southwest wire rope company for sale

Southwest Wire Rope"s Engineering Services Department provides engineered lifting devices, lift plans, and engineered load testing services under the leadership of experienced Professional Engineers with extensive experience in heavy lifting.

HOUSTON, Jan. 13, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it has entered into a definitive asset purchase agreement for the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excludes approximately $2.6 million of trade accounts receivable, which HWCC will retain. HWCC expects to use the net sales proceeds and accounts receivable collections to further reduce Revolver debt. HWCC has already reduced Revolver debt to approximately $21.4 million as of January 13, 2021, from a peak of $95.2 million in the first quarter of 2020.

James L. Pokluda III, HWCC President & CEO commented, “Southwest Wire Rope is a company that for over fifty years has been a leading supplier of quality lifting slings, wire rope and rigging supplies to the lifting industry. We wish them much success in the future. Proceeds from the sales of Southern Wire and Southwest Wire Rope allow us to reduce debt, which lessens financial risk in these uncertain times.”

With 45 years’ experience in the industry, Houston Wire & Cable Company, an industrial distributor, is a large provider of products in the U.S. market. Headquartered in Houston, Texas, the Company has sales and distribution facilities strategically located throughout the United States.

Standard stock items available for immediate delivery include continuous and interlocked armor cable; instrumentation cable; medium voltage cable; high temperature wire; portable cord; power cable; primary and secondary aluminum distribution cable; private branded products, including LifeGuard™, a low-smoke, zero-halogen cable; mechanical wire and cable and related hardware, including wire rope, lifting products and synthetic rope and slings; corrosion resistant fasteners, hose clamps, and rivets.

HOUSTON, March 15, 2021 (GLOBE NEWSWIRE) -- Houston Wire & Cable Company (Nasdaq: HWCC) today announced that it completed the sale of its Southwest Wire Rope business, a leading provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excluded approximately $2.9 million of trade accounts receivable, which HWCC retained. HWCC used the net sales proceeds of approximately $3.4 million to further reduce revolver debt.

James L. Pokluda III, HWCC President & CEO commented, “We are pleased that we were able to complete the sale of Southwest Wire Rope and, as communicated in prior releases, applied all sale transaction proceeds towards the reduction of debt. The company has made remarkable revolver debt reduction progress over the last twelve months. Including the $3.4 million received, and collection of the estimated $2.9 million of trade accounts receivable, we estimate proforma revolver debt to be $15.4 million, which is a reduction of $70.5 million versus the close of the first quarter 2020.”

With 45 years’ experience in the industry, Houston Wire & Cable Company, an industrial distributor, is a large provider of products in the U.S. market. Headquartered in Houston, Texas, the Company has sales and distribution facilities strategically located throughout the United States.

Standard stock items available for immediate delivery include continuous and interlocked armor cable; instrumentation cable; medium voltage cable; high temperature wire; portable cord; power cable; primary and secondary aluminum distribution cable; private branded products, including LifeGuard™, a low-smoke, zero-halogen cable; and corrosion resistant fasteners, hose clamps, and rivets.

HOUSTON — Houston Wire & Cable Company (HWCC) announced Wednesday that it has entered into a definitive asset purchase agreement for the sale of its Southwest Wire Rope business, a provider of lifting slings and wire rope and rigging products, for a purchase price of $5 million, subject to a working capital adjustment. The sale excludes approximately $2.6 million of trade accounts receivable, which HWCC will retain. HWCC expects to use the net sales proceeds and accounts receivable collections to further reduce Revolver debt. HWCC has already reduced Revolver debt to approximately $21.4 million as of January 13, from a peak of $95.2 million in the first quarter of 2020.

James L. Pokluda III, HWCC President & CEO commented, “Southwest Wire Rope is a company that for over fifty years has been a leading supplier of quality lifting slings, wire rope and rigging supplies to the lifting industry. We wish them much success in the future. Proceeds from the sales of Southern Wire and Southwest Wire Rope allow us to reduce debt, which lessens financial risk in these uncertain times.”

HWCC announced Jan. 6 that it completed the sale of its Southern Wire business, a wholesale distributor of wire rope and rigging products, to Southern Rigging Companies. The sale closed on December 31, 2020 for a purchase price of $20 million, subject to a working capital adjustment. HWCC used the net proceeds of approximately $18.1 million to reduce debt.

The Company made great progress reducing debt during the year as Revolver debt decreased $66.4 million from its peak of $95.2 million in the first quarter to $22.6 million at year-end. The Revolver debt reflects proceeds from the sale of the Southern Wire division at December 31, 2020 of $18.1 million. Excluding the Southern Wire proceeds, Revolver debt at year-end would have been $40.7 million.

As previously communicated, the Company’s year-end goal was to lower Revolver debt to between $40 to $45 million, excluding a divestiture. The Company achieved its Revolver debt goal and believes the substantial debt reduction of $66.4 million lessens financial risk without any deterioration of its ability to provide excellent customer service.

The Company also has a Paycheck Protection Program (“PPP”) loan of $6.2 million which was received on May 4, 2020 and funded under the Coronavirus Aid, Relief, and Economic Security Act. We anticipate approximately $5.8 million of this loan will be forgiven in 2021. Total debt at December 31, 2020, which includes the Revolver and PPP debt, was $28.8 million.

James L. Pokluda III, HWCC President & CEO commented, “We are excited we were able to complete the Southern Wire sale in 2020 and I am pleased to report that the sale of this division, together with our prudent management of working capital and expense reduction initiatives, has allowed us to reduce our debt to $28.8 million at year end, down 70% from the peak in 2020. In addition, we were able to achieve this debt reduction while maintaining our outstanding customer service.”

With 45 years’ experience in the industry, Houston Wire & Cable Company, an industrial distributor, is a large provider of products in the U.S. market. Headquartered in Houston, Texas, the Company has sales and distribution facilities strategically located throughout the United States.

Standard stock items available for immediate delivery include continuous and interlocked armor cable; instrumentation cable; medium voltage cable; high temperature wire; portable cord; power cable; primary and secondary aluminum distribution cable; private branded products, including LifeGuard™, a low-smoke, zero-halogen cable; mechanical wire and cable and related hardware, including wire rope, lifting products and synthetic rope and slings; corrosion resistant fasteners, hose clamps, and rivets.

Houston Wire & Cable Co. (Nasdaq: HWCC), Houston, Texas, on Monday announced that it completed the sale of its Southwest Wire Rope business in an asset transaction for $5 million.

“We are pleased that we were able to complete the sale of Southwest Wire Rope and, as communicated in prior releases, applied all sale transaction proceeds towards the reduction of debt,” said James L. Pokluda III, HWCC president and CEO. “The company has made remarkable revolver debt reduction progress over the last 12 months. Including the $3.4 million received, and collection of the estimated $2.9 million of trade accounts receivable, we estimate proforma revolver debt to be $15.4 million, which is a reduction of $70.5 million versus the close of the first quarter 2020.”

Houston Wire & Cable Co. (Nasdaq: HWCC), Houston, Texas, on Wednesday announced that it has agreed to sell its Southwest Wire Rope business in an asset transaction for $5 million.

The sale of Southern Wire Rope, a Houston-based provider of lifting slings and wire rope and rigging products, excludes $2.6 million of trade accounts receivable, which HWCC will retain. HWCC said it expects to use the net sales proceeds and accounts receivable collections to further reduce revolver debt.

“Southwest Wire Rope is a company that for over 50 years has been a leading supplier of quality lifting slings, wire rope and rigging supplies to the lifting industry,” said James L. Pokluda III, HWCC president and CEO. “We wish them much success in the future. Proceeds from the sales of Southern Wire and Southwest Wire Rope allow us to reduce debt, which lessens financial risk in these uncertain times.”

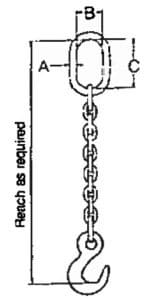

Since 1966 Southwest Wire Rope has expanded to become a recognized global wire rope supplier serving diversified markets with material handling, lifting & mooring products at five full-service locations. Large, full-range inventory includes their trademark “Gold Strand” wire rope; bright, galvanized, stainless steel & vinyl coated cable; plus wire rope slings & a variety of fittings & hardware.

Industrial distributor Houston Wire & Cable Co. (Nasdaq: HWCC) completed the sale of its Southwest Wire Rope business, which provides lifting slings, wire rope and rigging products. The deal was first announced in January.

Southwest Wire Rope was purchased for $5 million, and the deal excluded approximately $2.9 million of trade accounts receivable that HWCC retained. Net proceeds from the sale of around $3.4 million were used to further reduce HWCC"s revolver debt, the company announced March 15.

"We are pleased that we were able to complete the sale of Southwest Wire Rope and, as communicated in prior releases, applied all sale transaction proceeds towards the reduction of debt. The company has made remarkable revolver debt reduction progress over the last 12 months," said James Pokluda III, president and CEO of HWCC. "Including the $3.4 million received, and collection of the estimated $2.9 million of trade accounts receivable, we estimate proforma revolver debt to be $15.4 million, which is a reduction of $70.5 million versus the close of the first quarter 2020."

In late December, HWCC completed the sale of its Southern Wire business to Paducah, Kentucky-based Southern Rigging Cos. LLC for $20 million, in order to further reduce debt.

Stewart has closed several acquisitions to further digitize and simplify the title and closing process. In February, the company announced the acquisition of Ohio-based Signature Closers, which offers full- and self-service signing support for title companies and lenders. Last year, Stewart acquired NotaryCam, a provider of online notary services.

Rubicon also provides technology and technical services to the oil and gas sector. Rubicon has presences in North America, South America, Europe, Africa, Asia and the Middle East, according to the company"s website. The combined firm is led by Adam Anderson, CEO of Innovex.

8613371530291

8613371530291