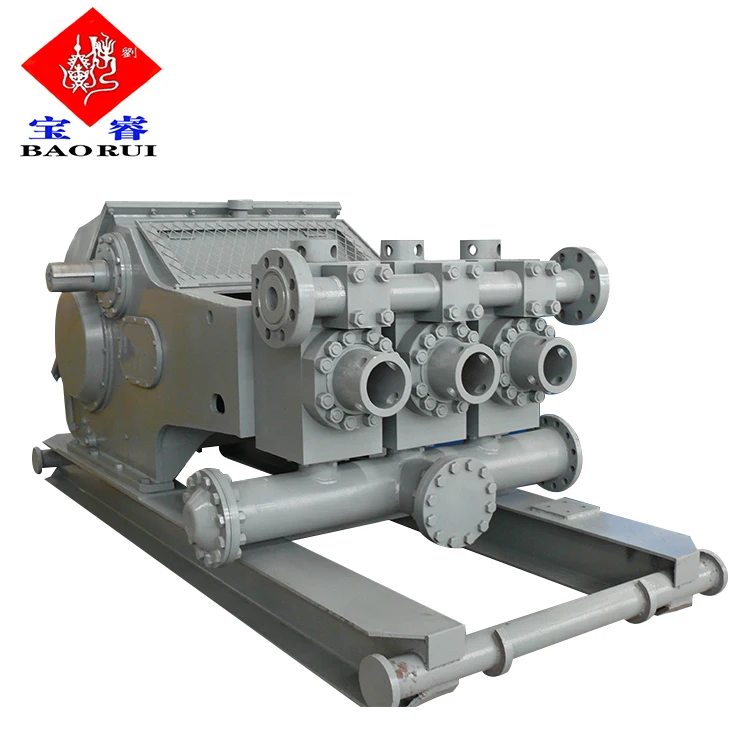

onshore mud pump free sample

The 2,200-hp mud pump for offshore applications is a single-acting reciprocating triplex mud pump designed for high fluid flow rates, even at low operating speeds, and with a long stroke design. These features reduce the number of load reversals in critical components and increase the life of fluid end parts.

The pump’s critical components are strategically placed to make maintenance and inspection far easier and safer. The two-piece, quick-release piston rod lets you remove the piston without disturbing the liner, minimizing downtime when you’re replacing fluid parts.

A comprehensive range of mud pumping, mixing, and processing equipment is designed to streamline many essential but time-consuming operational and maintenance procedures, improve operator safety and productivity, and reduce costly system downtime.

The report covers comprehensive information about market trends, volume (Units) and value (US$ Mn) projections, competition and recent developments and market dynamics in the global mud pumps market for the study period of 2013 to 2026.

The global mud pumps market is expected to reach a little over US$ 1,085 Mn over the forecast period, registering a CAGR of 4.4%. Growth in drilling activities in the oil & gas Industry to increase hydrocarbon production and ease of the mud circulation operation in drilling holes are some of the factors expected to lay a robust foundation for the growth of the global mud pumps market.

Mud pumps can be classified on the basis of the number of pistons into duplex, triplex and quintuplex, which consist of two, three and five pistons respectively. The triplex segment is expected to dominate the mud pumps market in terms of value as well as volume during the entire forecast period.

Triplex mud pumps find extensive usage in circulating drilling fluid with high pressure for deep oil well drilling application. These usage characteristics make them preferable for use, primarily in onshore and offshore oil well drilling applications.

Mud pumps are widely utilized in the oil & gas industry. On the basis of the mode of operation, mud pumps can be classified as electric and fuel engine mud pumps.

Fuel engine mud pumps use petroleum oils as the key liquefying agent. These types of mud pumps release hazardous gases into the environment. In order to contain the hazardous impact of fuel engine mud pumps on the environment, regulatory authorities are compelling manufacturers and consumers to opt for electric mud pumps, which do not emit volatile organic compounds and operate with low noise and low vibration. Electric mud pumps offer smooth operations in drilling rigs and are environment-friendly, which is why they dominate the market for mud pumps.

The electric mud pumps segment is projected to grow with a 4.5% CAGR during the forecast period in view of the tightening emission control regulations and is expected to create an absolute $ opportunity worth US$ 134 Mn between 2018 and 2026.

Among all the applications analyzed in this global mud pumps market study, the onshore application of mud pumps is expected to register about 1.43X growth in terms of value between 2018 and 2026. The offshore application of mud pumps is projected to register moderate growth during the entire forecast period, led by land oil field discoveries.

In terms of incremental $ opportunity, onshore and offshore segments are expected to compete within large margins. The onshore application of mud pumps is expected to occupy over an 86% share in terms of value by the end of 2026.

Increasing oil-well exploration activities, stable economic conditions and consistent growth in oil well drilling rig sales in the region are expected to drive the demand for mud pumps in the region.

The comparatively well-established production sector in the region and increasing oil and gas industry and hydrocarbon consumption will create a healthy platform for the growth of the mud pumps market. Some regions including China and Europe are expected to gain traction in the latter half of the forecast period, owing to the anticipated growth of the oil & gas industry in these regions. North America is expected to register above-average 1.1X growth in the market. All the other regions are anticipated to exhibit moderate growth during the same period.

The global mud pumps market is consolidated with limited market players holding considerable double-digit market shares as of 2017. Globally, the top 12 players in the mud pumps market collectively hold between 53% and 58% of the market share.

Over the past few years, the mud pumps market has witnessed significant technological advancement from the competition perspective. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global mud pumps market.

In 2018, National Oil Varco signed a deal with Dubai Saudi Armaco to form a joint venture for the manufacturing of onshore rigs and equipment in Saudi Arabia

In 2015, Flowserve opened a new pump manufacturing plant in Coimbatore, India. Through this new facility, the company aims to provide pump products for the oil and gas industry in Asia Pacific

Some of the key players involved in this market study on the global mud pumps market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

Cavitation is an undesirable condition that reduces pump efficiency and leads to excessive wear and damage to pump components. Factors that can contribute to cavitation, such as fluid velocity and pressure, can sometimes be attributed to an inadequate mud system design and/or the diminishing performance of the mud pump’s feed system.

When a mud pump has entered full cavitation, rig crews and field service technicians will see the equipment shaking and hear the pump “knocking,” which typically sounds like marbles and stones being thrown around inside the equipment. However, the process of cavitation starts long before audible signs reveal themselves – hence the name “the silent killer.”

Mild cavitation begins to occur when the mud pump is starved for fluid. While the pump itself may not be making noise, damage is still being done to the internal components of the fluid end. In the early stages, cavitation can damage a pump’s module, piston and valve assembly.

The imperceptible but intense shock waves generated by cavitation travel directly from the fluid end to the pump’s power end, causing premature vibrational damage to the crosshead slides. The vibrations are then passed onto the shaft, bull gear and into the main bearings.

If not corrected, the vibrations caused by cavitation will work their way directly to critical power end components, which will result in the premature failure of the mud pump. A busted mud pump means expensive downtime and repair costs.

To stop cavitation before it starts, install and tune high-speed pressure sensors on the mud suction line set to sound an alarm if the pressure falls below 30 psi.

Although the pump may not be knocking loudly when cavitation first presents, regular inspections by a properly trained field technician may be able to detect moderate vibrations and slight knocking sounds.

Gardner Denver offers Pump University, a mobile classroom that travels to facilities and/or drilling rigs and trains rig crews on best practices for pumping equipment maintenance.

Severe cavitation will drastically decrease module life and will eventually lead to catastrophic pump failure. Along with downtime and repair costs, the failure of the drilling pump can also cause damage to the suction and discharge piping.

When a mud pump has entered full cavitation, rig crews and field service technicians will see the equipment shaking and hear the pump ‘knocking’… However, the process of cavitation starts long before audible signs reveal themselves – hence the name ‘the silent killer.’In 2017, a leading North American drilling contractor was encountering chronic mud system issues on multiple rigs. The contractor engaged in more than 25 premature module washes in one year and suffered a major power-end failure.

Gardner Denver’s engineering team spent time on the contractor’s rigs, observing the pumps during operation and surveying the mud system’s design and configuration.

The engineering team discovered that the suction systems were undersized, feed lines were too small and there was no dampening on the suction side of the pump.

Following the implementation of these recommendations, the contractor saw significant performance improvements from the drilling pumps. Consumables life was extended significantly, and module washes were reduced by nearly 85%.

Although pump age does not affect its susceptibility to cavitation, the age of the rig can. An older rig’s mud systems may not be equipped for the way pumps are run today – at maximum horsepower.

Mud pumps are the pumps deployed in the oil and gas industry, mainly to circulate drilling fluids and other kinds of fluids in and out of the drilled wells for exploration. The mud pumps transfer the fluids at a very high pressure inside the well using the piston arrangement. The number of pistons decides the displacement and efficiency of working of the mud pumps, originally only dual piston pumps and three-piston pumps were used, but the technological advancements have seen pumps with five and six pistons to come up. Currently the triplex pumps which have three pistons are used, but the duplex pumps having two pumps are still deployed in the developing countries.

Based on its types, global mud pump market can be segmented into duplex, triplex, and others. The triplex mud pumps will dominate the mud pump marking in the given forecast period owing to its advantages and ongoing replacement of duplex pumps with triplex pumps. Based on operation, the global mud pumps market can be segmented into electric and fuel engine.

The electric mud pumps will dominate the market during the given forecast period due to the advantage of eliminating the harmful carbon emission which is done in the case of fuel engine pumps. Based on its application, the global mud pumps market can be segmented into oil & gas, mining, construction, and others.

The major market driver for the global mud pumps market is the increasing exploration activities taking place in various regions of the world to satisfy the increased energy demand. The number of drilled wells has increased in recent years, which has certainly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

Key market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to reduce the carbon emissions, which will certainly decrease the demand for oil & gas and therefore will have a negative impact on the growth of the global mud pumps market.

Some of the notable companies in the global mud pump market are Mud King Products, Inc. Gardner Denver Pumps, Weatherford, Schlumberger, National Oilwell Varco, China National Petroleum Corporation, Flowserve Corporation, MHWirth, American Block, Herrenknecht Vertical Gmbh, Bentec GmbH Drilling & Oilfield Systems, Drillmec Inc, Sun Machinery Company, Shale Pumps, and Dhiraj Rigs.

The global mud pump market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Owing to the well-established production sector and stable exploration industry North America holds the largest market for the mud pumps. The onshore exploration activities of oil & gas have increased at a good rate in the North America region, which has certainly boosted the growth of the mud pumps market in the region.

The demand from Europe and Asia Pacific has also increased due to exploration activities in both the regions owing to the increased energy demand. The energy demand specifically in the Asia Pacific has increased due to the increased population and urbanization. The Middle East and Africa also hold significant opportunities for the mud pumps market with increased exploration activities in the given forecast period.

In August 2018, Henderson which is a leading company in sales and service of drilling rigs, and capital drilling equipment in Texas signed a contract with Energy Drilling Company for the purchase and upgrade of oil field equipment’s which included three 1600hp × 7500psi mud pumps. This will be the first refurbishment completed at Henderson’s new service center and rig yard.

In January 2018, Koltek Energy Services launched the 99-acre facility for the testing of the oil field equipment in Oklahoma. This will allow the oil field equipment manufacturers to test their equipment at any given time. The company has deployed the MZ-9 pump which has a power rating of 1000Hp.

Estimated to surpass the valuation of US$ 800 Mn, the market is pegged for over 4% year on year revenue growth in 2019. Onshore applications of mud pumps hold clear dominance over offshore, and accounts for over 70% share of the mud pumps market revenue.

Growing oilfield explorations and land drilling activities will continue to encourage mud pumps demand, according to Persistence Market Research. In its recently released intelligence study, PMR offers exclusive insights on the competition landscape of global mud pumps market. The study analyses the market performance over an eight-year projection period, i.e. 2018-2026.

A senior research analyst refers to the global market for mud pumps as a moderately consolidated landscape, around 55% of which belongs to the top 10 performers.

The analyst explains, "Tier 1 manufacturers of mud pumps account for an average 40% value share in market, whereas over 50% share is contributed by Tier 2 companies. While market leaders are zooming in on NPD for R&D investments, innovation and direct distribution are also the most commonly used differentiating strategies". Elaborating further on competition tracking, the analysts says, "Key market players are concentrating more on strengthening their regional footprint and entering new territories. They are thus prominently opting for strategic collaborations and joint ventures with leading regional players, in addition to frequent M&A of regionally active distributors".

On the backdrop of towering oil & gas prices due to lowering production, a recent appeal by IEA (International Energy Agency) asks the OPEC and non-OPEC countries to up their oil & gas production output. The demand for new oil wells is thus likely to create a plethora of growth opportunities for manufacturers of mud pumps and other drilling equipment.

As oil well explorations at remote sites is constantly on the rise, manufacturers of mud pumps are innovating their existing product lines to cater to demands of remote sites such as efficient operability in a wide range of environmental conditions. Regional oil & gas industry players are focusing on strategically acquiring specialized contractors for remote site projects.

Mud Pumps Market Segmentation by Key Players National Oilwell Varco, Gardner Denver, Schlumberger Limited (Cameron International), WeatherFord International plc, Flowserve Corporation, CNPC Baoji Oilfield Machinery Co., Ltd., Honghua Group Ltd., MHWirthTrevi Group (Drillmec), Bentec GmbH Drilling & Oilfield Systems: https://www.persistencemarketresearch.com/market-research/mud-pumps-market.asp

Although triplex mud pumps have been holding the lion"s share of over 65% in the global market revenue primarily due to their lightweight and cost effective attributes, the consistent quest for advanced technological features and superior performance has been introducing a number of innovative mud pumps in the market. The most recent of these innovations include hexa mud pumps, quintuplex mud pumps, and quadraplex mud pumps.

For advanced technology drilling rigs, a majority of manufacturers are prioritizing development of quintuplex mud pumps owing to their ability to deliver a significantly improved flow rate that eventually curtails overall operational costs. PMR projects that the revenue growth of quintuplex mud pumps will reach its peak in 2019, i.e. above 4%.

Sustained activities for hydrocarbon exploration, coupled with strong presence of a majority of mud pumps manufacturers, enable North America to secure the top market position in terms of mud pumps demand. Onshore applications are likely to witness around 5% year on year revenue growth in the next couple of years, which is clearly due to ever-increasing hydraulic fracturing and shale gas exploration activities in the region.

On the other side, Chinese market for mud pumps is slated for considerable expansion owing to the discovery of new oil reservoirs within Western China, according to Persistence Market Research.

Market Research Future published a research report on “Mud Pumps Market Research Report – Forecast to 2023” – Market Analysis, Scope, Stake, Progress, Trends and Forecast to 2023.

The global mud pumps market 2020 and its shares are preparing for new strategies that could help the market to regain its position post novel coronavirus. Market Research Future digs information and comes up with a prediction that the global mud pumps market expects a steady growth at a ~8.0% CAGR. The growth pace will be happening in the years from 2018 to 2023 (forecast period), and in this period, the market expects a towering valuation.

The mud pump market is chiefly driven by the factor of rising demand for oil & gas. Mud pumps are mostly used to move a massive amount of sludge and mud during the oil well drilling process. Countries such as India, Russia, China, U.S., Canada, Oman, Saudi Arabia, Argentina, and Venezuela have a large number of oil wells. The rising number of wells is anticipated to motivate the demand for mud pumps across the globe.

Mud pumps market is further anticipated to expand. It has tremendous scope during the forecast period owing to its functionality in rugged and hostile environments as well as for being bulky and robust. To add in this, the electric mud pumps will lead the market owing to the advantage of eliminating the harmful carbon emission, which is done in the case of fuel engine pumps.

Furthermore, the primary motivator for the global mud pumps market is the escalating exploration activities that are taking place in various regions of the world to satisfy the surged energy demand. The number of drilled wells has augmented in current years, which has undoubtedly impacted the growth of the mud pumps market in both oil & gas and mining sectors.

On the contrary, significant market restraint for the global mud pumps market is the drift towards the cleaner sources of energy to diminish the carbon emissions, which will undoubtedly decrease the oil & gas demand and therefore will have a negative impact on the growth of the global Mud Pumps Market.

The global mud pump market seems consolidated with limited key players holding sizeable market share. Acquisitions, collaborations and new product launches are some of the key strategies adopted by prominent players to expand and sustain in the global Mud Pumps Market.

Some of the prominent players in the mud pump market include National Oil Varco Inc., Schlumberger Limited, Gardner Denver Inc., Weatherford International Plc., China National Petroleum Corporation, Trevi-Finanziaria Industriale S.p.A., MhWirth, BenTech GmbH Drilling Oilfield systems, American Block Inc., Honghua Group Limited, White Star Pump Company LLC, Flowserve corporation, Ohara Corporation, Mud King Products, Inc. and Herrenknecht Vertical GmbH.

In terms of type segment, mud pumps have included duplex and triplex pumps. Triplex pumps are estimated to progress in the stake of the ~30.0% lesser weight than duplex pumps offering similar efficiency. The pump transfers the fluids with the help of mechanical movements.

In terms of application, mud pumps have included oil & gas industry and building industry. As oil and gas fields are maturing, operators must drill wells with large offset, high laterals, widening their applicability by using mud motors, and high-pressure pumps. To fulfil the demand, drilling companies boost their mud pumping installation capacity, with higher flexibility. In case of point, LEWCO has developed W-3000 mud pump model for oil drilling, which can handle power up to 3000 HP.

Regionally, North America is leading in the wake of tight oil and shale gas sources due to the augmented number of wells in the regions. Also, due to the well-established production sector and stable exploration industry, North America occupies the largest market for the mud pumps. The onshore exploration activities of oil & gas have improved in the North America region, which has positively boosted the growth of the mud pumps market in the region.

Asia Pacific region is also witnessing upward move for the market, especially in countries such as China and India. This is owing to rapid urbanization and industrialization. Authorities in India, China are working on enhancing their production capacities for reducing the import bills, which eventually help in the growth of the mud pumps market.

The mud pumps market size is expected to grow at a significant rate during the forecast period. A mud pump is a large, high-pressure (up to 7500 psi), single-acting triplex reciprocating pump used to circulate mud in a well at a specific flow rate (between 100 and 1300 gallons per minute). Instead of a triplex reciprocating pump, a double-acting two-cylinder reciprocating pump is occasionally utilized as a mud pump. Typically, a rig operator keeps two or three mud pumps on hand, one of which is active and the others on standby in case of an emergency. Mud is gathered up with the use of mud pumps, which use suction to circulate the mud from the wellbore to the surface during the drilling process.

Increased demand for directional and horizontal drilling, higher pressure handling capabilities, and some new oil discoveries are the main drivers of this market"s growth. Mud pumps are specialized pumps that are used to transport and circulate drilling fluids and other related fluids in a variety of industries, including mining and onshore and offshore oil and gas. The global energy demand is boosting the market for mud pumps. However, high drilling costs, environmental concerns, and shifting government energy and power laws may stymie industry growth.

Innovation in technology is the key for further growth for example, MTeq uses Energy Recovery’s Pressure exchanger technology in the drilling industry, as the ultimate engineered solution to increase productivity and reduce operating costs in pumping process by rerouting rough fluids away from high-pressure pumps, which helps reduce the cost of maintenance for operators.

The major key player in global mud pumps market are Flowserve (U.S.), Grundfos (Denmark), Halliburton (U.S.), Sulzer (Switzerland), KSB Group (Germany), Ebara Corporation (Japan), Weir Group (U.K), and SRS Crisafulli, Inc (U.S.). Tsurumi Pump (Japan), Shijiazhuang Industrial Pump Factory Co. Ltd (China), Excellence Pump Industry Co.Ltd (China), Kirloskar Ebara Pumps Limited (India), Xylem Inc (U.S.), and Goulds Pumps (U.S.) are among others.

In the drilling business, MTeq uses Energy Recovery"s Pressure exchanger technology as the ultimate engineering solution to boost productivity and lower operating costs in the pumping process by rerouting abrasive fluids away from high-pressure pumps, which helps operators save money on maintenance. The latest trend reveals that regulatory agencies are persuading manufacturers and consumers to choose electric mud pumps over fuel engine mud pumps to reduce the environmental impact of fuel engine mud pumps.

The global mud pumps market is segmented on the basis of type (duplex pump, triplex pump, and others), component (fluid end and power end), application (oil & gas industry and building industry), and Region (North America, Europe, Asia Pacific, and Rest of the World).

Based on type, mud pumps can be segmented as duplex and triplex pumps. Triplex pumps are expected to progress because of the ~30.0% lesser weight than duplex pumps offering similar efficiency. The pump transfers the fluids with the help of mechanical movements.

Based on application, mud pumps market can be segmented as oil & gas industry and building industry. As oil and gas fields going mature, operators must drill wells with large offset, high laterals, widening their applicability by using mud motors, and high-pressure pumps. To fulfill the demand drilling companies increase their mud pumping installation capacity, with higher flexibility. For instance, LEWCO has developed W-3000 mud pump model for oil drilling, which can handle power up to 3000 HP.

Based on region, North America is predominant because of tight oil and shale gas sources, followed by Asia-Pacific due to the increased number of wells in the regions, especially in countries such as China and India due to the rapid urbanization and industrialization. Authorities in countries such as India, China are working on enhancing their production capacities for reducing the import bills, which ultimately help in the growth of mud pumps market.

This market is broadly driven by oil and gas industry as mud pumps are used to move massive amount of sludge and mud at the time of drilling. Countries such as China, Russia, Saudi Arabia, and the U.S. have the largest number of oil wells. The demand for mud pumps will increase with the number of oil wells, across the globe.

Estimated to surpass the valuation of US$ 800 Mn, the market is pegged for over 4% year on year revenue growth in 2019. Onshore applications of mud pumps hold clear dominance over offshore, and accounts for over 70% share of the mud pumps market revenue.

Growing oilfield explorations and land drilling activities will continue to encourage mud pumps demand, according to Persistence Market Research. In its recently released intelligence study, PMR offers exclusive insights on the competition landscape of global mud pumps market. The study analyses the market performance over an eight-year projection period, i.e. 2018-2026.

A senior research analyst refers to the global market for mud pumps as a moderately consolidated landscape, around 55% of which belongs to the top 10 performers.

The analyst explains, "Tier 1 manufacturers of mud pumps account for an average 40% value share in market, whereas over 50% share is contributed by Tier 2 companies. While market leaders are zooming in on NPD for R&D investments, innovation and direct distribution are also the most commonly used differentiating strategies". Elaborating further on competition tracking, the analysts says, "Key market players are concentrating more on strengthening their regional footprint and entering new territories. They are thus prominently opting for strategic collaborations and joint ventures with leading regional players, in addition to frequent M&A of regionally active distributors".

On the backdrop of towering oil & gas prices due to lowering production, a recent appeal by IEA (International Energy Agency) asks the OPEC and non-OPEC countries to up their oil & gas production output. The demand for new oil wells is thus likely to create a plethora of growth opportunities for manufacturers of mud pumps and other drilling equipment.

As oil well explorations at remote sites is constantly on the rise, manufacturers of mud pumps are innovating their existing product lines to cater to demands of remote sites such as efficient operability in a wide range of environmental conditions. Regional oil & gas industry players are focusing on strategically acquiring specialized contractors for remote site projects.

Mud Pumps Market Segmentation by Key Players National Oilwell Varco, Gardner Denver, Schlumberger Limited (Cameron International), WeatherFord International plc, Flowserve Corporation, CNPC Baoji Oilfield Machinery Co., Ltd., Honghua Group Ltd., MHWirthTrevi Group (Drillmec), Bentec GmbH Drilling & Oilfield Systems:https://www.persistencemarketresearch.com/market-research/mud-pumps-market.asp

Although triplex mud pumps have been holding the lion"s share of over 65% in the global market revenue primarily due to their lightweight and cost effective attributes, the consistent quest for advanced technological features and superior performance has been introducing a number of innovative mud pumps in the market. The most recent of these innovations include hexa mud pumps, quintuplex mud pumps, and quadraplex mud pumps.

For advanced technology drilling rigs, a majority of manufacturers are prioritizing development of quintuplex mud pumps owing to their ability to deliver a significantly improved flow rate that eventually curtails overall operational costs. PMR projects that the revenue growth of quintuplex mud pumps will reach its peak in 2019, i.e. above 4%.

Sustained activities for hydrocarbon exploration, coupled with strong presence of a majority of mud pumps manufacturers, enable North America to secure the top market position in terms of mud pumps demand. Onshore applications are likely to witness around 5% year on year revenue growth in the next couple of years, which is clearly due to ever-increasing hydraulic fracturing and shale gas exploration activities in the region.

On the other side, Chinese market for mud pumps is slated for considerable expansion owing to the discovery of new oil reservoirs within Western China, according to Persistence Market Research.

The arrangement of piping and special valves, called chokes, through which drilling mud is circulated when the blowout preventers are closed to control the pressures encountered during a kick.†

A centrifugal device for removing sand from drilling fluid to prevent abrasion of the pumps. It may be operated mechanically or by a fast-moving stream of fluid inside a special cone-shaped vessel, in which case it is sometimes called a hydrocyclone.†

A series of open tanks, usually made of steel plates, through which the drilling mud is cycled to allow sand and sediments to settle out. Additives are mixed with the mud in the pit, and the fluid is temporarily stored there before being pumped back into the well. Mud pit compartments are also called shaker pits, settling pits, and suction pits, depending on their main purpose.†

A trough or pipe, placed between the surface connections at the well bore and the shale shaker. Drilling mud flows through it upon its return to the surface from the hole.†

A mud pit in which a supply of drilling fluid has been stored. Also, a waste pit, usually an excavated, earthen-walled pit. It may be lined with plastic to prevent soil contamination.†

The hose on a rotary drilling rig that conducts the drilling fluid from the mud pump and standpipe to the swivel and kelly; also called the mud hose or the kelly hose.†

A vertical pipe rising along the side of the derrick or mast. It joins the discharge line leading from the mud pump to the rotary hose and through which mud is pumped going into the hole.†

The multiphase pumps market size is expected to be USD 255.1 million in 2022. The global COVID-19 pandemic has been unprecedented and staggering, with multiphase pumps experiencing higher-than-anticipated demand across all regions compared to pre-pandemic levels. As per our research, the market is projected to touch USD 349.8 million by 2028, exhibiting a CAGR of 5.4% during the forecast period. The sudden spike in CAGR is attributable to the market"s growth and demand returning to pre-pandemic levels once the pandemic is over.

Fluids of various sorts, often oil and gas, are moved via pipelines using multiphase pumps. Water and other liquids may be moved with them as well. In order to move these fluids more effectively and affordably, businesses may benefit from multiphase pumps, which are crucial.

When moving liquid in two directions at once, twin screw multiphase pumps are employed. It comprises of two interlocked screws, one of which is propelled by an electric motor and the other by mechanical devices such as gears or chains. The primary benefit of utilizing this pump is that it is simple to use with liquids of all viscosities, including high and low viscosities.

Fluid is transferred using both helical and axial flow in helico-axial multiphase pumps, a type of axial flow multiphase pump. The main benefit of utilizing helico-axial multiphase pumps is that they can be used to move fluids with high viscosities in both directions, as opposed to other traditional single-phase or two-phase pumps that can only do so.

Covid badly affected the multiphase pumps market due to supply chain disruptions and shortage in raw materials was also observed. Shortage of labor and strict protocols such as lockdowns and restrictions on movement created roadblocks, disruptions in end-use sectors of the product led to lower demand.

Over 60% of the total revenue share in the market for multiphase pumps was accounted for by onshore applications. Due to rising demand for crude oil and natural gas from different sectors, including the energy, petrochemical, and civil construction industries, the segment is anticipated to maintain its dominance during the projection period. Demand will also be further fueled by sustained expansion in onshore production across key economies including Saudi Arabia, Iran, Argentina, and the UAE. Over the next eight years, it is anticipated that the increasing relevance of these liquids in a variety of sectors, including automotive lubricants, will positively affect industry growth.

By type, market is segmented into twin screw multiphase pumps, helico -axial multiphase pumps and others. The twin screw multiphase pumps segment will dominate the market in the coming years.

Multiphase pumps are becoming more and more in demand, both from the oil and gas sector and from the chemical and petrochemical sectors, which need them to handle dangerous fluids and produce hydrocarbons efficiently. The requirement for multiphase pumps in water and wastewater treatment facilities is also anticipated to be driven by rising infrastructure development investments.

Systems for multiphase pumping must be dependable and high-performing due to the emergence of novel applications including micropumps, fuel cells, and medical devices. The market is also being driven by technical developments that have resulted in the creation of more compact and energy-efficient multiphase pumps.

The primary market restraint is the shift toward greener energy sources in an effort to reduce carbon emissions. This trend will undoubtedly reduce demand for oil and gas, which will negatively affect the expansion of the global mud pumps market.

From 2022 to 2030, the market that is expected to expand the quickest is Asia Pacific. The expansion is explained by the rising offshore operations in this area and the rising demand for oil and gas in developing nations like China and India. Further driving the market will be the growing number of projects, such as LNG terminals and other petrochemical facilities. A low rise is anticipated in North America during the projection period as a result of the region"s strict environmental impact regulatory framework and the high cost of Multiphase Pumps (MP). Nevertheless, it is anticipated that throughout the projected period, regional demand for MP would increase due to technical developments such enhanced oil recovery (EOR) employing multistage pumps.

Nevertheless, it is anticipated that throughout the projected period, regional demand for MP would increase due to technical developments such enhanced oil recovery (EOR) employing multistage pumps. In addition, the shale gas boom in North America has prompted major players like Schlumberger Limited and Halliburton Company to adopt helical-axial pump technology, which will favorably impact the market"s growth over the coming years.

8613371530291

8613371530291