad range of service lines, including sewer lines.

This all depends on your provider, but sewer line coverage is often not built into a standard homeowners policy. Some providers do include it, though, and others offer it as an add-on or standalone policy. Some insurers may offer home warranties that include sewer line damage. Check out some of our favorite homeowners insurance policies below to see if they offer sewer line coverage as part of their available products.

Just like others say, this is a s****** company. SIX times my home has been flooded because they refuse to fix the problem THEY identified...tree roots in a broken section of pipe. Their idea of fixing it is to snake the pipe out then make you wait until the flooding occurs. Then its same story as last time, you dont need the expensive fix just keep filling your house with stench and water. AVOID at all ..Read Full Review

Just like others say, this is a s****** company. SIX times my home has been flooded because they refuse to fix the problem THEY identified...tree roots in a broken section of pipe. Their idea of fixing it is to snake the pipe out then make you wait until the flooding occurs. Then its same story as last time, you dont need the expensive fix just keep filling your house with stench and water. AVOID at all cost. My next step is court. ..View less

They tried to send 2 out if state companies with 5 day lead time. My main sewer line was clogged and needed excavated for repair. I called my own plumber and got reimbursed $3800 of $7300 not including landscaping and concrete repair. Terrible continuity of phone personnel to manager/dispatchers. I got higher coverage through my homeowners policy and I can call my own contractors.

This company has some very serious issues in their billing department and apparently has taken no steps to correct them. Every monthly bill requires a painful phone call.

I appreciate all the help from SLW. After having back up sewage and a clogged line for years. It is a blessing not having that problem anymore. The plumbing company was prompt in coming out and they explained what was going on and what was needed. The company called back to make sure that the service was completed and Solid plumbing follow up also.

I"ve been with this company since the city of Arlington offered it to homeowners about 5 years ago. I have had NOTHING BUT PROBLEMS with their billing department. I"ve been billed odd amounts. My payments haven"t been posted properly, then they have had the nerve to suspend my services!! I"ve spent hours and hours and hours on the phone trying to get things straightened out and STILL CONTINUE TO HAVE ..Read Full Review

I"ve been with this company since the city of Arlington offered it to homeowners about 5 years ago. I have had NOTHING BUT PROBLEMS with their billing department. I"ve been billed odd amounts. My payments haven"t been posted properly, then they have had the nerve to suspend my services!! I"ve spent hours and hours and hours on the phone trying to get things straightened out and STILL CONTINUE TO HAVE MAJOR PROBLEMS. Their excuses get tiresome. their coverage has been good the two times I"ve used them, but KNOW THAT IT IS AT THEIR CONVENIENCE to get help to you. Their contractors are low budget, slap a temporary fix on it kind of guys, and don"t fix things completely without having to call them back for a second or third trip. A total inconvenience to schedule and budget!!!!. overall, this company SUCKS. I"m in the process of taking my 5 homes away from them. ..View less

My father died and I only wanted to stop the auto pay. Holy Moly! I wasted an hour on the phone talking to complete and total idiots that can only read from a script. I was on the phone for over an hour and never once did anyone ask for documentation or offer any help. Instead what happened was that I was patronized and harassed and placed on hold for 10 to more mins at a time and jerking me around. I then got angry and contacted the BBB, WV attorney General and am fling fraud charges with my bank and changing my bank card. Today, I get a call from this company. I said you had your chance to do the right thing and you choose not to. I am taking action against this company. I can only imagine the hell I would have to go through if something actually happened. I have canceled the plan and will get my money back for the last payment.

I am writing reviews online all over the place to warn people about this terrible company - Unprofessional, patronizing and incapable of completing the most basic of tasks. ..View less

Over and over they send bill for premium that"s already been paid then YOU must take time to call them to make it right and their CS is not that great, this may be the last time I use them. The city of Tulsa should be ashamed to be associated with this clown company.

If i could give 0! They kept billing me an over due bill which I knew I had paid every month. Every time i called they apologized because they just got their new billing system. At one point I had to faxed them my bank statement to show that I had paid them for previous month. AVOID this company!

Smart home devices are becoming a common fixture in homes across the country. But smart devices aren"t just for turning off lights and making playlists. In combination with a home insurance policy, they can also save homeowners some cash while increasing home safety. However, smart device discounts are usually minimal compared to the overall cost of home insurance.

Perhaps more importantly, homeowners can get larger discounts for centrally monitored security systems, meaning you are often better off installing traditional centralized alarm systems than purchasing smart devices.

Although some programs are not worth the investment if you"re simply looking to save money on homeowners insurance, they are still worth considering if you"re in the market for a smart home or security system for other reasons.

Homeowners insurance discounts for smart home devices range from one company to the next. Allstate offers customers up to a 5% discount on their premium when using a Canary theft-protection system, while Hippo offers up to 13% off, depending on the type of system you choose.

Many homeowners insurance companies don"t publicize the exact amount you"ll save by purchasing a smart home device. This is partially because the size of your discount is dependent on how risks are weighted for your individual home. If you live in Florida and nonhurricane risks represent a small share of your overall premium, your discounts from smart devices will be fairly small.

Liberty Mutual offers to double your smart home discount if you allow the company to verify your home monitoring system by communicating with your provider and occasionally receiving data on your system.

{"backgroundColor":"ice","content":"\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cstrong\u003EHow do I get a smart home discount?\u003C\/strong\u003E\u003C\/p\u003E\n\n\u003Cp\u003ESome insurance companies will require you to provide a \u003Cstrong\u003Ecertificate of monitoring\u003C\/strong\u003E to receive a home insurance discount. Companies like Ring and SimpliSafe give customers the option to download a monitoring certificate online or via their app.\u003C\/p\u003E\n\n\u003Cp\u003ELiberty Mutual offers to double your smart home discount if you allow the company to verify your home monitoring system by communicating with your provider and occasionally receiving data on your system.\n","padding":"double"}

In the hopes of increasing customer safety and lowering the risk that policyholders will make claims, these insurers are offering discounts and deals on devices that help maintain a safer home:

With the $20 savings, a Canary premium service plan would cost $79 per year for a single device. Based on the average home insurance premium, homeowners can save $84 per year on an Allstate policy. At a $5-per-year net savings for the base package, this program is worth it if you"re planning to invest in security cameras.

AmFam does not list the amount you"ll save with its Safe, Secure, Smart Home Discount. However, the Hedge system does not have a monthly fee, and based on the cost of its equipment packages, you will probably save enough on your homeowners insurance within the first two years to make this investment worth it.

The ADT monitoring system discounts are probably not worth the investment. Basic monitoring packages with ADT start around $336 per year, and homeowners are required to sign a 36-month contract that includes early termination fees. Even without knowing how much you"ll save, it"s not likely you"ll earn a large enough discount on your home insurance to cover the cost of this system.

Amica Mutual offers homeowners a 20% discount on Flo by Moen whole home protection systems, which monitor water flow, pressure and temperature and automatically shut off the water to your home in the event of a catastrophic leak. Flo by Moen systems start at $499. Amica also offers a home insurance discount when the system is installed.

Because the systems are so expensive, homeowners aren"t likely to recoup the cost of a Flo by Moen water shutoff valve with the discount Amica provides on your home insurance rate, which varies by state. However, this system could be worth it if you live in a home with older plumbing, as it has the potential to save you a lot of money by preventing significant water damage.

Hippo is partnered with multiple smart home monitoring systems, including SimpliSafe, Kangaroo and Notion. The company offers up to 10% savings on your annual premium for self-monitored systems and up to 13% savings when you purchase a professionally monitored system from SimpliSafe.

Liberty Mutual customers can save $100 on select Vivint home monitoring devices. The company also offers a verified smart home discount, which it states will double your home monitoring system discount. In return, customers must allow Liberty Mutual to verify their home monitoring system with the provider and periodically receive data on the system.

Liberty Mutual doesn"t share the amount of its smart home discount. However, given that homeowners have to purchase a minimum of $600 in equipment from Vivint, along with professional installation and a service agreement, this program is probably not worth it.

Nationwide has partnered with the Notion Smart Home Monitoring System to provide homeowners with nearly 50% off of the price of a Notion kit and an average savings of $50 per year on their home insurance. Notion sensors monitor water leaks, temperature changes, smoke and carbon monoxide alarms, and the opening and closing of doors and windows, and kits start at $75 for Nationwide customers.

The Notion system is self-monitored, so there are no monthly recurring fees. Homeowners that save $50 per year on insurance can expect to recoup the cost of Notion hardware in one to two years, making this program worth it for those in the market for a DIY security system.

State Farm offers homeowners a free Ting smart plug, which monitors your home’s electrical network for damaged wires, faulty devices or loose connections that can lead to fires, along with three years of monitoring at no additional cost. Your Ting subscription also includes repair coordination and a $1,000 hazard repair credit. Installing a Ting device may also qualify you for an additional home insurance discount.

The SimpliSafe system may be worth it if you are already in the market for a self-monitored system. ADT"s costs are too high to be offset by a homeowners insurance security discount.

The prevalence of smart devices in the home has raised concerns about data privacy and the extent to which the devices may be recording a homeowner"s private information, known or unbeknownst to them. Consumers who have smart devices in their residence may be vulnerable to their data being compromised, both directly from their devices and from insurance companies that collect and store their data.

For instance, a Florida insurance filing for First Community Insurance states that if its customers receive a discount for a home telematics advice, they "consent to the release of all data and/or information produced, monitored, obtained and/or captured by such device(s), by the devices’ third-party provider to the insurance company." Unwittingly, homeowners seeking a discount may be sharing sensitive data with their insurer.

Self-monitored security camera systems can lower your home insurance costs, although the discount depends on the company. Allstate offers a discount of up to 5% to homeowners who install the Canary camera system, while

Chubb offers standard homeowners insurance, as well as condo and co-op, renters and flood insurance policies. Many of the base protections included in its standard policies as well as add-on coverage options are rare, even among large national insurers, and these protections are especially valuable to high-net-worth individuals or those seeking protections from unique risks like cyberattacks.

Chubb Masterpiece homeowners insurance policies include several rare coverages, such as extended replacement cost, cash settlement and risk consulting services, as well as several unique add-on coverage options such as family protection and cyber insurance. And as with auto insurance, Chubb offers high liability limits — up to $100 million in personal liability.

These options may be attractive to homeowners that want the flexibility of cash payment, appraisal services or coverage options that protect against unique risks like home invasion and cyberattacks.

Below we list several coverages that can be bought in addition to Chubb"s Masterpiece homeowners insurance policy, though availability may vary by state.

{"backgroundColor":"ice","content":"\u003C\/p\u003E\n\n\u003Cp\u003EBelow we list several coverages that can be bought in addition to Chubb"s Masterpiece homeowners insurance policy, though availability may vary by state.\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cdiv class=\"ReactComponent--root\"\u003E\n \u003Cdiv class=\"js-react-component-rendered js-react-component-Accordion\" data-component-name=\"Accordion\"\u003E\n \u003Cdiv class=\"Root-sc-1p4b1c4 jtQORB\"\u003E\u003Cdiv class=\"Root-sc-18uhp3r bjqdvu\"\u003E\u003Cdiv tabindex=\"0\" class=\"HeaderWrapper-sc-9iud4t gnyuvR\"\u003E\u003Cdiv class=\"TitleWrapper-sc-8jgky4 ibypas\"\u003E\u003Cp class=\"pTitleElement-sc-9cz7ej dKoVkb\"\u003EEquipment breakdown\u003C\/p\u003E\u003C\/div\u003E\u003Cspan aria-hidden=\"true\" class=\"StyledIcon-sc-e7wugl jwzcXa ValuePenguinIcon--root ValuePenguinIcon--minus\" color=\"blue\" name=\"minus\"\u003E\u003C\/span\u003E\u003C\/div\u003E\u003Cdiv class=\"ContentWrapper-sc-1c2drvb gQWUK\"\u003E\u003Cdiv\u003E\u003C\/p\u003E\n\n\u003Cp\u003EPays for the full replacement or repair of your home"s appliances and equipment in the event of sudden and unexpected damage. It"s available in both Essential and Enhanced coverages. \u003C\/div\u003E\u003C\/div\u003E\u003C\/div\u003E\u003Cdiv class=\"Root-sc-18uhp3r bjqdvu\"\u003E\u003Cdiv tabindex=\"0\" class=\"HeaderWrapper-sc-9iud4t gnyuvR\"\u003E\u003Cdiv class=\"TitleWrapper-sc-8jgky4 ibypas\"\u003E\u003Cp class=\"pTitleElement-sc-9cz7ej dKoVkb\"\u003EFamily protection\u003C\/p\u003E\u003C\/div\u003E\u003Cspan aria-hidden=\"true\" class=\"StyledIcon-sc-e7wugl jwzcXa ValuePenguinIcon--root ValuePenguinIcon--plus\" color=\"blue\" name=\"plus\"\u003E\u003C\/span\u003E\u003C\/div\u003E\u003Cdiv class=\"ContentWrapper-sc-1c2drvb hkIbYG\"\u003E\u003Cdiv\u003E\u003C\/p\u003E\n\n\u003Cp\u003EHelps policyholders pay for expenses following traumatic events like home invasion, carjacking or cyberbullying. \u003C\/div\u003E\u003C\/div\u003E\u003C\/div\u003E\u003Cdiv class=\"Root-sc-18uhp3r bjqdvu\"\u003E\u003Cdiv tabindex=\"0\" class=\"HeaderWrapper-sc-9iud4t gnyuvR\"\u003E\u003Cdiv class=\"TitleWrapper-sc-8jgky4 ibypas\"\u003E\u003Cp class=\"pTitleElement-sc-9cz7ej dKoVkb\"\u003ECyber insurance\u003C\/p\u003E\u003C\/div\u003E\u003Cspan aria-hidden=\"true\" class=\"StyledIcon-sc-e7wugl jwzcXa ValuePenguinIcon--root ValuePenguinIcon--plus\" color=\"blue\" name=\"plus\"\u003E\u003C\/span\u003E\u003C\/div\u003E\u003Cdiv class=\"ContentWrapper-sc-1c2drvb hkIbYG\"\u003E\u003Cdiv\u003E\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cspan\u003E\u003Ca class=\"ShortcodeLink--root ShortcodeLink--black\" title=\"What Is Cyber Insurance?\" href=\"https:\/\/www.valuepenguin.com\/personal-cyber-home-insurance\"\u003ECyber insurance\u003C\/a\u003E\u003C\/span\u003E covers cyber extortion, cyber financial loss and cyber personal protection for high-value home insurance policies.\u003C\/div\u003E\u003C\/div\u003E\u003C\/div\u003E\u003C\/div\u003E\n \u003C\/div\u003E\n\n \u003Cscript type=\"application\/json\" class=\"js-react-component\" data-component-name=\"Accordion\"\u003E{\"maxContentHeight\":\"180\",\"tabItems\":[\"\\u003C\\\/p\\u003E\\n\\n\\u003Cp\\u003EPays for the full replacement or repair of your home"s appliances and equipment in the event of sudden and unexpected damage. It"s available in both Essential and Enhanced coverages. \",\"\\u003C\\\/p\\u003E\\n\\n\\u003Cp\\u003EHelps policyholders pay for expenses following traumatic events like home invasion, carjacking or cyberbullying. \",\"\\u003C\\\/p\\u003E\\n\\n\\u003Cp\\u003E\\u003Cspan\\u003E\\u003Ca class=\\\"ShortcodeLink--root ShortcodeLink--black\\\" title=\\\"What Is Cyber Insurance?\\\" href=\\\"https:\\\/\\\/www.valuepenguin.com\\\/personal-cyber-home-insurance\\\"\\u003ECyber insurance\\u003C\\\/a\\u003E\\u003C\\\/span\\u003E covers cyber extortion, cyber financial loss and cyber personal protection for high-value home insurance policies.\"],\"tabTitles\":[\"Equipment breakdown\",\"Family protection\",\"Cyber insurance\"],\"titleStyle\":\"p\"}\u003C\/script\u003E\n\n\u003C\/div\u003E\n","padding":"double"}

In addition to these coverages, Chubb offers the standard homeowners insurance coverages you"d expect to see from any major insurer: liability, personal belongings, medical payments and additional living expenses.

Homeowners insurance premiums at Chubb are generally more expensive than rates offered by other large national insurance companies. However, Chubb offers many homeowners discounts that could garner valuable savings for eligible policyholders.

The rates above reflect costs for a New York home built in 1961 and worth $314,500. Homeowners insurance rates vary drastically by state and property, so you should always compare quotes from several insurers to find the cheapest rate.

Customers can mitigate the high base prices of Chubb"s policies with its extensive discount list. Discounts vary from state to state and can depend on whether you live in an urban, suburban or rural community. To give an idea of the company"s offerings, however, we"ve listed the discounts available in New York state below:

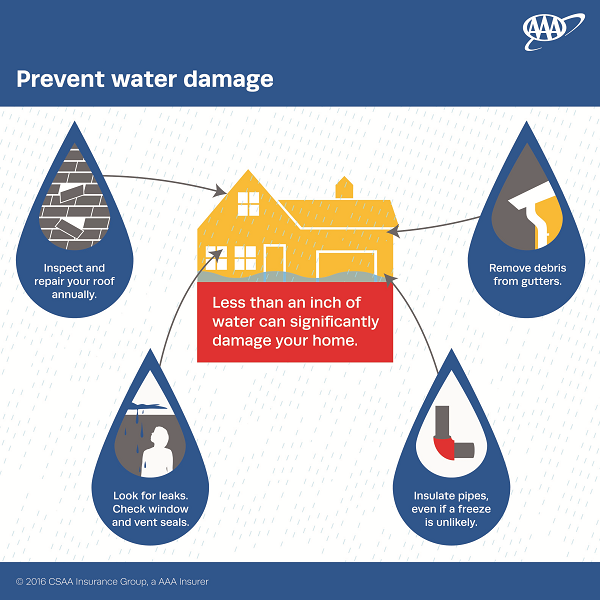

A water backup and sump pump overflow endorsement on your homeowners or renters insurance provides added protection from costly water damage resulting from backed up drains or failed sump pumps.

Homeowners insurance does not typically cover water backup damage. Water backup and sump pump overflow coverage is an optional coverage that must be added on to a homeowners policy.

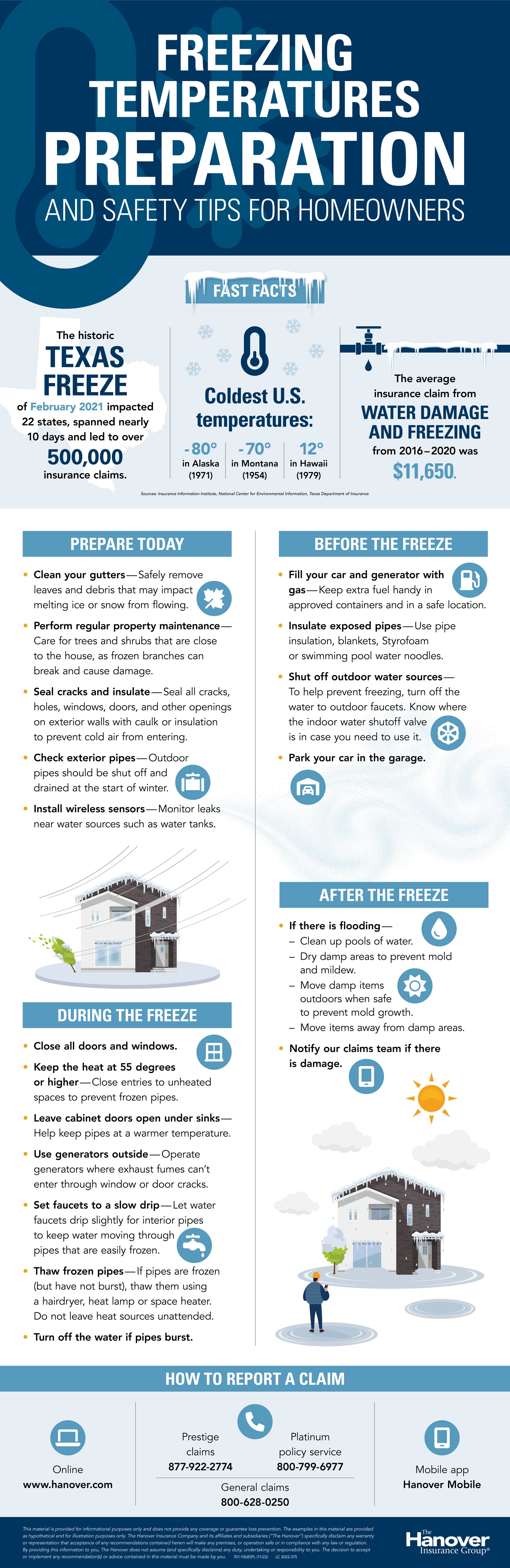

Whether it’s in pipes or under the ground, your property is surrounded by water. Water damage — resulting from backed up drains or failed pumps — is one of the most common homeowners insurance claims. Water damage is the third most costly claim behind fire and liability lawsuits, according to the Insurance Information Institute. Because water damage incidents like these are often not covered by a home policy, it’s important to make sure you are protected with a water backup endorsement. Talk to your independent insurance agent about what water backup endorsement limits suit your needs.

A backwater valve (sometimes called a backflow or sewer backup valve) is a valve you can install on your sewer line and is designed to allow water or sewage to flow only one way—out of your house. Sudden heavy rainfall can overwhelm city sewer lines, causing water or sewage to flow back towards your home. A backwater valve prevents sewage from flowing backwards into your house during such events.

They can be installed in the initial new construction or retrofitted into existing homes. Installing during the initial construction is naturally much cheaper, costing around $500. To retrofit a backwater valve, a section of the home’s foundation needs to be removed to access the main sewer line. The cost to retrofit a backwater valve ranges from $2,000 to $5,000.

Backwater valves are required by some municipalities and recommended by others. Some municipalities offer subsidies to assist with the installation of backwater valves—check out the links at the end of this article.

The risk of water backup increases if there is a basement in your home, or if the ground floor is less than 30 cm above street level. If a new home has any fixtures located below street level, The National Plumbing Code requires a backwater valve.

Your home’s sewer system allows water and sewage to flow out of the house. A backwater valve stops water or sewage from flowing into your house should the main sewer line become overloaded.

Inside the valve is a small flap that is normally open, allowing water to exit your home and any sewer gases to vent. There is a small floatation device on each side of the flap. If water or sewage starts to flow backwards into the house, the floaters cause the flap to lift up and close, thus preventing anything from entering your home.

When you retrofit a backwater valve onto your existing home (as opposed to installing it during construction), you’ll need a plumbing permit from your municipality. During installation, a plumber will have to cut a hole in the concrete floor, usually near the floor drain. Then, they’ll dig down to the main sewer line, cut out a portion, and replace it with the new valve.

The valves often have a clear top so you can see if it is operating properly. There’s also a lid that you can remove for cleaning. Without a properly functioning backwater valve, sewage could come into the basement through a floor drain, sinks, tubs, and toilets.

Before you install a backwater valve in your home, talk to your municipal government to find out if any local permits are required, as well as to find out what sort of equipment they recommend.

When it comes time for installation, hire a licensed plumber. They can install the backwater valve and can also obtain any necessary building permits. Municipal governments sometimes maintain lists of pre-approved plumbers.

“People often forget this and cover them with flooring. This stops the ability for inspection and maintenance as well as losing access to the drains for clearing blockages if they occur. Drains can still block and cause a backup even with a backwater valve installed. Underground piping in the basement may require the expected installation location to change.”

Things can get stuck inside the valve, preventing it from closing. Sharp items moving through can also damage the valve. Proper, regular maintenance can catch these issues before there is a serious problem.

Backwater valves are usually easily accessible. They have a clear top, so you should be able to see if water is flowing freely or if anything is stuck. You’ll find plenty instructional videos to help you DIY the maintenance. Or, you can call an expert if the thought of sticking your hand in a sewage pipe is not particularly appealing. If you do attempt to clear a block on your own, be sure to follow all the instructions carefully—especially wearing gloves.

If everything is clear, and the city sewer backs up during a major rainstorm, your backwater valve will close, which is exactly what you want to happen.

When the valve is closed, water can’t flow out of your house either. There is a certain amount of storage space in your plumbing system to account for this. But, you may not want to shower and run your washing machine or dishwasher all at once during a major rainstorm or snowmelt event. Since none of your wastewater will be able to escape with the backwater valve closed, you could wind up flooding your own house.

Always consult with a licensed plumber to determine if you would benefit from a backwater valve since having one installed in on certain properties can actually make things worse.

A licensed plumber will assess the condition and layout of your sewer lateral. He or she will identify the most appropriate location to install the valve. Always consult with a licensed plumber to determine the location since a backwater valve installed in the wrong place can actually make things worse.

It depends on a number of factors, including the layout of your sewer pipes, the depth and location of the pipe that connects your home to the sewer, if there are environmental hazards (i.e. lead paint) in the area where the valve will be installed, what type of valve is installed, etc. The cost can be as little as $600 or more than $5,000.

You"ll know if your valve is closed because water will stop going down your drains. If you suspect the valve might be closed, you can also check using the valve access point provided by the plumber during the installation. Some valves have alarms connected to them that are activated when the valve closes, though they can be costly.

You could install backwater valves on all plumbing fixtures that are below the Base Flood Elevation rather than installing one on the sewer pipe connecting your home to the sewer, if deemed appropriate by a licensed and qualified plumber. You could also flood-proof your basement and use it only for parking or storage. Sewage may still back up, but your belongings would be protected. The New York City Department of Environmental Protection (NYCDEP) prepared this Flood Preparedness Flyer to help homeowners reduce the chances of their home flooding during a rain event.

There is a small risk that the backwater valve will fail. Backwater valves reduce the chance of sewage backing up into your home through your sewer pipe, but if the valve is not maintained properly, sewage can get stuck and leak through.

A backwater valve should only be installed by a licensed plumber who has completed other backwater valve installations in your neighborhood. You can ask for references!

NFIP is not currently written to allow premium reductions for dry flood proofing mitigation, which backwater valves fall under. For example, elevating your home gives you a discount because you"re raising your lowest floor above the BFE. A backwater valve reduces but does not remove the risk of flooding.

You are currently eligible if you live within the community boundaries of Lower Manhattan, Rockaway East, Southeast Brooklyn Waterfront, Gravesend and Bensonhurst, Howard Beach, Gerritsen Beach and Sheepshead Bay, and the Southern Brooklyn Peninsula as defined by the Governor’s Office of Storm Recovery (GOSR). After filling out the application, we’ll review your eligibility and let you know what our determination is. Even then, if the plumber or engineer find existing conditions that make it infeasible to install a valve once they get into your home, your eligibility could be put on hold until the issue with the existing conditions are fixed by the homeowner.

Applicants in Canarsie and Red Hook who did not participate in the Home Resiliency Audit program are not eligible to participate at this time. Those who participated in the program previously will move through the backwater valve portion of the program at the same pace as all other participants.

Yes, among others, there are gate, ball, and flapper valves. Backwater valves go by a variety of names including check valve and duckbill valve. A licensed plumber or engineer can tell you which, if any, is best for your home.

Homeowners who meet all of the eligibility requirements will be able to participate in the program. If you are interested in being considered, please fill out our brief intake form online.

Homeowners can discuss how to get a sewage backup insurance rider with their homeowners insurance provider. Sewage backup insurance typically costs less than $100 per year. Previous claims, credit and street-level elevation can sometimes affect rates.

The best way to find out if you have a sewer backwater valve or if you need one is to consult with a licensed and qualified plumber. A sewer backwater valve can be difficult to identify on your own, especially if it was installed a long time ago.

The best way to determine if you have a sewer backwater valve or if you need one is to consult with a licensed and qualified plumber. A sewer backwater valve can be difficult to identify on your own, especially if it was installed a long time ago.

The DFE determines the safest elevation for construction in flood hazard zones. In NYC, the DFE is usually the Base Flood Elevation plus two feet — known as “freeboard,” for added safety. Your designer or architect should consult the NYC Department of Buildings during design and permitting to ensure that they are following the DFE.

Ask your plumber to provide you with the operation and maintenance instructions from your valve’s manufacturer. It"s usually pretty simple — open your valve access point a couple of times per year to make sure nothing is clogging your valve. If something is clogging it, remove it. If the flap needs lubricant, apply it. Some plumbers offer maintenance programs and will do this for you. If you receive a sewer backwater valve through our program, the plumber who installs your valve will show you where the valve is, how it works, and how to maintain it. In addition, you’ll receive a field report when the installation is complete containing specific operation and maintenance instructions from the manufacturer of your valve.

If only one individual needs to sign your Homeowner Grant Agreement (that is, there is only one person listed on the deed for the property), then you can electronically sign the document. After we determine your eligibility, we’ll send you a link to do this. If more than one person needs to sign your Homeowner Grant Agreement, you can download and print the document from your status page. Once completed, you can fax it to (646) 506-4621, email a copy to info@floodhelpny.org or mail it via the postal service to FloodHelpNY, Center for NYC Neighborhoods, 55 Broad Street, 10th Floor, New York, NY 10004.

This is only in Canarsie and Red Hook. Canarsie was one of the most participative communities in the initial home resiliency audit program before backwater valve installations were added. Funding for audits in Canarsie was used up, but we have since received additional funding to install backwater valves there. Since nobody can get a backwater valve installed without having an audit, people in Canarsie who have not already had an audit and gone to counseling before funding ran out will not be eligible to get an audit or a backwater valve. It is possible that funding allocations could change in the future, and we will be sure to touch base if that happens.

If you have already received a FloodHelpNY Home Resiliency Audit we’ll need you to be home for three things: the engineer’s feasibility review, the Kick-Off Meeting with the plumber, and the installation. If you have not received a FloodHelpNY Home Resiliency Audit we’ll need you to be home for the audit, the Kick-Off Meeting, and the installation itself. We expect the audit to take a maximum of two hours. The timeline for the Kick-Off Meeting and the installation remain the same for homeowners who have received an audit.

You"ll need to be home for the kick-off meeting and the installation. The kick-off meeting is when the homeowner will meet their plumber and inspector, and should take a maximum of one hour. A typical installation should take one to two days, depending on the home.

If the applicant lives in an AE zone, flood insurance must be purchase before they will be accepted into the program. The building flood insurance coverage must be equal to the cost of the backwater valve installation, on average, around $1,500.

You must have homeowners insurance before you will be accepted to the program. We do not specify how much homeowners insurance you must have, just that you have it.

The applicant must have homeowners insurance before they will be accepted to the program. We do not specify how much homeowners insurance they must have. They just have to have it in general.

In additional to making sure the plumber has easy access to the basement area where the valve will be installed, please also be prepared to be home and make plans for when the water is shut off.

You will be retroactively considered for the Residential Backwater Valve Installation Program. When the program launches the Center will email you the Backwater Valve application. The application will have to be completed and returned to the Center for further eligibility review. Your eligibility will be contingent upon the outcome of our review of your application and the engineer’s and plumber’s findings in your home. An eligible determination does not necessarily mean that you will get a valve since only low-to-moderate income households will be served at this time.

If an applicant from Canarsie or Red Hook received an elevation certificate and attended counseling, will they be considered for the Backwater Valve program?

Yes, the only residents from Canarsie and Red Hook that will be considered for the Backwater Valve Program are those who have received an audit and attended counseling.

Sewage backup is not typically covered by standard homeowners insurance policies. Sewage backup insurance is an “endorsement” or “rider” that can often be added to standard homeowners insurance.

You"ll know if your valve is closed because water will stop going down your drains. If you suspect the valve might be closed, you can also check using the valve access point provided by the plumber during the installation. Some valves have alarms connected to them that are activated when the valve closes, though they can be costly.

We need legible copies of all of the requested documents to review your homeowners insurance, driver"s license, current gross annual income information, proof of flood insurance (if applicable), and tenant income information (if applicable). We will ask for additional information if the documents submitted are illegible or are missing from your application.

If the existing conditions don"t allow for a backwater valve installation (i.e. not enough space or the condition of the sewer lateral is too poor for the plumber to be able to cut into it without making major repairs), if the home doesn"t need a backwater valve (there is no indication that the home is at risk of sewage backup based on elevations of the home, sewer house connection, nearby sewer, base flood elevation, etc.)

You can flood-proof your basement and elevate your mechanical equipment so that the basement is only used for parking or storage. Sewage may still back up, but your belongings will be protected. The New York City Department of Environmental Protection (NYCDEP) prepared a Flood Preparedness Flyer to help homeowners reduce the chances of their home flooding during a rain event.\n\nhttp://www.nyc.gov/html/dep/pdf/brochures/flood-preparedness-flyer.pdf\n

After the valve is installed, it’s the homeowner’s responsibility to maintain it. The Center will provide a Field Report that will contain pre- and post-construction photos and information from the valve manufacturer regarding operation and maintenance. The contract is likely to contain some extent of warranty on the work. If there is an issue with the valve during the warranty period, then the homeowner can call the Center to discuss the issue and possibly get the plumber who installed the valve back out to the home to correct the issue.

Please refer to this document to learn about the main terms and conditions of the HGA. It is the responsibility of the homeowner(s) to review the document in its entirety to fully understand all of its conditions.

Homeowners with tenants are required to complete a Tenant Income Verification form; one form per unit. The homeowner is responsible for submitting the form with supporting documentation to the Center. If the Center receives information indicating their rental units, a Tenant Verification form will be sent via email. For questions, please email info@floodhelpny.org or call the Center at 646-786-0888.

Your plumber will install your backwater valve, return the work area to pre-construction conditions, and show you how to maintain your backwater valve. Your inspector will do a final inspection to make sure all work is done correctly and go through a closeout checklist with you and your plumber.

Your technical report includes pre- and post-construction photos; a sketch showing the location of your valve relative to permanent items in your home or on your property; product data sheets on your valve from the manufacturer; operation and maintenance instructions from your valve’s manufacturer; and copies of permits obtained for your installation, if applicable.

Your feasibility review will be similar to your first home assessment, but a little shorter! The engineer and accompanying staff will need to take some photos and measurements of your home to determine whether it would benefit from a backwater valve.

Most homes in New York City have a pipe that collects waste from their sinks and toilets and carries it to the city sewer. A sewer backwater valve is a device that is installed on this pipe to reduce the risk of sewage backing up through that pipe and into your home. It has an internal mechanism called the “flapper,” which closes to help protect your home from flooding with raw sewage. When the overflow subsides, the change in pressure releases the flapper, allowing wastewater to flow from your home and into the sewer. To learn more, see our resource page.

The counselor will provide a customized explanation of your property’s flood risk by reviewing the data from the elevation certificate and technical report the engineers have put together. At the end of your counseling session, you will leave with a better understanding of your home"s backwater valve eligibility, specific flood risk, insurance cost, and options to reduce future storm damage.

Most homes in New York City have a pipe that collects waste from the sinks and toilets in your home and carries it to the city sewer. A sewer backwater valve is a device that is installed on this pipe to reduce the risk of sewage backing up through that pipe and into your home, especially during heavy rain. Learn more about backwater valves.

Most homes in New York City have a pipe that collects waste from the sinks and toilets in your home and carries it to the city sewer. A sewer backwater valve is a device that is installed in this pipe to reduce the risk of sewage backing up through that pipe and into your home, especially during a heavy rain event.\n

Freeboard is additional elevation above the Base Flood Elevation, and ensures that construction is at a safer elevation from future flooding. In NYC, this means adding two additional fees above the BFE. Besides increasing safety from floods, freeboard can lead to lower insurance premiums that can help in recouping construction costs.

It depends on a number of factors, including the layout of your sewer pipes, the depth and location of the pipe that connects your home to the sewer, if there are environmental hazards (e.g., lead paint) in the area where the valve will be installed, what type of valve is installed, etc. The cost can be as little as $600 or more than $5,000.

The Homeowner Flood Insurance Affordability Act of 2014 slowed down or reversed some of the changes to the National Flood Insurance Program made by the Biggert-Waters Act of 2012. HFIAA restored “grandfathering” and slowed the phase-out of other premium subsidies by capping the premium increases at 18% per year for most properties. Some properties, such as commercial properties or severely damaged properties, can still see an increase of 25% per year.

The Homeowner Grant Agreement allows the Center, as the program administrator, to award a portion of federal disaster recovery funds to eligible homeowner(s) and requires that the homeowner(s) agree to all of the terms and conditions detailed in the document.

If you’re receiving this form, your landlord has enrolled in the FloodHelpNY Home Resiliency Audit program, aimed at strengthening New York’s coastal communities by providing free services to eligible homeowners and their tenants in certain coastal neighborhoods. To learn more, please visit FloodHelpNY.org. As part of this program, your landlord may be eligible to receive a free sewer backwater valve. A sewer backwater valve is a device that is installed on the pipe that connects a home’s plumbing fixtures to the city’s sewer to reduce the risk of sewage backup into the home during a flood event such as heavy rain or storm surge.

This will depend on the home. We’ll let the homeowner know as soon as we can. Homeowners will be unable to put water down their drains or flush their toilet while the plumber is cutting into their sewer pipe and installing the new valve. It will not necessarily be the entire time of the installation since the installation is likely to include other work such as patching the floor. It could be as little as 8 hours.

They’ll know before signing the Tri-Party Agreement, which is the agreement signed by the plumber, the Center, and the homeowner prior to installing the valve.

You should consult a well-qualified engineer or architect before installing vents. The NYC Department of Buildings can give you advice on selecting a designer and contractors with experience working with homeowners. The DOB also hosts weekly information sessions with homeowners where New Yorkers can learn about construction standards and how to assess contractors.

The consultation will take place in an office in your neighborhood. Please check your email for details or call our Homeowner Hotline at 646-786-0888.

Counselors are legal or housing professionals from non-profit community-based organizations with experience serving homeowners in New York’s coastal communities. Counselors are trained in resiliency topics and flood insurance.

All individuals who are listed on the deed for the property and who live at the property MUST be listed as a Co-Applicant. Each Co-Applicant is required to sign where requested in this Full Application, the Homeowner Grant Agreement, the Tri-Party Agreement, and any other agreements that the applicant must sign prior to receiving services under the program.

FloodHelpNY is made possible by funding from the New York State Governor’s Office of Storm Recovery through a federal Community Development Block Grant for Disaster Recovery from the U.S. Department of Housing and Urban Development. The program is administered by the Center for NYC Neighborhoods, a non-profit organization committed to promoting and protecting affordable homeownership in New York so that middle– and working-class families are able to build strong, thriving communities. Learn more about the Center at cnycn.org.

All individuals listed on the deed must sign the Homeowner Grant Agreement, even if they are not listed on the application as the applicant or co-applicant.

Feel free to call the Center’s Homeowner Hub at (646) 786-0888 at any time. Inquires about installation appointment will be directed the inspector if their kick-off meeting has already taken place.

There are many reasons why this can happen: Your home will not benefit from a sewer backwater valve; you do not have flood insurance and you are in an AE flood zone; you do not have homeowners insurance; you did not own your home during Hurricane Sandy; and other factors. Have questions? Call us at (646) 786-0898 or email us at info@floodhelpny.org.

FloodHelpNY strives to serve moderate- and low-income homeowners and their tenants. We are required to obtain household income information, including income information of tenants in 2-4 unit buildings, so that we can make sure we are only serving to lower-income households. This is required by the U.S. Department of Housing and Urban Development and the New York State Governor’s Office of Storm Recovery (GOSR), which fund the program.

The engineer needs to take measurements around your plumbing fixtures, photos of the area where the valve would be installed, and observe the space around your home to determine if installing a valve is feasible. This will help the plumber prepare for the installation by providing a clear picture of the construction area.

The National Flood Insurance Program is not currently written to allow premium reductions for dry flood proofing mitigation strategies, such as backwater valves. In contrast, wet floodproofing solutions, like elevating your home, result in a flood insurance discount because your lowest floor is raised above the Base Flood Elevation (BFE). A sewer backwater valve may reduce flood risk, but does not remove the risk completely.

Since this is a federally-funded program, we are required to gather documentation from all homeowners who apply. Don"t worry, your information will be stored securely. See our privacy policy.

The Tri-Party Agreement is signed by the Homeowner, the Center, and the plumber. It sets the obligations of all three parties to each other and puts the plumber and the homeowner into a direct agreement. You’ll be able to see an executed copy of the Tri-Party Agreement on your status page once all parties have signed it.

When a disaster occurs, a poorly managed staff response can put the safety and well-being of housing residents at risk, and expose housing owners to unnecessary costs, difficulties and potential liability. Affordable housing organizations face unique challenges during emergency events. Unable to easily relocate residents, housing organizations depend on the continuous operation of their buildings, or at least a rapid return to service. To learn more go here.

No. However, it might be a factor to consider when you are looking at the amount of contents coverage to carry in your flood insurance policy. The backwater valve may have an impact on your homeowner’s insurance premium.

Sewer backwater valves have no effect on flood insurance premiums but they can save you hundreds, or even thousands of dollars in damage in the event of a flood. It can also protect precious items and mementos stored in your basement from damage and keep your basement sewage free.

It depends. Some insurance companies offer homeowners insurance discounts. However, specific coverage for sewage backups often need to be added to your home insurance policy in the form of a sewage backup rider. Such a rider generally costs between $50 to $70 per year and can be as high as $175, depending on the deductible and how much coverage you need. If your homeowners insurance does not offer a discount, you are still taking an important step to prevent future sewer backup damage and the costly repairs that could come with it.

To the extent possible, the plumber will return the work area to pre-construction conditions. There might have to be some changes (for example, there has to be a way to access the valve for maintenance, so there might be an access port to the valve. If it"s being installed outside, then replacing any part of a lawn that had to be torn up would be part of the contract.

The inspector will be in touch to schedule the backwater valve installation. If an applicant has to reschedule their installation, they should contact their inspector.

It could. During the feasibility review, your engineer will evaluate whether or not your home would benefit from a backwater valve and if the conditions of your home allow for the valve to be installed. If they determine that your home would not benefit from a backwater valve, or that the conditions of your home do not allow a valve to be installed, you will be ineligible to receive a backwater valve installation.

Yes, the home’s water will need to be shut off during the backwater valve installation. The duration depends on the home. We’ll let the homeowner know as soon as we can. Homeowners will be unable to put water down their drains or flush their toilet while the plumber is cutting into their sewer pipe and installing the new valve. It will not necessarily be the entire time of the installation since the installation is likely to include other work such as patching the floor. It could take as little as eight hours.

8613371530291

8613371530291