southwest wire rope company free sample

Southwest Wire Rope"s Engineering Services Department provides engineered lifting devices, lift plans, and engineered load testing services under the leadership of experienced Professional Engineers with extensive experience in heavy lifting.

• Tensile Strengths are determined in accordance with Cordage Institute 1500.2. Test Methods for Fiber Rope. Minimum Tensile Strength (MTS) published assumes spliced eye tenninations at each end of the rope. Weights actually calculated at linear density under state preloaded (200d’J plus 4%. Diameter and circumference size published is nominal and reflects rope size after loading (10 cycles) to 50% ofMTS. See reverse side for application and safety information .

Plasma® 12 strand is the highest strength synthetic rope available. Plasma® 12 strand is manufactured from High Modulus Polyethylene (HMPE) that has been enhanced by Cortland’s patented recrystallization process. This process is especially effective in medium to large diameter ropes where strengths are over 50% higher and creep is significantly less than that of standard Spectra® 12 strand.

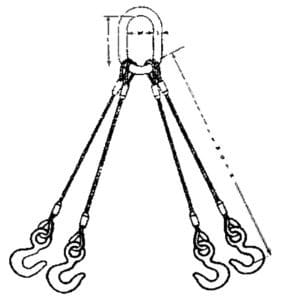

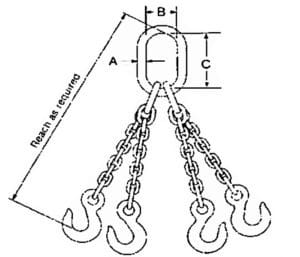

Manufacturer of material handling, lifting and mooring products required by industries along the Gulf Coast. The company"s products include wire rope slings, nylon slings, round slings, chain, shackles, thimbles, sockets and other related products.

Since 1966 Southwest Wire Rope has expanded to become a recognized global wire rope supplier serving diversified markets with material handling, lifting & mooring products at five full-service locations. Large, full-range inventory includes their trademark “Gold Strand” wire rope; bright, galvanized, stainless steel & vinyl coated cable; plus wire rope slings & a variety of fittings & hardware.

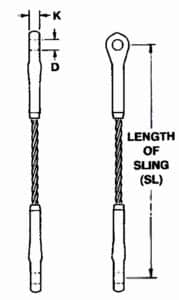

Southwest Wire Rope is the leading distributor, fabricator and service provider of lifting, rigging, towing and mooring products in North America with 4 locations in Texas and Louisiana. We service the Marine, Oil & Gas and Construction Industries within the Gulf Coast region. We offer a complete line of products; wire ropes, crane & winch ropes, elevator ropes, synthetic ropes, chain, custom fabricated slings (wire rope, synthetic rope, chain), flat web nylon and polyester slings, polyester round slings, shackles, sockets, and rigging hardware. Our service division provides mobile visual inspections & proof load test re-certifications, non-destructive testing, and mobile spooling services. Our rope products range in diameters from 1/4 inch up to 3-1/2 inch. We have over 49 years of experience providing products and services to the Gulf Coast region. We are a division of Houston Wire & Cable Company and publicly traded on NASDAQ as HWCC.

CLEVELAND, OH – Mazzella Lifting Technologies, a Mazzella Company, is pleased to announce the acquisition of Denver Wire Rope & Supply. This acquisition will strengthen Mazzella’s footprint west of the Mississippi River and reinforce Mazzella’s commitment to be a one-stop resource for lifting and rigging services and solutions.

Denver Wire Rope & Supply has been in business since 1983 and services a variety of industries out of their location in Denver, CO. Denver Wire Rope & Supply is a leading supplier of rigging products, crane and hoist service, below-the-hook lifting devices, and certified rigging inspection and training. Effective immediately, Denver Wire Rope & Supply will operate as Mazzella / Denver Wire Rope. Terms of the transaction are not being disclosed.

“Denver Wire Rope & Supply will complement the wide range of products and services that Mazzella Companies offers. We are dedicated to being a single-source provider for rigging products, overhead cranes, rigging inspections, and rigging training. Both companies commit to a customer-first mentality, providing the highest-quality products, and leading by example when it comes to safety and sharing our expertise with customers and the market,” says Tony Mazzella, CEO of Mazzella Companies.

“Our team and family are excited to be part of the Mazzella Companies. This acquisition strengthens our place in the market and allows our team to continue to provide excellent service and products to our valued customer base and expand our offering,” says Ken Gubanich, President of Denver Wire Rope & Supply.

“Over the years, we have had numerous companies show interest in purchasing Denver Wire Rope & Supply, none seemed to be the right fit. We are looking forward to becoming a part of an aggressive, passionate, and progressive organization. As a family business for over 36 years, it is important to us that our customers/friends, suppliers, and team members continue to be treated with first-class service, products, and employment opportunities. Again, we are very enthusiastic about our future and look forward to being a quality supplier for your crane, safety training, rigging, and hoisting needs for years to come,” says Gubanich.

“We wish Ed and Carol Gubanich all the best in their retirement. We welcome Ken and the other second and third-generation Gubanich family members, as well as the entire Denver Wire Rope Team, into the Mazzella organization,” says Mazzella.

We’ve changed our name from Denver Wire Rope to Mazzella. Aside from the new name and logo, our member experience is virtually unchanged. Here are some common questions and answers related to this change.

In 2019, Denver Wire Rope & Supply was acquired by Mazzella Companies to expand lifting and rigging products and services to the western half of the United States.

In 1954, James Mazzella founded Mazzella Wire Rope & Sling Co. in Cleveland, OH. For over 65 years, the company has grown organically by nurturing historic relationships, expanding its product offerings, and entering new markets through acquisition.

Wire ropes are essential for safety purposes on construction sites and industrial workplaces. They are used to secure and transport extremely heavy pieces of equipment – so they must be strong enough to withstand substantial loads. This is why the wire rope safety factor is crucial.

You may have heard that it is always recommended to use wire ropes or slings with a higher breaking strength than the actual load. For instance, say that you need to move 50,000 lbs. with an overhead crane. You should generally use equipment with a working load limit that is rated for weight at least five times higher – or 250,000 lbs. in this case.

This recommendation is all thanks to the wire rope safety factor. This calculation is designed to help you determine important numbers, such as the minimum breaking strength and the working load limit of a wire rope.

The safety factor is a measurement of how strong of a force a wire rope can withstand before it breaks. It is commonly stated as a ratio, such as 5:1. This means that the wire rope can hold five times their Safe Work Load (SWL) before it will break.

So, if a 5:1 wire rope’s SWL is 10,000 lbs., the safety factor is 50,000 lbs. However, you would never want to place a load near 50,000 lbs. for wire rope safety reasons.

The safety factor rating of a wire rope is the calculation of the Minimum Break Strength (MBS) or the Minimum Breaking Load (MBL) compared to the highest absolute maximum load limit. It is crucial to use a wire rope with a high ratio to account for factors that could influence the weight of the load.

The Safe Working Load (SWL) is a measurement that is required by law to be clearly marked on all lifting devices – including hoists, lifting machines, and tackles. However, this is not visibly listed on wire ropes, so it is important to understand what this term means and how to calculate it.

The safe working load will change depending on the diameter of the wire rope and its weight per foot. Of course, the smaller the wire rope is, the lower its SWL will be. The SWL also changes depending on the safety factor ratio.

The margin of safety for wire ropes accounts for any unexpected extra loads to ensure the utmost safety for everyone involved. Every year there aredue to overhead crane accidents. Many of these deaths occur when a heavy load is dropped because the weight load limit was not properly calculated and the wire rope broke or slipped.

The margin of safety is a hazard control calculation that essentially accounts for worst-case scenarios. For instance, what if a strong gust of wind were to blow while a crane was lifting a load? Or what if the brakes slipped and the load dropped several feet unexpectedly? This is certainly a wire rope safety factor that must be considered.

Themargin of safety(also referred to as the factor of safety) measures the ultimate load or stress divided by theallowablestress. This helps to account for the applied tensile forces and stress thatcouldbe applied to the rope, causing it to inch closer to the breaking strength limit.

A proof test must be conducted on a wire rope or any other piece of rigging equipment before it is used for the first time.that a sample of a wire rope must be tested to ensure that it can safely hold one-fifth of the breaking load limit. The proof test ensures that the wire rope is not defective and can withstand the minimum weight load limit.

First, the wire rope and other lifting accessories (such as hooks or slings) are set up as needed for the particular task. Then weight or force is slowly added until it reaches the maximum allowable working load limit.

Some wire rope distributors will conduct proof loading tests before you purchase them. Be sure to investigate the criteria of these tests before purchasing, as some testing factors may need to be changed depending on your requirements.

When purchasing wire ropes for overhead lifting or other heavy-duty applications, understanding the safety dynamics and limits is critical. These terms can get confusing, but all of thesefactors serve an important purpose.

Our company has served as a wire rope distributor and industrial hardware supplier for many years. We know all there is to know about safety factors. We will help you find the exact wire ropes that will meet your requirements, no matter what project you have in mind.

THIRD AMENDMENT, dated as of December 10, 2019, to the Fourth Amended and Restated Loan and Security Agreement, dated as of October 1, 2015, among HWC Wire & Cable Company (“Borrower Agent”), PFI, LLC (as successor by merger to Vertex Corporate Holdings, Inc. and Vertex-PFI, Inc.) (“PFI, LLC” and together with Borrower Agent, individually a “Borrower” and collectively “Borrowers”), Houston Wire & Cable Company (“Guarantor”), the lenders or lender named therein (“Lenders”) and Bank of America, N.A. (“Bank of America”), as agent for said Lenders (Bank of America, in such capacity, “Agent”). Said Fourth Amended and Restated Loan and Security Agreement, as amended by that certain First Amendment to Fourth Amended and Restated Loan and Security Agreement dated as of October 3, 2016, as amended by that certain Second Amendment to Fourth Amended and Restated Loan and Security Agreement dated as of March 12, 2019, as hereby amended and modified by this Third Amendment to Fourth Amended and Res

Headwinds for Houston Wire and Cable Company (NASDAQ:HWCC) end markets have depressed revenues and earnings for the current year. The stock is trading at a historical 52/week low and has pushed the company in a deep undervaluation. Headwinds are temporary and there is an ever increasing demand for HWCC"s products. In 2-3 years there will most likely be mean reversion, letting the company trade at a much higher multiple.

HWCC operates its business in the energy, utility, infrastructure and the industrial markets. They have been around since 1975 and have a very broad wire and cable product offering. As a business, they help customers that require multiple cables and complex engineering requirements or electrical codes. HWCC sells over 30,000 products on an annual basis, has over 44,000 SKUs and has offices all over the US. What makes them stand out from their competition is that they have a huge array of inventory (most of the times they have ~$100mm in inventory), a ton of different cables and they specialize in hard to find items.

HWCC is a microcap company with a very easy to understand business model. There is a clear absolute undervaluation, high cash flow and the company is trading near a 52/week low. However, there are industry headwinds, a decent amount of debt and the company has a strategy of keeping hardly any cash on the balance sheet. Despite the former, you can pick up a decent 7.67% sustainable dividend yield coupled with a clear undervaluation. Market Cap 103.92 M Cash N/A

Moving on, we can see that HWCC would have been more profitable in the first six months of 2015 if it wasn"t for a non-cash impairment charge. Their newly acquired business, Southwest Wire Rope (bought in 2010), had a non-cash goodwill impairment charge of $2.6mm recorded in Q2. Investors should remember that this was just a non-cash charge, which had no effect on operating results or cash flow.

From around 2010 until 2014, revenues have pretty much bounced around $390mm. If you go back to 2010, you can see that revenues jumped up around $90mm, from an improving economy and more importantly from the investment into Southwest Wire Rope. Up until late 2014, the company performed at pretty much the same rate (revenues were around the same each year and so were margins, to an extent). Then the O&G sector got hit by a plunging price of oil. Capex from customers slowed and industrial projects were put off. As I have stated before, revenues dropped a good 25%, earnings took a beating and investors rapidly sold off their shares.

You may notice that so far this year EPS has been at a historical low; industry headwinds and impairment charges on goodwill can do that. However, if you look at HWCC from another perspective (FCF), you can see that the company has been performing very well despite the headwinds. Cash flow is up a ton so far this year. Looking at the free cash flow statement, you may think to yourself that FCF is up due to abnormally high changes in working capital. This is true, but what it interesting is that cash provided by operating activities clocked in ~$22mm in the first six months of 2015. So yes, FCF is high due to larger changes in working capital accounts, but also from high cash provided by operating activities as well.

Another item that stands out on the free cash flow statement is higher than normal capex. One question investors may have is; why is capex up when the industry is down? It does seem counterintuitive, but capex is up in order to realize more savings going forward. Expenditures are up in 2015 due to the renovation of a facility associated with the Southwest business segment (one-time expense). The renovation is slightly expensive at first, but it will save the company ~$400,000/year (four existing Southwest locations are being moved to the renovated location).

Based on the company"s contractual obligations, and its historical FCF, the company will have plenty of liquidity going forward. The company has enhanced their FCF and are in the final draft of getting a new credit facility established, that will be valid up until September of 2020.

In 2014, the board of directors authorized a share repurchase program of $25mm. So far the company has spent $10.1mm on repurchases and bought back 4.8% of the shares outstanding. This share repurchase program has no expiration date and based on the company"s strong/enhanced FCF, I am going to assume that the company will continue incrementally buying back shares. In fact, I hope that the company continues to buy shares at these low levels.

As for the dividend, in 2014, 2013 and 2012, the company spent $8.2mm, $7.4mm and $6.3mm on stock dividends. Because of the rapid drop in the share price, the yield looks rickety. In reality, the dividend is currently sustainable (as long a FCF holds its ground). Management has even stated in their recent quarterly reports that they plan to continue paying the dividend going forward. However, I wouldn"t count on them raising it until these headwinds become tailwinds.

So far this year, FCF has clocked in at ~$20mm, OCF in at $30.13mm and LFCF at $28.69mm. HWCC is a very good generator of cash, and their business really is not in any danger from these headwinds. Analysts believe that HWCC will start to generate higher revenues in 2016 (around $324mm), based on the headwinds subsiding. Right now you can pick up HWCC at a historical low not seen since the depths of 2009 and lock in a 7.67% sustainable dividend. The company is in deep value territory (EV/EBITDA and EV/Revenue of 6.71 and 0.42, respectively), there is a program addressing cost management and the company returns tons of wealth to shareholders every year (very good management team). I have provided the steps below on how I figured out the forward FCF for 2015.

What really stood out to me after reading the company"s annual reports is its ability to outperform manufacturers. The way they do this is by keeping a huge amount of inventory on their balance sheet. Thus, no manufacture can compete with HWCC when it comes to the inventory the company has (this makes same day shipping possible, a thing manufactures can"t do). What is interesting is that ADDvantage Technologies (AEY) also utilizes the same strategy of keeping a high amount of inventory on their balance sheet to give customers one day shipping (I found both of these companies using the same screener). Although, the bad part of keeping a huge amount of inventory is the risk of an inventory write-down (will talk about later in the risks section).

What is also very interesting is that there is no on-site labor costs associated with HWCC"s business model. The company buys wire, then sells it. Gross margins have been able to stay relatively around 21.7% despite industry headwinds. Manufactures also can"t offer services such as custom cutting, cable coiling, custom slings and harness, etc. This gives HWCC an advantage over wire manufactures.

This allows the company to give very good customer service and also goes back to the same day shipping value it can provide. All in all, HWCC has >6,300 customers, >10,500 different customer locations and there wasn"t one customer that accounted for over 10% of consolidated net sales.

HWCC is the leading supplier in the US of the low-smoke, zero halogen products, there are critical barriers to entry in the industry (LifeGuard products), there is an estimated $1.4bn market for this specific product and it is accepted by over 300 end users. The company has a leading market position in this product line and in other product lines as well. As the construction market continues to grow, the LifeGuard product will continue to see demand (proprietary product in construction).

James Pokluda is currently the CEO and President of HWCC. His career at HWCC started in 1987 as an Account Manager. Before becoming the CEO, Pokluda was the VP of Sales and Marketing, and he held other senior leadership positions in the company.

From studying microcap stocks this past year, I have come to realize that when management guides for earnings and revenues going forward, they really are not doing shareholders a favor (especially when the company misses guidance). Digging into management and HWCC, I have noticed that management does not provide forward guidance when it comes to future revenues and earnings. Not providing guidance is an item that I like about a management team.

There have been some authors on HWCC in the past that suggested that margins will stay the same across the whole board, despite how much the company sells and how weak the industry may be. I think the former can be argued. First, we can see in Q2 that revenues have fallen, but sales and commissions (as a percentage of revenues) have went up. Secondly, when prices of copper, steel, aluminum and petrochemicals rise, so does the cost of buying wire. Finally, if the cost of these four former byproducts of wire decline, so will the value of the inventory. All three of these former examples can squeeze margins. Investors should realize that gross margins may be able to hold steady, but other margins do have a potential of being squeezed.

The biggest risk in HWCC"s business model is the cynical end markets that the company serves. Pretty much all of HWCC"s end markets are very cynical. A downturn in one of these markets will also put the company in a downturn (as what is happening in the O&G industry right now).

Investors should realize that HWCC has been a company for 40 years now. They have survived the ups and downs of many different troubled economic time periods. The worst time period was probably the Great Recession, in which the company survived. HWCC is a company that has potential to be around for a long time (due to the simple business model, the continual demand for its products and the great management team).

If you want to buy a company near a 52/week low that has a bright future, HWCC may be the company you are looking for. There are many things to like about the company; a great management team, the simple business model, a clear absolute undervaluation, and history of providing shareholders value (dividends and repurchases). When the company survives this downturn, they will continue to provide value for the huge market that they serve (infrastructure, utility and industrial markets are $73bn, $30bn and $219bn markets, respectively). Lock in that sustainable 7.67% dividend and patiently wait for mean reversion.

8613371530291

8613371530291