mud pump mfg free sample

My invention relates to valves of the character employed in mud pumps or other pumps adapted to pump fluid mixtures containing abrasive materials, and relates particularly to an improved form of such valve capable of longer periods of uninterrupted use than valves which are at present employed in pumps of this character.

Mud pump valves of the character to which my invention relates are subject to very rapid wear owing to the presence of abrasive materials, such -as fine particles of rocks, quartz, or sand contained in the drilling fluid or mud, and therefore must be replaced after comparatively short periods of use. Such valves ordinarily include a seat member consisting of an annular ring with a sealing seat near the upper end thereof and a spider structure across the lower portion thereof, and a valve element including a body of metal adapted to strike against the spider when the valve element is in lowered or relatively closed position and a sealing member on the metal body adapted to engage the sealing face of the seat member and prevent leakage of fluid through the valve when the valve is in its closed position. It is an object of my invention to provide a valve of the above character of simple construction yet being capable of giving a greater period of service than valves of complex structure.

It is a further object of the invention to provide a valve which may be used for abrasive subo5 stances and which may be also employed in pumps for circulating other fluids, such as crude oils.

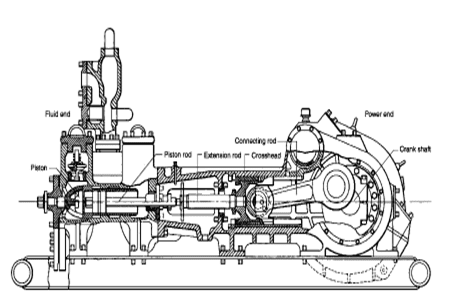

Further objects and advantages of the invention will be made evident throughout the following part of the specification. Referring to the drawings, which are for illustrative purposes only, Fig. 1 is a partly sectioned elevational view showing a mud pump equipped with valves embodying my invention. Fig. 2 is an enlarged fragmentary cross section showing one of the valves in closed position.

Fig. 6 is a fragmentary sectional view showing a form of my invention adapted for use in other types of pumps, such as oil pumps. Fig. 7 is a section on a plane represented by the line 7-7 of Fg. 2.

In Fig. 1 I show a reciprocating pump 10 having a pumping cylinder I in which a piston 12 is reciprocated by a steam powered engine 13. The rightward portion of the pump 10 is sectioned so as to show discharge valves 14 which are connected with the opposite ends of the cylinder II so that as the piston 12 is reciprocated, fluid will be forced upwardly from the respective ends of the cylinder into an outlet chamber 15 which in mud pumps is connected through a rotary hose to the rotary drilling string.

Above the spider 20 the annular wall 18 is formed with an annular sealing surface 24. This sealing surface is shown as preferably flaring outwardly and upwardly at a comparatively steep angle; or the sealing surface may have no taper but be cylindrical as will be later described with reference to Fig. 5, it being the steep angle of the sealing surface that greatly contributes to the improved operation and wear resisting qualities of my new valve. The valve body I1 is in the form of a metal enlargement 25 having a lower abutment area which includes abutment surfaces adjacent both"the axis and the periphery of said enlargement and adapted, when the valve is closed, to engage the upper face of the hub 22 and the radial arms 21 which constitute the spider. The abutment surface of the enlargement 25 which is adjacent the periphery thereof engages the abutment formed by the arms 21 adjacent and extending inwardly from the annular wall 18, and the abutment surface of the enlargement 25 which is adjacent the axis thereof engages the abutment formed by the hub 22 adjacent the axis of the valve. The enlargement is equipped with guide means in the form of upwardly and downwardly projecting axial stems 26 and 27 of Sthe character commonly employed in mud pump valves. On the upper face of the body IT is a sealing member 30 consisting essentially of a flat disc of yieldable material, such as rubber or rubber compound, having an opening 31 therein through which the stem 26 projects, the sealing member 30 being held in place on the body 1I by a flange member 32 which is held down against the upper face of the sealing member 30 by means of a pin 33 extended through the stem 26. The sealing member 30 is of such external diameter that it will enter the space enclosed by the surface 24 as the closure member T1 moves from the open position in which it is shown in Fig. 3 to the closed position in which it is shown in Fig. 2. As the member I7 moves to closed position fluid pressure within the chamber 15 is exerted downwardly against the annular upwardly directed surface 34 of the sealing member 30 exposed around the flange 32, such pressure compressing the rubber or yieldable material of the peripheralportion of the sealing member 30 against the upper face of the body 17 and causing the periphery of the sealing member 30 to be expanded or deformed radially outwardly so as to be confined within and radially contact the surrounding annular wall surface 24. The sealing member 30 is shown with a shallow peripheral groove 35 so as to form the semblance 7 of a lip 36, but for some uses satisfactory results may be obtained where the upper face of the sealing member 30 is left flat.

In Fig. 5 the wall surface 24a is shown cylindrical for a portion of its length and slightly flared at its upper end. In Figs. 2, 3, and 4, the wall surface 24 is shown comparatively steeply upwardly flared for the purpose of self-adjustment of the parts as the upper face of the support or spider wears down due to the repeated hammering of the body 17 thereagainst during the operation of the pump. Accordingly, in the preferred practice of my invention the wall surface 24 may have such a comparatively steep angle that the annular peripheral engagement surface of the sealing member is adapted to be radially expanded and confined within the annular wall surface 24, and moves relative to surface 24 in the direction of closing movement of the valve so as to permit ready dislodgement of abrasives rather than trapping the same between the surfaces 24-37; and the wall 24 may be flared at such a steep angle as to compensate for the wear between the surfaces 24 and 37 and between the bottom of the body 17 and the upper face of the support 20. As the stopping position of the body 17 moves downwardly as the result of the last named wear, the sealing member, which has worn slightly, assumes a stopping position relative to a lower portion of the wall surface 24 of slightly reduced diameter.

In Fig. 6 I show an alternative form of my valve having a seat member 16 of a form identical with the illustration thereof in Figs. 2, 3, and 4. In this form of the invention, however, the sealing member 30 is replaced by a dished or cupshaped sealing member 50 having a circular wall 51 and an upturned, slightly upwardly flared lip or wall 52 which provides an outer surface 53 adapted to enter the annular wall surface 24 and to be forced outwardly by fluid pressure against the upper and inner faces of the lip 52. The sealing member 50 may be made of leather and may be held in place on the body 17 by use of a flat metal disc 54 of a size to fit under the holddown flange 32. This alternative form of my invention isespecially designed for use in high pressure oil pumps or high pressure pumps for transferring other liquids. The same wiping action between the surfaces 24 and 53 of the members 16 and 50 may be accomplished, and the pounding effect due to the high pressure on the upper face of the movable valve part is received by the spider or support 20.

I’ve run into several instances of insufficient suction stabilization on rigs where a “standpipe” is installed off the suction manifold. The thought behind this design was to create a gas-over-fluid column for the reciprocating pump and eliminate cavitation.

When the standpipe is installed on the suction manifold’s deadhead side, there’s little opportunity to get fluid into all the cylinders to prevent cavitation. Also, the reciprocating pump and charge pump are not isolated.

The suction stabilizer’s compressible feature is designed to absorb the negative energies and promote smooth fluid flow. As a result, pump isolation is achieved between the charge pump and the reciprocating pump.

The isolation eliminates pump chatter, and because the reciprocating pump’s negative energies never reach the charge pump, the pump’s expendable life is extended.

Investing in suction stabilizers will ensure your pumps operate consistently and efficiently. They can also prevent most challenges related to pressure surges or pulsations in the most difficult piping environments.

When choosing a size and type of mud pump for your drilling project, there are several factors to consider. These would include not only cost and size of pump that best fits your drilling rig, but also the diameter, depth and hole conditions you are drilling through. I know that this sounds like a lot to consider, but if you are set up the right way before the job starts, you will thank me later.

Recommended practice is to maintain a minimum of 100 to 150 feet per minute of uphole velocity for drill cuttings. Larger diameter wells for irrigation, agriculture or municipalities may violate this rule, because it may not be economically feasible to pump this much mud for the job. Uphole velocity is determined by the flow rate of the mud system, diameter of the borehole and the diameter of the drill pipe. There are many tools, including handbooks, rule of thumb, slide rule calculators and now apps on your handheld device, to calculate velocity. It is always good to remember the time it takes to get the cuttings off the bottom of the well. If you are drilling at 200 feet, then a 100-foot-per-minute velocity means that it would take two minutes to get the cuttings out of the hole. This is always a good reminder of what you are drilling through and how long ago it was that you drilled it. Ground conditions and rock formations are ever changing as you go deeper. Wouldn’t it be nice if they all remained the same?

Centrifugal-style mud pumps are very popular in our industry due to their size and weight, as well as flow rate capacity for an affordable price. There are many models and brands out there, and most of them are very good value. How does a centrifugal mud pump work? The rotation of the impeller accelerates the fluid into the volute or diffuser chamber. The added energy from the acceleration increases the velocity and pressure of the fluid. These pumps are known to be very inefficient. This means that it takes more energy to increase the flow and pressure of the fluid when compared to a piston-style pump. However, you have a significant advantage in flow rates from a centrifugal pump versus a piston pump. If you are drilling deeper wells with heavier cuttings, you will be forced at some point to use a piston-style mud pump. They have much higher efficiencies in transferring the input energy into flow and pressure, therefore resulting in much higher pressure capabilities.

Piston-style mud pumps utilize a piston or plunger that travels back and forth in a chamber known as a cylinder. These pumps are also called “positive displacement” pumps because they literally push the fluid forward. This fluid builds up pressure and forces a spring-loaded valve to open and allow the fluid to escape into the discharge piping of the pump and then down the borehole. Since the expansion process is much smaller (almost insignificant) compared to a centrifugal pump, there is much lower energy loss. Plunger-style pumps can develop upwards of 15,000 psi for well treatments and hydraulic fracturing. Centrifugal pumps, in comparison, usually operate below 300 psi. If you are comparing most drilling pumps, centrifugal pumps operate from 60 to 125 psi and piston pumps operate around 150 to 300 psi. There are many exceptions and special applications for drilling, but these numbers should cover 80 percent of all equipment operating out there.

The restriction of putting a piston-style mud pump onto drilling rigs has always been the physical size and weight to provide adequate flow and pressure to your drilling fluid. Because of this, the industry needed a new solution to this age-old issue.

As the senior design engineer for Ingersoll-Rand’s Deephole Drilling Business Unit, I had the distinct pleasure of working with him and incorporating his Centerline Mud Pump into our drilling rig platforms.

In the late ’90s — and perhaps even earlier — Ingersoll-Rand had tried several times to develop a hydraulic-driven mud pump that would last an acceptable life- and duty-cycle for a well drilling contractor. With all of our resources and design wisdom, we were unable to solve this problem. Not only did Miller provide a solution, thus saving the size and weight of a typical gear-driven mud pump, he also provided a new offering — a mono-cylinder mud pump. This double-acting piston pump provided as much mud flow and pressure as a standard 5 X 6 duplex pump with incredible size and weight savings.

The true innovation was providing the well driller a solution for their mud pump requirements that was the right size and weight to integrate into both existing and new drilling rigs. Regardless of drill rig manufacturer and hydraulic system design, Centerline has provided a mud pump integration on hundreds of customer’s drilling rigs. Both mono-cylinder and duplex-cylinder pumps can fit nicely on the deck, across the frame or even be configured for under-deck mounting. This would not be possible with conventional mud pump designs.

The second generation design for the Centerline Mud Pump is expected later this year, and I believe it will be a true game changer for this industry. It also will open up the application to many other industries that require a heavier-duty cycle for a piston pump application.

The report covers comprehensive information about market trends, volume (Units) and value (US$ Mn) projections, competition and recent developments and market dynamics in the global mud pumps market for the study period of 2013 to 2026.

The global mud pumps market is expected to reach a little over US$ 1,085 Mn over the forecast period, registering a CAGR of 4.4%. Growth in drilling activities in the oil & gas Industry to increase hydrocarbon production and ease of the mud circulation operation in drilling holes are some of the factors expected to lay a robust foundation for the growth of the global mud pumps market.

Mud pumps can be classified on the basis of the number of pistons into duplex, triplex and quintuplex, which consist of two, three and five pistons respectively. The triplex segment is expected to dominate the mud pumps market in terms of value as well as volume during the entire forecast period.

Triplex mud pumps find extensive usage in circulating drilling fluid with high pressure for deep oil well drilling application. These usage characteristics make them preferable for use, primarily in onshore and offshore oil well drilling applications.

Mud pumps are widely utilized in the oil & gas industry. On the basis of the mode of operation, mud pumps can be classified as electric and fuel engine mud pumps.

Fuel engine mud pumps use petroleum oils as the key liquefying agent. These types of mud pumps release hazardous gases into the environment. In order to contain the hazardous impact of fuel engine mud pumps on the environment, regulatory authorities are compelling manufacturers and consumers to opt for electric mud pumps, which do not emit volatile organic compounds and operate with low noise and low vibration. Electric mud pumps offer smooth operations in drilling rigs and are environment-friendly, which is why they dominate the market for mud pumps.

The electric mud pumps segment is projected to grow with a 4.5% CAGR during the forecast period in view of the tightening emission control regulations and is expected to create an absolute $ opportunity worth US$ 134 Mn between 2018 and 2026.

Among all the applications analyzed in this global mud pumps market study, the onshore application of mud pumps is expected to register about 1.43X growth in terms of value between 2018 and 2026. The offshore application of mud pumps is projected to register moderate growth during the entire forecast period, led by land oil field discoveries.

In terms of incremental $ opportunity, onshore and offshore segments are expected to compete within large margins. The onshore application of mud pumps is expected to occupy over an 86% share in terms of value by the end of 2026.

Increasing oil-well exploration activities, stable economic conditions and consistent growth in oil well drilling rig sales in the region are expected to drive the demand for mud pumps in the region.

The comparatively well-established production sector in the region and increasing oil and gas industry and hydrocarbon consumption will create a healthy platform for the growth of the mud pumps market. Some regions including China and Europe are expected to gain traction in the latter half of the forecast period, owing to the anticipated growth of the oil & gas industry in these regions. North America is expected to register above-average 1.1X growth in the market. All the other regions are anticipated to exhibit moderate growth during the same period.

The global mud pumps market is consolidated with limited market players holding considerable double-digit market shares as of 2017. Globally, the top 12 players in the mud pumps market collectively hold between 53% and 58% of the market share.

Over the past few years, the mud pumps market has witnessed significant technological advancement from the competition perspective. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global mud pumps market.

In 2015, Flowserve opened a new pump manufacturing plant in Coimbatore, India. Through this new facility, the company aims to provide pump products for the oil and gas industry in Asia Pacific

Some of the key players involved in this market study on the global mud pumps market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

With the necessary tophead rotation speed, head feed speed, and plenty of mud pump options to get the job done, complete your water well drilling, geothermal drilling, and cathodic protection drilling jobs with a single, compact water well drill.

Outfit as down the hole drill or mud drill with the power of 28.5-foot stroke, 40,000 lb pullback, and 8,000 ft-lb torque to handle deeper wells along with weight of steel casing.

The mud pumps market size is expected to grow at a significant rate during the forecast period. A mud pump is a large, high-pressure (up to 7500 psi), single-acting triplex reciprocating pump used to circulate mud in a well at a specific flow rate (between 100 and 1300 gallons per minute). Instead of a triplex reciprocating pump, a double-acting two-cylinder reciprocating pump is occasionally utilized as a mud pump. Typically, a rig operator keeps two or three mud pumps on hand, one of which is active and the others on standby in case of an emergency. Mud is gathered up with the use of mud pumps, which use suction to circulate the mud from the wellbore to the surface during the drilling process.

Increased demand for directional and horizontal drilling, higher pressure handling capabilities, and some new oil discoveries are the main drivers of this market"s growth. Mud pumps are specialized pumps that are used to transport and circulate drilling fluids and other related fluids in a variety of industries, including mining and onshore and offshore oil and gas. The global energy demand is boosting the market for mud pumps. However, high drilling costs, environmental concerns, and shifting government energy and power laws may stymie industry growth.

Innovation in technology is the key for further growth for example, MTeq uses Energy Recovery’s Pressure exchanger technology in the drilling industry, as the ultimate engineered solution to increase productivity and reduce operating costs in pumping process by rerouting rough fluids away from high-pressure pumps, which helps reduce the cost of maintenance for operators.

The major key player in global mud pumps market are Flowserve (U.S.), Grundfos (Denmark), Halliburton (U.S.), Sulzer (Switzerland), KSB Group (Germany), Ebara Corporation (Japan), Weir Group (U.K), and SRS Crisafulli, Inc (U.S.). Tsurumi Pump (Japan), Shijiazhuang Industrial Pump Factory Co. Ltd (China), Excellence Pump Industry Co.Ltd (China), Kirloskar Ebara Pumps Limited (India), Xylem Inc (U.S.), and Goulds Pumps (U.S.) are among others.

In the drilling business, MTeq uses Energy Recovery"s Pressure exchanger technology as the ultimate engineering solution to boost productivity and lower operating costs in the pumping process by rerouting abrasive fluids away from high-pressure pumps, which helps operators save money on maintenance. The latest trend reveals that regulatory agencies are persuading manufacturers and consumers to choose electric mud pumps over fuel engine mud pumps to reduce the environmental impact of fuel engine mud pumps.

The global mud pumps market is segmented on the basis of type (duplex pump, triplex pump, and others), component (fluid end and power end), application (oil & gas industry and building industry), and Region (North America, Europe, Asia Pacific, and Rest of the World).

Based on type, mud pumps can be segmented as duplex and triplex pumps. Triplex pumps are expected to progress because of the ~30.0% lesser weight than duplex pumps offering similar efficiency. The pump transfers the fluids with the help of mechanical movements.

Based on application, mud pumps market can be segmented as oil & gas industry and building industry. As oil and gas fields going mature, operators must drill wells with large offset, high laterals, widening their applicability by using mud motors, and high-pressure pumps. To fulfill the demand drilling companies increase their mud pumping installation capacity, with higher flexibility. For instance, LEWCO has developed W-3000 mud pump model for oil drilling, which can handle power up to 3000 HP.

Based on region, North America is predominant because of tight oil and shale gas sources, followed by Asia-Pacific due to the increased number of wells in the regions, especially in countries such as China and India due to the rapid urbanization and industrialization. Authorities in countries such as India, China are working on enhancing their production capacities for reducing the import bills, which ultimately help in the growth of mud pumps market.

This market is broadly driven by oil and gas industry as mud pumps are used to move massive amount of sludge and mud at the time of drilling. Countries such as China, Russia, Saudi Arabia, and the U.S. have the largest number of oil wells. The demand for mud pumps will increase with the number of oil wells, across the globe.

Mud pumps are the pumps deployed in the oil and gas industry, mainly to circulate drilling fluids and other kinds of fluids in and out of the drilled wells for exploration. The mud pumps transfer the fluids at a very high pressure inside the well using the piston arrangement. The number of pistons decides the displacement and efficiency of working of the mud pumps, originally only dual piston pumps and three-piston pumps were used, but the technological advancements have seen pumps with five and six pistons to come up. Currently the triplex pumps which have three pistons are used, but the duplex pumps having two pumps are still deployed in the developing countries.

Based on its types, global mud pump market can be segmented into duplex, triplex, and others. The triplex mud pumps will dominate the mud pump marking in the given forecast period owing to its advantages and ongoing replacement of duplex pumps with triplex pumps. Based on operation, the global mud pumps market can be segmented into electric and fuel engine.

The electric mud pumps will dominate the market during the given forecast period due to the advantage of eliminating the harmful carbon emission which is done in the case of fuel engine pumps. Based on its application, the global mud pumps market can be segmented into oil & gas, mining, construction, and others.

The major market driver for the global mud pumps market is the increasing exploration activities taking place in various regions of the world to satisfy the increased energy demand. The number of drilled wells has increased in recent years, which has certainly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

Key market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to reduce the carbon emissions, which will certainly decrease the demand for oil & gas and therefore will have a negative impact on the growth of the global mud pumps market.

Some of the notable companies in the global mud pump market are Mud King Products, Inc. Gardner Denver Pumps, Weatherford, Schlumberger, National Oilwell Varco, China National Petroleum Corporation, Flowserve Corporation, MHWirth, American Block, Herrenknecht Vertical Gmbh, Bentec GmbH Drilling & Oilfield Systems, Drillmec Inc, Sun Machinery Company, Shale Pumps, and Dhiraj Rigs.

The global mud pump market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Owing to the well-established production sector and stable exploration industry North America holds the largest market for the mud pumps. The onshore exploration activities of oil & gas have increased at a good rate in the North America region, which has certainly boosted the growth of the mud pumps market in the region.

The demand from Europe and Asia Pacific has also increased due to exploration activities in both the regions owing to the increased energy demand. The energy demand specifically in the Asia Pacific has increased due to the increased population and urbanization. The Middle East and Africa also hold significant opportunities for the mud pumps market with increased exploration activities in the given forecast period.

In August 2018, Henderson which is a leading company in sales and service of drilling rigs, and capital drilling equipment in Texas signed a contract with Energy Drilling Company for the purchase and upgrade of oil field equipment’s which included three 1600hp × 7500psi mud pumps. This will be the first refurbishment completed at Henderson’s new service center and rig yard.

In January 2018, Koltek Energy Services launched the 99-acre facility for the testing of the oil field equipment in Oklahoma. This will allow the oil field equipment manufacturers to test their equipment at any given time. The company has deployed the MZ-9 pump which has a power rating of 1000Hp.

8613371530291

8613371530291