workover rig vs drilling rig pricelist

Workover Rig is available for both onshore as well as offshore Workover purposes at affordable prices. There are a number of companies that manufacture the Workover Rig as well as Rig packages that are required for different kinds of drilling jobs and meet the standards that have been set by the American Petroleum Institute or the API. The Rig packages are shipped worldwide. The rigs are included other than the simple Workover and they include the following:

Workover Rig is known as the Workover the different types of rigs include the offshore and onshore Rig that range from 150 horsepower to 1000 horsepower. Workover rigs have a surface depth that is equipped with diesel engines and transmissions and is available from 8000 ft to 30000 ft. Workover rigs contain a full line of drilling packages. Rig takes into account the skid mounted drilling rigs and the ones that are trailer mounted. Workover skid mounted drilling rigs incorporate the diesel-electric AC/VFD or the DC/SCR drive rigs, mechanical drive rigs and the combination drive Rig that ranges from 1000 horsepower to 6000 horsepower; while the trailer mounted Rig ranges from 450 horsepower to 1000 horsepower.

A lot of Workover Rig uses the double telescopic mast with the help of a single mast and is operated by wide wheel base axels, high strength steel beam, low cross section tires, dual pipeline brakes as well as hydraulic assist steering for the Workover. Rig mast is a double section type and uses a telescopic mast for dual safety protection. The gear shift and throttle of the engine can be remote controlled.

Workover types of Rig are available in the form of the single drum as well as the double drum. The groove ensures the alignment of in place as well as for long life. The optional Workover accessories for the auxiliary brakes include air thrust disc type clutch, brakes for the braking of the main drum, forced water circulating cooling with the brake rims as well as the optional brakes. Workover rigs are centrally controlled with electricity. The other kinds of drilling equipment include drilling equipment, triplex mud pumps, well control equipment; solids control equipment, oil control tubular goods and quality equipment. Work over rigs run casing tools and clean outs inside and outside a hole already drilled.

Each day on the rig comes with hard manual labor for many workers, sometimes including night shifts on the 24-hour operation. Two straight weeks at sea can be a harrowing experience for many, although some rigs are equipped with impressive living quarters for the crew.

Rig Crew and Schedule Drilling rig crews are generally made up of six (6) people: Rig Manager, Driller, Derrickhand, Motorhand, Floorhand, and Leasehand. Each crew works 12 hours shifts as the rig operates 24 hours per day, and each position is vital to the operation of the rig.

A workover is a complex maintenance task that involves pulling completion hardware out of a well in order to extend the life of the well. A workover rig is a specially designed rig that makes it easier to take out or insert tubing into a well. To complete a well servicing, the well is first killed.

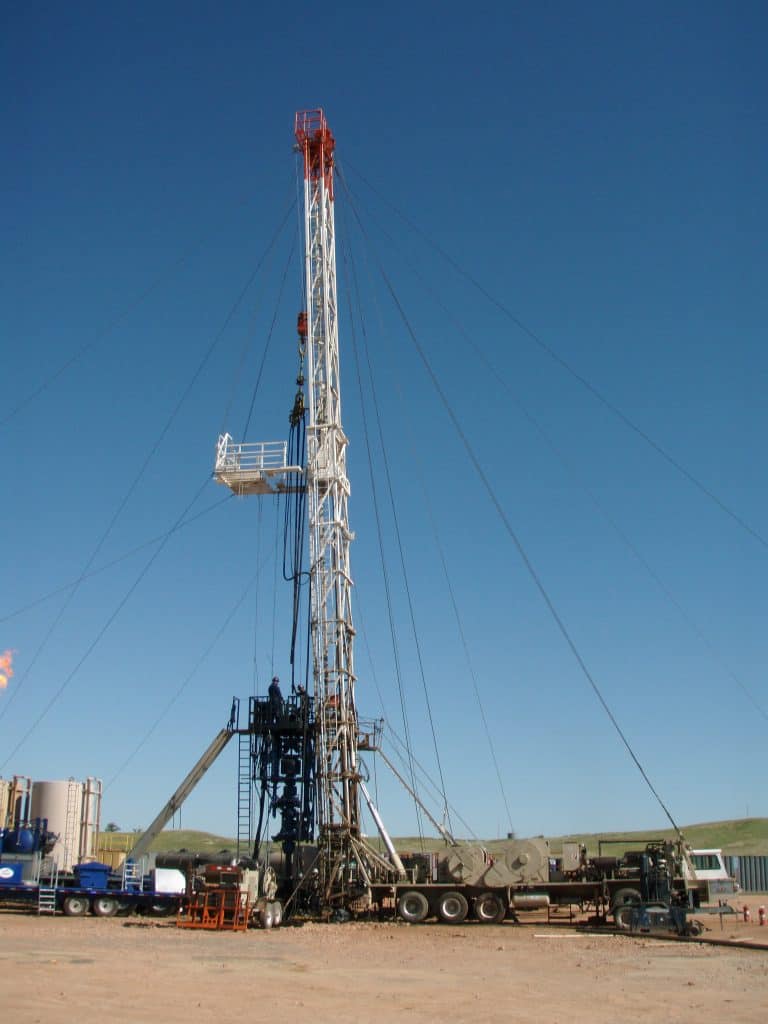

Workover rigs are very similar to drill rigs in that they are truck-mounted mobile rigs that travel between job sites on public roads. However, these machines are generally located at the job site for weeks before relocating to a different location.

Regular safety training is conducted before and during employment. Oil rig workers have an 8-12 hour shift with breaks for food in the morning, noon and night. One might have to do night shifts since this industry operates 24 hours a day and seven days a week.

The term workover is used to refer to any kind of oil well intervention involving invasive techniques, such as wireline, coiled tubing or snubbing. More specifically, a workover refers to the expensive process of pulling and replacing completion or production hardware in order to extend the life of the well.

Workover operations mean the work conducted on wells after the initial well-completion operation for the purpose of maintaining or restoring the productivity of a well. Well completion/well workover means those operations following the drilling of a well that are intended to establish or restore production.

Even accounting for inflation, it’s a huge jump for the 45-year-old American. Salaries on oil rigs have soared because of a global boom in offshore drilling. Managers and workers are scarce in this specialised industry, where the work is intense and the job involves living on a platform in remote seas for weeks.

Unfortunately, a cell signal booster won’t help improve cell phone connectivity on most offshore rigs because these structures are typically too far away from the nearest cell phone towers. That said, there is something you can get to make your workers’ stay on the platform more enjoyable.

Snubbing Unit Applications In essence, a snubbing unit is a hydraulic rig that can do everything a rig can do, plus it can perform under pressure in an under balanced live well state. This is especially critical to the operators in the Haynesville Shale, which is known for HPHT wells.

Keeping an oil rig operational for 24 hours a day means that it’s crucial for offshore personnel to be at the top of their game at all times; generally alcohol and non-prescription drugs are completed banned.

While on the job, workers are required to wear hard hats, safety glasses, coveralls and safety boots. Interestingly enough, smoking is not banned on offshore oil rigs, but smokers must be careful to smoke only in the designated areas to avoid any explosions. The offshore rig offers a unique commute experience.

Drilling rigs come in three sizes: singles, doubles and triples. These categories refer to how many lengths of pipe can stand in the rig’s derrick. On a single, the derrick holds one length of pipe. A double holds two, and a triple holds three.

Workover Rig is known as the Workover the different types of rigs include the offshore and onshore Rig that range from 150 horsepower to 1000 horsepower. Workover rigs have a surface depth that is equipped with diesel engines and transmissions and is available from 8000 ft to 30000 ft.

The HWO unit (Hydraulic Workover Unit) utilizes hydraulic cylinders to lift the tubular in- or out of the well. The use of hydraulic cylinders allows perfect control over tubular movements and eliminates the use of a large mast construction which is present on conventional drilling rigs.

Enjoy the best returns on your investment with these supreme workover rig price ranges at Alibaba.com. Their efficacy and reliability will prove that they’re worth their price tags. They will empower you to attain your mining and drilling goals and definitely surpass your expectations.

workover rig price options also include an air compressor, a mud pump, drilling rods of various sizes, connectors, and a drilling tower. Drilling is done using drill bits of various shapes, sizes, and compositions. You can choose between diamond bits, alloy ring-shaped bits, 3-wing alloy bits, PDC bits, and hammer bits. Each drill bit uses different drilling methods, including rotary, percussion, blast hole, and core drilling.

Are you looking for a wholesale workover rig price? Look no more as Alibaba.com has all sorts of pile drivers that will ease your next pile driving process. A pile-driving machine is critical equipment in constructing structures and buildings as it helps in driving piles into the soil. These piles help in providing foundation support for a structure or building under construction. In that way, you can comfortably move a load of the structure to a difficult depth without a machine. Regarding your liking workovers rig price, visit Alibcom.com as they have unlimited pile available at wholesale prices. Inther you are looking for pneumatic tools or hydraulic pipes, you will find them type at affordable prices. If you need a drill, it can advisable to have a workover r price.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

The cost for drilling and completion rigs plus the associated drilling tools can be a substantial fraction of the total drilling costs, particularly offshore. Properly estimating these costs for inclusion in an authority for expenditure (AFE) is important.

The first three cases used the same well design criteria and equipment (i.e., casing, mud, and logging—with the exception of the rig cost). Case 4 uses the same well in an offshore environment, resulting in the need for a jackup rig. As a result, it is easily seen that careful attention must be given to defining cost for the drilling rig and tools.

Moving the rig into the location before drilling the well and out of the location after it is completed can be a substantial cost item. Jack-up rigs require a fleet of tugboats, while drillships may be able to move themselves onto the location. Many states have published tariffs that specify the allowable trucking charges for various types of moves. Large land rigs are normally transported by truck to the location. Generally, IADC Type 3 and 4 rigs are sufficiently large that they must be transported piecewise by truck. Types 1 and 2 are usually truck-mounted rigs, which reduces the moving time and associated trucking requirements.

Procedures for estimating rig cost can be developed with the rig cost and average moving times. A survey of numerous drilling contractors showed that Type 1 and 2 rigs usually require approximately 4 days for move-in, rig-up, rig-down, and move-out. Type-3 and -4 rigs required 8 days for land and offshore rates, although the elements of this time value are different (i.e., land rigs are transported by truck while jackups are towed by boat).

The cost for move-in and move-out is estimated as the standby rig rate over the moving time (4 or 8 days). The standby rate is slightly less than the day rate for drilling and may include support services, such as crewboats, that would be required for normal drilling operations. This method for estimating the rig moving costs is effective and reasonably accurate. It is not useful, however, in unusual circumstances, such as overseas rig moves and drillsites, requiring helicopter transportation.

Many operators prefer to drill on a footage or turnkey basis. The drilling contractor provides a bid to drill the well to a certain depth, or until a certain event, such as encountering a particular formation, kickoff point, or geopressure. Footage contracts may call for drilling and casing a certain size hole through or to the expected pay zone. Contract clauses may allow reversion to day work (flat rate per day), if a marked increase in drilling hazards (loss of circulation, kick, etc.) occurs. For example, ABC Oil Co. may contract XYZ Drilling Co. to drill a well to 10,000 ft for a flat fee of U.S. $27.50/ft. The drilling company is responsible for all well operations until the contracted depth is reached.

The footage contract defines cost responsibilities for both parties. The operator may pay for all pipe, cement, logging, and mud cost. The contractor is responsible for all rig-associated costs such as move-in and move-out, drilling time, and bits. At the target depth or operation, all costs and operational responsibilities revert to the operator.

This contract arrangement can offer significant advantages to both parties. Operators are not required to staff a drilling department for drilling a single well or a few wells. The drilling contractor, with proper bid preparation and efficient drilling practices, can gain a greater profit than while on straight day-work rates. Possible problem areas for the drilling contractor include:

Perhaps the most common drilling contract is the day-work rate. The contractor furnishes the rig at a contracted cost per day. The operator directs all drilling activities and is responsible for the well-being of the hole. The rig may be with or without crews or drillpipe. In addition, options such as high-pressure blowout preventers (BOPs) or sophisticated solids-control equipment required by the operator must be furnished at his own expense.

Rig selection and cost depend on the well. Although rigs are often rated by their capability to drill to a certain depth, the controlling criterion is usually the casing-running capability (i.e., derrick and substucture capacity). A rig rated for 18,000 ft of drilling may not be capable of running 15,000 ft of heavy 9⅝-in. casing. Therefore, the well plan must be developed and analyzed before rig selection.

Rig costs vary considerably and are dependent on items such as supply and demand, rig characteristics, and standard items found on the rig. Results of a study to compare U.S.-operated rig costs are shown in Fig. 2. The guidelines were the rig’s derrick and structure capacity and disregarded items such as optional equipment that might otherwise be rented for lesser rigs. An interesting point on the illustration is that the over-supply rig costs were reasonably equal regardless of the rig size (i.e., U.S. $6,000 vs. $9,500/day for small to very large rigs).

Standby rates for drilling rigs usually range from U.S. $200 to $500/day less than the amounts shown in Fig. 2. The rates include crews and drillpipe. The costs are used to estimate move-in and move-out charges.

Drilling contracts are either inclusive or exclusive of fuel on the rig. This major contract policy change occurred in the late 1970s when fuel charges increased from $0.20 to $1.20/gal.

Fuel usage is dependent on equipment type and rig. Fuel consumption rates were evaluated in the study previously described for rig cost rates. The results are shown in Fig. 3. The average consumption rate is evaluated as a function of the rig size measured by its ability to run casing.

Water can be supplied in three ways. A shallow water well can be drilled. This method is common in most land operations, but it is not feasible offshore or with deepwater tables on land. Water can be transported to the rig by means of truck, pipelines, barges, or boats. In addition, offshore rigs can use seawater.

Polycrystalline bits are a staple in the drilling industry. Their physical structure, drilling performance, and cost are significantly different from roller-cone or diamond bits. Sample costs for these bits are shown in Table 2.

A completion rig is a small workover rig that costs considerably less than a large drilling rig. Operators often use these rigs when the completion procedures are expected to require significant amounts of time. The drilling rig is used until the production casing is run and cemented.

Costs for completion rigs can be determined from Fig. 2. Tubing or small drillstring load requirements are used instead of casing capacity. Economic decisions to use a completion rig must also consider the cost of the rig moving onto the location, as well as the daily-rate differences between the drilling and completion rigs.

Independent producers and operators ramping up shale exploration and development programs are pushing the limits of conventional drilling equipment. Whether they are drilling multiple long-lateral horizontal wells from single pads, testing new bits and mud motors to boost penetration rates, or deploying next-generation rig floor and automation systems to slash “spud to sales” times, independents and their service company partners continue to find ways to improve resource play economics and crack the unconventional drilling frontier wide open.

Goodrich Petroleum is a case in point. Over the past two years, the company has transitioned from vertical Cotton Valley wells to horizontal wells in the Cotton Valley and the underlying Haynesville Shale. To unlock the shale’s vast potential, the company worked with its partners and service providers to discover the right casing points and to choose bottom hole assemblies that could build at sufficient rates to maximize lateral lengths, reports Clarke Denney, the company’s vice president of drilling. He notes that in the Haynesville Shale, Goodrich is utilizing robust directional equipment and mud cooling units to drill laterals at vertical depths of 15,000 feet, where circulating temperatures can reach upward of 340 degrees Fahrenheit.

With oil prices trading much higher than natural gas on a Btu equivalent basis, Goodrich also is targeting the oil window of the Eagle Ford Shale. In South Texas, the company is drilling wells with vertical depths between 6,500 and 8,500 feet and lateral lengths from 4,500 to 6,000 feet. Although these wells take skill, time, and money to plan and construct, company officials say they believe they can achieve 50 plus percent returns on investment.

Drilling wells in either play requires rigs with the right equipment, says Denney. He says top drives are important because they allow pumping and rotating the drill string while coming out of the hole, which is necessary at times for hole cleaning. This reduces drag and the chance of getting stuck. Top drives also maximize directional drilling performance.

Drawworks that can deliver at least 1,500 horsepower are also key, Denney adds. “We believe in high horsepower,” he stresses. “A 1,500-horsepower rig carries a premium over a 1,000-horsepower rig, but it speeds trips and puts less strain on the equipment. We get our money’s worth.”

Just as important as the drawworks and top drive is having powerful mud pumps on the rig, Denney says. “In the Eagle Ford, we would prefer to have at least 1,600-horsepower pumps, especially when drilling long laterals,” he relates. “That horsepower is needed for mud hydraulics to keep the hole clean, and to drive the downhole motor and other equipment. We have achieved up to 6,000-foot laterals to date, and we are targeting 9,000-foot long laterals in the near future.”

In many cases, it makes sense for the rig to have the ability to skid, Denney says. He explains that drilling multiple horizontal well bores on one pad reduces construction costs and rig transit times. “In the Eagle Ford, if we can skid, our drilling costs can be reduced as much as $500,000 a well,” he says.

Goodrich Petroleum is far from the only company that needs “high-spec” rigs with powerful top drives, hoisting systems and pumps. According to industry sources, rigs with larger (+1,000) horsepower ratings account for an estimated 60 percent of the active rig fleet. Moreover, rigs with at least 1,000 horsepower account for nine of every 10 rigs that are under construction or planned for the near future.

With its operational focus transitioning from the Cotton Valley trend to the Haynesville Shale, and more recently to the Eagle Ford Shale, Goodrich Petroleum is achieving consistent production and reserve growth through horizontal drilling with high-spec land rigs and advanced downhole tools. Even during the economic recession of 2009, the company increased average net daily production 24 percent and proved reserves 5 percent. Over the past four years, it has more than doubled its daily production while expanding its reserves 30 percent.

Trent Latshaw, the founder and head of Latshaw Drilling in Tulsa, can verify that the demand for 1,000-2,000 horsepower rigs is high. He says the company’s fleet, which includes 15 rigs within that range, has 100 percent utilization. In fact, Latshaw reports that the only unused rig his company has on the books is a new, 1,700-horsepower diesel electric that is still under construction.

Many of today’s high-spec rigs have closed-loop mud systems, Latshaw notes. “Closed-loop mud systems do away with the need for a reserve pit,” he says. “The systems also processes drilling fluid more efficiently. They are able to take more solids from the drilling fluid, which enables more fluid to be reused and makes the solids dryer and easier to dispose of. That becomes very important when dealing with oil-based mud, which often is used in horizontal wells.”

Latshaw encourages operators to consider using high-horsepower rigs when the class they want is difficult to obtain. “We consider our 2,000-horsepower rig to be identical to our 1,500-horsepower rigs, except for the drawworks size and the mast/substructure capacity,” he says. “The 2,000-horsepower rigs have the same footprint and move as fast as the 1,500-horsepower units, and for all practical purposes, the day rates are the same.”

He also says diesel-electric SCR rigs are comparable to AC rigs. “They have the same top drives, the same mud pumps, the same mud systems, the same engines, and the same blowout preventers,” he reports. “From the customers’ perspective, they drill wells as fast as AC rigs.”

In reference to safety, Latshaw says people matter more than technology. “You can try to design a piece of equipment that is accident proof, but safety comes down to the people on the rig floor and what their mindsets are,” he insists. “We are putting more money into training, beefing up our safety department, and having more safety coaches go around the rigs to work with the hands.”

He points out that many rigs, including several of Latshaw Drilling’s units, use automated iron roughnecks to improve safety. “Those are expensive, high-maintenance pieces of equipment,” he says. “We decided to take some of them off our rigs, then track closely to see if we had more finger and hand accidents on the rigs using manual tongs and a drill pipe spinner versus the rigs that had iron roughnecks. We have not seen a difference.”

For Joe Hudson, the president of Nabors Drilling USA, the future looks bright. “We have at least 103 AC rigs deployed at this point,” he reports. “We are in the process of building 25 more, and we always are looking for opportunities to expand further, be it in the Bakken, the Mid-Continent, West Texas, the Eagle Ford, or the Marcellus.”

Hudson says the new rigs include larger pumps, AC top drives, and tubular handling tools such as automatic catwalks and floor wrenches. “With the automatic catwalk, there is no need for a rig hand to pick pipe off the catwalks, pull it up with a hoist, and drag it to the rig floor,” he says. “Instead, the catwalk picks up pipe and elevates it to the rig floor. No one is touching the pipe or rolling pipe onto the catwalk, which keeps people away from tubulars, reducing the risk of pinch-point injuries.”

The rigs also employ advanced software. “With conventional rigs, the driller would drill ahead with a hand on the brake handle. He had only basic drilling information available to him, and his skill and his experience with the area dictated his ability to drill the well,” Hudson recalls. “Today, the software associated with smart drilling systems allows him to drill the well with a better understanding of the factors that influence drilling performance, such as delta P, hydraulic horsepower, weight on bit and rate of penetration. That translates to a faster rate of penetration.”

To ensure that its employees work as safely and efficiently as possible, Nabors has fully functional training rigs in Williston, N.D., Casper, Wy., and Tyler, Tx., where it trains personnel with no previous experience, Hudson reports. He adds that the company carefully defines the training and competency individuals need to be promoted.

The newest generation of high-spec land rigs purpose-built for horizontal drilling in unconventional resource plays features integrated subsystems to automate key processes such as pipe handling. Automated catwalks and floor wrenches not only increase operating efficiency, but also improve rig floor safety and extend pipe longevity by reducing handling damage.

When downturns do occur, Nabors tries to keep competent people and trainers on staff, Hudson says. By doing so during the last economic downturn, he says the company managed to go from 92 rigs in fall 2009 to 190 rigs today without compromising its personnel or safety standards.

Regardless of the market condition, Hudson says it is vital to design rigs for specific areas. “Every area is unique,” he says. “Carrying the top drive in the mast is a great way to reduce the number of loads needed, but in areas where road weights are critical, other approaches have to be adopted.”

To illustrate regional developments, Hudson points to Nabors’ B-series rigs, which were designed to accommodate pad drilling in the Bakken Shale. “We built a box-on-box substructure because we can close in that substructure, which makes it easier to winterize,” Hudson says. “Also, the way we can rotate the substructure lets the company conduct completion and production-related operations on one well while we are drilling another on the same location.”

In the Rocky Mountains, mobility is vital, says Patrick Hladky, a principal and contract manager for Rockies-focused Cyclone Drilling. “It is important to optimize mobility because we cover such a large area,” he says.

Dealing with cold weather is also important, he observes. “We protect the rig floor from wind by putting the dog house and wind walls around it, then put heaters on the floor,” he says.

Like other contractors, Cyclone is expanding its fleet. “We built five rigs in 2010 and we are scheduled to build four more in 2011,” Hladky details. “They all have 1,600-horsepower pumps, with 270- and 500-ton AC top drives.”

Hladky says Cyclone tries to keep the rigs’ designs simple. “We engineer all the rigs similarly,” he adds. “Even if they are different sizes or different applications, the basics are all the same. That lets employees move from rig to rig efficiently and safely.”

In the Bakken Shale, Continental Resources is drilling four-well pads. By drilling and casing all four surface holes, then all four intermediate holes and finally all four laterals, the company reduces the number of times it needs to change the mud type and drill pipe. Continental says this process reduces drilling costs as much as 10 percent.

Like the other drilling contractors, Hladky stresses the importance of good people. “A high-spec rig is nothing without good people,” he declares. “We are drilling with mechanical rigs built in the 1980s and 1990s with good people right next to and as efficiently as high-spec rigs.

Cyclone Drilling also trains hands on site through a mobile training center, Hladky reports. He adds that the company hired Afterburner, a leadership consultant, to help its supervisors and managers promote safety and efficiency. “We are seeing results from that already,” he reports, noting that Afterburner emphasizes focusing leaders on teaching, rather than policing.

Pad drilling has a long and successful history in the Rockies and has spread to basins across the United States, Hladky points out. “It creates efficiencies for drilling times and costs, as well as environmental benefits. The pad is only disturbing the land in one area, even though it allows several wells to be drilled, completed and produced from that one surface site.”

Cyclone skids its rigs with hydraulic feet rather than rails because rigs can get slightly off target each time they move from one well to the next. “If you are on a rail system, the error is difficult to deal with. A walking rig can move in any direction needed to position exactly over the well bore,” he says.

On pads with several gas wells, Hladky says the operator can do simultaneous operations. “As we are drilling one well, he can set up his frac crews on a different location and pipe fluids to the pad to complete a well or put wells on production. That lets the operator get a return on the investment without waiting for the entire pad to be completed.”

On other pads, Hladky says Cyclone advocates batch drilling. “In this case, we drill all of the well’s surface holes as a batch, then drill all of the intermediate sections, and conclude with drilling all the laterals,” he says. “Instead of swapping mud systems several times for each well, we can use the same mud system and tools over and over.”

In addition to reducing the amount of time directional drilling companies need to be on site, that approach makes life easier for the crew. “They are not changing hole sizes or changing well parameters,” Hladky explains. “The repetition creates efficiencies. More than likely, your last well will be faster than your first one.

Continental Resources has used batch drilling to great effect in the Bakken, reports Glenn Cox, the company’s northern drilling manager. He says the company is using four-well pads, with two wells on each pad targeting the Middle Bakken interval and two targeting the Three Forks formation.

“We started looking at these pads primarily from a surface usage viewpoint,” Cox says. “Since the terrain in North Dakota can be difficult, we wanted to reduce the number of pads, handling facilities, power lines, and pipelines we had to build. As we dug into the process, we began to ask if we would save any money beyond the cost of building the location and moving the rigs. The batch process provided the cost savings that gave us the impetus to keep working on the project.”

To use pad drilling to full effect, Continental had to overcome a hurdle: North Dakota’s setback laws. “Setbacks from the lease line were normally 500 feet,” Cox recalls. “When we drill a well, the curve radius is 450 feet. The drilling location is roughly 150-200 feet from the section line, so once we drill the curve and set the casing, we have achieved the required setback.”

As of mid-March, Continental had drilled seven pads. The batch drilling process and pad construction savings reduce the cost of drilling each well as much as 10 percent, enough to save the company $2.5 million for each pad, Cox says. He adds that the process reduces surface impacts by as much as 75 percent.

To explain the process’s economic and environmental benefits to investors, Continental dubbed it ECO-Pad® and produced a video, which is now available on its website. “It’s been amazing how many people have watched the video and asked to show it to others,” says Brian Engel, Continental’s vice president of public affairs. “The walking rig is something almost no one has seen before, especially in the investor community.”

As drilling contractors build their fleets and train employees, equipment manufacturers are coming up with better ways to design and manufacture components. These include downhole motor manufacturers. “We are dedicating significant resources toward boosting overall motor performance, with specific focus on increased power and equipment reliability,” says Mpact Downhole Motors Vice President David Stuart.

From the field to the office, equipment manufacturers are working with operators and service companies to improve drilling efficiency. For example, they are developing mud motors that can support higher rates of penetration without sacrificing reliability, as well as solids control equipment that offers greater efficiency and flexibility.

To maximize reliability, Stuart says manufacturers are designing downhole motors that can operate under increasingly higher loads. In addition, they must ensure motors are designed to be compatible with ever-changing drilling conditions. “Drilling motors have to be designed and calibrated for each specific application to compensate for changes in temperature and other downhole conditions, which will cause the components to expand and contract during drilling,” Stuart remarks.

Even with the best motors, Stuart advises operators to stay within the motors’ optimum operating parameters. “The drilling motor is similar to an engine in a car,” Stuart says. “You can run it at the red line on the tachometer and go really, really fast for a short time, but if you run that hard for a long time, the engine is going to have problems.”

The ideal operating range varies with motor sizes and configurations, Stuart says. “Experience goes a long way in determining the right range, and it comes not only from the drilling motor provider, but also from the service companies and operators. Collaboration among the three is important for efficient drilling operations,” he advises.

No matter how hard operators push their equipment, the fundamental goal of fluids handling systems remains the same: keeping the drilling mud in good condition. But with the cost of drilling fluid additives and oil-based mud on the rise, KEM-TRON Technologies President Michael Rai Anderson says it is becoming increasingly beneficial to manage mud through solids control treatment systems. “Fluids handling companies have responded,” Anderson states. “We are finding ways to remove contaminants from the drilling mud while recovering as much usable material as possible.”

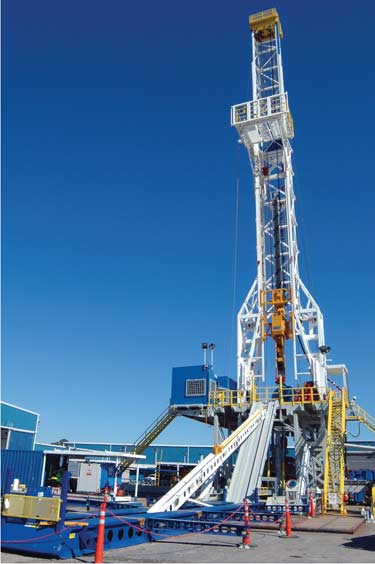

Drilling contractors are expanding their fleets to accommodate growing demand for high-horsepower land rigs equipped with powerful mud pumps, heavy-duty drawworks, closed-loop mud systems, automated rig floor equipment and ‘smart’ data management systems. As with this 1,500-horsepower electric rig, these new high-spec units often are fitted with top drives to rotate the drill string to optimize drilling efficiency and reduce the chance of pipe sticking while coming out of long horizontal laterals.

Anderson says several developments will help with that effort, including a new shaker that enables the operator to vary the gravitational force imparted between three and eight gravities. “Being able to fine-tune the shaker to the solids load will help operators get a better cut and reduce screen consumption,” Anderson says. “High G-forces can be used during top-hole drilling, when solids loading is high, and lower G-forces can be used when solids loading drops. This improves residence time and ultimately solids cut.”

Vertical cutting dryer technology also is improving, Anderson indicates. “We are working on new chemical injection techniques to break the surface tension between oil-based drilling fluids and the cuttings. This lowers the energy required to separate the fluid from the cuttings.”

A typical cuttings dryer can reduce the amount of drilling fluid on the cuttings from 15 percent to 5 percent, Anderson says. “With chemical injection enhancement, we may be able to bring that down to 1 percent,” he reports.

To help centrifuges separate water and cuttings, operators often add coagulants and flocculants to the drilling fluid before it reaches the centrifuge, Anderson notes. Ideally, the coagulant neutralizes the suspended solids’ electrical charge. Once that happens, the flocculants’ electrical charge will attract the solids and bind them, which will keep them from mixing with the water in the centrifuge. This makes the centrifuge more effective, Anderson explains.

“Getting hydration right can be tricky,” Anderson says. “The coagulants and flocculants typically used to dewater drilling fluid have long, fragile chains, so they are sensitive to high mechanical shear forces and temperatures. Low pressure is also a concern; it increases residence times.”

Latshaw Drilling’s Trent Latshaw says improvements in rig designs, downhole motors, and fluids handling equipment are only a small part of a larger effort to improve drilling efficiency. “Polychrystalline diamond compact bits, measurement-while-drilling tools and rotary steerables will continue to be major drivers,” he predicts.

“The world has changed with respect to domestic exploration, drilling, and production,” he says. “Unconventional development has expanded the United States’ oil and gas reserves dramatically, but it also has increased the complexity of the technology needed to drill, log, and complete a well.

“Total well drilling, completion and construction costs range from $7 million to $8 million in many of the established shale plays, particularly for wells with ultralong laterals.” he says. “In the Granite Wash, drilling and completing a well can carry a price tag exceeding $8 million. Given these costs, it is imperative for operators and contractors to be aware of the latest technology.”

workover rigs, onshore and offshore drilling workover rig packages meet the industry standards established by the American Petroleum Institute (API). As a global supplier of quality workover rigs to the oil and gas industry, we ship our workover rig packages around the world.

Besides workover rigs, we supply drilling rigs, top drives, triplex mud pumps, blowout preventers, BOP control systems, solids control equipment, oil country tubular goods, etc. Please visit our company website

Our product line includes offshore and onshore workover rigs, which range from 150 HP to 1,000 HP. The service depth of our workover rigs usually equipped with Caterpillar diesel engines and Allison transmissions is from 8,000 ft to 30,000 ft.

We supply a full line of drilling rig packages: skid-mounted drilling rigs, truck-mounted drilling rigs and trailer-mounted drilling rigs. Our skid-mounted drilling rigs include diesel electric AC/VFD or DC/SCR drive rigs, mechanical drive rigs, and combination drive rigs, from 1,000 HP to 6,000 HP. Our truck-mounted drilling rigs range from 450 HP to 1,000 HP.

You have the requirements, we have the rig. At our production base in China we design and develop oil, gas, and geothermal drilling rigs for drill depths ranging from 3,000 m to 9,000 m (3,000 ft-30,000 ft)—including special-purpose rigs such as our fast moving land rigs and deep temperature rigs.

Our extensive experience in the industry allows us build some of the most technologically advanced drilling rigs on the market and we regularly have new and refurbished drilling rigs for sale that can ship immediately.

A drilling rig is only as good as the components it is made of. As we manufacture most major rig components ourselves in China, we are in full of control of the quality of each part.

Production strictly conforms to API Q1 quality management requirements. Each rig component is manufactured according to its respective API standard, giving our skid mounted drilling rigs an excellent track record of consistent high quality.

Sovonex™ land rigs are turn-key rig packages that include all supporting rig systems such as the solid control and electronic control system. Several advanced mast and substructure designs are available to meet different drilling operation requirements.

Your drilling rig can be 100% made in China, or you can choose rig components from distinguished international suppliers as you like. By default, the following rig components are imported:Main diesel engines: Caterpillar

With every drilling rig we send technical staff to the drill site to provide first hand technical support. The engineer responsible for the rig is always part of the service crew. On-site training instructions include:Rig up

With a static hook load of 1,700 kN, our 750 hp land rig is equipped to reach a drill depth of 3000 m (9,840 ft) using 4-1/2” drill pipe. The maximum drill depth with a 5” drill string is 2500 m or 8200 ft.

Equipped with a 1000 hp drawworks and three 1,632 hp (1,200 kW) diesel engines from Caterpillar, our 1000 hp drill rig is your ideal choice for drilling depths of up to 4000 m (13200 ft).

With a maximum drilling depth of 5000 m (16400 ft), the 1500 hp rig is the most popular skid-mounted drilling rig. Powered by four 1,632 hp (1,200 kW) Caterpillar engines and equipped with two 2 × 1600 hp (1180 kW) mud pumps, a Sovonex™ 1500 hp drilling rig is well suited for a wide range of drilling operations.

With a static hook load of 4500 kN, our 2000 hp oil & gas drilling rig is idally suited for drilling medium to deep wells of up to 7000 m (23000 ft). Four powerful Caterpillar engines (1,632 hp/1,200 kW) and three 3 × 1600 hp (1180 kW) make sure your drilling operations are going smoothly.

Our 3000 hp electric drilling rig (either DC SCR or AC VFD) is specifically designed for deep well drilling operations of up to 9,000 m or 30,000 feet.

Special requirements require special solutions. At Elegant Technology we developed several special purpose drilling rigs that provide unique advantages in their designated area of operations:

The complete rig is mounted to a platform on wheels that can be moved by a track. No rig down necessary, the rig stays in ‘drill-ready’ mode all the time. Time needed for moving the rig and starting drilling the new well normally is only 24 hours.

Manufactured from low-temperature steel with thermal protection for all major equipment and the drilling crew, our fully winterized arctic drilling rig is ideally suited for operation in deep temperature environments. Mounted on a rail track for efficient drilling of cluster wells.

The September 23rd Baker Hughes rig count report shows the active rig count is steady. Baker Hughes reports 764 active drilling rigs in the US. One month ago, the total active rig count was 765, and one year ago, it was 521 rigs.

The oil rig count is currently 602 rigs, compared to 605 one month ago, and 421 one year ago. The gas rig count is 160, compared to 158 one month ago and 99 last September.

8613371530291

8613371530291