mud pump use free sample

Created specifically for drilling equipment inspectors and others in the oil and gas industry, the Oil Rig Mud Pump Inspection app allows you to easily document the status and safety of your oil rigs using just a mobile device. Quickly resolve any damage or needed maintenance with photos and GPS locations and sync to the cloud for easy access. The app is completely customizable to fit your inspection needs and works even without an internet signal.Try Template

Fulcrum lets employees on the floor who actually are building the product take ownership. Everyone’s got a smartphone. So now they see an issue and report it so it can be fixed, instead of just ignoring it because that’s the way it’s always been done.

It is so easy to use. You don"t have to be a GIS specialist or coder to set up the app. Just a regular person is able to set up their own app and use it.

A comprehensive range of mud pumping, mixing, and processing equipment is designed to streamline many essential but time-consuming operational and maintenance procedures, improve operator safety and productivity, and reduce costly system downtime.

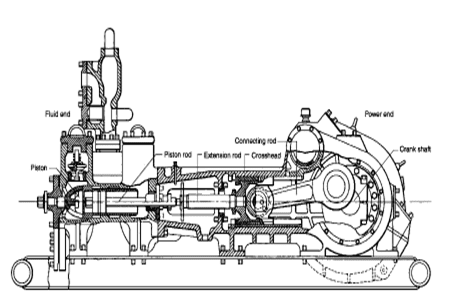

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

I’ve run into several instances of insufficient suction stabilization on rigs where a “standpipe” is installed off the suction manifold. The thought behind this design was to create a gas-over-fluid column for the reciprocating pump and eliminate cavitation.

When the standpipe is installed on the suction manifold’s deadhead side, there’s little opportunity to get fluid into all the cylinders to prevent cavitation. Also, the reciprocating pump and charge pump are not isolated.

The gas over fluid internal systems has limitations too. The standpipe loses compression due to gas being consumed by the drilling fluid. In the absence of gas, the standpipe becomes virtually defunct because gravity (14.7 psi) is the only force driving the cylinders’ fluid. Also, gas is rarely replenished or charged in the standpipe.

Another benefit of installing a suction stabilizer is eliminating the negative energies in fluids caused by the water hammer effect from valves quickly closing and opening.

The suction stabilizer’s compressible feature is designed to absorb the negative energies and promote smooth fluid flow. As a result, pump isolation is achieved between the charge pump and the reciprocating pump.

The isolation eliminates pump chatter, and because the reciprocating pump’s negative energies never reach the charge pump, the pump’s expendable life is extended.

Investing in suction stabilizers will ensure your pumps operate consistently and efficiently. They can also prevent most challenges related to pressure surges or pulsations in the most difficult piping environments.

Specifically designed for drilling companies and others in the oil and gas industry, the easy to use drilling rig inspections app makes it easy to log information about the drill rigs, including details about the drill rigs operators, miles logged and well numbers. The inspection form app covers everything from the mud pump areas and mud mixing area to the mud tanks and pits, making it easy to identify areas where preventative maintenance is needed. The drilling rig equipment checklist also covers health and safety issues, including the availability of PPE equipment, emergency response and preparedness processes, and other critical elements of the drilling process and drill press equipment.

Heating, Ventilating and Air Conditioning General Office Area: The building shall be equipped with a combination heating, ventilation and air conditioning system. The system shall have ducted supply and return air. The space above the ceiling shall not be used as a supply or return plenum. The systems shall be sized in accordance with the weather conditions identified in Chapter 13, “Energy Conservation” of the 1996 BOCA Building Code and supplemented by the “Building Code Rules”. All HVAC equipment shall be commercial or light industrial grade. If new construction it shall be installed at grade or within mechanical rooms for easy access and maintenance. If existing construction, roof mounted equipment will be considered after all other options have been exhausted, including the elimination of noise and vibration transfer to the structural members. The HVAC systems shall be zoned, with units sized and placed as required by heating and cooling loads on the building. Zoning of systems is dependent on the size, shape and orientation of the building. The HVAC system shall be divided into a minimum of 4 exterior and 1 interior temperature control zones. Return air shall be taken from the area supplied or adjacent to the area in the same temperature control zone. The ventilation and exhaust system shall be sized to maintain a positive pressure throughout the building envelope to limit air and dust infiltration. No HVAC ductwork shall be installed under the floor slab or underground.

Heating, Ventilation and Air Conditioning Landlord shall furnish to the Premises heating, ventilation and air-conditioning (“HVAC”) in accordance with the Design Standards set forth in Exhibit D during Ordinary Business Hours. Landlord shall have access to all air-cooling, fan, ventilating and machine rooms and electrical closets and all other mechanical installations of Landlord (collectively, “Mechanical Installations”), and Tenant shall not construct partitions or other obstructions which may interfere with Landlord’s access thereto or the moving of Landlord’s equipment to and from the Mechanical Installations. No Tenant Party shall at any time enter the Mechanical Installations or tamper with, adjust, or otherwise affect such Mechanical Installations. Landlord shall not be responsible if the HVAC System fails to provide cooled or heated air, as the case may be, to the Premises in accordance with the Design Standards by reason of (i) any equipment installed by, for or on behalf of Tenant, which has an electrical load in excess of the average electrical load and human occupancy factors for the HVAC System as designed, or (ii) any rearrangement of partitioning or other Alterations made or performed by, for or on behalf of Tenant. Tenant shall install, if missing, blinds or shades on all windows, which blinds and shades shall be subject to Landlord’s approval, and shall keep operable windows in the Premises closed, and lower the blinds when necessary because of the sun’s position, whenever the HVAC System is in operation or as and when required by any Requirement. Tenant shall cooperate with Landlord and shall abide by the rules and regulations which Landlord may reasonably prescribe for the proper functioning and protection of the HVAC System. Tenant acknowledges that the server room in the Premises currently has three heat pumps installed, being two 4-ton units, and one 2.5-ton unit (the “Existing Heat Pumps”). The 2.5-ton unit is currently connected and operational. Tenant shall determine whether it is satisfied with the condition of the Existing Heat Pumps and Landlord shall not have any responsibility or liability for the condition, operation, maintenance, repair or replacement of the Existing Heat Pumps. Tenant may operate the Existing Heat Pumps. Tenant shall be responsible for, and pay directly for, all necessary maintenance and repairs to the Existing Heat Pumps. Tenant shall reimburse Landlord monthly for the cost of all utility services used to operate the Existing Heat Pumps within 10 Business Days after receipt of Landlord’s invoice for such amount. Landlord may measure Tenant’s usage of such utility services by either a sub-meter or by other reasonable methods such as by temporary check meters or by survey. Tenant, at its cost, may replace the Existing Heat Pumps with one or more new heat pumps, provided, however, that the capacity of such replacement heat pump(s) shall not exceed the 10.5-ton capacity cooling capacity of the Existing Heat Pumps.

Rubric The rubrics are a scoring tool used for the Educator’s self-assessment, the formative assessment, the formative evaluation and the summative evaluation. The districts may use either the rubrics provided by ESE or comparably rigorous and comprehensive rubrics developed or adopted by the district and reviewed by ESE.

Heating and Air Conditioning During the normal business hours of 7:00 a.m. to 6:00 p.m., Monday through Friday, and 8:00 a.m. to 12:00 noon on Saturday, Landlord shall furnish heating and air conditioning to provide a comfortable temperature, in Landlord"s judgment, for normal business operations, except to the extent Tenant installs additional equipment which adversely affects the temperature maintained by the air conditioning system. Landlord acknowledges that Tenant is in the business of providing software development and services and therefore stipulates that normal business operations include the use of computer hardware and devices necessary for its business. If Tenant installs such additional equipment not necessary for its normal business operations, Landlord may install supplementary air conditioning units in the Premises, and Tenant shall pay to Landlord upon demand as Additional Rent the cost of installation, operation and maintenance thereof. Landlord shall furnish heating and air conditioning after business hours if Tenant provides Landlord reasonable prior written notice, and pays Landlord all charges for such additional heating or air conditioning, to be billed at $25.00 per hour.

Heating, Ventilating and Air Conditioning General Office Area: The building shall be equipped with a combination heating, ventilation and air conditioning system. The system shall have ducted supply and return air. The space above the ceiling shall not be used as a supply or return plenum. The systems shall be sized in accordance with the weather conditions identified in Chapter 13, “Energy Conservation” of the 1996 BOCA Building Code and supplemented by the “Building Code Rules”. All HVAC equipment shall be commercial or light industrial grade. If new construction it shall be installed at grade or within mechanical rooms for easy access and maintenance. If existing construction, roof mounted equipment will be considered after all other options have been exhausted, including the elimination of noise and vibration transfer to the structural members. The HVAC systems shall be zoned, with units sized and placed as required by heating and cooling loads on the building. Zoning of systems is dependent on the size, shape and orientation of the building. The HVAC system shall be divided into a minimum of 4 exterior and 1 interior temperature control zones. Return air shall be taken from the area supplied or adjacent to the area in the same temperature control zone. The ventilation and exhaust system shall be sized to maintain a positive pressure throughout the building envelope to limit air and dust infiltration. No HVAC ductwork shall be installed under the floor slab or underground.

System Logging The system must maintain an automated audit trail which can 20 identify the user or system process which initiates a request for PHI COUNTY discloses to 21 CONTRACTOR or CONTRACTOR creates, receives, maintains, or transmits on behalf of COUNTY, 22 or which alters such PHI. The audit trail must be date and time stamped, must log both successful and 23 failed accesses, must be read only, and must be restricted to authorized users. If such PHI is stored in a 24 database, database logging functionality must be enabled. Audit trail data must be archived for at least 3 25 years after occurrence.

There are many different ways to drill a domestic water well. One is what we call the “mud rotary” method. Whether or not this is the desired and/or best method for drilling your well is something more fully explained in this brief summary.

One advantage of drilling with compressed air is that it can tell you when you have encountered groundwater and gives you an indication how much water the borehole is producing. When drilling with water using the mud rotary method, the driller must rely on his interpretation of the borehole cuttings and any changes he can observe in the recirculating fluid. Mud rotary drillers can also use borehole geophysical tools to interpret which zones might be productive enough for your water well.

The mud rotary well drilling method is considered a closed-loop system. That is, the mud is cleaned of its cuttings and then is recirculated back down the borehole. Referring to this drilling method as “mud” is a misnomer, but it is one that has stuck with the industry for many years and most people understand what the term actually means.

The water is carefully mixed with a product that should not be called mud because it is a highly refined and formulated clay product—bentonite. It is added, mixed, and carefully monitored throughout the well drilling process.

The purpose of using a bentonite additive to the water is to form a thin film on the walls of the borehole to seal it and prevent water losses while drilling. This film also helps support the borehole wall from sluffing or caving in because of the hydraulic pressure of the bentonite mixture pressing against it. The objective of the fluid mixture is to carry cuttings from the bottom of the borehole up to the surface, where they drop out or are filtered out of the fluid, so it can be pumped back down the borehole again.

When using the mud rotary method, the driller must have a sump, a tank, or a small pond to hold a few thousand gallons of recirculating fluid. If they can’t dig sumps or small ponds, they must have a mud processing piece of equipment that mechanically screens and removes the sands and gravels from the mixture. This device is called a “shale shaker.”

The driller does not want to pump fine sand through the pump and back down the borehole. To avoid that, the shale shaker uses vibrating screens of various sizes and desanding cones to drop the sand out of the fluid as it flows through the shaker—so that the fluid can be used again.

This is where well development is performed to remove the thin bentonite layer or “wall cake” that was left behind. Various methods are used to remove the wall cake and develop the well to its maximum productivity.

Some drillers use compressed air to blow off the well, starting at the first screened interval and slowly working their way to the bottom—blowing off all the water standing above the drill pipe and allowing it to recover, and repeating this until the water blown from the well is free of sand and relatively clean. If after repeated cycles of airlift pumping and recovery the driller cannot find any sand in the water, it is time to install a well development pump.

Additional development of the well can be done with a development pump that may be of a higher capacity than what the final installation pump will be. Just as with cycles of airlift pumping of the well, the development pump will be cycled at different flow rates until the maximum capacity of the well can be determined. If the development pump can be operated briefly at a flow rate 50% greater than the permanent pump, the well should not pump sand.

Mud rotary well drillers for decades have found ways to make this particular system work to drill and construct domestic water wells. In some areas, it’s the ideal method to use because of the geologic formations there, while other areas of the country favor air rotary methods.

To learn more about the difference between mud rotary drilling and air rotary drilling, click the video below. The video is part of our “NGWA: Industry Connected” YouTube series:

The report covers comprehensive information about market trends, volume (Units) and value (US$ Mn) projections, competition and recent developments and market dynamics in the global mud pumps market for the study period of 2013 to 2026.

The global mud pumps market is expected to reach a little over US$ 1,085 Mn over the forecast period, registering a CAGR of 4.4%. Growth in drilling activities in the oil & gas Industry to increase hydrocarbon production and ease of the mud circulation operation in drilling holes are some of the factors expected to lay a robust foundation for the growth of the global mud pumps market.

Mud pumps can be classified on the basis of the number of pistons into duplex, triplex and quintuplex, which consist of two, three and five pistons respectively. The triplex segment is expected to dominate the mud pumps market in terms of value as well as volume during the entire forecast period.

Triplex mud pumps find extensive usage in circulating drilling fluid with high pressure for deep oil well drilling application. These usage characteristics make them preferable for use, primarily in onshore and offshore oil well drilling applications.

Mud pumps are widely utilized in the oil & gas industry. On the basis of the mode of operation, mud pumps can be classified as electric and fuel engine mud pumps.

Fuel engine mud pumps use petroleum oils as the key liquefying agent. These types of mud pumps release hazardous gases into the environment. In order to contain the hazardous impact of fuel engine mud pumps on the environment, regulatory authorities are compelling manufacturers and consumers to opt for electric mud pumps, which do not emit volatile organic compounds and operate with low noise and low vibration. Electric mud pumps offer smooth operations in drilling rigs and are environment-friendly, which is why they dominate the market for mud pumps.

The electric mud pumps segment is projected to grow with a 4.5% CAGR during the forecast period in view of the tightening emission control regulations and is expected to create an absolute $ opportunity worth US$ 134 Mn between 2018 and 2026.

Among all the applications analyzed in this global mud pumps market study, the onshore application of mud pumps is expected to register about 1.43X growth in terms of value between 2018 and 2026. The offshore application of mud pumps is projected to register moderate growth during the entire forecast period, led by land oil field discoveries.

In terms of incremental $ opportunity, onshore and offshore segments are expected to compete within large margins. The onshore application of mud pumps is expected to occupy over an 86% share in terms of value by the end of 2026.

Increasing oil-well exploration activities, stable economic conditions and consistent growth in oil well drilling rig sales in the region are expected to drive the demand for mud pumps in the region.

The comparatively well-established production sector in the region and increasing oil and gas industry and hydrocarbon consumption will create a healthy platform for the growth of the mud pumps market. Some regions including China and Europe are expected to gain traction in the latter half of the forecast period, owing to the anticipated growth of the oil & gas industry in these regions. North America is expected to register above-average 1.1X growth in the market. All the other regions are anticipated to exhibit moderate growth during the same period.

The global mud pumps market is consolidated with limited market players holding considerable double-digit market shares as of 2017. Globally, the top 12 players in the mud pumps market collectively hold between 53% and 58% of the market share.

Over the past few years, the mud pumps market has witnessed significant technological advancement from the competition perspective. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global mud pumps market.

In 2015, Flowserve opened a new pump manufacturing plant in Coimbatore, India. Through this new facility, the company aims to provide pump products for the oil and gas industry in Asia Pacific

Some of the key players involved in this market study on the global mud pumps market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

The ‘GlobalMud Pumps Market Price, Size, Share, Trends, Growth, Report and Forecast 2023-2028’ by Expert Market Research gives an extensive outlook of the global mud pumps market, assessing the market on the basis of its segments like type, operation, application, and major regions.

The need for mud pumps has increased along with the growing demand for minerals, oil, and gas. The market for mud pumps is anticipated to grow throughout the forecast period due to increased offshore mining activities and the globally expanding population. With the advantages it offers, the mud pumps market is expected to grow quickly. The market would be further boosted by rising demand for directional and horizontal drilling as well as the mud pump’s capacity to handle high-pressure drilling activities.

Due to technological advancements, mud pumps operate more efficiently and without producing harmful carbon emissions. Electric mud pumps are in higher demand, which may create new prospects for market expansion. The performance of mud pumps is influenced by the pump design along with a variety of other elements like pipelines, panel boards, and electricity. For maximum efficiency, manufacturers are therefore concentrating on improvements to the overall pumping system, which is aiding the mud pumps market.

Mud pumps are attracting attention as an innovative component of offshore drilling equipment as every hour, mud pumps help reach deeper levels, saving the rig operator time and money. In on-shore drilling, for instance, 7500-psi mud pump systems are becoming common.

Mud pumps are a particular kind of piston/plunger-driven pump that can use drilling fluids while under high pressure. Mud pumps are typically used in conjunction with other pumps and are a crucial component of heavy drilling techniques. These pumps assist in returning the drilling fluid to the surface after it has passed past the drill bit.

Triplex pumps are likely to hold a significant mud pumps market share since triplex pumps are lighter and more efficient than duplex pumps. Triplex mud pumps are widely used to circulate high-pressure drilling fluid for deep oil well drilling applications. They are more advantageous for use, especially in onshore and offshore oil well drilling applications, due to these applications.

The electrically powered mud pump market is expanding quickly due to its environmental advantages over fuel engine pumps. The mud pumps market value is anticipated to increase as a result of the increased exploration operations being carried out in all regions of the world to satisfy the growing demand for energy and minerals. In nations including the United States, Canada, China, and Argentina, shale gas exploration has expanded, which will raise the demand for oil rigs and consequently mud pumps.

The use of oil rigs, equipment, and mud pumps is being accelerated by operators in nations like the United States who are also relocating to isolated areas in Alaska. Old pumps are now being replaced by many governments, and oil and gas production businesses in Europe and the United States have noticed a continuous growth in this trend, thus aiding the market growth of mud pumps.

When choosing a size and type of mud pump for your drilling project, there are several factors to consider. These would include not only cost and size of pump that best fits your drilling rig, but also the diameter, depth and hole conditions you are drilling through. I know that this sounds like a lot to consider, but if you are set up the right way before the job starts, you will thank me later.

Recommended practice is to maintain a minimum of 100 to 150 feet per minute of uphole velocity for drill cuttings. Larger diameter wells for irrigation, agriculture or municipalities may violate this rule, because it may not be economically feasible to pump this much mud for the job. Uphole velocity is determined by the flow rate of the mud system, diameter of the borehole and the diameter of the drill pipe. There are many tools, including handbooks, rule of thumb, slide rule calculators and now apps on your handheld device, to calculate velocity. It is always good to remember the time it takes to get the cuttings off the bottom of the well. If you are drilling at 200 feet, then a 100-foot-per-minute velocity means that it would take two minutes to get the cuttings out of the hole. This is always a good reminder of what you are drilling through and how long ago it was that you drilled it. Ground conditions and rock formations are ever changing as you go deeper. Wouldn’t it be nice if they all remained the same?

Centrifugal-style mud pumps are very popular in our industry due to their size and weight, as well as flow rate capacity for an affordable price. There are many models and brands out there, and most of them are very good value. How does a centrifugal mud pump work? The rotation of the impeller accelerates the fluid into the volute or diffuser chamber. The added energy from the acceleration increases the velocity and pressure of the fluid. These pumps are known to be very inefficient. This means that it takes more energy to increase the flow and pressure of the fluid when compared to a piston-style pump. However, you have a significant advantage in flow rates from a centrifugal pump versus a piston pump. If you are drilling deeper wells with heavier cuttings, you will be forced at some point to use a piston-style mud pump. They have much higher efficiencies in transferring the input energy into flow and pressure, therefore resulting in much higher pressure capabilities.

Piston-style mud pumps utilize a piston or plunger that travels back and forth in a chamber known as a cylinder. These pumps are also called “positive displacement” pumps because they literally push the fluid forward. This fluid builds up pressure and forces a spring-loaded valve to open and allow the fluid to escape into the discharge piping of the pump and then down the borehole. Since the expansion process is much smaller (almost insignificant) compared to a centrifugal pump, there is much lower energy loss. Plunger-style pumps can develop upwards of 15,000 psi for well treatments and hydraulic fracturing. Centrifugal pumps, in comparison, usually operate below 300 psi. If you are comparing most drilling pumps, centrifugal pumps operate from 60 to 125 psi and piston pumps operate around 150 to 300 psi. There are many exceptions and special applications for drilling, but these numbers should cover 80 percent of all equipment operating out there.

The restriction of putting a piston-style mud pump onto drilling rigs has always been the physical size and weight to provide adequate flow and pressure to your drilling fluid. Because of this, the industry needed a new solution to this age-old issue.

As the senior design engineer for Ingersoll-Rand’s Deephole Drilling Business Unit, I had the distinct pleasure of working with him and incorporating his Centerline Mud Pump into our drilling rig platforms.

In the late ’90s — and perhaps even earlier — Ingersoll-Rand had tried several times to develop a hydraulic-driven mud pump that would last an acceptable life- and duty-cycle for a well drilling contractor. With all of our resources and design wisdom, we were unable to solve this problem. Not only did Miller provide a solution, thus saving the size and weight of a typical gear-driven mud pump, he also provided a new offering — a mono-cylinder mud pump. This double-acting piston pump provided as much mud flow and pressure as a standard 5 X 6 duplex pump with incredible size and weight savings.

The true innovation was providing the well driller a solution for their mud pump requirements that was the right size and weight to integrate into both existing and new drilling rigs. Regardless of drill rig manufacturer and hydraulic system design, Centerline has provided a mud pump integration on hundreds of customer’s drilling rigs. Both mono-cylinder and duplex-cylinder pumps can fit nicely on the deck, across the frame or even be configured for under-deck mounting. This would not be possible with conventional mud pump designs.

Centerline stuck with their original design through all of the typical trials and tribulations that come with a new product integration. Over the course of the first several years, Miller found out that even the best of the highest quality hydraulic cylinders, valves and seals were not truly what they were represented to be. He then set off on an endeavor to bring everything in-house and began manufacturing all of his own components, including hydraulic valves. This gave him complete control over the quality of components that go into the finished product.

The second generation design for the Centerline Mud Pump is expected later this year, and I believe it will be a true game changer for this industry. It also will open up the application to many other industries that require a heavier-duty cycle for a piston pump application.

Global Mud Pump Market, Product Type (Duplex, Triplex, Quintuplex), Driven System (Electric, Fuel Engine), Application (Onshore, Offshore), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

The mud pump market is expected to witness market growth at a rate of 6.80% in the forecast period of 2021 to 2028. Data Bridge Market Research report on mud pump market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The increase in the use of product in various industries globally is escalating the growth of mud pump market.

A mud pump or drilling mud pump refers to the type of pump that is utilized for circulating drilling mud on a drilling rig at high pressure. The mud is generally circulated down through the drill string, and back through the annulus at high pressures. These are positive displacement pumps and are ideal wherever a lot of fluid needs to be pumped under high pressure.

The increased demand for directional and horizonal drilling across the globe acts as one of the major factors driving the growth of mud pump market. The use of for moving and circulating drilling fluids and other similar fluids in several applications such as mining and onshore and offshore oil and gas, and deployment for transfering fluids at substantially high pressures accelerate the market growth. The rise in the popularity of electric mud pumps as they offer smooth operations in drilling rigs and are environment-friendly, and growth in mineral extraction activities further influence the market. Additionally, expansion of mining industry, rapid urbanization, increase in investments and emergence of industry 4.0 positively affect the mud pump market. Furthermore, surge in number if foreign investors and government initiatives extend profitable opportunities to the market players in the forecast period of 2021 to 2028.

On the other hand, lack of universal directives pertaining to applications of mud pump and stringent regulations are expected to obstruct the market growth. Lack of awareness and less adoption of mud pump is projected to challenge the mud pump market in the forecast period of 2021-2028.

This mud pump market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info mud pump market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The mud pump market is segmented on the basis of product type, driven system and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

The mud pump market is analyzed and market size, volume information is provided by country, product type, driven system and application as referenced above.

The countries covered in the mud pump market report are the U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific dominates the mud pump market due to the increase in number of oil wells and high investment within the region. North America is expected to witness significant growth during the forecast period of 2021 to 2028 because of the high production of oil and gas in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter"s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

The mud pump market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to mud pump market.

The major players covered in the mud pump market report are NOV Inc., Schlumberger Limited., Gardner Denver, Weatherford, Flowserve Corporation., Honghua Group Ltd., China National Petroleum Corporation, Trevi Finanziaria Industriale S.p.A., MHWirth, Bentec, American Block, White Star Pump, Ohara Corporation, Herrenknecht Vertical GmbH, Mud King Products, Grundfos Holding A/S, Halliburton, Sulzer Ltd, KEPL, and EPIC Corporation., among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

8613371530291

8613371530291