workover rig count manufacturer

Dublin, May 30, 2019 (GLOBE NEWSWIRE) -- The "Global Workover Rigs Market 2019-2023" report has been added to ResearchAndMarkets.com"s offering.

The growing demand for oil and natural gas will drive the growth of the global workover rigs market during the predicted period. The global consumption of natural gas has seen a significant rise due to the increasing use of natural gas as a fuel. With the increase in the demand for oil and natural gas, companies will try to enhance oil and gas production to meet the demand.

Oil and gas companies can increase the production in two ways. One way is to drill new oil and gas wells, while another way is to increase production from existing less-producing oil and gas wells. Workover rigs are used in both cases. Therefore, the increase in the demand for oil and natural gas will spur the need for workover rigs during well E&P activities such as intervention and completion and drive the growth of the global workover rigs market during the forecast period.

The increase in oil and gas investments, as well as government support for oil and gas E&P activities, will give rise to the need for intervention and completion services. where workover rigs are required. These factors are supporting the growth of the global drilling rig count. which indicates the growth of the global workover rigs market during the forecast period.

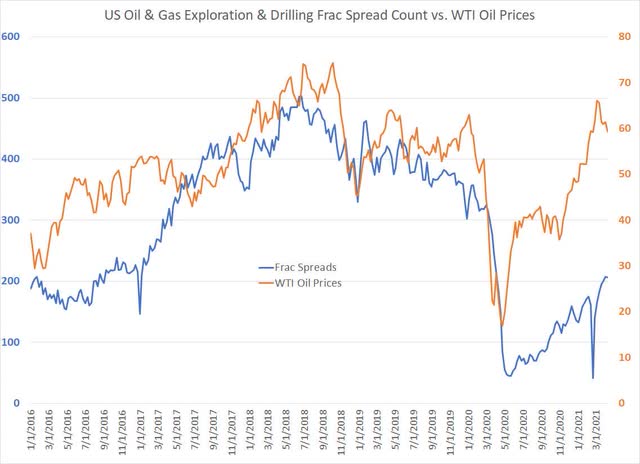

Crude oil prices have encountered large variations over the years, which have a negative impact on the profitability and performance of upstream oil and gas companies. A large number of drilling rigs were shut down, and many employees were laid off due to the variations in global crude of prices. E&P projects are executed only when the revenue generated is high enough for upstream companies to make profits. Thus, the uncertainty and fluctuations in global crude oil prices will hamper investments in E&P projects in both onshore and offshore fields, which will, in turn, impact the global workover rigs market during the forecast period.

The market appears to be moderately fragmented. The presence of several companies including TOKAIRIKA and Valeo makes competitive environment quite intense. Factors such as the increase in global drilling rig count and the growing demand for oil and natural gas, will provide considerable growth opportunities considerable growth opportunities to workover rigs manufacturers.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XMYRPMRVYVIVFDQ3B63SKJODDY.jpg)

While the active well service rig count has risen steadily since a pandemic-low of 456 in April 2020, the number is currently 15% below March 2020 total of 1,086 rigs. The sector added 20 rigs in the Permian, 18 in the Mid-Continent, and 14 in the Texas Gulf Coast and Rocky Mountain regions.

The monthly rig count, first published by the Association of Energy Service Companies (AESC) in 1970, is compiled from data submitted by oil and gas production and servicing companies throughout North America. Followed closely by well servicing contractors, government agencies, financial institutions and market analysts, the report is a key indicator of oil and gas production.

Idle — A rig that’s available for work in less than 48 hours, does not require spending of more than $50,000 to activate, and does not have a crew currently assigned.

Active rigs can be moving from one location to another, waiting on equipment/weather, rigging up/down, or undergoing maintenance. Rig counts provided by other companies may use data that has been sourced differently or only report on actively operating drilling rigs, resulting in counts that may vary from those reported by IHS Markit.

{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"facts","url":"https://cdn.ihsmarkit.com/www/pdf/1021/711671198_0621_CU_ENR_Upstream_US-Drilling-and-Development-Activity_Brochure-Final-LowRes.pdf","enabled":true,"desc":"Download product information","alt":"Download product information","mobdesc":"PDF","mobmsg":"Download product information"},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales

[num]","alt":"Call Sales

[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"chat","enabled":true,"desc":"Chat Now","mobdesc":"Chat","mobmsg":"Welcome! How can we help you today?"}, {"name":"share","enabled":true,"desc":"Share","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fihsmarkit.com%2fproducts%2fonshore-weekly-rig-count.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fihsmarkit.com%2fproducts%2fonshore-weekly-rig-count.html&text=Drilling+%26+Development+%7c+Onshore+Weekly+Rig+Count+%7c+IHS+Markit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fihsmarkit.com%2fproducts%2fonshore-weekly-rig-count.html","enabled":true},{"name":"email","url":"?subject=Drilling & Development | Onshore Weekly Rig Count | IHS Markit&body=http%3a%2f%2fihsmarkit.com%2fproducts%2fonshore-weekly-rig-count.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Drilling+%26+Development+%7c+Onshore+Weekly+Rig+Count+%7c+IHS+Markit http%3a%2f%2fihsmarkit.com%2fproducts%2fonshore-weekly-rig-count.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

The September 23rd Baker Hughes rig count report shows the active rig count is steady. Baker Hughes reports 764 active drilling rigs in the US. One month ago, the total active rig count was 765, and one year ago, it was 521 rigs.

The oil rig count is currently 602 rigs, compared to 605 one month ago, and 421 one year ago. The gas rig count is 160, compared to 158 one month ago and 99 last September.

TCI Business Capital is a leading provider of accounts receivable factoring for oilfield service companies. Factoring is a type of financing many companies use to get immediate cash for their open receivables.

Amid the recent downturn in the oil and gas industry exploration, drilling and production companies are struggling to stay active and profitable. Currently oil futures are trading at around $45 a barrel, which is about half the price they were this time last year. Signs of relief don’t appear to be in the immediate future either. The Houston-based oilfield services company, Baker Hughes Inc., released its weekly report earlier this week which indicates the number of U.S. production rigs continues to fall, according to the investment research firm Zacks.com.

According to the report, there were 838 U.S. rigs engaged in exploration and production for the week ending September 25. This was four less than the week prior, and the lowest of such levels since January of 2003. This is approximately half the number of rigs there were last year when the total stood at 1,931.

The one area of the industry that showed positive signs was in offshore drilling operations. The number of rigs involved in offshore rose by two to a total of 33. This makes sense as approximately 30% of the total world oil production (and half the natural gas) is now done by offshore operations. Recent technological advancements now allow offshore drilling to take place 200 miles from the shore in waters over 7,500 feet deep.

Somewhat surprisingly is the report’s findings that natural gas rigs are declining as well. Procedures like hydraulically fracturing shale sites have created a burgeoning market for oil alternatives in the United States. In 2013 alone there were at least two million hydraulically fractured oil and gas wells in the U.S. and up to 95% of all new wells are done that way, according to the Department of Energy. Still, the total number of natural gas rigs dropped by one to 197.

Even as the oil and natural gas rig count in the U.S. mostly increased over the past two years, weekly increases have been in the single digits for months and oil production remains below record levels seen before the pandemic.

In the third quarter, oil and gas drillers added rigs for an eighth quarter in a row but the addition of 12 rigs was the smallest increase since September 2020.

In the third quarter, drillers added oil and gas rigs for an eighth quarter in a row but the addition of 12 rigs was the smallest increase since September 2020.

U.S. oil rigs rose three to 602 this week, while gas rigs fell two to 160. The total rig count fell in August and was on track to fall again in September after rising for a record 24 months in a row.

The biggest increase in rigs was in the Permian Basin in Texas and New Mexico, the biggest U.S. oil field, which rose by three to 343 this week, the most since August.

Oil services company Baker Hughes reported that the U.S. oil and gas rig count fell for the fifth straight week the week of Sept. 5, following recent forecasts of disappointing oil output gains from EOG Resources and Pioneer Resources executives.

Land drill rig day rates have increased in a number of regions due to an increase in drilling demand combined with higher commodity pricing. In the U.S., in particular, day rates have increase by 25% in 2022, according to Westwood’s latest analysis.

In August, the combined oil and gas count in the U.S. was down two rigs after rising for a record 24 months in a row, according to Baker Hughes in its closely followed report.

Manufacturer of standard & mobile rigs & carriers for oilfield applications. Includes well servicing from 14,000 ft. to 22,000 ft., workovers from 10,000 ft. to 16,000 ft. & drilling from 6000 ft. to 10,000 ft. Specifications include brakes range from 28 in. dia. x 8 in. wide to 42 in. dia. x 12 in. wide, barrels from 12 3/4 in. x 38 in. to 18 in. x 43 in., chains from 1 1/4 in. to 1 3/4 in., clutches of 24 in. with single & 2 plate air friction outboards, shafts of 5 in. dia. to 6 1/2 in. dia. & gross weights from 63,200 lbs. to 115,000 lbs. Also includes forged steel, demountable options, mufflers with spark arrestors, dry type air cleaners, transmissions with torque converters, water splash brake cooling & up to 6 axles.

With access to Enverus, you can identify new sales leads, plan visits to drilling rigs, determine market share, identify exploration trends, find available rigs, identify new production, monitor competitive activity or define sales territories. Our survey team talks with hundreds of specialists each week to verify our data as well as ensure it is fresh and as detailed as possible for your use.

Rotary Rigs in Operation: Baker Hughes, Inc., Houston, TX, "North America Rig Count," used with permission. See http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother.

Active Well Service Rig Count: Energy Workforce & Technology Council, Houston, TX. Rotary rigs in operation are reported weekly. Monthly data are averages of 4- or 5-week reporting periods, not calendar months. Annual data are averages over 52 or 53 weeks, not calendar year. Published data are rounded to the nearest whole number. Geographic coverage is the 50 States and the District of Columbia.

In its weekly release, Baker HughesCompany BKR reported that the U.S. rig count was lower than the prior-week tally. The rotary rig count, issued by BKR, is usually published in major newspapers and trade publications.

Baker Hughes’ data, issued at the end of every week since 1944, helps energy service providers gauge the overall business environment of the oil and gas industry. The number of active rigs and its comparison with the prior-week figure indicates the demand trajectory for Baker Hughes’ oilfield services from exploration and production companies.

Total U.S. Rig Count Declines: The count of rigs engaged in the exploration and production of oil and natural gas in the United States was 759 for the week ended Sep 9. The figure is lower tha nthe prior week’s count of 760. Thus, the tally decreased for two straight weeks. The current national rig count is higher than the year-ago level of 503.

The onshore rigs in the week ended Sep 9 totaled 741, in line with the prior-week count. In offshore resources, 15 rigs were operating, lower than the prior-week count of 16.

U.S. Oil Rig Count Falls: Oil rig count was 591 for the week ended Sep 9, lower than the prior week’s figure of 596. The current number of oil rigs — far from the peak of 1,609 attained in October 2014 — is up from the year-ago figure of 401.

U.S. Natural Gas Rig Count Rises: Natural gas rig count of 166 was higher than the prior-week figure of 162. The count of rigs exploring the commodity is also higher than the prior-year week’s tally of 101. Per the latest report, the number of natural gas-directed rigs is 89.7% lower than the all-time high of 1,606 recorded in 2008.

Rig Count by Type:The number of vertical drilling rigs totaled 24 units, lower than the prior-week count of 26. Horizontal/directional rig count (encompassing new drilling technology with the ability to drill and extract gas from dense rock formations, also known as shale formations) of 735 is higher than the prior-week level of 734.

Permian — the most prolific basin in the United States — recorded a weekly oil rig tally of 334, lower than the prior week"s count of 337. The tally decreased for two straight weeks.

The West Texas Intermediate crude price is approaching the $90-per-barrel mark, which is extremely favorable for exploration and production activities. Higher oil prices will likely pave the way for rig additions, despite a slowdown in drilling activities, as upstream players mainly focus on stockholder returns rather than boosting output.

EOG Resources, a leading oil and natural gas exploration and production company currently carrying a Zacks Rank #3 (Hold), is well-placed to capitalize on the promising business scenario. EOG has an estimated 11,500 net undrilled premium locations, resulting in a brightened production outlook. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The land drilling market worldwide is structured primarily as a rental market, not a sales market, where land drilling companies lease their rigs to E&P companies for an agreed period of time – weeks, months, or years – at a day-rate. The rigs are then used to drill wells and execute the E&P’s drilling programs.

Drilling opportunities are analysed and explored in order, leaving a series of dry holes, until a discovery is made. It is rare for an E&P company to actually own the rigs which they operate, but there are some exceptions such as Chesapeake, who will purchase their own fleet of rigs.

Investors require a minimum level of return for their investment dollars in drilling operations, and typically equate cost with risk. These turnkey drilling contracts may limit risk by guaranteeing a minimum number of wells that can be drilled with the rig. The contract will also outline how the rig can be used – including the pieces of equipment, when to change pieces, temperature and pressure tolerances and the weight of mud.

Nabors operates the world’s largest land drilling rig fleet, with around 500 rigs operating in over 25 countries – in almost every significant O&G basin on the planet. It also has the largest number of high-specification rigs (including new AC rigs and refurbished SCR rigs) and custom rigs, built to withstand challenging conditions such as extreme cold, desert and many complex shale plays.

Headquartered in Tulsa, Oklahoma, H&P is a global business with land operations across the US, as well as offshore operations in the Gulf of Mexico. It is engaged primarily in the drilling of O&G wells for E&P companies, and recognised for its innovative FlexRig technology.

Patterson-UTI operates land based drilling rigs, primarily in O&G producing regions of the continental US, and western Canada. The company also provides pressure pumping services to US E&P companies and specialist technology, notably pipe handling components, to drilling contractors globally.

Precision is an oilfield services company and Canada’s largest drilling rig contractor, with over 240 rigs in operation worldwide. The Company has two segments. The Contract Drilling Services segment operates its rigs in Canada, the United States and internationally. The Completion and Production Services segment provides completion and workover services and ancillary services to O&G E&P companies in Canada and the US.

Pioneer operates a modern fleet of more than 24 top performing drilling rigs throughout onshore O&G producing regions of the US and Colombia. The company also offers production services include well servicing, wireline, and coiled tubing services – supported by 100 well-servicing rigs, and more than 100 cased-hole, open-hole and offshore wireline units.

In Texas, generally considered to be the centre of US land drilling, RigData reports that there are currently 678 active rigs – split between Helmerich & Payne (160), Patterson-UTI (85), Nabors (64), Precision Drilling (39) and 77 other drillers (330).

Most new onshore rigs, both drilling and work over rigs, are built by OEMs in China. In the US, the larger vertically integrated land drillers have in-house manufacturing operations, so they will outsource some equipment construction, but assemble the new rigs at their own facilities. The leading provider of US newbuild rigs is National Oilwell Varco.

The secondary market, where existing rigs are sold, is largely auction dominated with mostly older rigs changing hands. As a rule, the big land drillers do not sell their newbuild rigs, as each has their own flagship designs.

Aug 5 (Reuters) - U.S. energy firms this week cut the number of oil rigs by the most since September as production grows incrementally because energy firms are boosting shareholder returns and facing higher operating costs due to inflationary and supply chain pressures.

The number of oil rigs, an early indicator of future output, fell seven to 598 in the week to Aug. 5, the first weekly decline in 10 weeks, energy services firm Baker Hughes Co (BKR.O) said in its closely followed report on Friday. , ,

Gas rigs rose four to 161, their highest since August 2019, while the combined oil and gas fell by three to 764, which puts the total rig count up 273, or 56%, over this time last year, Baker Hughes said.

Even though the total rig count has climbed for a record 24 months through July, weekly increases have mostly been in the single digits and oil production is only forecast to recover to pre-pandemic record levels next year.read more

The North American rig count is issued as a service to the petroleum industry. In 1944 they began weekly counts of US and Canadian drilling activity. These are an important business barometer for the drilling industry and its suppliers. When drilling rigs are active they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons. They are released weekly at noon Central Time on the last day of the work week.

8613371530291

8613371530291