workover rig vs drilling rig supplier

Workover Rig is available for both onshore as well as offshore Workover purposes at affordable prices. There are a number of companies that manufacture the Workover Rig as well as Rig packages that are required for different kinds of drilling jobs and meet the standards that have been set by the American Petroleum Institute or the API. The Rig packages are shipped worldwide. The rigs are included other than the simple Workover and they include the following:

Workover Rig is known as the Workover the different types of rigs include the offshore and onshore Rig that range from 150 horsepower to 1000 horsepower. Workover rigs have a surface depth that is equipped with diesel engines and transmissions and is available from 8000 ft to 30000 ft. Workover rigs contain a full line of drilling packages. Rig takes into account the skid mounted drilling rigs and the ones that are trailer mounted. Workover skid mounted drilling rigs incorporate the diesel-electric AC/VFD or the DC/SCR drive rigs, mechanical drive rigs and the combination drive Rig that ranges from 1000 horsepower to 6000 horsepower; while the trailer mounted Rig ranges from 450 horsepower to 1000 horsepower.

A lot of Workover Rig uses the double telescopic mast with the help of a single mast and is operated by wide wheel base axels, high strength steel beam, low cross section tires, dual pipeline brakes as well as hydraulic assist steering for the Workover. Rig mast is a double section type and uses a telescopic mast for dual safety protection. The gear shift and throttle of the engine can be remote controlled.

Workover types of Rig are available in the form of the single drum as well as the double drum. The groove ensures the alignment of in place as well as for long life. The optional Workover accessories for the auxiliary brakes include air thrust disc type clutch, brakes for the braking of the main drum, forced water circulating cooling with the brake rims as well as the optional brakes. Workover rigs are centrally controlled with electricity. The other kinds of drilling equipment include drilling equipment, triplex mud pumps, well control equipment; solids control equipment, oil control tubular goods and quality equipment. Work over rigs run casing tools and clean outs inside and outside a hole already drilled.

Inserting and pulling up pipe tubing from oil wells is a precise and challenging job that not every rig is up for. That’s why you need a mobile workover rig from Dragon to get it done right every time. Our workover rigs are state-of-the-art and ready to tackle even the harshest conditions. A workover rig is perfect for site preparation while a standard mobile oil rig can handle a variety of piping tasks. Need workover rig parts, or service on another mobile rig? Dragon has that covered with our parts selection, too. View all of our workover rigs and other drilling rigs today.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Manufacturer of standard & mobile rigs & carriers for oilfield applications. Includes well servicing from 14,000 ft. to 22,000 ft., workovers from 10,000 ft. to 16,000 ft. & drilling from 6000 ft. to 10,000 ft. Specifications include brakes range from 28 in. dia. x 8 in. wide to 42 in. dia. x 12 in. wide, barrels from 12 3/4 in. x 38 in. to 18 in. x 43 in., chains from 1 1/4 in. to 1 3/4 in., clutches of 24 in. with single & 2 plate air friction outboards, shafts of 5 in. dia. to 6 1/2 in. dia. & gross weights from 63,200 lbs. to 115,000 lbs. Also includes forged steel, demountable options, mufflers with spark arrestors, dry type air cleaners, transmissions with torque converters, water splash brake cooling & up to 6 axles.

Super capacitor energy storing dual—power workover rig mainly consists of Diesel engine power unit which is made up of Diesel engine and Hydraulic transmission box, Electric power unit which is made up of Frequency conversion motor and Mechanical transmission box, Transfer case, Angle gear box, Drawworks, Mast assembly, Super capacitor energy storing and control system, Hydraulic and Pneumatic control system, Voltage transformer, Power connection box, MCC control cabinet, Frequency conversion cabinet, Electric air compressor, Electric hydraulic pump station etc.

The power of Diesel engine is used for the heavy load workover job of workover rig, such as running and jam release etc. The power of Frequency conversion motor is used for the normal trip—up and down operation

Workover rigs, also called pulling unit rigs, are specialized oil rigs set up for inserting or pulling pipe tubing in and out of wells. Workover crews are called when an oil well has been drilled, is undergoing repair or is being retired, as indicated by Schlumberger.

These crews are relatively small compared to other rig crews and consist of tool pushers, operators or relief operators, derrick men and floormen or roughnecks. The average workover rig salary overall was $65,039 as reported by Simply Hired in 2022. Available workover rig jobs and descriptions can be found on the Rigzone website.

The acting supervisor on a workover rig is called the tool pusher. The main task of a pusher is to hire, fire and supervise contracting work crews. When contractors have an issue on site, the first person they report concerns to is the tool pusher. Pushers need to have an intimate knowledge of how each and every part of a rig works, both individually and as an overall part of the drilling operation as a whole.

If equipment fails or needs to be reordered, the tool pusher talks with suppliers to get the right parts out on site with a minimum of downtime for the rig. The pusher is responsible for the overall safety of a rig. If the tool pusher has any safety concerns, he has the power to halt production until the concern is resolved.

The operator/relief operator is next in order of responsibility to the tool pusher on a workover rig. The main task of an operator is to control the crane and derrick that hauls pipe in and out of the bored well. In smaller crews, the operator is also the one who drives the rig truck. When laying pipe into a well, the operator directs the truck or derrick to the optimum spot next to the bore opening.

The operator then instructs the derrick hands and roughnecks where to place the bore pipe for easy access by the crane or by hand-loading methods. During a well breakdown or repair, the operator directs the crew hands in storage of extracted pipelines. Because the operators work most closely with derrick hands and roughnecks, they are typically responsible for selection and maintenance of their immediate workover rig crew.

In the pulling unit rig crew hierarchy, the derrick hands come after the operator/relief operators. The main responsibility of a derrick hand is everything that is above ground on the rig. During laying operations, derrick hands assist the operators/relief operators in inserting boring into the well. During repair or breakdown, they assist the operator in pulling pipe out of the well and storing it properly.

In between laying, derrick hands have other responsibilities as well, depending on the size of the crews. In smaller crews, Derrick hands also see to the maintenance of the rig-based electric and diesel generators necessary to power rig equipment.

At the bottom of the pulling unit rig crew in terms of seniority is the floorhand or roughneck. The main task of a roughneck is to perform any kind of tasks asked by either the derrick hand or the operator. These tasks can range from assisting with laying new pipe or removal of old tubing, general construction, to moving new equipment, such as generators. Most crew members on a work-about start their career as a floorhand or roughneck before working their way up to more senior positions.

By connecting with the best workover rigs manufacturers and suppliers you can grow your business and satisfy your clients with top-notch products and services. At ExportHub you’ll find global workover rigs suppliers and manufacturers ready to serve your demands. Regardless of where you are located, you can get your products manufactured easily without setting foot out of your national border. As a leading B2B platform, we highlight the following attributes of the listed manufacturers and suppliers.

Rig means the vessel described in Recital (A) hereto and includes any share or interest therein and her engines, machinery, boats, tackle, outfit, spare gear, fuel, consumable or other stores, belongings and appurtenances whether on board or ashore and whether now owned or hereafter acquired (but excluding therefrom any leased equipment owned by third parties);

In this whitepaper, the focus in on analyzing the underlying supply risk for Indian E&P operators in hiring Variable Frequency Drive (VFD) AC Rigs due to sudden increase in demand in the Indian market. Also identified are the reasons behind the VFD rig shortage from E&P operator’s perspective. The whitepaper analyzes the impact that an E&P operator faces due to rig shortage and suggests suitable sourcing strategies for the E&P companies to overcome the VFD rig shortage.

VFD rigs are AC-driven high power rigs with horse power varying from 1500 HP to 3000 HP. These rigs are used for high depth wells and in hilly terrain regions where normal Silicon Controlled Rectifier (SCR) rigs cannot be used. VFD rigs help advanced drilling technologies such as pad drilling, directional drilling and horizontal drilling. VFD rigs come with high level of automation that involves automated drilling pipe handling, drill pipe connection and auto drilling. With increase in demand for directional drilling and mature oil fields in India, the demand for VFD rigs is increasing. These rigs help in achieving higher cost savings for E&P operators through a highly-efficient variable power system.

Indian work-over market is estimated to be worth $75.88 million. With nine suppliers, India has always been a supply-surplus market with easy availability of readily stacked rigs to pursue drilling. However, things changed in 2017 as industry faced the first ever VFD rig shortage.

Among the various capacity of VFD rigs, 2000 HP is the most sought by E&P operators. With deeper wells and high pressure wells, the demand for 2000 HP is increasing.

Marginal field auction, increase in demand for directional drilling and horizontal drilling, and increased drilling in high terrain fields are seen as the key reasons for shortage of VFD rigs.

While the fields awarded are explored earlier and wells drilled, they are completed with proper installation of well heads for pursuing development activities later. Therefore, the focus for smaller E&P companies will be on servicing these drilled wells to reduce the exploration risk. Hence, demand of work-over rig is set to increase.

Directional drilling involves drilling of wells with a controlled direction and deviation of wellbore to a determined target for hydrocarbons. Whereas horizontal drilling is chosen for slanted wells in difficult terrain where drilling in not possible in the exact location of hydrocarbons. Both these drilling types use power-controlled directional drilling motors that help in deviating the wells as required. Therefore, the need arises for AC-driven VFD rigs to perform directional and horizontal drilling.

Indian states of Assam, Tripura and Arunachal Pradesh have some of the high terrain hydrocarbons fields. These fields have well depth of 3000 meters and more to reach the gas reservoir. Latest discovery of gas fields in Tripura has increased the drilling activity in the state. Given the high terrain, oil companies prefer to go with single-pad multi-well drill that helps to reduce the need for individual field development plan. With strong preference for directional drilling, E&P companies hire only high-power VFD rigs to manage the drill program.

Oil & gas exploration involves huge investment with high level of risk. Delays in hiring the rigs can be costlier for the E&P operator as the production is impacted directly.

Risk of increase in day rates – With increasing demand for workover rigs, E&P companies are rushing on to seal the workover rig contracts to avoid risking the rig availability. As an impact, day rates of 2000 HP rigs have gone up by $1,000 per day in 2017 in comparison to 2016. 2000 HP workover rigs attracted an average day rate of $21,000. Even though oil prices stayed lower over last 12 months, the day rates for workover have reached $22,000 owing to the increased demand.

Delayed production risk – E&P operators have to adhere to timelines defined by the DGH for field exploration, drilling, development and production. Therefore, lead time for workover rig in managing the production schedule. Delays in procuring workover drilling and associated equipment can delay the well intervention plans of operators. Especially, operators with single or smaller oil fields cannot afford to have any delays as it can increase the non-productive time impacting the production.

Budget risk– As most of the new E&P operators with smaller fields have constrained budget, it is essential to manage the drilling, completion and production schedule. With prevailing lower oil prices, any delays in operation or reservoir complication can completely squeeze their budget.

Government procurement guidelines– Under the exploration licensing policy, E&P operators must follow certain procurement rules while procuring service equipment such as rigs. When there is a rig shortage with the suppliers, there is a risk for E&P to find at least three bidders for the contracts.

Though risks cannot be eliminated completely, they can be minimized. By choosing the appropriate sourcing strategy and contract type, E&P operators can safeguard themselves from risks due to workover rig shortage.

Risk of increase in day rate for VFD rigs can be negated by E&P operators with long term contracts, typically for three years. In most workover contracts, contract duration is the deciding factor in finalizing the day rates. Longer terms are found more attractive by the rig owners as it assures the rig owner with consistent revenue. Therefore, it is essential for E&P operators to make use of negotiation to leverage for lower day rates.

From the operators’ perspective, long term workover rig contracts give a cost saving of 15-20 percent. Moreover, it eliminates the risk of rig unavailability which is likely to incur a significant cost for the operators.

While majority of the Indian workover rig suppliers buy rigs outrightly from the Original Equipment Manufacturers, few suppliers have their own fabrication unit. With fabrication and assembly unit, these suppliers cater to the demand for E&P operators with a lead time of 9-12 months. In such cases when the need for workover is immediate and for a longer duration, E&P companies can prefer to have joint ventures with the rig OEM to have a secured rig supply for longer duration. Skipping the supplier stage in this JV can help E&P operators in reducing the day rates for VFD rig.

Real time example– Recently, Saudi Aramco entered into a joint venture with offshore drilling rig supplier for jack up rigs. The joint venture will initially own seven offshore rigs while four additional rigs will be added in future. By entering into the JV, Aramco has ensured it supply chain for drilling rigs. This eliminates the risk of rig unavailability and ensures that production schedule is met with planned timelines.

When E&P operators get into a JV, the rig fleet comes under the operators. This will help E&P operators to mitigate the risk arising due to the government procurement rules which require a minimum of three bidders for a contract.

Given the utilization rate of 55 percent for VFD rigs, rig sharing is one of the options to ensure procurement of VFD rigs to avoid the supply risk. In long term contracts, there is a provision of ‘Assignment’ which is a novation of agreement allowing transfer of rig from one operator to another operator. Under rig sharing agreement, E&P operator hires rig from the supplier and shares it with another operator to maximize the efficiency. Rig sharing is usually done in two different forms. Under type 1, single oil company contracts a drilling rig and shares the same with different subsidiaries holding the exploration license in the same field or other field. Under type 2, multiple operators together contract a workover rig. Under this type, the operators share the crews, supplies and equipment.

Rig hiring suits smaller E&P companies with budget constraints or limited operations, typically single field operators. When two or more operators contract a workover rig, the shortage of rig is mitigated without affecting the well intervention operations at a lower cost.

Choosing a suitable sourcing strategy for contracting a VFD rig is highly dependent on the factors such as field size, number of exploration licenses, license duration and financial strength of the E&P operator. For large E&P operators with multiple fields and good cash flow, joint venture with an OEM can be the most suitable sourcing strategy. For E&P operators with constrained budgets, limited operations and operating in single field or in marginal field, rig sharing can the ideal sourcing strategy for hiring workover rig. Long term contracts are suitable for E&P operators with longer exploration license as the need for VFD rigs will be for a longer duration.

This article is about the onshore oil rig. For offshore oil rig, see Oil platform. For drilling tunnels, see Tunnel boring machine. For handheld drilling tool, see Drill.

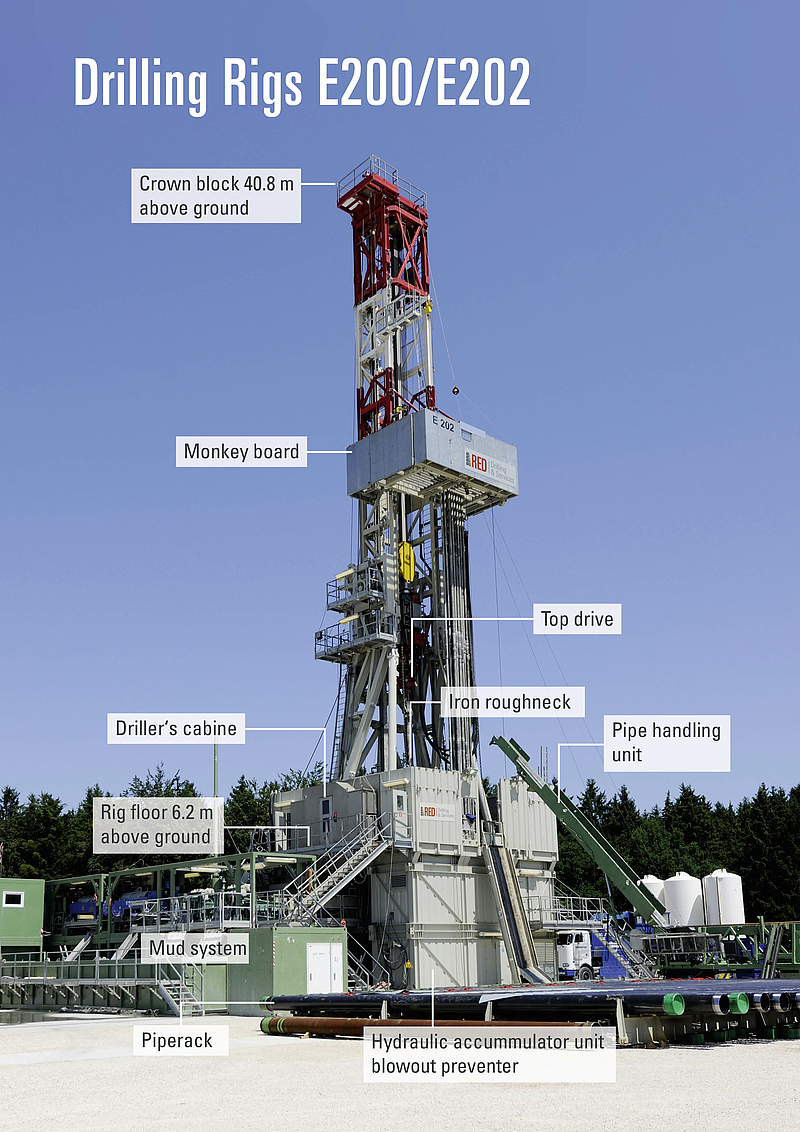

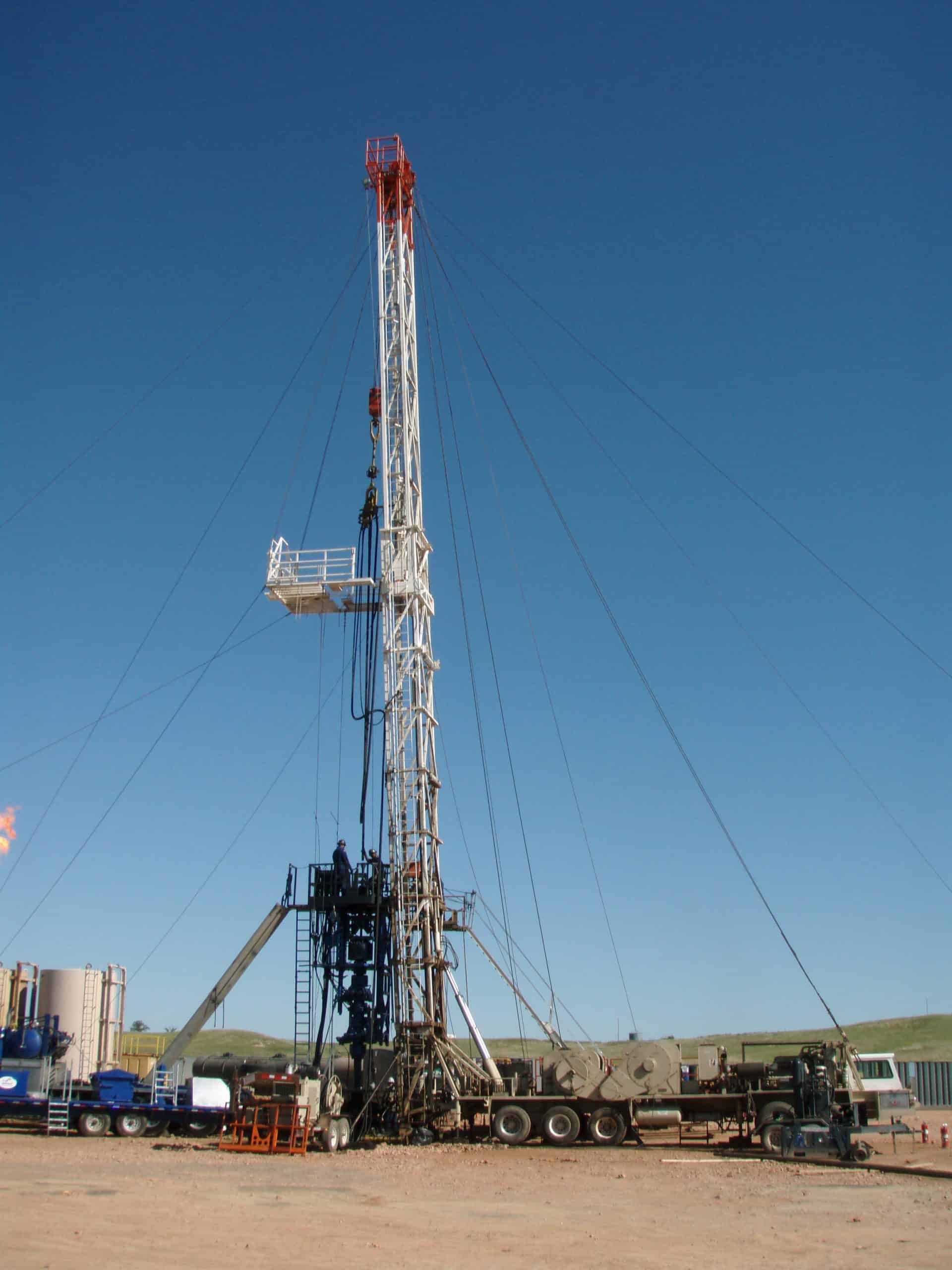

A drilling rig is an integrated system that drills wells, such as oil or water wells, in the earth"s subsurface. Drilling rigs can be massive structures housing equipment used to drill water wells, oil wells, or natural gas extraction wells, or they can be small enough to be moved manually by one person and such are called augers. Drilling rigs can sample subsurface mineral deposits, test rock, soil and groundwater physical properties, and also can be used to install sub-surface fabrications, such as underground utilities, instrumentation, tunnels or wells. Drilling rigs can be mobile equipment mounted on trucks, tracks or trailers, or more permanent land or marine-based structures (such as oil platforms, commonly called "offshore oil rigs" even if they don"t contain a drilling rig). The term "rig" therefore generally refers to the complex equipment that is used to penetrate the surface of the Earth"s crust.

Small to medium-sized drilling rigs are mobile, such as those used in mineral exploration drilling, blast-hole, water wells and environmental investigations. Larger rigs are capable of drilling through thousands of metres of the Earth"s crust, using large "mud pumps" to circulate drilling mud (slurry) through the drill bit and up the casing annulus, for cooling and removing the "cuttings" while a well is drilled. Hoists in the rig can lift hundreds of tons of pipe. Other equipment can force acid or sand into reservoirs to facilitate extraction of the oil or natural gas; and in remote locations there can be permanent living accommodation and catering for crews (which may be more than a hundred). Marine rigs may operate thousands of miles distant from the supply base with infrequent crew rotation or cycle.

Antique drilling rig now on display at Western History Museum in Lingle, Wyoming. It was used to drill many water wells in that area—many of those wells are still in use.

Until internal combustion engines were developed in the late 19th century, the main method for drilling rock was muscle power of man or animal. The technique of oil drilling through percussion or rotary drilling has its origins dating back to the ancient Chinese Han Dynasty in 100 BC, where percussion drilling was used to extract natural gas in the Sichuan province.Edwin Drake to drill Pennsylvania"s first oil well in 1859 using small steam engines to power the drilling process rather than by human muscle.Cable tool drilling was developed in ancient China and was used for drilling brine wells. The salt domes also held natural gas, which some wells produced and which was used for evaporation of the brine.

In the 1970s, outside of the oil and gas industry, roller bits using mud circulation were replaced by the first pneumatic reciprocating piston Reverse Circulation (RC) drills, and became essentially obsolete for most shallow drilling, and are now only used in certain situations where rocks preclude other methods. RC drilling proved much faster and more efficient, and continues to improve with better metallurgy, deriving harder, more durable bits, and compressors delivering higher air pressures at higher volumes, enabling deeper and faster penetration. Diamond drilling has remained essentially unchanged since its inception.

Oil and natural gas drilling rigs are used not only to identify geologic reservoirs, but also used to create holes that allow the extraction of oil or natural gas from those reservoirs. Primarily in onshore oil and gas fields once a well has been drilled, the drilling rig will be moved off of the well and a service rig (a smaller rig) that is purpose-built for completions will be moved on to the well to get the well on line.

Mining drilling rigs are used for two main purposes, exploration drilling which aims to identify the location and quality of a mineral, and production drilling, used in the production-cycle for mining. Drilling rigs used for rock blasting for surface mines vary in size dependent on the size of the hole desired, and is typically classified into smaller pre-split and larger production holes. Underground mining (hard rock) uses a variety of drill rigs dependent on the desired purpose, such as production, bolting, cabling, and tunnelling.

In early oil exploration, drilling rigs were semi-permanent in nature and the derricks were often built on site and left in place after the completion of the well. In more recent times drilling rigs are expensive custom-built machines that can be moved from well to well. Some light duty drilling rigs are like a mobile crane and are more usually used to drill water wells. Larger land rigs must be broken apart into sections and loads to move to a new place, a process which can often take weeks.

Small mobile drilling rigs are also used to drill or bore piles. Rigs can range from 100 short tons (91,000 kg) continuous flight auger (CFA) rigs to small air powered rigs used to drill holes in quarries, etc. These rigs use the same technology and equipment as the oil drilling rigs, just on a smaller scale.

The drilling mechanisms outlined below differ mechanically in terms of the machinery used, but also in terms of the method by which drill cuttings are removed from the cutting face of the drill and returned to surface.

An automated drill rig (ADR) is an automated full-sized walking land-based drill rig that drills long lateral sections in horizontal wells for the oil and gas industry.Athabasca oil sands. According to the "Oil Patch Daily News", "Each rig will generate 50,000 man-hours of work during the construction phase and upon completion, each operating rig will directly and indirectly employ more than 100 workers." Compared to conventional drilling rigs", Ensign, an international oilfield services contractor based in Calgary, Alberta, that makes ADRs claims that they are "safer to operate, have "enhanced controls intelligence," "reduced environmental footprint, quick mobility and advanced communications between field and office."steam assisted gravity drainage (SAGD) applications was mobilized by Deer Creek Energy Limited, a Calgary-based oilsands company.

Baars, D.L.; Watney, W.L.; Steeples, D.W.; Brostuen, E.A (1989). Petroleum; a primer for Kansas (Educational Series, no. 7 ed.). Kansas Geological Survey. p. 40. Archived from the original on 8 November 2020. Retrieved 18 April 2011. After the cementing of the casing has been completed, the drilling rig, equipment, and materials are removed from the drill site. A smaller rig, known as a workover rig or completion rig, is moved over the well bore. The smaller rig is used for the remaining completion operations.

"Ensign Launches Newest And Most Powerful Automated ADR 1500S Pad Drill Rigs In Montney Play", New Tech Magazine, Calgary, Alberta, 21 November 2014, archived from the original on 10 December 2014, retrieved 6 December 2014

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

AOSS can also package ancillary equipment like Fishing Tools, Handling Tools, Drill Pipe and accessories along with the rig package thus offering an entire package to the client by bringing significant value in the supply chain process and cost.

Independent producers and operators ramping up shale exploration and development programs are pushing the limits of conventional drilling equipment. Whether they are drilling multiple long-lateral horizontal wells from single pads, testing new bits and mud motors to boost penetration rates, or deploying next-generation rig floor and automation systems to slash “spud to sales” times, independents and their service company partners continue to find ways to improve resource play economics and crack the unconventional drilling frontier wide open.

Goodrich Petroleum is a case in point. Over the past two years, the company has transitioned from vertical Cotton Valley wells to horizontal wells in the Cotton Valley and the underlying Haynesville Shale. To unlock the shale’s vast potential, the company worked with its partners and service providers to discover the right casing points and to choose bottom hole assemblies that could build at sufficient rates to maximize lateral lengths, reports Clarke Denney, the company’s vice president of drilling. He notes that in the Haynesville Shale, Goodrich is utilizing robust directional equipment and mud cooling units to drill laterals at vertical depths of 15,000 feet, where circulating temperatures can reach upward of 340 degrees Fahrenheit.

With oil prices trading much higher than natural gas on a Btu equivalent basis, Goodrich also is targeting the oil window of the Eagle Ford Shale. In South Texas, the company is drilling wells with vertical depths between 6,500 and 8,500 feet and lateral lengths from 4,500 to 6,000 feet. Although these wells take skill, time, and money to plan and construct, company officials say they believe they can achieve 50 plus percent returns on investment.

Drilling wells in either play requires rigs with the right equipment, says Denney. He says top drives are important because they allow pumping and rotating the drill string while coming out of the hole, which is necessary at times for hole cleaning. This reduces drag and the chance of getting stuck. Top drives also maximize directional drilling performance.

Drawworks that can deliver at least 1,500 horsepower are also key, Denney adds. “We believe in high horsepower,” he stresses. “A 1,500-horsepower rig carries a premium over a 1,000-horsepower rig, but it speeds trips and puts less strain on the equipment. We get our money’s worth.”

Just as important as the drawworks and top drive is having powerful mud pumps on the rig, Denney says. “In the Eagle Ford, we would prefer to have at least 1,600-horsepower pumps, especially when drilling long laterals,” he relates. “That horsepower is needed for mud hydraulics to keep the hole clean, and to drive the downhole motor and other equipment. We have achieved up to 6,000-foot laterals to date, and we are targeting 9,000-foot long laterals in the near future.”

In many cases, it makes sense for the rig to have the ability to skid, Denney says. He explains that drilling multiple horizontal well bores on one pad reduces construction costs and rig transit times. “In the Eagle Ford, if we can skid, our drilling costs can be reduced as much as $500,000 a well,” he says.

Goodrich Petroleum is far from the only company that needs “high-spec” rigs with powerful top drives, hoisting systems and pumps. According to industry sources, rigs with larger (+1,000) horsepower ratings account for an estimated 60 percent of the active rig fleet. Moreover, rigs with at least 1,000 horsepower account for nine of every 10 rigs that are under construction or planned for the near future.

With its operational focus transitioning from the Cotton Valley trend to the Haynesville Shale, and more recently to the Eagle Ford Shale, Goodrich Petroleum is achieving consistent production and reserve growth through horizontal drilling with high-spec land rigs and advanced downhole tools. Even during the economic recession of 2009, the company increased average net daily production 24 percent and proved reserves 5 percent. Over the past four years, it has more than doubled its daily production while expanding its reserves 30 percent.

Trent Latshaw, the founder and head of Latshaw Drilling in Tulsa, can verify that the demand for 1,000-2,000 horsepower rigs is high. He says the company’s fleet, which includes 15 rigs within that range, has 100 percent utilization. In fact, Latshaw reports that the only unused rig his company has on the books is a new, 1,700-horsepower diesel electric that is still under construction.

Many of today’s high-spec rigs have closed-loop mud systems, Latshaw notes. “Closed-loop mud systems do away with the need for a reserve pit,” he says. “The systems also processes drilling fluid more efficiently. They are able to take more solids from the drilling fluid, which enables more fluid to be reused and makes the solids dryer and easier to dispose of. That becomes very important when dealing with oil-based mud, which often is used in horizontal wells.”

Latshaw encourages operators to consider using high-horsepower rigs when the class they want is difficult to obtain. “We consider our 2,000-horsepower rig to be identical to our 1,500-horsepower rigs, except for the drawworks size and the mast/substructure capacity,” he says. “The 2,000-horsepower rigs have the same footprint and move as fast as the 1,500-horsepower units, and for all practical purposes, the day rates are the same.”

He also says diesel-electric SCR rigs are comparable to AC rigs. “They have the same top drives, the same mud pumps, the same mud systems, the same engines, and the same blowout preventers,” he reports. “From the customers’ perspective, they drill wells as fast as AC rigs.”

In reference to safety, Latshaw says people matter more than technology. “You can try to design a piece of equipment that is accident proof, but safety comes down to the people on the rig floor and what their mindsets are,” he insists. “We are putting more money into training, beefing up our safety department, and having more safety coaches go around the rigs to work with the hands.”

He points out that many rigs, including several of Latshaw Drilling’s units, use automated iron roughnecks to improve safety. “Those are expensive, high-maintenance pieces of equipment,” he says. “We decided to take some of them off our rigs, then track closely to see if we had more finger and hand accidents on the rigs using manual tongs and a drill pipe spinner versus the rigs that had iron roughnecks. We have not seen a difference.”

For Joe Hudson, the president of Nabors Drilling USA, the future looks bright. “We have at least 103 AC rigs deployed at this point,” he reports. “We are in the process of building 25 more, and we always are looking for opportunities to expand further, be it in the Bakken, the Mid-Continent, West Texas, the Eagle Ford, or the Marcellus.”

Hudson says the new rigs include larger pumps, AC top drives, and tubular handling tools such as automatic catwalks and floor wrenches. “With the automatic catwalk, there is no need for a rig hand to pick pipe off the catwalks, pull it up with a hoist, and drag it to the rig floor,” he says. “Instead, the catwalk picks up pipe and elevates it to the rig floor. No one is touching the pipe or rolling pipe onto the catwalk, which keeps people away from tubulars, reducing the risk of pinch-point injuries.”

The rigs also employ advanced software. “With conventional rigs, the driller would drill ahead with a hand on the brake handle. He had only basic drilling information available to him, and his skill and his experience with the area dictated his ability to drill the well,” Hudson recalls. “Today, the software associated with smart drilling systems allows him to drill the well with a better understanding of the factors that influence drilling performance, such as delta P, hydraulic horsepower, weight on bit and rate of penetration. That translates to a faster rate of penetration.”

To ensure that its employees work as safely and efficiently as possible, Nabors has fully functional training rigs in Williston, N.D., Casper, Wy., and Tyler, Tx., where it trains personnel with no previous experience, Hudson reports. He adds that the company carefully defines the training and competency individuals need to be promoted.

The newest generation of high-spec land rigs purpose-built for horizontal drilling in unconventional resource plays features integrated subsystems to automate key processes such as pipe handling. Automated catwalks and floor wrenches not only increase operating efficiency, but also improve rig floor safety and extend pipe longevity by reducing handling damage.

When downturns do occur, Nabors tries to keep competent people and trainers on staff, Hudson says. By doing so during the last economic downturn, he says the company managed to go from 92 rigs in fall 2009 to 190 rigs today without compromising its personnel or safety standards.

Regardless of the market condition, Hudson says it is vital to design rigs for specific areas. “Every area is unique,” he says. “Carrying the top drive in the mast is a great way to reduce the number of loads needed, but in areas where road weights are critical, other approaches have to be adopted.”

To illustrate regional developments, Hudson points to Nabors’ B-series rigs, which were designed to accommodate pad drilling in the Bakken Shale. “We built a box-on-box substructure because we can close in that substructure, which makes it easier to winterize,” Hudson says. “Also, the way we can rotate the substructure lets the company conduct completion and production-related operations on one well while we are drilling another on the same location.”

In the Rocky Mountains, mobility is vital, says Patrick Hladky, a principal and contract manager for Rockies-focused Cyclone Drilling. “It is important to optimize mobility because we cover such a large area,” he says.

Dealing with cold weather is also important, he observes. “We protect the rig floor from wind by putting the dog house and wind walls around it, then put heaters on the floor,” he says.

Like other contractors, Cyclone is expanding its fleet. “We built five rigs in 2010 and we are scheduled to build four more in 2011,” Hladky details. “They all have 1,600-horsepower pumps, with 270- and 500-ton AC top drives.”

Hladky says Cyclone tries to keep the rigs’ designs simple. “We engineer all the rigs similarly,” he adds. “Even if they are different sizes or different applications, the basics are all the same. That lets employees move from rig to rig efficiently and safely.”

In the Bakken Shale, Continental Resources is drilling four-well pads. By drilling and casing all four surface holes, then all four intermediate holes and finally all four laterals, the company reduces the number of times it needs to change the mud type and drill pipe. Continental says this process reduces drilling costs as much as 10 percent.

Like the other drilling contractors, Hladky stresses the importance of good people. “A high-spec rig is nothing without good people,” he declares. “We are drilling with mechanical rigs built in the 1980s and 1990s with good people right next to and as efficiently as high-spec rigs.

Cyclone Drilling also trains hands on site through a mobile training center, Hladky reports. He adds that the company hired Afterburner, a leadership consultant, to help its supervisors and managers promote safety and efficiency. “We are seeing results from that already,” he reports, noting that Afterburner emphasizes focusing leaders on teaching, rather than policing.

Pad drilling has a long and successful history in the Rockies and has spread to basins across the United States, Hladky points out. “It creates efficiencies for drilling times and costs, as well as environmental benefits. The pad is only disturbing the land in one area, even though it allows several wells to be drilled, completed and produced from that one surface site.”

Cyclone skids its rigs with hydraulic feet rather than rails because rigs can get slightly off target each time they move from one well to the next. “If you are on a rail system, the error is difficult to deal with. A walking rig can move in any direction needed to position exactly over the well bore,” he says.

On pads with several gas wells, Hladky says the operator can do simultaneous operations. “As we are drilling one well, he can set up his frac crews on a different location and pipe fluids to the pad to complete a well or put wells on production. That lets the operator get a return on the investment without waiting for the entire pad to be completed.”

On other pads, Hladky says Cyclone advocates batch drilling. “In this case, we drill all of the well’s surface holes as a batch, then drill all of the intermediate sections, and conclude with drilling all the laterals,” he says. “Instead of swapping mud systems several times for each well, we can use the same mud system and tools over and over.”

In addition to reducing the amount of time directional drilling companies need to be on site, that approach makes life easier for the crew. “They are not changing hole sizes or changing well parameters,” Hladky explains. “The repetition creates efficiencies. More than likely, your last well will be faster than your first one.

Continental Resources has used batch drilling to great effect in the Bakken, reports Glenn Cox, the company’s northern drilling manager. He says the company is using four-well pads, with two wells on each pad targeting the Middle Bakken interval and two targeting the Three Forks formation.

“We started looking at these pads primarily from a surface usage viewpoint,” Cox says. “Since the terrain in North Dakota can be difficult, we wanted to reduce the number of pads, handling facilities, power lines, and pipelines we had to build. As we dug into the process, we began to ask if we would save any money beyond the cost of building the location and moving the rigs. The batch process provided the cost savings that gave us the impetus to keep working on the project.”

To use pad drilling to full effect, Continental had to overcome a hurdle: North Dakota’s setback laws. “Setbacks from the lease line were normally 500 feet,” Cox recalls. “When we drill a well, the curve radius is 450 feet. The drilling location is roughly 150-200 feet from the section line, so once we drill the curve and set the casing, we have achieved the required setback.”

As of mid-March, Continental had drilled seven pads. The batch drilling process and pad construction savings reduce the cost of drilling each well as much as 10 percent, enough to save the company $2.5 million for each pad, Cox says. He adds that the process reduces surface impacts by as much as 75 percent.

To explain the process’s economic and environmental benefits to investors, Continental dubbed it ECO-Pad® and produced a video, which is now available on its website. “It’s been amazing how many people have watched the video and asked to show it to others,” says Brian Engel, Continental’s vice president of public affairs. “The walking rig is something almost no one has seen before, especially in the investor community.”

As drilling contractors build their fleets and train employees, equipment manufacturers are coming up with better ways to design and manufacture components. These include downhole motor manufacturers. “We are dedicating significant resources toward boosting overall motor performance, with specific focus on increased power and equipment reliability,” says Mpact Downhole Motors Vice President David Stuart.

From the field to the office, equipment manufacturers are working with operators and service companies to improve drilling efficiency. For example, they are developing mud motors that can support higher rates of penetration without sacrificing reliability, as well as solids control equipment that offers greater efficiency and flexibility.

To maximize reliability, Stuart says manufacturers are designing downhole motors that can operate under increasingly higher loads. In addition, they must ensure motors are designed to be compatible with ever-changing drilling conditions. “Drilling motors have to be designed and calibrated for each specific application to compensate for changes in temperature and other downhole conditions, which will cause the components to expand and contract during drilling,” Stuart remarks.

Even with the best motors, Stuart advises operators to stay within the motors’ optimum operating parameters. “The drilling motor is similar to an engine in a car,” Stuart says. “You can run it at the red line on the tachometer and go really, really fast for a short time, but if you run that hard for a long time, the engine is going to have problems.”

The ideal operating range varies with motor sizes and configurations, Stuart says. “Experience goes a long way in determining the right range, and it comes not only from the drilling motor provider, but also from the service companies and operators. Collaboration among the three is important for efficient drilling operations,” he advises.

No matter how hard operators push their equipment, the fundamental goal of fluids handling systems remains the same: keeping the drilling mud in good condition. But with the cost of drilling fluid additives and oil-based mud on the rise, KEM-TRON Technologies President Michael Rai Anderson says it is becoming increasingly beneficial to manage mud through solids control treatment systems. “Fluids handling companies have responded,” Anderson states. “We are finding ways to remove contaminants from the drilling mud while recovering as much usable material as possible.”

Drilling contractors are expanding their fleets to accommodate growing demand for high-horsepower land rigs equipped with powerful mud pumps, heavy-duty drawworks, closed-loop mud systems, automated rig floor equipment and ‘smart’ data management systems. As with this 1,500-horsepower electric rig, these new high-spec units often are fitted with top drives to rotate the drill string to optimize drilling efficiency and reduce the chance of pipe sticking while coming out of long horizontal laterals.

Anderson says several developments will help with that effort, including a new shaker that enables the operator to vary the gravitational force imparted between three and eight gravities. “Being able to fine-tune the shaker to the solids load will help operators get a better cut and reduce screen consumption,” Anderson says. “High G-forces can be used during top-hole drilling, when solids loading is high, and lower G-forces can be used when solids loading drops. This improves residence time and ultimately solids cut.”

Vertical cutting dryer technology also is improving, Anderson indicates. “We are working on new chemical injection techniques to break the surface tension between oil-based drilling fluids and the cuttings. This lowers the energy required to separate the fluid from the cuttings.”

A typical cuttings dryer can reduce the amount of drilling fluid on the cuttings from 15 percent to 5 percent, Anderson says. “With chemical injection enhancement, we may be able to bring that down to 1 percent,” he reports.

To help centrifuges separate water and cuttings, operators often add coagulants and flocculants to the drilling fluid before it reaches the centrifuge, Anderson notes. Ideally, the coagulant neutralizes the suspended solids’ electrical charge. Once that happens, the flocculants’ electrical charge will attract the solids and bind them, which will keep them from mixing with the water in the centrifuge. This makes the centrifuge more effective, Anderson explains.

“Getting hydration right can be tricky,” Anderson says. “The coagulants and flocculants typically used to dewater drilling fluid have long, fragile chains, so they are sensitive to high mechanical shear forces and temperatures. Low pressure is also a concern; it increases residence times.”

Latshaw Drilling’s Trent Latshaw says improvements in rig designs, downhole motors, and fluids handling equipment are only a small part of a larger effort to improve drilling efficiency. “Polychrystalline diamond compact bits, measurement-while-drilling tools and rotary steerables will continue to be major drivers,” he predicts.

“The world has changed with respect to domestic exploration, drilling, and production,” he says. “Unconventional development has expanded the United States’ oil and gas reserves dramatically, but it also has increased the complexity of the technology needed to drill, log, and complete a well.

“Total well drilling, completion and construction costs range from $7 million to $8 million in many of the established shale plays, particularly for wells with ultralong laterals.” he says. “In the Granite Wash, drilling and completing a well can carry a price tag exceeding $8 million. Given these costs, it is imperative for operators and contractors to be aware of the latest technology.”

The following is a list of seasonal work gear worn by drilling rig workers. Savanna supplies rig employees with coveralls, hard hat, safety glasses & impact gloves (1 pair).

Drilling rig crews are generally made up of six (6) people: Rig Manager, Driller, Derrickhand, Motorhand, Floorhand, and Leasehand. Each crew works 12 hours shifts as the rig operates 24 hours per day, and each position is vital to the operation of the rig.

Work in the oil and gas services industry is seasonal. Because of the weight of rigs and their equipment, and the remote location of wells, these locations are often only accessible when the ground conditions can tolerate heavy loads. Therefore, wells are typically drilled and serviced in the winter when the ground is frozen solid, or in the summer, when the ground has thawed and dried sufficiently. During the spring and fall, when the ground is in a transitional state, it is too soft to move equipment on and easily damaged. For this reason, provincial governments implement “road bans” prohibiting heavy loads from operating in certain areas. During this time, rig work is slower, and many rigs are shut down and their crews sent home. Be prepared to be off for anywhere from 6 to 12 weeks without pay during this time. However, rigs that are shut down are usually in need of maintenance, and there may be opportunities for employees who would like to help in this regard. Employees may be eligible for Employment Insurance benefits during seasonal shutdowns.

To work on a drilling rig, you must be able to get to and from all of your work locations. As drilling often occurs in remote areas, having reliable transportation is considered mandatory for non-camp locations. Drilling rigs commonly operate 24 hours per day, 7 days per week with either three crews working 8 hour shifts or two crews working 12-hour shifts. Most often day crews and night crews will alternate weekly, so each crew has a chance to work during both the day and night. Most crews will work 14 days straight with 7 days off in-between. The typical living situation while working falls into three categories: Non-Camp, Full Camp and Texas Camp.

Non-Camp: When the rig site is near a town, non-camp conditions normally apply. Crews will stay in hotel rooms and receive a per day living allowance for food and accommodation. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and accommodation out of your own pocket.

Full-Camp: When a rig site is in a remote location, crews may stay in a full camp. In a full-camp all food and full accommodation is provided. Once at the camp, the crew travels to and from the rig in the crew truck. Almost all camp work is available in the winter only.

Texas Camp: These camps are typically located nearby the rig location. Crews are responsible for supplying their own bedding, cooking supplies, groceries and toiletries. While staying at a texas camp, a daily allowance is provided for food and toiletries. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and toiletries out of your own pocket.

Once you have completed your orientation, you will immediately receive any other necessary training. This involves Workplace Hazardous Materials Information System (WHMIS) and Transportation of Dangerous Goods (TDG), along with an in-depth General Safety Orientation. This training is mandatory and provided by Savanna at no cost to the employee. Job-related, hands on training is conducted in the field through Savanna’s Rig Mentoring Program.

While it is not mandatory to have this certification, each service rig crew is required to have two members who are certified in Standard First Aid with CPR level C. Therefore, obtaining a certification beforehand is a great way to improve your chances of being hired.

A wide variety of oilfield workover rig options are available to you, You can also choose from diesel, electric and gasoline oilfield workover rig,As well as from energy & mining, construction works , and manufacturing plant. and whether oilfield workover rig is unavailable, 2 years, or 3 months.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

8613371530291

8613371530291