pulling unit vs workover rig pricelist

Pumping services tend to get more expensive offshore, because of the degree to which the equipment must be assembled on location. Wire based services still require assembly, but because the parts are smaller can usually be mobilized in larger ‘chunks’ thus requiring less assembly on location. On land, fluid pumping equipment is much more readily portable on trucks or trailers. Workover rigs on land are incredibly cheap in most places as measured on a per diem basis. Part of their advantage is that they arrive to location with most of their key components already assembled in/on one truck. This advantage disappears offshore where the rig must be assembled on site first.

Paying for a drilling rig or intervention vessel is the price of gaining physical access to the well. Everything else must be added to it to get physical access to the general area and then gain access to the well. There is no need for various forms of standalone pumping services because the vessel or rig will already have a cementing unit and/or the mud pumps available for that sort of work.

Performing the same operation over and over again has significant cost savings attached to it. Once the correct housing and supply arrangements are in place, and all the necessary people and equipment have been assembled, continuing to use it altogether ‘as is’ can save an enormous amount of money compared to dispersing it all and starting over again later. For land operations, this is most pronounced in areas where reservoir, surface, and operational practices allow for grouping wells together in relatively small areas, and for clustering well pads. Depending on what work is being done to the wells and how close together they are it may be possible to ‘hop’ from one well to the other without ever moving the equipment on a road or doing a complete rig-down.

Deepwater operations can benefit from this too, but not as much as ‘traditional’ fixed or surface access facilities, because the overall day rate of the rig or intervention vessel is often much higher, and the process of switching between wells is often much lengthier.

On land, you hire the unit and crew, and a small diem fee is added to the cost of employing them so they can stay in a hotel and get food when they are not working. The crews will transport themselves to and from the well and move the equipment to and from the well also.

The costs of conducting business in each of these 3 areas tend to scale very roughly in factors of 10. 100 wells making 50 bbls of oil each on land is a cash cow. Offshore that is a disaster, because the cost of servicing those wells is prohibitive. A more reasonable scenario is 10 wells making 500 bbls of oil each. In deepwater, a well making 500 bbls of oil a day is an abandonment candidate, if indeed it got that far along before abandonment. One well making 5,000 bbls a day is more. The direct cost of hiring (for example) a snubbing unit do not scale by factors of 10, but the overall cost of employing a snubbing unit do. As a result, different types of well servicing make sense in one area which may not make sense in another. On land in areas with ordinary access to infrastructure (not the Sahara or Alaska) operations like slickline are often so cheap that they are a routine procedure, with preventative or predictive maintenance schedules to scrape away paraffin or remove small amounts of scale. By contrast, it is completely cost prohibitive to try and attempt to perform similar work in deepwater – you either design and operate the well in such a way that paraffin and scale do not build up in the wellbore at appreciable rates, or you P&A the well. The cost of routine mitigation is simply too high. The relative cheapness of most workover rigs on land is another major factor. Many types of operations which could in theory be carried out in some other way are done with a workover rig simply because it is the most cost-effective technique, even if other methods might be faster, or involve fewer people. The relatively high cost of a rig for offshore facilities means that in most cases every effort short of getting a rig is tried first. Then a catalogue or list of operations to be conducted by a rig at a given facility will be gradually built up over time until they reach a critical level. At that point, a rig will be sent out to conduct all the operations which only it can perform, moving from one well another to save costs by making the work repeatable.

Snubbing units have evolved into one of the most capable and efficient well servicing tools in the oil & gas industry. In the 1920"s, the need for a rig to work with pressures at surface drove the invention of the snubbing unit. The first snubbing unit was primarily designed to work in well control situations to "snub" drill pipe and or casing into, or out of, a well bore when conventional well killing methods could not be used. The first snubbing unit relied on the draw works of the companion rig to supply its" power. A series of sheaves, cables and counter weights were rigged up so that as the rig"s traveling blocks hoisted up, the snubbing unit would snub in the hole. Conversely, when the traveling blocks on the rig were lowered, the snubbing unit would snub out of the hole. As you can imagine, this required close communication with several different contractors in order to perform the work safely and efficiently.

One of the main components of a snubbing unit is the slip. Stationary and travelling slips are operated in sequence to grip the pipe as it is snubbed into the well. Typically, a minimum of four slip bowls are used in snubbing operations. Two slip bowls are designated for "pipe light" operations. Pipe light is when the well bore forces are greater than the tubular weight in the well bore. The other two slip bowls are designated for "pipe heavy" operations. Pipe heavy occurs when either enough pipe has been snubbed into the well bore and fluid weight inside of the pipe is greater than the snub forces acting against the pipe in the well bore.

Modern snubbing units are powered by sophisticated hydraulic systems. These hydraulic units typically supply all power required by the components of a snubbing operation. With a better understanding of hydraulics and modern advances, companies have been able to harness this hydraulic energy to develop precision controlled snubbing units. These units move tubulars into and out of a well bore by use of a "multi cylinder jack"; a snubbing jack comes in many sizes depending on the task at hand. They are usually denoted in size by the snubbing unit description (i.e. 460K, 340K, 200K, etc). The 460K snubbing unit has the ability to lift 460,000 LBS and a snubbing capacity of 230,000 LBS. Most snubbing units can typically snub half of their lift rating. Assume you had a well with 10,000 PSI at surface and wished to snub in a string of 2 3/8" tubing. The snubbing contractor can calculate the snub force, add in their respective friction calculations and project the snub force to overcome will be approximately 51,000 LBS. This would put a 120K snubbing unit to close to its maximum capacity of 60,000 LBS snub loading. The safest bet would be a 150K or 235K snubbing unit.

Pipe handling is performed by the snubbing units "gin pole" and "pipe winches". The gin pole is typically telescoped out in excess of 40ft above the snubbing unit. With the use of dual tubing winches, multiple joints of pipe can be handled simultaneously, speeding up the operation.

The snubbing "basket" is the platform where the snubbing personnel work. The basket contains all of the necessary hydraulic controls to operate all the features of the snubbing unit, as well as a large bank of BOP"s and hydraulic valve controls.

Today"s snubbing units can be employed to provide a wide range of services. In essence, a snubbing unit is a hydraulic rig that can do everything a rig can do, plus it can perform under pressure in an under balanced live well state. This is especially critical to the operators in the Haynesville Shale, which is known for HPHT wells. With the use of the snubbing units" hydraulic rotary, the unit can be employed for fishing, milling, drilling, side tracking or any task needed to remove bridge plugs, cement or deepen wells.

The industry has become more aware of damages caused by heavy kill weight fluids and mud. This has helped make snubbing units more popular in a completion and workover role, versus its" traditional use as a well control response tool. With the advances in drilling technologies in the unconventional shale market, the benefits of snubbing units have become very apparent. These types of completions often have laterals extending out thousands of feet. With costly stimulations used to help extract the gas more efficiently, operators often times do not wish to turn around and load the well with heavy fluids to complete the well dead.

Coiled tubing has its limitations in reach, due to wall to wall mechanical friction in horizontal wells. Often times the coiled tubing units cannot reach TD or supply the needed weight on bit to mill up composite plugs typically used in completions.

Another clear advantage to using a snubbing unit is its" small footprint, which is critical on the tight locations in the unconventional shale"s. Moreover, the small size and ease of mobilizing is especially useful and cost effective with offshore wells.

In conclusion, with the snubbing unit"s size, ability to handle pressure, rotary capabilities, rigidity of jointed tubing and minimal wall contact, snubbing units have become the chosen resource for these types of completions.

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

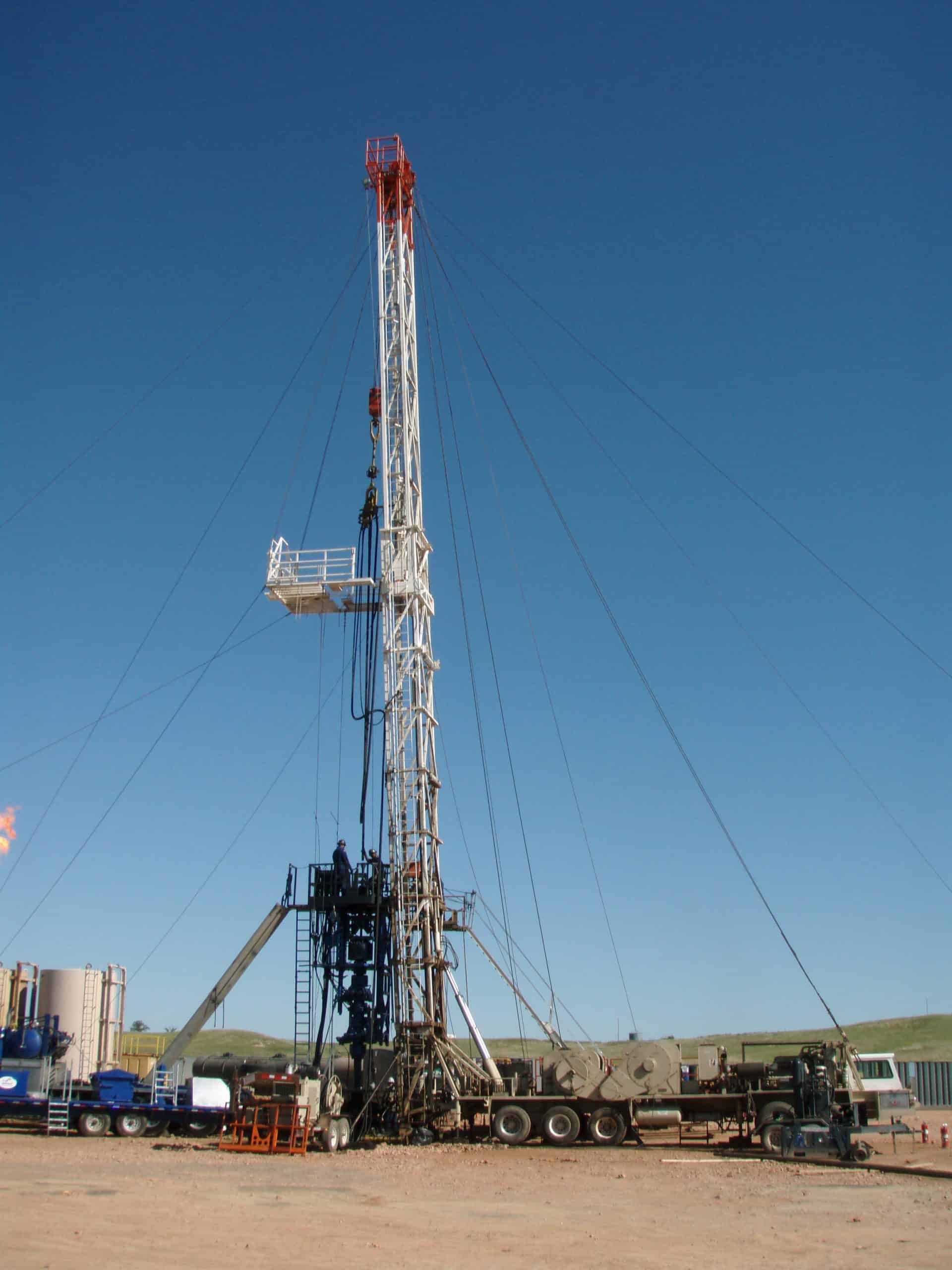

Well servicing rigs, also known as workover rigs or pulling units, are used in well completion, well maintenance and well abandonment operations. The well servicing and coiled tubing market rises and falls based primarily in conjunction with the number and type of new wells completed. Increased oil demand, rising oil prices and improved operator cash flow are expected to drive higher upstream investment going forward and lift the $5 billion well servicing and coiled tubing services markets in 2021 and beyond.

The coiled tubing services market includes the supply of coiled tubing services to drilling, completion, and production operations. The coiled tubing (CT) services market is now primarily driven by the use of CT units in place of well servicing units when completing horizontal wells. While production services, or well intervention, were the original application of coiled tubing, completion-related services now drive this market because continuous tubing can be tripped into a well more quickly than conventional tubing handled by a well servicing unit. However, with new horizontal laterals now regularly exceeding 10000’ in the US, coiled tubing runs into a mechanical limit. This is driving oil companies to large, high spec well servicing rigs for new well completions.

Workover rigs are specialized oil rigs utilized in the process of pulling and replacing production to extend the life of the well. They are also called completion rigs or pulling units. They are used in various operations such as handling rod & tubing work and other associated activities to improve the well output and perform plug & abandonment services. Moreover, oil & gas companies have shifted to workover operations to increase their oil & gas output from mature oilfields. Workover rigs are preferred in onshore and offshore applications. They provide high mobility, which allows companies to move them across oilfields. The stability in oil prices is expected to increase the demand for workover rigs due to increase in production activities across the globe. The rise in demand for oil and natural gas is expected to propel the growth of the workover rigs market over the forecast period.

Oil & gas industries are adversely affected due to the coronavirus outbreak. With decrease in oil prices, many companies are facing financial crisis, which is one of the major factors that reduce the demand for workover rigs over the forecast period. Similarly, the worldwide lockdown has suspended travel privileges, thereby decreasing the fuel consumption across the globe. The lockdown has disrupted the supply chain and forced many companies to shut down their power plants to prevent the spread of the virus. This has further reduced the demand for workover rigs across the globe.

The workover rigs market is expected to grow vigorously due to rise in demand for oil and natural gas. Rise in population and rapid urbanization have increased the demand for these fuels. Increase in demand for oil and natural gas is expected to make companies to enhance oil and gas production to meet the demand. Moreover, increase in oil & gas investments and government support for oil & gas E&P activities are anticipated to increase the requirement for intervention and completion services. Rise in well E&P activities, such as intervention and completion, is expected to boost the growth of the workover rigs market during the forecast period. However, uncertainty and fluctuations in crude oil prices are expected to reduce investments in E&P projects, which, in turn, may impact the workover rigs market over the forecast period.

Digitalization of workover rigs is one of the major trends observed. Automated workover rigs provide better safety and higher precision in operations as they use remotely operated robotic equipment. Integrated software system provides precise data to the operators for future decision making. This technological advancement in the workover rigs market is expected to boost the market growth over the forecast period.

Furthermore, huge investment from government and other private companies to drilling activities is also expected to propel the workover rigs market over the forecast period.

By region, the global workover rigs market is segmented into North America, Latin America, Western Europe & Eastern Europe, Asia-Pacific, and the Middle East & Africa. The Middle East & Africa is expected to become the market leader during the forecast period. High investments and increased current production activities contribute to the market growth in the region. North America is also expected to grow, owing to its increased shale field activities,

Key benefits of the report:This study presents the analytical depiction of the workover rigs market along with the current trends and future estimations to determine the imminent investment pockets.

Key Market Players Mesa Southern Well Servicing, Sun Well Service, Inc., Nordic Gulf, Drillmec Drilling Technologies, Automated Rig Technologies Ltd, Moncla Companies, San Antonio International, Eastern Well Services, MBI Energy Services, Superior Energy Services

The Workover Rigs market will remain attractive over the forecast period owing to rising consumption of petroleum products. As a result, the Exploration and Production (E&P) located globally will increase their investment due to increasing demand and positive outlook of the oil and gas market.

The ongoing rise in oil prices can be regarded as new phase for the companies operating in the sector. Adding to this, the participants are looking to attain growth through domestic and international expansion as well as adding new production related services. As Workover Rigs providers play important role in the production operation making them key segment in the reviving upstream sector and hold massive share in the overall spending of the companies.

Moreover, the investment from government as well as private sector in the drilling activities is also expected to rise and surge in shale gas production is expected to fuel the growth of the Workover Rigs market in the coming years. The oversupply of Workover Rigs in the cyclical oil & gas market is one of the major restraint to the market.

However, the industry has recovered successfully from the recent oil price crisis and industry outlook will remain positive in the coming years. One of the major trend in the market will use of environment friendly Workover Rigs. The government authorities are directing energy companies to decrease carbon footprint that will shift the focus of the companies towards use of components that run renewable energy in the coming years.

We are committed to total customer satisfaction, achieving excellence in our operations through continuous improvement, development and empowerment of our people, and providing a positive contribution to our community.

Snubbing is a process that controls the pressure of oil or gas in order to run or pull tubing, drill pipe, or casing. These applications use the standard snubbing unit to complete or re-complete wells in a “live well” condition. Any type of workover application can be performed utilizing quick jacks.

Snubbing units are often used in place of workover units for offshore applications. Snubbing can offer the same services at a greatly reduced cost to the customer. Snubbing can be performed on live and dean wells. Milling operations can be faster and more precise with snubbing units due to infinite control of torque and speed of the rotary mounted on the snubbing jack. Snubbing is versatile alternative that can overcome the limitations of other workover systems - wireline, coiled tubing and conventional workover rigs. It eliminates the use of kill fluids that can damage the producing formation and require costly disposal. Snubbing is also a faster solution. Snubbing units can often have the task completed before a conventional workover operation is even rigged up.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

The global hydraulic workover unit (HWU) market size was USD 8.11 billion in 2020. The market is anticipated to grow from USD 8.59 billion in 2021 to USD 13.21 billion in 2028 at a CAGR of 6.4% in the 2021-2028 period. The global impact of COVID-19 has been unrivaled and staggering, with it witnessing a negative demand across all regions amid the pandemic. Based on our analysis, the global hydraulic workover unit (HWU) market exhibited a decline of -14.5% in 2020 compared to the average year-on-year growth during 2017-2019. The growth during the forecast period is attributable to this market"s demand and growth, returning to pre-pandemic levels once the epidemic is over.

The COVID-19 pandemic initiated by the spread of the novel coronavirus has had a damaging impact on the global industrial landscape. This industry faced significant losses and have had to reduce operations due to the imposition of rigorous lockdowns to contain the spread of the COVID-19 virus. Consequently, the outbreak of the virus has transformed the demand for HWUs.

As the hydraulic workover unit industry is majorly dependent on oil and gas activities, the decline in oil prices in a long time has significantly impacted the investment in the instrument. The imposition of lockdowns in various countries and the shutting down businesses except for essential services with minimal workforce affected the energy demand. This factor has directly impacted work in the well interventions sector.

In July 2019, Kuwait signed a USD 600 billion offshore exploration contract with Halliburton. The contract aimed to drill six exploration wells in the next two to three years, which is anticipated to increase around 100,000 b/d in the forecast period. The United Arab Emirates invested approximately 31,000 square kilometers of acreage for offshore oil gas production, majorly in the Abu Dhabi and Ras Al Khaima regions. In January 2020, Russia announced a significant investment of around USD 300 billion for new offshore oil and gas projects.

The world is likely to derive massive oil and gas from offshore production. The more arduous production conditions in offshore locations increase the investment in more complex and newer technologies like hydraulic workover units. The onerous requirement for offshore with ease of operations is the primary market driver during the projected period.

There is a substantial increase in demand for developing a safe, versatile, and cost-effective tool for workover and well intervention operations due to the increasing number of mature oil fields. This factor bolsters the demand for HWUs globally. This equipment can be efficiently used with low setup times and are more cost-effective. Earlier workover rigs were used for similar operations, which took a lot of time and effort to be set up and used. Further, the wells had to be killed before operations, However, with newer technologies, HWUs with snubbing capabilities have made snubbing capabilities possible with newer technologies.

In 2021, MEIL, India started manufacturing a new type of HWUs with indigenous know-how, especially for the local market. The increasing demand for more effortless functioning, avoiding well-killing, secure and cost-effective well intervention units is an important trend for the hydraulic workover unit market.

A mature oil and gas field is past peak production. These oilfields account for a majority of the world"s crude oil production. With enhanced technological approaches like enhanced oil recovery (EOR), the recovery of mature oil fields has seen a tremendous increase. Increasing recovery from mature fields has necessitated prolonging the well and improving production using well interventions and workover.

With the deterioration in oil reserves, companies have increased their focus on inventing equipment required to access remaining reserves on mature wells. The prime focus is to improve recovery and prolong life. But the amplified water cut with constrained topside facilities, growing flow assurance problems, rising operating costs, and integrity issues because of the maturing facilities have made brownfield operationally and economically impractical. The increasing requirement for workover services is anticipated to bolster the market growth.

The growing population explosion and urbanization has resulted in a spike in energy requirement from the various end-user sector. As renewable energy is still in an early adoption stage of its product life cycle, the majority of power generation is handled by hydrocarbons. Due to inadequate development of other energy sources, the growing global oil and gas demand enhances well drilling and maintenance. The increase in crude oil and shale gas production capacities and an increasing number of brownfields is expected to enhance the well workover and intervention demand, fueling the market growth.

The primary factor restraining the hydraulic workover unit market growth is the consumer shift towards clean fuels. The increasing requirement of the renewable energy sector will undoubtedly decrease the investment being made in the oil and gas energy sector, which will harm the well intervention sector. The increasing proportion of power generation using renewable energy can hinder the principal investments being made for oil and gas. Also, the necessity to reduce carbon emissions has powered the acceptance of renewable energy, with government incentives being granted worldwide. Further, the developing competence of renewables for power generation with durable benefits can result in increased adoption over conventional fuels.

The services carried out by hydraulic workover units are completions, plug & abandonment, ESP completion, sand screen installations, well deepening, fishing/clean-outs, casing repairs, etc. Workover segment includes operations over dead-wells, while snubbing involves installing or removing pipes in or out of live wells. The increasing demand for dead wells" services due to the high number of brownfields is critical for the workover segment. The workover segment involves a broader range of services, making the segment significant.

Due to the high oil production from the onshore segment and the larger number of onshore oil rigs, the segment dominates the market. Moreover, most of the onshore oil rigs are mature and drive significant demand for the market.

The North American region holds a significant share in the market due to the high adoption of workover and snubbing services, coupled with demand for ease and efficiency of operations and technological advancement. Also, the rising proportion of mature oilfields in the region drives the market. Additionally, the government norms to reduce emissions led to companies finding it unviable to increase exploration and an increased necessity to prolong existing oil wells and drive the region"s market.

The competitive landscape for the hydraulic workover unit study shows that very few current companies have invested widely in research and development. The market has seen substantial recent technological advancements to keep pace with the best manufacturers. Considering all the scenarios, Balance Point Control and Halliburton are the major companies that have invested in developing HWUs. They are anticipated to continue being the key players in the future.

April 2021- Megha Engineering and Infrastructures Limited (MEIL) started manufacturing advanced hydraulic technology rigs with indigenous knowledge for the oil and gas sector. The development of HWUs commenced in the Kalol oil field near Ahmedabad, Gujarat. This manufacturing project was taken up to support the Government of India"s "Make in India" initiative.

July 2021-In its quarterly results, Norwegian Energy Company ASA announced that the Noble Sam Turner drilling program began a well workover and maintenance campaign in spring 2021 and completed three well workovers, which contributed to almost 2000 bpd bringing positive results on operating performance during the second quarter. The use of HWUs significantly contributed to the success of the campaign.

The global hydraulic workover unit market research report highlights the leading regions worldwide to understand the user better. Also, it provides insights into the latest market trends and analyzes technologies deployed rapidly with market statistics. The report highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the industry.

To fill a glaring gap in the decommissioning market, Voll Marintek Limited is pioneering the HWU-150 Lean Machine, a dual jack lifting system with key advantages over rigless operations and MDR to deliver significant cost, risk and climate benefits for the industry.

“It comes down to knowing well conditions. Wells which are coming to the end of their life are usually decades old and in this time the way data is collected has changed. In many cases you don’t even know which revision is the most updated one. In these cases, you have two options: either a customised approach with the deployment of specialised workover units for each subtask or use a rig.”

There are drawbacks to both. In the former, rigless workover units require intensive planning, a detailed knowledge of well integrity and, due to their simplicity and dependency on crane support, they are highly vulnerable to unforeseen events and weather conditions. Rigs on the other hand have more capacity and can simplify the planning and execution phase, but generally have a very high spread cost and carbon footprint.

“The Lean Machine is basically a hybrid solution between a hydraulic workover unit (HWU) and a modular drilling rig (MDR). It combines the main features of a HWU such as fast assembly, lightness, compactness and only requires a small footprint in addition to the benefits of MDR such as drilling, milling, making pipe connections respectively handling different pipe types conventionally and in a safe manner.”

The dual jack lifting system is a modular adaptable multipurpose unit which has the capacity to be upgraded with additional features so that it can be customised for each project and adapted to various interfaces. It consists of different modules designed to cover a specific P&A task which can be stacked on top of each other, extending the previous operational envelope of the complete system (this is called ‘The Happy Meal’). This means it can be upgraded with existing modules at the offshore location to perform sequential tasks instead of mobilising specialised equipment for each subtask or oversized workover rigs.

The operator can choose the options required based on additional costs for each contingency as desired always keeping integrated costs in mind. Importantly, the compactness of the 10 ft container footprint and the lightness of each module (around 12 mt) allow its assembly on a skid beam substructure, heave compensation platform or in a derrick structure of an existing rig.

Explaining the benefits of the system, Vollmar commented, “Cost and risk are the main drivers here. When looking at costs for an operation you want to see exactly the expenditure that will be incurred. Often this is not possible without an extensive preparation phase and even then unforeseen circumstances can occur – which is why rigs are often used.

Vollmar claimed that the deployment of the modular adaptable unit to tackle challenges within the P&A and decommissioning space will enable the highest potential cost savings available. The faster pipe recovery system alone allows cost savings of US$1mn per well based on a five day execution phase reduction. A global operator has already performed a preliminary total cost analysis in comparison to conventional solutions and identified a cost reduction above 30% for his 100 well campaign.

The high cost of a rig is also mirrored in its high carbon footprint, a somewhat neglected but increasingly pressing concern for the oil and gas industry. HWU’s of course have an advantage here, but poor weather, unforeseen events and the mobilisation of additional equipment to cover all P&A phases can bring down operational efficiency and extends the time duration for a P&A campaign– which is not a problem for the Lean Machine.

“There is also interest beyond decommissioning in production enhancement, for example. As the oil and gas prices increases, we need to look at solutions which reduce costs and simplify the process. Usually, you can collect wells with the same well challenges which only require wireline (for example) for a campaign. Then you need to get a certain threshold to justify the costs to mobilise other equipment. Our approach gives you the advantage as it is multipurpose and has all this included. You can combine now all the different well interventions and justify the cost much easier, which obviously increases the recovery factor of mature fields.” The wide application range simplifies wireline, side track drilling, coiled tubing, ESP runs, conductor pulling, life well interventions or slot recovery operations. On top, the dual jacking system reduces operational time by almost 40% and its offering a hoisting capacity up to 250mt.

“This solution has been developed through niche market research and I looked at a lot which are not currently provided for with a sufficient solution. For example, Australia and Brunei have a lot of wells in four to five metres water depth which you cannot enter with normal jackups. So you need to engineer something which is light, compact and could be added to any vessel of opportunity. But, at the same time, you don’t want to make any large vessel modification. So companies have been looking at lift barges to put a cantilever on but this is not economical or would only be so with a contract for 5-10 years as, again, you need to make modifications. It would be much easier to have something light and compact which could be put on top of the wellheads and even deployed by a jacking barge (or between two).”

“In Asia and Africa, people did not really think about workovers and so you often find wells with a production facility incredibly close. Workover equipment is only feasible if you look really deeply into interfaces and have the time and resources to do it. The Lean Machine could really help here and can be easily adapted depending on how much space is available at location.”

Service rigs in Canada, and the crews that operate them, are sought after around the globe. CAOEC Service Rig members have operated their equipment from Australia to Russia and everywhere in between. The Western Canadian Sedimentary Basin (WCSB) is one of the most challenging basins to produce hydrocarbons, and the rigs and people developed working in the WCSB have experience that is second to none.

Service rigs are much smaller than drilling rigs and they are fully mobile. Where a drilling rig requires trucks to move its various pieces, a service rig"s equiment is on wheels, and can be driven from location to location. Mobility is required because unlike drilling rigs that, once situated, can spend months in the same location, service rigs will move often (sometimes daily) to new jobs on different well sites.

Combined, CAOEC Service Members operate over 900 rigs in Canada. The demand for service rigs is generally different than for drilling rigs, and is not as directly impacted by the price of oil or natural gas. Work on existing wells can be more economical when commodity prices are lower because operating costs are not as high, and returns are often more predictable. This means service rigs may still be busy when producers aren"t otherwise looking to drill new wells.

From turning exploratory wells into producing wells, to shutting wells in (temporarily halting well production), to repairing wells as required, to abandoning wells (permanently and safely closing the well) service rigs are used to perform a variety of different services and will often return to the same well site many times. The service rig unit carries the mast structure (otherwise known as the derrick) and the rig floor. When a rig is working downhole, the unit is secured with its derrick sitting over top of the well bore.

Like drilling rigs, service rigs also come in different sizes. A typical rig is close to 20 meters long with the board. With the board and derrick laid over, it is just over four meters high. The laid-over derrick can hang out anywhere from one to eight meters beyond the cab. When loaded up and ready to move a typical rig can weigh up to 50,000 kilograms and is close to 20 meters long (with the laid-over derrick extending anywhere from 1 to 8 meters beyond the cab) and 4 meters high.

Additionally, service rigs work on both oil and natural gas wells, and must adjust their procedures accordingly. These must rigs keep pace with all of the market driven changes in activity, and as such have made technological adjustments along the way. Service rigs, however, don"t vary as greatly as drilling rigs, and many of the anciliary well services are handled by purpose-built, specialty equipment such as coil tubing or fracking units.

Workover rigs, also called pulling unit rigs, are specialized oil rigs set up for inserting or pulling pipe tubing in and out of wells. Workover crews are called when an oil well has been drilled, is undergoing repair or is being retired, as indicated by Schlumberger.

These crews are relatively small compared to other rig crews and consist of tool pushers, operators or relief operators, derrick men and floormen or roughnecks. The average workover rig salary overall was $65,039 as reported by Simply Hired in 2022. Available workover rig jobs and descriptions can be found on the Rigzone website.

The acting supervisor on a workover rig is called the tool pusher. The main task of a pusher is to hire, fire and supervise contracting work crews. When contractors have an issue on site, the first person they report concerns to is the tool pusher. Pushers need to have an intimate knowledge of how each and every part of a rig works, both individually and as an overall part of the drilling operation as a whole.

If equipment fails or needs to be reordered, the tool pusher talks with suppliers to get the right parts out on site with a minimum of downtime for the rig. The pusher is responsible for the overall safety of a rig. If the tool pusher has any safety concerns, he has the power to halt production until the concern is resolved.

The operator/relief operator is next in order of responsibility to the tool pusher on a workover rig. The main task of an operator is to control the crane and derrick that hauls pipe in and out of the bored well. In smaller crews, the operator is also the one who drives the rig truck. When laying pipe into a well, the operator directs the truck or derrick to the optimum spot next to the bore opening.

The operator then instructs the derrick hands and roughnecks where to place the bore pipe for easy access by the crane or by hand-loading methods. During a well breakdown or repair, the operator directs the crew hands in storage of extracted pipelines. Because the operators work most closely with derrick hands and roughnecks, they are typically responsible for selection and maintenance of their immediate workover rig crew.

In the pulling unit rig crew hierarchy, the derrick hands come after the operator/relief operators. The main responsibility of a derrick hand is everything that is above ground on the rig. During laying operations, derrick hands assist the operators/relief operators in inserting boring into the well. During repair or breakdown, they assist the operator in pulling pipe out of the well and storing it properly.

In between laying, derrick hands have other responsibilities as well, depending on the size of the crews. In smaller crews, Derrick hands also see to the maintenance of the rig-based electric and diesel generators necessary to power rig equipment.

At the bottom of the pulling unit rig crew in terms of seniority is the floorhand or roughneck. The main task of a roughneck is to perform any kind of tasks asked by either the derrick hand or the operator. These tasks can range from assisting with laying new pipe or removal of old tubing, general construction, to moving new equipment, such as generators. Most crew members on a work-about start their career as a floorhand or roughneck before working their way up to more senior positions.

8613371530291

8613371530291